The U.S. wholesale trade industry continues to expand, driven by increasing demand for efficient supply chain solutions and the rise of e-commerce. According to a 2023 report by Grand View Research, the U.S. wholesale distribution market was valued at over $6.5 trillion and is projected to grow at a compound annual growth rate (CAGR) of 4.8% through 2030. This sustained expansion reflects heightened procurement needs across retail, manufacturing, and construction sectors. Mordor Intelligence further highlights that digital transformation and just-in-time inventory practices are reshaping how businesses source products, favoring wholesalers and manufacturers that offer scalability, reliability, and competitive pricing. With more companies prioritizing cost-efficiency and domestic sourcing, identifying top-performing U.S.-based wholesalers and manufacturers has become critical for procurement success. Based on sales volume, distribution reach, and industry reputation, the following list highlights the top 10 U.S. wholesalers and manufacturers shaping the supply chain landscape.

Top 10 Usa Wholesalers Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 JanSan, Foodservice, Technology: Wholesale Distributor

Domain Est. 2013

Website: essendant.com

Key Highlights: Essendant helps resellers drive their businesses forward by powering smarter operations, category expansion, and strategies for business growth….

#2 Sysco

Domain Est. 1994

Website: sysco.com

Key Highlights: Sysco delivers exceptional produce, custom cuts of meat, high-quality seafood, and imported foods offering global flavors….

#3 Orgill

Domain Est. 1996

Website: orgill.com

Key Highlights: Orgill was founded in 1847 and today is the fastest-growing independent hardware distributor in the world. The company serves retailers throughout the United ……

#4 Two’s Company

Domain Est. 1996

Website: twoscompany.com

Key Highlights: VISIT OUR FAMILY OF BRANDS. Two’s Company. SHOP BY COLLECTION. NEW ARRIVALS · SHOP ALL · AL FRESCO · BIRTHDAY · BOYAR NYC · CHINOISERIE CHIC….

#5 C&S Wholesale Grocers

Domain Est. 1996 | Founded: 1918

Website: cswg.com

Key Highlights: C&S Wholesale Grocers is a leader in food solutions across the United States. Founded in 1918, we have a strong heritage of innovation that continues today….

#6 Associated Wholesale Grocers

Domain Est. 1997

Website: awginc.com

Key Highlights: Associated Wholesale Grocers supplies stores in more than half the states in the country. We have 9 modern and efficient distribution centers, totaling more ……

#7 Harbor Wholesale

Domain Est. 1999 | Founded: 1923

Website: harborwholesale.com

Key Highlights: Since 1923, Harbor delivers the best national and regional food products available for people on the go….

#8 FLOMO

Domain Est. 1999

Website: flomousa.com

Key Highlights: We are your partner for wholesale distribution, e-Commerce fulfillment, custom product development, private label manufacturing, 3rd party logistics/outsourcing ……

#9 Food Wholesalers Miami & Doral FL

Domain Est. 2007

Website: mdist.us

Key Highlights: Welcome to Martinez Distributors! We revamped our website so you can easily learn more about us, and what we can do for you and for your business….

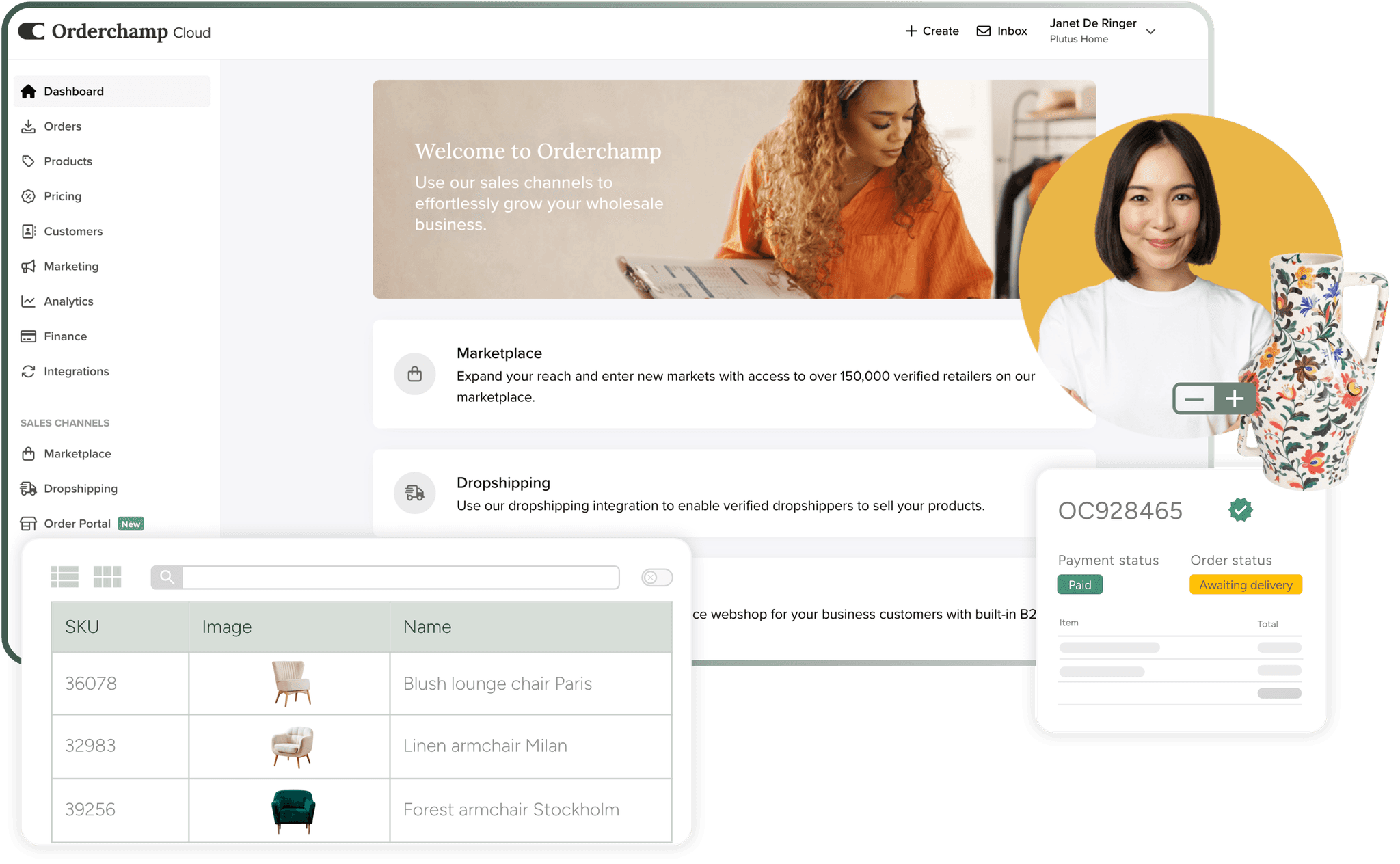

#10 Orderchamp

Domain Est. 2018

Website: orderchamp.com

Key Highlights: Online wholesale with low minimum order value, buy now pay later, free shipping and dropshipping. Sign up for free to see wholesale prices….

Expert Sourcing Insights for Usa Wholesalers

2026 Market Trends for U.S. Wholesalers: Navigating a Transformative Landscape

The U.S. wholesale distribution sector is poised for significant transformation by 2026, driven by technological acceleration, shifting customer expectations, and evolving economic and supply chain dynamics. Wholesalers must proactively adapt to remain competitive and capitalize on emerging opportunities.

Digital Transformation and E-commerce Integration

By 2026, digital channels will no longer be supplementary but central to wholesale operations. B2B buyers increasingly expect Amazon-like experiences, including intuitive online ordering, real-time inventory visibility, personalized pricing, and self-service portals. Wholesalers investing in robust e-commerce platforms integrated with ERP and CRM systems will gain a critical edge. AI-driven tools for demand forecasting, dynamic pricing, and customer service (e.g., chatbots) will become standard, enhancing efficiency and decision-making.

Supply Chain Resilience and Localization

Ongoing global uncertainties will push wholesalers to prioritize supply chain resilience. This includes diversifying supplier bases, increasing nearshoring or reshoring of critical inventory, and leveraging advanced analytics for risk assessment. Expect growth in regional distribution hubs to reduce lead times and transportation costs. Transparency in the supply chain—from sourcing to delivery—will be a key differentiator, with customers demanding greater visibility and sustainability credentials.

Sustainability and Regulatory Compliance

Environmental, social, and governance (ESG) factors will increasingly influence purchasing decisions and regulatory frameworks. Wholesalers will need to measure and report on carbon footprints, adopt sustainable packaging, and ensure ethical sourcing. Compliance with evolving regulations—such as those related to data privacy, labor practices, and product safety—will require dedicated resources and digital tracking systems. Those that lead in sustainability will attract environmentally conscious customers and business partners.

Labor Challenges and Automation

The persistent labor shortage in logistics and warehousing will intensify, driving greater adoption of automation technologies. By 2026, expect wider use of robotics for picking and packing, automated guided vehicles (AGVs), and AI-powered warehouse management systems. Upskilling the workforce to manage and maintain these technologies will be crucial. Wholesalers that invest in employee retention, flexible work models, and training will be better positioned to maintain operational stability.

Data-Driven Decision Making and Personalization

Data will become the cornerstone of competitive advantage. Wholesalers leveraging big data analytics will gain insights into customer behavior, optimize inventory levels, and identify emerging market trends. Personalization—tailoring product recommendations, pricing, and marketing—will move beyond e-commerce to include sales reps and account management, enhancing customer loyalty and average order value.

Consolidation and Niche Specialization

Market pressures will likely accelerate industry consolidation, with larger players acquiring regional or specialized distributors to expand reach and capabilities. Simultaneously, successful smaller wholesalers will thrive by focusing on niche markets, offering deep expertise, customized solutions, and superior service. The “one-size-fits-all” model will diminish in favor of specialization and agility.

In conclusion, the 2026 landscape for U.S. wholesalers demands agility, technological investment, and customer-centric innovation. Those embracing digital transformation, building resilient and sustainable supply chains, and leveraging data strategically will not only survive but lead the next era of wholesale distribution.

Common Pitfalls Sourcing USA Wholesalers (Quality, IP)

Sourcing from U.S. wholesalers can offer advantages like shorter shipping times and access to well-known brands. However, businesses often encounter significant challenges related to product quality and intellectual property (IP) protection. Being aware of these pitfalls is crucial to avoiding costly mistakes.

Inconsistent or Subpar Product Quality

One of the most frequent issues when sourcing from U.S. wholesalers is inconsistent product quality. Not all wholesalers maintain rigorous quality control standards, especially those dealing in overstock, liquidation, or closeout goods. Products may be damaged, expired, or refurbished without proper disclosure. Additionally, some wholesalers source internationally and repackage goods for resale, potentially bypassing U.S. safety or regulatory requirements.

Key Risks:

– Receiving defective or non-compliant items

– Lack of standardized quality checks across product batches

– Misrepresentation of product condition (e.g., “new” vs. “used”)

To mitigate this, always request product samples, verify certifications, and read contractual terms carefully before placing large orders.

Intellectual Property (IP) Infringement Risks

Another major concern is unintentional involvement in intellectual property violations. Some U.S. wholesalers may sell counterfeit, gray market, or IP-infringing goods—especially in categories like electronics, apparel, and cosmetics. Even if you’re unaware, purchasing and reselling such products can expose your business to legal liability, including cease-and-desist letters, fines, or account suspensions on platforms like Amazon or eBay.

Common IP Pitfalls:

– Sourcing branded goods from unauthorized distributors

– Acquiring parallel imports (legally imported but unauthorized)

– Reselling products with counterfeit trademarks or patented designs

Always confirm that the wholesaler is an authorized distributor and request proof of authenticity or chain-of-custody documentation. Conduct due diligence on brand licensing and trademark registrations to protect your business.

Lack of Transparency and Verification

Many U.S. wholesalers operate with limited transparency, making it difficult to verify their legitimacy or sourcing practices. Scams involving fake warehouses, shell companies, or misrepresented inventory are not uncommon. Without proper vetting, businesses risk paying for goods that don’t exist or are significantly different from what was promised.

Red Flags to Watch For:

– Unwillingness to provide business licenses or resale certificates

– No physical address or refusal to allow facility visits

– Pressure to pay upfront without contracts or guarantees

Conduct background checks, use escrow services for large transactions, and leverage third-party verification tools to reduce risk.

Conclusion

While U.S. wholesalers can be reliable partners, overlooking quality control and IP compliance can lead to reputational damage, legal action, and financial loss. Thorough due diligence, clear contracts, and proactive verification are essential to sourcing safely and sustainably.

Logistics & Compliance Guide for USA Wholesalers

Understanding Domestic Logistics Infrastructure

To operate efficiently, wholesalers must have a firm grasp of the U.S. domestic logistics network. This includes transportation modes such as trucking (the most common method for short- and medium-haul shipments), rail for bulk goods over long distances, air freight for time-sensitive items, and intermodal solutions that combine methods. Partnering with reliable carriers and utilizing transportation management systems (TMS) can optimize routing, reduce delivery times, and lower freight costs.

Warehouse Management and Distribution Strategies

Effective warehouse operations are essential for timely order fulfillment. Wholesalers should implement warehouse management systems (WMS) to track inventory in real time, optimize storage layouts, and streamline picking and packing processes. Establishing strategically located distribution centers—near major transportation hubs or customer-dense regions—can reduce transit times and shipping expenses. Consider drop-shipping, cross-docking, or third-party logistics (3PL) partnerships to scale operations efficiently.

Inventory Control and Demand Forecasting

Maintaining optimal inventory levels prevents stockouts and overstocking. Use inventory management software to monitor stock turns, set reorder points, and integrate with sales channels. Apply demand forecasting techniques using historical sales data, seasonal trends, and market analysis to align inventory with customer needs. Just-in-time (JIT) inventory strategies can improve cash flow but require reliable suppliers and logistics.

Regulatory Compliance: Federal and State Requirements

Wholesalers must comply with federal, state, and local regulations. Key compliance areas include:

- Business Licensing: Obtain a federal Employer Identification Number (EIN) and register for state-level sales tax permits.

- Sales Tax Collection: Collect and remit sales tax in states where you have economic nexus, per the South Dakota v. Wayfair ruling. Use automated tax software to stay compliant.

- Product Regulations: Adhere to industry-specific rules (e.g., FDA for food and supplements, CPSC for children’s products, FTC for labeling).

- Labeling and Packaging: Ensure products meet truth-in-advertising standards, ingredient disclosures, and safety warnings as required.

Transportation and Carrier Compliance

Freight carriers must comply with Department of Transportation (DOT) regulations. Wholesalers using private fleets need:

- DOT and MC (Motor Carrier) numbers if operating across state lines

- Hours-of-Service (HOS) logs for drivers

- Vehicle maintenance records

- Cargo insurance and liability coverage

When working with third-party carriers, verify their FMCSA registration, safety ratings, and insurance coverage.

Import and Export Compliance (If Applicable)

For wholesalers sourcing internationally:

- Importing: Comply with U.S. Customs and Border Protection (CBP) regulations. Classify goods using HTS codes, pay applicable duties, and maintain accurate import documentation (e.g., commercial invoices, packing lists, ISF filings).

- Exporting: Follow Export Administration Regulations (EAR) and International Traffic in Arms Regulations (ITAR) when shipping controlled goods. File Electronic Export Information (EEI) through the AES when required.

- Trade Agreements: Leverage benefits from free trade agreements like USMCA to reduce tariffs on qualifying goods.

Product Safety and Recalls

Wholesalers share responsibility for product safety. Maintain traceability through batch/lot tracking, especially for consumables and electronics. In the event of a defect, follow recall protocols set by relevant agencies (e.g., FDA, CPSC). Notify distributors and retailers promptly and cooperate with investigations to minimize liability.

Data Security and Privacy Compliance

Protect customer and transaction data under applicable privacy laws. While the U.S. lacks a federal comprehensive privacy law, several states (e.g., California with CCPA, Virginia with VCDPA) enforce consumer data protection rules. Implement cybersecurity measures, conduct audits, and ensure third-party vendors adhere to data handling standards.

Environmental and Sustainability Regulations

Comply with Environmental Protection Agency (EPA) rules related to hazardous materials, emissions, and waste disposal. Consider sustainable packaging, energy-efficient warehousing, and carbon footprint reduction to meet growing customer and regulatory expectations.

Recordkeeping and Audits

Maintain accurate records for:

- Inventory transactions

- Sales and tax filings

- Carrier contracts and shipping logs

- Product certifications and safety testing

- Import/export documentation

Retain records for the required period (typically 3–7 years) to support audits by state tax authorities, CBP, or other regulatory bodies.

Best Practices for Continuous Improvement

- Regularly review logistics performance metrics (on-time delivery rate, order accuracy, freight cost per unit).

- Stay updated on regulatory changes through trade associations (e.g., NAW, CSCMP).

- Invest in employee training on compliance and safety procedures.

- Use technology (automation, AI-driven analytics) to increase efficiency and reduce errors.

By integrating sound logistics practices with rigorous compliance protocols, U.S. wholesalers can enhance operational resilience, reduce risk, and build trust with suppliers, customers, and regulators.

In conclusion, sourcing wholesalers from the USA offers numerous advantages for businesses seeking quality products, reliable supply chains, and efficient logistics. With a well-established distribution network, strict quality control standards, and a wide range of industry-specialized wholesalers, the U.S. market provides scalable opportunities for retailers, e-commerce entrepreneurs, and brick-and-mortar stores alike. However, success in sourcing depends on thorough research, due diligence, and building strong relationships with reputable suppliers. By leveraging online B2B platforms, trade shows, and industry directories, businesses can identify trustworthy partners that align with their goals. Ultimately, effective sourcing from U.S. wholesalers enhances product credibility, reduces lead times, and supports long-term growth in competitive markets.