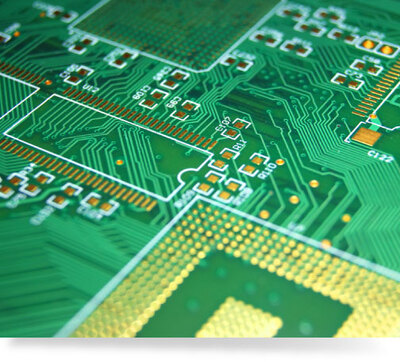

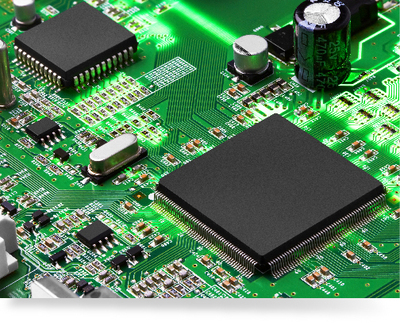

The U.S. printed circuit board (PCB) manufacturing industry is experiencing a resurgence, driven by rising demand in aerospace, defense, automotive electronics, and advanced computing. According to Mordor Intelligence, the North American PCB market was valued at approximately USD 5.6 billion in 2023 and is projected to grow at a CAGR of over 4.8% from 2024 to 2029. Similarly, Grand View Research reports that the increasing adoption of high-density interconnect (HDI) and flexible PCBs, along with supply chain localization efforts, is bolstering domestic production capacity. As companies prioritize shorter lead times, IP protection, and quality control, onshoring PCB fabrication has become a strategic imperative. This shift, combined with advancements in 5G, electric vehicles, and AI infrastructure, has strengthened the position of leading U.S.-based manufacturers. Based on production scale, technological capability, industry certifications, and customer verticals, here are the top 9 PCB manufacturers in the United States shaping the future of electronics innovation.

Top 9 Usa Pcb Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 TTM Technologies

Domain Est. 1995

Website: ttm.com

Key Highlights: TTM Technologies is an advanced Printed Circuit Board (PCB) manufacturer and a leading supplier in technology solutions….

#2 Summit Interconnect leads Complex Circuits and Rigid Flex PCB

Domain Est. 2016

Website: summitinterconnect.com

Key Highlights: Summit Interconnect is a manufacturer of advanced technology printed circuit boards focused on complex rigid, flex and rigid-flex PCBs….

#3 to American Standard Circuits

Domain Est. 1996

Website: asc-i.com

Key Highlights: Explore top-tier printed circuit board manufacturing with American Standard Circuits. Your USA-based solution for quality PCBs and circuit boards….

#4 PCB Manufacturer, PCB Prototype & PCB Assembly

Domain Est. 2004

Website: rushpcb.com

Key Highlights: RUSH PCB Inc Is Your One-Stop PCB Prototype Fabrication and Assembly Service. Leading PCB Manufacturing Company in USA. Your only Source for High Quality ……

#5 AdvancedPCB

Domain Est. 2018

Website: advancedpcb.com

Key Highlights: Prototype to Production PCBs from AdvancedPCB. Choose us as your trusted PCB board manufacturer and circuit board manufacturer….

#6 PCB Assembly: PCB Board Manufacturer USA

Domain Est. 2023

Website: pcbpower.us

Key Highlights: Leading PCB board manufacturer in the USA. Fast PCB fabrication and assembly services with high quality, low cost, and quick quotes. Trusted by engineers….

#7 Sunstone Circuits Printed Circuit Boards

Domain Est. 1995

Website: sunstone.com

Key Highlights: Sunstone Offers Expert Service In High Quality Printed Circuit Board Manufacturing & PCB Assembly, Including Prototype & Production PCBs….

#8 Sierra Circuits

Domain Est. 1997

Website: protoexpress.com

Key Highlights: Sierra Circuits can manufacture your PCB and have it expedited to you within 24 hours. Full turnkey boards, with assembly and components in as fast as 5 days….

#9 OSH Park ~

Domain Est. 2011

Website: oshpark.com

Key Highlights: We produce high quality bare printed circuit boards, focused on the needs of prototyping, hobby design, and light production….

Expert Sourcing Insights for Usa Pcb

H2 2026 Market Trends for the USA PCB Industry

As the global electronics landscape evolves, the U.S. printed circuit board (PCB) market is undergoing significant transformation in the second half of 2026. Driven by technological innovation, supply chain reshoring, and increasing demand from high-growth industries, the domestic PCB sector is experiencing a resurgence. Below is an analysis of key H2 2026 market trends shaping the U.S. PCB industry.

1. Reshoring and Supply Chain Localization Accelerates

In H2 2026, the U.S. government’s continued emphasis on supply chain resilience—bolstered by incentives from the CHIPS and Science Act and Defense Production Act—has catalyzed a wave of PCB manufacturing reshoring. Companies are increasingly shifting production from Asia to domestic facilities to mitigate geopolitical risks and reduce lead times. This trend is particularly evident in defense, aerospace, and medical electronics, where reliability and IP security are paramount.

Advanced packaging and high-mix, low-volume (HMLV) PCB fabrication are being localized, supported by federal grants and private sector investments in facilities across states like Arizona, Texas, and New York.

2. Growth in High-Performance and HDI PCBs

Demand for high-density interconnect (HDI) and advanced PCBs is surging, driven by next-generation applications in artificial intelligence (AI), data centers, 5G/6G infrastructure, and autonomous vehicles. In H2 2026, U.S. PCB manufacturers are expanding capabilities to produce ultra-fine pitch, rigid-flex, and buried via technologies essential for AI accelerators and edge computing devices.

Leading tech firms are co-developing PCBs with domestic suppliers to ensure compatibility with cutting-edge semiconductor packages like chiplets and 3D-stacked ICs. This vertical integration is fostering innovation and reducing dependency on offshore fabrication.

3. Sustainability and Green Manufacturing Gains Momentum

Environmental, social, and governance (ESG) standards are becoming central to PCB production. In H2 2026, U.S. manufacturers are adopting sustainable practices such as lead-free processes, water recycling, and reduced chemical usage. Regulatory pressures and consumer demand are pushing companies to achieve ISO 14001 certification and disclose lifecycle emissions.

Innovations in recyclable substrates and bio-based laminates are entering pilot stages, with several startups partnering with national labs to commercialize eco-friendly PCB materials.

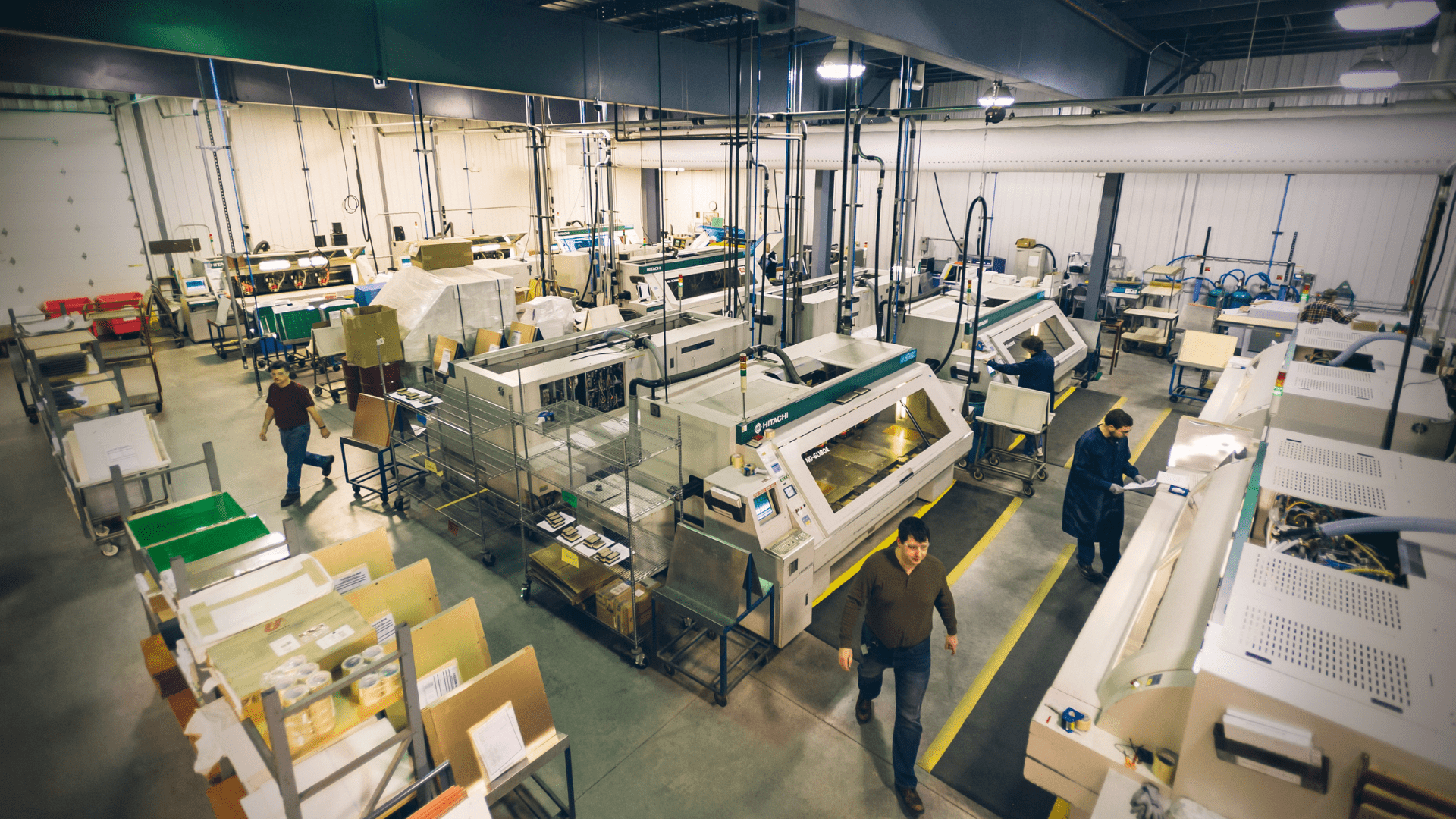

4. Workforce Development and Automation Integration

The U.S. PCB industry faces a skilled labor shortage, but H2 2026 sees increased investment in workforce training programs through collaborations between industry, community colleges, and federal initiatives like the National Network for Manufacturing Innovation (NNMI).

Simultaneously, automation and Industry 4.0 technologies—including AI-driven optical inspection, robotic assembly, and digital twin modeling—are being deployed to improve yields, reduce costs, and enhance precision in complex PCB manufacturing.

5. Defense and Aerospace Drive High-Reliability Demand

With rising global tensions and modernization of U.S. military systems, the defense sector remains a cornerstone of the domestic PCB market. In H2 2026, demand for ruggedized, high-reliability (hi-rel) PCBs used in radar, electronic warfare, and satellite communications is at an all-time high.

The Department of Defense (DoD) is prioritizing trusted foundries, leading to long-term contracts with U.S.-based PCB fabricators compliant with ITAR and NIST 800-171 standards.

6. Consolidation and Strategic Partnerships

The competitive landscape is shifting as mid-sized U.S. PCB manufacturers consolidate to achieve economies of scale and expand technological capabilities. M&A activity is rising, with larger players acquiring niche firms specializing in RF, microwave, or embedded passives.

Strategic partnerships between PCB fabricators, material suppliers (e.g., Isola, DuPont), and design software companies (e.g., Cadence, Altium) are enabling faster time-to-market and better design-for-manufacturability (DFM) outcomes.

Conclusion

H2 2026 marks a pivotal phase for the U.S. PCB industry, characterized by strategic reindustrialization, technological sophistication, and sector-specific growth. While challenges remain—including raw material volatility and global competition—the convergence of policy support, innovation, and domestic demand positions the U.S. to reclaim a stronger foothold in the global PCB value chain. Manufacturers that invest in advanced capabilities, sustainability, and workforce development are best positioned to lead in this new era.

Common Pitfalls When Sourcing PCBs from the USA: Quality and Intellectual Property Concerns

Logistics & Compliance Guide for USA PCB Manufacturing

Import Regulations and Customs Clearance

When importing printed circuit boards (PCBs) into the United States, compliance with U.S. Customs and Border Protection (CBP) regulations is essential. All shipments must be accompanied by accurate documentation, including a commercial invoice, packing list, and bill of lading or air waybill. PCBs are typically classified under Harmonized Tariff Schedule (HTS) code 8534.00.00, which covers printed circuit assemblies. Importers should verify the correct HTS classification to ensure proper duty assessment—many PCBs qualify for duty-free entry under this code, but specific components or finishes may affect eligibility. Additionally, compliance with Section 321 (de minimis) rules allows duty-free entry for shipments valued under $800 per day per importer.

Restricted Substances and Environmental Compliance

PCBs must comply with U.S. environmental and safety standards, particularly those related to hazardous substances. While the U.S. does not enforce the EU’s RoHS (Restriction of Hazardous Substances) directive federally, many states (e.g., California under the RoHS-like Electronic Waste Recycling Act) and commercial customers require RoHS compliance. Manufacturers should ensure PCBs are free from lead, mercury, cadmium, hexavalent chromium, PBB, and PBDEs unless specifically exempted. Additionally, adherence to IPC standards (e.g., IPC-6012 for qualification and performance of rigid PCBs) is strongly recommended to meet industry expectations for quality and reliability.

Trade Agreements and Tariff Exclusions

U.S. importers may benefit from free trade agreements (FTAs) such as the USMCA (United States-Mexico-Canada Agreement) if PCBs are sourced from or substantially transformed in member countries. Proper Certificate of Origin documentation is required to claim preferential tariff treatment. Importers should also monitor the Federal Register for any Section 301 tariff exclusions related to Chinese-origin electronics components, which may include certain PCBs. Although some exclusions have expired, periodic renewals or new filings could impact landed costs.

Labeling and Product Marking Requirements

All imported PCBs must comply with U.S. labeling regulations. While there is no federal mandate for specific PCB markings, industry best practices and customer requirements often necessitate clear identification, including part numbers, revision levels, manufacturer logos, and date codes. If PCBs are sold as part of a consumer product, compliance with FCC labeling (if applicable) and state-specific requirements (e.g., California Prop 65 warnings for certain materials) may be required. Traceability markings also support compliance during audits or recalls.

Transportation and Logistics Best Practices

PCBs are sensitive to electrostatic discharge (ESD), moisture, and physical damage. Use ESD-safe packaging, moisture barrier bags with desiccants (especially for bare PCBs), and rigid outer packaging to prevent warping. Choose logistics partners experienced in handling electronic components, and consider air freight for high-value or time-sensitive orders. For sea freight, ensure proper container sealing and climate control if needed. Real-time shipment tracking and insurance are recommended to mitigate risks during transit.

Recordkeeping and Audit Preparedness

Maintain comprehensive records for a minimum of five years, including import documentation, certificates of compliance (e.g., RoHS, REACH), test reports, and supplier declarations. The U.S. CBP and the Environmental Protection Agency (EPA) may conduct audits to verify compliance with trade and environmental regulations. Digital record management systems can help streamline compliance and facilitate quick response to regulatory inquiries.

Conclusion

Successfully navigating the logistics and compliance landscape for PCBs in the U.S. requires attention to classification, environmental standards, trade policies, and proper handling. Staying informed on regulatory updates and maintaining strong supplier communication ensures smooth import operations and market readiness.

Conclusion: Sourcing PCB Manufacturers in the USA

Sourcing PCB (Printed Circuit Board) manufacturers in the USA offers numerous advantages, particularly for companies prioritizing quality, reliability, fast turnaround times, and supply chain security. Domestic manufacturing reduces lead times, minimizes logistical complexities, and ensures compliance with stringent industry standards such as IPC, ITAR, and ISO. Additionally, working with U.S.-based manufacturers supports greater transparency, easier communication due to time zone alignment, and enhanced intellectual property protection.

While cost may be higher compared to offshore alternatives, the long-term benefits—especially for low-to-medium volume, high-complexity, or mission-critical applications in sectors like defense, aerospace, medical devices, and industrial technology—often justify the investment. The growing emphasis on supply chain resilience and “onshoring” further strengthens the case for partnering with American PCB manufacturers.

Ultimately, sourcing PCBs from the USA aligns with strategic goals of quality control, innovation speed, and risk mitigation. Businesses should evaluate manufacturers based on certifications, technical capabilities, capacity, and responsiveness to ensure a reliable and efficient partnership tailored to their specific project needs.