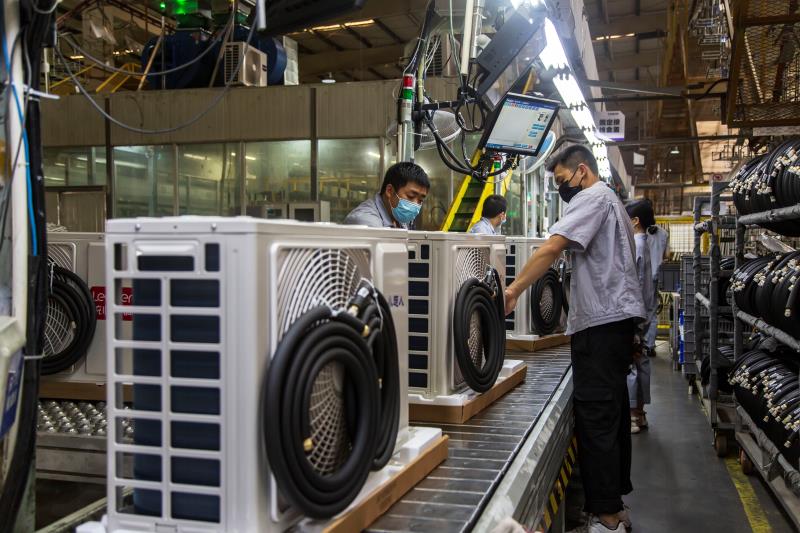

The automotive air conditioning (AC) manufacturing sector is experiencing robust expansion, driven by rising vehicle production, increasing demand for enhanced cabin comfort, and stringent regulations around fuel efficiency and emissions. According to Mordor Intelligence, the global automotive HVAC market was valued at USD 46.7 billion in 2023 and is projected to grow at a CAGR of 6.8% through 2029. This growth trajectory underscores the critical need for manufacturers to adopt advanced tools that improve precision, efficiency, and compliance across production and service workflows. From refrigerant recovery machines to automated climate control diagnostic software, the right tools not only enhance product performance but also support sustainability and regulatory adherence. In this data-driven landscape, AC manufacturers must leverage cutting-edge technologies to stay competitive and meet evolving market demands. Below are the top 10 tools empowering today’s leading automotive AC producers to innovate and scale.

Top 10 Tools For Ac Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 HVAC Tools Manufacturer

Domain Est. 1998

Website: jbind.com

Key Highlights: JB Industries provides PT Conversion, Manifold Vacuum HVAC, and other products, built in the USA, predominantly in our factory in Aurora, IL….

#2 Service Tools & Accessories

Domain Est. 1997

Website: mastercool.com

Key Highlights: Service Tools & Accessories · 80013. AUTOMOTIVE REFRIGERANT HOSE CUTTER · 85510. R134a CAN TAP VALVE – SCREW-ON MODEL (US Standard) · 85512. R134a 1/2” ACME-M SELF ……

#3 CPS Products

Domain Est. 1996

Website: cpsproducts.com

Key Highlights: CPS Products develops tools and equipment for HVAC/Refrigeration and Automotive systems. Find innovative solutions for professional service technicians….

#4 Bard Manufacturing

Domain Est. 1996

Website: bardhvac.com

Key Highlights: Bard offers high-quality commercial heating and cooling equipment to support a functional, comfortable environment….

#5 DiversiTech

Domain Est. 1996

Website: diversitech.com

Key Highlights: Tools · Tube Working · Service Tools · Sheet Metal Tools · Hand Tools · Condenser and Coil Cleaning Tools · Manifold Gauges and Hoses · Service Equipment ……

#6 Johnstone Supply

Domain Est. 1996

Website: johnstonesupply.com

Key Highlights: Johnstone Supply is a leading wholesale distributor for HVACR equipment, parts and supplies available and in-stock at local branches….

#7 HVAC Vacuum Pump

Domain Est. 1997

Website: fieldpiece.com

Key Highlights: One tool, one sensor, detects A3, A2L, A1 refrigerants and combustible gas leaks, fast. A heated-diode sensor on a flexible wand provides audio and visual cues….

#8 AC Pro Store

Domain Est. 2000

Website: store.acpro.com

Key Highlights: 30 Years of Serving HVAC Pros. Expert Service & tech support. Vast Inventory selection. Committed to your success. Join Now & View Your Special Pricing….

#9 P&M HVAC/R Tube Tools for Air Conditioning and Refrigeration …

Domain Est. 2002

Website: pnm-hvacr.com

Key Highlights: Main products include tubing expander tools, flaring swaging tool, gear bender, manifold gauges,service manifold and so on….

#10 Appion Tools

Domain Est. 2011

Website: appiontools.com

Key Highlights: Creating great products for HVAC/R technicians while continuously striving to improve the AC/R industry through innovation and education….

Expert Sourcing Insights for Tools For Ac

H2: 2026 Market Trends for Tools for AC

As we approach 2026, the market for air conditioning (AC) tools is undergoing substantial transformation driven by technological innovation, regulatory changes, and evolving consumer demands. Key trends shaping this sector include the rise of smart diagnostics, a shift toward eco-friendly refrigerants, increased demand for energy-efficient tools, and the growing influence of automation and digital integration.

-

Smart and Connected AC Tools

By 2026, smart tools equipped with IoT (Internet of Things) capabilities are expected to dominate the AC service market. Devices such as Bluetooth-enabled manifold gauges, wireless leak detectors, and cloud-connected vacuum pumps allow technicians to monitor system performance in real time, store service histories, and generate automated reports. Integration with mobile apps and cloud platforms enhances workflow efficiency and enables remote diagnostics, especially in commercial HVAC applications. -

Transition to Low-GWP Refrigerants

Regulatory pressures, particularly from the EPA’s AIM Act and global agreements like the Kigali Amendment, are accelerating the phase-down of high-global-warming-potential (GWP) refrigerants such as R-410A. This transition is driving demand for specialized tools compatible with next-generation refrigerants like R-32 and A2Ls (mildly flammable refrigerants). Manufacturers are responding with redesigned gauges, charging cylinders, and recovery units that ensure safety and precision during handling. -

Emphasis on Precision and Efficiency

The growing complexity of modern AC systems—especially inverter-driven and variable refrigerant flow (VRF) units—requires tools that offer greater accuracy. Digital micron meters, automated vacuum controllers, and precision electronic leak detectors are becoming standard in technician toolkits. Tools with auto-calibration and data logging features are increasingly favored to reduce human error and ensure compliance with service protocols. -

Expansion of Battery-Powered and Portable Tools

Cordless, battery-operated AC tools are gaining traction due to their portability and versatility. In 2026, expect wider adoption of rechargeable vacuum pumps, digital manifolds, and portable refrigerant scales. Advances in lithium-ion battery technology have extended run times and reduced charging cycles, making these tools ideal for on-site servicing in both residential and commercial settings. -

Growth in Preventive Maintenance Tools

With a rising focus on system longevity and energy savings, demand for tools that support preventive maintenance is increasing. Infrared thermal cameras, airflow meters, and smart pressure transducers are being used more frequently to conduct system health checks before major failures occur. These predictive tools are particularly popular among facility managers and HVAC service providers offering maintenance contracts. -

Training and Certification Integration

As AC systems become more advanced, there is a growing need for technician upskilling. In response, tool manufacturers are partnering with training institutions to offer tools bundled with certification modules. Augmented reality (AR)-assisted tools and interactive diagnostic interfaces are being developed to support on-the-job learning and improve first-time fix rates. -

Sustainability and Tool Lifecycle Management

Environmental sustainability is influencing tool design and disposal practices. By 2026, leading brands are expected to emphasize recyclable materials, modular designs for easy repair, and take-back programs. This aligns with broader industry goals of reducing the carbon footprint across the HVAC lifecycle, including maintenance and service operations.

In summary, the 2026 market for AC tools is characterized by smart connectivity, regulatory adaptation, and a strong push toward efficiency and sustainability. Companies that innovate in digital integration, safety for new refrigerants, and user-centric design will be best positioned to capture market share in this evolving landscape.

Common Pitfalls When Sourcing Tools for Air Conditioning (Quality and Intellectual Property)

Sourcing tools for air conditioning (AC) systems—whether for manufacturing, installation, maintenance, or repair—can be fraught with challenges, particularly concerning quality assurance and intellectual property (IP) protection. Overlooking these factors can lead to operational inefficiencies, safety hazards, legal disputes, and reputational damage. Below are the most common pitfalls to avoid.

Poor Quality Control and Substandard Materials

One of the most frequent issues when sourcing AC tools is receiving products made from inferior materials or with inconsistent manufacturing standards. Low-quality tools—such as manifold gauges, vacuum pumps, refrigerant scales, or leak detectors—may fail prematurely, deliver inaccurate readings, or pose safety risks. This is especially common when sourcing from suppliers offering significantly lower prices without verifiable quality certifications (e.g., ISO 9001).

Lack of Compliance with Industry Standards

AC tools must meet specific regional and international standards (e.g., CE, UL, RoHS) to ensure safety and performance. Sourcing tools that do not comply can result in regulatory penalties, rejected shipments, or unsafe working conditions. Tools that lack calibration traceability or fail to meet ANSI/ASHRAE guidelines may compromise system integrity and violate HVAC industry best practices.

Inadequate Supplier Verification

Failing to conduct due diligence on suppliers increases the risk of partnering with unreliable or unqualified manufacturers. Red flags include lack of transparency about production processes, refusal to provide samples, or absence of customer references. This can lead to delayed deliveries, inconsistent quality, and difficulty in resolving disputes.

Intellectual Property Infringement Risks

Sourcing tools from unauthorized or counterfeit manufacturers can expose companies to intellectual property (IP) violations. Replicas of branded diagnostic equipment, refrigerant handling tools, or proprietary software may infringe on patents, trademarks, or copyrights. Using or distributing such tools can result in legal action, product seizures, or damage to brand reputation.

Use of Counterfeit or Clone Tools with Embedded Software

Many modern AC tools include embedded software for diagnostics, data logging, or system calibration. Cloned or counterfeit versions may contain pirated software, which not only violates IP laws but can also introduce cybersecurity vulnerabilities. Additionally, these tools often lack updates or technical support, leading to compatibility issues and inaccurate diagnostics.

Insufficient Warranty and After-Sales Support

Tools sourced from unreliable vendors may come with weak or non-existent warranties. When issues arise, the lack of technical support, spare parts, or repair services can lead to costly downtime. This is especially critical for precision instruments used in commercial HVAC systems where tool reliability directly impacts service quality.

Failure to Protect Custom Tool Designs

When developing proprietary tools or modifying existing ones for specialized AC applications, companies risk IP theft if proper safeguards are not in place. This includes failing to patent designs, neglecting non-disclosure agreements (NDAs) with suppliers, or allowing third-party manufacturers to replicate and sell the tools independently.

Overlooking Long-Term Total Cost of Ownership

Focusing solely on initial purchase price can be misleading. Poor-quality tools may require frequent replacement, increase maintenance costs, or lead to errors during AC servicing. A low-cost tool that fails during a critical repair job can result in lost revenue and customer dissatisfaction, outweighing any upfront savings.

Avoiding these pitfalls requires thorough supplier vetting, adherence to quality standards, robust IP protection strategies, and a focus on long-term performance rather than short-term savings.

Logistics & Compliance Guide for Tools For AC

This guide outlines the essential logistics and compliance considerations for the import, distribution, and use of tools designed for air conditioning (AC) systems. Adhering to these standards ensures safety, regulatory compliance, and efficient operations across the supply chain.

Import and Customs Compliance

Ensure all tools entering your market comply with local import regulations. This includes accurate tariff classification (HS codes), proper documentation (commercial invoice, packing list, bill of lading), and adherence to country-specific import restrictions. Verify that tools meet labeling requirements (e.g., country of origin, voltage specifications). For electrical tools, confirm compliance with electromagnetic compatibility (EMC) and safety directives such as CE (Europe) or UL/ETL (North America) before customs clearance.

Product Safety and Certification Standards

All AC tools must meet recognized safety standards to protect users and ensure reliability. In the U.S., look for UL (Underwriters Laboratories) or ETL certification. In Europe, tools must carry the CE mark, indicating conformity with health, safety, and environmental protection standards. For refrigerant-handling tools, compliance with EPA Section 608 regulations (U.S.) or F-Gas regulations (EU) is mandatory. Regularly audit suppliers to confirm ongoing certification validity.

Hazardous Material Handling and Shipping

Some AC tools may contain or be used with hazardous substances (e.g., refrigerants, pressurized components). When shipping such tools, classify and package them according to IATA (air), IMDG (sea), or 49 CFR (U.S. ground) regulations if applicable. Provide Safety Data Sheets (SDS) for any hazardous components. Clearly label packages with appropriate hazard warnings and ensure staff are trained in handling and emergency response procedures.

Inventory Management and Traceability

Maintain a robust inventory system that tracks tool batches, serial numbers (if applicable), and certification documents. This traceability is crucial for recalls, warranty claims, and compliance audits. Store tools in a clean, dry, and secure environment to prevent damage and ensure longevity. Implement FIFO (First In, First Out) practices to manage stock rotation, especially for toolkits with perishable components like seals or lubricants.

Training and End-User Compliance

Ensure all end-users (technicians, installers) are trained in the proper use of AC tools, per manufacturer guidelines. Training should cover safety protocols, calibration procedures, and compliance with environmental regulations (e.g., refrigerant recovery and recycling). Distributors and retailers must provide access to user manuals and safety documentation. Maintain records of training completion where required by local law.

Environmental and Disposal Regulations

Dispose of obsolete or damaged AC tools in accordance with local environmental laws. Tools containing electronic components or batteries must be recycled through certified e-waste facilities. Refrigerant recovery equipment should never be discarded in regular waste streams. Stay updated on extended producer responsibility (EPR) regulations that may require take-back programs or reporting on product lifecycle management.

Recordkeeping and Audit Preparedness

Maintain comprehensive records for a minimum of five years, including supplier certifications, import documentation, safety test reports, training logs, and disposal receipts. These records support compliance during regulatory inspections or audits. Conduct internal audits annually to verify adherence to logistics and compliance protocols, and implement corrective actions as needed.

Conclusion on Sourcing Tools for Air Conditioning (AC) Systems:

Sourcing the right tools for air conditioning systems is crucial to ensuring efficient installation, maintenance, and repair operations. A comprehensive selection of tools—ranging from basic hand tools to advanced diagnostic equipment such as manifold gauges, vacuum pumps, refrigerant leak detectors, and digital multimeters—enhances technician accuracy, safety, and productivity. Investing in high-quality, reliable tools not only improves service outcomes but also reduces downtime and long-term costs.

Additionally, considering factors such as tool compatibility with different AC types (residential, commercial, HVAC-R), adherence to industry standards, and the availability of technical support and calibration services, enables organizations to build a sustainable and effective maintenance infrastructure. As the HVAC industry continues to evolve with eco-friendly refrigerants and smart technologies, staying updated with modern, precision tools becomes even more essential.

In conclusion, a strategic approach to sourcing AC tools—emphasizing quality, versatility, and technological relevance—ensures optimal performance, regulatory compliance, and customer satisfaction in today’s dynamic HVAC environment.