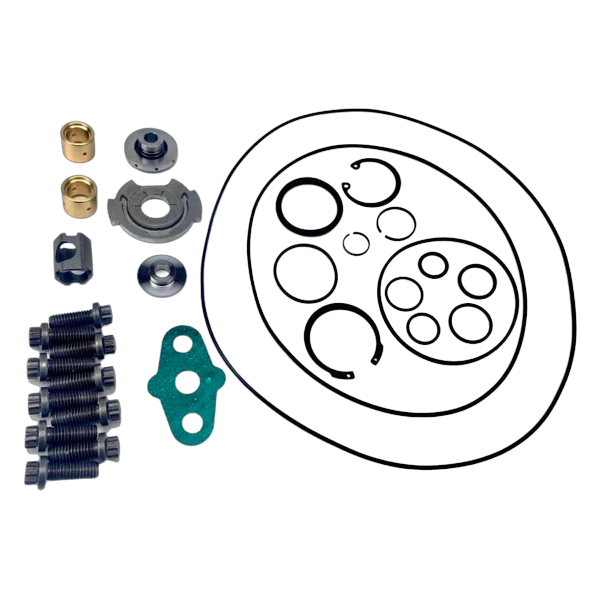

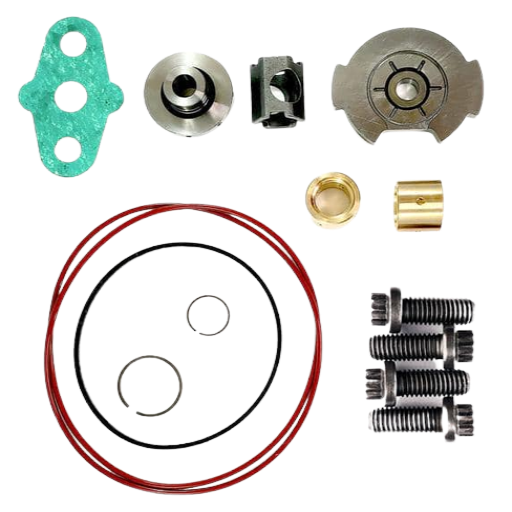

The global turbocharger market is experiencing robust growth, driven by increasing demand for fuel-efficient and low-emission vehicles across passenger car and commercial vehicle segments. According to a report by Mordor Intelligence, the turbocharger market was valued at USD 21.6 billion in 2023 and is projected to grow at a CAGR of over 6.5% from 2024 to 2029. This expansion is further supported by stringent emission regulations and the rising adoption of downsized engines equipped with turbocharging technology. As turbochargers become more integral to modern engine systems, the aftermarket demand for reconditioning and remanufacturing has surged. Turbo reconditioning kits—containing essential components like bearings, seals, gaskets, and hardware—play a critical role in restoring turbo performance, reducing waste, and offering cost-effective alternatives to full replacements. With the global focus on sustainability and circular economy models gaining traction, the market for reconditioning solutions is expanding steadily alongside the broader turbocharger industry. This growing demand has led to a competitive landscape of manufacturers specializing in high-quality, reliable reconditioning kits—many of which are engineered to meet or exceed OEM specifications. The following list highlights the top 10 turbo reconditioning kit manufacturers shaping this dynamic and evolving sector.

Top 10 Turbo Reconditioning Kits Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Turbochargers

Domain Est. 1998

Website: rotomaster.com

Key Highlights: Manufacturer of the largest range of turbochargers in the industry, including the complete Ford Ecoboost and Power Stroke range, Sprinter Van, Chevy Cruze, and ……

#2 Turbo Technics

Domain Est. 1998 | Founded: 1981

Website: turbotechnics.com

Key Highlights: Turbo Technics is a world leader in all aspects of turbochargers and turbocharging. Founded in 1981 at the beginning of the turbo car era….

#3 KC Turbos

Domain Est. 2014

Website: kcturbos.com

Key Highlights: KC Turbos is a family-owned and operated company that has been providing high-quality turbochargers, turbo kits, and performance parts for diesel trucks and ……

#4 Precision Engineered Turbochargers & Turbo Parts

Domain Est. 1999

Website: melett.com

Key Highlights: Supplier of turbochargers, Core Assemblies, turbo parts and repair kits. Our range allows turbo reconditioning, remanufacturing and repair of turbo models….

#5 Turbo Kits, Turbocharger Upgrades, and Performance Auto Parts

Domain Est. 2000

#6 Pureturbos

Domain Est. 2010

Website: pureturbos.com

Key Highlights: We are a company offering high quality new and remanufactured turbochargers. We pride ourselves in providing the best in turbocharger services and products….

#7 Work Turbochargers

Domain Est. 2010 | Founded: 1998

Website: workturbochargers.com

Key Highlights: Specializing in High Performance Turbochargers since 1998. Authorized Distributor For BorgWarner, Garrett, TiAL and Turbosmart….

#8 Turbo Kits

Domain Est. 2014

Website: maxpeedingrods.com

Key Highlights: Free deliverySupply turbo kits for your car. Maxpeedingrods provide quality turbo kits for wide variety of models from Maxpeedingrods with one year warranty and express ……

#9 HD Turbo Official

Domain Est. 2016

Website: hdturbo.com

Key Highlights: HD Turbo is a Chicago-based turbocharger remanufacturing company focused on delivering the highest precision and quality turbochargers on the market.Missing: reconditioning kits…

#10 Original Turbo Reman

Domain Est. 2018

Website: garrettmotion.com

Key Highlights: Garrett Original Reman turbos are remanufactured to deliver price-competitive original equipment performance for older vehicles….

Expert Sourcing Insights for Turbo Reconditioning Kits

H2: 2026 Market Trends for Turbo Reconditioning Kits

The global turbo reconditioning kits market is poised for steady growth and significant transformation by 2026, driven by evolving vehicle fleets, economic pressures, and technological advancements. Key trends shaping the landscape include:

1. Sustained Demand from Aging Vehicle Fleets:

A primary driver remains the increasing average age of vehicles on the road, particularly in mature markets like North America and Europe. As engines accumulate mileage, turbocharger failures become more common. Reconditioning kits—offering cost-effective solutions with gaskets, seals, bearings, and hardware—will remain highly attractive for both professional workshops and DIY enthusiasts seeking to avoid expensive new turbo replacements.

2. Rising Popularity of Remanufactured Turbos & Kit Bundling:

The growth of professionally remanufactured turbochargers is creating a parallel demand for high-quality reconditioning kits. Manufacturers and distributors are increasingly bundling kits with reman cores or offering comprehensive “rebuild kits” tailored to specific turbo models. This trend ensures compatibility and convenience, boosting market confidence and adoption.

3. Expansion in Emerging Markets:

Markets in Asia-Pacific (especially India and Southeast Asia), Latin America, and Africa are witnessing growing vehicle ownership and a strong preference for affordable maintenance solutions. As turbocharged engines become more common even in budget vehicles, the demand for reconditioning kits is expected to surge, supported by expanding automotive aftermarket networks.

4. Focus on Quality and Standardization:

With the rise of counterfeit or substandard parts, there is increasing emphasis on OEM-equivalent quality, precise material specifications (e.g., high-temp silicone seals, precision-machined thrust collars), and standardized packaging. Brands investing in certifications (ISO, IATF) and clear traceability will gain competitive advantage. Digital part lookup tools and QR-coded packaging will enhance trust and ease of use.

5. Technological Adaptation to Advanced Turbo Designs:

As OEMs adopt variable geometry turbos (VGT), twin-scroll, and electrically assisted turbos (e-boosters), reconditioning kits must evolve. By 2026, expect specialized kits for VGT actuators, advanced bearing systems, and integration with electronic components, requiring more technical know-how but opening new market segments.

6. E-Commerce and Digital Distribution Growth:

Online platforms will continue to dominate distribution, with robust product databases, compatibility filters, and video-guided installations enhancing user experience. B2B e-commerce portals for workshops and fleet operators will streamline procurement, increasing market reach and efficiency.

7. Environmental and Circular Economy Drivers:

Reconditioning supports sustainability by extending component life and reducing waste. As environmental regulations tighten and circular economy principles gain traction, turbo reconditioning will be positioned as an eco-friendly alternative, potentially receiving indirect policy support or incentives.

In summary, the 2026 turbo reconditioning kits market will be defined by resilience, innovation, and digital transformation. Success will favor suppliers who combine technical precision, global distribution agility, and responsive adaptation to both mechanical evolution and consumer demand for value and sustainability.

Common Pitfalls When Sourcing Turbo Reconditioning Kits

Poor Quality Components

One of the most frequent issues when sourcing turbo reconditioning kits is receiving substandard parts. Low-quality bearings, seals, or compressor wheels can lead to premature turbo failure, reduced performance, and costly repeat repairs. These components may not meet OEM tolerances or material specifications, compromising reliability and efficiency.

Lack of Genuine or OEM-Compatible Parts

Many kits on the market use generic or imitation parts that are not true to original equipment manufacturer (OEM) standards. This can result in improper fitment, reduced durability, and potential engine damage. Buyers often assume “compatible” means equivalent performance, but this is not always the case.

Intellectual Property (IP) and Counterfeit Risks

Sourcing kits from unverified suppliers increases the risk of encountering counterfeit products that infringe on manufacturer IP. These knock-offs may mimic branding and packaging but deliver inferior performance. Using such parts can expose repair shops or distributors to legal liability and damage their reputation.

Incomplete or Inconsistent Kit Contents

Some reconditioning kits lack essential components such as gaskets, nuts, washers, or specialized lubricants. Others may include mismatched or outdated parts, leading to installation challenges and the need for additional purchases, increasing downtime and labor costs.

Inadequate Supplier Documentation and Traceability

Reputable turbo reconditioning requires traceability and technical support. Many low-cost suppliers provide little to no documentation, such as material certifications, torque specifications, or assembly instructions. This lack of transparency makes quality control and warranty claims difficult.

Misleading Marketing and Specifications

Suppliers may exaggerate performance claims or use ambiguous terminology like “premium” or “OEM-quality” without verification. Without independent testing or certification, it’s hard to assess true product reliability, leading to mismatched expectations and customer dissatisfaction.

Logistics & Compliance Guide for Turbo Reconditioning Kits

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legal handling of Turbo Reconditioning Kits throughout the supply chain—from manufacturing and distribution to end-user delivery and installation.

Supply Chain Management

Establish a reliable network of suppliers for core components (e.g., bearings, seals, gaskets, tools) and ensure consistent quality. Maintain buffer stock of critical parts to mitigate supply disruptions. Implement vendor qualification programs to verify compliance with industry standards and environmental regulations.

Packaging & Labeling Requirements

Package kits in durable, anti-static, and moisture-resistant materials to protect sensitive components during transit. Clearly label each kit with:

– Part number and compatibility (e.g., applicable turbo model, OEM references)

– Batch/lot number for traceability

– “Fragile” and “Handle with Care” indicators

– Storage conditions (e.g., temperature, humidity)

– Country of origin

Ensure labeling complies with international shipping standards (e.g., ISO, IATA) and local language requirements where applicable.

Shipping & Transportation

Use certified carriers experienced in handling automotive components. For international shipments, comply with:

– Incoterms (e.g., FOB, DAP) clearly defined in contracts

– Export controls and customs documentation (commercial invoice, packing list, certificate of origin)

– Hazardous materials regulations (if any components are classified, e.g., adhesives)

Monitor transit conditions (temperature, shock) when necessary using data loggers.

Inventory Management

Utilize an inventory management system with lot traceability to support recalls and warranty tracking. Apply FIFO (First In, First Out) principles to prevent component degradation. Store kits in a climate-controlled environment (typically 10–25°C, <60% humidity) away from direct sunlight and contaminants.

Regulatory Compliance

Ensure all kits meet relevant regional regulations:

– EU: Compliance with REACH (chemical safety) and RoHS (restriction of hazardous substances)

– USA: Adherence to EPA and DOT guidelines where applicable

– Global: Conformity with ISO 9001 (quality management) and IATF 16949 (automotive quality standards)

Maintain technical documentation (e.g., Declarations of Conformity) for audit readiness.

Warranty & Returns Handling

Define clear warranty terms (duration, coverage, exclusions) and communicate them with each kit. Establish a returns process for defective or incorrect items, including inspection, root cause analysis, and disposition (repair, replace, scrap). Track return data to improve product quality.

End-of-Life & Environmental Responsibility

Provide guidance for proper disposal of used kit components (e.g., metal parts, packaging). Partner with certified recyclers for end-of-life management. Comply with WEEE (Waste Electrical and Electronic Equipment) directives where applicable, even for mechanical kits with electronic tools.

Training & Documentation

Provide certified technicians with detailed installation manuals, torque specifications, and safety instructions. Offer training modules (online or in-person) to ensure correct reconditioning procedures. Maintain records of training completion for compliance audits.

Audits & Continuous Improvement

Conduct regular internal audits of logistics and compliance processes. Perform supplier audits annually. Use customer feedback, warranty claims, and non-conformance reports to drive continuous improvement in kit design, packaging, and distribution efficiency.

Conclusion on Sourcing Turbo Reconditioning Kits

Sourcing turbo reconditioning kits requires a strategic approach that balances quality, cost, availability, and technical compatibility. After evaluating various suppliers, product ranges, and market trends, it is evident that selecting the right kit involves more than just competitive pricing—reliability, OEM specifications, and comprehensive component inclusion are critical to ensuring long-term turbocharger performance and engine efficiency.

High-quality reconditioning kits from reputable manufacturers minimize the risk of premature failure and reduce downtime, ultimately offering better value for money. Sourcing from certified suppliers with proven track records, strong technical support, and global distribution networks enhances supply chain resilience. Additionally, considering kits that include all necessary seals, gaskets, bearings, and hardware ensures a complete and professional rebuild.

In conclusion, a well-informed sourcing decision—based on technical requirements, supplier credibility, and total cost of ownership—will optimize turbo reconditioning outcomes, extend turbo life, and support overall vehicle or machinery performance. Prioritizing quality and compatibility over short-term savings is essential for sustainable and efficient operations.