The global electronics manufacturing industry is undergoing rapid transformation, driven by rising demand for consumer electronics, advancements in IoT, and the expansion of 5G infrastructure. According to Mordor Intelligence, the electronics manufacturing services (EMS) market was valued at USD 634.5 billion in 2023 and is projected to grow at a CAGR of over 6.5% through 2029. This growth trajectory underscores the increasing complexity and scale of electronics production, necessitating the adoption of advanced tools to improve efficiency, reduce time-to-market, and maintain quality standards. As manufacturers face mounting pressure to innovate and scale, the integration of cutting-edge software and hardware tools—from PCB design platforms to automated optical inspection systems—has become critical. Below are the top 10 tools empowering electronics manufacturers to stay competitive in this evolving landscape.

Top 10 Tools For Electronics Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Newark Electronics

Domain Est. 1994

Website: newark.com

Key Highlights: Newark Electronics – We’re a fast and reliable distributor of products and technology for electronic and industrial system design, maintenance, and repair….

#2 Triplett Test Equipment & Tools for Industrial & Electronics Solutions

Domain Est. 1996

Website: triplett.com

Key Highlights: Triplett offers a wide range of electrical testers, meters, detectors and other measurement tools and testing equipment for HVAC, telecom, MRO, automotive, ……

#3 Milwaukee® Tool

Domain Est. 2000

Website: milwaukeetool.com

Key Highlights: Milwaukee Tool is the most respected manufacturer of heavy-duty power tools, hand tools, instruments, and accessories….

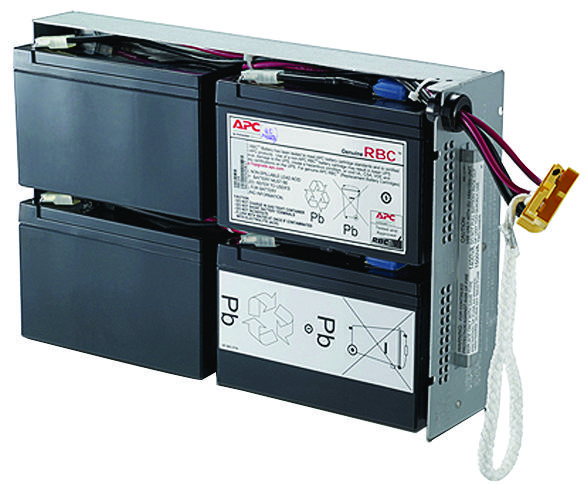

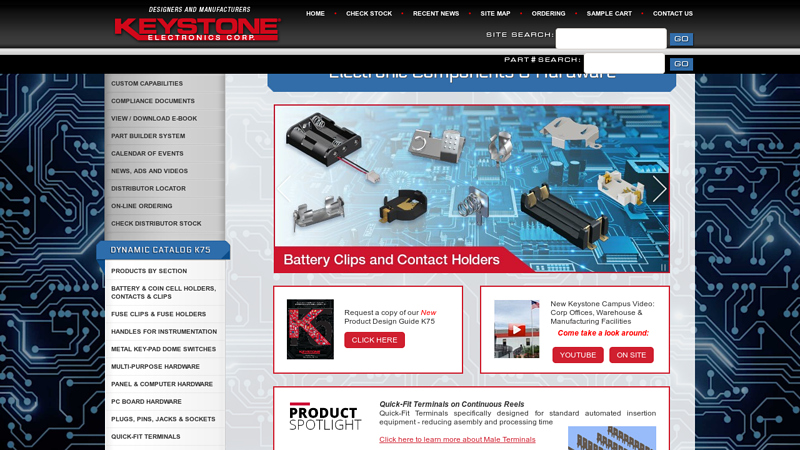

#4 Keystone Electronics Corp.

Domain Est. 1995

Website: keyelco.com

Key Highlights: Electronic Components & Hardware · Battery Clips Contacts Holders · Fuse Clips Holders · Terminals Test Points · Spacers Standoffs · Panel Hardware · Pins Plugs Jacks ……

#5 DMC tools

Domain Est. 1997

Website: dmctools.com

Key Highlights: For 75 years, DMC® has manufactured tooling for mission-critical electrical systems in aerospace and defense, rail, marine, and several other industries….

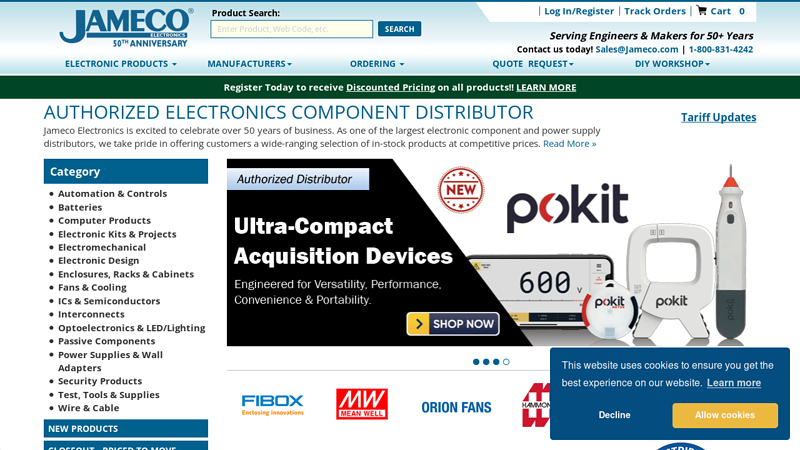

#6 Jameco Electronics

Domain Est. 1998

Website: jameco.com

Key Highlights: Jameco Electronics is an authorized electronics component distributor with over 50 years in business, selling electronic components, parts, ……

#7 Tools

Domain Est. 2001

Website: ifixit.com

Key Highlights: 3–5 day delivery · 30-day returnsThe original electronics toolkit: Designed for computer, smartphone, tablet, and gaming repair, backed by thousands of free instructions….

#8 Soldering and Rework equipment for electronics

Domain Est. 2002

Website: jbctools.com

Key Highlights: JBC Tools is a leading global company specializing in advanced soldering and rework solutions. Offering high-performance soldering stations, irons, ……

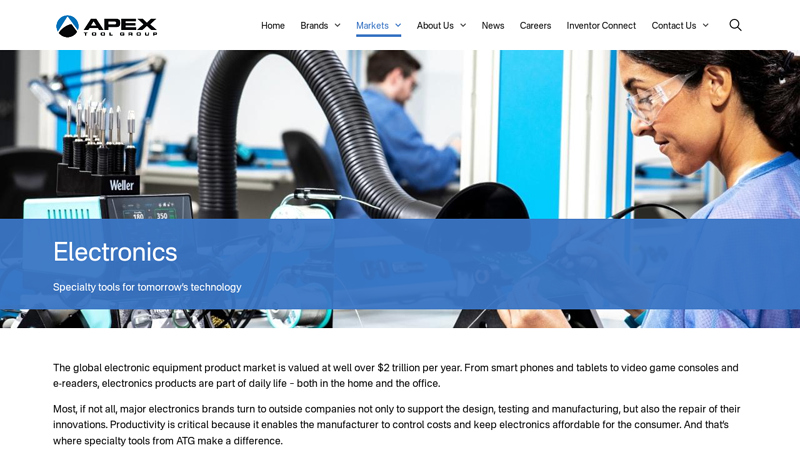

#9 Electronics

Domain Est. 2010

Website: apextoolgroup.com

Key Highlights: ATG serves this industry with products from Weller®, including soldering, desoldering and fume extraction tools used for circuit board assembly and rework….

#10 WEP Tools

Domain Est. 2022 | Founded: 2000

Website: weptools.com

Key Highlights: Free delivery over $50 Free 30-day returnsSoldering tools are the main focus of WEP, we have designed and manufactured soldering stations, hot air rework stations, lab DC power sup…

Expert Sourcing Insights for Tools For Electronics

H2: Emerging Market Trends in Tools for Electronics (2026 Forecast)

By 2026, the global market for tools for electronics is poised for significant transformation, driven by rapid technological advancements, evolving industry demands, and the expansion of high-tech applications. Based on current trajectories and projected developments, the following key trends are expected to define the landscape:

1. Integration of AI and Smart Diagnostics

Electronics tools—including oscilloscopes, multimeters, and signal generators—are increasingly incorporating artificial intelligence (AI) and machine learning (ML) capabilities. By 2026, AI-powered tools will offer predictive diagnostics, automated fault detection, and intelligent data interpretation, reducing human error and accelerating troubleshooting. For example, smart soldering stations may adapt temperature profiles in real time based on joint quality feedback, while AI-enhanced test equipment will recommend next-step diagnostics.

2. Rise of Modular and Portable Test Equipment

As electronics design becomes more decentralized and field service grows (especially in IoT and renewable energy sectors), demand for compact, modular, and handheld tools will surge. Tools with interchangeable probes, modular input/output modules, and smartphone/tablet integration will dominate, enabling engineers and technicians to conduct sophisticated measurements in the lab, on the factory floor, or in remote locations.

3. Growth Driven by 5G, IoT, and Edge Computing

The proliferation of 5G infrastructure, connected devices, and edge computing systems will drive demand for high-frequency and high-speed test tools. In 2026, spectrum analyzers, network analyzers, and protocol testers capable of handling mmWave frequencies and complex modulation schemes will be essential. Equipment suppliers will focus on tools that support RF/EMI testing and signal integrity validation in dense electronic environments.

4. Sustainability and Green Manufacturing Tools

Environmental regulations and corporate sustainability goals will influence tool design and usage. Manufacturers will prioritize energy-efficient tools, recyclable materials, and longer product lifecycles. Additionally, tools that support lead-free soldering, reduce hazardous waste, and enable accurate rework will gain market share, particularly in Europe and North America under stricter environmental standards.

5. Cloud-Based Collaboration and Data Management

Electronics testing tools will increasingly feature cloud connectivity, enabling real-time data sharing, remote monitoring, and collaborative analysis. By 2026, engineers will routinely upload test results to centralized platforms for AI-driven analysis, team review, and compliance reporting. This trend supports distributed R&D teams and improves traceability in regulated industries like medical devices and automotive electronics.

6. Expansion in Emerging Markets and Education Sectors

Rapid industrialization in Southeast Asia, India, and Latin America will boost demand for affordable, reliable electronic tools. At the same time, STEM education initiatives will drive adoption of entry-level development kits, programmable logic tools, and educational oscilloscopes in schools and universities, creating a pipeline of skilled users and future professionals.

7. Increased Adoption of Automation and Robotics in Testing

Automated test equipment (ATE) and robotic probing systems will become more accessible to mid-sized electronics manufacturers. In 2026, integration with Industry 4.0 systems will allow tools to communicate with production lines, enabling real-time quality control, adaptive calibration, and reduced downtime.

Conclusion:

By 2026, the electronics tools market will be characterized by intelligence, connectivity, and versatility. Companies that innovate in AI integration, sustainability, and user-centric design will lead the industry. As electronics become more complex and embedded in every aspect of life, the tools used to develop, test, and repair them will become smarter, more integrated, and more essential than ever.

Common Pitfalls When Sourcing Tools for Electronics: Quality and Intellectual Property Risks

Sourcing tools for electronics—ranging from test and measurement equipment to development kits and software—presents significant challenges, particularly concerning product quality and intellectual property (IP) protection. Overlooking these aspects can lead to project delays, compromised product integrity, and legal exposure. Here are key pitfalls to avoid:

Poor Quality Control and Counterfeit Equipment

One of the most prevalent issues in sourcing electronics tools is receiving substandard or counterfeit products. Tools such as oscilloscopes, multimeters, and signal generators from unreliable suppliers may lack proper calibration, durability, or accuracy. Counterfeit development boards or probes often fail under regular use and can introduce faults into sensitive circuits. Buyers may be tempted by low-cost offers, especially from online marketplaces or unverified vendors, only to discover that the tools do not meet specifications or lack essential safety certifications.

Lack of Traceability and Documentation

Inadequate documentation and poor traceability make it difficult to verify the authenticity and service history of sourced tools. Reputable suppliers provide calibration certificates, serial numbers, compliance reports (e.g., CE, FCC), and detailed specifications. Without these, users cannot ensure the tool’s reliability or meet regulatory requirements in industries like medical or aerospace. Missing documentation also complicates warranty claims and technical support.

Intellectual Property Infringement in Software Tools

Sourcing software tools—such as integrated development environments (IDEs), simulation software, or firmware programming tools—carries hidden IP risks. Unauthorized or pirated software licenses may seem cost-effective but expose organizations to legal liability, compliance violations, and cybersecurity threats. Additionally, some third-party tools may incorporate open-source components without proper attribution or licensing, leading to potential IP disputes when used in commercial products.

Use of Cloned or Reverse-Engineered Hardware

Certain suppliers offer “compatible” or “cloned” versions of popular electronics tools (e.g., Arduino clones, logic analyzers). While some clones are legitimate and well-documented, others infringe on design patents or trademarks. Using such tools in product development may inadvertently incorporate protected IP into your designs, increasing legal risk. Moreover, cloned tools often lack firmware updates, community support, or long-term availability.

Inadequate Supplier Vetting and Due Diligence

Failing to properly vet suppliers increases exposure to both quality and IP issues. Organizations that prioritize speed or cost over due diligence may partner with distributors or manufacturers lacking transparency. It’s essential to verify a supplier’s reputation, audit their supply chain, and confirm their adherence to industry standards (e.g., ISO 9001 for quality management).

Overlooking Licensing and Usage Rights

Even when tools are legitimately sourced, overlooking usage rights can create problems. For example, development kits or software may have restrictions on commercial use, redistribution, or integration into end products. Violating these terms—even unintentionally—can result in license termination or legal action.

Conclusion

To mitigate these risks, procurement teams should establish clear sourcing criteria that prioritize certified suppliers, enforce compliance checks, and include IP audits for software and hardware tools. Investing in quality assurance and legal review during the sourcing process safeguards both product integrity and long-term innovation.

Logistics & Compliance Guide for Tools For Electronics

Order Fulfillment & Shipping

All orders placed through Tools For Electronics are processed from our central distribution center located in the European Union. Standard processing time is 1–2 business days. We offer multiple shipping options, including standard, express, and same-day dispatch for eligible in-stock items. Shipping carriers include DHL, UPS, and national postal services, depending on destination and service level. Customers receive tracking details via email upon shipment.

Import Duties & Taxes

For deliveries outside the European Union, customers are responsible for any import duties, customs fees, or local taxes imposed by their country. These charges are not included in the product price or shipping cost and must be paid upon delivery. Tools For Electronics does not collect or remit import taxes on behalf of international customers. We recommend checking your local customs regulations before placing an order.

Export Compliance

Tools For Electronics complies with all applicable export control regulations, including the EU Dual-Use Regulation (EU) 2021/821 and international trade sanctions. Certain electronic tools and test equipment may be subject to export restrictions based on destination, end-user, or end-use. We conduct automated screening of all orders against restricted party lists and may require additional documentation (e.g., end-user statements) for high-risk shipments.

Product Compliance & Certifications

All products sold by Tools For Electronics meet relevant CE, RoHS, and REACH requirements for sale within the EU. Where applicable, items are also certified to IEC, EN, and other international safety standards. Technical documentation, including Declaration of Conformity (DoC) and safety data sheets (SDS), is available upon request. We do not sell equipment intended for medical, aerospace, or military applications unless explicitly stated.

Packaging & Environmental Responsibility

Our packaging is designed to minimize environmental impact while ensuring product safety during transit. We use recyclable cardboard, biodegradable void fill, and avoid unnecessary plastic where possible. Tools For Electronics complies with the EU Packaging and Packaging Waste Directive (94/62/EC) and supports the circular economy through responsible sourcing and waste reduction initiatives.

Returns & Warranty Logistics

Customers may return unused, undamaged items within 30 days for a full refund or exchange. Return shipping costs are the responsibility of the customer unless the item is defective or incorrect. All warranty claims are handled in accordance with the EU Consumer Sales Directive. Repairs or replacements are processed through authorized service partners within the EU, with return shipping provided for covered claims.

Data Privacy & GDPR Compliance

Tools For Electronics processes customer data in full compliance with the General Data Protection Regulation (GDPR). Personal and transactional data is encrypted, stored securely, and used solely for order fulfillment, customer support, and legal compliance. Customers have the right to access, correct, or request deletion of their data at any time through our privacy portal.

Restricted Items & Prohibited Uses

Certain tools, such as high-voltage test equipment, signal generators, or items with cryptographic functions, may be restricted or prohibited in some countries. It is the customer’s responsibility to ensure that purchased items comply with local laws and regulations. Tools For Electronics reserves the right to cancel or block orders that violate export controls or involve prohibited end-uses, such as surveillance, weapons development, or unauthorized network access.

In conclusion, sourcing tools for electronics requires a strategic approach that balances cost, quality, availability, and reliability. Utilizing a combination of online marketplaces (such as Digi-Key, Mouser, and RS Components), manufacturer direct channels, and specialty distributors ensures access to a wide range of components and tools. Leveraging comparison platforms and procurement software can streamline the selection process, improve inventory management, and reduce lead times. Additionally, building relationships with trusted suppliers and staying informed about market trends—such as component shortages or emerging technologies—enhances sourcing efficiency. Ultimately, effective electronics sourcing supports innovation, reduces downtime, and contributes to the overall success of engineering and manufacturing projects.