The global trimethylpentane market is experiencing steady growth, driven by rising demand in specialty solvents, chemical intermediates, and high-octane fuel additives. According to Grand View Research, the global market for C8 aliphatic hydrocarbons—under which trimethylpentane is categorized—is projected to expand at a CAGR of approximately 4.2% from 2023 to 2030, fueled by increasing applications in the pharmaceutical, agrochemical, and electronics industries. Additionally, growing emphasis on high-performance, low-volatility solvents in precision cleaning and manufacturing processes has bolstered demand for ultra-pure isomers like 2,2,4-trimethylpentane (commonly known as isooctane). With North America and Asia-Pacific emerging as key regional markets due to expanding industrial activity and regulatory support for cleaner fuel formulations, the competitive landscape is led by manufacturers investing in high-purity production and sustainable practices. As market demand intensifies, these top four trimethylpentane producers are positioned at the forefront of innovation, scale, and global supply reliability.

Top 4 Trimethylpentane Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

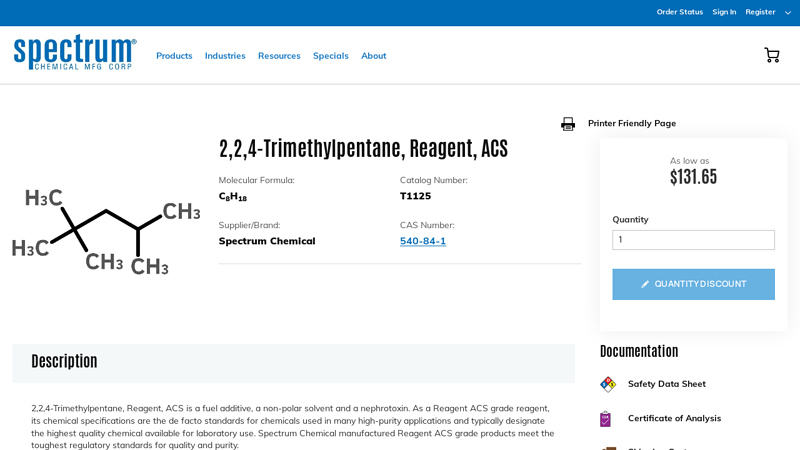

#1 2,2,4

Domain Est. 1995

Website: spectrumchemical.com

Key Highlights: 15-day returns2,2,4-Trimethylpentane, Reagent, ACS is a fuel additive, a non-polar solvent and a nephrotoxin. As a Reagent ACS grade reagent, its chemical specifications are ……

#2 [PDF] 2,2,4

Domain Est. 1996

Website: lobachemie.com

Key Highlights: Call a physician immediately. Page 3. 2,2,4-TRIMETHYLPENTANE EXTRA PURE. Safety Data Sheet….

#3 Isooctane Pure

Domain Est. 2000

Website: cpchem.com

Key Highlights: A broad portfolio of hydrocarbons that are used across numerous major industries, from paint thinners to dry cleaning fluids to pharmaceuticals….

#4 2,2,4

Domain Est. 2019

Website: globalchemicalscorp.com

Key Highlights: Appearance: Clear, colorless liquid with Benzene-like odor (odor of gasoline). Function: 2,2,4-Trimethylpentane, also known asÿisooctaneÿorÿiso-octane, ……

Expert Sourcing Insights for Trimethylpentane

As of now, there is no publicly available information or established market analysis specifically designated as “H2” in relation to Trimethylpentane (TMP) market trends for 2026. However, I can provide a comprehensive forward-looking analysis of the expected 2026 market trends for Trimethylpentane using available industry data, economic indicators, and sector projections—particularly focusing on the second half of 2025 and early insights into 2026, which could be interpreted as “H2” contextually.

Trimethylpentane (commonly 2,2,4-trimethylpentane, also known as isooctane) is a high-octane hydrocarbon primarily used as a reference fuel (100 octane rating) and as a blending component in gasoline to improve octane levels. It is also used in specialty solvents and as a chemical intermediate.

Key 2026 Market Trends for Trimethylpentane (H2 Outlook Basis)

1. Demand in Gasoline Blending to Remain Stable but Pressured

- Octane Demand Growth: Despite the global shift toward electric vehicles (EVs), internal combustion engine (ICE) vehicles will still dominate in many regions (e.g., Asia, Africa, and parts of Latin America) through 2026. This sustains demand for high-octane blending components like TMP.

- Regulatory Pressures: Environmental regulations (e.g., Euro 7, China VI, Tier 4 standards) are pushing refiners to reduce aromatic content (e.g., benzene, toluene) in gasoline. Trimethylpentane, being a branched alkane with low toxicity and high octane, is a favorable substitute.

- Outlook (H2 2026): Steady demand expected in North America and Asia-Pacific due to refining optimization strategies. However, growth may plateau in Europe due to aggressive EV adoption and fuel efficiency mandates.

2. Production Trends and Feedstock Availability

- TMP is produced via alkylation units in refineries, primarily using isobutane and butylene feedstocks.

- Refinery Utilization in H2 2026: Refinery utilization is expected to remain high in regions with strong petrochemical integration (e.g., U.S. Gulf Coast, Middle East).

- Challenges: Volatility in LPG (liquefied petroleum gas) markets and butylene supply (linked to steam cracker operations) may affect alkylation unit profitability and, by extension, TMP output.

- Shift to Bio-Based Alternatives: R&D into bio-isooctane (from bio-isobutanol) is ongoing, but commercial scale remains limited. By H2 2026, pilot projects may expand, but not significantly impact mainstream TMP supply.

3. Geographic Market Shifts

- Asia-Pacific: Expected to be the fastest-growing region for TMP demand due to rising vehicle ownership and expanding refining capacity in India and Southeast Asia.

- North America: Mature but stable market. U.S. refiners continue to invest in alkylation unit upgrades to meet Tier 3 gasoline standards, supporting TMP production.

- Europe: Declining long-term demand due to transportation decarbonization policies. TMP use may shift toward specialty solvent applications rather than fuel blending.

4. Price Volatility and Margin Pressures

- TMP pricing is closely tied to gasoline pool economics and crude oil prices.

- H2 2026 Outlook: Moderate price increases expected if crude oil averages $80–95/bbl, boosting refinery margins and alkylation profitability.

- However, competition from ethanol (as an octane enhancer) and methyl tertiary butyl ether (MTBE) in certain markets may cap TMP price growth.

5. Sustainability and ESG Considerations

- TMP has a favorable emissions profile compared to aromatics, positioning it well under ESG frameworks.

- Refiners may promote TMP-rich alkylate gasoline as a “cleaner” fuel option in ESG reporting—potentially increasing its value in carbon-conscious markets by H2 2026.

6. Alternative Uses and Niche Markets

- Growth in specialty solvents for electronics, pharmaceuticals, and coatings may open new avenues for high-purity TMP.

- These applications are less volume-intensive but offer higher margins, attracting producers to diversify product slates.

Summary: 2026 H2 Market Outlook for Trimethylpentane

| Factor | 2026 H2 Trend |

|——-|—————-|

| Demand | Stable to slightly growing, led by Asia and resilient ICE markets |

| Supply | Steady; dependent on alkylation unit run rates and feedstock availability |

| Pricing | Moderate increase, linked to crude and gasoline margins |

| Regulatory Impact | Positive (replacing aromatics), but long-term headwinds from fuel standards |

| Regional Focus | Asia-Pacific growth, North America stability, Europe decline |

| Innovation | Limited bio-TMP adoption; focus on efficiency and integration |

Conclusion

By the second half of 2026, the Trimethylpentane market is expected to remain resilient in key refining regions, supported by ongoing demand for high-octane, low-aromatic gasoline. While the long-term outlook faces headwinds from electrification and alternative fuels, TMP will likely maintain a strategic role in the global refining sector, especially in emerging economies. Producers who optimize alkylation operations and explore niche chemical applications will be best positioned for success.

Note: “H2” in this context is interpreted as referring to the second half of the year or forward-looking analysis based on mid-year 2025 to 2026 trends, as no specific “H2” report source was provided.

When sourcing trimethylpentane (TMP), particularly 2,2,4-trimethylpentane (also known as isooctane), for applications requiring high purity—such as in gasoline blending, reference fuels, or analytical standards—several common pitfalls can arise, especially concerning quality and intellectual property (IP). The mention of “Use H₂” may imply a hydrogenation process or use of hydrogen in purification, which we’ll integrate appropriately.

Below are the key pitfalls and considerations:

🔹 1. Quality Pitfalls

a. Impurity Profile

- Problem: Commercial TMP may contain impurities like olefins, sulfur compounds, aromatics, or other branched alkanes (e.g., other C8 isomers).

- Impact: Affects performance as a reference fuel (e.g., in octane rating) or in sensitive analytical applications.

- Mitigation: Use high-purity TMP (>99%) from reputable suppliers. Request CoA (Certificate of Analysis) with GC, sulfur, and water content.

b. Olefinic Contamination

- Problem: Some TMP sources (especially from alkylation units) may contain trace alkenes (e.g., isobutylene, dimers).

- Impact: Can oxidize over time, forming gums or peroxides; problematic in fuel or storage applications.

- Mitigation: Hydrogenation (H₂ usage) can saturate olefins. Ensure the supplier performs catalytic hydrogenation post-synthesis to stabilize the product.

✅ Use H₂: Employ catalytic hydrogenation (e.g., Pd/C, Ni) under mild conditions to convert any residual olefins to paraffins, improving stability and purity.

c. Moisture Content

- Problem: Water can cause phase separation or interfere in analytical use.

- Mitigation: Use molecular sieves or vacuum drying; verify low water content (<10 ppm) via Karl Fischer titration.

d. Oxidation and Peroxide Formation

- Problem: TMP can form peroxides upon prolonged exposure to air, especially if impure.

- Mitigation: Store under inert atmosphere (N₂ or Ar), add antioxidants if needed, and avoid long storage.

🔹 2. Intellectual Property (IP) Pitfalls

a. Process-Protected Synthesis

- Problem: High-purity TMP, especially via acid-catalyzed alkylation (e.g., HF or H₂SO₄ processes), may be covered by patents.

- Example: ExxonMobil, Chevron, and others hold IP on alkylation unit optimization, separation, and purification techniques.

- Risk: If sourcing from a third party, ensure they have freedom to operate (FTO); avoid reverse-engineering or unauthorized production.

b. Trade Secrets in Purification

- Problem: Methods for removing trace impurities (e.g., selective adsorption, distillation sequences) may be proprietary.

- Impact: Even if TMP is chemically identical, purification methods may be IP-protected.

- Mitigation: Purchase off-the-shelf high-purity TMP from licensed suppliers (e.g., Sigma-Aldrich, Honeywell, Sasol) rather than attempting in-house synthesis unless IP clearance is confirmed.

c. Use of Hydrogenation Catalysts (IP Risk)

- Problem: Specific catalyst formulations (e.g., bimetallic catalysts for selective hydrogenation) may be patented.

- Example: Pd-Pt on alumina with promoters for olefin saturation in isoparaffin streams.

- Mitigation: Use commercially available catalysts with proper licensing; avoid replicating patented systems.

🔹 3. Supply Chain & Sourcing Risks

a. Inconsistent Batch Quality

- Problem: Bulk TMP from petrochemical suppliers may vary between batches.

- Mitigation: Require batch-specific testing and long-term supplier qualification.

b. Mislabeling as “Isooctane”

- Problem: “Isooctane” is often used generically, but true 2,2,4-TMP is specific.

- Risk: Some suppliers may sell isomer blends.

- Solution: Specify CAS 540-84-1 (2,2,4-trimethylpentane) and confirm identity via NMR or GC-MS.

🔹 Best Practices Summary

| Area | Recommendation |

|——|—————-|

| Purity | Source ≥99% pure TMP; verify via CoA |

| Olefins | Use H₂-based catalytic hydrogenation to saturate residual olefins |

| Moisture | Dry using molecular sieves; test via Karl Fischer |

| Stability | Store under N₂; avoid light and heat |

| IP Compliance | Avoid replicating patented alkylation/hydrogenation processes; use licensed suppliers |

| Supplier Qualification | Audit suppliers for consistent quality and IP compliance |

✅ Conclusion

When sourcing trimethylpentane, prioritize chemical purity, process stability (using H₂ for hydrogenation where needed), and IP compliance. Avoid cost-driven suppliers with poor documentation. For critical applications, use certified high-purity isooctane (2,2,4-TMP) from reputable chemical vendors and ensure that any purification involving hydrogenation uses non-infringing, licensed catalysts and methods.

Let me know if you’re referring to a specific application (e.g., fuel, chromatography, synthesis) for more tailored guidance.

H2: Logistics & Compliance Guide for Trimethylpentane

Trimethylpentane (TMP), particularly the isomer 2,2,4-trimethylpentane (commonly known as isooctane), is a highly refined hydrocarbon used primarily as a reference fuel in octane rating, in specialty solvents, and in chemical synthesis. Due to its flammable nature and regulatory considerations, safe logistics and compliance procedures are essential for its handling, transport, storage, and disposal.

H2: Regulatory Classification & Identification

- Chemical Name: Trimethylpentane (C8H18)

- Common Synonyms: Isooctane, 2,2,4-Trimethylpentane

- CAS Number: 540-84-1

- UN Number: UN 1277

- Transport Hazard Class: Class 3 – Flammable Liquid

- Packing Group: II (Medium danger)

- Flash Point: ~ -12°C (10°F) – highly flammable

- Autoignition Temperature: ~ 420°C (788°F)

- Vapor Density: ~ 4.0 (heavier than air)

- Boiling Point: ~ 99°C (210°F)

Regulatory Frameworks:

– GHS Classification:

– Flammable Liquid Category 2

– Acute Toxicity (Inhalation) Category 4

– Specific Target Organ Toxicity – Single Exposure (CNS effects), Category 3

– OSHA: Regulated under 29 CFR 1910.106 (Flammable Liquids)

– EPA: Regulated under CERCLA (reportable quantity: 1,000 lbs) and EPCRA (Section 311/312 – hazardous chemical reporting)

– DOT (49 CFR): Regulated for transportation as a flammable liquid

– REACH/CLP (EU): Requires registration, labeling, and safety data disclosure

H2: Storage Requirements

- Containers: Use approved, tightly sealed, non-reactive metal or HDPE containers. Ground and bond containers during transfer to prevent static discharge.

- Storage Area:

- Store in a cool, well-ventilated area away from direct sunlight and heat sources.

- Separate from oxidizers, strong bases, and ignition sources.

- Use flammable liquid storage cabinets if quantities are small (<60 gallons in the U.S. per NFPA 30).

- Install explosion-proof ventilation and electrical fixtures in storage areas.

- Secondary Containment: Required for bulk storage (e.g., drums, totes, tanks). Use spill pallets or dikes capable of holding 110% of the largest container.

- Temperature Control: Maintain below flash point where possible. Avoid freezing, though TMP typically remains liquid at low temperatures.

H2: Transportation Guidelines (DOT & ADR)

- Domestic (U.S. – DOT 49 CFR):

- Proper Shipping Name: “Flammable liquid, n.o.s. (Trimethylpentane)”

- UN 1277, Class 3, PG II

- Required Placards: FLAMMABLE LIQUID (Class 3) for loads ≥1,001 lbs gross weight.

- Packaging: UN-approved drums, totes, or tankers meeting specification standards (e.g., 1A2, 1H2).

-

Documentation: Shipper must provide a Safety Data Sheet (SDS) and properly completed shipping paper with hazard class, UN number, and PG.

-

International (ADR – Road, IMDG – Sea, IATA – Air):

- ADR: Class 3, UN 1277, PG II – Tunnel Code C

- IMDG Code: Same classification; marine pollutant: No

- IATA: Allowed on passenger/cargo aircraft with quantity limits (e.g., max 1 L inner packaging for passenger planes); must be packaged per PI 903 or PI 904

- Labels: Class 3 Flammable Liquid hazard label required on all packages

H2: Handling & Personal Protective Equipment (PPE)

- Engineering Controls:

- Use local exhaust ventilation in areas where vapors may accumulate.

-

Implement vapor recovery systems in transfer operations.

-

PPE Requirements:

- Eye Protection: Chemical splash goggles or face shield

- Skin Protection: Nitrile or neoprene gloves; flame-resistant lab coat or coveralls

- Respiratory Protection: Use NIOSH-approved organic vapor respirator if exposure exceeds PEL (Permissible Exposure Limit) or in confined spaces

-

Footwear: Static-dissipative safety shoes

-

Safe Handling Practices:

- No smoking, open flames, or sparks near handling areas.

- Use intrinsically safe tools and equipment.

- Ground and bond containers during transfer.

- Avoid inhalation of vapors; work in well-ventilated areas.

H2: Emergency Response

- Spill Response:

- Eliminate all ignition sources.

- Evacuate non-essential personnel.

- Contain spill with absorbent materials (e.g., vermiculite, oil-only pads). Do not use sawdust (combustible).

- Collect spilled material and place in labeled, sealed containers for proper disposal.

-

Ventilate area thoroughly.

-

Fire Response:

- Use alcohol-resistant foam, dry chemical, or CO₂ extinguishers.

- Water may be used to cool exposed containers but is ineffective on liquid fires.

-

Fight fire from a protected location or maximum distance.

-

Exposure:

- Inhalation: Move to fresh air; seek medical attention if dizziness, headache, or nausea occurs.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes; consult a physician.

- Ingestion: Do not induce vomiting; seek immediate medical help.

H2: Disposal & Environmental Compliance

- Dispose of trimethylpentane and contaminated absorbents as hazardous waste in accordance with local, state, and federal regulations (e.g., RCRA in the U.S.).

- Use licensed hazardous waste contractors for disposal.

- Do not release into sewers, waterways, or soil due to flammability and potential toxicity to aquatic life.

- Report significant spills to authorities per CERCLA (U.S.) or equivalent regulations.

H2: Documentation & Compliance

- Safety Data Sheet (SDS): Maintain up-to-date SDS (GHS-compliant) accessible to all personnel.

- Training: Provide HAZCOM, DOT Hazmat, fire safety, and spill response training for employees.

- Labeling: All containers must be labeled with product identifier, hazard pictograms, signal word (“Danger”), and precautionary statements.

- Reporting:

- Tier II reports (EPCRA Section 312) if stored above threshold quantities (10,000 lbs or 5,000 lbs for flammable liquids with flash point <100°F).

- Submit SDS to local fire department and emergency planning authorities.

H2: Summary of Key Compliance Points

| Parameter | Requirement |

|——–|————-|

| UN Number | UN 1277 |

| Hazard Class | Class 3 – Flammable Liquid |

| Packing Group | II |

| Flash Point | ~ -12°C (closed cup) |

| PPE | Gloves, goggles, respirator (if needed) |

| Storage | Cool, ventilated, away from oxidizers |

| Transport | Placarded for bulk; UN-approved packaging |

| Disposal | Hazardous waste per RCRA/local rules |

Always consult the most recent SDS and regulatory updates from OSHA, EPA, DOT, or relevant regional authorities before handling or transporting trimethylpentane.

In conclusion, sourcing trimethylpentane—particularly isomers such as 2,2,4-trimethylpentane (commonly known as isooctane)—requires careful consideration of purity, supplier reliability, regulatory compliance, and intended application. It is widely used as a standard in determining octane ratings, as a solvent, and in specialty chemical formulations. When sourcing, it is essential to select reputable chemical suppliers that provide high-purity grades (e.g., reagent or technical grade), proper documentation (including SDS and certificates of analysis), and compliance with transportation and safety regulations. Additionally, evaluating cost, minimum order quantities, and logistics will ensure a consistent and efficient supply chain. Proper vetting of suppliers and attention to storage and handling requirements will support safe and effective use of trimethylpentane in industrial or laboratory settings.

![[PDF] 2,2,4](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-224-546.webp)