The global 3D printing market is experiencing robust expansion, driven by advancements in manufacturing technologies, growing adoption in industries such as healthcare, aerospace, and automotive, and increasing demand for rapid prototyping and custom production. According to a report by Mordor Intelligence, the 3D printing market was valued at USD 17.3 billion in 2023 and is projected to reach USD 44.6 billion by 2028, growing at a compound annual growth rate (CAGR) of 20.8% during the forecast period. Similarly, Grand View Research estimates that the market size surpassed USD 18.8 billion in 2023 and is expected to expand at a CAGR of 21.6% from 2024 to 2030. This accelerating growth has led to a diversification of 3D printer manufacturers, each specializing in distinct technologies, materials, and applications—from industrial-grade systems to desktop solutions for hobbyists. As the ecosystem evolves, understanding the top types of manufacturers becomes essential for businesses and consumers navigating a rapidly expanding and increasingly specialized market.

Top 10 Types Of 3D Printer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Markforged

Domain Est. 2013

Website: markforged.com

Key Highlights: Industrial 3D printers built for the factory floor. A complete line of machines with the precision and reliability manufacturing requires….

#2 Stratasys 3D Printers

Website: stratasys.com

Key Highlights: We provide industrial-grade additive 3D printers all along the production cycle, from design and prototyping to production and end-use parts….

#3 Large-Format 3D Printers: Industrial & Professional

Website: bigrep.com

Key Highlights: Industrial 3D Printers Designed for Professionals. Large Scale High-Performance 3D Printing for Commercial Prototyping and Production….

#4 3D Systems

Domain Est. 1996

Website: 3dsystems.com

Key Highlights: 3D Systems provides comprehensive products and services, including 3D printers, print materials, software, on-demand manufacturing services, and healthcare ……

#5 Creality

Domain Est. 2000

Website: creality.com

Key Highlights: Spark X: The Journey to Ready-to-Use 3D Creation. SPARKX is a new 3D printing brand born from Creality’s technical legacy, but engineered for a new generation….

#6 MakerBot

Domain Est. 2009

Website: makerbot.com

Key Highlights: Discover MakerBot’s classroom solutions: 3D printers, software, and certification that help teachers pioneer 3D printing in education….

#7 3D Printers

Domain Est. 2010

Website: ultimaker.com

Key Highlights: Discover how UltiMaker S series and Method series 3D printers offer the perfect production solution for any business or application….

#8 Original Prusa 3D printers directly from Josef Prusa

Domain Est. 2013

Website: prusa3d.com

Key Highlights: Experience High-Performance 3D Printing with Prusa PRO Line. Master high-performance & engineering materials. Achieve unparalleled manufacturing speed and high ……

#9 EOS GmbH: Professional 3D Printing Solutions

Website: eos.info

Key Highlights: EOS is the world’s leading provider of 3D printing solutions, offering professional 3D printers, materials and software from a single source….

#10 3D Printing Guide

Domain Est. 2009

Website: formlabs.com

Key Highlights: The three most established types of 3D printers for plastics parts are stereolithography (SLA), selective laser sintering (SLS), and fused deposition ……

Expert Sourcing Insights for Types Of 3D Printer

2026 Market Trends for Types of 3D Printers

As the global 3D printing industry continues to evolve, 2026 is expected to bring significant advancements and shifts across various types of 3D printers. Driven by innovation in materials, software integration, automation, and expanding applications in healthcare, aerospace, automotive, and consumer goods, the market is poised for robust growth. Below is an analysis of the key trends projected for the major types of 3D printers by 2026.

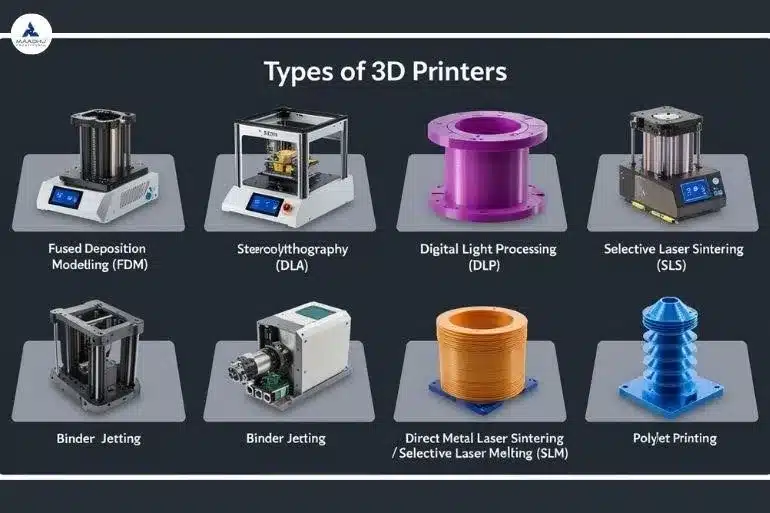

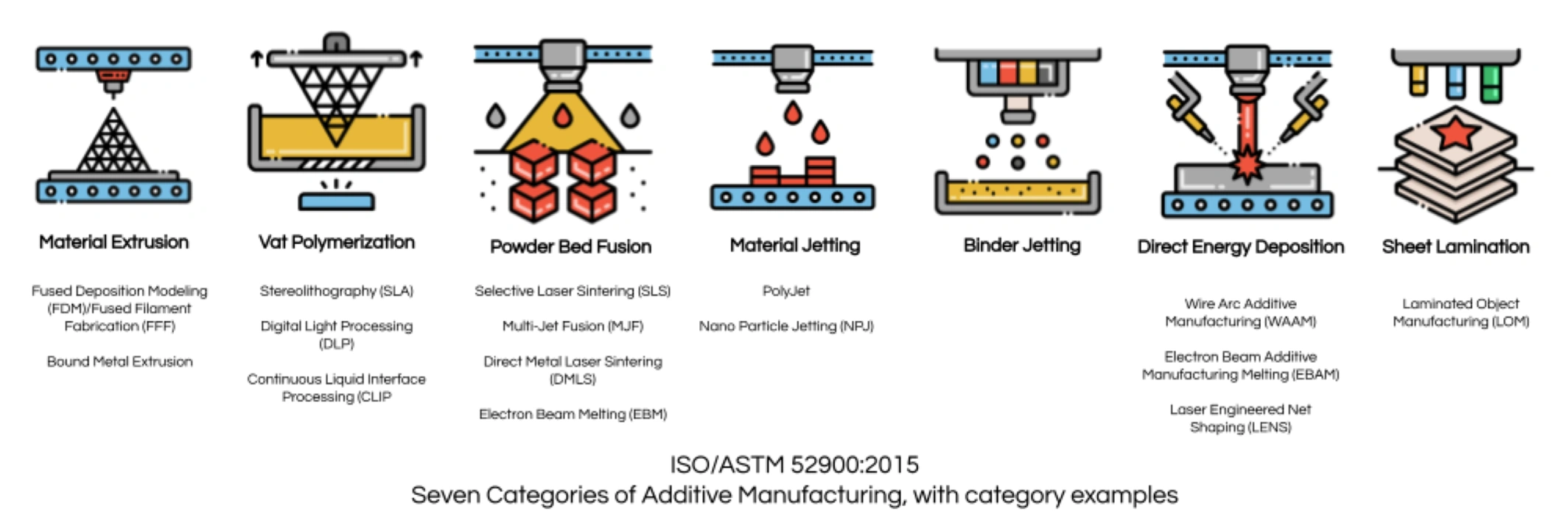

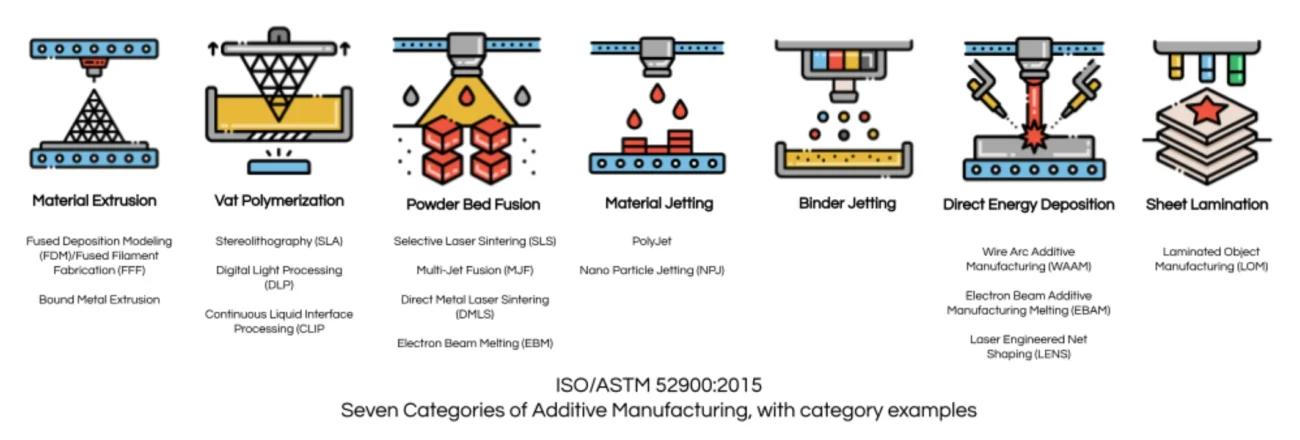

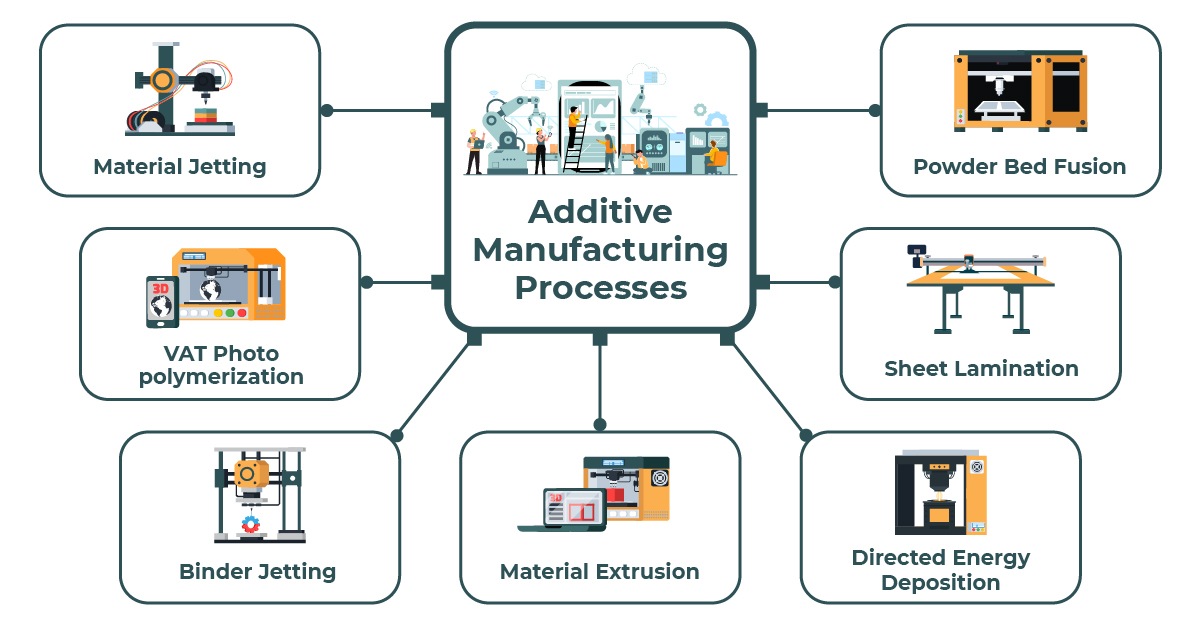

Fused Deposition Modeling (FDM)

FDM remains the most accessible and widely adopted 3D printing technology, especially in consumer and small business markets. By 2026, FDM printers are expected to see improvements in print speed, precision, and material versatility. Enhanced nozzle technologies, dual-extrusion systems, and better temperature control will support the use of advanced engineering thermoplastics such as PEEK and ULTEM. Additionally, integration with AI-powered slicing software will optimize print parameters automatically, reducing user error and material waste.

The industrial segment will continue adopting FDM for rapid prototyping and end-use part production, particularly in automotive and tooling sectors. Sustainability trends will also push manufacturers toward recyclable and biodegradable filaments, aligning with environmental regulations.

Stereolithography (SLA)

SLA technology is projected to grow significantly in 2026, especially in high-precision industries such as dentistry, jewelry, and medical devices. Advancements in resin formulations—including biocompatible, tough, and flexible resins—will expand SLA’s application range. The emergence of large-format SLA printers will enable the production of bigger, detailed parts without sacrificing resolution.

Moreover, the integration of continuous liquid interface production (CLIP) and other speed-enhancing techniques will reduce print times dramatically. As companies invest in digital dentistry and custom medical solutions, demand for desktop and industrial SLA systems will surge, particularly in North America and Asia-Pacific regions.

Selective Laser Sintering (SLS)

SLS is expected to dominate the industrial additive manufacturing landscape in 2026 due to its ability to produce strong, functional parts without support structures. Innovations in laser efficiency, powder handling, and recycling systems will lower operational costs and improve sustainability. The technology will increasingly be adopted for low-volume production and customized manufacturing in aerospace and defense sectors.

New entrants offering more affordable benchtop SLS printers will democratize access to this technology, enabling small and medium enterprises (SMEs) to utilize industrial-grade printing. Additionally, developments in multi-material and multi-laser SLS systems will enhance throughput and design flexibility.

Digital Light Processing (DLP)

DLP technology will experience strong growth in 2026, particularly in applications requiring high-resolution outputs and smooth surface finishes. The dental and hearing aid industries will remain primary drivers, with customized inlays and ear molds produced at scale. DLP printers will benefit from faster curing times due to improved light source efficiency (e.g., LED arrays) and dynamic pattern generation.

Integration with AI-driven quality inspection systems will allow real-time monitoring and defect detection, increasing reliability for production environments. As material science advances, DLP-compatible resins with improved mechanical and thermal properties will broaden the technology’s industrial applications.

Metal 3D Printing (Powder Bed Fusion & Binder Jetting)

Metal 3D printing is set to be a high-growth segment by 2026, fueled by demand in aerospace, automotive, and energy sectors. Technologies such as Direct Metal Laser Sintering (DMLS) and Electron Beam Melting (EBM) will see increased adoption due to their ability to produce lightweight, complex geometries for high-performance components.

Binder jetting will gain momentum as a cost-effective alternative for mass production of metal parts, especially with innovations in sintering techniques that reduce porosity and improve mechanical strength. Major industrial players are expected to invest heavily in metal additive manufacturing to achieve supply chain resilience and reduce waste.

Additionally, the development of hybrid systems that combine 3D printing with CNC machining will enhance precision and post-processing efficiency, making metal 3D printing more viable for large-scale production.

Emerging and Hybrid Technologies

By 2026, emerging technologies such as Directed Energy Deposition (DED) and Cold Spray will see increased use in repair and refurbishment applications, especially in aviation and heavy machinery. These methods allow for on-site component restoration, reducing downtime and material costs.

Hybrid 3D printers—combining multiple technologies (e.g., FDM with CNC or laser engraving)—will become more common in prototyping labs and manufacturing floors, offering greater versatility in a single system. Cloud-based printing platforms and IoT integration will also enable remote monitoring and collaborative design workflows.

Conclusion

The 3D printing market in 2026 will be characterized by technological convergence, increased automation, and broader industrial adoption. While FDM and SLA will remain dominant in entry-level and precision applications, SLS and metal printing technologies will drive innovation in high-performance sectors. Sustainability, digitalization, and customization will continue to shape the evolution of 3D printer types, positioning additive manufacturing as a cornerstone of modern industrial production.

Common Pitfalls When Sourcing Types of 3D Printers (Quality and Intellectual Property)

Sourcing 3D printers—whether for industrial use, prototyping, or resale—requires careful evaluation to avoid compromising on quality or inadvertently infringing on intellectual property (IP). Below are key pitfalls to watch for when procuring different types of 3D printers, such as FDM, SLA, SLS, and metal additive systems.

Poor Quality Control and Inconsistent Performance

Many suppliers, especially low-cost manufacturers, offer 3D printers with inconsistent build quality. Components like stepper motors, linear rails, and hotends may vary between units, leading to unreliable print performance. Buyers often discover that advertised specifications—such as layer resolution, build volume accuracy, or temperature stability—do not match real-world results. This is particularly common with FDM and resin-based (SLA/DLP) printers sourced from less-regulated markets.

Lack of Technical Documentation and Support

A frequent issue when sourcing 3D printers, particularly from overseas suppliers, is inadequate technical documentation. Missing calibration guides, firmware details, or maintenance manuals can hinder integration and troubleshooting. Additionally, poor post-purchase support makes it difficult to resolve mechanical or software issues, ultimately increasing downtime and operational costs.

Counterfeit or Cloned Firmware and Software

Many budget 3D printers use open-source firmware like Marlin or Klipper without proper licensing or modification attribution. While open-source, these projects have specific licensing terms (e.g., GPL). Unauthorized modifications or distribution without compliance can expose the buyer or reseller to legal liability. Worse, some clones incorporate pirated commercial software or slicers, raising serious IP infringement concerns.

Infringement of Patented Technologies

Certain 3D printing technologies—especially in SLS, metal printing, and high-resolution resin systems—are protected by active patents. Sourcing printers that replicate patented mechanisms (e.g., selective laser sintering processes, recoater designs, or resin vat technologies) from unauthorized manufacturers can lead to IP litigation. For example, using a low-cost SLS printer that mimics a patented powder handling system may expose the end user to legal risk, even if they were unaware of the infringement.

Misrepresentation of Printer Capabilities

Suppliers may exaggerate or misrepresent a printer’s capabilities to increase sales. Claims about material compatibility, precision, or production speed may not hold under testing. For instance, a printer marketed as “industrial-grade” may lack the thermal stability or repeatability required for consistent manufacturing. This is especially problematic when sourcing for mission-critical applications.

Hidden Costs from Substandard Components

Initial cost savings from low-priced printers can be offset by frequent part failures, high consumable costs, or the need for constant recalibration. Printers using non-standard or proprietary components make maintenance expensive and limit third-party upgrades. This undermines total cost of ownership and long-term reliability.

Inadequate IP Due Diligence in Supply Chain

Buyers often overlook the importance of auditing a supplier’s IP compliance. Without proper vetting, companies risk importing printers that violate design patents, utility models, or software copyrights. This is particularly important for distributors or integrators who may bear secondary liability for selling infringing products.

Conclusion

To mitigate these risks, conduct thorough due diligence: verify technical specifications with independent testing, audit firmware licensing compliance, assess supplier IP practices, and prioritize vendors with transparent documentation and support. Investing time upfront can prevent costly quality failures and legal exposure down the line.

Logistics & Compliance Guide for Types of 3D Printers

Understanding the logistics and compliance requirements for different types of 3D printers is essential for safe transportation, regulatory adherence, and operational efficiency. Below is a breakdown by common 3D printer technology types.

Fused Deposition Modeling (FDM) Printers

Logistics Considerations:

– Weight and Size: Generally lightweight and compact, suitable for standard parcel shipping.

– Filament Transport: Thermoplastic filaments (e.g., PLA, ABS, PETG) must be stored in dry, cool conditions to prevent moisture absorption. Desiccant packs and vacuum-sealed packaging are recommended.

– Shipping Preparation: Secure print heads and build plates to prevent movement during transit. Use foam or molded packaging to minimize vibration damage.

Compliance Requirements:

– Electrical Safety: Must comply with regional standards such as UL 60950-1 (North America), CE (Europe), or CCC (China).

– EMC Regulations: Electromagnetic compatibility compliance (e.g., FCC Part 15 in the U.S., EMC Directive in EU).

– Material Safety: Filaments must be labeled with safety data sheets (SDS) under GHS and comply with REACH (EU) or TSCA (U.S.) if applicable.

– Ventilation: Enclosed models with filtration may be required in workplaces under OSHA or EU health and safety directives due to ultrafine particle emissions.

Stereolithography (SLA) Printers

Logistics Considerations:

– Resin Handling: Photopolymer resins are classified as hazardous materials (flammable and irritant). They require UN-certified packaging for air and ground transport (e.g., IATA Dangerous Goods Regulations).

– Light and Temperature Sensitivity: Resins must be shipped in opaque, UV-protected containers and kept at stable temperatures to prevent premature curing.

– Spill Prevention: Sealed secondary containment is mandatory. Include absorbent materials in packaging.

Compliance Requirements:

– Hazardous Materials Transport: Compliance with IATA, IMDG (maritime), or ADR (road) for international shipping. Proper labeling, documentation (e.g., Safety Data Sheet), and shipper training required.

– Chemical Regulations: Resins must comply with REACH (EU), TSCA (U.S.), and CLP/GHS for classification, labeling, and safety information.

– Workplace Safety: Use in ventilated enclosures or with fume extraction. Personal protective equipment (PPE) required under OSHA or EU directives.

– Waste Disposal: Cured resin and contaminated materials may be regulated as hazardous waste; disposal must follow local environmental regulations.

Selective Laser Sintering (SLS) Printers

Logistics Considerations:

– Powder Handling: Nylon and other polymer powders are combustible and pose inhalation risks. Transport in sealed, airtight containers with UN certification if classified as hazardous.

– Machine Weight: Industrial SLS systems are large and heavy—require freight shipping with palletization and liftgate services.

– Environmental Controls: Ensure consistent temperature and low humidity during shipping to avoid powder clumping.

Compliance Requirements:

– Dust Explosion Safety: Compliance with ATEX (EU) or NFPA 652 (U.S.) for handling combustible dust in both transport and operation.

– Machinery Directive: Industrial SLS printers must meet EU Machinery Directive 2006/42/EC or equivalent standards (e.g., ANSI B11 in the U.S.).

– Laser Safety: Class 1 or enclosed laser systems must comply with IEC 60825-1 for laser radiation safety.

– Occupational Health: Requires local exhaust ventilation and PPE per OSHA or EU-OSHA guidelines due to fine particulate exposure.

Direct Metal Laser Sintering (DMLS) / Metal 3D Printers

Logistics Considerations:

– Metal Powder Transport: Metal powders (e.g., titanium, aluminum, stainless steel) are often pyrophoric or reactive. Ship under inert atmosphere (argon/nitrogen) in UN-certified containers.

– Heavy Equipment: Full-sized DMLS machines require specialized freight, rigging, and installation planning.

– Climate Control: Sensitive to moisture and static; climate-controlled transport is recommended.

Compliance Requirements:

– Dangerous Goods Regulations: Metal powders may require ORM-D or Class 4.1 (flammable solid) classification under IATA/IMDG/ADR.

– Laser and High-Pressure Systems: Must meet laser safety (IEC 60825), pressure system (PED in EU), and machinery safety standards.

– Environmental & Health Regulations: Enclosed handling systems needed to prevent airborne metal particulate exposure. Comply with OSHA PELs or EU OELs.

– Export Controls: Some high-precision metal printers and powders may be subject to ITAR or EAR export regulations due to aerospace/defense applications.

Binder Jetting Printers

Logistics Considerations:

– Powder and Binder Transport: Both components may have specific handling needs. Powders may be abrasive or reactive; binders may be flammable liquids.

– System Size: Industrial systems are large and require freight logistics with site access planning.

Compliance Requirements:

– Chemical Handling: Binders may require SDS and compliance with VOC regulations (e.g., EPA or EU solvent directives).

– Dust and Flammability: Follow combustible dust standards (NFPA 652, ATEX) and flammable liquid storage codes (e.g., NFPA 30).

– Waste Management: Slurry and used powders may require hazardous waste classification and disposal.

General Compliance Best Practices

- Documentation: Maintain up-to-date SDS, CE/UL markings, and conformity declarations.

- Training: Ensure personnel are trained in handling hazardous materials and operating machinery safely.

- Labeling: Use proper GHS-compliant labels on all consumables and machines.

- Insurance: Verify cargo and liability insurance covers 3D printer-specific risks (e.g., fire from powder, chemical spills).

By adhering to these logistics and compliance guidelines, businesses can ensure the safe and lawful distribution, operation, and maintenance of various 3D printing technologies.

In conclusion, sourcing the right type of 3D printer requires careful consideration of various factors such as application needs, budget, material requirements, print quality, and scalability. The main types of 3D printers—FDM (Fused Deposition Modeling), SLA (Stereolithography), and SLS (Selective Laser Sintering)—each offer distinct advantages and limitations. FDM printers are cost-effective and user-friendly, making them ideal for hobbyists and educational purposes. SLA printers provide high-resolution prints, suitable for detailed prototypes and professional models. SLS printers, while more expensive, offer industrial-grade strength and durability, perfect for functional parts and end-use products.

When sourcing a 3D printer, it’s essential to evaluate your specific use case, anticipated volume, and long-term goals. Additionally, consider factors such as after-sales support, consumable availability, and ease of integration into existing workflows. By aligning the printer type with your technical and operational requirements, you can ensure a successful and efficient implementation of 3D printing technology in your projects or business.