The global truck engine parts manufacturing industry is experiencing robust growth, driven by rising commercial vehicle production, stringent emission regulations, and increasing demand for fuel-efficient and durable engine components. According to Mordor Intelligence, the truck market size was valued at USD 425.6 billion in 2023 and is projected to grow at a CAGR of over 5.8% from 2024 to 2029, underpinning strong demand for high-performance engine parts. Additionally, Grand View Research reports that the global automotive engine market, which includes key components used in trucks, reached USD 175.3 billion in 2022 and is expected to expand at a CAGR of 7.1% through 2030. This sustained growth is fueled by advancements in engine technology, increasing adoption of electric and hybrid commercial vehicles, and the expansion of logistics and freight transport networks worldwide. As the backbone of heavy-duty transportation, reliable and innovative truck engine parts have become more critical than ever, placing leading manufacturers at the forefront of automotive engineering and supply chain resilience. The following list highlights the top 10 truck engine parts manufacturers shaping this dynamic and evolving industry.

Top 10 Truck Engine Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Truck Engines

Domain Est. 1990

Website: cummins.com

Key Highlights: Cummins truck engines are made to ensure you get the most out of your vehicle. See why we’re the world’s leading independent engine manufacturer….

#2 PAI Industries, Inc.

Domain Est. 1993

Website: pai.com

Key Highlights: PAI Industries manufactures and distributes quality service parts to the heavy-duty truck industry. For over 40 years we’ve been supplying distributors ……

#3 Elgin Industries

Domain Est. 1996

Website: elginind.com

Key Highlights: Based in Elgin, Ill., Elgin Industries has long been one of the transportation industry’s premier manufacturers of engine and chassis components….

#4 ACDelco: OEM & Aftermarket Auto Parts

Domain Est. 1996

Website: gmparts.com

Key Highlights: ACDelco offers the only aftermarket parts backed by GM. ACDelco’s Gold and Silver lines of premium aftermarket parts offer a precise fit for GM vehicles….

#5 Shop GM Genuine Parts & ACDelco Parts for Chevrolet Vehicles

Domain Est. 1994

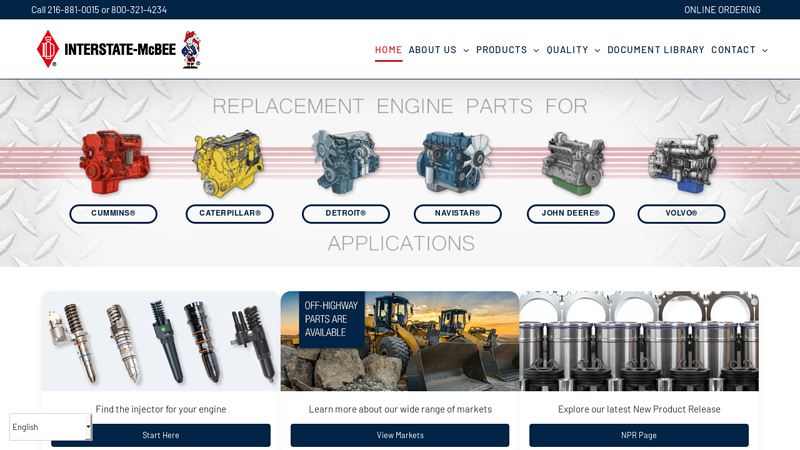

#6 Interstate-McBee Diesel Engine and Fuel Injection Parts

Domain Est. 1996

Website: interstate-mcbee.com

Key Highlights: Interstate-McBee reaches around the globe to provide engine parts, fuel injectors/components and gaskets for the heavy-duty diesel and natural gas industry….

#7 Commercial Trucks, Buses, Engines & Parts

Domain Est. 1998

Website: international.com

Key Highlights: Proud makers of trucks, buses, engines, parts, and history….

#8 Dorman Products

Domain Est. 2001

Website: dormanproducts.com

Key Highlights: Dorman gives auto repair professionals and vehicle owners greater freedom to fix cars and trucks by focusing on solutions first….

#9 Diesel Engine Parts for Semi-Trucks and Heavy Equipment

Domain Est. 2010

Website: highwayandheavyparts.com

Key Highlights: Shop HHP – quality diesel engine parts for heavy-duty trucks, construction, oil and gas, and ag equipment. Great prices, fast shipping, ASE Certified Techs….

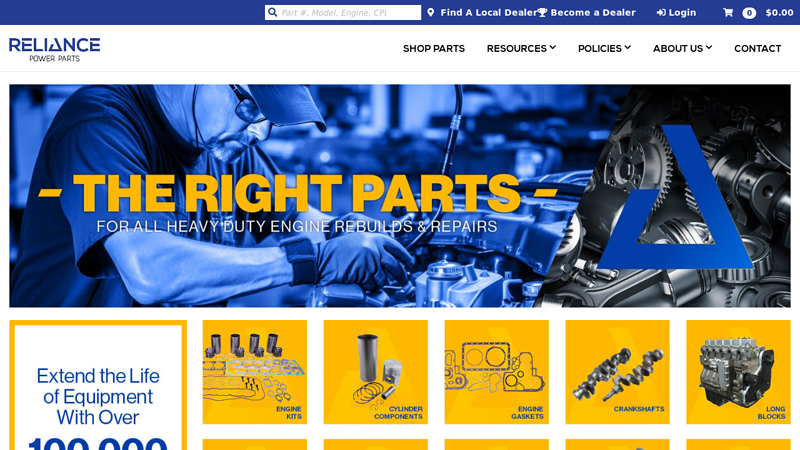

#10 RELIANCE

Domain Est. 2015

Website: reliancepowerparts.com

Key Highlights: The Trusted Source For Aftermarket Wholesale New & Remanufactured Diesel Engine & Heavy Duty Equipment Parts ; 100,000+. Machine Parts in Stock. Shop Now ; 5,000+….

Expert Sourcing Insights for Truck Engine Parts

2026 Market Trends for Truck Engine Parts

The truck engine parts market is poised for significant transformation by 2026, driven by regulatory pressures, technological innovation, and evolving operational demands. Key trends shaping the industry include a strong push toward electrification and alternative fuels, increased integration of digital technologies, stringent emissions regulations, and growing emphasis on sustainability and total cost of ownership.

Electrification and Alternative Powertrains Accelerate Adoption

By 2026, the shift toward electrification will significantly impact the truck engine parts sector. Battery-electric trucks (BETs) and hydrogen fuel cell vehicles (FCEVs) are expected to capture a growing share of the medium- and heavy-duty truck market, particularly in urban delivery and regional haul applications. This transition will reduce demand for traditional internal combustion engine (ICE) components such as pistons, fuel injectors, and turbochargers, while increasing demand for electric motors, power electronics, battery management systems, and thermal management components. Major OEMs and suppliers are investing heavily in electric drivetrain technologies, signaling a long-term structural shift in parts manufacturing and supply chains.

Digitalization and Predictive Maintenance Gain Momentum

Connectivity and data analytics are transforming how fleets manage engine health. By 2026, widespread adoption of telematics, IoT-enabled sensors, and AI-driven diagnostics will enable predictive maintenance, reducing unplanned downtime and extending component lifespan. Engine parts manufacturers are increasingly embedding smart sensors into critical components (e.g., turbochargers, fuel systems) to provide real-time performance data. This shift supports the growth of subscription-based service models and aftermarket digital platforms, where parts are replaced proactively based on usage analytics rather than fixed schedules.

Stricter Emissions Regulations Drive Advanced Aftertreatment Demand

Global emissions standards, including Euro VII in Europe and EPA Phase 3 in the United States, will take full effect by 2026, mandating further reductions in NOx and particulate matter. As a result, demand for advanced aftertreatment systems—such as selective catalytic reduction (SCR), diesel particulate filters (DPF), and exhaust gas recirculation (EGR) components—will remain strong, even as ICE adoption declines. Suppliers will focus on improving the durability, efficiency, and integration of these systems, while also developing low-maintenance solutions to reduce total cost of ownership for fleet operators.

Sustainability and Circular Economy Influence Supply Chains

Environmental, social, and governance (ESG) considerations are reshaping procurement strategies. By 2026, there will be increased demand for remanufactured, recycled, and lightweight engine components to reduce carbon footprints. OEMs and Tier 1 suppliers are adopting circular economy principles, implementing take-back programs and investing in closed-loop manufacturing. Aluminum and composite materials will gain traction in engine part design to reduce weight and improve fuel efficiency, particularly in hybrid and range-extended electric trucks.

Aftermarket Resilience Amid Fleet Electrification

While electrification reduces the number of moving parts and maintenance intervals, the global fleet of diesel and hybrid trucks will remain substantial through 2026, ensuring continued demand for traditional engine parts. The aftermarket segment will benefit from aging fleets in emerging markets and extended service cycles in developed regions. Additionally, hybrid powertrains will create hybrid service needs, requiring technicians trained in both ICE and electric systems, driving demand for specialized tools and training solutions.

In summary, the 2026 truck engine parts market will be defined by technological duality—legacy ICE systems coexisting with emerging electric drivetrains—while digitalization, sustainability, and regulatory compliance shape innovation and competitiveness across the value chain.

Common Pitfalls Sourcing Truck Engine Parts (Quality, IP)

Sourcing truck engine parts involves navigating a complex landscape of quality concerns and intellectual property (IP) risks. Buyers, fleet operators, and repair shops must be vigilant to avoid costly mistakes. Below are some of the most common pitfalls in these two critical areas.

Quality-Related Pitfalls

Inconsistent Part Standards

One of the biggest quality risks is sourcing parts that do not meet original equipment manufacturer (OEM) specifications. Aftermarket or used components may claim compatibility but fail to meet the durability, performance, or safety standards required for heavy-duty truck engines. This can lead to premature failure, costly downtime, and safety hazards.

Counterfeit or Substandard Components

The market is flooded with counterfeit engine parts that mimic OEM branding but are made from inferior materials or manufacturing processes. These parts often fail under high stress and temperature conditions typical in diesel engines, leading to engine damage and increased maintenance costs.

Lack of Certification and Traceability

Many suppliers, especially from unregulated markets, provide parts without proper certification (e.g., ISO, TS 16949) or traceability. Without documentation, it’s difficult to verify material composition, manufacturing origin, or compliance with industry standards—making quality assurance nearly impossible.

Poor Packaging and Handling

Even genuine parts can be compromised during transit if not properly packaged. Exposure to moisture, improper storage, or rough handling can lead to corrosion, contamination, or physical damage, affecting performance once installed.

Intellectual Property (IP) Pitfalls

Unauthorized Reproduction of OEM Designs

Many aftermarket parts replicate OEM designs without licensing, infringing on patents, trademarks, or design rights. Using such parts—even unknowingly—can expose companies to legal liability, especially in regulated industries or cross-border operations.

Trademark and Branding Violations

Some suppliers use logos or part numbers identical to OEMs, misleading buyers into believing they are purchasing genuine components. This not only violates IP laws but also undermines warranties and service agreements tied to authentic parts.

Risk of Legal Action or Seizures

Importing or distributing parts that infringe on intellectual property rights can result in customs seizures, fines, or lawsuits—particularly in regions with strict IP enforcement like the EU or North America. Companies may face reputational damage and operational disruption.

Voided Warranties and Insurance Claims

Using non-OEM or IP-infringing parts may void engine warranties or complicate insurance claims following engine failure. Manufacturers and insurers often require the use of approved, traceable components to honor coverage.

Best Practices to Mitigate Risks

- Source from certified, reputable suppliers with verifiable track records.

- Request documentation for compliance, material specs, and IP licensing.

- Conduct periodic audits or third-party inspections of critical parts.

- Train procurement teams to recognize red flags in branding, packaging, and pricing.

- Consult legal counsel when sourcing complex or high-value components.

By addressing both quality and IP concerns proactively, organizations can ensure reliability, compliance, and long-term cost efficiency in their truck engine maintenance operations.

Logistics & Compliance Guide for Truck Engine Parts

Overview

This guide outlines key logistics and compliance considerations for the transportation, storage, and handling of truck engine parts. Adhering to these standards ensures regulatory compliance, product integrity, and efficient supply chain operations across domestic and international markets.

Classification & Harmonized System (HS) Codes

Accurate classification of truck engine parts is essential for customs clearance and tariff determination. Common HS codes include:

– 8409.91: Parts of internal combustion piston engines (for vehicles)

– 8409.99: Other parts of engines (non-specified)

– 8708.29: Other parts and accessories of motor vehicles (engine-related)

Ensure precise categorization based on part type (e.g., turbochargers, fuel injectors, pistons) to avoid customs delays or penalties.

Packaging & Handling Requirements

- Use moisture-resistant, shock-absorbent packaging to protect sensitive components (e.g., sensors, electronic control units).

- Secure heavy parts (e.g., engine blocks, crankshafts) with wooden crates or pallets and proper strapping.

- Label packages with:

- Part number and description

- Net/gross weight

- Handling instructions (e.g., “Fragile,” “Do Not Invert”)

- Country of origin

Transportation & Freight Modes

- Road Freight: Primary mode for regional distribution; ensure temperature control if transporting sensitive components.

- Air Freight: Used for urgent or high-value parts; comply with IATA regulations for hazardous materials (e.g., oil-lubricated parts).

- Ocean Freight: Cost-effective for bulk shipments; use containers with desiccants to prevent corrosion.

- Utilize temperature and shock monitoring devices for high-precision components.

Import/Export Documentation

Essential documents include:

– Commercial Invoice

– Packing List

– Bill of Lading or Air Waybill

– Certificate of Origin (required for preferential tariff treatment under trade agreements)

– Export Declaration (e.g., AES filing in the U.S.)

– Import License (if required by destination country)

Regulatory Compliance

- EPA & DOT (U.S.): Rebuilt or remanufactured engine parts must comply with emissions standards if affecting engine performance.

- REACH & RoHS (EU): Ensure materials used in engine parts (e.g., plastics, coatings) are compliant with chemical restrictions.

- Customs-Trade Partnership Against Terrorism (C-TPAT): Recommended for U.S.-bound shipments to expedite customs processing.

- Country-Specific Regulations: Verify local requirements (e.g., INMETRO in Brazil, CCC in China).

Product Certification & Standards

- Confirm parts meet original equipment manufacturer (OEM) specifications or industry standards (e.g., SAE, ISO).

- For safety-critical components (e.g., fuel systems), provide test reports or certifications (e.g., ISO 9001, IATF 16949).

Inventory & Warehouse Management

- Store parts in dry, secure facilities with controlled temperature and humidity.

- Separate new, used, and remanufactured parts to prevent mix-ups.

- Implement FIFO (First In, First Out) practices to minimize obsolescence.

- Maintain traceability through barcode or RFID systems.

Returns & Reverse Logistics

- Establish a clear returns authorization (RMA) process.

- Inspect returned parts for damage or contamination before restocking.

- Comply with environmental regulations for disposal or recycling of non-repairable components.

Risk Mitigation & Insurance

- Insure shipments against loss, damage, or theft.

- Verify carrier liability limits and consider additional freight insurance.

- Audit suppliers and logistics partners for compliance with safety and quality standards.

Sustainability & Environmental Compliance

- Recycle packaging materials and reduce waste.

- Properly dispose of oil, coolant, or hazardous residues from used parts per local regulations (e.g., EPA, WEEE).

- Optimize routes and load efficiency to reduce carbon footprint.

Conclusion

Effective logistics and compliance management for truck engine parts minimizes delays, reduces costs, and ensures adherence to global trade regulations. Regular training, documentation accuracy, and supply chain transparency are critical to long-term success.

In conclusion, sourcing truck engine parts requires a careful balance between quality, reliability, cost, and availability. Whether procuring new, remanufactured, or used components, it is essential to partner with reputable suppliers, verify part specifications, and ensure compatibility with the engine make and model. Considerations such as lead time, warranty, and after-sales support further influence the effectiveness of the sourcing strategy. By conducting thorough market research, leveraging trusted supply channels, and maintaining strong vendor relationships, businesses can ensure timely maintenance, reduce downtime, and extend the lifespan of their truck fleets. Ultimately, a well-structured sourcing approach contributes to operational efficiency and long-term cost savings in the heavy-duty transportation industry.