The underground utilities construction sector is experiencing robust expansion, driven by aging infrastructure, increasing urbanization, and rising investments in water, wastewater, power, and telecommunications networks. According to a 2023 report by Grand View Research, the global underground pipeline construction market was valued at USD 44.7 billion and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030. Similarly, Mordor Intelligence projects steady growth in the utility construction equipment segment, fueled by advancements in trenchless technologies and government-led infrastructure modernization programs across North America, Europe, and Asia-Pacific. As demand for resilient and sustainable underground utility systems rises, a select group of manufacturers has emerged as industry leaders, combining innovation, reliability, and global reach to shape the future of subsurface infrastructure. Here’s a data-informed look at the top 10 underground utilities construction manufacturers leading this transformation.

Top 10 Underground Utilities Construction Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Underground Construction

Domain Est. 2004

Website: undergroundconstruction.com

Key Highlights: Underground Construction Co., Inc. has provided efficient gas, power, airport fueling and telecom construction solutions for 90 years. Since laying our first ……

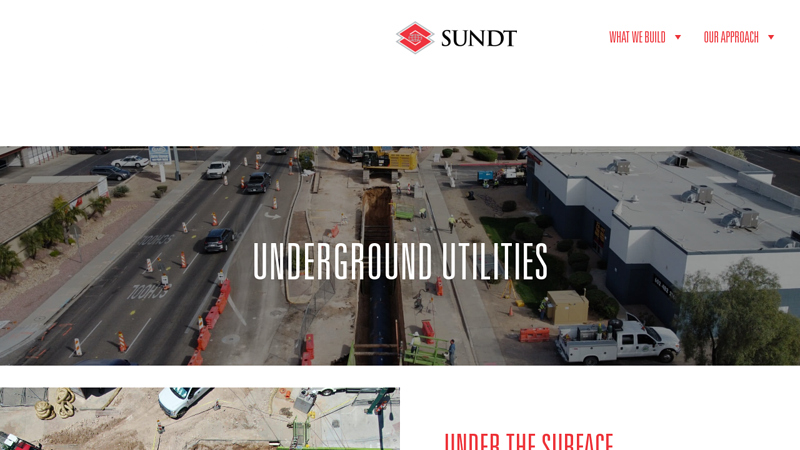

#2 Underground Utilities

Domain Est. 1996

Website: sundt.com

Key Highlights: Sundt is a builder with the capabilities and experience to install water and sewer/wastewater underground utilities across the country….

#3 Utility Construction

Domain Est. 1998

Website: intercon-const.com

Key Highlights: InterCon Construction is a utility construction company that focuses on gas pipelines construction, electric lines, and communications nationwide….

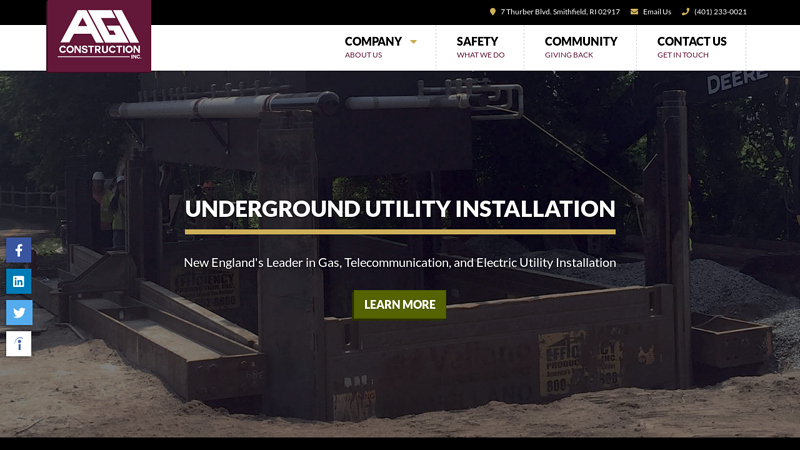

#4 AGI Construction

Domain Est. 2001

Website: agiconstruction.com

Key Highlights: New England’s premier underground utility contractor. For over 25 years we have provided a comprehensive range of contracting services….

#5 MGE Underground

Domain Est. 2001

Website: mgeunderground.com

Key Highlights: Proven utility contractors, our civil and electrical crews safely complete complex infrastructure construction projects across California….

#6 Michels Corporation

Domain Est. 2002

Website: michels.us

Key Highlights: Michels Corporation is a contractor for energy and infrastructure projects. Michels is family owned and committed to safety, quality and evolving market ……

#7 Anchor Construction

Domain Est. 2004

Website: anchorconst.com

Key Highlights: Anchor’s expertise includes constructing safe and reliable structures and bridges to help get you to your destination….

#8 Underground Utilities Corp

Domain Est. 2005

Website: undergroundutilitiescorp.com

Key Highlights: Construction Industry. At Underground Utilities Corporation, we have 30 years of industry expertise in every aspect of site development….

#9 USIC

Domain Est. 2013

Website: usicllc.com

Key Highlights: USIC locates and marks these utility lines to prevent damage and service disruptions and keep excavators and our communities safe….

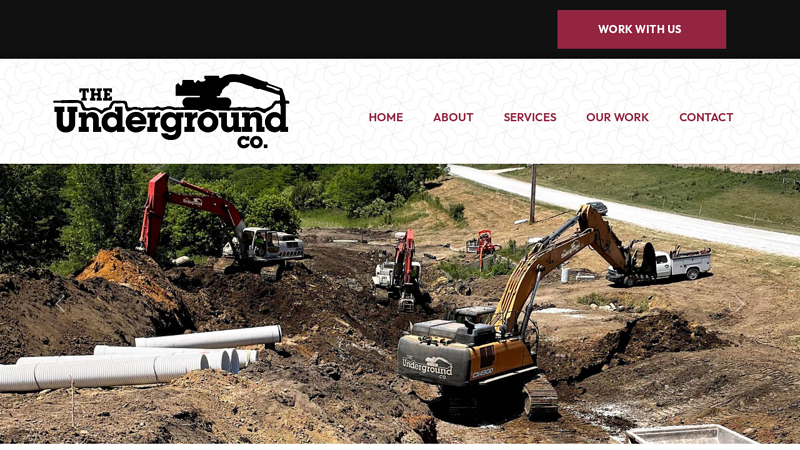

#10 The Underground Company

Domain Est. 2023

Website: undergroundcoltd.com

Key Highlights: We’re a family-owned underground utility company that specializes in stormwater systems, sanitary sewers, water mains, and concrete structures….

Expert Sourcing Insights for Underground Utilities Construction

2026 Market Trends for Underground Utilities Construction

Accelerated Adoption of Trenchless Technologies

By 2026, trenchless methods such as horizontal directional drilling (HDD), pipe bursting, and microtunneling are expected to dominate underground utilities construction. Driven by urbanization and the need to minimize surface disruption, municipalities and contractors are increasingly favoring these techniques. Regulatory support and advancements in guidance systems and drill head durability are enhancing precision and reducing project timelines, making trenchless solutions cost-competitive even for mid-sized projects.

Expansion Driven by Infrastructure Modernization and Climate Resilience

Aging utility networks in North America and Europe are prompting large-scale reinvestment, with governments allocating funds through initiatives like the U.S. Infrastructure Investment and Jobs Act. Simultaneously, climate change adaptation is pushing demand for resilient underground systems—particularly stormwater, wastewater, and power conduits—capable of withstanding extreme weather and rising sea levels. Undergrounding electrical grids is becoming a priority in fire-prone regions like California and Australia, further boosting market growth.

Digital Transformation and Smart Infrastructure Integration

The adoption of Building Information Modeling (BIM), Geographic Information Systems (GIS), and digital twins is streamlining project planning, execution, and asset management. In 2026, real-time monitoring via IoT-enabled sensors embedded in pipelines and conduits allows for predictive maintenance and leak detection. Augmented reality (AR) is increasingly used for subsurface utility locating, reducing the risk of strikes and improving safety. These technologies enhance efficiency, reduce rework, and support lifecycle management of underground assets.

Labor Shortages and Automation Solutions

The industry continues to face a skilled labor gap, especially in specialized areas like horizontal drilling and utility locating. By 2026, automation and robotics are being leveraged to offset this challenge, with remotely operated microtunneling systems and autonomous excavation assistants entering mainstream use. Training programs incorporating VR simulations are also emerging to upskill workers more rapidly, ensuring safer and more efficient operations.

Sustainability and Regulatory Pressures

Environmental regulations are tightening, particularly regarding groundwater protection, soil contamination, and carbon emissions from construction equipment. This is accelerating the shift toward electric-powered trenchless machinery and sustainable trench backfill materials. Additionally, ESG (Environmental, Social, and Governance) compliance is becoming a procurement criterion for public projects, favoring contractors with green certifications and low-impact construction methodologies.

Geopolitical and Material Supply Dynamics

Fluctuations in raw material costs—especially for ductile iron, HDPE, and copper—remain a concern. In 2026, supply chain diversification and localized manufacturing of utility components are helping mitigate risks. Trade policies and national security concerns are also influencing procurement, with many governments prioritizing domestic production of critical infrastructure materials to ensure resilience.

Common Pitfalls in Sourcing Underground Utilities Construction (Quality, IP)

Sourcing underground utilities construction services involves significant risks, particularly concerning work quality and intellectual property (IP) protection. Failing to address these areas can lead to costly rework, project delays, legal disputes, and compromised infrastructure integrity.

Poor Quality Control and Oversight

One of the most frequent pitfalls is inadequate quality control throughout the construction process. Contractors may cut corners to reduce costs or accelerate timelines, resulting in substandard installations. Issues such as improper trenching, poor pipe alignment, inadequate backfilling, and insufficient testing can compromise the longevity and safety of utility systems. Without rigorous on-site inspections, standardized quality assurance protocols, and independent verification, clients risk accepting work that fails to meet regulatory standards or technical specifications.

Lack of Clear Quality Assurance Protocols

Many sourcing agreements fail to define clear quality benchmarks, inspection schedules, and acceptance criteria. Without documented procedures for verifying welds, material specifications, depth compliance, and pressure testing, disputes can arise over whether deliverables meet expectations. Ambiguity in contracts allows contractors to interpret quality loosely, increasing the likelihood of rework and liability exposure for the client.

Inadequate Verification of Contractor Competence

Selecting contractors based solely on low bids without thoroughly vetting their technical expertise, safety records, and past performance in similar projects often leads to poor outcomes. Inexperienced or underqualified crews may lack familiarity with local geotechnical conditions or modern utility installation techniques, increasing the risk of errors, accidents, and non-compliance with industry standards like ASCE 38 or ASTM guidelines.

Intellectual Property Risks in Design and Documentation

Underground utility projects often involve proprietary designs, GIS mapping data, and engineering schematics. A critical pitfall arises when contracts do not clearly assign ownership of IP created during the project. Without explicit clauses, contractors or third-party designers may retain rights to designs, limiting the client’s ability to modify, maintain, or share the information with future vendors. This can hinder long-term asset management and create dependency on specific contractors.

Insufficient Protection of Sensitive Location Data

Geospatial data related to utility routes, depths, and connections is highly sensitive. When sourcing construction services, clients risk exposing critical infrastructure information to unauthorized parties if data-sharing agreements and cybersecurity measures are not enforced. Leakage of such data could lead to security vulnerabilities, competitive disadvantages, or misuse by bad actors.

Failure to Secure As-Built Documentation

As-built drawings and digital records are essential for future maintenance and expansion. A common issue is contractors failing to deliver accurate or complete as-built documentation, or delivering it in proprietary formats that limit accessibility. Without enforceable requirements for standardized, open-format deliverables, clients may lose critical IP and operational data, impacting asset lifecycle management.

Incomplete Contractual Safeguards

Many sourcing agreements overlook critical clauses related to warranties, defect liability periods, indemnification, and IP ownership. Without comprehensive contracts, clients have limited recourse in cases of shoddy workmanship or IP infringement. Ambiguous terms can lead to protracted legal battles, especially when subcontractors are involved and responsibility becomes diffuse.

Conclusion

To mitigate these pitfalls, organizations must implement rigorous contractor vetting, define clear quality and IP terms in contracts, require standardized deliverables, and maintain active project oversight. Proactive management of both quality assurance and intellectual property rights is essential to ensuring the reliability, safety, and long-term value of underground utility infrastructure.

Logistics & Compliance Guide for Underground Utilities Construction

This guide outlines essential logistics planning and compliance requirements for safe, efficient, and legally compliant underground utilities construction projects. Adherence to these principles helps prevent damage, ensures worker safety, minimizes disruptions, and avoids regulatory penalties.

Project Planning and Permitting

Develop a comprehensive project plan that includes detailed scope, timelines, resource allocation, and risk assessments. Initiate the permitting process early by identifying all required federal, state, and local permits—including excavation, encroachment, environmental (e.g., stormwater discharge), and traffic control permits. Submit applications with accurate plans and supporting documentation to avoid delays.

Utility Locating and Damage Prevention

Before any ground disturbance, conduct a formal “Call Before You Dig” request (e.g., 811 in the U.S.) to notify utility operators. Allow adequate time for all affected utilities to mark their underground lines. Verify utility locations using professional surveying and ground-penetrating radar if necessary. Implement a Damage Prevention Plan (DPP) that includes safe digging practices, hand exposure near marked utilities, and clear communication protocols.

Site Access and Traffic Management

Establish safe and legal access points to the work site, considering equipment size and weight restrictions. Develop a Traffic Control Plan (TCP) in accordance with Manual on Uniform Traffic Control Devices (MUTCD) standards. Deploy proper signage, cones, barriers, and flaggers to protect workers and the public. Coordinate with local authorities for road closures, lane shifts, or temporary detours when required.

Equipment and Material Logistics

Schedule delivery and positioning of construction equipment (e.g., excavators, boring machines, compaction tools) to minimize site congestion. Store materials such as pipes, fittings, and backfill in designated, organized areas that do not impede work zones or utility markings. Implement inventory controls to track material usage and reduce waste.

Environmental Compliance

Comply with all environmental regulations, including the National Pollutant Discharge Elimination System (NPDES) for stormwater runoff. Install and maintain erosion and sediment controls (e.g., silt fences, inlet protection). Handle hazardous materials according to EPA and OSHA standards. Dispose of excavated soil and waste properly, testing for contaminants when necessary.

Worker Safety and Training

Ensure all personnel are trained in OSHA safety standards, including trenching and excavation safety (29 CFR 1926 Subpart P), confined space entry, and hazard communication. Provide personal protective equipment (PPE) and conduct regular safety meetings (tailgate sessions). Implement trench protection systems such as shoring, shielding, or sloping for excavations deeper than 5 feet.

Quality Control and Inspection

Establish a quality assurance program to verify materials, installation methods, and alignment meet project specifications and industry standards (e.g., ASTM, AWWA). Schedule inspections with regulatory agencies and utility owners at key milestones. Document all inspections, tests (e.g., pressure testing, vacuum testing), and as-built drawings for recordkeeping and future reference.

Public Communication and Community Relations

Notify adjacent property owners, businesses, and residents about construction schedules, expected disruptions, and safety precautions. Provide contact information for inquiries or concerns. Use signage and digital channels to share updates and minimize community impact.

Recordkeeping and As-Builts

Maintain accurate logs of daily activities, inspections, permits, and compliance documents. Prepare and submit as-built drawings that reflect the final installed utility locations and depths. Deliver records to project owners, municipalities, and utility databases to support future maintenance and excavation safety.

Emergency Preparedness

Develop and communicate an emergency response plan for incidents such as utility strikes, trench collapses, or hazardous material spills. Ensure all crew members know emergency procedures and contact numbers. Keep first aid kits, fire extinguishers, and communication devices accessible on-site.

Conclusion for Sourcing Underground Utilities Construction

In conclusion, sourcing underground utilities construction requires a strategic and collaborative approach that balances technical expertise, regulatory compliance, cost-efficiency, and risk management. The complexity of underground infrastructure—encompassing water, sewer, electrical, telecommunications, and gas systems—demands thorough planning, accurate utility locating, and coordination among stakeholders including municipal authorities, engineering firms, contractors, and utility providers.

Effective sourcing involves selecting qualified contractors with proven experience, robust safety records, and the necessary equipment and technology—such as ground-penetrating radar and GIS mapping—to minimize disruptions and prevent costly damages. Emphasizing pre-construction surveys, detailed project specifications, and clear contractual agreements ensures transparency and accountability throughout the project lifecycle.

Furthermore, investing in sustainable practices, resilient materials, and future-ready designs supports long-term infrastructure performance and reduces lifecycle costs. As urban development continues to expand, proactive sourcing of underground utility construction not only safeguards public safety and service reliability but also lays the foundation for smart, resilient cities.

Ultimately, successful project outcomes depend on early engagement, comprehensive due diligence, and continuous communication among all parties involved. By prioritizing quality, safety, and innovation in the sourcing process, organizations can ensure the reliable delivery of essential underground utility services for generations to come.