The global tumbler drum market is experiencing steady growth, driven by increasing demand for efficient material processing across industries such as pharmaceuticals, food and beverage, mining, and chemicals. According to Grand View Research, the global tumbling and polishing equipment market was valued at USD 1.7 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 5.2% from 2023 to 2030. This growth is fueled by rising industrial automation, stringent quality control standards, and the need for high-precision surface finishing. Additionally, Mordor Intelligence projects expanding applications in recycling and waste management to further accelerate market demand. As industries prioritize consistency, throughput, and durability, the role of advanced tumbler drum manufacturers becomes increasingly critical. In this evolving landscape, the following nine manufacturers stand out for their innovation, global reach, and technological expertise in delivering high-performance tumbler drum solutions.

Top 9 Tumbler Drum Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

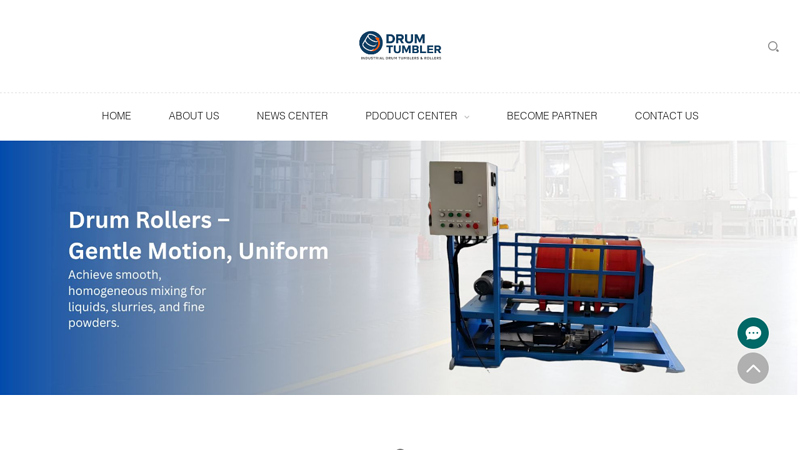

#1 Drum Tumbler Engineering Technology Co., Ltd

Website: drumtumbler.com

Key Highlights: DrumTumbler, a sub-brand of Z-MIXER Group, is the leading manufacturer of drum tumblers and in-drum mixing equipment with over 15 years of industry experience….

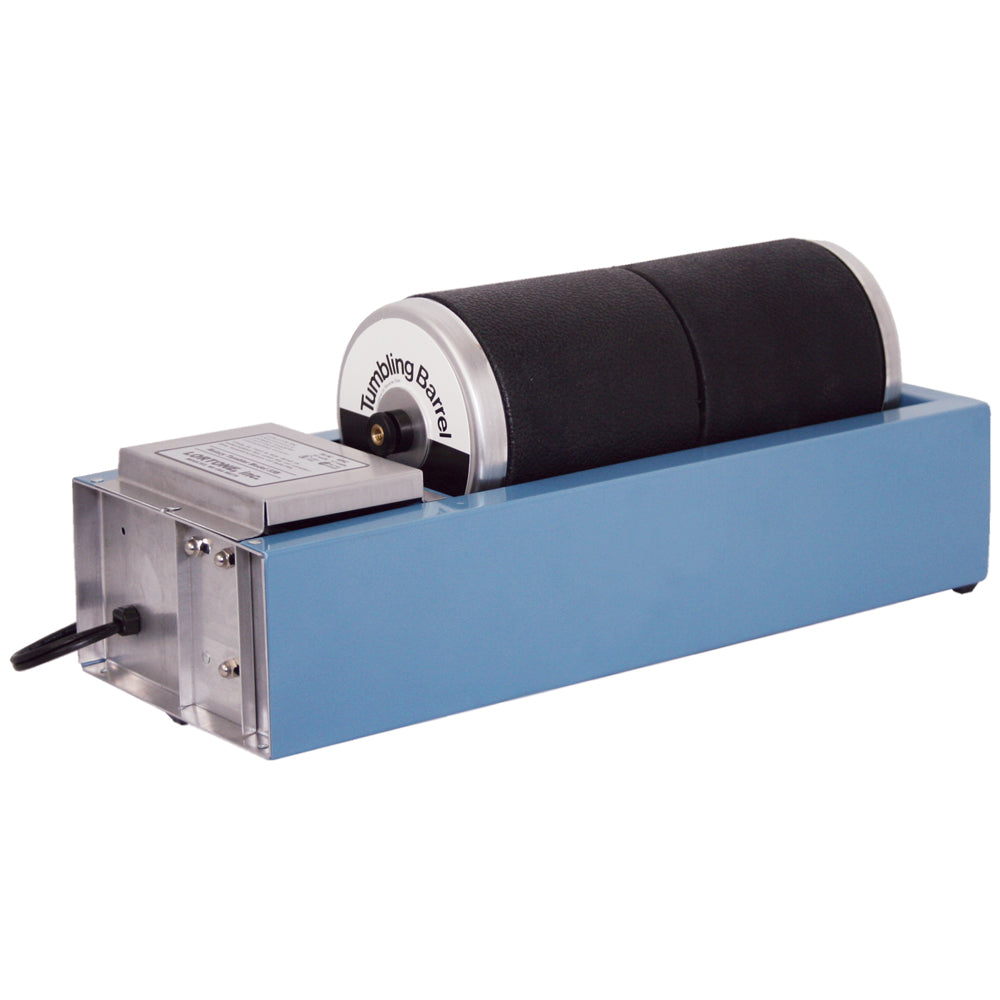

#2 IMS Company

Domain Est. 1996

Website: imscompany.com

Key Highlights: 5 Gallon Can Mini-Tumbler, 1/4 hp, 115 Volt, 1-Phase/60Hz, TEFC Motor with 1 to 60 Minute Timer, Tumbling Speed 23 rpm, Complete with 8′ Power Cord….

#3 Leading Tumbler Manufacturers

Domain Est. 2000

Website: deburringmachinery.com

Key Highlights: Leading Tumbler Manufacturers. A tumbler is a barrel or drum on finishing and deburring equipment that holds items during the finishing process….

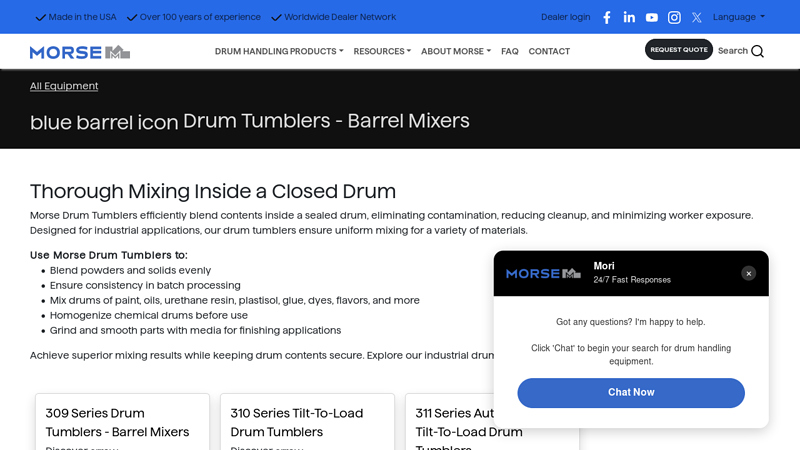

#4 Morse Drum Tumblers

Domain Est. 2010

Website: morsedrum.com

Key Highlights: Designed for industrial applications, our drum tumblers ensure uniform mixing for a variety of materials. Use Morse Drum Tumblers to: Blend powders and solids ……

#5 33B Rotary Tumbler

Domain Est. 1996

Website: lortone.com

Key Highlights: Out of stockThe ever-popular 33B tumbler offers greater capacity and an upgraded drive. Now you can polish more stones at the same time in a compact unit. Comes with twin 3 ……

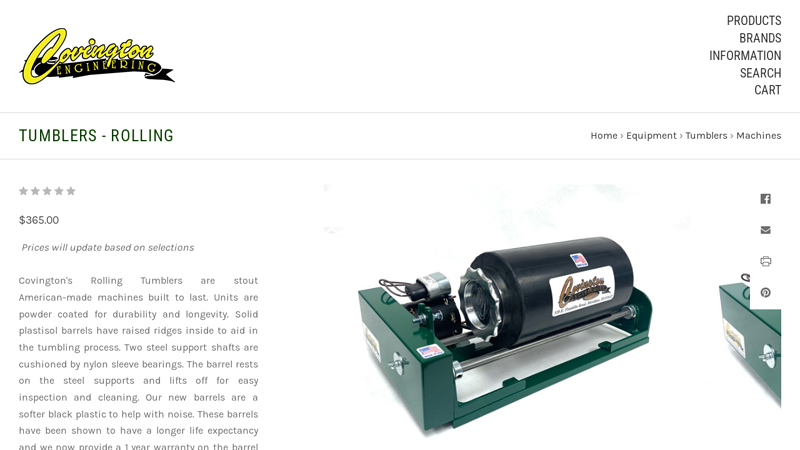

#6 Tumblers

Domain Est. 1998

#7 Thumler’s Tumblers

Domain Est. 2000

#8 Drum Tumbler

Domain Est. 2006

Website: stewarthandling.com

Key Highlights: In stockDrum Tumbler. 309-E3-50. Drum Tumbler; Plastic; Steel Or Fiber Drum 12 RPM. Explosion-Proof 3-Phase 230 ……

#9 MJR Tumblers, Highest Quality, Lowest Prices on Rock Tumblers …

Domain Est. 2015

Website: mjrtumblers.com

Key Highlights: MJR Tumblers are versatile, with 8 different barrel sizes and 19 different barrel combinations possible. Achieve a Flawless Finish with MJR Tumblers’ Grit Kits….

Expert Sourcing Insights for Tumbler Drum

2026 Market Trends for Tumbler Drum

The tumbler drum market is poised for significant evolution by 2026, driven by advancements in industrial automation, sustainability demands, and growing applications across sectors such as recycling, mining, food processing, and pharmaceuticals. This analysis explores key trends expected to shape the tumbler drum industry in the coming years.

Increasing Demand from Recycling and Waste Management Sectors

One of the most influential drivers of tumbler drum adoption by 2026 will be the global push toward circular economies and sustainable waste processing. Tumbler drums are extensively used in material recovery facilities (MRFs) for size separation, composting, and sorting recyclables. With stricter environmental regulations and rising volumes of municipal solid waste, especially in emerging economies, investment in efficient sorting and composting equipment is accelerating. Tumbler drums—valued for their robustness and low maintenance—are expected to see increased deployment in waste-to-energy and organic waste composting plants.

Technological Advancements and Automation Integration

By 2026, tumbler drums will increasingly integrate smart technologies such as IoT-enabled sensors, predictive maintenance systems, and real-time monitoring controls. These advancements will enhance operational efficiency, reduce downtime, and improve process consistency. Manufacturers are focusing on modular designs that allow for easy customization and scalability, catering to diverse industry needs. Additionally, AI-driven analytics will enable operators to optimize drum speed, retention time, and feed rates based on material characteristics, leading to higher throughput and reduced energy consumption.

Growth in Mining and Mineral Processing Applications

The mining industry continues to adopt tumbler drums for ore screening, scrubbing, and agglomeration processes. As global demand for critical minerals—such as lithium, cobalt, and rare earth elements—rises to support electric vehicles and renewable energy infrastructure, efficient mineral processing becomes essential. Tumbler drums play a vital role in pre-treatment stages, and their use is expected to grow, especially in regions with expanding mining activities like Africa, South America, and Australia. Innovations in wear-resistant materials and drum linings will further extend service life and reduce operational costs.

Expansion in Food and Pharmaceutical Industries

Stringent hygiene standards and the need for gentle material handling are driving the adoption of sanitary-grade tumbler drums in food processing and pharmaceutical manufacturing. By 2026, demand for food-safe, CIP (Clean-in-Place)-compatible tumbler systems is expected to rise, particularly for applications such as vegetable washing, tablet coating, and particle size grading. The shift toward precision and traceability in these industries will promote the use of enclosed, automated tumbler drum systems with minimal cross-contamination risks.

Sustainability and Energy Efficiency Focus

Environmental regulations and corporate ESG (Environmental, Social, and Governance) goals will push manufacturers to develop energy-efficient tumbler drum designs. Lightweight materials, optimized rotational mechanics, and variable frequency drives (VFDs) will become standard features to reduce power consumption. Additionally, the use of recycled steel and sustainable coatings in drum construction will appeal to eco-conscious buyers, further shaping product development strategies.

Regional Market Dynamics

Asia-Pacific is expected to emerge as the fastest-growing market for tumbler drums by 2026, owing to rapid industrialization, urbanization, and government investments in waste management and mining infrastructure. China, India, and Southeast Asian nations will lead demand. Meanwhile, North America and Europe will focus on retrofitting existing facilities with advanced tumbler systems to meet regulatory standards and improve efficiency.

Conclusion

By 2026, the tumbler drum market will be shaped by technological innovation, regulatory pressures, and expanding industrial applications. Companies that prioritize smart integration, sustainability, and sector-specific customization will be well-positioned to capitalize on growing opportunities across recycling, mining, food, and pharmaceutical industries. Strategic investments in R&D and global market expansion will be key to maintaining competitive advantage in this evolving landscape.

Common Pitfalls Sourcing Tumbler Drum (Quality, IP)

Sourcing tumbler drums—commonly used in mixing, grinding, polishing, or thermal processing applications—can present several challenges, especially concerning product quality and intellectual property (IP) protection. Being aware of these pitfalls helps ensure reliable supply, consistent performance, and legal compliance.

Poor Quality Control and Material Specifications

One of the most frequent issues when sourcing tumbler drums is inconsistent quality, particularly with suppliers from regions with lax manufacturing standards. Buyers may receive drums made from substandard materials, such as low-grade stainless steel or improperly welded components, leading to premature wear, deformation, or failure under operational stress. Lack of adherence to dimensional tolerances or surface finish requirements can also impact performance, especially in precision applications.

To mitigate this, it is critical to:

– Request material certifications (e.g., mill test reports)

– Conduct third-party inspections or factory audits

– Define clear technical specifications in procurement contracts

Inadequate Design Validation and Testing

Many suppliers may offer tumbler drums based on generic designs without validating performance under real-world conditions. Without proper load testing, vibration analysis, or endurance trials, the drum may fail during operation, causing downtime or safety hazards. This is particularly risky when sourcing from OEMs without proven industry experience.

Best practices include:

– Requiring performance data or test results

– Prototyping and field testing before large-scale orders

– Engaging suppliers with documented engineering capabilities

Intellectual Property Infringement Risks

Sourcing tumbler drums—especially custom-engineered units—can expose buyers to IP risks. Some suppliers may replicate patented designs, proprietary geometries, or trademarked features without authorization. Unknowingly importing or using such products may result in legal liability, seizure of goods, or reputational damage.

To safeguard IP:

– Conduct due diligence on supplier design origins

– Include IP indemnification clauses in contracts

– Register designs and patents in relevant jurisdictions

Lack of Traceability and Documentation

Poor documentation—such as missing design drawings, weld maps, or compliance certificates—can hinder maintenance, regulatory approval, and quality audits. This is a common issue with low-cost suppliers who prioritize speed over record-keeping.

Ensure suppliers provide:

– Complete technical dossiers

– As-built drawings and material traceability

– Certifications for pressure, safety, or industry-specific standards (e.g., ASME, CE)

Supply Chain Transparency and Counterfeit Components

Some tumbler drum suppliers may source critical components (e.g., bearings, seals, motors) from unverified sub-suppliers, increasing the risk of counterfeit or non-compliant parts. This undermines reliability and may void warranties.

Mitigation strategies:

– Require full bill of materials (BOM) disclosure

– Audit sub-tier suppliers when possible

– Specify branded or approved components in procurement agreements

Avoiding these pitfalls requires thorough supplier vetting, robust contractual terms, and proactive quality management throughout the sourcing lifecycle.

Logistics & Compliance Guide for Tumbler Drum

Product Overview and Classification

Tumbler drums, commonly used in industrial processes for mixing, blending, tumbling, or polishing materials, are categorized as industrial machinery. They must be classified correctly under the Harmonized System (HS) code for import/export purposes. Typical HS codes include 8479.89 (machines for specific purposes, not elsewhere specified) or 8474.20 (crushing, pulverizing, or screening machines), depending on the model and primary function. Accurate classification is essential to determine tariffs, restrictions, and regulatory requirements.

Packaging and Handling Requirements

Tumbler drums are typically heavy and bulky, requiring robust packaging and careful handling. Secure crating with wooden or metal frames is recommended to prevent damage during transit. Use anti-vibration mounts and protective padding to safeguard motor components and rotating mechanisms. Clearly label packages with handling instructions such as “Fragile,” “This Side Up,” and “Heavy Machinery.” Follow OSHA and IEC standards for weight limits and lifting procedures when loading/unloading.

Transportation Regulations

Transport of tumbler drums may involve road, rail, or sea freight. Oversized loads may require special permits and route planning. For international shipping, ensure compliance with IMDG Code (for sea), ADR (for road in Europe), or 49 CFR (for U.S. domestic transport). Verify weight distribution and secure the drum using certified tie-downs. If the drum includes electrical components, ensure compliance with voltage and wiring standards for the destination country.

Import/Export Compliance

Exporters must provide a commercial invoice, packing list, bill of lading, and a certificate of origin. Depending on the destination, an export license may be required—especially if the equipment includes dual-use technology. Importers must verify local customs requirements, including conformity assessment procedures and payment of duties and VAT. Use an HS code-specific import declaration and ensure all documentation matches the physical shipment.

Electrical and Safety Standards

Tumbler drums with electrical components must meet regional safety certifications. In the U.S., look for UL or CSA certification; in the EU, CE marking per Machinery Directive 2006/42/EC and Low Voltage Directive is mandatory. Equipment should comply with IEC 60204-1 (safety of machinery – electrical equipment). Provide technical files, risk assessments, and user manuals in the local language.

Environmental and Waste Compliance

Dispose of packaging materials according to local environmental regulations (e.g., EPA in the U.S., WEEE Directive in the EU). If the tumbler drum reaches end-of-life, follow regional guidelines for recycling industrial machinery. Avoid releasing lubricants or metal shavings into the environment during operation or decommissioning.

Documentation and Recordkeeping

Maintain detailed records of shipping manifests, compliance certificates, inspection reports, and maintenance logs. Retain these documents for a minimum of five years to support audits or customs inquiries. Digital records should be securely stored and backed up.

Risk Mitigation and Insurance

Insure shipments against loss, damage, or delay. Include coverage for mechanical breakdown during transit. Conduct supplier and carrier due diligence to ensure reliability and compliance history. Include indemnity clauses in contracts to address non-compliance or delivery failures.

Final Inspection and Delivery

Perform a pre-shipment inspection to verify functionality and compliance. Upon delivery, conduct a joint inspection with the recipient to document condition and completeness. Address any discrepancies immediately with the carrier or supplier. Provide training or installation support if required by the end-user.

Conclusion for Sourcing Tumbler Drum

In conclusion, sourcing a tumbler drum requires careful evaluation of technical specifications, material quality, supplier reliability, and cost-effectiveness. It is essential to identify the specific application requirements—such as capacity, rotation speed, material compatibility, and operational environment—to ensure optimal performance and durability. Engaging with reputable suppliers who offer customization options, robust after-sales support, and compliance with industry standards will contribute to long-term efficiency and reduced downtime. Additionally, considering factors such as lead time, logistics, and total cost of ownership helps in making a well-informed procurement decision. By adopting a strategic and thorough sourcing approach, organizations can secure a high-quality tumbler drum that enhances operational productivity and supports sustainable manufacturing processes.