The global urea for plants market is experiencing steady growth, driven by rising agricultural demand and the need for cost-effective nitrogen fertilizers to enhance crop yields. According to a report by Mordor Intelligence, the global urea market was valued at approximately USD 54.8 billion in 2023 and is projected to grow at a CAGR of around 3.5% from 2024 to 2029. This expansion is largely fueled by increasing arable land cultivation, government support for fertilizer subsidies in key agricultural economies, and advancements in fertilizer application technologies. With urea accounting for over 60% of global nitrogen fertilizer consumption, manufacturers are scaling production capacities and investing in efficiency improvements to meet growing demand, particularly in Asia-Pacific, North America, and Latin America. As sustainability and nutrient-use efficiency gain prominence, leading companies are also focusing on controlled-release and stabilized urea formulations. Against this backdrop, the following list highlights the top 10 urea manufacturers shaping the future of modern agriculture.

Top 10 Urea For Plants Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Technical Urea

Domain Est. 2002

Website: yara.us

Key Highlights: Technical grade urea and agriculture grade urea are sold by Yara in the USA. Yara is a urea manufacturer in several of its 30 plants around the world….

#2 QAFCO

Website: qafco.qa

Key Highlights: QAFCO is a fertilizer producer with 6 world-class plants producing a sizeable annual capacity of 3.8 million MT of ammonia and 5.6 million MT of urea….

#3 Urea Ammonium Nitrate (UAN)

Domain Est. 1996

Website: cfindustries.com

Key Highlights: Urea Ammonium Nitrate (UAN) solution, produced by combining urea, nitric acid, and ammonia, is a liquid fertilizer product with a nitrogen content that ……

#4 Urea

Domain Est. 1996

Website: dakotagas.com

Key Highlights: Urea is a granular fertilizer commonly used in agricultural applications. Dakota Gas currently produces two other fertilizers, anhydrous ammonia and ammonium ……

#5 YaraVera™

Domain Est. 1999

Website: yara.com

Key Highlights: YaraVera nitrogen fertilizers are cost-effective, highly concentrated and highly efficient sources of urea. With a nitrogen concentration of 46 %, YaraVera ……

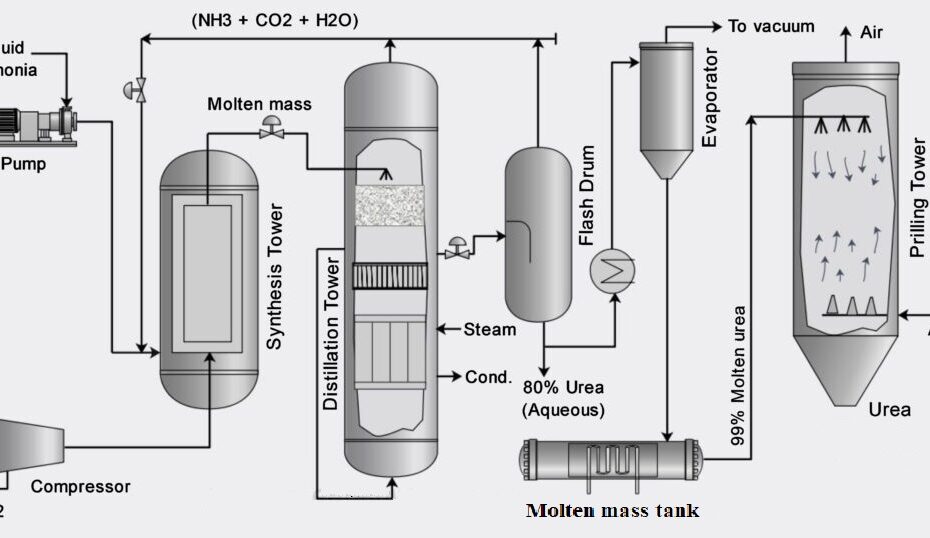

#6 Granular Urea

Domain Est. 2006

Website: notore.com

Key Highlights: Notore Granular Urea fertilizer is a premium-quality source of Nitrogen (N) produced from Ammonia and carbon dioxide reactions….

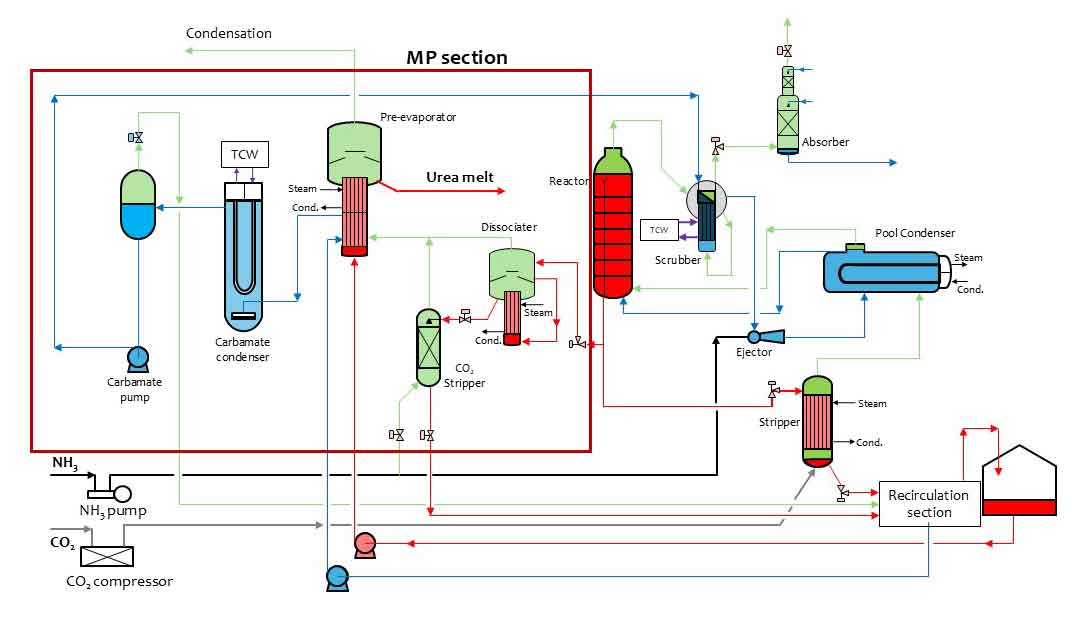

#7 Urea Plants

Domain Est. 2011

Website: thyssenkrupp-uhde.com

Key Highlights: Discover thyssenkrupp Uhde’s expertise in building the world’s largest urea plants. Explore cutting-edge CO₂ stripping and fluid bed granulation ……

#8 Urea

Domain Est. 2015

Website: rfcl.co.in

Key Highlights: Urea is a highly concentrated, solid, nitrogenous fertilizer, containing 46.0% Nitrogen. It is completely soluble in water hence Nitrogen is easily available ……

#9 Fertiliser

Domain Est. 2016

Website: indoramafertilizers.com

Key Highlights: The main function of Urea fertilizer is to provide the plants with nitrogen to promote green leafy growth and make the plants look lush. Urea also aids the ……

#10 UREA

Domain Est. 2020

Website: elnubar.com

Key Highlights: Urea fertilizer is a stable, organic fertilizer that can improve the quality of your soil, provide nitrogen to your plants, and increase the yield of your crops ……

Expert Sourcing Insights for Urea For Plants

H2: 2026 Market Trends for Urea for Plants

The global market for urea in agricultural applications is poised for significant transformation by 2026, driven by evolving farming practices, sustainability demands, and technological advancements. As one of the most widely used nitrogen fertilizers, urea continues to play a pivotal role in enhancing crop productivity. However, emerging trends are reshaping its production, distribution, and application methods.

1. Rising Demand for Enhanced-Efficiency Urea Products

By 2026, the demand for enhanced-efficiency urea (EEU), including polymer-coated, stabilized, and slow-release formulations, is expected to grow substantially. These variants minimize nitrogen loss through volatilization, leaching, and denitrification, addressing both environmental concerns and cost inefficiencies. Governments and agribusinesses are increasingly investing in urease and nitrification inhibitors, which improve nitrogen use efficiency (NUE) and align with precision farming goals.

2. Sustainability and Regulatory Pressures

Environmental regulations are tightening globally, particularly in regions like the European Union and North America. Policies aimed at reducing greenhouse gas emissions—especially nitrous oxide from nitrogen fertilizers—are pushing manufacturers and farmers toward greener alternatives. By 2026, compliance with carbon footprint standards and fertilizer use caps will likely accelerate the adoption of low-emission urea technologies and integrated nutrient management systems.

3. Integration with Precision Agriculture

Digital farming tools such as GPS-guided application systems, variable-rate technology (VRT), and soil nutrient sensors are becoming mainstream. This shift enables site-specific urea application, reducing waste and optimizing yields. By 2026, urea distribution is expected to increasingly rely on data-driven models, allowing farmers to apply the right amount of nitrogen at the right time and place.

4. Shift Toward Green and Blue Urea

The production of traditional urea is energy-intensive and reliant on fossil fuels, primarily natural gas. However, by 2026, there is growing momentum toward “green urea” produced using renewable energy and “blue urea” derived from fossil fuels with carbon capture and storage (CCS). Pilot projects in countries like China, India, and Australia are paving the way for scalable low-carbon urea production, supported by climate financing and carbon credit mechanisms.

5. Regional Market Dynamics

Asia-Pacific, particularly India and China, will remain the largest consumers of urea due to intensive agriculture and government subsidies. However, by 2026, Africa and South America are expected to see accelerated growth as smallholder farmers gain better access to improved fertilizers. In contrast, Europe may witness a plateau or slight decline in conventional urea use due to regulatory restrictions and a stronger push for organic and alternative nutrient sources.

6. Supply Chain Resilience and Price Volatility

Global geopolitical tensions and fluctuating natural gas prices continue to impact urea supply chains. By 2026, stakeholders are likely to prioritize localized production and strategic stockpiling to mitigate disruptions. Additionally, digital platforms for urea trading and transparent pricing mechanisms are expected to enhance market stability and access for small-scale farmers.

In summary, the urea for plants market in 2026 will be defined by innovation, sustainability, and digital integration. While demand remains strong, the industry is transitioning toward smarter, cleaner, and more efficient nitrogen management solutions to meet both food security and environmental goals.

H2: Common Pitfalls When Sourcing Urea for Plants (Quality & Intellectual Property)

Sourcing urea fertilizer is essential for agricultural productivity, but overlooking key quality and intellectual property (IP) aspects can lead to reduced crop yields, financial losses, and compliance issues. Here are the common pitfalls to avoid:

1. Compromised Product Quality

- Low Nitrogen Content: Urea should typically contain 46% nitrogen (N). Sourcing urea with lower N content means paying for less actual nutrient, directly reducing fertilizer efficiency and crop response.

- High Biuret Levels: Biuret is a toxic byproduct formed during urea production. Levels above 1.0–1.5% can damage seedlings and reduce germination. Low-quality urea often has elevated biuret, harming plant health.

- Moisture and Caking: Poor storage or manufacturing can lead to high moisture content, causing urea granules to cake. Caked urea is difficult to handle, spread unevenly, and may degrade faster.

- Impurities and Contaminants: Substandard urea may contain heavy metals (e.g., chromium, cadmium) or other chemical residues that harm soil health and food safety, especially in regulated markets.

- Inconsistent Granule Size: Non-uniform granule size leads to uneven spreading and variable nutrient distribution across fields, reducing application efficiency.

2. Lack of Certification and Traceability

- Missing Quality Certifications: Failing to verify standards like ISO 9001, Fertilizer Standards (e.g., ASTM D-7162), or regional regulations (e.g., EU Fertilising Products Regulation) increases the risk of receiving subpar product.

- No Batch Traceability: Without proper lot numbering and documentation, it’s difficult to trace issues (e.g., contamination or underperformance) back to the source, complicating recalls or claims.

3. Intellectual Property (IP) and Branding Risks

- Counterfeit or Misbranded Products: Some suppliers may falsely label generic urea as premium-branded or patented slow-release formulations (e.g., polymer-coated urea). This infringes IP rights and delivers inferior agronomic performance.

- Unauthorized Use of Technology: Premium urea products often involve patented technologies (e.g., urease inhibitors like NBPT, or nitrification inhibitors). Sourcing knock-offs denies access to enhanced efficiency and may breach IP laws.

- Grey Market Imports: Purchasing branded urea through unauthorized channels may void warranties, lack technical support, and expose buyers to legal risks in jurisdictions with strict IP enforcement.

4. Inadequate Supplier Due Diligence

- Unverified Manufacturers: Relying on intermediaries without vetting the actual producer can result in inconsistent quality. Always audit supplier facilities or demand third-party test reports.

- Lack of Transparency: Suppliers unwilling to provide Material Safety Data Sheets (MSDS), Certificates of Analysis (CoA), or production details may be hiding quality issues.

5. Logistics and Storage Mismanagement

- Exposure to Humidity and Heat: Urea is hygroscopic. Poor transport or storage conditions (e.g., open trucks, damp warehouses) lead to moisture absorption, caking, and nitrogen loss through volatilization.

- Extended Storage Without Protection: Long-term storage without proper sealing or climate control degrades urea quality, especially in tropical climates.

Mitigation Strategies:

– Require Third-Party Testing: Insist on CoA from accredited labs verifying N content, biuret levels, moisture, and granule strength.

– Choose Reputable Suppliers: Partner with certified, transparent suppliers with a proven track record and compliance history.

– Verify IP Status: For enhanced-efficiency urea, ensure products are licensed and legally sourced to avoid infringement.

– Implement Proper Storage: Store urea in dry, covered areas on pallets, away from direct sunlight and moisture.

– Audit Supply Chain: Trace the product from manufacturer to delivery to ensure integrity.

By addressing these pitfalls, agricultural buyers can ensure they source effective, safe, and legally compliant urea—maximizing yield potential and protecting their operations.

Logistics & Compliance Guide for Urea for Plants

Overview

Urea (chemical formula: CO(NH₂)₂) is one of the most widely used nitrogen fertilizers in agriculture due to its high nitrogen content (approximately 46%). While essential for plant growth, its transport, storage, and handling are subject to various regulations due to its chemical properties and potential environmental and safety risks. This guide outlines key logistics and compliance considerations for the safe and legal management of urea intended for agricultural use.

Classification and Regulatory Status

Urea is generally classified as a non-hazardous material for transport under most international regulations when intended for agricultural use and in standard granular form. However, specific regulatory frameworks may apply depending on the region and mode of transport.

- UN Number: Typically not assigned for agricultural-grade urea (non-hazardous classification).

- IMO/IMDG Code: Not classified as a dangerous good under the International Maritime Dangerous Goods (IMDG) Code when transported in bulk or bags for agricultural purposes.

- IATA/ICAO: Not regulated as a dangerous good for air transport when shipped as fertilizer.

- ADR (Europe): Not subject to ADR regulations for road transport in its standard form.

- OSHA (USA): Not classified as a hazardous chemical under OSHA’s Hazard Communication Standard (HCS) when used as a fertilizer, though safety data sheets (SDS) must still be available.

Note: Always confirm the classification based on the specific product formulation and purity, as industrial or technical grades may have different regulatory requirements.

Packaging and Labeling Requirements

Proper packaging and labeling ensure product integrity and regulatory compliance.

- Packaging: Urea is commonly shipped in:

- Woven polypropylene bags (25–50 kg)

- Bulk in containers (20’ or 40’) or in bulk vessels

- Big bags (1,000 kg capacity)

Packaging must be moisture-resistant to prevent caking and degradation.

- Labeling:

- Bags must display:

- Product name (“Urea Fertilizer” or equivalent)

- Nitrogen content (e.g., “46% N”)

- Net weight

- Manufacturer or distributor name and address

- Batch or lot number

- Applicable regulatory symbols (e.g., agriculture product logo, if required locally)

- Safety Data Sheet (SDS): Must be provided to buyers and handlers per GHS (Globally Harmonized System) requirements, even if urea is non-hazardous.

Storage Guidelines

Proper storage prevents quality loss and environmental contamination.

- Environment: Store in a cool, dry, and well-ventilated area.

- Moisture Control: Urea is hygroscopic—protect from rain and humidity to prevent caking and decomposition.

- Compatibility: Do not store with strong oxidizers, acids, or alkaline materials to avoid chemical reactions.

- Stacking: Limit stack height to prevent bag compression and caking (typically max 10 bags high).

- Pest Control: Protect from rodents and insects to avoid packaging damage.

- Spill Management: Have procedures in place to contain and clean spills to prevent runoff into water bodies.

Transportation Requirements

Transport methods must maintain product quality and comply with local and international rules.

- Road/Rail:

- Use covered vehicles to protect from moisture.

- Secure loads to prevent shifting.

- Avoid contamination with incompatible goods.

- Maritime:

- In bulk, ensure holds are clean and dry.

- Monitor for moisture ingress during long voyages.

- Declare as non-dangerous cargo unless impurities or additives alter classification.

- Air:

- Permitted as non-dangerous cargo; follow IATA packaging guidelines.

- Declare accurately on air waybills.

Environmental and Safety Compliance

Urea is low-risk but not without environmental concerns.

- Water Contamination: Urea can hydrolyze to ammonia in water, posing risks to aquatic life. Prevent runoff into rivers, lakes, or drains.

- Air Quality: Dust generated during handling can be an irritant. Use dust suppression methods (e.g., misting, enclosed systems).

- Worker Safety:

- Provide gloves and dust masks where dust exposure is likely.

- Ensure adequate ventilation in enclosed storage or handling areas.

- Train staff on SDS content and emergency procedures.

- Spill Response:

- Sweep up dry material; avoid using water unless necessary (can promote ammonia release).

- Contain spill area and prevent entry into drainage systems.

Regulatory Compliance by Region

Compliance varies by jurisdiction. Key considerations include:

- United States (EPA, DOT):

- Reportable Quantity (RQ) under CERCLA: Urea is not listed, but ammonia (its breakdown product) is.

- Maintain SDS and comply with state-level fertilizer registration (e.g., state departments of agriculture).

- European Union:

- Subject to Fertilising Products Regulation (EU) 2019/1009.

- CE marking may be required for compliant products.

- REACH/CLP regulations: Urea is registered but not classified as hazardous.

- Canada (CFIA, Transport Canada):

- Regulated under Fertilizers Act; must be registered with CFIA.

- Transport as non-dangerous under TDG regulations.

- Australia (APVMA):

- Requires registration under the Agricultural and Veterinary Chemicals Code.

- Follow ADG Code for transport (non-hazardous classification applies).

Documentation and Record-Keeping

Maintain accurate records to support compliance and traceability.

- Safety Data Sheet (SDS) – updated and accessible

- Certificate of Analysis (CoA) for quality assurance

- Transport documentation (bill of lading, air waybill, etc.)

- Regulatory permits or registrations (e.g., fertilizer product license)

- Storage and handling logs (especially for large facilities)

Best Practices Summary

- Always verify local regulations before shipping.

- Use moisture-resistant, robust packaging.

- Label clearly and provide SDS to all handlers.

- Train staff in safe handling and emergency response.

- Store properly to maintain product quality.

- Monitor environmental impact and prevent contamination.

By adhering to this guide, stakeholders in the urea supply chain can ensure safe, efficient, and compliant operations—from production to delivery at the farm gate.

In conclusion, sourcing urea for plants can be a highly effective and economical choice for providing a concentrated form of nitrogen, which is essential for healthy plant growth, leaf development, and high agricultural productivity. Urea’s high nitrogen content (46%) makes it one of the most nitrogen-dense fertilizers available, offering efficiency in both transport and application. However, careful consideration must be given to proper application methods—such as timing, placement, and incorporation into the soil—to minimize nitrogen loss through volatilization and prevent potential damage to seeds or seedlings. Additionally, environmental factors like soil pH, moisture, and temperature should be monitored to optimize urea’s effectiveness. When sourced responsibly and used according to best agronomic practices, urea can significantly enhance crop yields while maintaining cost-efficiency, making it a valuable component of modern sustainable farming systems.