The global connector manufacturing industry is experiencing robust growth, driven by increasing demand across automotive, consumer electronics, industrial machinery, and telecommunications sectors. According to a 2023 report by Mordor Intelligence, the global electrical connectors market was valued at USD 72.7 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2028. Similarly, Grand View Research reports that the market size reached USD 76.8 billion in 2022 and is expected to expand at a CAGR of 5.7% over the same period, fueled by advancements in electric vehicles, 5G infrastructure, and IoT-enabled devices. As technological innovation accelerates, the role of connector manufacturers has become increasingly critical—ensuring reliable, high-performance connections in compact and demanding environments. This evolving landscape has given rise to specialized manufacturers catering to niche applications, from ruggedized industrial connectors to high-speed data transmission solutions. In this context, understanding the top 10 types of connector manufacturers offers strategic insight into the companies shaping the backbone of modern electronic interconnectivity.

Top 10 Types Of Connector Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Neutrik

Domain Est. 1996

Website: neutrik.com

Key Highlights: Neutrik is the leading manufacturer of audio connectors and receptacles. Neutrik produces XLR, plugs, jacks, speaker and power connectors, patch panels, ……

#2 EPIC® Industrial connectors

Domain Est. 1996

Website: products.lappgroup.com

Key Highlights: EPIC® Connectors, the reliable connector for industrial applications, safe and removable connection in machine building, control cabinets and in outdoor ……

#3 GCT

Domain Est. 2010

Website: gct.co

Key Highlights: GCT is a leading manufacturer of Standard and Custom PCB Connectors and Cable Assemblies. Browse our innovative product ranges for solutions to your ……

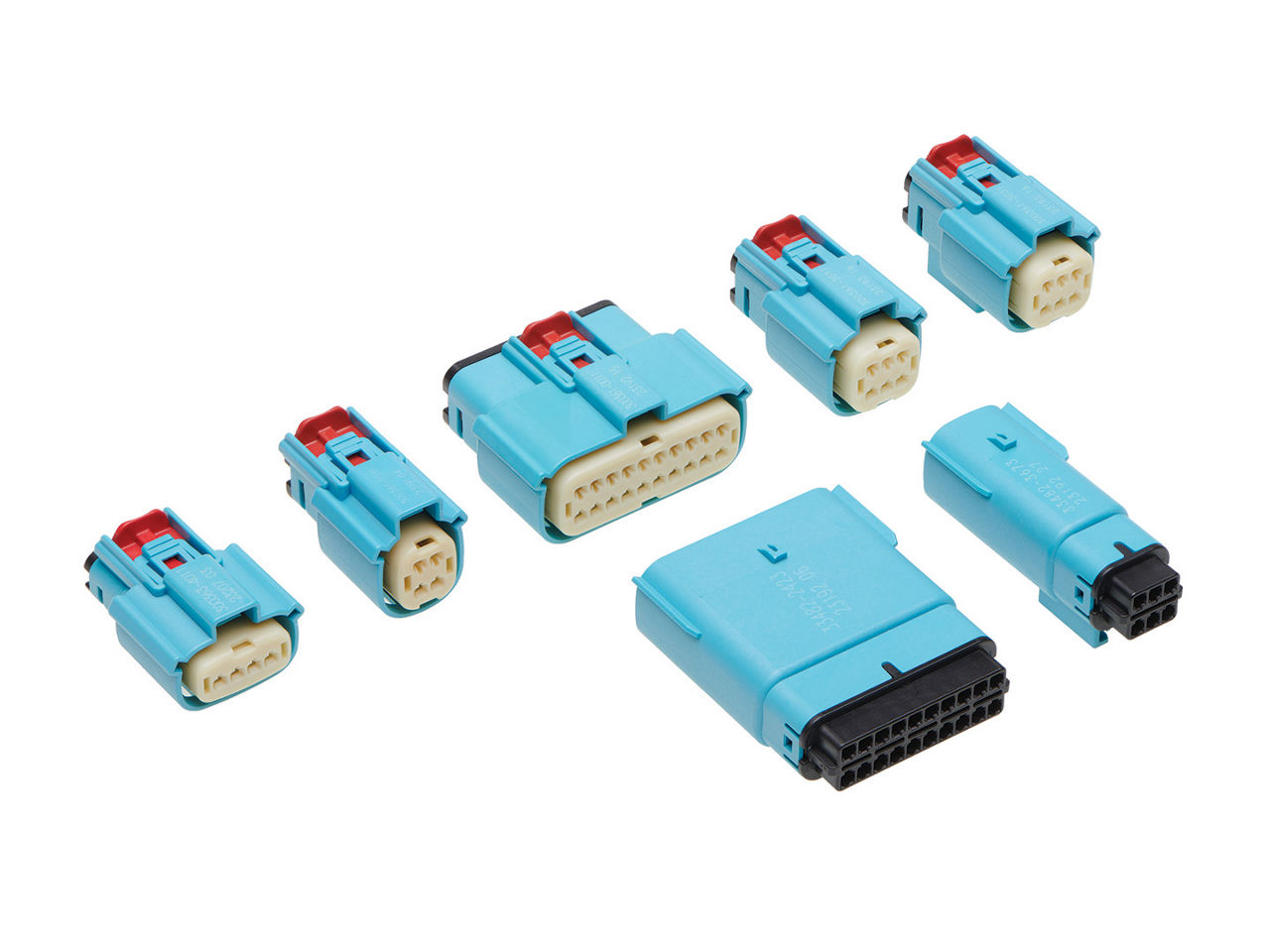

#4 Types of Electrical Connectors and Wire Connectors

Domain Est. 1992

Website: te.com

Key Highlights: From USB connectors and RJ45 connectors to TE’s DEUTSCH connectors and AMP connectors, we design and manufacture the electrical connectors and wire connectors ……

#5 Molex

Domain Est. 1994

Website: molex.com

Key Highlights: Connectors · Backplane Connectors · Board-to-Board Connectors · Card Edge Connectors · Circular Connectors · D-Shaped Connectors · D-Sub Connectors ……

#6 Electrical and Electronic Connectors

Domain Est. 1996

Website: hirose.com

Key Highlights: Connector Selector Categories, Applications, Customer Support, Partners, Locations, Contact Us, Privacy Policy | Terms of Use | Membership Agreement…

#7 Connectors

Domain Est. 1996

Website: jae.com

Key Highlights: For PCs and mobile devices, we have line up of interface connectors, board to board connectors, and card connectors. For automotive market, we have line up of ……

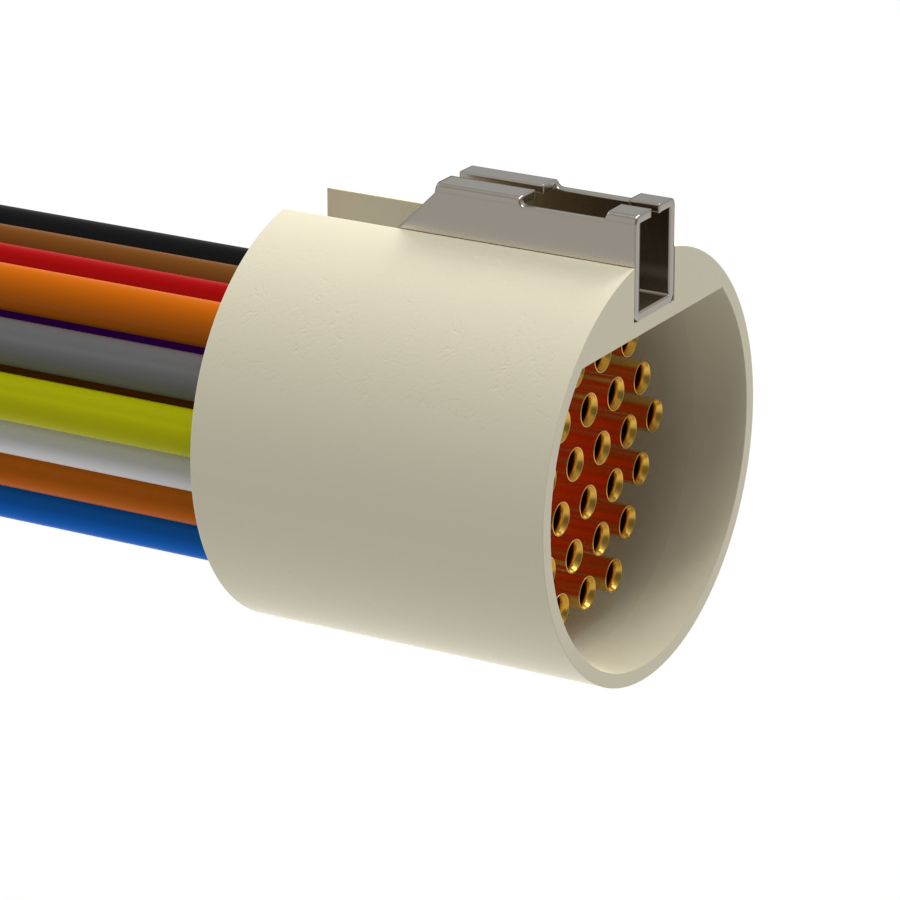

#8 Omnetics Connector Corp.

Domain Est. 1997

Website: omnetics.com

Key Highlights: Omnetics is a world-class miniature connector design and manufacturing company with over 30 years of experience, focused on Micro-miniature and Nano-miniature ……

#9 Fischer Connectors

Domain Est. 1997 | Founded: 1954

Website: fischerconnectors.com

Key Highlights: Founded in 1954, Fischer Connectors designs, develops and deploys end-to-end interconnect solutions for ecosystems requiring local transfer and management….

#10 Amphenol Connectors

Domain Est. 2021

Website: amphenol-cs.com

Key Highlights: Amphenol Communications Solutions (ACS), a division of Amphenol Corporation, is a world leader in interconnect solutions for Communications, Mobile, RF, ……

Expert Sourcing Insights for Types Of Connector

H2: 2026 Market Trends for Types of Connectors

The global connectors market is poised for significant transformation by 2026, driven by technological advancements, increasing automation, and the proliferation of smart devices. As industries adapt to evolving demands in electric mobility, telecommunications, industrial automation, and consumer electronics, the types of connectors witnessing the most growth reflect these shifts. Below is an analysis of key connector types and their expected market trends in 2026.

1. High-Speed Data Connectors

High-speed data connectors, including USB Type-C, HDMI 2.1, and Mini/Micro connectors, are expected to dominate the consumer electronics and data communication sectors. With the rise of 5G networks, cloud computing, and high-definition content streaming, demand for connectors capable of supporting data transfer rates exceeding 40 Gbps will grow substantially. USB4 and Thunderbolt 4 adoption will further accelerate the need for compact, reversible, and high-performance connectors in laptops, smartphones, and docking stations.

2. Automotive Connectors

The automotive sector remains one of the largest consumers of connectors, with a sharp increase in demand driven by electric vehicles (EVs), advanced driver-assistance systems (ADAS), and vehicle electrification. By 2026, high-voltage connectors designed for EV powertrains and battery systems will experience robust growth. Additionally, high-density, lightweight, and miniaturized connectors for infotainment and sensor integration are expected to be in high demand. Trends toward autonomous driving will further push the need for reliable, EMI-shielded connectors with high durability.

3. RF and Coaxial Connectors

The expansion of 5G infrastructure and the Internet of Things (IoT) will drive demand for RF (radio frequency) and coaxial connectors. These connectors are essential in base stations, antennas, and wireless communication devices. By 2026, miniaturized, high-frequency RF connectors capable of operating at millimeter-wave bands (24–100 GHz) will gain prominence. Connectors such as SMA, N-Type, and MCX will see increased use in small cells, satellite communication, and defense applications.

4. Circular Connectors

Used extensively in industrial, aerospace, and defense applications, circular connectors are valued for their durability and ability to transmit power, signals, and data in harsh environments. In 2026, there will be rising adoption of hybrid and modular circular connectors that integrate multiple signal types within a single housing. The push for ruggedized, corrosion-resistant, and quick-lock mechanisms will support growth in sectors like oil & gas, renewable energy, and military equipment.

5. Board-to-Board (BTB) and Wire-to-Board (WTB) Connectors

Miniaturization of electronic devices continues to fuel demand for compact, high-density BTB and WTB connectors. In smartphones, wearables, and medical devices, space optimization is critical. By 2026, ultra-low-profile connectors with fine pitch (below 0.3 mm) will see strong market traction. Increased use of flexible printed circuits (FPCs) and high-speed differential pairs will also influence connector design, emphasizing signal integrity and thermal management.

6. Fiber Optic Connectors

With data centers expanding and enterprise networks upgrading to support higher bandwidths, fiber optic connectors such as LC, SC, MTP/MPO will be in growing demand. The 2026 landscape will see increased deployment of multi-fiber push-on (MPO) connectors in high-density data center applications. Emerging technologies like silicon photonics and co-packaged optics will drive innovation in high-speed, low-latency optical interconnects.

7. Power Connectors

The transition to renewable energy and electrified transportation systems will boost demand for high-current and high-voltage power connectors. Solar inverters, wind turbines, EV charging stations, and industrial machinery will require connectors capable of handling loads from 600V to over 1,000V. Safety, efficiency, and thermal performance will be key design considerations, with growing adoption of IP67 and IP68-rated connectors for outdoor and harsh environments.

8. Smart and Hybrid Connectors

An emerging trend by 2026 is the integration of intelligence into connectors. Smart connectors with embedded sensors, diagnostics, and data logging capabilities are gaining ground in industrial IoT and predictive maintenance applications. Hybrid connectors that combine power, signal, data, and even fluid transmission in a single unit will find increasing use in robotics, automation, and medical systems.

Conclusion

By 2026, the connector market will be shaped by the convergence of digitalization, electrification, and connectivity across industries. Connector types will evolve to meet demands for higher speed, greater reliability, miniaturization, and environmental resilience. Manufacturers that innovate in materials, signal integrity, and integration capabilities will lead the market, while regional growth in Asia-Pacific—particularly China and India—will drive volume demand. As connectivity becomes foundational to modern technology, the role of advanced connectors will be more critical than ever.

Common Pitfalls When Sourcing Types of Connectors (Quality, IP Rating)

Logistics & Compliance Guide for Types of Connectors

When managing the logistics and ensuring compliance for various types of connectors—whether electrical, mechanical, hydraulic, or data—organizations must consider a range of regulatory, transportation, packaging, and documentation requirements. This guide outlines key considerations based on common connector types.

Electrical Connectors

Electrical connectors, such as USB, HDMI, D-sub, and terminal blocks, are subject to strict electrical safety and electromagnetic compatibility (EMC) standards.

- Regulatory Compliance:

- Must comply with IEC, UL, CE, and RoHS directives.

- Ensure connectors meet REACH regulations for hazardous substances.

-

In North America, UL certification may be required for safety compliance.

-

Packaging & Handling:

- Use anti-static packaging for sensitive components to prevent electrostatic discharge (ESD).

-

Clearly label contents and ESD-sensitive symbols where applicable.

-

Shipping & Documentation:

- Declare proper Harmonized System (HS) codes (e.g., 8536.69 for electrical connectors).

- Provide safety data sheets (SDS) if applicable (e.g., for connectors with coatings or plating materials).

Fiber Optic Connectors

Used in telecommunications and data networks, fiber optic connectors (e.g., LC, SC, ST) require special handling due to fragility and optical precision.

- Regulatory Compliance:

- Must meet IEC 61753 and Telcordia GR-326 standards.

-

Comply with ITU-T recommendations for optical performance.

-

Packaging & Handling:

- Use protective caps on ferrules to prevent contamination and scratches.

-

Pack in rigid containers with cushioning to prevent breakage.

-

Logistics Considerations:

- Avoid extreme temperatures and humidity during transit.

- Mark packages as “Fragile” and “This Side Up.”

Hydraulic & Pneumatic Connectors

These connectors (e.g., NPT, JIC, ISO 8434) are used in industrial fluid power systems and must meet pressure and leakage standards.

- Compliance Requirements:

- Adhere to ISO, SAE, and ANSI standards for thread types and sealing performance.

-

Ensure materials are compatible with fluids (oil, water, air) per safety regulations.

-

Packaging:

- Use sealed, moisture-resistant packaging to prevent corrosion.

-

Apply thread protectors to prevent damage.

-

Transportation:

- Classify under correct commodity codes (e.g., 8481.80 for pipe fittings).

- Declare any materials subject to environmental regulations (e.g., nickel-plated connectors under REACH).

RF & Coaxial Connectors

Used in radio frequency applications (e.g., BNC, SMA, N-type), these connectors must maintain signal integrity.

- Compliance & Certification:

- Meet IEC 60169 standards for RF connectors.

-

MIL-STD certifications may be required for defense applications.

-

Handling & Storage:

- Protect connector interfaces with caps to prevent dust and physical damage.

-

Store in low-humidity environments to avoid oxidation.

-

Export Controls:

- Some RF connectors may be subject to export restrictions (e.g., under the Wassenaar Arrangement or ITAR) if used in military or high-frequency systems.

- Verify ECCN (Export Control Classification Number) before international shipment.

Data & Network Connectors

Includes Ethernet (RJ45), PCIe, and other high-speed data transmission connectors.

- Compliance:

- Must comply with IEEE standards (e.g., IEEE 802.3 for Ethernet).

-

CE and FCC certifications required for EMC in consumer and commercial electronics.

-

Logistics:

- Use moisture barrier bags for humidity-sensitive devices (MSL ratings).

-

Ensure traceability with lot numbers and date codes for compliance audits.

-

Sustainability & Disposal:

- Follow WEEE directives for end-of-life management in the EU.

- Recycle connectors containing precious metals (e.g., gold-plated contacts) per environmental regulations.

General Best Practices

- Labeling: Clearly mark packages with product type, compliance marks (CE, UL, RoHS), and handling instructions.

- Documentation: Maintain certificates of compliance (CoC), test reports, and material declarations.

- Supplier Audits: Ensure suppliers adhere to quality standards (e.g., ISO 9001) and ethical sourcing (e.g., conflict minerals compliance).

- Customs Clearance: Accurately classify connectors using HS codes and provide commercial invoices, packing lists, and origin certificates as needed.

By aligning logistics operations with regulatory and industry standards for each connector type, businesses can ensure smooth global distribution, avoid compliance penalties, and maintain product integrity.

Conclusion on Sourcing Types of Connectors

In conclusion, sourcing the appropriate type of connector is a critical decision that significantly impacts the performance, reliability, and longevity of electrical and electronic systems. The selection process must take into account various factors such as application environment (e.g., industrial, medical, automotive), signal type (power, data, RF), mating cycles, size constraints, and compliance with industry standards.

Different sourcing strategies—whether direct from OEMs, through authorized distributors, or via third-party suppliers—offer distinct advantages in terms of cost, availability, quality assurance, and lead times. While authorized channels ensure authenticity and technical support, alternative sources may provide cost savings but require careful evaluation to avoid counterfeit or substandard components.

Ultimately, a balanced sourcing approach that prioritizes quality, compatibility, and supply chain resilience will ensure optimal system functionality and reduce long-term maintenance and failure risks. As technology advances and connector designs evolve, ongoing supplier assessment and staying informed about emerging connector technologies will remain key to effective procurement and system design.