The global truck frame rails market continues to grow steadily, driven by increasing demand for heavy-duty commercial vehicles and advancements in lightweight, high-strength materials. According to a report by Grand View Research, the global commercial vehicle market was valued at USD 585.6 billion in 2023 and is expected to expand at a compound annual growth rate (CAGR) of 5.8% from 2024 to 2030, directly influencing the demand for durable truck frame components. Similarly, Mordor Intelligence projects that the heavy and medium-duty truck market will witness a CAGR of over 6% during the forecast period of 2024–2029, underpinned by rising freight transportation needs and infrastructure development across emerging economies. As structural backbone components critical to vehicle safety and performance, truck frame rails are witnessing heightened innovation in material composition—including high-strength low-alloy (HSLA) steel and advanced composites—positioning leading manufacturers at the forefront of automotive engineering and compliance with evolving emission and payload regulations. Against this backdrop, identifying the top truck frame rails manufacturers becomes essential for OEMs and Tier-1 suppliers aiming to balance strength, weight efficiency, and cost-effectiveness in next-generation vehicle platforms.

Top 9 Truck Frame Rails Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Linamar

Domain Est. 1998

Website: linamar.com

Key Highlights: Linamar is an advanced manufacturing company where the intersection of leading edge technology and deep manufacturing expertise is creating solutions….

#2 PG Adams, Inc.

Domain Est. 2002

Website: pgadams.com

Key Highlights: The trusted source for truck frames. Over 50 years of exceptional craftsmanship. PG Adams, Inc. Truck Frames. Unparalleled accuracy. Unbeatable service….

#3 Frame rails – AHSS steel for truck & LCV subframe

Domain Est. 1996

Website: ssab.com

Key Highlights: Frame rails made from Docol ® AHSS and UHSS steels can improve the strength, stiffness, and durability of delivery vans, pick-up trucks, and other light ……

#4 Bending of Steel

Domain Est. 1996

Website: cmrp.com

Key Highlights: Chicago Metal Rolled Products uses a variety of methods for the Bending of Steel. Our capacity includes tight radius bends to large, heavy plate rolling….

#5 Truck Frames

Domain Est. 1996

Website: customtruck.com

Key Highlights: 3-day delivery · 30-day returnsCustom Truck One Source offers stock frames and parts for Load King vehicles along with customization capabilities. Request a quote for a truck fram…

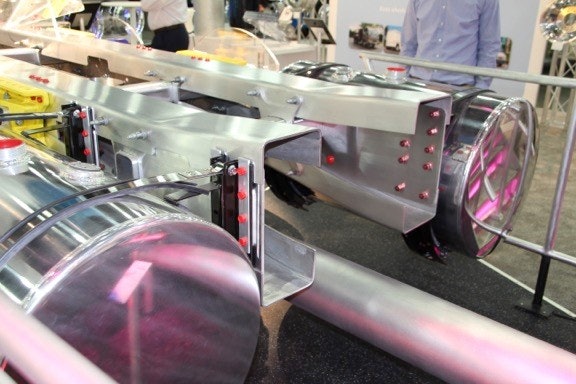

#6 Truck Frame Rails & Chassis Components

Domain Est. 2000

Website: viconfab.com

Key Highlights: Chassis frame rails and liners are cut and formed from high-strength steels up to 140,000 ksi. Hole patterns are punched to custom files supplied. Cross members ……

#7 The Production of Heavy Truck Frame Rail Blanks

Domain Est. 2001

Website: ohiovalleymfg.com

Key Highlights: Learn how heavy truck frame rail blanks enhance automotive manufacturing and ensure structural reliability in production….

#8 Metalsa

Domain Est. 2005

Website: metalsa.com

Key Highlights: We are a supplier of choice in structural products and integrated chassis systems. We have over 60 years of experience providing the best-tailored solutions….

#9 Frame extension Edinburg and South Texas

Domain Est. 2014

Website: us281trucktrailerservices.com

Key Highlights: We are the best place for frame extensions in Edinburg & all of South Texas. (956) 783-8991 Call us now! We have stretched more than 5000 truck frames over the ……

Expert Sourcing Insights for Truck Frame Rails

H2: 2026 Market Trends for Truck Frame Rails

The global truck frame rails market is poised for significant transformation by 2026, driven by evolving regulatory standards, material innovations, and shifts in commercial vehicle demand. Frame rails—critical structural components that form the backbone of heavy- and medium-duty trucks—are undergoing technological and material advancements to meet the dual imperatives of lightweighting and durability.

One of the dominant trends shaping the 2026 outlook is the increasing adoption of high-strength steel (HSS) and advanced high-strength steel (AHSS). Manufacturers are prioritizing these materials to reduce vehicle weight without compromising structural integrity, thereby improving fuel efficiency and reducing emissions—a key compliance factor under tightening global emissions regulations such as EPA Tier 5 and Euro VII.

Additionally, aluminum and composite frame rails are gaining traction, particularly in specialized and vocational truck segments where weight savings directly impact payload capacity and operational costs. While steel remains the dominant material due to its cost-effectiveness and recyclability, the penetration of alternative materials is expected to grow at a compound annual growth rate (CAGR) of approximately 4.5% through 2026.

Another key trend is the integration of modular frame rail designs. OEMs are increasingly adopting modular platforms to streamline production, reduce costs, and enhance customization for diverse applications—from long-haul freight to last-mile delivery trucks. This shift supports scalability across vehicle models and facilitates faster assembly, particularly in regions with rising e-commerce logistics demands.

Geographically, North America and Europe are leading in the adoption of advanced frame rail technologies, driven by stringent safety and emissions norms. Meanwhile, Asia-Pacific—especially China and India—is expected to register the highest market growth, fueled by expanding infrastructure, urbanization, and government initiatives promoting commercial vehicle modernization.

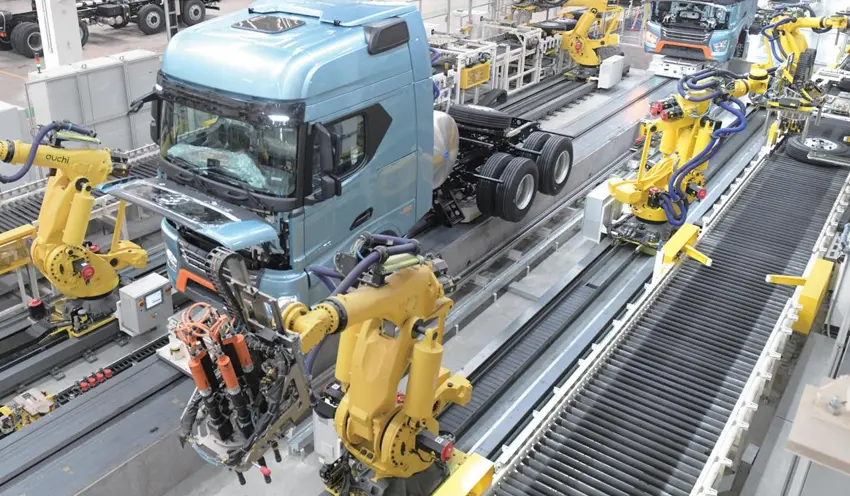

Automation and digitalization in manufacturing are also influencing frame rail production. By 2026, smart factories employing IoT-enabled monitoring, predictive maintenance, and robotics are expected to enhance precision in rail fabrication, reduce waste, and improve supply chain responsiveness.

Finally, sustainability is becoming a core market driver. With circular economy principles gaining momentum, recyclability of frame rail materials and end-of-life vehicle processing are receiving increased attention. OEMs and suppliers are investing in closed-loop recycling systems and low-carbon production methods to align with ESG (Environmental, Social, and Governance) goals.

In summary, the 2026 truck frame rails market will be defined by material innovation, regulatory compliance, modular design, and sustainability—positioning the sector at the intersection of engineering excellence and environmental responsibility.

Common Pitfalls in Sourcing Truck Frame Rails: Quality and Intellectual Property (IP) Concerns

Sourcing truck frame rails—critical structural components that support the entire vehicle—requires careful attention to both quality assurance and intellectual property (IP) considerations. Failure to address these aspects can lead to safety risks, legal liabilities, and costly delays. Below are two major areas where sourcing pitfalls commonly occur.

Quality-Related Pitfalls

-

Substandard Material Composition

A frequent issue when sourcing frame rails, especially from low-cost or unverified suppliers, is the use of inferior-grade steel. Frame rails must meet specific strength, ductility, and fatigue resistance standards (e.g., ASTM A569, SAE J500). Suppliers may cut costs by using recycled or improperly alloyed steel, leading to premature cracking or failure under load. -

Inconsistent Manufacturing Processes

Poor control over roll forming, welding, or hole punching can compromise structural integrity. Variations in tolerances, misaligned mounting points, or weak weld seams reduce performance and complicate assembly. Lack of process validation or inadequate quality control (QC) documentation increases the risk of batch inconsistencies. -

Insufficient Testing and Certification

Reputable suppliers provide material test reports (MTRs), dimensional certifications, and fatigue test data. Sourcing without verifying these documents—or accepting falsified or generic certifications—can result in non-compliant parts that fail under real-world conditions. -

Corrosion Resistance Deficiencies

Frame rails are exposed to harsh environments. Inadequate or inconsistent surface treatments (e.g., galvanization, e-coating) can lead to rapid corrosion, especially if the coating is applied too thinly or unevenly. This diminishes the lifespan of the frame and may violate durability warranties.

Intellectual Property (IP) Risks

-

Unauthorized Use of Proprietary Designs

Many truck frame rail designs are protected by patents, trade secrets, or design rights held by OEMs or Tier 1 suppliers. Sourcing from third parties who replicate these designs without licensing—common with “copycat” manufacturers—exposes buyers to IP infringement claims, even if unintentional. -

Lack of IP Warranty and Indemnification

Suppliers may not provide contractual assurances that their products do not infringe on existing IP. Without clear indemnification clauses, the buyer assumes full legal and financial liability in case of a dispute, including product recalls or litigation costs. -

Reverse Engineering Without Legal Clearance

Some suppliers develop frame rails by reverse engineering OEM parts. While this is not always illegal, it can cross into IP violation if protected features (e.g., unique cross-sections, mounting systems) are copied. Buyers may unknowingly source such components, creating downstream legal exposure. -

Ambiguity in Design Ownership

In custom sourcing arrangements, unclear contracts may leave ownership of design modifications or tooling in dispute. This can hinder future production, limit supplier switching, or result in unexpected licensing fees.

Conclusion

To mitigate these risks, buyers should conduct thorough supplier audits, demand full material and process traceability, and ensure legal review of design rights before procurement. Partnering with reputable manufacturers who offer IP assurance and robust quality certifications is essential for reliable and compliant sourcing of truck frame rails.

Logistics & Compliance Guide for Truck Frame Rails

Truck frame rails are critical structural components in commercial vehicle manufacturing and repair. Their transportation and handling must adhere to strict logistics protocols and regulatory standards to ensure safety, quality, and regulatory compliance. This guide outlines key considerations for the logistics and compliance aspects of truck frame rails.

Product Classification & Handling Requirements

Truck frame rails are typically classified as heavy steel components, often exceeding several hundred pounds and measuring over 20 feet in length. They must be handled with appropriate lifting equipment (e.g., overhead cranes, forklifts with rail clamps) to prevent deformation or damage. Proper lifting points and secure rigging are essential to avoid worker injury and product damage. Handling should minimize contact with sharp edges or abrasive surfaces to prevent coating or material degradation.

Packaging & Protection Standards

Frame rails must be adequately packaged to prevent corrosion, surface scratches, and mechanical deformation during transit. Common packaging includes:

– Protective coatings (e.g., rust-inhibitive oils or temporary coatings)

– Edge protectors on flanges

– Bundling with steel strapping or wooden skids

– Use of dunnage to prevent movement within loads

– Weather-resistant wrapping or tarping for outdoor storage or open-deck transport

Proper packaging ensures compliance with customer specifications and industry standards such as ASTM A123 (zinc coating) or SAE J2334 (corrosion testing).

Transportation & Load Securing

Due to their length and weight, truck frame rails are typically transported via flatbed trailers, step-deck trailers, or enclosed freight containers. Secure load lashing is critical to comply with the Federal Motor Carrier Safety Administration (FMCSA) Load Securement Rules (49 CFR Part 393, Subpart I). Key requirements include:

– Use of tiedowns (minimum of four for loads over 5 ft and under 10 ft; additional for longer loads)

– Proper load positioning over axles to maintain trailer balance

– Edge protection for tiedown straps to prevent chafing

– Use of blocking and bracing to prevent longitudinal and lateral movement

Carriers must ensure frame rails do not exceed legal length (typically 48–53 ft), height (13.5 ft), and weight limits per axle and gross vehicle weight (GVWR).

Regulatory Compliance

Compliance with national and international regulations is mandatory:

– DOT & FMCSA Regulations: Ensure carriers are registered, vehicles are inspected, and drivers comply with hours-of-service rules.

– Hazardous Materials: While frame rails are non-hazardous, any protective coatings (e.g., oils) may require documentation under OSHA HazCom (29 CFR 1910.1200) if they contain regulated substances.

– Environmental Regulations: Spent oils or coatings from handling must be disposed of in accordance with EPA regulations (e.g., RCRA for hazardous waste).

– Customs & Trade: For cross-border shipments (e.g., USMCA), accurate Harmonized System (HS) codes (e.g., 7308.90 for structural elements of iron or steel) and certificates of origin must be provided.

Quality & Traceability

Frame rails must meet material specifications (e.g., ASTM A572, A710) and be traceable through heat numbers or batch codes. Logistics providers should maintain chain-of-custody documentation, including mill test reports (MTRs), inspection certificates, and delivery records. Non-conforming materials must be quarantined and handled per ISO 9001 or customer-specific quality management systems.

Storage & Inventory Management

Frame rails should be stored on level, well-drained surfaces to prevent warping or water accumulation. Outdoor storage requires elevation on dunnage and covering with waterproof tarps. Indoor storage is preferred to minimize corrosion risk. First-in, first-out (FIFO) inventory practices help maintain material integrity and traceability. Climate-controlled environments may be required in high-humidity regions.

Safety & Training

Personnel involved in handling, loading, and transporting frame rails must be trained in:

– Safe lifting techniques and rigging procedures

– Use of personal protective equipment (PPE)

– Load securement standards

– Emergency response for dropped loads or transport incidents

– Forklift and crane operation (OSHA 29 CFR 1910.178 compliance)

Regular safety audits and equipment inspections are necessary to maintain compliance and prevent accidents.

Documentation & Recordkeeping

Accurate documentation is essential for compliance and traceability:

– Bill of Lading (BOL) with item description, weight, and dimensions

– Packing slips and shipment manifests

– Inspection and test reports

– Certificates of compliance or conformance

– Chain-of-custody logs for traceable materials

Records should be retained per federal requirements (typically 1–5 years) and customer agreements.

Conclusion

Effective logistics and compliance management for truck frame rails ensures structural integrity, regulatory adherence, and on-time delivery. By following industry standards and maintaining rigorous handling, transport, and documentation practices, manufacturers and logistics partners can minimize risk and support high-quality vehicle production.

Conclusion for Sourcing Truck Frame Rails:

Sourcing truck frame rails requires a strategic approach that balances quality, cost, availability, and compliance with industry standards. After thorough evaluation of potential suppliers, material specifications, manufacturing processes, and supply chain reliability, it is essential to partner with vendors who demonstrate consistent quality control, adherence to structural and safety standards (such as SAE or ASTM), and the capacity for scalability and timely delivery.

The selection should prioritize high-strength, durable materials—typically high-tensile steel or advanced composites—capable of withstanding heavy loads and harsh operating conditions. Additionally, considerations such as lead times, logistical capabilities, and post-sale support play a critical role in minimizing downtime and ensuring production continuity.

In conclusion, a successful sourcing strategy for truck frame rails hinges on building strong supplier relationships, conducting regular performance evaluations, and staying informed about advancements in materials and manufacturing technologies. This ensures long-term reliability, cost-efficiency, and competitiveness in the commercial vehicle market.