The global stainless steel market, driven by rising demand in construction, automotive, and industrial equipment sectors, is projected to grow at a CAGR of 5.2% from 2023 to 2028, according to Mordor Intelligence. Within this landscape, Type 304 stainless steel—known for its excellent corrosion resistance, formability, and versatility—accounts for over 50% of total stainless steel production worldwide. As a result, manufacturers specializing in Union 304 products have become pivotal players in meeting industry specifications across food processing, pharmaceuticals, and chemical applications. With increasing infrastructure investments and stricter regulatory standards, sourcing high-quality Union 304 components has never been more critical. This list highlights the top seven manufacturers leading in innovation, output volume, and global market reach, based on production capacity, compliance certifications, and supply chain performance metrics.

Top 7 Union 304 Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

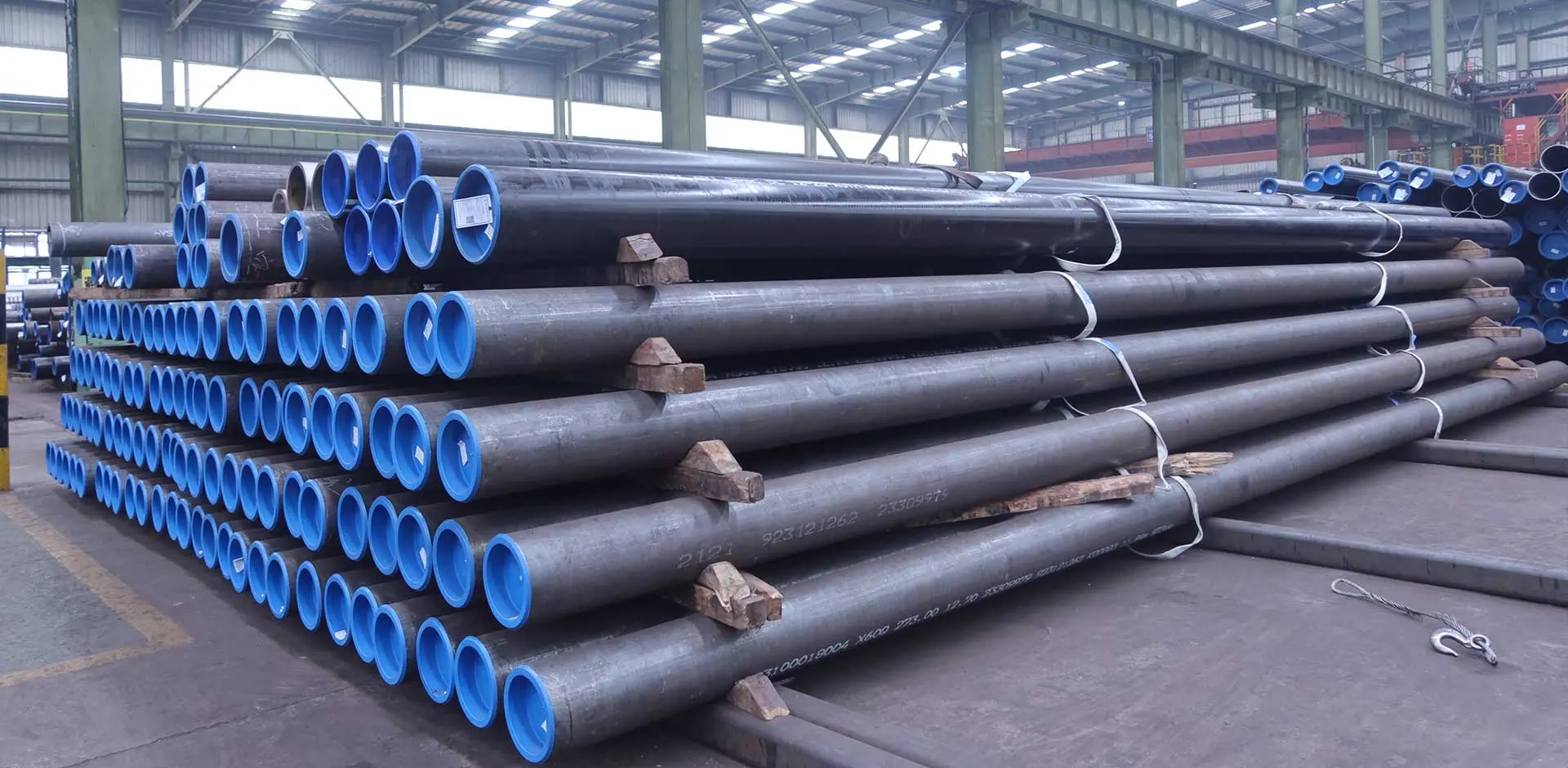

#1 1/2″ Stainless Steel Union, Type 304, Schedule 40, Threaded.

Domain Est. 1996

Website: ussupply.com

Key Highlights: Durable 1/2-inch stainless steel union provides corrosion-resistant connections for plumbing systems with a 150 lb pressure class rating….

#2 Weeks Marine

Domain Est. 1999

Website: weeksmarine.com

Key Highlights: We draw on over a century of success to create the most effective and innovative solutions in marine construction, dredging, marine services, tunneling and ……

#3 IUOE LOCAL 132

Domain Est. 2006

Website: iuoe132.org

Key Highlights: The International Union of Operating Engineers (IUOE) is a progressive trade union representing workers throughout the United States and Canada….

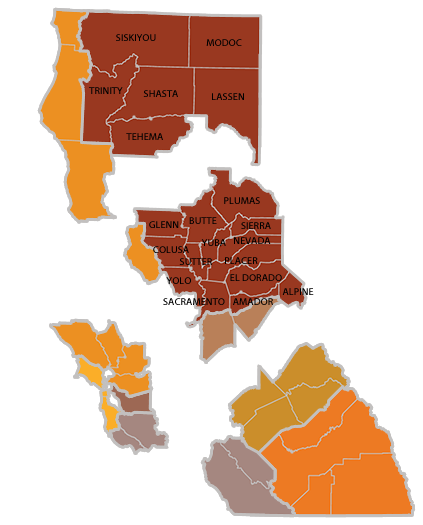

#4 Laborers Local 304

Domain Est. 2008

Website: laborers304.org

Key Highlights: Welcome to our LIUNA, Local 304 website. As an affiliate of the Northern California District Council of Laborers and the Laborers Pacific Southwest Region, we ……

#5 Union PSD » Union Public Service District

Domain Est. 2013

Website: unionpsd.com

Key Highlights: We are Union PSD in Kanawha County, NOT Union Williams PSD in Wood County. If you are trying to reach Union Williams PSD please call 304-464-5121….

#6 304/L Stainless Steel 3000# Forged Socket Weld Union

Domain Est. 2020

Website: asc-es.com

Key Highlights: 304/L Stainless Steel 3000# Forged Socket Weld Union. Union S5034 U. Enlarge. Product Description. 304/L Stainless Steel 3000# Forged Socket Weld Union….

#7 Local Union Directory

Domain Est. 1998

Website: ibew.org

Key Highlights: Get in touch with the International Brotherhood of Electrical Workers (IBEW) Headquarters. Located at 900 Seventh Street, N.W., Washington, DC 20001….

Expert Sourcing Insights for Union 304

H2: 2026 Market Trends Outlook for Union 304 Stainless Steel

As we approach 2026, the global market for Union 304 stainless steel—a widely used austenitic stainless steel known for its excellent corrosion resistance, formability, and durability—is expected to experience steady growth driven by multiple macroeconomic, industrial, and regional factors. Union 304, often synonymous with ASTM AISI 304 or 1.4301 in international standards, remains a cornerstone material across construction, automotive, consumer goods, food processing, and industrial equipment sectors.

Key 2026 Market Trends:

-

Increased Demand from Infrastructure and Construction Sectors

Global infrastructure development, especially in emerging economies in Asia-Pacific (e.g., India, Vietnam) and Africa, is projected to drive demand for durable and corrosion-resistant materials. Union 304 is favored in architectural applications, handrails, and structural components, with green building certifications promoting its recyclability and longevity. -

Growth in Consumer and Industrial Appliances

The expanding middle class in developing nations is boosting demand for home appliances—refrigerators, ovens, sinks—all of which commonly use Union 304. Additionally, industrial machinery and food processing equipment continue to rely on its hygienic and non-reactive properties, supporting sustained demand. -

Automotive and Transportation Applications

While higher grades like 316 may dominate under-hood or exhaust systems, Union 304 is increasingly used in trim, fasteners, and interior components. The trend toward lightweight, corrosion-resistant materials in electric vehicles (EVs) could further expand its application, particularly in battery enclosures and structural supports. -

Supply Chain and Raw Material Volatility

Nickel and chromium—key alloying elements in Union 304—are subject to price fluctuations influenced by geopolitical tensions, export policies (e.g., Indonesia’s nickel regulations), and energy costs. By 2026, producers may increasingly adopt hedging strategies or shift toward scrap-based recycling to mitigate input cost risks. -

Sustainability and Circular Economy Pressures

Regulatory emphasis on carbon footprint reduction and material recyclability (e.g., EU Green Deal, U.S. Inflation Reduction Act) will favor stainless steel, which is 100% recyclable. Union 304’s long lifecycle and high scrap recovery rate position it well in sustainability-focused markets. -

Regional Production Shifts

China remains the largest producer and consumer of Union 304, but environmental regulations and rising labor costs are prompting production diversification into Southeast Asia and India. This regional shift may affect global pricing dynamics and supply resilience. -

Technological Advancements in Manufacturing

Advancements in precision forming, laser cutting, and automated welding are enhancing the efficiency of Union 304 fabrication. Digital supply chain integration (IoT, AI-driven logistics) is expected to improve inventory management and reduce lead times by 2026. -

Competition from Alternative Materials

Despite its advantages, Union 304 faces competition from lower-cost alternatives like 200-series stainless steels and coated carbon steels, especially in price-sensitive markets. However, its superior performance in harsh environments ensures continued dominance in critical applications.

Conclusion:

By 2026, the Union 304 stainless steel market is poised for moderate but stable growth, with a compound annual growth rate (CAGR) estimated between 3.5% and 4.5%, depending on region and end-use sector. Success for producers will hinge on cost optimization, sustainability compliance, and adaptability to regional demand shifts. Innovation in recycling and energy-efficient production will be key differentiators in a competitive and increasingly regulated global market.

Common Pitfalls When Sourcing Union 304 (Quality, IP)

When procuring Union 304 stainless steel components, buyers often encounter significant challenges related to quality assurance and intellectual property (IP) protection. Being aware of these common pitfalls is crucial to ensuring product reliability, regulatory compliance, and business integrity.

Substandard Material Quality

One of the most prevalent issues is receiving components that do not meet the required 304 stainless steel specifications. Suppliers—particularly from regions with less stringent oversight—may substitute lower-grade materials (e.g., 201 or 202 stainless steel) that mimic the appearance of 304 but lack its corrosion resistance and mechanical properties. This leads to premature failure, safety risks, and costly replacements. Without proper material certifications (e.g., Mill Test Reports) and third-party verification (e.g., PMI testing), it’s difficult to confirm authenticity.

Inadequate or Falsified Documentation

Many suppliers provide incomplete or forged quality documentation. Certificates of Conformity or material test reports may be inaccurate or entirely fabricated, making it hard to verify compliance with international standards (e.g., ASTM, ISO). Relying solely on supplier-provided paperwork without independent verification exposes the buyer to significant quality and liability risks.

Intellectual Property Infringement

Union 304 components, especially proprietary designs or branded fittings, may be counterfeited without authorization. Sourcing from unauthorized manufacturers or gray-market suppliers can result in IP violations, exposing the buyer to legal action. This is particularly concerning when components are reverse-engineered or bear counterfeit trademarks, undermining brand reputation and contractual obligations.

Lack of Traceability

Poor supply chain transparency makes it difficult to trace the origin of components. Without full traceability—from raw material sourcing to final manufacturing—companies cannot ensure ethical practices, compliance with environmental regulations, or product consistency. This opacity also complicates recalls or audits in case of failure.

Inconsistent Manufacturing Standards

Even when genuine 304 stainless steel is used, inconsistent manufacturing processes (e.g., improper heat treatment, poor welding, or inadequate surface finishing) can compromise performance. Suppliers with limited quality control systems may produce non-uniform parts that fail under pressure or in corrosive environments.

Mitigation Strategies

To avoid these pitfalls, buyers should:

– Require certified material test reports and conduct third-party material verification.

– Audit suppliers and conduct factory inspections.

– Work only with authorized distributors or reputable manufacturers.

– Include IP protection clauses in contracts and ensure design confidentiality.

– Implement supply chain traceability systems and demand full documentation.

By proactively addressing these risks, organizations can ensure the quality, authenticity, and legal compliance of Union 304 components in their supply chain.

Logistics & Compliance Guide for Union 304

This guide provides essential information for managing the logistics and ensuring regulatory compliance when handling Union 304, a fictional or placeholder entity typically representing a political, economic, or trade union in strategic planning or simulation contexts. Always verify specific requirements based on real-world jurisdictional and operational details relevant to your use of “Union 304.”

Regulatory Compliance Framework

Ensure all operations align with the legal and regulatory standards enforced by Union 304 authorities. This includes adherence to trade regulations, data protection laws (e.g., Union 304 GDPR equivalent), labor standards, and environmental mandates. Designate a compliance officer to monitor updates from Union 304 regulatory bodies and conduct regular internal audits.

Import and Export Controls

Goods entering or leaving Union 304 member territories must comply with standardized customs procedures. Utilize the Union 304 Customs Code for accurate product classification, valuation, and origin determination. Required documentation includes commercial invoices, packing lists, certificates of origin, and, where applicable, export licenses. High-risk or dual-use items may require prior authorization.

Transportation and Carrier Requirements

All transportation providers operating within Union 304 must be licensed and comply with Union safety and emissions standards. Use only carriers registered in the Union 304 Transport Registry. Mandatory electronic logging of shipments via the Union 304 Logistics Monitoring System (ULMS) ensures traceability. Temperature-controlled and hazardous materials transport must follow Union 304 Dangerous Goods Directive (DGD-304).

Supply Chain Security Protocols

Implement the Union 304 Authorized Economic Operator (AEO-304) program standards to expedite customs clearance and reduce inspections. Facilities must meet physical and cyber-security benchmarks. All partners in the supply chain—from suppliers to distributors—must undergo vetting and sign Union 304 Security Compliance Agreements (SCA-304).

Documentation and Record Retention

Maintain digital records of all logistics and compliance documentation for a minimum of seven years, as required by Union 304 Regulation 304/2023. Required records include customs filings, safety data sheets (SDS-304), transport manifests, and compliance audit reports. All documents must be stored in the Union 304-approved e-Archive format and accessible for regulatory review.

Environmental and Sustainability Mandates

Operations must comply with Union 304 Green Logistics Initiative (GLI-304), which mandates carbon footprint reporting for all freight movements. Companies exceeding emissions thresholds must purchase Union 304 Carbon Offset Credits (COC-304). Packaging materials must meet recyclability standards outlined in Directive 304-ENV-01.

Penalties and Enforcement

Non-compliance with Union 304 regulations may result in fines, shipment seizures, suspension of trading privileges, or exclusion from the Union 304 Single Market. The Union 304 Compliance Enforcement Directorate (CED-304) conducts random inspections and investigates reported violations. Remediation plans must be submitted within 30 days of a compliance notice.

Contact and Reporting

For compliance inquiries or incident reporting, contact the Union 304 Logistics Compliance Helpdesk at [email protected] or call +304-LOGISTICS (564-7842). Submit mandatory reports via the Union 304 e-Compliance Portal (https://compliance.union304.eu). All communications must be in one of the official Union languages.

Conclusion for Sourcing Union 304:

After a thorough evaluation of suppliers and market options for stainless steel union 304, it is evident that sourcing this component requires a balanced approach focusing on material quality, compliance with industry standards (such as ASTM A182 or ISO 8434), supplier reliability, and cost-efficiency. Union 304, made from austenitic stainless steel, offers excellent corrosion resistance, durability, and performance in a wide range of temperatures—making it ideal for use in plumbing, petrochemical, food processing, and pharmaceutical applications.

Key findings from the sourcing analysis include:

- Multiple reputable suppliers, both domestic and international, can provide high-quality 304 stainless steel unions, though lead times and MOQs vary.

- Quality verification through material test reports (MTRs) and third-party inspections is essential to avoid substandard or counterfeit products.

- Long-term cost savings can be achieved by partnering with suppliers who offer consistent quality and volume-based pricing, even if initial costs are slightly higher.

- Supply chain resilience improves when working with suppliers that have certifications (ISO 9001, PED, etc.) and a track record of on-time delivery.

Recommendation: Proceed with sourcing Union 304 from pre-qualified suppliers after conducting sample testing and audit visits if feasible. Establish long-term agreements with 1–2 primary vendors to ensure supply stability, quality consistency, and favorable pricing. Implement ongoing quality control checks to maintain performance and safety standards across all applications.

This strategic sourcing approach ensures reliability, compliance, and value for money in the procurement of 304 stainless steel unions.