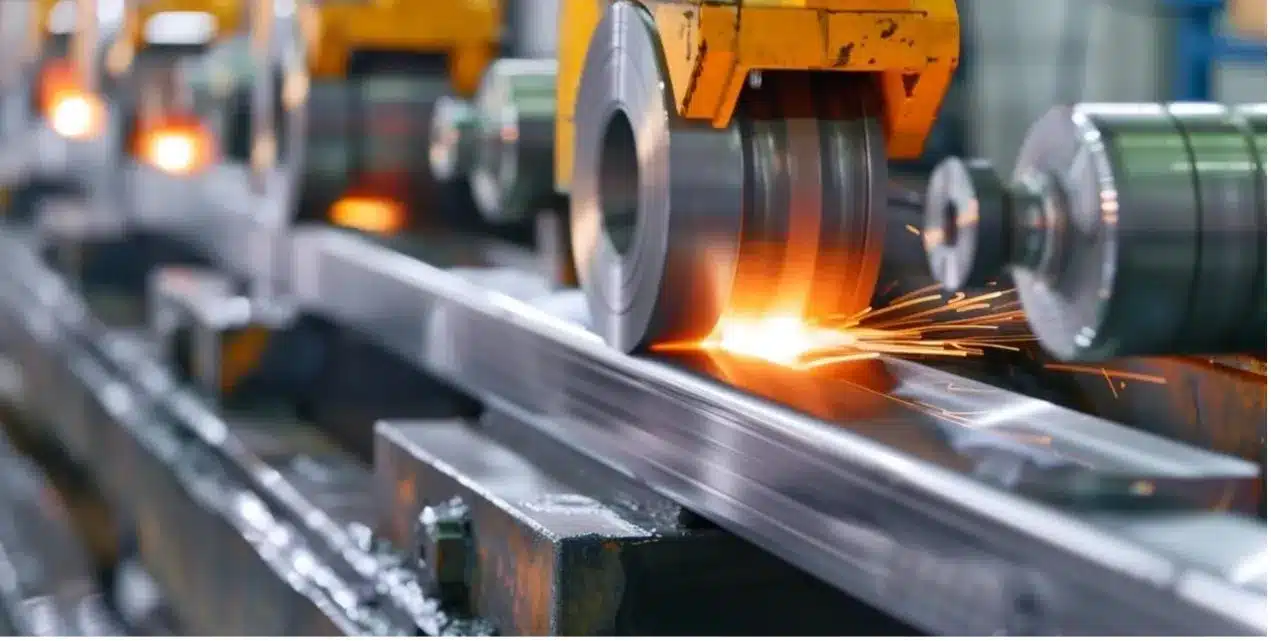

The global transmission manufacturing market is experiencing robust growth, driven by rising automotive production, increasing demand for fuel-efficient vehicles, and the rapid expansion of electric and hybrid powertrains. According to Mordor Intelligence, the global automotive transmission market was valued at USD 137.8 billion in 2023 and is projected to grow at a CAGR of over 6.2% from 2024 to 2029. This growth is further fueled by technological advancements such as dual-clutch transmissions (DCT) and automated manual transmissions (AMT), along with stricter emissions regulations pushing automakers toward more efficient drivetrain solutions. As original equipment manufacturers (OEMs) intensify partnerships with transmission suppliers to meet evolving vehicle dynamics, a select group of industry leaders are shaping the future of mobility. Based on market share, innovation, global footprint, and production volume, the following are the top 10 transmission manufacturers leading this transformation.

Top 10 Transmission Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dodge® Mechanical Power Transmission Products

Domain Est. 2021

Website: dodgeindustrial.com

Key Highlights: Dodge Industrial, Inc. is a leading manufacturer of mounted bearings, enclosed gearing, and power transmission products and solutions….

#2 Homepage ZF Friedrichshafen AG

Domain Est. 1996

Website: zf.com

Key Highlights: ZF is a global technology company supplying advanced mobility products and systems for passenger cars, commercial vehicles and industrial technology….

#3 Twin Disc

Domain Est. 1996

Website: twindisc.com

Key Highlights: Discover Twin Disc, a leader in power transmission technology. We provide solutions for marine, industrial, and off-highway applications….

#4 Xtrac

Domain Est. 1997

Website: xtrac.com

Key Highlights: Xtrac is the world’s leading supplier of high performance transmissions for top level professional motorsport, high performance automotive….

#5 Heavy duty and semi truck transmissions

Domain Est. 1996

Website: eaton.com

Key Highlights: Eaton is a global leader in commercial vehicle transmissions with a portfolio of manual and automated manual transmissions to meet your needs. Learn more….

#6 JASPER® Engines & Transmissions

Domain Est. 1996

Website: jasperengines.com

Key Highlights: JASPER’s remanufactured automatic and standard transmissions are designed for your peace of mind. You don’t have to worry about your bill growing….

#7 Allison Transmission

Domain Est. 1998

Website: allisontransmission.com

Key Highlights: Allison Transmission is a global leader in automatic transmissions, with locations worldwide providing hybrid propulsion solutions for commercial vehicles ……

#8 Performance Transmissions, Torque Converters & Components …

Domain Est. 1999

Website: tciauto.com

Key Highlights: Leading provider of high performance automatic transmissions, torque converters and drivetrain components for race, street/strip, hot rod, street rod and ……

#9 TREMEC

Domain Est. 2000

Website: tremec.com

Key Highlights: Performance engineered line of transmissions and components for line haul and vocational vehicles. Optimal durability, ease of shifting and low ownership costs ……

#10 ETE REMAN

Domain Est. 2005

Website: etereman.com

Key Highlights: HAVE ANY QUESTIONS? CALL OR TEXT US AT 1-800-934-9479 | installer locator | car care centers · Etereman menu. HAVE ANY QUESTIONS? CALL OR TEXT US. Etereman ……

Expert Sourcing Insights for Transmission

H2: 2026 Market Trends for the Transmission Sector

The global transmission sector is undergoing a transformative shift as it approaches 2026, driven by energy transition goals, digitalization, and infrastructure modernization. In the second half of 2025 and extending into 2026, several key trends are shaping the transmission market across regions, technologies, and investment landscapes.

1. Accelerated Grid Expansion for Renewable Integration

With global renewable energy capacity projected to grow by over 50% between 2023 and 2026, transmission systems are being expanded and upgraded to accommodate variable generation from wind and solar. Long-distance high-voltage transmission lines—particularly HVDC (High-Voltage Direct Current) corridors—are being prioritized to move clean energy from remote generation sites (e.g., offshore wind farms, desert solar arrays) to urban demand centers. Countries like the U.S., India, and members of the EU are fast-tracking cross-border and interregional interconnectors to enhance grid resilience and energy security.

2. Rise of Digital and Smart Grid Technologies

By 2026, digitalization is becoming standard in transmission infrastructure. Advanced monitoring systems, including PMUs (Phasor Measurement Units), AI-driven grid analytics, and IoT-enabled sensors, are being widely deployed to improve grid visibility, fault detection, and response times. Utilities are investing in digital twins and predictive maintenance platforms to optimize asset performance and reduce downtime. These technologies support dynamic line rating and adaptive grid control, enabling higher utilization of existing transmission corridors without physical upgrades.

3. Regulatory and Policy-Driven Modernization

Governments and regulators are introducing new frameworks to accelerate transmission development. In the U.S., FERC Order No. 1920 (issued in 2023) mandates more robust regional planning and cost allocation for transmission projects, expected to unlock billions in new investments by 2026. Similarly, the EU’s TEN-E (Trans-European Networks for Energy) regulation is streamlining permitting and funding for cross-border projects. These policy shifts are reducing project delays and improving investor confidence.

4. Increased Private and Institutional Investment

Transmission assets are attracting significant capital from infrastructure funds and institutional investors due to their stable, regulated returns and alignment with ESG criteria. In 2026, public-private partnerships (PPPs) and green bonds are becoming common financing models for large-scale transmission projects. The U.S. Inflation Reduction Act (IRA) and EU Green Deal are further catalyzing investment through tax incentives and grants for clean energy infrastructure.

5. Focus on Grid Resilience and Cybersecurity

With increasing frequency of extreme weather events and cyber threats, transmission operators are prioritizing grid hardening and cybersecurity. By 2026, investments in underground cabling, fire-resistant materials, and storm-resilient towers are rising—especially in wildfire-prone and hurricane-affected regions. Simultaneously, NERC CIP (Critical Infrastructure Protection) standards are being strengthened, and AI-powered threat detection systems are being integrated into grid operations.

6. Growth of Hybrid and Multi-Use Transmission Corridors

Innovative transmission designs are emerging, including hybrid AC/DC lines and co-located corridors that integrate power lines with broadband or hydrogen pipelines. These multi-use corridors reduce land use conflicts and lower overall project costs. Pilot projects in Europe and North America are demonstrating the feasibility of such integrated infrastructure, with broader deployment expected by 2026.

7. Electrification of Transport and Industry Driving Demand

The expansion of EV charging networks and industrial electrification (e.g., green hydrogen production) is increasing demand for reliable, high-capacity transmission. Transmission planners are now factoring in these new load centers when designing future grid upgrades, particularly in industrial zones and along major transportation corridors.

Conclusion

By 2026, the transmission sector is evolving from a passive backbone to an intelligent, flexible, and proactive enabler of the energy transition. Investment is surging, innovation is accelerating, and regulatory support is strengthening. Stakeholders who embrace digitalization, sustainability, and strategic planning will be best positioned to capitalize on the opportunities in this dynamic market.

Common Pitfalls in Sourcing Transmission Components (Quality, IP)

When sourcing transmission components—whether for automotive, industrial, or renewable energy applications—organizations often face significant challenges related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to costly delays, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Standards

Many suppliers, especially in emerging markets, may lack rigorous quality management systems. Relying on inconsistent manufacturing processes or inadequate testing can result in premature transmission failures, increased warranty claims, and safety risks. Always verify that suppliers adhere to recognized quality standards such as ISO/TS 16949 (for automotive) or ISO 9001, and conduct regular on-site audits.

Inadequate Due Diligence on Supplier Capabilities

Assuming a supplier can meet technical specifications without validating their production capacity, material sourcing, and engineering support often leads to performance shortfalls. Conduct technical assessments and request sample testing under real-world conditions before finalizing contracts.

Lack of Intellectual Property Clarity

Transmissions involve complex designs and proprietary technologies. Sourcing from third parties without clear IP agreements can expose your company to infringement risks. Ensure contracts explicitly define ownership of designs, tooling, and modifications, and confirm the supplier has the legal right to manufacture and supply the components.

Use of Counterfeit or Reverse-Engineered Parts

Some suppliers may offer “compatible” or “aftermarket” transmission parts that are reverse-engineered or counterfeit, potentially violating patents and compromising performance. These components often lack traceability and fail under stress. Source only from authorized or vetted manufacturers with documented IP licenses.

Insufficient Protection of Custom Designs

When providing custom transmission designs to a supplier, failing to secure non-disclosure agreements (NDAs) or design ownership clauses can allow the supplier to replicate or sell your design to competitors. Always assert IP ownership in writing and include confidentiality and non-compete terms.

Overlooking Regulatory and Certification Requirements

Different regions have specific regulations for transmission efficiency, emissions, and safety (e.g., EPA standards in the U.S., Euro norms in Europe). Sourcing components that don’t meet local compliance requirements can delay market entry or result in fines. Confirm that suppliers provide certified documentation and stay updated on evolving standards.

By proactively addressing these quality and IP-related pitfalls, companies can mitigate risks, ensure reliable supply chains, and protect their innovation and brand integrity.

Logistics & Compliance Guide for Transmission

This guide outlines the essential logistics and compliance considerations for the transmission of goods, data, or energy across operational, regulatory, and safety frameworks. Adherence to these guidelines ensures efficient, legal, and secure transmission processes.

Scope and Applicability

This guide applies to all departments involved in the physical or digital transmission of materials, information, or power, including supply chain, operations, IT, and regulatory affairs. It covers international and domestic transmissions subject to relevant laws and standards.

Regulatory Compliance

Transmission activities must comply with all applicable local, national, and international regulations. Key areas include:

– Export Controls: Adherence to EAR (Export Administration Regulations), ITAR (International Traffic in Arms Regulations), and sanctions lists (e.g., OFAC).

– Data Privacy: Compliance with GDPR, CCPA, HIPAA, or other data protection laws when transmitting personal or sensitive information.

– Environmental Regulations: Following EPA, REACH, or RoHS standards for hazardous material transport.

– Energy Transmission Standards: Compliance with FERC, NERC, or regional grid codes for power transmission.

Documentation Requirements

Accurate and complete documentation is mandatory for all transmission activities. Required documents may include:

– Commercial invoices and packing lists

– Transport permits and customs declarations

– Material Safety Data Sheets (MSDS/SDS)

– Data Processing Agreements (for data transmission)

– Transmission licenses or interconnection agreements (for energy)

Packaging and Labeling Standards

All transmitted items must be packaged and labeled according to industry and regulatory standards:

– Use UN-certified packaging for hazardous materials

– Apply proper hazard labels (e.g., flammable, corrosive)

– Include tracking identifiers, barcodes, and compliance marks (e.g., CE, FCC)

– Ensure data transmissions are encrypted and metadata properly classified

Carrier and Routing Selection

Choose carriers and transmission routes based on:

– Regulatory compliance capability

– Security certifications (e.g., ISO 27001 for data, TSA for freight)

– Environmental impact and carbon footprint

– Redundancy and reliability, especially for critical transmissions

Security and Risk Mitigation

Implement controls to protect transmissions from theft, loss, or tampering:

– Utilize secure containers, tamper-evident seals, and GPS tracking for physical shipments

– Employ end-to-end encryption and secure protocols (e.g., TLS, SFTP) for data

– Conduct risk assessments for high-value or sensitive transmissions

– Maintain incident response plans for breaches or disruptions

Recordkeeping and Audit Trail

Retain all transmission records for the required duration (typically 3–7 years):

– Shipping logs, transmission confirmations, and delivery receipts

– Compliance certifications and audit reports

– Data access logs and transmission encryption keys (where permitted)

– Regular internal audits to verify compliance adherence

Training and Accountability

Ensure personnel involved in transmission activities receive regular training on:

– Regulatory updates and compliance procedures

– Proper handling, packaging, and documentation

– Security protocols and breach reporting

– Designate compliance officers responsible for oversight and reporting

Continuous Improvement

Review transmission processes annually or following regulatory changes:

– Analyze performance metrics (on-time delivery, compliance incidents)

– Update procedures to reflect new laws or technologies

– Solicit feedback from carriers, recipients, and auditors

By following this guide, organizations can ensure that transmission operations remain efficient, secure, and fully compliant with all applicable requirements.

Conclusion for Sourcing Transmission Manufacturers

Sourcing transmission manufacturers is a critical step in ensuring the performance, reliability, and cost-efficiency of automotive or industrial systems. After thorough evaluation, it is evident that a successful sourcing strategy should balance technical expertise, production capacity, quality certifications, geographic advantages, and long-term collaboration potential. Leading manufacturers in regions such as Germany, Japan, China, and the United States offer diverse capabilities—ranging from highly automated, precision engineering to cost-effective mass production.

Key considerations include technological proficiency in manual, automatic, CVT, or electric drivetrain systems; adherence to international quality standards such as ISO/TS 16949; scalability for volume demands; and strong after-sales support. Additionally, partnerships with manufacturers investing in innovation—especially in hybrid and electric transmission technologies—are vital for future-proofing supply chains.

Ultimately, the optimal choice depends on specific project requirements, including application type, budget constraints, and sustainability goals. A strategic, well-researched approach to sourcing transmission manufacturers will enhance product quality, reduce time-to-market, and strengthen competitive advantage in an evolving industry landscape.