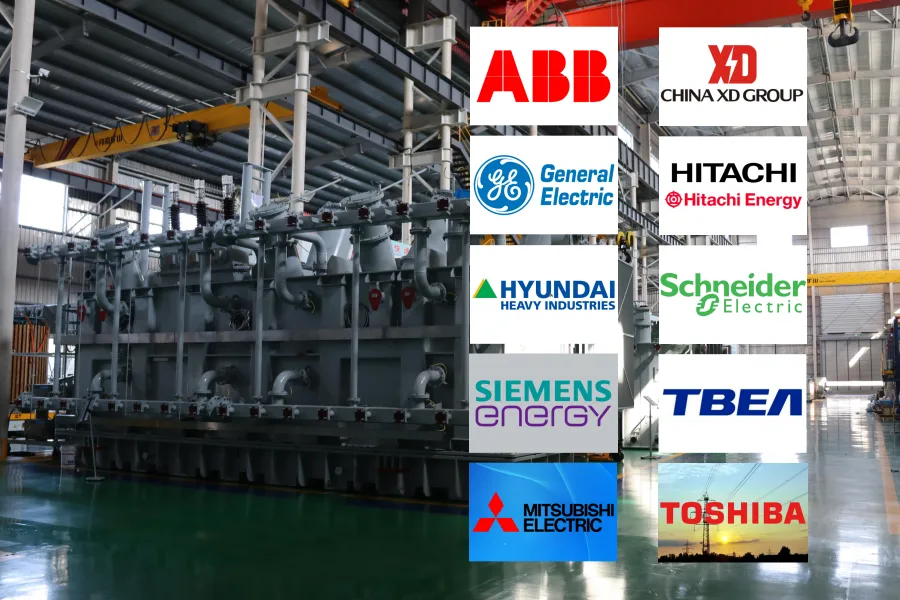

The global transformer market is experiencing robust growth, driven by increasing electricity demand, modernization of power infrastructure, and the expansion of renewable energy integration. According to a report by Mordor Intelligence, the transformer market was valued at USD 104.6 billion in 2023 and is projected to reach USD 141.2 billion by 2029, growing at a CAGR of approximately 5.1% during the forecast period. Similarly, Grand View Research estimates rising investments in smart grid technologies and high-voltage transmission networks as key catalysts, particularly in emerging economies. As grid reliability and energy efficiency become critical priorities worldwide, the role of advanced transformer manufacturing has never been more pivotal. In this evolving landscape, a select group of manufacturers stand out for their technological innovation, global reach, and market share—defining the future of power transmission and distribution.

Top 9 Transformer Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Transformers & Custom Magnetics

Domain Est. 1995

Website: hubbell.com

Key Highlights: Custom magnetics. We help OEMs develop, test, and manufacture transformers, inductors and filters to support their product development and exact specifications….

#2 Sun Transformer

Domain Est. 1996

Website: suntransformer.com

Key Highlights: We are an ITAR registered manufacturer specializing in small to mid-size magnetics, and we are capable of building custom electronic transformers up to 5 KVA….

#3 Virginia Transformer Corp

Domain Est. 1997 | Founded: 1971

Website: vatransformer.com

Key Highlights: The largest U.S.-owned custom power transformer manufacturer since 1971, with six advanced facilities across the U.S. and Mexico….

#4

Domain Est. 1999

Website: ermco-eci.com

Key Highlights: As the leading US manufacturer of oil-filled distribution transformers, we customize solutions to tackle your challenges — and meet your goals. LEARN MORE….

#5 Hammond Power Solutions Americas

Domain Est. 2000

Website: americas.hammondpowersolutions.com

Key Highlights: HPS is the largest manufacturer of dry-type transformers in North America. We engineer and manufacture a wide range of standard and custom transformers….

#6 Top Industrial Transformer Company

Domain Est. 2019

Website: sunbeltsolomon.com

Key Highlights: America’s leading transformer company for industrial sales & services. 100+ years of expertise, nationwide coverage, and 24/7 support. Get a quote today!…

#7 Transformer Manufacturer

Website: prolec.energy

Key Highlights: Prolec manufactures 1200MVA, 345kV transformers top rated and manufactured to the latest IEEE, ANSI, NEMA & ISO 9001:2015 quality standards….

#8 ELSCO Transformers

Domain Est. 2007

Website: elscotransformers.com

Key Highlights: Leading transformer manufacturing company offering high-quality transformers that will provide efficient uninterrupted power for decades to come….

#9 WEG Transformers USA

Domain Est. 2015

Website: weg.us

Key Highlights: WEG Transformers USA has three facilities in Washington, Missouri and two in Mexico that manufacture distribution and power transformers….

Expert Sourcing Insights for Transformer

H2: Market Trends for Transformers in 2026

As the global energy landscape evolves, the transformer market is undergoing significant transformation driven by technological innovation, regulatory shifts, and increasing demand for reliable and sustainable power infrastructure. By 2026, several key trends are shaping the transformer industry, particularly in the high-voltage and distribution segments.

-

Growth in Renewable Energy Integration

The continued expansion of renewable energy sources—especially solar and wind—is a primary driver of transformer demand. These intermittent power sources require advanced grid interconnection solutions, where transformers play a critical role in stepping up voltage for efficient transmission. By 2026, grid operators are increasingly investing in smart transformers and phase-shifting transformers to manage bidirectional power flows and stabilize grids under fluctuating supply conditions. -

Adoption of Smart and Digital Transformers

The rise of smart grids is accelerating the deployment of intelligent transformers equipped with sensors, IoT connectivity, and real-time monitoring capabilities. These digital transformers enable predictive maintenance, improve efficiency, and enhance grid resilience. By 2026, a growing number of utilities are adopting digital twin technology and AI-driven analytics to optimize transformer performance and reduce downtime. -

Increased Focus on Energy Efficiency and Sustainability

Regulatory standards such as the EU’s Ecodesign Directive and the U.S. DOE efficiency rules are pushing manufacturers to produce more efficient transformers with lower no-load and load losses. In 2026, there is a rising preference for amorphous metal core transformers and high-temperature superconducting (HTS) transformers, which offer significantly lower energy losses and reduced environmental impact. -

Electrification and Urbanization Driving Distribution Transformer Demand

Rapid urbanization, especially in Asia-Pacific and Africa, along with the electrification of transport and heating, is increasing demand for distribution transformers. The growing adoption of electric vehicles (EVs) is placing new loads on local grids, requiring upgraded and resilient distribution infrastructure. By 2026, compact, modular, and mobile transformers are gaining traction to support fast-deploying EV charging networks. -

Supply Chain and Material Innovation

Ongoing supply chain constraints for key materials like copper, silicon steel, and insulating oils are prompting innovation. In 2026, manufacturers are increasingly exploring alternative materials and designs, including dry-type transformers using eco-friendly insulation systems, to reduce dependency on scarce resources and improve fire safety in urban installations. -

Geopolitical and Regional Market Shifts

Investment in grid modernization is particularly strong in North America and Europe due to aging infrastructure and climate targets. Meanwhile, countries in Southeast Asia, India, and the Middle East are expanding their transmission networks to support industrial growth. China remains a dominant player in both production and deployment, but trade dynamics and localization policies are reshaping global supply chains. -

Rise of HVDC and UHV Transformers

As long-distance transmission of renewable power becomes essential, high-voltage direct current (HVDC) and ultra-high-voltage (UHV) transformers are seeing increased deployment. By 2026, several cross-border and offshore wind integration projects are leveraging UHVAC and HVDC transformer technology to minimize transmission losses over thousands of kilometers.

In summary, by 2026 the transformer market is characterized by a shift toward smarter, more efficient, and sustainable solutions, driven by clean energy goals and digital transformation. Companies that innovate in digital integration, materials science, and grid adaptability are well-positioned to lead in this evolving landscape.

Common Pitfalls in Sourcing Transformers: Quality and Intellectual Property (IP) Risks

When sourcing transformers—especially custom or high-performance units—organizations must navigate several critical pitfalls related to quality assurance and intellectual property (IP) protection. Overlooking these aspects can lead to operational failures, legal liabilities, and reputational damage.

Quality-Related Pitfalls

1. Inadequate Supplier Qualification

Failing to thoroughly vet transformer manufacturers can result in substandard products. Red flags include missing certifications (e.g., ISO 9001, IEEE, IEC), lack of testing infrastructure, or poor track record. Always verify a supplier’s quality management systems and past performance.

2. Non-Compliance with Technical Standards

Sourced transformers may not meet required regional or industry standards (e.g., ANSI, IEC, CSA). This can lead to safety hazards, rejection by utilities, or costly retrofits. Ensure specifications are clearly defined and enforced in procurement contracts.

3. Use of Inferior Materials

Some suppliers may cut costs by using lower-grade core steel, subpar insulation, or counterfeit copper windings. These compromises reduce efficiency, increase losses, and shorten transformer lifespan. Require material certifications and conduct independent audits.

4. Insufficient Testing and Documentation

Lack of factory acceptance tests (FATs)—such as dielectric, temperature rise, and no-load loss tests—increases the risk of field failures. Demand comprehensive test reports and, when possible, witness key tests on-site.

5. Poor Workmanship and Design Flaws

Even with correct materials, poor assembly (e.g., loose windings, improper clamping) can cause premature failure. Review design drawings and ensure the supplier follows proven engineering practices.

Intellectual Property (IP) Risks

1. Lack of IP Ownership Clarity

Custom transformer designs often involve proprietary configurations or innovations. Without clear contractual terms, the buyer may not own the design, limiting rights to replicate, modify, or service the unit independently.

2. Risk of Design Theft or Reverse Engineering

Suppliers, especially in regions with weak IP enforcement, may reuse or sell your design to competitors. This is particularly risky when sourcing from low-cost manufacturers without robust legal safeguards.

3. Inadequate Protection in Contracts

Procurement agreements may omit clauses on IP ownership, confidentiality, and non-disclosure. Always include explicit terms stating that designs, drawings, and specifications remain the buyer’s exclusive property.

4. Third-Party IP Infringement

A supplier might unknowingly (or knowingly) incorporate patented technologies into your transformer, exposing your organization to infringement claims. Conduct IP due diligence and require warranties from the supplier.

5. Dependence on Supplier for Technical Support

If the supplier retains design control, you may become locked into their service and spare parts ecosystem, increasing lifecycle costs and reducing flexibility.

Mitigation Strategies

- Conduct rigorous supplier audits and request production site visits.

- Include detailed technical specifications and mandatory compliance with standards.

- Require material traceability and third-party testing where critical.

- Draft robust contracts with clear IP ownership, confidentiality, and indemnification clauses.

- Consider partnering with trusted, certified manufacturers and using escrow arrangements for design files.

By proactively addressing quality and IP concerns, organizations can minimize risks and ensure reliable, legally protected transformer sourcing.

Logistics & Compliance Guide for Transformers

This guide outlines key logistics and compliance considerations when transporting and handling power transformers, ensuring safety, regulatory adherence, and operational efficiency.

Regulatory Compliance

Ensure all transformer shipments comply with local, national, and international regulations. This includes adherence to standards such as IEEE, IEC, and NEMA for design and testing, and transportation regulations from bodies like the Department of Transportation (DOT), International Maritime Organization (IMO), and International Air Transport Association (IATA) when applicable. Obtain required permits for oversized or heavy loads, especially for cross-border shipments.

Packaging and Handling

Use manufacturer-approved packaging to protect the transformer during transit. Large transformers are typically shipped in sealed, weatherproof enclosures with desiccants to prevent moisture ingress. Clearly label units with handling instructions (e.g., “Do Not Tilt,” “Fragile,” “This Side Up”) and include safety warnings. Use lifting points as specified by the manufacturer to prevent structural damage.

Transportation Planning

Plan routes carefully to accommodate the transformer’s dimensions and weight. Coordinate with transport providers experienced in heavy haul logistics. Verify bridge weight limits, road restrictions, and overhead clearances. For international shipments, ensure proper export documentation, customs declarations, and adherence to import regulations in the destination country.

Environmental and Safety Compliance

Comply with environmental regulations regarding insulating fluids (e.g., mineral oil, SF₆ gas). Ensure transformers are leak-tested and sealed properly to prevent hazardous material release. For units containing PCBs (in older models), follow EPA or equivalent guidelines for handling and disposal. Maintain Material Safety Data Sheets (MSDS) for all fluids used.

Documentation and Tracking

Maintain comprehensive shipping documentation, including bills of lading, certificates of compliance, test reports, and packing lists. Use GPS tracking for real-time monitoring of high-value shipments. Ensure all paperwork is accurate and available for customs or inspection authorities.

On-Site Delivery and Installation Support

Coordinate delivery with site readiness, including foundation preparation and crane availability. Verify that receiving personnel are trained in safe unloading procedures. Provide compliance documentation to the end-user for regulatory and warranty purposes. Schedule post-delivery inspections to confirm integrity upon arrival.

Storage Requirements

If interim storage is required, store transformers in a dry, level, and secure location. Keep them upright and protected from weather, dust, and physical impact. Monitor for moisture buildup and maintain seal integrity. Follow manufacturer guidelines for maximum storage duration before energization.

Decommissioning and End-of-Life Compliance

At end-of-life, follow environmental regulations for decommissioning, including safe fluid recovery, recycling of metals, and disposal of hazardous components. Use certified recycling partners and maintain records to demonstrate compliance with WEEE, RoHS, or local e-waste directives.

Conclusion for Sourcing Transformer Manufacturer:

After a thorough evaluation of potential transformer manufacturers, it is recommended to partner with a supplier that demonstrates a strong combination of technical expertise, proven manufacturing experience, quality certifications (such as ISO 9001, IEC, and IEEE compliance), and a reliable track record in delivering products on time and within budget. The selected manufacturer should have the capacity to meet specific project requirements—whether for distribution, power, or specialty transformers—while adhering to international standards and local regulatory requirements.

Geographical proximity, after-sales support, warranty terms, and responsiveness to technical queries are also key factors that contribute to long-term reliability and operational efficiency. Additionally, conducting on-site audits or factory inspections can provide valuable insights into production processes and quality control measures.

In conclusion, the ideal transformer manufacturer should not only offer competitive pricing but also provide consistent quality, innovation, and strong customer support, ensuring a sustainable and dependable supply chain for current and future electrical infrastructure needs.