The global welding helmets market is experiencing steady growth, driven by rising industrialization, expanding construction activities, and increased focus on worker safety across manufacturing and metal fabrication sectors. According to a report by Mordor Intelligence, the global welding equipment market—of which welding helmets are a critical component—is projected to grow at a CAGR of over 5.2% from 2023 to 2028. Similarly, Grand View Research estimates that the global welding helmets market size was valued at USD 1.3 billion in 2022 and is expected to expand at a CAGR of 6.1% from 2023 to 2030. This growth is further fueled by technological advancements such as auto-darkening filters (ADF), increased adoption of lightweight and ergonomic designs, and rising compliance with occupational health and safety regulations. As demand surges, a diverse range of manufacturers—from established industry leaders to innovative niche players—have emerged to dominate the market across North America, Europe, and Asia Pacific. The following is a data-driven look at the top 10 types of welding helmet manufacturers shaping the industry landscape.

Top 10 Types Of Welding Helmets Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Welding Helmets & Masks

Domain Est. 2007

Website: pwpind.com

Key Highlights: We are an official partner and supplier of 3M welding helmets and masks, which are designed with the latest technology to offer maximum protection and comfort….

#2 Helmets and Hoods

Domain Est. 1988

Website: automation.honeywell.com

Key Highlights: Welding Helmets & Hoods. Designed with the worker in mind to provide maximum safety and comfort. Welding helmets, helmets with respirator and more….

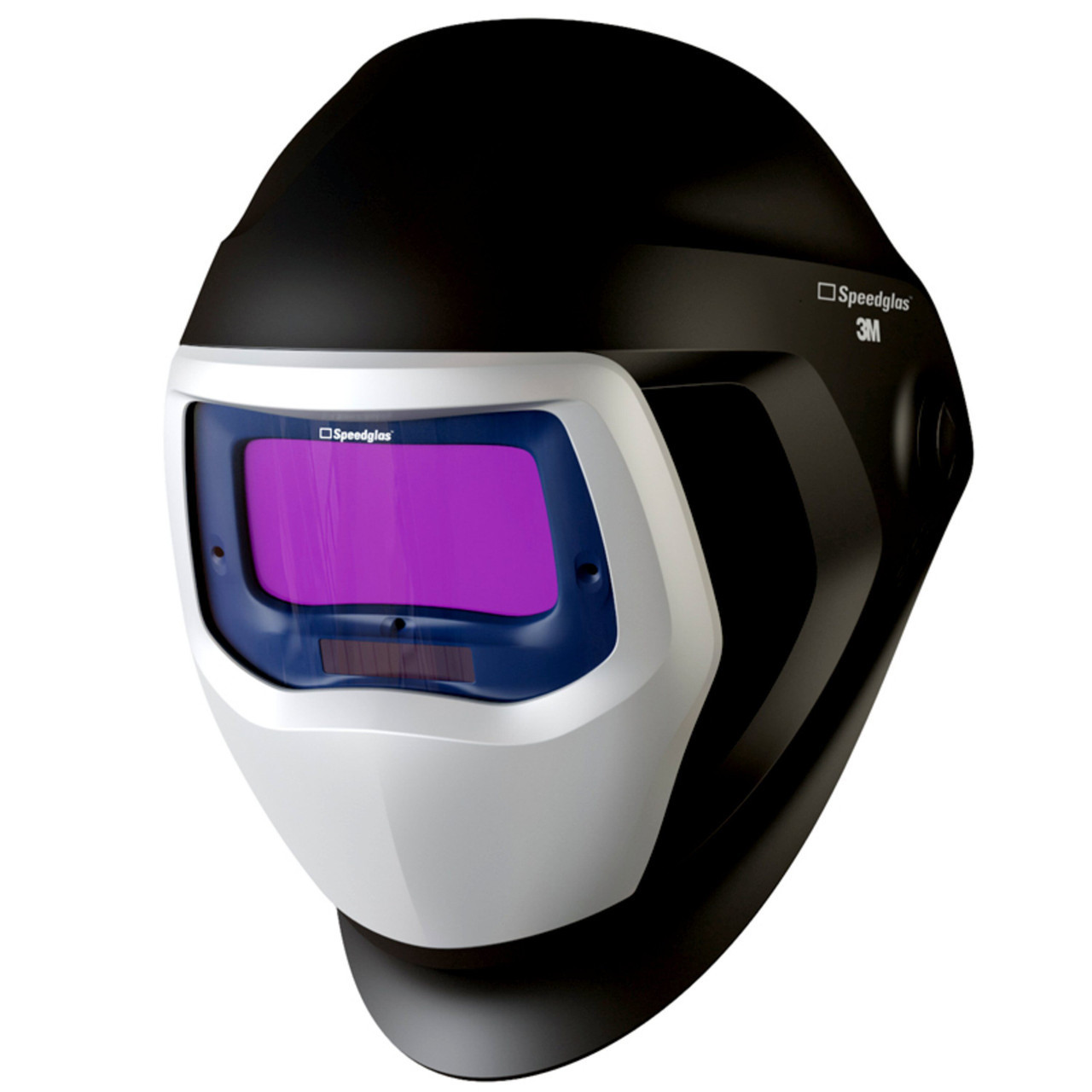

#3 3M Welding Helmets

Domain Est. 1988

Website: 3m.com

Key Highlights: The 3M Speedglas G5-01 Heavy-Duty Welding Helmet offers integrated respiratory protection and is quickly adjustable for both welding and grinding….

#4 Digital Elite™, Forged in Freedom™, ClearLight 4x

Domain Est. 1996

Website: millerwelds.com

Key Highlights: Rating 4.7 (699) · Free deliveryAdvanced high-definition optics deliver a clearer, brighter, more realistic view for every stage of every weld….

#5 Welding Helmets

Domain Est. 1996

Website: aih.com

Key Highlights: Fibre-Metal® by Honeywell 906GY Tigerhood Classic™ Passive Welding Helmet With Lift-Front Lens, 10 Lens Shade, Gray, 2 x 4-1/4 in Viewing Area, ……

#6 Welding Helmets Archives

Domain Est. 1997

Website: weldmark.com

Key Highlights: Filter By · Brand · Enriched Indicator · Welding Helmet Type · Helmet Style · Helmet Graphic · Helmet Color · Helmet Series · Email….

#7 Welding helmets

Domain Est. 2000

Website: bolle-safety.com

Key Highlights: Free delivery over $70 · 30-day returns…

#8 Welding and Abrasives Products Online Catalog

Domain Est. 2006

Website: weldcotemetals.com

Key Highlights: Their core products include filler metals and electrodes, abrasives, safety equipment, and welding tools and machines designed in-house….

#9 Outlaw Leather

Domain Est. 2012

Website: outlawleather.com

Key Highlights: Welding hoods: We supply a wide range of welding hoods, including options like the Slimline and LeatherClick series, pancake hoods, Pipeliner and Proliner….

#10 Welding Helmet with Respirator Mask

Domain Est. 2021

Website: gvs-rpb.com

Key Highlights: A lightweight and ergonomic respirator that is designed to withstand the demands of harsh welding operations….

Expert Sourcing Insights for Types Of Welding Helmets

2026 Market Trends for Types of Welding Helmets

The welding helmet market is undergoing significant transformation driven by technological innovation, evolving workplace safety standards, and increasing demand across industrial sectors. As we approach 2026, several key trends are shaping the landscape for different types of welding helmets. Below is an analysis of these trends segmented by helmet type.

Auto-Darkening Welding Helmets

Auto-darkening welding helmets are expected to dominate the market in 2026 due to advancements in sensor technology and growing emphasis on welder safety and productivity. These helmets feature liquid crystal display (LCD) filters that automatically adjust shade levels in response to arc intensity, protecting users from harmful UV/IR radiation.

Key 2026 trends:

– Enhanced Sensitivity and Speed: New models are incorporating multi-sensor systems with response times under 0.1 milliseconds, improving protection during start-up arcs.

– Wide Viewing Areas: Manufacturers are expanding lens sizes (up to 4×5 inches) to improve peripheral vision and reduce neck strain.

– Wireless Connectivity: Integration with IoT platforms enables real-time data tracking for training, compliance, and performance analytics.

– Solar and Hybrid Power Options: Increased adoption of solar-battery hybrid systems reduces dependency on disposable batteries, appealing to sustainability-focused industries.

Market growth is fueled by rising automation in manufacturing and infrastructure development in emerging economies.

Passive (Fixed-Shade) Welding Helmets

Passive helmets, which feature a fixed-shade filter lens, continue to serve niche markets due to their simplicity and low cost. However, their market share is projected to decline by 2026.

Key trends:

– Declining Popularity: With increased awareness of arc flash hazards, passive helmets are being phased out in professional environments.

– Use in Training and DIY Settings: They remain popular in educational institutions and among hobbyists due to affordability.

– Regulatory Pressure: OSHA and international safety standards are increasingly favoring auto-darkening technology, limiting passive helmet use in industrial applications.

Despite these challenges, passive helmets will maintain a small but stable presence in low-risk or infrequent welding tasks.

Powered Air-Purifying Respirator (PAPR) Welding Helmets

PAPR-integrated welding helmets are gaining traction in 2026 as workplace health regulations become stricter, particularly in confined spaces or high-fume environments.

Key trends:

– Dual Protection Demand: These helmets combine respiratory protection with auto-darkening face shields, offering comprehensive safety in hazardous conditions.

– Lightweight Design Improvements: Advances in battery and blower technology are reducing weight and enhancing comfort for extended use.

– Compliance with OSHA and ISO Standards: Industries such as shipbuilding, petrochemicals, and heavy fabrication are adopting PAPR helmets to meet stringent air quality regulations.

– Growth in North America and Europe: Regulatory mandates and higher safety budgets are accelerating adoption in these regions.

The PAPR helmet segment is projected to register the highest compound annual growth rate (CAGR) through 2026.

Virtual Reality (VR) and Smart Welding Helmets

Smart helmets equipped with augmented reality (AR) and VR capabilities represent the frontier of welding technology. Though still in early adoption, their presence is growing rapidly.

Key trends:

– Real-Time Guidance and Training: AR overlays provide welders with real-time data, such as bead placement, travel speed, and angle, improving precision and reducing errors.

– Integration with Welding Simulators: VR-enabled helmets are being used in vocational training programs to enhance skill development in a risk-free environment.

– AI-Powered Analytics: Onboard AI interprets welding performance and provides feedback, supporting quality control and continuous improvement.

– Adoption in Aerospace and Precision Manufacturing: High-value industries are investing in smart helmets to ensure weld integrity and reduce rework.

While high initial costs limit mass adoption, the smart helmet market is expected to expand significantly post-2026 as prices decrease and ROI becomes clearer.

Conclusion

By 2026, the welding helmet market will be characterized by a shift toward intelligent, multifunctional, and safety-compliant solutions. Auto-darkening and PAPR helmets will lead industrial adoption, driven by regulatory and technological forces. Passive helmets will remain relevant in entry-level applications, while smart and VR-enabled helmets will begin to redefine advanced welding practices. As digitalization and worker safety converge, manufacturers who innovate in connectivity, ergonomics, and integrated protection will capture the largest market share.

Common Pitfalls When Sourcing Types of Welding Helmets (Quality and IP)

Sourcing welding helmets, especially with attention to quality and impact protection (IP) ratings, involves several common pitfalls that buyers should be aware of to ensure safety, compliance, and long-term value. Below are key issues to avoid:

Overlooking Certification Standards

One of the most frequent mistakes is failing to verify that the welding helmet meets recognized safety standards such as ANSI Z87.1 (in the U.S.) or EN 379 (in Europe). Helmets must be certified for both optical clarity and impact resistance. Purchasing non-compliant models may expose workers to eye injuries and leave employers liable in case of accidents.

Confusing IP Ratings with Optical Class

Impact Protection (IP) ratings—often expressed as “Z87+” or “High Impact”—indicate the helmet’s ability to withstand physical force. A common pitfall is assuming that a high shade level or auto-darkening feature implies impact resistance. However, not all helmets, even those with advanced lenses, are rated for high impact. Always confirm the presence of “Z87+” or equivalent marking.

Prioritizing Cost Over Build Quality

Choosing the cheapest available helmet may save money upfront but often results in poor durability, substandard materials, and compromised safety. Low-quality plastics may crack under stress or degrade quickly when exposed to UV radiation and extreme temperatures, putting users at risk.

Ignoring Lens Response Time and Shade Range

A slow auto-darkening lens (response time >1/20,000 second) can expose welders to harmful UV/IR radiation before protection activates. Similarly, a limited shade range (e.g., only shades 9–13) restricts usability across different welding processes (e.g., TIG vs. MIG). Sourcing helmets without verifying these specs can reduce safety and efficiency.

Neglecting Comfort and Fit for Long-Term Use

Helmets that are too heavy, poorly balanced, or lack adjustable headgear lead to user discomfort, neck strain, and reduced wear time. This often results in workers removing the helmet during critical operations. Ensure ergonomic design and adjustable suspension systems are included, especially for full-shift use.

Assuming All Auto-Darkening Helmets Are Equal

Auto-darkening helmets vary significantly in sensor quality, battery life (solar vs. battery-assisted), and reliability in low-light conditions. Some budget models may flicker or fail to activate consistently. Sourcing without testing performance under real-world conditions can compromise safety.

Overlooking Compatibility with Accessories

Some helmets are not designed to accept side windows, grind shields, or respirator attachments. Failing to confirm accessory compatibility can limit functionality and force additional purchases later, increasing total cost and reducing workflow efficiency.

Buying from Unverified Suppliers

Purchasing from third-party marketplaces or uncertified distributors increases the risk of counterfeit or misrepresented products. These helmets may carry fake certification labels or use inferior components. Always source from reputable suppliers with verifiable product documentation.

By being aware of these pitfalls, buyers can make informed decisions that prioritize welder safety, regulatory compliance, and long-term equipment performance when sourcing welding helmets.

Logistics & Compliance Guide for Types of Welding Helmets

Product Classification and Regulatory Framework

Welding helmets fall under the category of personal protective equipment (PPE), designed to safeguard workers from hazards such as intense ultraviolet (UV) and infrared (IR) radiation, sparks, spatter, and heat generated during welding operations. As such, they are subject to international, national, and regional safety standards that govern their manufacture, import, distribution, and use.

Key classifications include:

– Auto-Darkening Welding Helmets (ADF): Feature liquid crystal display (LCD) technology that automatically darkens upon arc detection.

– Passive (Fixed-Shade) Welding Helmets: Use a single, fixed-shade filter lens requiring manual positioning.

– Flip-Up (Dual-Lens) Helmets: Combine a fixed-shade outer lens with a flip-up inner faceplate.

– Powered Air-Purifying Respirator (PAPR) Welding Helmets: Integrate respiratory protection with head and eye shielding.

These products are classified under HS Code 6506.10 (Headgear and parts thereof, protective) for customs and import/export purposes in most jurisdictions.

International and Regional Compliance Standards

To be legally sold and used in various markets, welding helmets must comply with region-specific safety and performance standards:

United States (OSHA & ANSI)

– Governed by OSHA 29 CFR 1910.136 and 1910.252, which reference ANSI Z87.1 (American National Standard for Occupational and Educational Eye and Face Protection).

– ADF helmets must also meet ANSI Z87.1-2020 requirements for optical clarity, impact resistance, and auto-darkening performance (response time, sensitivity, shade levels).

– Voluntary certification by third parties (e.g., UL or CSA) enhances market acceptance.

European Union (CE Marking and PPE Regulation)

– Subject to EU Regulation 2016/425 on Personal Protective Equipment.

– Must undergo conformity assessment (typically under Category III) and bear the CE mark.

– Complies with EN 175 (protective equipment for welding) and EN 379 (auto-darkening filters).

– Requires involvement of a Notified Body for design examination and production quality assurance.

Canada (CSA Group Standards)

– Must meet CSA Z94.3-15 (Eye and Face Protectors).

– Certification by CSA Group or other accredited bodies is mandatory for workplace use.

– Aligns closely with ANSI Z87.1 but includes additional testing for extreme temperatures and electrical insulation.

Australia and New Zealand (AS/NZS Standards)

– Compliance with AS/NZS 1337.1 (Eye Protectors for Industrial Applications) and AS/NZS 1338.1 (Filters for Eye Protectors).

– ADF helmets must also meet performance criteria in AS/NZS 1639 (Occupational Eye Protection – Welding Filters).

Other Markets (e.g., China, India, Brazil)

– China: Requires CCC (China Compulsory Certification) for certain PPE categories.

– India: Follows BIS certification under IS 13554 (Eye Protectors for Welding).

– Brazil: Must comply with INMETRO regulations and NBR 6422 standards.

Import and Export Logistics Considerations

Proper documentation, packaging, and customs compliance are essential for the global trade of welding helmets:

- Customs Documentation: Commercial invoices, packing lists, and certificates of origin must accurately describe the product using the correct HS code (6506.10).

- Compliance Certificates: Include copies of test reports, conformity certificates (CE, CSA, ANSI, etc.), and declarations of conformity with each shipment.

- Labeling Requirements: Products must display required safety markings (e.g., CE, ANSI, CSA) and user instructions in the local language where applicable.

- Packaging Standards: Use durable, moisture-resistant packaging to prevent damage during transit. Include protective inserts to avoid lens scratches.

- Battery Regulations (for ADF Helmets): Lithium batteries (common in ADF helmets) are subject to IATA/IMDG regulations for air and sea transport. Proper UN38.3 testing certification and packaging are mandatory.

Quality Assurance and Supply Chain Controls

To ensure consistent compliance and product reliability:

– Conduct regular third-party testing for optical performance, drop resistance, and environmental durability.

– Audit manufacturing facilities (especially overseas suppliers) for adherence to ISO 9001 and relevant safety standards.

– Implement traceability systems (batch/lot tracking) for recalls or compliance investigations.

– Maintain technical documentation (Technical File or Design Dossier) for at least 10 years post-manufacture in regulated markets.

Workplace Use and End-User Compliance

Employers using welding helmets must adhere to occupational health and safety regulations:

– Perform hazard assessments to select appropriate helmet types (e.g., ADF vs. passive).

– Ensure equipment is properly maintained, inspected, and replaced per manufacturer guidelines.

– Provide worker training on correct usage, limitations, and maintenance.

– Retain records of PPE selection, inspection, and employee training.

Summary

Logistics and compliance for welding helmets involve navigating a complex web of safety standards, customs regulations, and supply chain controls. Understanding the distinctions between helmet types and their applicable standards is vital for manufacturers, distributors, and end-users. By maintaining rigorous compliance and documentation practices, stakeholders can ensure these critical safety devices meet global regulatory expectations while protecting workers effectively.

In conclusion, selecting the appropriate type of welding helmet depends on various factors including the specific welding application, frequency of use, safety requirements, and personal comfort preferences. From passive helmets that offer simplicity and affordability to auto-darkening helmets providing enhanced visibility and convenience, each sourcing option presents unique advantages. Additionally, considerations such as optical clarity, response time, durability, and compliance with safety standards (like ANSI or EN) are crucial when evaluating suppliers and models. For professional welders, investing in high-quality auto-darkening or powered helmets from reputable manufacturers ensures better protection, improved efficiency, and long-term cost savings. Ultimately, a well-informed sourcing decision enhances both safety and productivity in welding operations, making it essential to match the helmet type with the user’s needs and working environment.