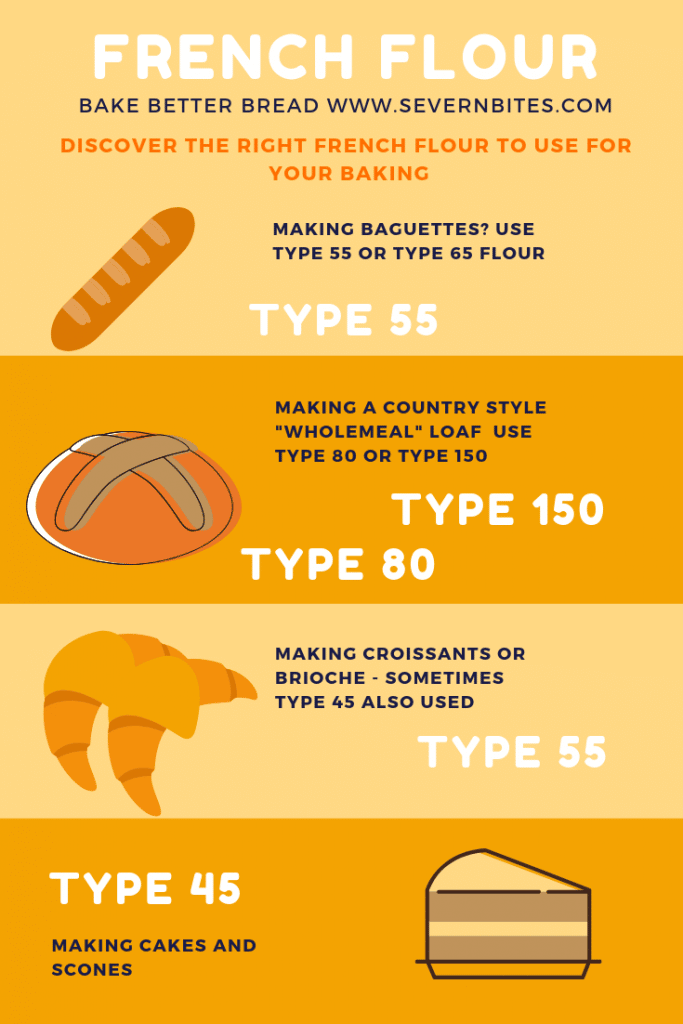

The global flour market is experiencing steady expansion, driven by rising demand for convenience foods, bakery products, and pasta across both developed and emerging economies. According to Grand View Research, the global flour market was valued at USD 124.6 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 4.3% from 2023 to 2030. This growth is particularly beneficial for specialized flours such as Type 55—also known as French T55 or bakers’ flour—favored for its balanced protein content (typically 10–11.5%) and exceptional performance in croissants, baguettes, and other artisanal breads. With increasing consumer preference for high-quality, authentic baked goods, manufacturers producing Type 55 flour are scaling operations and investing in milling precision to meet culinary standards across commercial and artisan sectors. As demand intensifies in Europe, North America, and parts of Asia-Pacific, a select group of companies have emerged as leading producers, combining traditional milling expertise with modern quality control to dominate this niche but growing segment.

Top 7 Type 55 Flour Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 French Type 55 White Flour (102) £1.70

Domain Est. 1996

Website: shipton-mill.com

Key Highlights: This flour is categorised in France by its ash content, which is where the name “T55” is derived from. We mill this flour from a blend of French, Canadian and ……

#2 Soft flour S

Domain Est. 2007

Website: molinidivoghera.it

Key Highlights: Flour made specifically for straight dough, which need a good hold, ideal for producing all sizes of bread, also those rich is added fats and puff pastry. Packs….

#3 Belle Blanc French T55 Flour

Domain Est. 2020

#4 Type 55%

Website: loulismills.gr

Key Highlights: Premium-quality flour from soft wheat. Loulis Mills-Fine Flour. Strengths. High yield; Ideal for bakery and pastry products; Suitable for blending with other ……

#5 What’s the Difference Between French Flour T55 and T65 …

Website: miaolin.global

Key Highlights: Uses: Fine-textured, ideal for delicate and crisp pastries such as croissants, Danish pastries, brioches, pie crusts, and French desserts. T55 ……

#6 Which types of flour do you use?

Domain Est. 2004

Website: boehli.fr

Key Highlights: For traditional (non-organic) Boehli products, we use type 55 wheat flour, from wheat sourced in France. For organic Boehli products, the recipe includes ……

#7 Flour Baccara

Domain Est. 2006

Website: dosschemills.com

Key Highlights: Baccara is a standard type T55 wheat flour with a guaranteed 13.5% protein content. This flour is suitable for large, white and crispy white bread, ……

Expert Sourcing Insights for Type 55 Flour

H2: Projected 2026 Market Trends for Type 55 Flour

The global market for Type 55 flour—a finely milled, low-ash soft wheat flour commonly used in French baking for pastries, croissants, and delicate breads—is expected to undergo notable shifts by 2026, driven by evolving consumer preferences, supply chain dynamics, and sustainability concerns. This analysis outlines key trends shaping the Type 55 flour market under the H2 (second half) 2026 outlook.

-

Growing Demand for Artisanal and Premium Baked Goods

By 2026, the rising popularity of artisanal and gourmet baking—both in commercial bakeries and home kitchens—is expected to increase demand for specialty flours like Type 55. Consumers are increasingly valuing authenticity and traditional European baking methods, particularly for French pastries. This trend is amplified by the expansion of premium bakery chains and the influence of social media-driven food culture. -

Expansion in E-Commerce and Direct-to-Consumer Sales

Online sales of specialty baking ingredients, including Type 55 flour, are projected to grow significantly by H2 2026. Consumers are turning to e-commerce platforms for hard-to-find ingredients, with brands investing in subscription models and educational content (e.g., recipe kits, baking tutorials) to drive engagement. International shipping improvements also enable wider access in non-European markets. -

Sustainability and Traceability as Key Differentiators

Environmental concerns are influencing procurement decisions. By 2026, flour producers are expected to emphasize sustainable farming practices, carbon footprint reduction, and transparent sourcing. Mills offering organic, non-GMO, or regeneratively farmed Type 55 flour will likely gain market share, especially in North America and Western Europe. -

Supply Chain Resilience and Price Volatility

Climate change and geopolitical instability continue to threaten wheat yields, particularly in key production regions like France, Ukraine, and the U.S. Great Plains. By H2 2026, flour prices may experience moderate volatility. As a result, large-scale bakers and foodservice operators are expected to secure long-term contracts with European mills to ensure stable supply and pricing. -

Regional Market Diversification

While Europe remains the dominant producer and consumer of Type 55 flour, emerging demand is anticipated in Asia-Pacific (especially Japan, South Korea, and China) and the Middle East, where Western-style patisseries are proliferating. Local adaptations—such as blending Type 55 with regional wheat varieties—may emerge to cater to local tastes and reduce import dependency. -

Innovation in Product Offerings

Anticipating health-conscious consumers, some manufacturers are expected to launch fortified or functional versions of Type 55 flour by 2026—such as protein-enriched or fiber-added variants—without compromising the flour’s signature texture and performance. However, purists will continue to demand unmodified, traditionally milled flour.

Conclusion

By H2 2026, the Type 55 flour market will be characterized by premiumization, digital accessibility, and sustainability. Stakeholders—from millers to bakers—must navigate supply challenges while capitalizing on the growing appetite for authentic, high-quality baking ingredients. Strategic investments in transparency, e-commerce, and regional expansion will be key to capturing value in this niche but expanding segment.

Common Pitfalls When Sourcing Type 55 Flour (Quality, IP)

Sourcing high-quality Type 55 flour—especially for artisanal or industrial baking—requires attention to both technical specifications and supply chain integrity. Below are common pitfalls related to quality and intellectual property (IP) considerations.

Quality-Related Pitfalls

1. Inconsistent Ash Content and Extraction Rate

Type 55 flour is defined by its low ash content (approximately 0.55%), which indicates a high degree of refinement. However, inconsistent milling practices or poor quality control can lead to batch variations. Sourcing from suppliers without rigorous testing may result in unpredictable dough behavior and final product quality.

2. Mislabeling or Non-Compliance with Regional Standards

“Type 55” is a European classification (especially French). Outside of Europe, the term may be misused or applied to flours that do not meet true Type 55 specifications. Buyers may inadvertently source flour labeled as Type 55 that fails to conform to the expected protein content, granulometry, or enzymatic activity.

3. Poor Traceability and Lack of Certification

Without proper traceability (e.g., origin of wheat, milling date, organic certification), it’s difficult to ensure consistent quality. This is especially critical when sourcing for premium or specialty products where ingredient provenance affects branding and performance.

4. Inadequate Gluten Strength and Performance Testing

Type 55 flour is often used in baguettes and pastries, where gluten development is crucial. Some suppliers may not provide alveograph or extensograph data, making it hard to assess dough handling and baking performance—leading to production issues downstream.

Intellectual Property-Related Pitfalls

1. Misuse of Protected Designations (e.g., “French-Style” or “Tradition”)

Some suppliers may imply or falsely claim that their Type 55 flour adheres to French baking traditions or protected geographical indications (PGIs), such as those linked to specific French mills. This can mislead buyers and pose legal risks if used in marketing claims.

2. Repackaging and Branding Without Authorization

Unauthorized repackaging of flour under private labels without proper agreements can infringe on trademarks or trade dress, particularly when mimicking well-known artisanal brands. This poses both IP and reputational risks.

3. Lack of Contracts Protecting Formulation Rights

If a bakery develops a proprietary blend using Type 55 flour, failing to secure contractual assurances from the supplier about consistency and exclusivity could lead to formulation drift or competitive exposure, especially if the supplier shares specifications with others.

4. Counterfeit or Grey Market Products

In global supply chains, counterfeit or diverted batches of branded flour (e.g., from premium French mills) may enter the market. These products may lack the quality and authenticity expected, and their use could indirectly expose buyers to IP misuse if they are marketed as genuine.

Recommendations

- Source from certified, reputable mills with transparent quality documentation.

- Request detailed technical data sheets (TDS) and batch-specific analysis.

- Verify compliance with regional flour classification standards.

- Include IP and quality clauses in supplier agreements, especially for private labeling.

- Conduct regular audits and sensory/performance testing.

Avoiding these pitfalls ensures both product integrity and legal compliance when sourcing Type 55 flour.

Logistics & Compliance Guide for Type 55 Flour

Overview of Type 55 Flour

Type 55 Flour is a refined wheat flour commonly used in French baking, particularly for breads, pastries, and croissants. It is characterized by an ash content of approximately 0.55%, indicating a moderate level of extraction from the wheat kernel. This flour is low in bran and germ, resulting in a fine texture and high gluten-forming potential. Due to its widespread use in food manufacturing and artisanal baking, proper logistics and compliance procedures are essential for safe, legal, and efficient handling.

Regulatory Compliance

Type 55 Flour must comply with national and international food safety regulations. Key requirements include:

– Labeling: Must include product name (“Type 55 Flour”), ingredient list (wheat flour, may contain traces of gluten), net weight, lot number, best-before date, storage conditions, and manufacturer/distributor information. In the EU, compliance with Regulation (EU) No 1169/2011 on food information to consumers is mandatory.

– Allergen Declaration: Must clearly state “Contains: Gluten” or “Wheat” as required by food allergen labeling laws (e.g., FALCPA in the U.S., EU Directive 2003/89/EC).

– Food Safety Standards: Must meet Good Manufacturing Practices (GMP) and Hazard Analysis and Critical Control Points (HACCP) principles. In the U.S., compliance with FDA’s Current Good Manufacturing Practice (cGMP) regulations (21 CFR Part 117) is required.

– Imports/Exports: When shipping internationally, ensure compliance with destination country regulations (e.g., USDA, EU, CFIA). Phytosanitary certificates may be required depending on origin and destination.

Storage Requirements

Proper storage is critical to maintain flour quality and prevent contamination:

– Temperature: Store in a cool, dry place at temperatures between 15°C and 20°C (59°F–68°F). Avoid temperature fluctuations.

– Humidity: Relative humidity should not exceed 60% to prevent moisture absorption and mold growth.

– Pest Control: Use sealed containers or packaging to prevent infestation by insects (e.g., flour beetles) and rodents. Implement regular pest monitoring programs.

– Shelf Life: Typically 9–12 months when stored properly. Rotate stock using FIFO (First In, First Out) principles.

Packaging and Handling

- Primary Packaging: Type 55 Flour is commonly packed in food-grade polyethylene or multi-layer paper bags (e.g., 1 kg, 5 kg, 25 kg). Industrial quantities may use bulk sacks (e.g., 1,000 kg Big Bags) made from woven polypropylene with inner liners.

- Labeling on Packaging: Must include batch code, production date, best-before date, storage instructions, and allergen warnings.

- Handling Procedures: Use clean, dry equipment. Avoid cross-contamination with allergens (e.g., nuts, soy) or non-food substances. Ensure personnel wear appropriate PPE (gloves, masks) when handling bulk flour to prevent inhalation and contamination.

Transportation

- Mode of Transport: Suitable for road, rail, sea, and air freight. For bulk shipments, use enclosed, food-grade containers or tanker trucks with dedicated flour compartments.

- Container Conditions: Vehicles and containers must be clean, dry, and free of异味 or residues. Use temperature-controlled transport if required by climate or destination.

- Documentation: Include commercial invoice, packing list, certificate of analysis (CoA), and any required phytosanitary or export certificates. For EU shipments, a health certificate may be necessary.

- Segregation: Keep flour separate from non-food items, chemicals, and allergenic goods during transport.

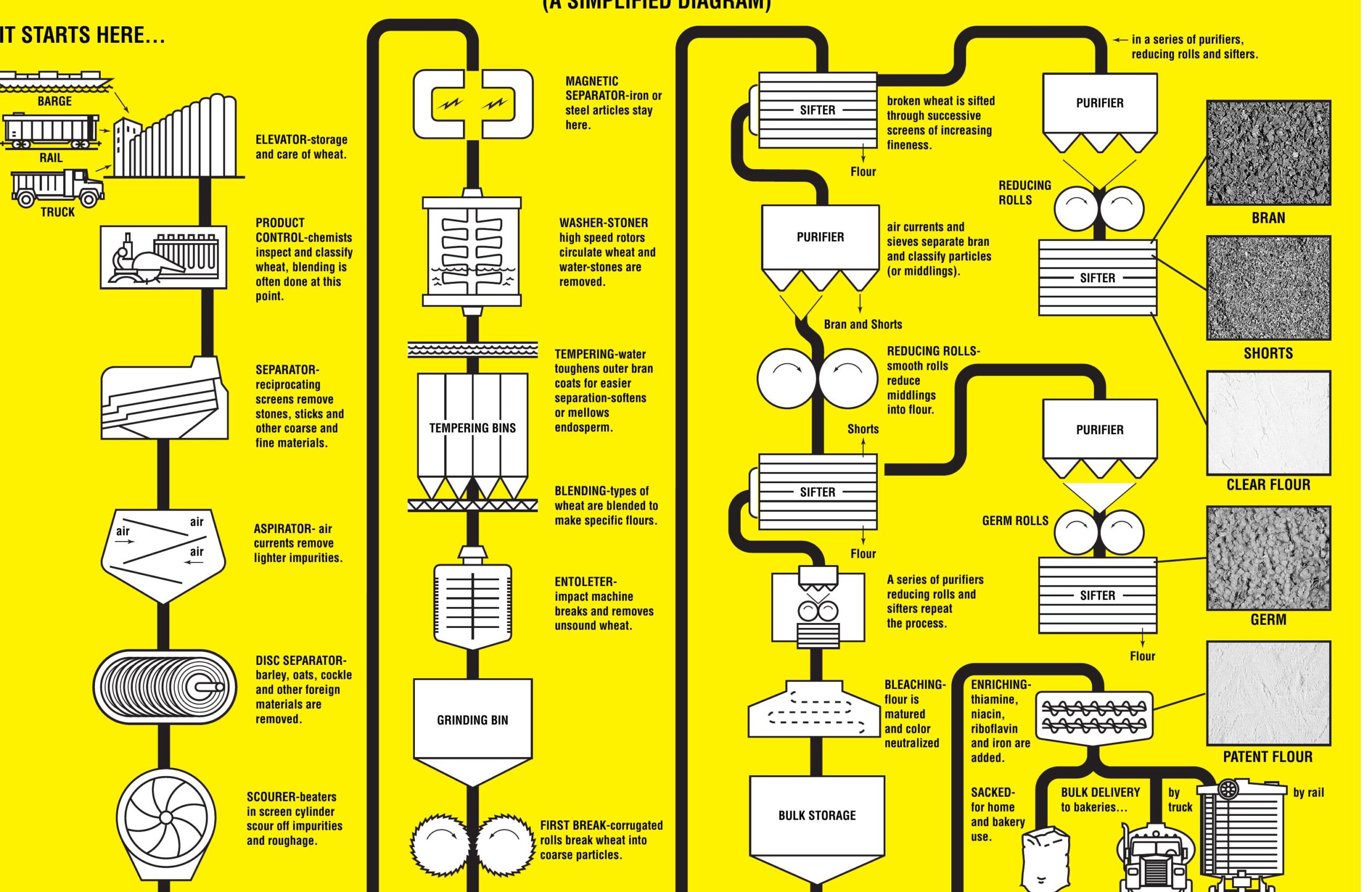

Quality Control and Testing

- Incoming Inspection: Verify packaging integrity, lot numbers, and expiration dates upon receipt. Check for signs of moisture, pests, or contamination.

- Laboratory Testing: Regularly test for moisture content (typically 13–15%), protein content, ash content (confirming Type 55 classification), microbiological safety (e.g., absence of Salmonella, E. coli), and pesticide residues.

- Certificate of Analysis (CoA): Must be provided by the supplier for each batch, confirming compliance with specifications and safety standards.

Sustainability and Traceability

- Traceability: Implement a full traceability system from wheat sourcing to final product. Maintain records of suppliers, batch numbers, processing dates, and distribution. Complies with EU General Food Law (Regulation (EC) No 178/2002) and FDA’s Food Traceability Rule (FSMA).

- Sustainable Sourcing: Encourage suppliers to use sustainable farming practices. Consider certifications such as Organic (EU Organic, USDA Organic) or non-GMO (Non-GMO Project Verified) if applicable.

- Waste Management: Recycle packaging materials where possible. Dispose of contaminated or expired flour in accordance with local waste regulations.

Emergency and Recall Procedures

- Contamination Response: In case of contamination (e.g., pests, foreign materials), isolate affected batches immediately and notify relevant authorities (e.g., FDA, RASFF in the EU).

- Recall Plan: Maintain a documented recall procedure including contact lists, communication protocols, and steps for product retrieval. Conduct regular mock recalls to test effectiveness.

- Incident Reporting: Report serious risks to food safety to national authorities within required timeframes (e.g., 24 hours under RASFF).

By adhering to this logistics and compliance guide, businesses can ensure the safe, legal, and efficient handling of Type 55 Flour throughout the supply chain.

Conclusion on Sourcing Type 55 Flour

Sourcing Type 55 flour requires careful consideration of quality, origin, consistency, and supplier reliability. As a finely milled wheat flour with a low ash content, Type 55 is prized in French-style baking for producing crisp baguettes, flaky pastries, and delicate cakes. To ensure optimal results, it is essential to source from reputable mills that maintain strict quality control and adhere to traditional milling standards.

When sourcing, evaluate suppliers based on their ability to provide consistent protein content (typically around 10–11.5%) and ash levels (approximately 0.55%), as these factors directly influence dough behavior and final product texture. Importing from established European mills may offer authenticity, but local or regional specialty mills can also provide high-quality alternatives with shorter supply chains and reduced environmental impact.

Additionally, consider factors such as organic certification, milling practices (stone-ground vs. industrial), and packaging to preserve freshness. Building strong relationships with trusted suppliers and requesting samples before large purchases will help ensure the flour meets your specific culinary requirements.

In conclusion, successfully sourcing Type 55 flour involves balancing authenticity, quality, and practicality. By prioritizing transparency and consistency, bakers and food producers can secure a reliable supply of flour that consistently delivers superior results in high-end artisanal baking.