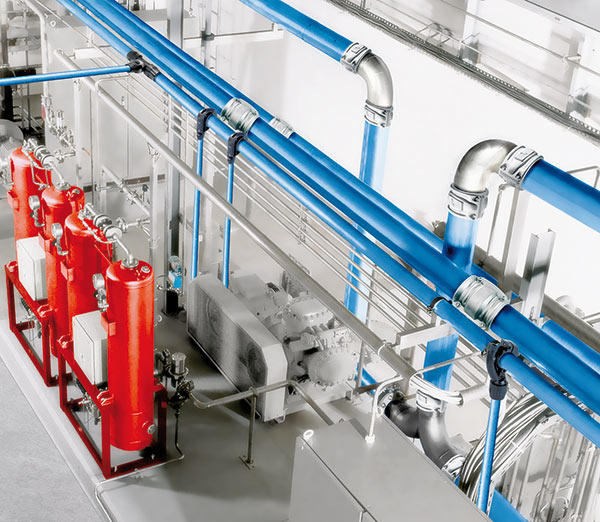

The global pipework manufacturing market is experiencing steady expansion, driven by rising demand across industrial, oil & gas, water treatment, and HVAC sectors. According to Mordor Intelligence, the industrial piping systems market was valued at USD 68.9 billion in 2022 and is projected to grow at a CAGR of over 5.8% through 2029. This growth is fueled by increased infrastructure investments, stringent safety regulations, and the need for energy-efficient fluid handling systems. Within this competitive landscape, Transair pneumatic tubing—known for its lightweight aluminum construction, rapid installation, and corrosion resistance—has become a preferred choice in compressed air distribution. As industries prioritize efficiency and scalability, leading Transair pipework manufacturers are leveraging innovative design and global supply chains to meet evolving demands. Below are the top four Transair pipework manufacturers distinguished by market presence, product performance, and technical advancement.

Top 4 Transair Pipework Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Parker Transair Aluminum Pipe System from Triad Technologies

Domain Est. 2002

Website: info.triadtechnologies.com

Key Highlights: Transair is an adaptable, lightweight, easy-to-modify piping system for compressed air, industrial/inert gas, and vacuum….

#2 Transair® Stainless Steel Pipe System

Domain Est. 2005

Website: transairstainlesssteelpipe.com

Key Highlights: Transair Stainless Steel Pipe is the ideal system for compressed air, inert gas, vacuum and industrial fluid networks and applications….

#3 Transair® Aluminum Pipe

Domain Est. 2005

Website: transairaluminumpipe.com

Key Highlights: Transair aluminum pipe is the ideal system for any compressed air, vacuum, or inert gas application. Transair pipe push-to-connect fittings eliminate the need ……

#4 Transair Pipe

Domain Est. 2010

Website: transairpipesales.com

Key Highlights: Transair pipe and connectors are the perfect choice for compressed air, vacuum, and inert gas systems and applications. Backed by a 10 Year Warranty….

Expert Sourcing Insights for Transair Pipework

H2: Market Trends Shaping Transair Pipework in 2026

As we approach 2026, the industrial pipework sector—particularly for specialized providers like Transair Pipework—is undergoing significant transformation driven by technological innovation, sustainability demands, and evolving industrial needs. Below are the key market trends expected to influence Transair Pipework’s position and strategy in the coming years:

1. Increased Demand for Energy Efficiency and Compressed Air Optimization

Industries are placing greater emphasis on reducing energy consumption, with compressed air systems accounting for up to 10% of industrial electricity use. Transair’s aluminum pipework systems—known for low pressure drop, corrosion resistance, and modular design—are well-positioned to meet growing demand for energy-efficient solutions. In 2026, companies will increasingly invest in optimized air distribution systems to cut operational costs and carbon footprints, benefiting Transair’s value proposition.

2. Shift Toward Sustainable and Low-Carbon Industrial Infrastructure

Global decarbonization targets are pushing manufacturers and plant operators to adopt greener technologies. Transair’s recyclable aluminum piping systems align with circular economy principles and ESG goals. By 2026, procurement decisions in sectors like automotive, food & beverage, and pharmaceuticals will increasingly favor sustainable infrastructure, giving Transair a competitive edge over traditional steel or plastic alternatives.

3. Growth in Modular and Prefabricated System Adoption

The industrial construction sector is moving toward modular and off-site fabrication to reduce installation time and labor costs. Transair’s pre-engineered, plug-and-play pipework solutions support this trend. In 2026, facility upgrades and new plant builds will increasingly rely on modular systems, accelerating demand for Transair’s standardized components and smart layout planning tools.

4. Digital Integration and Smart Monitoring

The rise of Industry 4.0 is driving integration between physical infrastructure and digital monitoring platforms. Transair is expected to expand into smart pipework solutions, potentially incorporating IoT sensors for real-time pressure, flow, and leak detection. By 2026, customers will prefer systems that offer predictive maintenance capabilities and data analytics, enhancing system reliability and reducing downtime.

5. Expansion in Emerging Markets and Regional Manufacturing Hubs

As global supply chains diversify, new manufacturing hubs are emerging in Southeast Asia, Eastern Europe, and Latin America. These regions are investing in modern industrial facilities, creating new opportunities for Transair. In 2026, international expansion—supported by local partnerships and regional distribution centers—will be critical for growth.

6. Regulatory Pressure and Compliance Standards

Stricter regulations around air quality, workplace safety, and energy efficiency (e.g., EU Ecodesign Directive, ISO 50001) are influencing plant design. Transair’s systems, which support clean, oil-free air distribution and meet high safety standards, will be increasingly specified in regulated industries such as pharmaceuticals and electronics.

7. Competitive Pressure and Market Consolidation

The pipework market is seeing increased competition from both established players and new entrants offering alternative materials or smart features. In 2026, Transair will need to differentiate through innovation, customer service, and lifecycle cost messaging to maintain market share, especially in price-sensitive segments.

Conclusion

By 2026, Transair Pipework is well-aligned with key industrial trends—energy efficiency, sustainability, digitalization, and modular construction. To capitalize on these opportunities, the company should focus on enhancing product intelligence, expanding into high-growth regions, and reinforcing its brand as a provider of future-ready compressed air infrastructure. Strategic investments in R&D and digital tools will be essential to maintain leadership in an increasingly competitive and technologically advanced market.

Common Pitfalls When Sourcing Transair Pipework: Quality and Intellectual Property Concerns

Sourcing Transair-style aluminum pipework systems can offer benefits such as fast installation and flexibility, but it also presents significant risks—particularly regarding quality consistency and intellectual property (IP) infringement. Being aware of these pitfalls is crucial for ensuring system safety, performance, and legal compliance.

Quality Inconsistencies and Substandard Materials

One of the most prevalent issues when sourcing Transair pipework, especially from non-authorized or third-party suppliers, is the variability in material quality. Many manufacturers produce look-alike systems using inferior-grade aluminum alloys that do not meet the mechanical or pressure specifications of genuine Transair components. This can result in:

- Reduced burst pressure ratings, increasing the risk of system failure

- Poor thread tolerances leading to leaks or difficulty in assembly

- Inadequate anodization, accelerating corrosion and shortening system lifespan

- Inconsistent wall thickness affecting structural integrity

These quality shortcomings may not be immediately apparent but can lead to costly downtime, safety hazards, and increased maintenance over time.

Intellectual Property and Trademark Infringement

Transair is a registered trademark and proprietary system owned by Tritech Group. Sourcing counterfeit or imitation products labeled as “Transair-compatible” or using similar branding can constitute trademark and design patent infringement. Common IP-related pitfalls include:

- Purchasing from suppliers using Transair’s name, logo, or distinctive color schemes (e.g., blue anodization) without authorization

- Acquiring systems that replicate patented jointing mechanisms or connector designs protected under international IP laws

- Exposure to legal liability, including cease-and-desist orders, financial penalties, or seizure of infringing goods

Using counterfeit or unauthorized products not only violates intellectual property rights but may void equipment warranties and insurance coverage in the event of failure.

Lack of Certification and Traceability

Genuine Transair systems come with full traceability, certifications (such as ISO and CE markings), and compliance documentation. Imitation products often lack proper certification, making it difficult to verify suitability for specific industrial applications—especially in regulated environments like food & beverage, pharmaceuticals, or hazardous areas. Without documentation, end-users assume full liability for system performance and safety.

Conclusion

To avoid these pitfalls, always source Transair pipework directly from authorized distributors or certified partners. Verify product authenticity through official channels, request material certifications, and ensure compliance with applicable standards. Investing in genuine, IP-compliant systems protects both operational integrity and legal standing.

Logistics & Compliance Guide for Transair Pipework

This guide outlines the essential logistics procedures and compliance requirements for Transair Pipework to ensure safe, efficient, and legally compliant operations across all stages of pipework project delivery.

Order Processing & Documentation

All customer orders must be confirmed in writing with a formal purchase order or contract. Transair Pipework will issue a detailed work order that includes pipe specifications (material, diameter, pressure rating, length), delivery timeline, installation requirements, and any special handling instructions. Required documentation includes material test reports (MTRs), certificates of conformance (CoC), and project-specific drawings approved by a licensed engineer.

Material Sourcing & Supplier Compliance

Materials must be sourced from certified suppliers compliant with ISO 9001 and relevant industry standards (e.g., ASME B31.3, ASTM A106, A312). Transair Pipework conducts annual supplier audits and maintains a documented supplier qualification program. All incoming materials undergo inspection for compliance with specifications, including visual checks, dimensional verification, and traceability of heat numbers.

Storage & Handling Protocols

Pipes and fittings must be stored horizontally on level racks or skids to prevent bending or deformation. Materials should be elevated above ground level and covered to protect from moisture, dirt, and weather exposure. Stainless steel components must be segregated from carbon steel to prevent galvanic corrosion. Handling equipment (e.g., forklifts, cranes) must use padded clamps or slings to avoid surface damage.

Transportation & Delivery

All transported materials must be securely strapped, blocked, and braced to prevent shifting during transit. Open trailers require tarpaulin coverage to protect against environmental elements. Drivers must follow DOT regulations (where applicable) and complete pre-trip inspections. Delivery schedules must be confirmed 24 hours in advance with the site contact. Proof of delivery (POD) with recipient signature and timestamp is required for all shipments.

Installation Compliance & Safety

Installation must be performed by certified welders and technicians holding valid qualifications (e.g., ASME Section IX). All welding procedures follow approved WPS (Welding Procedure Specifications) and are subject to non-destructive testing (NDT) as per project requirements. Safety protocols include adherence to OSHA standards, use of PPE, confined space entry permits when applicable, and site-specific risk assessments.

Quality Assurance & Inspection

Transair Pipework implements a documented Quality Management System (QMS) aligned with ISO 9001. Pre-installation, in-process, and final inspections are conducted using standardized checklists. Pressure testing, leak testing, and dimensional accuracy checks are performed as required. Inspection records and test reports are archived for a minimum of 10 years.

Regulatory & Environmental Compliance

Operations must comply with local, state, and federal regulations, including EPA, OSHA, and DOT. Hazardous materials (e.g., cutting fluids, welding gases) are stored and disposed of in accordance with RCRA guidelines. Spill prevention and response plans are maintained on-site. All employees receive annual compliance training.

Recordkeeping & Traceability

Full traceability of materials is maintained from receipt through installation. Batch numbers, heat numbers, and inspection records are logged in the company’s digital tracking system. As-built drawings and as-installed documentation are provided to the client upon project completion. All compliance records are retained per industry standards and legal requirements.

Continuous Improvement

Transair Pipework conducts quarterly compliance audits and reviews customer feedback to identify areas for improvement. Corrective and preventive actions (CAPA) are documented and implemented to enhance logistical efficiency and regulatory adherence.

Conclusion on Sourcing Transair Pipework

In conclusion, sourcing Transair pipework presents a reliable and efficient solution for compressed air distribution systems. Transair’s aluminum alloy piping system offers numerous advantages, including ease of installation, corrosion resistance, lightweight construction, and minimal maintenance requirements. These features contribute to reduced downtime and long-term cost savings, making it a preferred choice across industrial and commercial applications.

The modular design and push-fit connections streamline installation, significantly cutting labor time and costs compared to traditional steel piping. Additionally, Transair’s compliance with international standards ensures system integrity, safety, and energy efficiency—critical factors in modern compressed air networks.

Through careful supplier evaluation, price comparison, and verification of product authenticity, organizations can confidently source genuine Transair components that deliver performance, durability, and scalability. Partnering with authorized distributors further ensures technical support, warranty coverage, and access to compatible accessories.

Ultimately, investing in Transair pipework is a strategic decision that enhances system reliability, operational efficiency, and future adaptability—making it a worthwhile choice for sustainable compressed air infrastructure.