The global seaweed extract market, driven by rising demand for natural ingredients in food, cosmetics, and pharmaceuticals, is projected to grow at a CAGR of 8.9% from 2023 to 2030, according to Grand View Research. Within this expanding landscape, Undaria pinnatifida—commonly known as wakame—has emerged as a high-value seaweed species due to its rich nutrient profile and bioactive compounds. With Asia-Pacific dominating production and consumption, and increasing adoption in Western markets for functional foods and nutraceuticals, the demand for high-quality, sustainably sourced wakame is accelerating. As supply chains mature and regulatory scrutiny grows, a select group of manufacturers have distinguished themselves through consistent quality, traceability, and vertical integration. Based on production volume, export data, sustainability certifications, and market presence, these top 8 Undaria wakame manufacturers are leading the industry amid this upward trajectory.

Top 8 Undaria Wakame Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Edible Japanese seaweed, wakame (Undaria pinnatifida) as an …

Domain Est. 1997

Website: sciencedirect.com

Key Highlights: Wakame (Undaria pinnatifida) is edible seaweed rich in fucoxanthin; whilst, pasta is an important dish from nutritional and gastronomic point of view….

#2 Undaria Seaweed New Zealand

Domain Est. 1999

Website: nzclams.com

Key Highlights: (Undaria pinnitifda ) is a brown seaweed and is an invasive species known as Wakame in its native Japan, which is farmed for use in Japanese cuisine. Undaria is ……

#3 The Seaweed Site

Domain Est. 1999

Website: seaweed.ie

Key Highlights: This site is a free source of general information on all aspects of seaweeds. Seaweeds are marine algae: saltwater-dwelling, simple organisms….

#4 Aqualgae Undaria

Domain Est. 2002

Website: lessonia.com

Key Highlights: Undaria Pinnatifida, more commonly known as “wakame” is ideal for sensitive and mature skin. Rich in antioxidants and in oligo- elements….

#5 Wakame

Domain Est. 2002

Website: naturalimport.com

Key Highlights: The Natural Import Company offers the largest selection of the highest quality traditional Japanese natural foods available today….

#6 Wakame has so much to offer

Domain Est. 2019

Website: sensalg.fr

Key Highlights: Undaria pinnatifida or wakame is one of the most popular seaweeds in Asia. Knowing your culinary skills is a gateway to better innovation….

#7 Wholesale Wild

Domain Est. 2022

Website: southernseaweed.com

Key Highlights: The brown seaweed species Undaria pinnatifida, (known as Wakame in Japan) grows throughout New Zealand. It is classified as a pest species but can be harvested ……

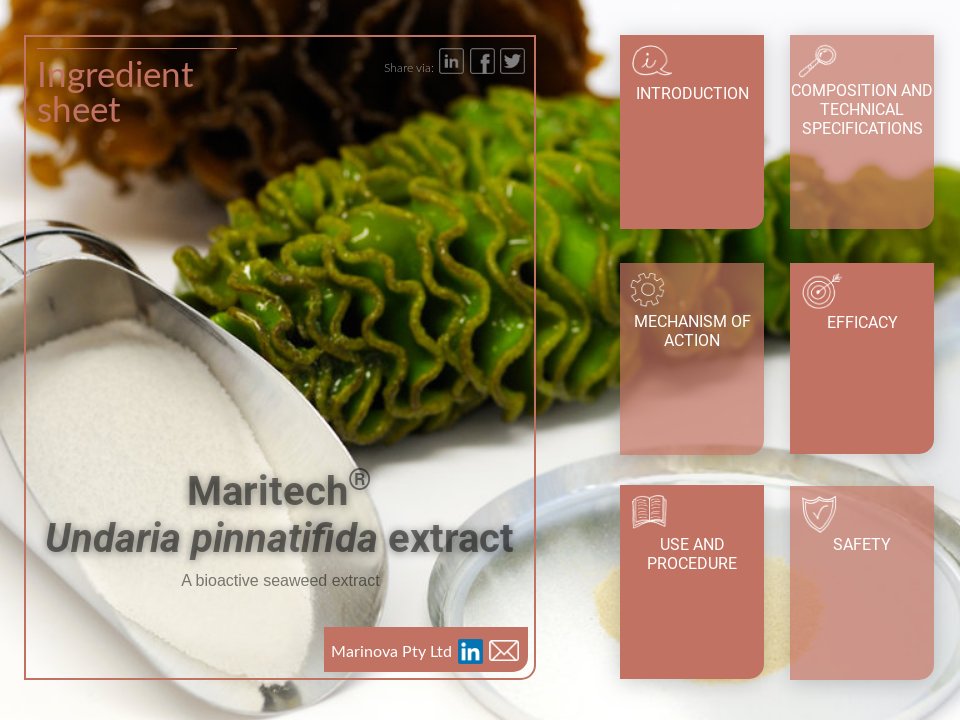

#8 Maritech® Undaria pinnatifida extract

Website: maritechfucoidan.com.au

Key Highlights: Maritech Undaria pinnatifida extract is a highly characterised, certified organic fucoidan ingredient sourced from wild Undaria pinnatifida seaweed….

Expert Sourcing Insights for Undaria Wakame

2026 Market Trends Analysis for Undaria Wakame (H2)

As we approach the second half of 2026, the global market for Undaria pinnatifida, commonly known as Wakame, is poised for dynamic shifts driven by sustainability concerns, evolving consumer preferences, and technological advancements. Here’s a comprehensive analysis of key trends shaping the Wakame market in H2 2026:

1. Sustainability and Responsible Cultivation Take Center Stage

By H2 2026, environmental accountability will be a dominant market driver. Wild harvesting of Wakame, particularly in regions like Europe and North America, faces increasing regulatory scrutiny due to its invasive species status and ecosystem disruption. As a result:

– Demand for certified sustainable farmed Wakame will surge, especially from EU and North American retailers adhering to stricter ESG (Environmental, Social, Governance) standards.

– Integrated Multi-Trophic Aquaculture (IMTA) systems, where Wakame is co-cultured with shellfish or fish, will gain traction as a carbon-negative solution, enhancing market appeal among eco-conscious consumers and investors.

– Traceability technologies such as blockchain will become standard, allowing consumers to verify the origin and environmental impact of their Wakame.

2. Asia Remains Core, But Western Markets Accelerate Adoption

While East Asia (Japan, Korea, China) continues to dominate consumption, H2 2026 will see notable growth in Western markets:

– Plant-based and flexitarian diets will fuel demand for Wakame as a nutrient-dense, umami-rich alternative to meat and dairy, especially in the U.S. and Western Europe.

– Functional food and beverage innovation will expand—Wakame extracts (rich in fucoxanthin and alginates) will be increasingly incorporated into weight management supplements, gut health products, and natural flavor enhancers.

– Retail presence will grow beyond Asian specialty stores into mainstream supermarkets and health food chains, supported by improved supply chain logistics.

3. Price Volatility and Supply Chain Resilience

Climate change and geopolitical factors will continue to impact supply:

– El Niño/La Niña effects may disrupt harvest cycles in key producing regions like China and Korea, leading to short-term price spikes in H2 2026.

– Diversification of production—including emerging farms in Canada, Chile, and France—will help stabilize supply but may face scalability challenges.

– Cold-chain infrastructure improvements will reduce post-harvest losses, especially for fresh and refrigerated Wakame, supporting premium product lines.

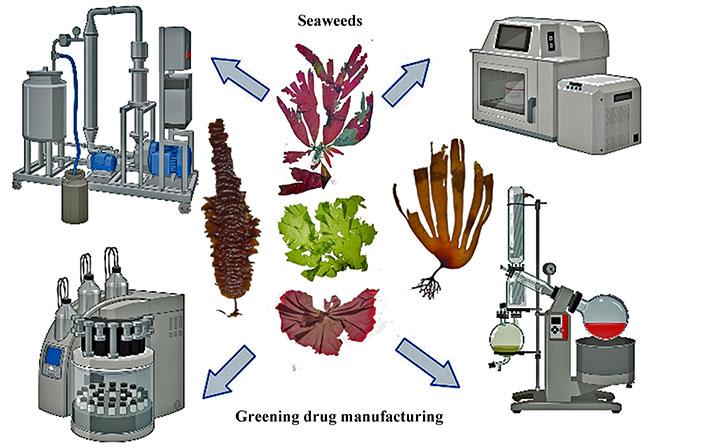

4. Innovation in Product Forms and Applications

Beyond traditional dried and rehydrated forms, H2 2026 will witness a rise in value-added products:

– Ready-to-eat seaweed snacks and Wakame-infused plant-based meals will target convenience-oriented consumers.

– Cosmeceutical applications will expand, with Wakame-based skincare products leveraging its hydrating and anti-aging properties gaining shelf space in premium beauty markets.

– Biotech applications, such as Wakame-derived biopolymers for sustainable packaging, may enter pilot commercialization phases, attracting venture capital interest.

5. Regulatory and Labeling Developments

Regulatory clarity will shape market access:

– The EU Novel Food regulation updates will likely finalize approvals for certain Wakame extracts, enabling broader use in supplements and fortified foods.

– “Clean label” trends will push manufacturers to minimize processing and avoid synthetic additives, favoring naturally preserved or freeze-dried Wakame variants.

– Allergen labeling and iodine content disclosures will become more standardized, improving consumer trust and safety.

Conclusion

In H2 2026, the Undaria Wakame market will be characterized by a strong push toward sustainability, geographic expansion, and product innovation. Stakeholders who invest in traceable, eco-friendly cultivation and develop versatile, value-added applications will be best positioned to capitalize on growing global demand. As seaweed gains recognition as a climate-smart crop, Wakame’s role in the blue economy is set to expand significantly by year-end.

Common Pitfalls in Sourcing Undaria Wakame (Quality and Intellectual Property)

Sourcing high-quality Undaria pinnatifida (wakame) involves navigating several potential pitfalls, particularly concerning product quality and intellectual property (IP) considerations. Being aware of these challenges is crucial for importers, food manufacturers, and retailers seeking reliable and legally compliant supply chains.

Quality-Related Pitfalls

Inconsistent Harvesting and Processing Standards

One of the most common quality issues arises from inconsistent harvesting times and processing methods across suppliers. Wakame harvested too early or too late can vary significantly in texture and flavor. Additionally, improper drying or freezing techniques may degrade nutritional content, lead to spoilage, or introduce contaminants.

Contamination Risks (Heavy Metals, Microplastics, Pathogens)

Wakame absorbs elements from its marine environment, making it vulnerable to contamination by heavy metals (e.g., arsenic, cadmium), microplastics, and harmful bacteria. Sourcing from polluted or unregulated waters increases these risks. Without third-party testing and certifications (e.g., ISO, HACCP, organic), there is no guarantee of safety.

Lack of Traceability and Transparency

Many suppliers fail to provide full traceability from harvest to packaging. Without clear documentation on origin, farming practices, and processing history, buyers cannot verify claims about sustainability, organic status, or wild vs. cultivated sourcing.

Adulteration and Species Substitution

In some cases, lower-cost seaweed species may be substituted for or mixed with genuine Undaria pinnatifida. This undermines product integrity and may mislead consumers, especially in powdered or processed forms where visual identification is difficult.

Poor Packaging and Storage Leading to Degradation

Inadequate packaging—such as non-moisture-proof materials or improper sealing—can result in mold growth, loss of freshness, and oxidation. Improper storage during transit (e.g., exposure to heat or humidity) further degrades quality.

Intellectual Property and Legal Pitfalls

Unlicensed Use of Cultivation Technology or Trademarks

Some wakame producers, particularly in countries like Korea and Japan, have developed proprietary cultivation techniques, seed stock, or branded varieties protected under agricultural IP laws. Sourcing from farms using such protected methods without proper licensing may expose buyers to legal risks, especially in markets with strong IP enforcement.

Misuse of Geographical Indications (GIs)

Products labeled as “Korean wakame” or “Japanese kombu” may falsely imply origin or quality. In certain regions, terms linked to specific growing areas (e.g., “Mujin Wakame” in Korea) are protected as geographical indications. Unauthorized use of such labels can lead to legal challenges and reputational damage.

Biodiversity and Access and Benefit-Sharing (ABS) Compliance

Under international agreements like the Nagoya Protocol, accessing genetic resources (including seaweed strains) from certain countries may require permits and benefit-sharing agreements. Sourcing wakame from regulated jurisdictions without complying with ABS rules can lead to legal complications, especially in the EU and other signatory regions.

Inadequate Verification of Export Compliance

Exporting wakame may be subject to national regulations regarding sustainable harvesting quotas, environmental impact assessments, or phytosanitary standards. Buyers sourcing directly from producers must ensure all export documentation is in order to avoid shipment delays or seizures.

By proactively addressing these quality and IP-related pitfalls—through rigorous supplier vetting, third-party testing, legal due diligence, and clear contractual agreements—businesses can secure a reliable, safe, and compliant supply of Undaria wakame.

Logistics & Compliance Guide for Undaria Wakame

Undaria pinnatifida, commonly known as Wakame, is a brown seaweed widely used in Asian cuisine and valued for its nutritional benefits. As global demand increases, proper logistics and regulatory compliance are essential to ensure safe, legal, and sustainable trade. This guide outlines key considerations for transporting and importing/exporting Undaria Wakame.

Harvesting and Sourcing Compliance

Ensure Undaria Wakame is harvested in accordance with local environmental and fisheries regulations. Many regions, including parts of Europe, North America, and Australia, classify Undaria as an invasive species. Harvesting permits may be required, and wild harvesting may be restricted or prohibited in certain areas. Sustainable aquaculture operations should follow best management practices and be certified by relevant authorities (e.g., ASC, MSC if applicable).

Phytosanitary and Food Safety Standards

Undaria Wakame intended for human consumption must meet food safety standards in both the country of origin and destination. Key requirements include:

- Microbiological testing for pathogens such as E. coli, Salmonella, and Listeria.

- Heavy metal screening (e.g., arsenic, cadmium, lead) as marine algae can bioaccumulate contaminants.

- Pesticide and contaminant analysis if processed or cultivated near agricultural runoff.

- Phytosanitary certificate may be required by importing countries to confirm freedom from pests and diseases.

Producers should adhere to Hazard Analysis and Critical Control Points (HACCP) principles and maintain traceability from harvest to export.

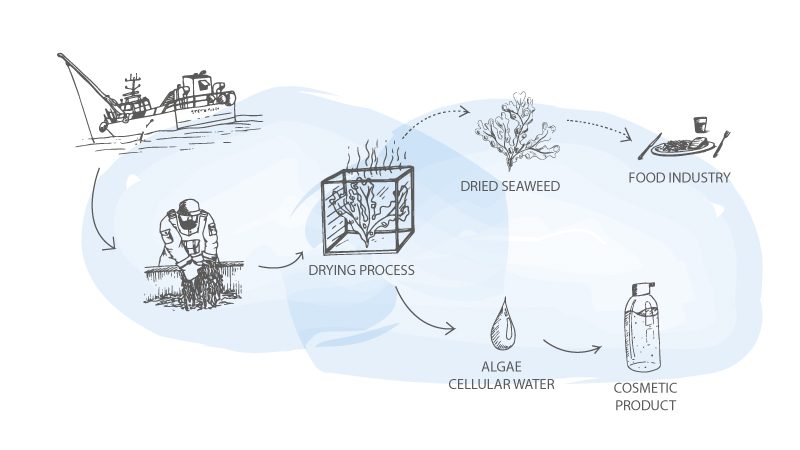

Processing and Packaging Requirements

Processing facilities must be registered and inspected under local food safety regulations (e.g., FDA in the U.S., FSSAI in India, EU Food Law). Key practices include:

- Drying and salting procedures that prevent microbial growth.

- Use of food-grade packaging materials that protect against moisture, light, and contamination.

- Labeling compliance, including product name (“Undaria pinnatifida” or “Wakame”), country of origin, harvest date, batch number, storage instructions, and allergen information (if processed in shared facilities).

Import/Export Regulations

Each country has specific import requirements for seaweed products. Common regulatory frameworks include:

- United States (FDA): Subject to the FDA’s Import Alert 29-17 for edible seaweed due to past contamination issues. Products may be detained without physical examination unless proof of compliance (e.g., lab testing) is provided.

- European Union: Must comply with Regulation (EC) No 178/2002 and Commission Regulation (EU) 2023/915, which set maximum levels for inorganic arsenic in seaweed and seaweed products intended for human consumption.

- Australia and New Zealand (FSANZ): Requires pre-market safety assessment for novel foods; Wakame is generally permitted but may require documentation depending on form and use.

- China and Japan: Require sanitary and phytosanitary (SPS) certificates, and may have specific labeling and registration requirements for imported food products.

Shipping and Cold Chain Logistics

Fresh or refrigerated Wakame requires temperature-controlled transport to maintain quality and prevent spoilage. Dried Wakame should be stored in cool, dry conditions to avoid moisture absorption and mold growth. Use of vacuum-sealed or nitrogen-flushed packaging helps preserve shelf life. Monitor shipment conditions (temperature, humidity) throughout the supply chain, especially during long-distance ocean freight.

Invasive Species and Biosecurity Protocols

Due to its invasive potential, live or reproductive forms of Undaria Wakame are restricted in many jurisdictions. Exporters must ensure that shipments:

- Contain only processed (dried, salted, blanched) material.

- Are free of reproductive spores or viable fragments.

- Are accompanied by documentation stating the product is non-viable and intended for consumption.

Failure to comply may result in shipment rejection or destruction under biosecurity laws (e.g., under New Zealand’s Biosecurity Act 1993 or Australia’s Biosecurity Act 2015).

Certification and Documentation

Essential documents for international trade include:

- Commercial invoice

- Packing list

- Bill of lading or air waybill

- Certificate of Analysis (CoA)

- Certificate of Origin

- Phytosanitary certificate (if required)

- Health certificate (for food products, as required by destination country)

Organic certification (e.g., USDA Organic, EU Organic) may be necessary if marketing the product as organic.

Sustainability and Traceability

Increasing consumer and regulatory demand for sustainable sourcing requires transparent traceability systems. Implement blockchain, QR codes, or batch tracking to verify origin, harvest methods, and processing history. Consider third-party audits to validate sustainability claims and support market access.

By adhering to this logistics and compliance framework, stakeholders can ensure safe, legal, and responsible trade of Undaria Wakame across global markets.

In conclusion, sourcing Undaria wakame requires careful consideration of sustainability, regulatory compliance, quality standards, and ethical practices. As a highly nutritious and commercially valuable seaweed, responsible sourcing is essential to prevent ecological disruption, particularly given its potential invasiveness in non-native marine environments. It is crucial to partner with reputable suppliers who adhere to sustainable harvesting or aquaculture practices, hold appropriate certifications (such as MSC or organic labels), and comply with local and international regulations. Additionally, traceability and transparency throughout the supply chain enhance product safety and support environmental stewardship. By prioritizing these factors, businesses can ensure a reliable, eco-friendly, and high-quality supply of Undaria wakame while contributing to the long-term health of marine ecosystems.