The global automotive air conditioning market is experiencing robust growth, driven by rising vehicle production, increasing consumer demand for comfort and energy efficiency, and stringent environmental regulations. According to Mordor Intelligence, the market was valued at USD 66.8 billion in 2023 and is projected to reach USD 91.3 billion by 2029, growing at a CAGR of 5.3% during the forecast period. This expansion is further fueled by the proliferation of electric vehicles, which require advanced thermal management systems, creating new opportunities for AC component manufacturers. Amid this evolving landscape, five universal automotive air conditioning manufacturers have emerged as key players, offering compatible solutions across a wide range of vehicle makes and models. These companies combine global reach, technological innovation, and strong supply chain networks to meet the escalating demand for reliable and efficient climate control systems.

Top 5 Universal Automotive Air Conditioning Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Vintage Air

Domain Est. 1996

Website: vintageair.com

Key Highlights: Our SureFit kits are complete, vehicle-specific integrated heat / cool / defrost systems designed to deliver a factory-installed look with modern performance….

#2 Universal Air Conditioner

Domain Est. 2011

Website: aezion.com

Key Highlights: UAC is an automotive aftermarket air conditioning parts manufacturer headquartered in Texas. It is a family-owned and operated third-generation business….

#3 Universal Air Conditioning Systems

Domain Est. 1999

Website: classicautoair.com

Key Highlights: Universal Air Conditioning from Classic Auto Air. High Performance / High Efficiency Custom AC Kits for your hot rod or pro touring classic….

#4 to UAC

Domain Est. 2000

Website: uacparts.com

Key Highlights: Automotive Climate Control Products · Compressors · Evaporators · Accumulators & Driers · Expansion Devices · Condensers · Hose Assemblies · Electrical Components….

#5 Treeligo

Domain Est. 2018

Website: treeligo.com

Key Highlights: Treeligo’s range of portable vehicle air conditioners and accessories are designed for convenience and optimal comfort….

Expert Sourcing Insights for Universal Automotive Air Conditioning

H2: 2026 Market Trends for Universal Automotive Air Conditioning

As the automotive industry evolves toward electrification, sustainability, and enhanced user experience, the universal automotive air conditioning (AAC) market is poised for significant transformation by 2026. Key trends shaping the landscape include technological innovation, regulatory pressures, shifting consumer demands, and supply chain dynamics. Below is an analysis of the major market trends expected to influence the universal AAC sector in 2026.

1. Electrification and EV Integration

With global electric vehicle (EV) adoption accelerating—driven by government mandates, falling battery costs, and improved infrastructure—universal AAC systems are being redesigned to meet the unique thermal management needs of EVs. Unlike internal combustion engine (ICE) vehicles, EVs rely entirely on electric compressors and heat pump systems for cabin cooling and battery thermal regulation. By 2026, universal air conditioning components will increasingly feature high-efficiency electric scroll compressors, refrigerant compatibility with R-1234yf or CO₂ (R-744), and integration with vehicle energy management systems to preserve driving range.

2. Sustainability and Refrigerant Regulations

Environmental regulations, particularly those targeting global warming potential (GWP) of refrigerants, are a major driver. The global phase-down of high-GWP hydrofluorocarbons (HFCs) under the Kigali Amendment to the Montreal Protocol will push widespread adoption of low-GWP alternatives. By 2026, R-1234yf will dominate the universal aftermarket, while CO₂-based systems will gain traction in premium and electric vehicles. Universal AAC manufacturers will need to ensure backward compatibility with older systems while offering retrofit solutions compliant with evolving environmental standards.

3. Growth of the Aftermarket and Universal Fit Components

As the global vehicle parc ages and includes a broader mix of makes and models—especially in emerging markets—the demand for universal, retrofit-compatible air conditioning components will rise. Universal condensers, hoses, evaporators, and compressor kits that can be adapted across multiple platforms will gain market share. This trend is supported by independent repair shops and DIY consumers seeking cost-effective, readily available replacements, especially as OEM parts remain expensive and supply-constrained.

4. Smart Climate Control and Connectivity

The integration of smart technologies into climate systems is expanding beyond OEMs into the aftermarket. By 2026, universal AAC solutions may incorporate smart sensors, remote diagnostics via mobile apps, and adaptive cooling algorithms. These features will appeal to consumers seeking enhanced comfort, energy efficiency, and predictive maintenance alerts—particularly in modified or vintage vehicles being retrofitted with modern HVAC systems.

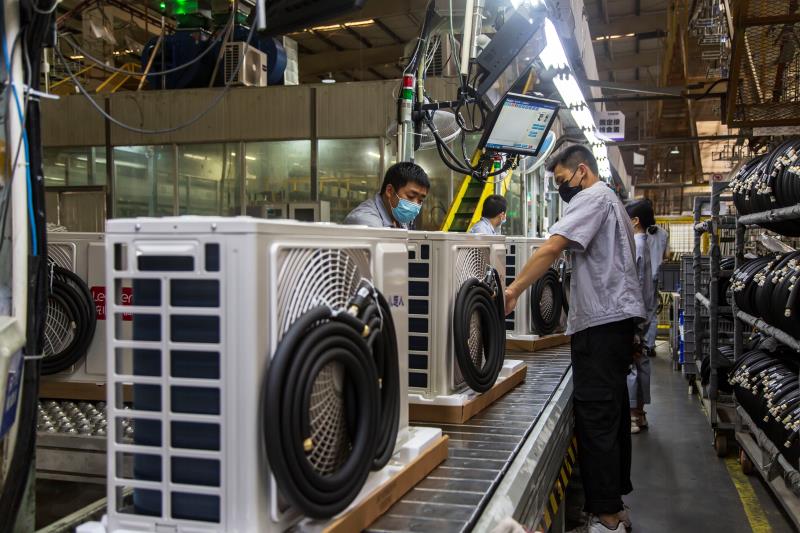

5. Supply Chain Resilience and Localization

Ongoing geopolitical tensions and post-pandemic supply chain disruptions have prompted manufacturers to regionalize production. By 2026, many universal AAC component suppliers will likely establish localized manufacturing hubs in North America, Europe, and Southeast Asia to reduce dependency on single-source suppliers and improve delivery times. This shift will also support faster response to regional regulatory changes and customization needs.

6. Increased Demand in Emerging Markets

In regions such as India, Southeast Asia, Africa, and Latin America, rising vehicle ownership and extreme climatic conditions will fuel demand for affordable, durable universal air conditioning systems. These markets favor cost-effective solutions that can be easily installed in diverse vehicle types, including commercial fleets and used imports. Universal AAC manufacturers will tailor product lines to these environments, emphasizing durability, heat resistance, and ease of service.

7. Consolidation and Innovation in the Aftermarket

The universal AAC space is expected to see increased consolidation among component suppliers and distributors as companies seek economies of scale and broader product portfolios. At the same time, innovation in materials—such as lightweight aluminum microchannel condensers and corrosion-resistant coatings—will enhance performance and longevity, differentiating leading brands in a competitive aftermarket.

Conclusion:

By 2026, the universal automotive air conditioning market will be defined by its adaptability to electrification, compliance with environmental standards, and responsiveness to global consumer needs. Manufacturers that invest in energy-efficient, smart, and universally compatible HVAC solutions will capture significant market share. As vehicles become more technologically advanced, the role of universal components in ensuring accessibility, affordability, and sustainability in automotive climate control will be more critical than ever.

Common Pitfalls Sourcing Universal Automotive Air Conditioning (Quality, IP)

Sourcing universal automotive air conditioning (A/C) components can offer cost savings and flexibility, but it also presents several risks—particularly in terms of quality and intellectual property (IP). Being aware of these pitfalls helps ensure reliable performance and legal compliance.

Quality Inconsistencies

Universal A/C parts are designed to fit a wide range of vehicle makes and models, which can lead to variability in manufacturing standards. Suppliers—especially those based overseas—may use subpar materials or lack rigorous quality control processes. This often results in premature system failure, refrigerant leaks, or inefficient cooling. Buyers may unknowingly receive components that don’t meet OEM specifications, impacting vehicle performance and safety.

Lack of Standardization

Unlike OEM parts, universal components are not always built to exacting standards. Differences in thread types, hose lengths, O-ring materials, and compressor compatibility can result in improper fits or installation issues. This lack of standardization increases the risk of system contamination, pressure loss, and long-term reliability problems.

Counterfeit and Non-Certified Products

The universal A/C market is prone to counterfeit goods that mimic reputable brands. These products often lack proper certification (e.g., ISO, SAE, or EPA compliance) and may not undergo required testing for pressure tolerance or refrigerant compatibility. Using uncertified parts can void vehicle warranties and expose suppliers or installers to liability.

Intellectual Property (IP) Infringement

Many universal A/C components replicate patented designs from OEMs or established aftermarket brands. Sourcing such parts—especially from manufacturers that reverse-engineer protected technology—risks IP violations. Distributors and resellers may face legal action, product seizures, or reputational damage if they distribute components that infringe on design or utility patents.

Limited Traceability and Support

Universal parts often lack batch tracking, manufacturer warranties, or technical support. When failures occur, diagnosing the root cause becomes difficult, and recourse is limited. This opacity also complicates compliance with environmental regulations, such as those governing refrigerant handling and disposal.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Source from reputable, certified suppliers with verifiable quality management systems.

– Request documentation such as test reports, material certifications, and compliance statements.

– Conduct product audits or third-party testing before large-scale procurement.

– Perform IP due diligence to ensure components do not infringe on existing patents.

– Prioritize suppliers that offer traceability, warranties, and responsive technical support.

Proactively addressing quality and IP concerns ensures reliable performance and reduces legal and operational risks when sourcing universal automotive A/C components.

Logistics & Compliance Guide for Universal Automotive Air Conditioning

This guide outlines the essential logistics and compliance considerations for the distribution, handling, and sale of Universal Automotive Air Conditioning (UAAC) products. Adherence to these standards ensures operational efficiency, regulatory compliance, and customer safety.

Regulatory Compliance

Environmental Protection Regulations

Universal Automotive Air Conditioning products often contain refrigerants regulated under environmental laws such as the U.S. Environmental Protection Agency (EPA) Section 608 of the Clean Air Act. All personnel involved in handling, installation, or servicing of HVAC systems must be EPA 608 certified. Refrigerant recovery, recycling, and reclamation procedures must follow EPA guidelines to prevent ozone depletion and greenhouse gas emissions.

International Shipping Standards (IMDG, IATA)

When shipping refrigerant-containing units or pressurized components internationally, compliance with International Maritime Dangerous Goods (IMDG) Code and International Air Transport Association (IATA) Dangerous Goods Regulations is mandatory. Proper classification, packaging, labeling, documentation, and training are required for safe and legal transport.

Product Certification and Labeling

All UAAC products must meet safety and performance standards such as SAE J639, UL, CE, or E-Mark certification where applicable. Products sold in the U.S. must include required labels indicating refrigerant type, safety warnings, and compliance with EPA and Department of Transportation (DOT) regulations.

Supply Chain & Inventory Management

Cold Chain and Temperature-Sensitive Components

While most UAAC components are not temperature-sensitive, certain seals, hoses, and electronic controls may degrade under extreme heat or cold. Storage facilities should maintain controlled environments (typically 40°F–80°F / 4°C–27°C) to preserve product integrity.

Inventory Rotation and Shelf Life

Implement a First-Expired, First-Out (FEFO) inventory system for components with shelf life limitations (e.g., desiccant filters, o-rings, and refrigerant oils). Regular audits ensure expired or degraded materials are not distributed.

Vendor and Supplier Compliance

Ensure all suppliers comply with ISO 9001 and ISO 14001 standards. Conduct periodic audits to verify adherence to quality management and environmental practices. Supplier documentation, including Material Safety Data Sheets (MSDS/SDS), must be current and accessible.

Transportation & Handling

Domestic Freight Compliance (DOT)

Refrigerant cylinders and pressurized components are regulated by the U.S. Department of Transportation (DOT). Use DOT-compliant cylinders, secure loads properly, and ensure transport vehicles are labeled according to hazardous materials regulations (49 CFR).

Packaging and Damage Prevention

Use manufacturer-approved packaging designed to prevent vibration, impact, and moisture damage during transit. Clearly label packages with handling instructions (e.g., “Fragile,” “This Side Up”) and refrigerant hazard symbols when applicable.

Carrier Selection and Tracking

Partner with carriers experienced in handling automotive HVAC components and hazardous materials. Use real-time tracking and insurance for high-value shipments. Maintain records of shipping manifests and delivery confirmations.

Import/Export Requirements

Customs Documentation

For international trade, ensure accurate Harmonized System (HS) codes are used (e.g., 8415.81 for air conditioning units). Prepare commercial invoices, packing lists, and certificates of origin. Refrigerant shipments may require EPA import/export authorizations.

Trade Compliance (ITAR, EAR)

While most UAAC products are not subject to ITAR, certain advanced electronic controls or sensors may fall under Export Administration Regulations (EAR). Conduct regular screening to confirm export classification and licensing requirements.

Safety and Training

Employee Training Programs

All logistics and warehouse staff must complete training in hazardous materials handling, OSHA safety standards, and emergency response procedures. Refresher courses should occur annually or as regulations change.

Incident Reporting and Emergency Preparedness

Establish protocols for refrigerant leaks, fire, or transportation incidents. Maintain spill kits, ventilation systems, and emergency contact lists. Report all incidents per EPA, OSHA, and DOT requirements.

Sustainability and Reverse Logistics

Refrigerant Recovery and Recycling

Implement a certified refrigerant reclamation program for used or off-spec refrigerants. Partner with EPA-approved reprocessors to ensure environmentally sound disposal.

End-of-Life Product Returns

Develop a return material authorization (RMA) process for defective or obsolete units. Evaluate returned products for refurbishment, resale, or recycling to minimize waste and support circular economy goals.

Auditing and Continuous Improvement

Regulatory Audits

Conduct internal and third-party audits at least annually to verify compliance with environmental, safety, and transportation regulations.

Key Performance Indicators (KPIs)

Monitor metrics such as on-time delivery rate, damage rate, compliance violation incidents, and inventory accuracy to drive operational improvements.

By following this guide, Universal Automotive Air Conditioning can ensure safe, compliant, and efficient logistics operations across its supply chain.

In conclusion, sourcing universal automotive air conditioning components requires careful consideration of compatibility, quality, supplier reliability, and cost-effectiveness. Universal AC parts offer flexibility and convenience, especially for older or less common vehicle models, but proper research and due diligence are essential to ensure proper fit and performance. By partnering with reputable suppliers, verifying product specifications, and staying informed about industry standards, businesses and technicians can efficiently source reliable universal AC solutions that meet diverse customer needs while maintaining system efficiency and longevity. Ultimately, a strategic sourcing approach supports operational efficiency, customer satisfaction, and long-term success in the automotive repair and maintenance industry.