The global urea formaldehyde resin market is experiencing steady growth, driven by rising demand across industries such as wood composites, adhesives, and coatings. According to Grand View Research, the market was valued at USD 21.8 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.3% from 2023 to 2030, fueled by increasing construction activities and the widespread use of UF resins in particleboard, medium-density fiberboard (MDF), and plywood manufacturing. Additionally, advancements in resin formulations to meet formaldehyde emission standards are reshaping production trends. As demand grows, particularly in Asia-Pacific—a region that both produces and consumes the majority of UF resins—manufacturers are scaling capacity and investing in sustainable technologies. Against this backdrop, the following nine companies have emerged as key players, leading innovation, volume output, and global market reach in the urea formaldehyde manufacturing landscape.

Top 9 Urea Formaldehyde Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Urea Formaldehyde Resin Manufacturers

Domain Est. 1998

Website: capitalresin.com

Key Highlights: We are melamine and urea formaldehyde resin manufacturers in Columbus, Ohio. At Capital Resin, we can manufacture and develop resin for your industry….

#2 Asta Chemicals – Urea Formaldehyde Resin

Domain Est. 2012 | Founded: 1974

Website: astachemicals.com

Key Highlights: Asta Chemicals Sdn. Bhd. was primarily established in 1974 as a producer of formaldehyde and adhesives resins for both local and export markets….

#3 AkzoNobel Urea

Domain Est. 1995

Website: woodadhesives.akzonobel.com

Key Highlights: Urea-formaldehyde (UF) adhesives are used mainly for interior applications. Advantages include high bonding quality combined with fast curing….

#4 Urea

Domain Est. 1998

Website: daviesmolding.com

Key Highlights: Urea-formaldehyde is a very hard, scratch-resistant material with good chemical resistance, electrical qualities, and heat resistance….

#5 High-Quality Urea Formaldehyde Resin

Domain Est. 2000

Website: bakelite.com

Key Highlights: Bakelite manufactures a range of ammoniated and non-ammoniated urea resins with varying physical properties to meet customer-specific processing and performance ……

#6 Urea formaldehyde resins (UF)

Domain Est. 2002

Website: achema.lt

Key Highlights: Urea formaldehyde resins are produced under the following brands: KF-FE, KF-HMN, KF-MEC07, KF-MEC13 and KF-MEC15….

#7 Urea Formaldehyde Resin

Domain Est. 2021

Website: sunshieldchemicals.com

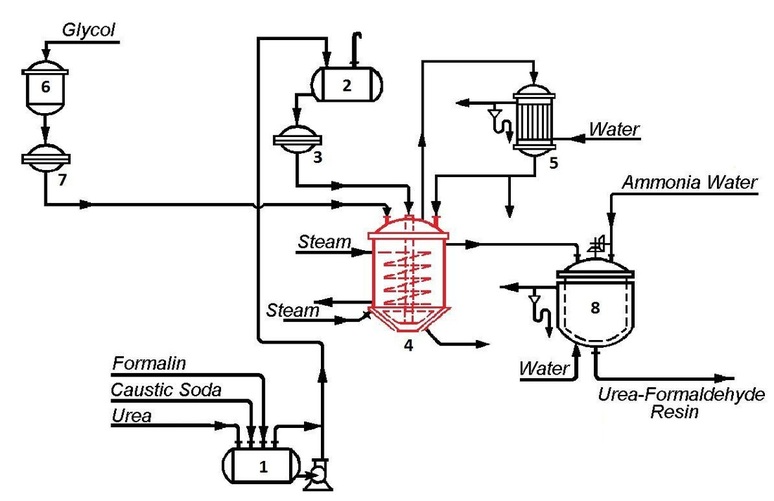

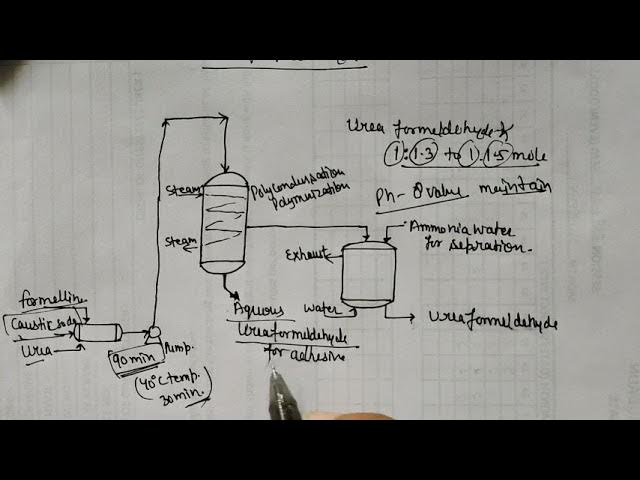

Key Highlights: Sunshield Chemicals Ltd, manufactures Urea formaldehyde, which is a water insoluble thermosetting resin. The process involves reaction of urea and ……

#8 Urea Formaldehyde Plants

Domain Est. 2022

Website: atommek.com

Key Highlights: Atommek provides full-scale Urea Formaldehyde plant solutions covering every stage of your project: Custom Design: Tailored plant layouts to meet ……

#9 To Hyma Synthesis Pvt. Ltd

Domain Est. 2022

Website: hymasynthesis.com

Key Highlights: Hyma Synthesis Private Limited offers a comprehensive catalogue, curated by expert chemists and microbiologists, comprising specialty chemicals and biologics….

Expert Sourcing Insights for Urea Formaldehyde

H2: 2026 Market Trends for Urea Formaldehyde

The global urea formaldehyde (UF) market is projected to experience moderate but steady growth by 2026, driven by ongoing demand in key end-use industries, particularly wood-based panels, agriculture, and adhesives. Several macroeconomic, regulatory, and technological factors are shaping the trajectory of the market in this period.

-

Growth in the Construction and Furniture Sectors

The primary driver of urea formaldehyde demand remains the wood panel industry, where UF resins are extensively used as adhesives in particleboard, medium-density fiberboard (MDF), and plywood. Rapid urbanization, especially in Asia-Pacific countries such as China, India, and Southeast Asian nations, continues to fuel residential and commercial construction, thereby increasing demand for engineered wood products. As a cost-effective and high-performance binder, urea formaldehyde maintains a significant market share despite environmental concerns. -

Environmental and Regulatory Pressures

A major challenge facing the urea formaldehyde market is tightening environmental regulations related to formaldehyde emissions. In regions such as the European Union and North America, standards like CARB (California Air Resources Board) Phase 2 and EPA TSCA Title VI have led to increased scrutiny of formaldehyde-releasing products. By 2026, manufacturers are adapting by developing low-emission or ultra-low-emitting UF resins and incorporating scavengers such as urea, ammonium salts, or melamine to reduce free formaldehyde content. These innovations help maintain market relevance while complying with health and safety norms. -

Shift Toward Sustainable and Bio-based Alternatives

Growing consumer preference for green building materials and sustainable products is encouraging research into bio-based or formaldehyde-free adhesives (e.g., soy-based or isocyanate resins). However, due to their higher cost and limited performance in certain applications, these alternatives have not yet displaced UF resins significantly. By 2026, the UF market is expected to coexist with emerging alternatives, with UF maintaining dominance in price-sensitive markets. -

Regional Market Dynamics

- Asia-Pacific: This region dominates global UF consumption, accounting for over 50% of demand. China and India are key producers and consumers, supported by large domestic construction and furniture industries. Government infrastructure initiatives in these countries are expected to sustain demand through 2026.

- North America and Europe: Growth is more subdued due to mature markets and stringent regulations. However, retrofitting and renovation activities continue to support steady demand for wood panels and UF-based adhesives.

-

Latin America and Africa: These regions are emerging as potential growth areas, driven by rising construction activity and expanding manufacturing sectors.

-

Raw Material Price Volatility

Urea and formaldehyde, the two main feedstocks for UF resin production, are derived from ammonia and methanol, respectively—both linked to natural gas prices. Fluctuations in energy markets can impact production costs. By 2026, integrated production facilities and long-term supply agreements are helping major players mitigate input cost volatility. -

Technological Advancements and Product Innovation

Manufacturers are investing in resin modification technologies to enhance water resistance, durability, and cure speed of UF resins. Hybrid systems that blend UF with melamine or phenolic components are gaining traction in applications requiring improved performance. Additionally, digitalization in production processes is improving consistency and reducing waste. -

Agricultural Applications

Beyond adhesives, urea formaldehyde is used in agriculture as a slow-release nitrogen fertilizer. This segment remains niche but stable, particularly in regions with long growing seasons and high-value crops. Innovations in controlled-release formulations may offer incremental growth opportunities by 2026.

Conclusion

By 2026, the urea formaldehyde market is expected to grow at a CAGR of approximately 3.5–4.5%, reaching a global market value of over USD 15 billion. While environmental concerns and regulatory pressures persist, ongoing innovation and adaptation are enabling UF resins to retain a strong foothold in cost-sensitive and high-volume applications. The future of the market will depend on the industry’s ability to balance performance, cost, and sustainability in an evolving regulatory landscape.

H2: Common Pitfalls in Sourcing Urea Formaldehyde – Quality and Intellectual Property Risks

Sourcing urea formaldehyde (UF) resin, widely used in wood composites, adhesives, and coatings, involves several critical pitfalls related to quality consistency and intellectual property (IP) concerns. Understanding these risks is essential for manufacturers and purchasers to ensure product performance, regulatory compliance, and legal safety.

1. Quality-Related Pitfalls

-

Inconsistent Resin Formulation: UF resins vary significantly in formaldehyde-to-urea ratio, molecular weight, and additives. Suppliers may lack standardized production processes, leading to batch-to-batch variability that affects curing time, bond strength, and emissions.

-

Excessive Free Formaldehyde Content: Poorly controlled synthesis can result in high levels of unreacted formaldehyde. This not only poses health and safety risks (classified as a carcinogen by IARC) but also leads to non-compliance with emission standards such as CARB P2, EPA TSCA Title VI, or E1/E0 in Europe.

-

Inadequate Cure Performance: Substandard resins may exhibit slow curing, incomplete cross-linking, or poor water resistance, compromising the durability of end products like plywood or particleboard.

-

Lack of Technical Documentation: Many suppliers, especially in emerging markets, fail to provide comprehensive data sheets, certificates of analysis (CoA), or safety data sheets (SDS), making it difficult to assess quality and suitability.

-

Stability and Shelf Life Issues: Poor storage conditions or improper formulation can lead to premature polymerization or gelation during transit or storage, rendering the resin unusable.

2. Intellectual Property (IP) Risks

-

Use of Counterfeit or Reverse-Engineered Formulations: Some suppliers may offer resins that mimic patented formulations without proper licensing. This exposes buyers to IP infringement claims, particularly in export markets with strong IP enforcement (e.g., the U.S., EU, or Japan).

-

Unclear IP Ownership in Custom Resins: When co-developing resins with suppliers, companies may assume they own the formulation, but contracts often retain IP rights with the manufacturer. This can limit scalability, freedom to operate, or future sourcing options.

-

Patent Infringement in Additives or Catalysts: Even if the base UF resin is generic, proprietary catalysts or modifiers (e.g., scavengers, accelerators) may be protected by patents. Unlicensed use can lead to legal disputes.

-

Limited Transparency in Supply Chain: Opaque sourcing from subcontractors or toll manufacturers increases the risk of unknowingly purchasing IP-violating products, especially in regions with weak IP enforcement.

Mitigation Strategies

- Conduct rigorous supplier audits, including on-site inspections and third-party lab testing.

- Require compliance with international standards (e.g., ISO 12767 for formaldehyde emissions).

- Secure clear contractual terms on IP ownership and indemnification.

- Work with reputable suppliers who disclose formulations and hold relevant certifications.

- Monitor patent landscapes, particularly when entering new markets or developing customized resins.

By proactively addressing these quality and IP pitfalls, companies can reduce operational risks, ensure product compliance, and protect their innovation investments when sourcing urea formaldehyde resins.

H2: Logistics & Compliance Guide for Urea Formaldehyde

Urea Formaldehyde (UF) resin presents specific logistical and compliance challenges due to its chemical nature, potential hazards, and regulatory oversight. This guide outlines key requirements for the safe and compliant handling, storage, transport, and use of UF resins.

H2: Regulatory Classification & Key Hazards

- Chemical Identity: Urea Formaldehyde Resin (Typically a solution or dispersion in water). CAS Numbers vary (e.g., 9015-00-3 for polymer, 50-00-0 for formaldehyde monomer).

- Primary Hazard: Formaldehyde Emissions. UF resins slowly release formaldehyde gas (a known human carcinogen – IARC Group 1) due to hydrolysis, especially under heat, acid conditions, or over time.

- Classification (GHS/CLP):

- Carcinogenicity: Category 1B (May cause cancer – primarily due to formaldehyde content).

- Specific Target Organ Toxicity (Repeated Exposure): Category 1 (May cause damage to organs – respiratory system).

- Acute Toxicity (Inhalation): Category 3 or 4 (Toxic or Harmful if inhaled – formaldehyde).

- Skin Irritation: Category 2 (Causes skin irritation).

- Serious Eye Damage: Category 1 (Causes serious eye damage).

- Skin Sensitization: Category 1 (May cause an allergic skin reaction).

- Aquatic Toxicity: Often Chronic Category 2 or 3 (Very toxic to aquatic life with long-lasting effects).

- Labeling: Requires GHS/CLP pictograms for Carcinogen, Health Hazard, and Exclamation Mark. Signal word “Danger”. Specific Hazard Statements (H-Statements) include H350 (May cause cancer), H372 (Causes damage to organs), H331 (Toxic if inhaled), H315 (Causes skin irritation), H318 (Causes serious eye damage), H317 (May cause an allergic skin reaction), H411 (Toxic to aquatic life with long-lasting effects). Precautionary Statements (P-Statements) are critical (e.g., P201, P202, P260, P261, P264, P270, P271, P272, P280, P304+P340, P305+P351+P338, P308+P313, P310, P312, P314, P332+P313, P333+P313, P337+P313, P362, P391, P403+P233, P405, P501).

- Regulatory Frameworks:

- REACH (EU): Registered. Subject to SVHC (Substance of Very High Concern) designation for formaldehyde. Requires SDS and potentially authorization/restriction depending on use and formaldehyde release.

- CLP (EU): Mandates correct classification, labeling, and SDS.

- OSHA (USA): Regulated under Formaldehyde Standard (29 CFR 1910.1048) if workplace exposure exceeds action levels. Hazard Communication Standard (29 CFR 1910.1200) requires SDS and labeling.

- TSCA (USA): Regulated chemical. Formaldehyde is subject to specific reporting rules (e.g., CDR).

- GHS: Basis for global classification (adopted variably by countries).

- Transport Regulations: Classified as Class 8 (Corrosive) and potentially Class 9 (Miscellaneous – Environmentally Hazardous) under ADR/RID (Road/Rail – Europe), IMDG (Sea), IATA (Air). UN Number typically UN 3082 (ENVIRONMENTALLY HAZARDOUS SUBSTANCE, LIQUID, N.O.S. (Urea formaldehyde resin)) or UN 2209 (FORMALDEHYDE SOLUTION, stabilized, with <25% formaldehyde) – Confirm exact UN Number and classification on the Safety Data Sheet (SDS) for the specific product formulation. Packing Group II or III.

H2: Safety Data Sheet (SDS) & Risk Assessment

- Mandatory: A current, compliant SDS (GHS/CLP format) must accompany every shipment and be readily available at the workplace.

- Critical Review: Thoroughly review Section 2 (Hazard Identification), Section 3 (Composition), Section 4 (First Aid), Section 7 (Handling & Storage), Section 8 (Exposure Controls/PPE), Section 9 (Physical/Chemical Properties – especially flash point, pH, viscosity), Section 11 (Toxicological Information – formaldehyde content/release), and Section 13 (Disposal).

- Formaldehyde Release Rate: Obtain data on the resin’s formaldehyde emission characteristics (e.g., CHIN, JIS, ASTM methods) for exposure assessment and control planning.

- Site-Specific Risk Assessment: Conduct a detailed assessment evaluating risks during all stages: receipt, storage, handling (pumping, mixing, application), processing (curing), waste handling, maintenance, and emergencies. Focus on inhalation, skin/eye contact, and environmental release.

H2: Handling & Storage

- Ventilation: Use only in well-ventilated areas. Local Exhaust Ventilation (LEV) is mandatory at points of potential emission (e.g., mixing tanks, application points, curing ovens). Ensure LEV is regularly tested and maintained.

- Containment: Prevent spills and leaks. Use closed systems where possible. Secondary containment (e.g., bunded area) is essential for bulk storage.

- Temperature Control: Store in a cool, dry, well-ventilated area away from heat, sparks, open flames, and direct sunlight. Avoid temperatures that accelerate decomposition/formaldehyde release. Follow manufacturer’s temperature recommendations.

- Incompatibilities: Store away from strong acids, strong bases, oxidizing agents, and amines (can cause rapid polymerization or decomposition). Segregate from food, feed, and incompatible chemicals.

- Containers: Use original, unopened containers whenever possible. Ensure containers are tightly closed. Use corrosion-resistant materials (stainless steel, specific plastics). Label clearly.

- Minimize Exposure: Minimize handling time. Avoid generating mists, vapors, or aerosols. Do not eat, drink, or smoke when handling.

H2: Personal Protective Equipment (PPE)

- Respiratory Protection: Required when engineering controls cannot maintain exposure below occupational exposure limits (OELs – e.g., OSHA PEL 0.75 ppm TWA, 2 ppm STEL; EU Indicative OEL 1 ppm / 1.2 mg/m³ TWA). Use appropriate respirators (e.g., NIOSH-approved N95/P2 for low levels/mist; half/full-face respirator with organic vapor cartridges and P100 filters for higher levels/vapors; supplied-air for high concentrations/confined spaces). Fit testing and training are mandatory.

- Eye/Face Protection: Chemical splash goggles are minimum. Face shield required if splash risk exists (e.g., during transfer, mixing).

- Skin Protection: Wear impervious gloves (e.g., nitrile, neoprene, butyl rubber – check SDS compatibility). Wear long sleeves, chemical-resistant apron, and boots. Avoid skin contact.

- Hygiene: Wash hands thoroughly after handling and before breaks/leaving work. Provide emergency showers and eyewash stations within 10 seconds’ reach of handling areas. Launder contaminated work clothing separately.

H2: Transport

- Regulations: Strictly comply with ADR/RID, IMDG Code, or IATA DGR, based on mode of transport.

- Classification: Use the correct UN Number, Proper Shipping Name, Class, and Packing Group as specified on the SDS and based on the specific product formulation.

- Packaging: Use UN-approved packaging marked with the correct specification. Ensure packaging is in good condition, compatible with UF resin, and securely closed.

- Marking & Labeling: Packages must display the correct hazard labels (Class 8 Corrosive, Class 9 Environmentally Hazardous if applicable), UN Number, Proper Shipping Name, and shipper/consignee information.

- Documentation: Prepare a Transport Document (Dangerous Goods Note) with all required information (UN Number, PSN, Class, PG, quantity, emergency info, etc.).

- Vehicle: Use vehicles suitable for dangerous goods, equipped with appropriate fire extinguishers and spill kits. Segregate from incompatible goods. Secure loads to prevent movement.

- Training: Personnel involved in preparing, offering, or transporting must have appropriate dangerous goods training (e.g., ADR Driver Training).

H2: Waste Management & Spill Response

- Waste Classification: Spent resin, contaminated materials (rags, filters, PPE), and residues are hazardous waste due to formaldehyde content and carcinogenicity. Classify according to local regulations (e.g., EU Waste Code 16 05 04 or 16 05 06; US RCRA D001/D003).

- Storage: Store waste in compatible, labeled, closed containers in a secure, bunded area.

- Disposal: Dispose of through licensed hazardous waste contractors only. Never pour down drains or into sewers. Follow disposal methods in SDS Section 13.

- Spill Response:

- Evacuate & Isolate: Clear non-essential personnel. Isolate area.

- Ventilate: Increase ventilation if safe to do so.

- Protect Yourself: Don appropriate PPE (respirator, gloves, suit, goggles/face shield).

- Contain: Prevent entry into drains, watercourses, or soil using absorbents (e.g., sand, vermiculite, commercial spill pads) or diking.

- Collect: Collect spilled material and contaminated absorbents into labeled, compatible containers for hazardous waste disposal.

- Clean: Wash area thoroughly with water and detergent. Ventilate until dry.

- Report: Report significant spills to relevant authorities as required by local regulations.

H2: Monitoring & Health Surveillance

- Exposure Monitoring: Conduct regular air monitoring (personal and area) for formaldehyde vapor, especially where processes involve heat or where engineering controls are used. Compare results to OELs.

- Biological Monitoring: In high-risk scenarios, consider biological monitoring (e.g., formic acid in urine) as per OSHA guidelines, though air monitoring is primary.

- Health Surveillance: Implement a medical surveillance program for exposed workers as required by regulations (e.g., OSHA Formaldehyde Standard). Includes pre-placement and periodic exams, focusing on respiratory and dermal health.

Disclaimer: This guide provides general information. Always consult the specific Safety Data Sheet (SDS) provided by the manufacturer/supplier and comply with all applicable local, national, and international regulations. Regulations and best practices evolve; seek expert advice for complex situations.

In conclusion, sourcing urea formaldehyde requires careful consideration of several key factors including supplier reliability, product quality, regulatory compliance, and cost-effectiveness. Given its widespread use in adhesives, resins, and industrial applications, ensuring a consistent and safe supply is crucial. It is essential to partner with reputable manufacturers or distributors who adhere to environmental and safety standards, particularly concerning formaldehyde emissions. Conducting due diligence, maintaining strong supplier relationships, and staying informed about market trends and regulatory changes will help secure a sustainable and efficient supply chain for urea formaldehyde.