The global umbrella components market is experiencing steady growth, driven by rising disposable incomes, increasing demand for protective outdoor gear, and expanding retail and e-commerce channels for fashion and functional accessories. According to Mordor Intelligence, the global umbrella market was valued at approximately USD 5.2 billion in 2023 and is projected to grow at a CAGR of over 6.8% during the forecast period from 2024 to 2029. A significant portion of this growth is attributed to the increased production and customization of umbrella parts—including canopies, ribs, shafts, and handles—fueling demand for reliable, high-quality component manufacturers. As brands seek durability, lightweight materials, and innovative designs, the supply chain for precision-engineered umbrella parts has become more specialized. Based on production capacity, material innovation, global distribution, and industry reputation, the following list highlights the top 10 umbrella part manufacturers shaping the future of this niche yet critical segment.

Top 10 Umbrella Part Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 the world’s most famous umbrella manufacturer

Domain Est. 1999 | Founded: 1928

Website: knirps.com

Key Highlights: The world’s most famous umbrella manufacturer has been producing umbrellas since 1928. Immerse yourself in the history of Knirps….

#2 Contact us

Domain Est. 2022

Website: citizenactivegear.com

Key Highlights: Established in 1882 , CITIZEN UMBRELLA MANUFACTURERS LTD. has made a name for itself in the list of top suppliers of frames ,printed umbrella ,Bearing Parts ……

#3 Totes Umbrellas and Rainwear

Domain Est. 1995

Website: totes.com

Key Highlights: 1–2 day delivery 60-day returns Trending storeShop compact umbrellas, rain boots, rain jackets, sandals and more at totes. Free shipping on orders over $35. Plus find our best deal…

#4 Galtech International Market Umbrellas and Stands

Domain Est. 1998

Website: galtechcorp.com

Key Highlights: Our shade products are designed with the finest materials available. Our aluminum umbrellas utilize stainless steel cables and patented auto tilt mechanisms….

#5 Treasure Garden

Domain Est. 1998

Website: treasuregarden.com

Key Highlights: Our innovative cantilever systems and vast array of stylish market umbrellas enable us to provide the ideal shade solution for any outdoor space. For 40 years, ……

#6 Large selection of doppler parasols and umbrellas

Domain Est. 2001

Website: dopplerschirme.com

Key Highlights: Whether classic stick umbrellas or doppler pocket umbrellas: you will find the right umbrella for every weather situation in the online store….

#7 Cherbourg Umbrellas

Domain Est. 2003

Website: parapluiedecherbourg.com

Key Highlights: 14-day returnsTo buy a quality umbrella, there’s only one address: the Le Parapluie de Cherbourgboutique. Elegant, durable, and quality umbrellas made in France….

#8 Our History

Domain Est. 2005

Website: frankfordumbrellas.com

Key Highlights: Frankford manufactured and repaired all types of umbrellas—even for famous “Mummers” parades in Philadelphia. Rain umbrellas started to become only a small ……

#9 SP Umbrella: Rain Umbrellas

Domain Est. 2017

Website: spumbrellas.com

Key Highlights: We are specialized in manufacturing umbrellas for more than fifteen years. Focus on middle and high-end umbrellas and raincoats. And we deeply understand ……

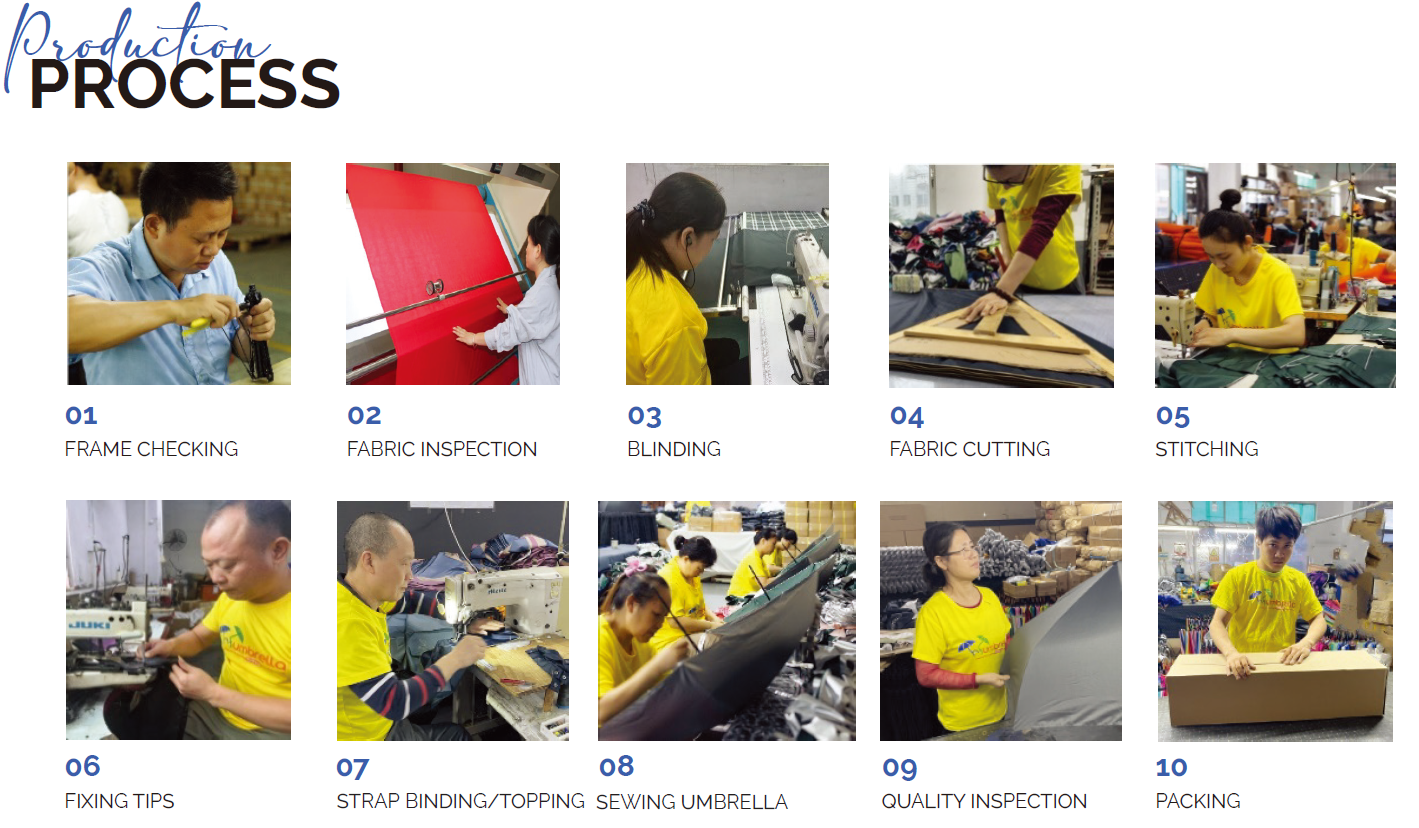

#10 About us

Domain Est. 2017

Website: topumbrella.com

Key Highlights: This marked the beginning of our journey into high-quality umbrella manufacturing, combining traditional craftsmanship with modern production. Topumbrella’s ……

Expert Sourcing Insights for Umbrella Part

H2 2026 Market Trends for Umbrella Parts

Based on current technological, environmental, economic, and consumer behavior trajectories, the umbrella parts market in H2 2026 is expected to be shaped by several converging trends focused on sustainability, performance, customization, and supply chain resilience.

1. Dominance of Sustainable & Eco-Friendly Materials (Key Driver):

* Shift from Virgin Plastics: Intensifying consumer and regulatory pressure (e.g., extended producer responsibility schemes, plastic taxes) will drastically reduce the use of virgin plastics (like standard polypropylene) in canopies, ribs, and handles. Recycled materials (rPET from bottles, recycled nylon, bio-based polymers) will become the de facto standard for major brands.

* Natural & Compostable Options: Demand for parts made from rapidly renewable resources (bamboo for shafts/handles, organic cotton or TENCEL™ lyocell for canopies) will grow significantly. Fully compostable components (e.g., bioplastics for joints, natural fiber-reinforced composites) will move from niche to mainstream, driven by circular economy goals.

* Durability as Sustainability: The focus will shift beyond just material origin to longevity. High-quality, repairable parts (replaceable ribs, joints, tips) will be a major selling point, reducing overall waste. “Buy less, buy better” sentiment will favor umbrellas designed for disassembly and part replacement.

2. Advanced Materials Driving Performance & Innovation:

* Superior Water & Stain Resistance: Canopy fabrics will increasingly utilize next-gen fluorine-free (PFC-free) durable water repellents (DWRs) and advanced coatings (e.g., based on silicones or ceramics) for longer-lasting performance without environmental toxins.

* Enhanced Strength & Lightweighting: Carbon fiber and advanced composites (e.g., fiberglass blends, carbon-fiber reinforced polymers) will become more common in ribs and shafts, offering superior wind resistance, reduced weight, and improved portability, especially in premium and compact models.

* Smart Material Integration: While still emerging, parts incorporating conductive threads (for heating elements in handles) or temperature-responsive polymers (for canopy tension adjustment) may appear in high-end or specialty umbrellas.

3. Customization & Personalization (B2B & B2C):

* B2B Branding Demand: Corporate gifting and promotional umbrellas will drive demand for highly customizable parts, particularly handles, tips, and canopy trims. Manufacturers will offer extensive options for logos, colors, textures, and unique shapes (ergonomic, branded).

* Consumer Customization: Direct-to-consumer (DTC) brands will leverage digital platforms allowing consumers to mix-and-match parts (e.g., different colored ribs, unique handle designs, specialized tips) to create personalized umbrellas, increasing perceived value and reducing returns.

4. Supply Chain Resilience & Regionalization:

* Diversification: Ongoing geopolitical tensions and past disruptions will push major umbrella assemblers and brands to diversify their part sourcing beyond traditional hubs (e.g., China). Increased manufacturing in Southeast Asia (Vietnam, Thailand), Eastern Europe, and potentially nearshoring for North American/European markets will be evident.

* Vertical Integration & Partnerships: Large players may invest in or form closer partnerships with key part suppliers (especially for high-tech materials like carbon fiber ribs) to secure supply and ensure quality control.

* Inventory Strategy Shift: A move towards “just-in-case” or hybrid models for critical, long-lead-time parts (e.g., specialized molds, carbon components) to mitigate disruption risks, balanced with lean practices for standard components.

5. Design Focus: Ergonomics, Safety, and Aesthetics:

* Ergonomic Handles: Continued innovation in handle design for comfort, grip (especially in wet conditions), and ease of opening/closing. Soft-touch, non-slip materials and contoured shapes will be standard.

* Safety Features: Increased adoption of parts designed for safety: non-pointed or blunt tips (especially for auto-open), highly visible canopy colors/patterns, and potentially integrated subtle reflectors in trims or ribs.

* Aesthetic Minimalism & Premiumization: Clean lines, minimalist hardware (e.g., hidden joints, seamless shafts), and sophisticated color palettes (earthy tones, muted metallics) will appeal to the premium market. Transparency (e.g., clear canopy sections) may see niche growth.

6. Cost Pressures & Value Engineering:

* Balancing Act: While sustainability and performance drive innovation, persistent inflation and economic uncertainty will keep cost under scrutiny. Manufacturers will focus on value engineering – optimizing designs for manufacturability and material efficiency without compromising core durability or sustainability credentials (e.g., using thinner but stronger composites, optimizing rib cross-sections).

* Material Substitution: Exploration of cost-effective, high-performance alternatives to expensive materials like pure carbon fiber (e.g., carbon-fiber reinforced composites, advanced glass fiber).

Conclusion for H2 2026:

The umbrella parts market in the second half of 2026 will be characterized by a maturing focus on sustainability as a baseline requirement, driven by regulation and consumer demand. Advanced materials will enable lighter, stronger, and more functional umbrellas. Supply chain resilience will be a critical operational factor, influencing sourcing strategies. While premiumization and customization grow, cost-effective innovation through value engineering will remain essential across segments. Success will belong to suppliers and assemblers who integrate eco-design, leverage new material science, ensure supply security, and offer solutions balancing performance, durability, aesthetics, and responsible production.

Common Pitfalls When Sourcing Umbrella Parts (Quality, IP)

Sourcing umbrella components—such as canopies, ribs, shafts, and mechanisms—can present significant challenges, particularly concerning quality control and intellectual property (IP) risks. Overlooking these aspects can lead to product failures, legal disputes, or reputational damage. Below are common pitfalls to avoid:

Quality Inconsistencies

Suppliers, especially low-cost manufacturers, may deliver inconsistent material quality or workmanship. For example, fiberglass ribs might be undersized or poorly coated, leading to premature breakage. Canopy fabrics may fade or tear quickly if not UV-resistant or properly woven. Without rigorous incoming inspections and clear quality agreements, these inconsistencies can result in high return rates and customer dissatisfaction.

Lack of Material Traceability

Many umbrella parts, particularly textiles and composite materials, require specific certifications (e.g., UV protection, water repellency, or flame resistance). Sourcing without verified documentation or supplier transparency can result in non-compliance with safety or regulatory standards, especially when selling in markets like the EU or North America.

Inadequate Testing and Durability Standards

Some suppliers claim products meet wind-resistance or durability benchmarks without third-party validation. Relying solely on supplier claims—without independent testing—can lead to umbrellas that fail under normal use. Establishing clear performance criteria and requiring test reports is essential.

Intellectual Property Infringement

Using patented umbrella mechanisms (e.g., automatic open/close systems, folding joints) without proper licensing exposes your business to legal action. Some suppliers may offer “similar” designs that infringe on existing patents, especially if they copy branded models. Conducting IP due diligence and ensuring design freedom-to-operate is critical.

Unauthorized Subcontracting

Suppliers may outsource part of the production to unapproved subcontractors to cut costs, resulting in uncontrolled quality and potential IP exposure. Without contractual prohibitions and audit rights, you lose visibility into the manufacturing chain and increase risk.

Poor Documentation and Specifications

Vague or incomplete technical drawings, material specs, and tolerance requirements can lead to misinterpretations during production. This often results in parts that don’t fit or function as intended, requiring costly rework or redesign.

Overlooking Tooling Ownership

In injection-molded or stamped metal parts, tooling is often paid for by the buyer. If IP and ownership of molds aren’t clearly defined in contracts, suppliers may retain control, making it difficult to switch manufacturers or protect proprietary designs.

Avoiding these pitfalls requires thorough supplier vetting, detailed contracts, proactive quality management, and IP risk assessments before production begins.

Logistics & Compliance Guide for Umbrella Partners

This guide outlines the essential logistics and compliance requirements for partners working with Umbrella. Adherence to these guidelines ensures smooth operations, regulatory compliance, and the protection of all parties involved.

Logistics Procedures

Order Fulfillment & Shipping

All orders must be processed within 24 hours of receipt. Shipments should be dispatched within 48 hours using approved carriers that provide real-time tracking. Packaging must be secure, branded appropriately, and include all required shipping documentation.

Inventory Management

Partners must maintain accurate, up-to-date inventory records through the Umbrella Partner Portal. Weekly stock reconciliations are mandatory, and low-stock alerts must be reported immediately to avoid supply chain disruptions.

Returns & Reverse Logistics

Approved returns must be processed within 5 business days. Returned goods must be inspected, documented, and securely stored. Partners must follow the standardized return workflow in the portal and coordinate with Umbrella’s logistics team for pickup or return shipping.

Warehousing Standards

Storage facilities must meet ISO 902007 or equivalent standards. Temperature control, security protocols, and pest infestation prevention are mandatory where applicable. Regular audits will be conducted to ensure compliance.

Compliance Requirements

Regulatory Compliance

All operations must comply with local, national, and international regulations, including customs, labor, and environmental laws. Partners are responsible for maintaining all necessary business licenses and permits.

Data Protection & Privacy

Partners must adhere to GDPR, CCPA, and other applicable data privacy regulations. Customer and transaction data must be encrypted, access-controlled, and never shared without explicit authorization. Annual data security audits are required.

Ethical Sourcing & Labor Practices

Suppliers must comply with the Ethical Trading Initiative (ETI) Base Code. Child labor, forced labor, and unsafe working conditions are strictly prohibited. Partners must provide proof of fair wages and safe working environments upon request.

Documentation & Auditing

Accurate records—including shipping manifests, invoices, compliance certifications, and training logs—must be retained for a minimum of seven years. Umbrella reserves the right to conduct unannounced audits to verify compliance.

Incident Reporting

Any logistics disruptions, compliance breaches, or safety incidents must be reported to the Umbrella Compliance Team within 2 hours of discovery. A formal incident report is required within 24 hours.

Failure to comply with these guidelines may result in suspension or termination of the partnership. Regular training and updates will be provided to ensure continued alignment with Umbrella’s standards.

Conclusion for Sourcing Umbrella Parts:

In conclusion, sourcing umbrella parts requires a strategic approach that balances cost, quality, reliability, and supply chain efficiency. By identifying key components such as canopies, frames, shafts, ribs, and handles, and evaluating suppliers based on material quality, production capacity, compliance standards, and lead times, businesses can ensure durable and consistent umbrella manufacturing. Exploring both domestic and international suppliers—particularly in manufacturing hubs like China, Vietnam, or India—can offer competitive pricing and scalability. Establishing strong supplier relationships, conducting regular quality audits, and maintaining supply chain flexibility are essential for mitigating risks such as delays or material shortages. Ultimately, a well-structured sourcing strategy not only enhances product performance and customer satisfaction but also supports long-term brand reputation and market competitiveness in the outdoor and fashion accessories industry.