The global tricone drill bit market is experiencing steady expansion, driven by rising demand in oil & gas exploration, mining, and geothermal drilling operations. According to Mordor Intelligence, the drill bit market is projected to grow at a CAGR of over 4.2% from 2023 to 2028, with increasing investments in energy infrastructure and deep-well drilling projects fueling demand for high-performance tricone bits. Similarly, Grand View Research valued the global drill bit market at USD 3.7 billion in 2022 and forecasts continued growth due to technological advancements and enhanced drilling efficiency requirements. In this evolving landscape, manufacturers are focusing on innovative materials, bearing designs, and hydraulic optimization to improve durability and penetration rates. As the industry scales, a select group of leading tricone drill bit producers have distinguished themselves through product reliability, global distribution, and R&D investment—shaping the competitive dynamics of today’s market.

Top 8 Tricone Drill Bit Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

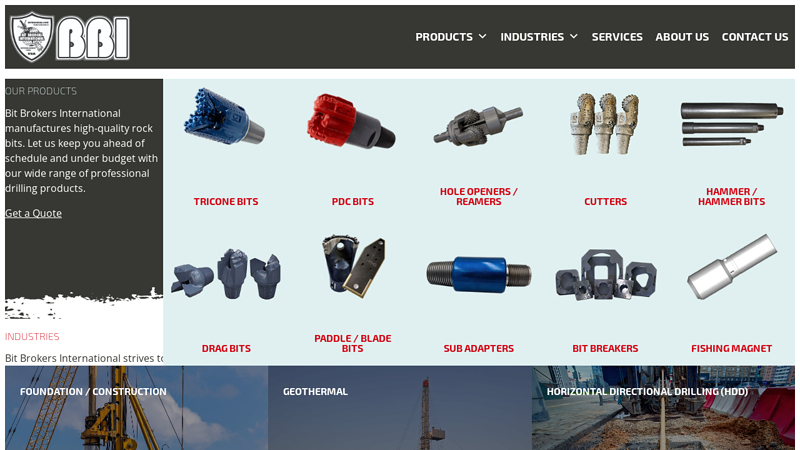

#1 Bit Brokers International

Domain Est. 1996

Website: bitbrokers.com

Key Highlights: Tricone bits from Bit Brokers International are designed for superior performance in drilling operations. With three rotating cones, each featuring precision- ……

#2 Custom TCI Tricone Drill Bit Manufacturer in China

Domain Est. 2004

Website: sinodrills.com

Key Highlights: We offer high-performance TCI (Tungsten Carbide Insert) Tricone Drill Bits, designed for superior efficiency and durability across diverse drilling ……

#3 Tricone Bit Manufacturer in China

Domain Est. 2023

Website: idrillio.com

Key Highlights: Idrillio is a professional manufacturer of tricone bits using different grades of materials such as alloy teeth, metal or rubber seals, etc….

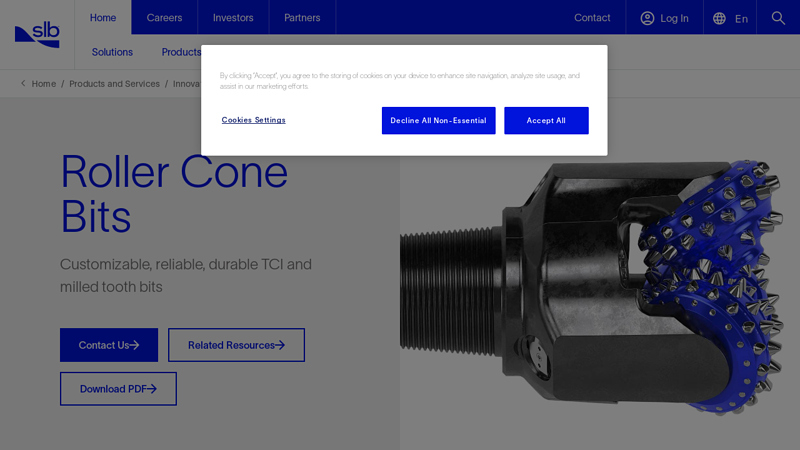

#4 Roller Cone Bits

Domain Est. 1987

Website: slb.com

Key Highlights: Superior drilling performance. The Smith Bits family of bits includes an extensive range of roller cone drill bits that provide superior drilling performance….

#5 Tricone Bits

Domain Est. 1996

Website: inrock.com

Key Highlights: Inrock offers a complete assortment of drill bits for drilling in soft soils to ultra hard rock using either mud motors or steerable jets….

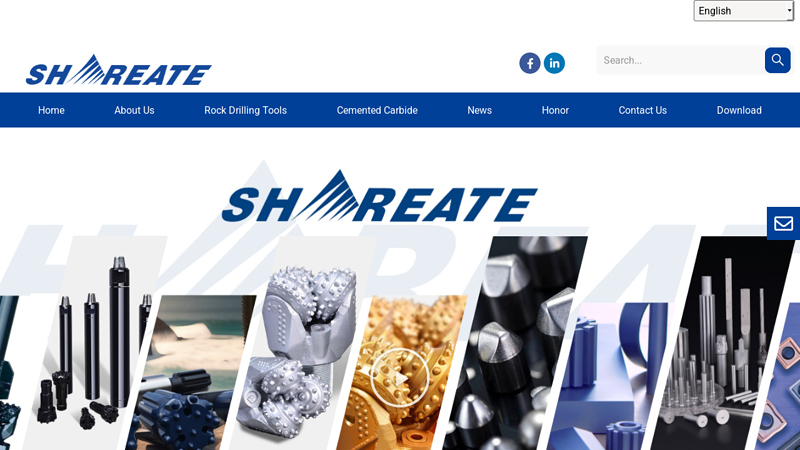

#6 SHAREATE:

Domain Est. 2004

Website: shareate.com

Key Highlights: Discover top-quality cemented carbide products and precision rock drilling tools at SHAREATE. Elevate your projects with our professional solutions and ……

#7 Rotary Drill Bits

Domain Est. 2017

Website: epiroc.com

Key Highlights: We have a comprehensive selection of rotary bits, such as tricone bits, PDC bits and klaw bits. All you need is right here, at Epiroc. Read more here!…

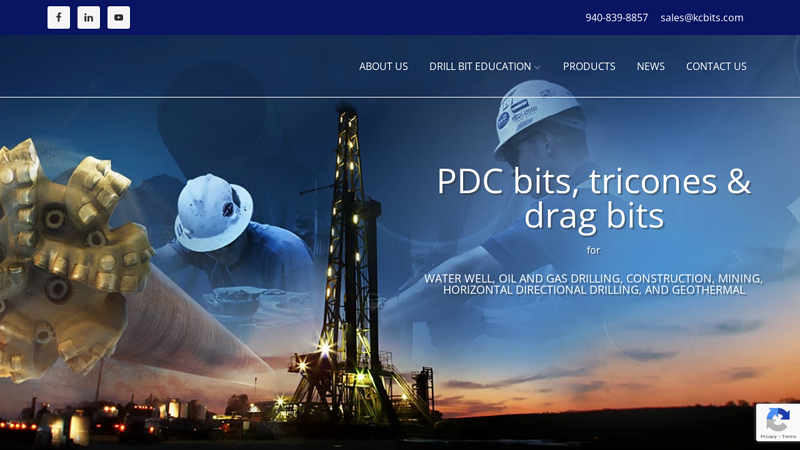

#8 KC Bit

Domain Est. 2017

Website: kcbits.com

Key Highlights: PDC bits, tricones & drag bits for Water well, oil and gas drilling, construction, mining, horizontal directional drilling, and geothermal….

Expert Sourcing Insights for Tricone Drill Bit

H2: 2026 Market Trends for Tricone Drill Bits – Navigating Evolution in a Transitioning Landscape

The tricone drill bit market in 2026 is poised at a critical juncture, characterized by enduring demand in specific sectors juxtaposed against significant headwinds from technological disruption and shifting energy dynamics. While not experiencing explosive growth, the market will demonstrate resilience and adaptation, driven by strategic factors.

1. Sustained Demand in Conventional & Challenging Formations:

* Core Strength: Tricone bits will remain the dominant choice in hard, abrasive, and highly interbedded formations (common in many onshore oil & gas plays, geothermal drilling, and deepwater applications) where their superior ability to handle variable rock strengths and deliver consistent Rate of Penetration (ROP) is unmatched.

* Geothermal Boom Driver: The significant push for geothermal energy development, particularly in regions like North America, Europe, and East Africa, will be a major growth catalyst. Geothermal wells often target fractured, hard crystalline basement rocks where tricone bits excel, creating a substantial new demand stream.

* Mining & Infrastructure: Steady demand will persist in mining exploration, water well drilling, and civil infrastructure projects (e.g., deep foundation piling) where cost-effectiveness, reliability, and availability for various hole sizes are paramount.

2. Intensifying Competition from PDC Bits:

* PDC Prowess: Polycrystalline Diamond Compact (PDC) bits continue to erode tricone market share, especially in medium-hard, homogenous formations (common in shale plays and many conventional reservoirs). Advances in PDC cutter technology, bit design (e.g., hybrid bits), and drilling dynamics modeling allow PDCs to achieve higher ROP and longer runs, reducing overall drilling costs.

* Hybrid Solutions: The line is blurring. Hybrid tricone-PDC bits combining tricone stability with PDC cutting efficiency in specific zones will gain traction, offering optimized performance and potentially extending tricone relevance.

3. Technological Refinement, Not Revolution:

* Focus on Durability & Efficiency: Innovation will center on advanced bearing systems (sealed, lubricated, enhanced materials), improved gauge protection (hardfacing, inserts, wear pads), optimized nozzle placement for better hydraulics and cuttings removal, and superior tungsten carbide insert (TCI) formulations for enhanced wear resistance.

* Smart Bits & Data Integration: While less prevalent than in PDC, integration of basic downhole sensors (temperature, vibration, wear indicators) into tricone assemblies will increase, providing real-time data for performance optimization and predictive maintenance, improving operational efficiency and reducing non-productive time (NPT).

4. Supply Chain & Cost Pressures:

* Raw Material Volatility: Fluctuations in the prices of tungsten, cobalt, and steel will continue to impact manufacturing costs. Suppliers will focus on supply chain resilience and material science to mitigate these pressures.

* Regional Manufacturing Shifts: Continued growth of manufacturing capabilities in Asia (especially China and India) will maintain competitive pricing pressure, while North American and European manufacturers will emphasize premium, high-performance, and specialized bits for demanding applications.

5. Energy Transition Impact:

* Fossil Fuel Volatility: Investment uncertainty in new conventional oil & gas exploration (outside specific regions like the Middle East, Guyana, or parts of Africa) may dampen overall drilling activity, impacting tricone demand. However, maintenance, workover, and infill drilling in existing fields will provide stable, albeit potentially reduced, demand.

* Focus on Efficiency: Across all sectors, the drive for lower drilling costs and improved efficiency will be paramount. This favors bits (including optimized tricones) that deliver predictable performance and minimize NPT, even if the initial cost is higher.

6. Regional Variations:

* Asia-Pacific: Expected to be the fastest-growing region, driven by infrastructure development, mining, geothermal projects, and ongoing onshore drilling in countries like China, India, and Indonesia.

* North America: Mature market with demand heavily influenced by shale activity (favoring PDC) and geothermal growth (favoring tricone). Focus on premium products and efficiency.

* Middle East & Africa: Significant upstream investment in conventional and deepwater projects will sustain strong demand for high-performance tricone bits.

* Europe & Latin America: Driven by geothermal potential (Europe) and ongoing energy projects (Latin America), with moderate growth expected.

Conclusion for 2026:

The tricone drill bit market in 2026 will be defined by steady, niche-driven demand rather than broad expansion. Its core strength in challenging formations and its pivotal role in the burgeoning geothermal sector will ensure its continued relevance. However, the market will operate under constant pressure from the superior performance of PDC bits in many applications. Success for manufacturers will hinge on continuous technological refinement (durability, efficiency, data integration), strategic focus on high-value segments (geothermal, deepwater, hard rock mining), and adaptation to energy transition dynamics and cost pressures. Tricone bits won’t dominate the future of drilling, but they will remain an indispensable, specialized tool within the drilling toolbox.

Common Pitfalls Sourcing Tricone Drill Bits (Quality, IP)

-

Compromised Quality Due to Substandard Materials

One of the most frequent issues when sourcing tricone drill bits is receiving products made from inferior materials. Low-quality bearings, poor-grade tungsten carbide inserts, or subpar steel reduce bit life and performance. This often occurs when suppliers cut costs to offer lower prices, leading to premature failure in the field. -

Inaccurate or Missing IP (Identification and Protection) Markings

Reputable tricone bits include manufacturer IP markings—such as logos, model numbers, and API certification stamps—to verify authenticity and compliance. Sourcing from unauthorized or unverified suppliers increases the risk of counterfeit products that lack proper IP, making it difficult to trace origin or ensure compliance with industry standards. -

Lack of API or Industry Certification

Many low-cost suppliers provide bits that do not meet API 6A or ISO standards. Without proper certification, there’s no assurance of design integrity, material performance, or reliability under high-pressure/high-temperature conditions—leading to operational risks and safety concerns. -

Inconsistent Manufacturing Tolerances

Poor quality control results in inconsistent cutting structures, misaligned cones, or improper seal fitments. These variances impact drilling efficiency, increase vibration, and can cause catastrophic downhole failures. -

Insufficient Technical Documentation and Support

Reputable suppliers provide detailed technical data sheets, application guidelines, and post-sale support. Sourcing from vendors without these resources leaves operators without critical performance information, increasing the risk of improper use and reduced bit effectiveness. -

Intellectual Property (IP) Infringement Risks

Some suppliers produce “copy” or “clone” bits that mimic patented designs from leading manufacturers. Using such bits may expose the buyer to legal liability due to IP infringement, especially in regulated markets where compliance is strictly enforced. -

Inadequate After-Sales Support and Warranty

Cheap or counterfeit bits often come with limited or no warranty. When failures occur, lack of support delays operations and increases total cost of ownership despite the lower initial purchase price. -

Supply Chain Transparency Issues

Without a traceable supply chain, buyers cannot verify manufacturing origins or quality assurance processes. This opacity increases exposure to counterfeit goods, inconsistent quality, and potential safety hazards.

To mitigate these risks, always source tricone drill bits from authorized distributors or certified manufacturers, verify IP markings and certifications, and insist on full technical and warranty documentation.

Logistics & Compliance Guide for Tricone Drill Bits

Overview and Product Classification

Tricone drill bits are specialized rotary drilling tools used primarily in oil and gas, mining, and geothermal drilling operations. They consist of three conical cutters (rollers) equipped with teeth or tungsten carbide inserts (TCIs) that crush and scrape rock formations. Due to their industrial nature and materials composition, proper classification under international trade codes is essential. They are typically classified under Harmonized System (HS) Code 8207.19, which covers interchangeable tools for hand tools, whether or not power-operated, or for machine tools, for working in the hand, of base metal—tools for drilling (including for rock drilling). Accurate classification ensures correct tariff application and compliance with export regulations.

Export Controls and Regulatory Compliance

Tricone drill bits may be subject to export control regulations depending on their design, materials, and intended end use. In the United States, items with potential dual-use applications (civilian and military) are regulated under the Export Administration Regulations (EAR) administered by the Bureau of Industry and Security (BIS). Most standard tricone bits fall under ECCN (Export Control Classification Number) 9A991, which includes “other” aerospace and drilling equipment not specifically listed. However, bits designed for ultra-deep, high-pressure, or directional drilling may require more stringent review. Exporters must determine the appropriate ECCN and obtain necessary licenses if required, particularly for destinations under sanctions (e.g., Iran, North Korea, Crimea).

International Shipping and Packaging Requirements

Tricone drill bits are heavy, robust tools that require secure packaging to prevent damage during transit. They must be crated in wooden or steel-reinforced containers with internal bracing and moisture-resistant wrapping to protect against corrosion. Proper labeling including handling instructions (e.g., “This Side Up,” “Fragile”), part numbers, weight, and country of origin is mandatory. For international shipments, compliance with International Safe Transit Association (ISTA) standards is recommended. Additionally, shippers must adhere to IATA (air), IMDG (sea), and ADR (road) regulations as applicable, although tricone bits typically do not contain hazardous materials unless coated with specialized lubricants or preservatives.

Documentation for Customs Clearance

Complete and accurate documentation is crucial for smooth customs clearance. Required documents typically include:

– Commercial Invoice (detailing value, currency, and transaction terms)

– Packing List (itemizing contents, weights, and dimensions per package)

– Bill of Lading or Air Waybill

– Certificate of Origin (to claim preferential tariffs under trade agreements)

– Export License (if applicable based on destination and ECCN)

– Technical Specifications or Product Datasheet (to support classification and compliance)

Ensure all documents are consistent and match the declared HS code and product description to avoid delays or penalties.

Import Regulations by Key Markets

Different countries impose specific import requirements for drilling equipment. For example:

– Canada: Requires compliance with the Canadian Customs Tariff and may assess duties based on NAFTA/USMCA rules of origin.

– European Union: Subject to CE marking if integrated into machinery, though drill bits themselves are typically exempt. Importers must provide an Import Control System (ICS) declaration.

– Saudi Arabia: Requires SASO (Saudi Standards, Metrology and Quality Organization) certification and conformity assessment for industrial products.

– Australia: Subject to import permit requirements under the Department of Industry for strategic goods, with potential scrutiny under the Defence and Strategic Goods List (DSGL).

Always verify destination-specific regulations prior to shipment.

Environmental and Material Compliance

Tricone drill bits often contain tungsten carbide and steel alloys, which may be subject to environmental regulations. Compliance with the EU’s RoHS (Restriction of Hazardous Substances) is generally not required for industrial tools used in oil and gas, but REACH (Registration, Evaluation, Authorization and Restriction of Chemicals) may apply if substances of very high concern (SVHCs) are present above threshold levels. Additionally, disposal of worn bits must follow local environmental guidelines, particularly regarding metal recycling and hazardous residue (e.g., drilling mud contamination). Producers and importers should maintain material declarations (e.g., IMDS or SCIP database submissions) where required.

Recordkeeping and Audit Preparedness

Maintain detailed records of all export transactions for a minimum of five years (as required by U.S. EAR and many international jurisdictions). Records should include classification decisions, license applications, correspondence with authorities, shipping documents, and end-use statements. Regular internal audits help ensure ongoing compliance with trade regulations and mitigate the risk of penalties. Training for logistics and compliance personnel on updates to export control lists and international trade policies is strongly recommended.

Conclusion

Successful logistics and compliance for tricone drill bits require careful attention to classification, export controls, packaging, documentation, and destination-specific regulations. By establishing robust compliance procedures and staying informed about regulatory changes, companies can ensure timely delivery, avoid legal risks, and maintain a strong reputation in global markets.

Conclusion for Sourcing Tricone Drill Bits

Sourcing tricone drill bits is a critical component in ensuring the efficiency, reliability, and cost-effectiveness of drilling operations, particularly in oil and gas, mining, and geothermal applications. A successful sourcing strategy requires a comprehensive evaluation of bit design, material quality, application compatibility, and supplier reliability. By prioritizing reputable manufacturers with proven track records, advanced engineering capabilities, and responsive technical support, operators can minimize downtime and maximize bit performance across various formations.

Additionally, considering factors such as bearing type, gauge protection, nozzle configuration, and customized design options helps tailor the selection to specific drilling conditions. Total cost of ownership—not just initial purchase price—should guide decision-making, factoring in durability, rate of penetration (ROP), and maintenance requirements.

In conclusion, effective sourcing of tricone drill bits involves a balanced approach that integrates technical specifications, operational needs, and supply chain efficiency. Investing time in due diligence, building strong supplier relationships, and staying informed about technological advancements will ultimately contribute to improved drilling performance and project profitability.