The global underground petrol tank market is experiencing steady expansion, driven by rising fuel consumption, infrastructure development, and increasing regulatory emphasis on leak prevention and environmental safety. According to a 2023 report by Mordor Intelligence, the global underground storage tank market is projected to grow at a CAGR of over 5.8% from 2023 to 2028, with petroleum storage accounting for a dominant share due to expanding fuel distribution networks in emerging economies and ongoing upgrades in aging fuel infrastructure in developed regions. Additionally, stringent regulations from environmental agencies, such as the U.S. Environmental Protection Agency (EPA), are accelerating demand for advanced, corrosion-resistant double-walled tanks made from fiberglass-reinforced plastic (FRP) and other high-performance composites. As fuel retailers, service stations, and government agencies prioritize safety, sustainability, and regulatory compliance, the role of innovative tank manufacturers becomes increasingly critical. This list highlights the top 10 underground petrol tank manufacturers leading the market through technological advancement, global reach, and adherence to international safety standards.

Top 10 Underground Petrol Tank Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Highland Tank

Domain Est. 1996

Website: highlandtank.com

Key Highlights: Manufacturing high-quality steel storage tank products accommodating commercial and industrial customers. Proven manufacturing and exceptional quality….

#2 Tanks and Petroleum Equipment

Domain Est. 1999 | Founded: 1947

Website: stanwade.com

Key Highlights: Stanwade Metal Products, Inc. was founded in 1947 and is a leader in petroleum storage producing a wide array of aboveground and underground storage tanks….

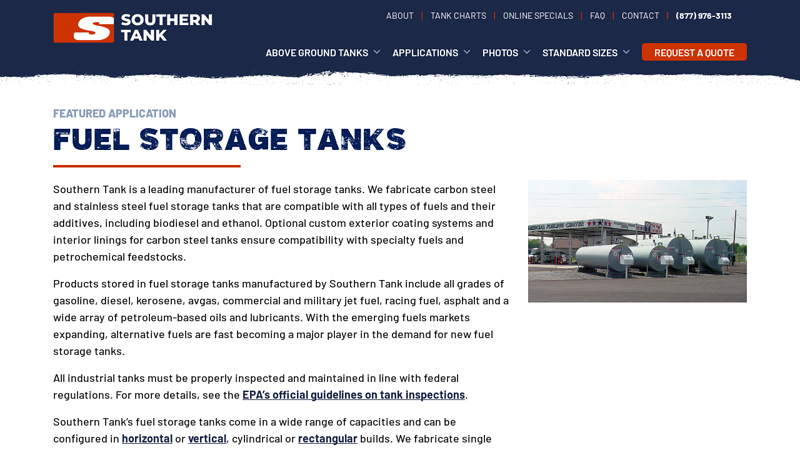

#3 Fuel Storage Tanks for Diesel & Gasoline

Domain Est. 2000

Website: southerntank.net

Key Highlights: Southern Tank is a leading manufacturer of fuel storage tanks. We fabricate carbon steel and stainless steel fuel storage tanks that are compatible with all ……

#4 Steel City Fueling Systems, Inc.

Domain Est. 2006

Website: steelcityfueling.com

Key Highlights: Steel City Fueling Systems, Inc. is a full service environmental contracting company. We specialize in furnishing and installing turn-key fuel storage and ……

#5 KBK Industries

Domain Est. 2011

Website: kbkindustries.com

Key Highlights: KBK specializes in carbon steel, stainless-steel, and fiberglass tanks offered for above ground and underground installation. We are proud to have achieved 99% ……

#6 Nationwide Tanks

Domain Est. 2013

Website: nationwidetanks.com

Key Highlights: We are the only manufacturer of underground fiberglass fuel tanks in the US in compliance with the Third Edition of UL 1316….

#7 Containment Solutions

Domain Est. 1995

Website: nov.com

Key Highlights: With decades of experience in manufacturing underground fiberglass and aboveground steel storage tanks, Fiber Glass Systems is a name that can be trusted. Our ……

#8 Underground Storage for Fuel, Water and Stormwater

Domain Est. 1998

Website: xerxes.com

Key Highlights: Our underground fuel and water tanks, and stormwater management products are designed and manufactured to meet – and exceed – industry standards….

#9 Newberry Tanks

Domain Est. 1998

Website: newberrytanks.com

Key Highlights: Use Newberry for delivery of skid tanks, containment dykes, Permatank, underground fuel tanks, lube oil tanks, & More. Up to 25000 gallons, ……

#10 Tanks

Domain Est. 2005

Website: eatonsalesservice.com

Key Highlights: Underground Petroleum Storage Tanks. Eaton Sales & Service manufactures the best underground and above ground fuel storage tanks in the market….

Expert Sourcing Insights for Underground Petrol Tank

H2: 2026 Market Trends for Underground Petrol Tanks

The global underground petrol tank (UPT) market is poised for notable transformation by 2026, driven by evolving environmental regulations, technological advancements, and shifts in energy infrastructure. Key trends shaping the market include increasing demand for corrosion-resistant and leak-proof storage solutions, growing investments in fuel retail infrastructure, and the gradual transition toward alternative fuels. Below is a detailed analysis of the primary market dynamics expected to influence the UPT sector by 2026.

-

Stringent Environmental Regulations

Governments worldwide are enforcing stricter environmental standards to prevent soil and groundwater contamination from fuel leaks. In the U.S., the Environmental Protection Agency (EPA) continues to mandate upgrades to secondary containment systems and regular leak detection. Similar regulations in the European Union and emerging markets are pushing operators to replace aging steel tanks with fiberglass-reinforced plastic (FRP) or composite UPTs, which offer superior resistance to corrosion and leakage. -

Growth in Fuel Retail Infrastructure

Despite the rise of electric vehicles (EVs), global demand for gasoline and diesel remains strong, particularly in developing regions such as Southeast Asia, Africa, and Latin America. This sustained demand is driving the expansion and modernization of fuel retail stations, increasing the need for new and upgraded underground storage tanks. Urbanization and road infrastructure development are further catalyzing investments in petrol station networks, supporting UPT market growth. -

Adoption of Smart Monitoring Technologies

By 2026, digitalization is expected to play a pivotal role in UPT management. The integration of Internet of Things (IoT) sensors, remote monitoring systems, and predictive analytics enables real-time leak detection, inventory tracking, and maintenance alerts. These “smart tanks” improve operational efficiency, reduce downtime, and ensure compliance with regulatory requirements, making them increasingly attractive to fuel retailers and operators. -

Shift Toward Composite and Dual-Wall Tank Systems

The market is witnessing a strong shift from traditional steel tanks to advanced materials such as FRP and polyethylene. Dual-wall tank systems, which provide an additional layer of containment, are becoming the industry standard. These tanks not only meet environmental regulations but also offer longer lifespans and lower lifecycle costs, driving their adoption across both new installations and retrofits. -

Impact of Energy Transition and Alternative Fuels

While the long-term outlook for petrol may be affected by the global push toward decarbonization and EV adoption, the transition is expected to be gradual. By 2026, hybrid infrastructure—where conventional fuel tanks coexist with EV charging stations—will become more prevalent. Additionally, UPTs are being adapted for biofuels and ethanol blends, expanding their application scope and maintaining relevance in a changing energy landscape. -

Regional Market Variations

North America and Europe will remain key markets due to regulatory mandates and aging infrastructure requiring replacement. Meanwhile, the Asia-Pacific region is expected to register the highest growth, fueled by rapid industrialization, increasing vehicle ownership, and government-led energy projects in countries like India and Indonesia.

In conclusion, the underground petrol tank market in 2026 will be characterized by innovation, regulatory compliance, and adaptation to broader energy trends. While challenges related to sustainability and fuel transition persist, the continued need for safe, efficient fuel storage ensures that UPTs will remain a critical component of global energy infrastructure.

Common Pitfalls When Sourcing Underground Petrol Tanks (Focus on Quality and Intellectual Property)

Sourcing Underground Petrol Tanks (UPTs) involves significant technical, safety, and legal considerations. Failing to address quality standards and intellectual property (IP) rights can lead to project delays, safety hazards, regulatory non-compliance, and costly legal disputes. Below are the most common pitfalls to avoid:

1. Ignoring Regional and International Quality Standards

One of the most critical mistakes is sourcing tanks that don’t comply with mandatory regional or international standards. For example:

- Non-compliance with API 12B, UL 1316, or EN 12285-1: These standards govern design, materials, welding, and testing procedures. Tanks not meeting these may fail inspections or pose environmental risks.

- Lack of third-party certification: Choosing suppliers who cannot provide verifiable certification from bodies like UL, TÜV, or Lloyd’s Register undermines trust in product quality.

- Using substandard materials: Some suppliers may cut costs by using inferior steel or composite materials that degrade prematurely when exposed to fuel and soil conditions.

Best Practice: Require full documentation of compliance with applicable standards and verify certifications through independent sources.

2. Overlooking Long-Term Environmental and Safety Performance

Quality isn’t just about initial build—it’s about long-term integrity. Pitfalls include:

- Inadequate corrosion protection: Single-wall tanks or poor cathodic protection systems can lead to leaks, soil contamination, and regulatory penalties.

- Insufficient secondary containment: Failure to source double-wall or spill/overfill containment systems increases environmental liability.

- Poor leak detection integration: Tanks not designed for compatible monitoring systems reduce early leak detection capabilities.

Best Practice: Specify tanks with factory-applied corrosion protection, secondary containment, and integrated leak detection compatible with local regulations.

3. Failing to Verify Manufacturing Origin and Supply Chain Transparency

Many low-cost suppliers source from unverified subcontractors or use misleading branding. Risks include:

- “White-label” tanks with unknown origins: Suppliers may rebrand generic tanks without assuming liability for quality.

- Lack of traceability: Inability to trace weld logs, material test reports (MTRs), or manufacturing dates complicates maintenance and audits.

- Counterfeit certifications: Some suppliers falsify compliance documents.

Best Practice: Audit the manufacturer’s facility, demand full material traceability, and verify certifications directly with issuing bodies.

4. Neglecting Intellectual Property (IP) Rights and Licensing

IP issues often arise when sourcing UPTs, particularly with proprietary designs or technologies:

- Use of patented designs without authorization: Some tank configurations, interstitial monitoring methods, or mounting systems are protected by patents. Unauthorized use can lead to injunctions or damages.

- Copying proprietary technology: Reverse engineering or replicating branded tank systems (e.g., specific bunding or vapor recovery features) may violate IP laws.

- Unclear licensing terms: Suppliers may claim to offer “equivalent” designs but fail to disclose IP restrictions, exposing the buyer to legal risk.

Best Practice: Conduct IP due diligence. Require suppliers to warrant that their products do not infringe third-party IP and provide proof of licensing where applicable.

5. Inadequate Contractual Safeguards for Quality and IP

Weak procurement contracts amplify risks:

- Vague quality clauses: Contracts that lack specific performance metrics or acceptance testing protocols make enforcement difficult.

- Missing IP indemnification: Without a clause requiring the supplier to defend against IP claims, the buyer assumes full liability.

- Limited warranty terms: Short or conditional warranties may not cover long-term degradation or latent defects.

Best Practice: Include detailed technical specifications, acceptance testing procedures, IP indemnification, and long-term warranties in sourcing agreements.

Conclusion

Sourcing Underground Petrol Tanks requires rigorous attention to both quality assurance and intellectual property compliance. Organizations must go beyond price comparisons and conduct thorough due diligence on standards compliance, manufacturing integrity, and legal rights. By addressing these common pitfalls proactively, buyers can ensure safe, compliant, and legally secure fuel storage infrastructure.

Logistics & Compliance Guide for Underground Petrol Tanks

Installation and Site Assessment

Before installing an underground petrol tank (UPT), a thorough site assessment must be conducted. This includes evaluating soil composition, groundwater proximity, seismic activity, and proximity to buildings or water sources. The installation site must comply with local, state, and federal regulations, including setback requirements from property lines, wells, and inhabited structures. Permits are typically required prior to excavation and installation.

Regulatory Compliance Requirements

Underground petrol tanks are subject to strict environmental and safety regulations. In the United States, the Environmental Protection Agency (EPA) regulates UPTs under the Resource Conservation and Recovery Act (RCRA) and the Underground Storage Tank (UST) program. Key compliance measures include:

- Use of approved tanks and piping systems that meet technical standards (e.g., corrosion-resistant materials, secondary containment)

- Installation by certified professionals

- Registration with the appropriate environmental authority

- Leak detection systems (e.g., interstitial monitoring, automatic tank gauging)

- Spill and overfill prevention equipment

Failure to comply can result in fines, enforcement actions, or mandated tank removal.

Environmental Protection and Leak Prevention

Protecting the environment is a core component of UPT management. Operators must implement measures to prevent leaks and spills, including:

- Regular inspection of tank integrity and piping

- Installation of cathodic protection systems for steel tanks

- Use of double-walled tanks with leak detection

- Monitoring for vapor and liquid leaks

In the event of a suspected release, immediate reporting to regulatory agencies is required, along with site assessment and remediation as needed.

Operational Safety Protocols

Safety is paramount when operating an underground petrol tank. Key protocols include:

- Proper signage indicating flammable materials and no-smoking zones

- Fire suppression equipment on-site

- Training for personnel on emergency procedures and spill response

- Ventilation systems to prevent vapor accumulation

- Lightning protection and grounding systems

All operations should follow Occupational Safety and Health Administration (OSHA) standards and National Fire Protection Association (NFPA) codes.

Maintenance and Inspection Schedule

Routine maintenance ensures the long-term integrity and safety of UPT systems. A comprehensive maintenance plan should include:

- Monthly visual inspections

- Annual tightness testing of tanks and pipes

- Periodic integrity testing (e.g., internal tank inspection every 5–10 years)

- Keeping detailed records of inspections, repairs, and upgrades

These records must be retained and made available for regulatory audits.

Decommissioning and Tank Removal

When an underground petrol tank is no longer in use, it must be properly decommissioned. Options include permanent closure in place or complete removal. Both methods require:

- Full tank cleaning and removal of residual product

- Notification of regulatory agencies

- Soil and groundwater sampling to check for contamination

- Submission of closure documentation

Improper decommissioning can lead to long-term environmental liabilities.

Recordkeeping and Documentation

Maintaining accurate records is a legal requirement and essential for compliance. Required documentation includes:

- Installation permits and certifications

- Leak detection logs and test results

- Inspection and maintenance reports

- Spill and incident reports

- Training records for personnel

- Closure or removal documentation

Records should be stored securely and retained for the period specified by local regulations—typically 10 years or more.

Training and Personnel Certification

Personnel involved in the operation, maintenance, or monitoring of underground petrol tanks must be trained and certified. Training programs should cover:

- UST system components and operation

- Leak detection methods

- Emergency response procedures

- Regulatory compliance requirements

Certification may be required by state environmental agencies and must be renewed periodically.

Emergency Response Planning

Facilities with underground petrol tanks must have a documented emergency response plan. This plan should include:

- Procedures for responding to leaks, spills, and fires

- Contact information for emergency services and regulatory agencies

- Evacuation routes and safety zones

- Spill containment materials and equipment

Regular drills and plan updates ensure preparedness for potential incidents.

Conclusion

Proper logistics and compliance management of underground petrol tanks are essential to protect human health, the environment, and regulatory standing. Adherence to installation standards, routine maintenance, safety protocols, and accurate recordkeeping ensures long-term operational integrity and legal compliance.

Conclusion for Sourcing an Underground Petrol Tank

Sourcing an underground petrol tank requires careful consideration of regulatory compliance, environmental safety, material quality, installation standards, and long-term maintenance. Selecting the right tank involves evaluating factors such as corrosion resistance (e.g., fiberglass vs. double-walled steel), appropriate capacity based on demand, compatibility with site conditions, and adherence to local environmental and fire safety regulations.

It is essential to work with certified suppliers and licensed installers to ensure the tank meets all industry standards, such as those set by the EPA, NFPA, or equivalent local authorities. Additionally, incorporating leak detection systems, cathodic protection, and proper secondary containment enhances operational safety and helps prevent soil and groundwater contamination.

In conclusion, a well-sourced underground petrol tank not only ensures reliable fuel storage and operational efficiency but also minimizes environmental risks and supports regulatory compliance. Investing in high-quality materials, professional installation, and routine inspections safeguards both the investment and the surrounding environment, making it a critical component of any fuel storage infrastructure.