The global ultraviolet (UV) water treatment market is experiencing robust growth, driven by rising concerns over water quality, stringent regulatory standards, and increasing demand for chemical-free disinfection solutions across municipal, industrial, and residential sectors. According to Grand View Research, the global UV water treatment market size was valued at USD 1.37 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 7.2% from 2023 to 2030. Similarly, Mordor Intelligence forecasts continued expansion, citing growing investments in water infrastructure and the adoption of advanced disinfection technologies in emerging economies. As industries and municipalities prioritize sustainable water treatment methods, UV technology stands out for its effectiveness in neutralizing pathogens without the use of chemicals. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining innovation, reliability, and global reach to shape the future of clean water. Here, we present the top 10 ultraviolet water treatment manufacturers driving this transformation.

Top 10 Ultraviolet Water Treatment Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 UVPure

Domain Est. 2001

Website: uvpure.com

Key Highlights: UV Pure is a manufacturer of advanced ultraviolet water disinfection systems for residential, commercial, industrial, public, and municipal applications….

#2 Aquafine UV Water Treatment Systems

Domain Est. 2005

Website: trojantechnologies.com

Key Highlights: Aquafine is the leader in innovative industrial fluid treatment using ultraviolet (UV) technology with over 70 years of experience….

#3 ULTRAAQUA

Domain Est. 1999

Website: ultraaqua.com

Key Highlights: ULTRAAQUA is an international manufacturer of UV & Ozone systems for a wide range of water treatment applications, such as Recirculated Aquaculture Systems (RAS) ……

#4 Discover our UV-C LED disinfection solutions

Domain Est. 2014

Website: aquisense.com

Key Highlights: We are passionate about developing solutions that solve real-world problems in water, air, and surface UV-C LED disinfection applications….

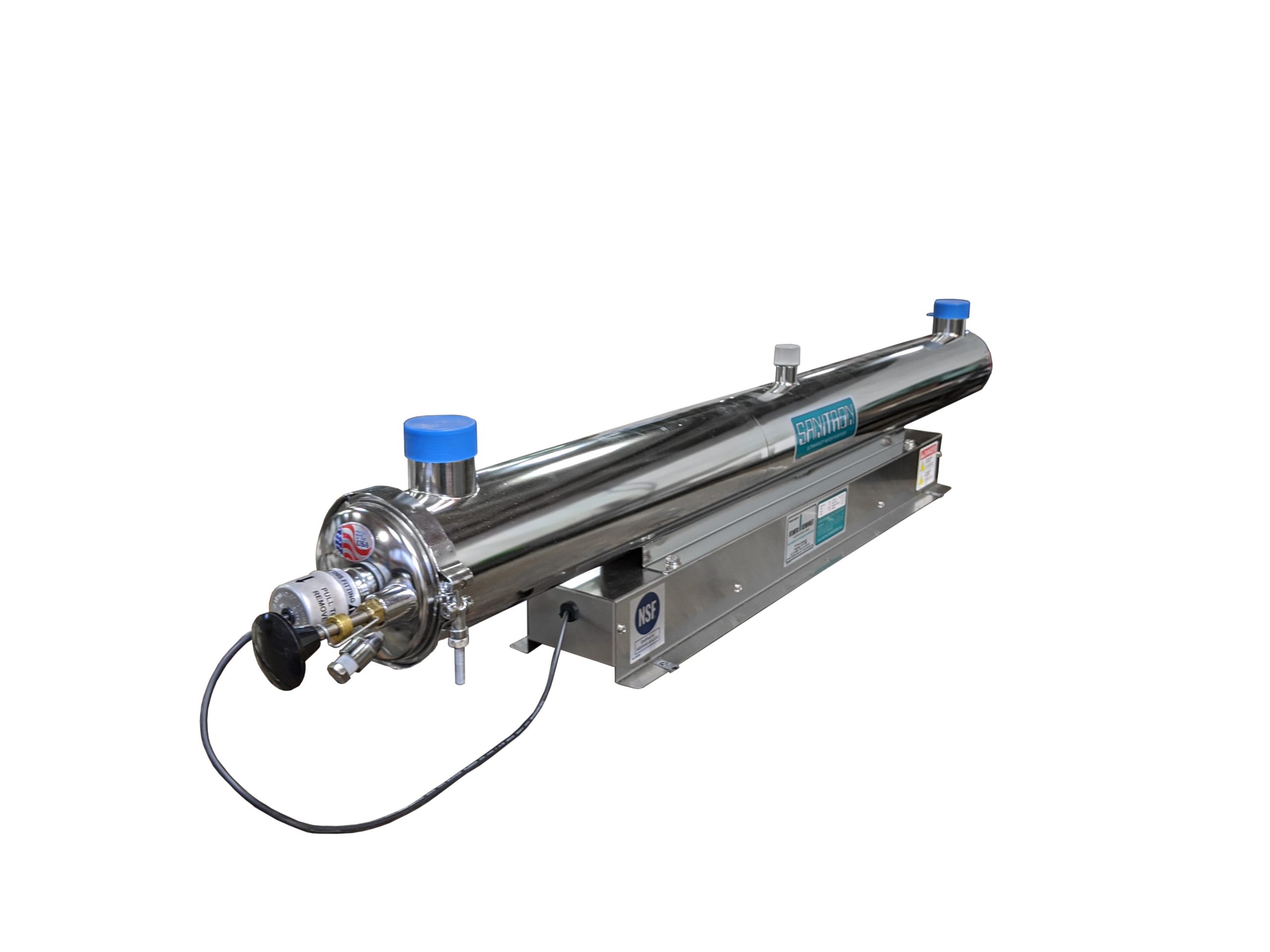

#5 Patented Wiper Makes Sanitron® UV Water Purifier the Clear Choice

Domain Est. 1994

Website: ultraviolet.com

Key Highlights: Sanitron is the best ultraviolet water purifier, with patented quartz sleeve wiper. It’s the clear choice for residential and commercial ……

#6 Aqua Ultraviolet

Domain Est. 1999

Website: aquaultraviolet.com

Key Highlights: Aqua Ultraviolet proudly offers innovative ultraviolet filters, sanitizers, sterilizers and disinfection systems for water, air, and surface application!…

#7 UV Dynamics

Domain Est. 1999

Website: uvdynamics.com

Key Highlights: UVDynamics is a privately held corporation that designs and manufactures ultraviolet water and air disinfection systems….

#8 UVCatalyst

Domain Est. 2002

Website: ultravation.com

Key Highlights: UVCatalyst is a whole-home PCO air purifier featuring activated-carbon air contamination capture · Creates better, healthier air · Proven germicidal performance ……

#9 VIQUA Page

Domain Est. 2003

Website: viqua.com

Key Highlights: VIQUA is proud to be one of the world’s leading suppliers of residential and light commercial UV water treatment systems….

#10 Ultraviolet Water Purifiers

Domain Est. 2004

Website: buyultraviolet.com

Key Highlights: Atlantic Ultraviolet manufactures ultraviolet water purifiers, air & surface sanitizers, ultraviolet germicidal lamps, and quartz sleeves for sale on ……

Expert Sourcing Insights for Ultraviolet Water Treatment

H2: Emerging Market Trends in Ultraviolet (UV) Water Treatment for 2026

As the global demand for safe, chemical-free water disinfection rises, the ultraviolet (UV) water treatment market is poised for significant transformation by 2026. Driven by technological innovation, regulatory shifts, and growing environmental awareness, the sector is expected to expand across municipal, industrial, and residential applications. Below are key market trends shaping the UV water treatment industry in 2026:

-

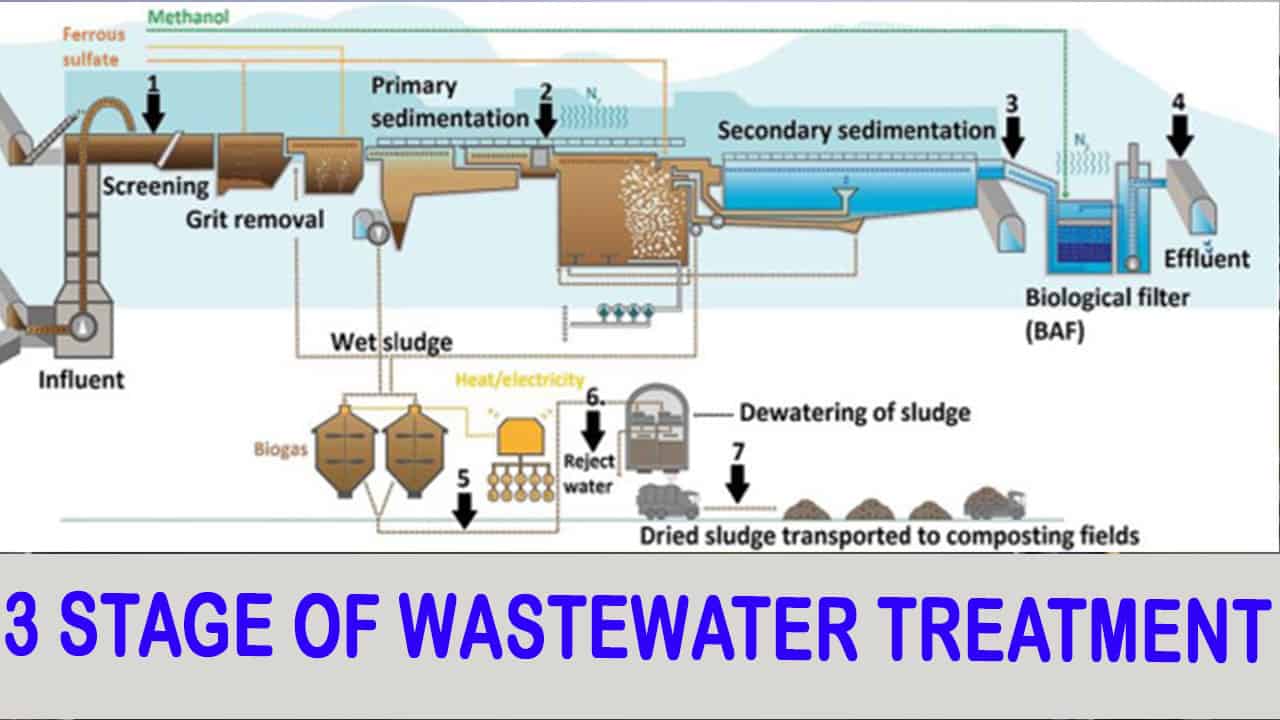

Increased Adoption in Municipal Water Infrastructure

Municipalities worldwide are upgrading aging water treatment facilities to meet stricter safety regulations and address emerging contaminants such as pharmaceuticals and pathogens. By 2026, UV technology is expected to become a standard component in municipal water treatment due to its effectiveness against chlorine-resistant microorganisms like Cryptosporidium and Giardia. Investment in smart water grids and resilient infrastructure—particularly in North America and Europe—will further accelerate UV system integration. -

Rise of Advanced UV-LED Technology

A major technological shift is the growing adoption of UV-LED systems over traditional mercury-vapor lamps. UV-LEDs offer benefits including lower energy consumption, longer lifespan, instant on/off functionality, and absence of toxic mercury. By 2026, declining manufacturing costs and improved efficiency are expected to make UV-LED systems commercially viable for broader applications, particularly in point-of-use (POU) and point-of-entry (POE) systems for homes and small businesses. -

Expansion in Industrial and Commercial Sectors

Industries such as food and beverage, pharmaceuticals, and power generation require high-purity water and are increasingly turning to UV treatment to ensure contamination-free processes. In 2026, stricter hygiene standards and sustainability goals will drive adoption, especially in emerging economies like India, Southeast Asia, and Latin America. Integration of UV systems with other treatment methods (e.g., reverse osmosis and filtration) will become standard for comprehensive water purification. -

Growth in Residential and Consumer Applications

Rising consumer awareness about water quality and health risks is fueling demand for home-based UV water purifiers. Compact, smart-enabled UV systems with IoT integration—offering remote monitoring, maintenance alerts, and real-time water quality feedback—are expected to gain market share by 2026. Asia-Pacific, led by China and India, will be a key growth region due to urbanization and concerns over tap water safety. -

Regulatory Support and Sustainability Goals

Governments and international organizations are promoting chemical-free disinfection methods to reduce chlorine byproducts such as trihalomethanes (THMs). In 2026, environmental regulations and green building certifications (e.g., LEED, WELL) will increasingly favor UV systems. Additionally, global sustainability initiatives like the UN Sustainable Development Goal 6 (Clean Water and Sanitation) will incentivize investment in UV technology for decentralized and off-grid water solutions. -

Innovation in Smart and Modular Systems

The integration of AI and IoT in UV water treatment systems will enable predictive maintenance, energy optimization, and remote diagnostics. Modular UV units designed for scalability and portability will cater to disaster relief, remote communities, and mobile applications. These innovations will enhance reliability and reduce operational costs—key factors for widespread adoption. -

North America and Europe Lead, Asia-Pacific Shows Fastest Growth

While North America and Europe dominate the current UV water treatment market due to stringent regulations and high infrastructure investment, the Asia-Pacific region is projected to witness the highest compound annual growth rate (CAGR) through 2026. Rapid urbanization, industrialization, and government-led clean water programs in countries like China, India, and Indonesia will drive demand.

Conclusion:

By 2026, the UV water treatment market will be characterized by technological advancement, regulatory support, and expanding application diversity. The shift toward energy-efficient, mercury-free, and intelligent systems will redefine industry standards. As water security becomes a global priority, UV disinfection is expected to play a central role in sustainable water management strategies across sectors.

Common Pitfalls in Sourcing Ultraviolet Water Treatment Systems (Quality & IP)

Sourcing ultraviolet (UV) water treatment systems requires careful due diligence to avoid significant risks related to performance, safety, and intellectual property (IP). Overlooking key aspects can lead to ineffective treatment, regulatory non-compliance, and legal exposure.

Inadequate Validation of UV System Performance and Quality

One of the most critical pitfalls is assuming published UV dose claims without independent verification. Many suppliers provide performance data based on ideal laboratory conditions that do not reflect real-world water quality or flow dynamics.

-

Lack of Third-Party Certification: Relying solely on manufacturer claims without certification from recognized bodies such as NSF/ANSI 55, DVGW, ÖNORM, or USEPA UV Disinfection Guidance Manual validation can lead to underperforming systems. Certified systems undergo rigorous testing for UV transmittance (UVT), flow rate, and microbial log reduction.

-

Ignoring Real-World Water Quality Parameters: UV effectiveness is highly dependent on water quality. Sourcing without assessing actual UVT, turbidity, iron, manganese, and hardness levels at the point of use can result in insufficient microbial inactivation. Pre-treatment requirements are often underestimated.

-

Poor Component Quality and Materials of Construction: Substandard quartz sleeves, low-output UV lamps, or non-corrosion-resistant reactor chambers degrade quickly, reducing system efficacy and lifespan. Stainless steel grade (e.g., 316L vs. 304), sleeve clarity, and lamp aging characteristics must be evaluated.

-

Inadequate Monitoring and Control Systems: Systems lacking real-time UV intensity sensors, automatic lamp output adjustment, or proper alarm functions fail to ensure consistent disinfection, especially during fluctuating flow or UVT conditions.

Overlooking Intellectual Property (IP) Risks

Sourcing UV systems—especially from low-cost or offshore suppliers—exposes buyers to significant IP-related risks that can result in legal liabilities, shipment seizures, or forced system decommissioning.

-

Use of Counterfeit or Reverse-Engineered Components: Some suppliers use unlicensed copies of patented lamp designs, reactor geometries, or electronic ballasts. These may appear functional but infringe on IP rights held by major OEMs (e.g., Trojan, Xylem, Evoqua).

-

Lack of IP Warranty or Indemnification: Contracts that do not include IP infringement warranties or indemnification clauses leave the buyer liable if a third party asserts patent or trademark violations related to the supplied equipment.

-

Unverified Supply Chain Transparency: Opaque supply chains make it difficult to confirm the origin of critical components. Procuring systems with OEM-labeled parts that are not genuine can breach licensing agreements and compromise system validation.

-

Impact on System Validation and Compliance: Using non-certified or IP-infringing systems may invalidate regulatory approvals or third-party validations, rendering the installation non-compliant in regulated environments (e.g., pharmaceutical, food and beverage).

Mitigation Strategies

To avoid these pitfalls, implement a structured sourcing process:

- Require Full Third-Party Validation Reports (e.g., from NSF, DVGW) for the exact model being procured.

- Conduct Site-Specific Feasibility Studies to match system performance with actual water quality.

- Audit Supplier Credentials, including manufacturing practices, quality control, and component sourcing.

- Include IP Indemnification Clauses in procurement contracts.

- Verify Component Authenticity through direct OEM confirmation where possible.

- Engage Independent Engineers for technical review prior to procurement.

By addressing both quality and IP concerns proactively, organizations can ensure reliable, compliant, and legally sound UV water treatment installations.

Logistics & Compliance Guide for Ultraviolet (UV) Water Treatment Systems

Regulatory Compliance Requirements

UV water treatment systems must adhere to stringent regulatory standards to ensure public health protection and environmental safety. Key compliance frameworks include:

- U.S. Environmental Protection Agency (EPA) Guidelines: The EPA’s Ultraviolet Disinfection Guidance Manual (UVDGM) provides validated design and operational criteria for municipal and community water systems. Systems must achieve a minimum 4-log reduction of pathogens like Cryptosporidium and Giardia.

- NSF/ANSI Standard 55: This standard classifies UV systems based on their intended use:

- Class A: Designed to disinfect and/or kill microorganisms in microbiologically unsafe water.

- Class B: Intended to provide supplemental bactericidal treatment for public or municipally treated water.

- European Union Drinking Water Directive (2020/2184): Requires UV systems to meet performance criteria for microbial inactivation, with periodic validation testing and monitoring.

- Health Canada Guidelines: Recognize UV treatment as an effective method for microbial control, provided systems are certified to NSF/ANSI 55 or equivalent standards.

Operators must maintain documentation of system certification, validation testing, and maintenance logs to demonstrate compliance during audits.

Equipment Handling and Storage

Proper handling and storage are critical to preserving UV system integrity prior to installation:

- Light-Sensitive Components: UV lamps and sensors degrade when exposed to direct sunlight or ambient UV light. Store in original opaque packaging in a cool, dry location.

- Fragile Components: Quartz sleeves and UV lamps are highly fragile. Handle with clean gloves to prevent oil contamination and avoid mechanical stress.

- Temperature Control: Store equipment between 40°F (4°C) and 100°F (38°C). Avoid freezing conditions that can compromise seals and electronic components.

- Orientation: Keep UV reactors and control panels upright to prevent internal damage. Do not stack heavy items on top of packaged units.

Transportation Guidelines

Ensure safe and compliant transportation of UV treatment systems:

- Palletized Shipping: Secure units on pallets using straps or shrink wrap to prevent shifting during transit.

- Environmental Protection: Use weather-resistant covers for outdoor transport. Avoid exposure to moisture, extreme temperatures, and corrosive atmospheres.

- Hazardous Materials: UV lamps may contain small amounts of mercury. Comply with Department of Transportation (DOT) regulations for hazardous materials (49 CFR) if applicable, including proper labeling and documentation.

- Fragile Labeling: Mark crates and packages with “Fragile” and “This Side Up” indicators.

Installation and Commissioning Protocols

Follow manufacturer and regulatory guidelines for correct installation:

- Pre-Installation Inspection: Verify all components are present and undamaged. Check for compliance markings (e.g., NSF, CE).

- Water Quality Requirements: Confirm feed water meets specifications for UV transmittance (UVT > 85% recommended), turbidity (<1 NTU), iron (<0.3 ppm), manganese (<0.05 ppm), and hardness to prevent fouling of quartz sleeves.

- Electrical Safety: Install grounding per NEC (National Electrical Code) standards. Use GFCI protection where required. Ensure voltage and phase match system requirements.

- Validation Testing: Perform biodosimetry testing during commissioning to confirm the delivered UV dose meets design requirements. Document results for regulatory submission.

Operational Maintenance and Monitoring

Sustained compliance depends on consistent maintenance:

- Lamp Replacement: Replace UV lamps annually or per manufacturer’s recommended interval (typically 9,000–12,000 hours of operation).

- Quartz Sleeve Cleaning: Inspect and clean sleeves every 3–6 months using manufacturer-approved cleaners to maintain UV transmittance.

- Sensor Calibration: Annually calibrate UV intensity sensors to ensure accurate dose monitoring.

- System Logs: Maintain records of lamp changes, sleeve cleaning, alarm events, and validation tests for a minimum of five years.

- Alarm Systems: Ensure high/low UV intensity, flow rate, and lamp failure alarms are functional and connected to supervisory control systems.

Decommissioning and Disposal

End-of-life management must comply with environmental regulations:

- Lamp Disposal: UV lamps are considered universal waste due to mercury content. Recycle through certified hazardous waste handlers in accordance with EPA regulations (40 CFR Part 273) or local equivalents.

- Electronic Waste: Dispose of ballasts, controllers, and sensors through e-waste recycling programs.

- Metal Components: Steel reactors and housings can typically be recycled as scrap metal.

- Documentation: Retain disposal records, including manifests and certificates of recycling, for audit purposes.

Adherence to this guide ensures regulatory compliance, operational effectiveness, and environmental responsibility throughout the lifecycle of UV water treatment systems.

In conclusion, sourcing ultraviolet (UV) water treatment systems offers an effective, chemical-free, and environmentally responsible solution for water disinfection. UV technology reliably inactivates a broad spectrum of pathogens—including bacteria, viruses, and protozoa—without altering the water’s taste, odor, or chemical composition. When sourcing UV systems, it is essential to consider factors such as flow rate, water quality (e.g., turbidity and UV transmittance), system validation, regulatory compliance, and maintenance requirements. Selecting a reputable supplier with proven technology, proper certifications (such as NSF/ANSI 55), and strong technical support ensures long-term performance and safety. Overall, investing in a well-sourced UV water treatment system provides a sustainable, low-maintenance, and highly efficient method for delivering safe, clean water across residential, commercial, and industrial applications.