The global automotive parts manufacturing industry is experiencing steady growth, driven by rising vehicle production, increasing demand for fuel-efficient components, and advancements in automotive technology. According to Mordor Intelligence, the automotive components market was valued at USD 1.27 trillion in 2022 and is projected to grow at a CAGR of over 5.4% from 2023 to 2028. A key contributor to this expansion is the growing need for high-performance, reliable parts—particularly in emerging markets across Asia-Pacific, where manufacturers like those in Tong Yang are playing an increasingly vital role. As original equipment manufacturers (OEMs) seek cost-effective yet quality-driven supply chains, Tong Yang has emerged as a notable hub for automotive component production, with several manufacturers gaining recognition for precision engineering and scalable output. These companies are well-positioned within a market landscape shaped by electrification trends, stricter emission norms, and the integration of smart manufacturing practices—factors highlighted in recent analyses by Grand View Research as critical drivers of sector growth. The following list highlights the top six Tong Yang-based parts manufacturers demonstrating leadership through innovation, export volume, and strategic industry partnerships.

Top 6 Tong Yang Parts Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

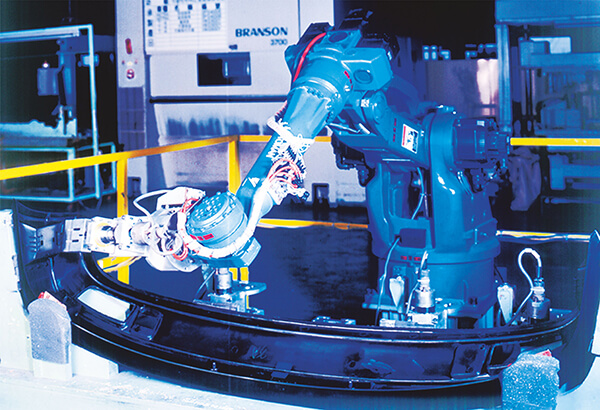

#1 Tong Yang Industry Co., Ltd.

Domain Est. 1998

Website: taiwantrade.com

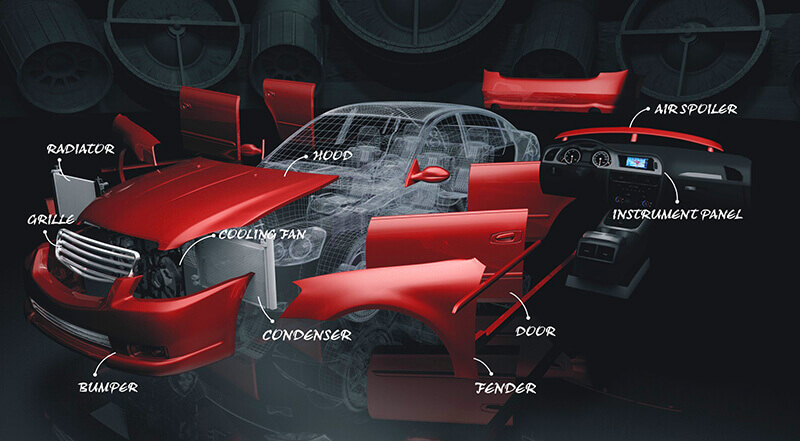

Key Highlights: Exporter, Manufacturer, OEM. Year Established 1956. Main Product Bumper, Grille, Door, Fender, Hood, Radiator, Fan, Condensor, Radiator support, Header panel, ……

#2 TONG YANG GROUP

Domain Est. 1986

Website: tyg.com.tw

Key Highlights: Tong Yang Group is the world’s largest manufacturer of auto repair parts.Mainly produces automobile bumper,instrument panel, fender, hood, radiator grille, ……

#3 About Tong Yang Industry Co Ltd (1319)

Domain Est. 1995

Website: ng.investing.com

Key Highlights: Tong Yang Industry Co., Ltd. engages in the manufacture and sale of parts, components, and models for automobile in Taiwan, China, the United States, ……

#4 Tong Yang Industry Co., Ltd. Approved to Use New CAPA …

Domain Est. 1997 | Founded: 1987

Website: autobpa.com

Key Highlights: “Tong Yang has participated in the CAPA Certification program since 1987, and we are happy to be able to support their continued growth with the ……

#5 Tong Yang Mulsan Agricultural Machinery Parts

Domain Est. 2005

Website: miralauto.com

Key Highlights: Miral Auto Camp Corp. supplies spare parts of Tong Yang Mulsan products such as tractor, combine harvester, rice transplanter, power tiller and etc….

#6 Tong Yang Hardware & Parts Sdn. Bhd.

Website: tongyanghardware.com

Key Highlights: Sarawak’s Trusted Excavator Parts Specialist. For over 30 years, we’ve been supplying quality excavator spare parts across Sarawak….

Expert Sourcing Insights for Tong Yang Parts

H2 2026 Market Trends Analysis for Tong Yang Parts

As we approach the second half of 2026, Tong Yang Parts—South Korea’s prominent automotive components manufacturer—finds itself navigating a rapidly evolving global automotive landscape shaped by technological innovation, shifting regulatory environments, and changing consumer demands. Below is an analysis of key market trends influencing Tong Yang Parts during H2 2026.

1. Accelerated Shift Toward Electrification

The global automotive industry continues its aggressive transition to electric vehicles (EVs), with EV adoption rates surpassing 40% in major markets such as Europe, China, and North America by H2 2026. For Tong Yang Parts, this shift presents both challenges and opportunities.

- Impact: Traditional internal combustion engine (ICE) component demand is declining, particularly for parts like fuel systems and exhaust manifolds.

- Strategic Response: Tong Yang has expanded its product portfolio to include EV-specific components such as electric compressors, battery cooling systems, and power electronics housings. Partnerships with Korean EV OEMs like Hyundai and Kia are driving growth in this segment.

- Outlook: Revenue from EV-related components is projected to account for over 35% of total sales by Q4 2026, up from 20% in 2024.

2. Supply Chain Resilience and Localization

Geopolitical tensions and trade policy shifts—including U.S.-China decoupling and EU carbon border adjustments—have accelerated supply chain localization.

- Trend: Automakers are prioritizing regional sourcing to mitigate risks and reduce lead times.

- Tong Yang’s Position: The company has strengthened its manufacturing presence in Mexico and Eastern Europe to serve North American and European OEMs.

- H2 2026 Insight: Over 60% of Tong Yang’s exports now originate from overseas plants, reducing dependency on South Korean production and enhancing competitiveness in key markets.

3. Sustainability and Carbon Neutrality Pressures

Regulatory mandates, particularly the EU’s Euro 7 standards and South Korea’s 2050 Carbon Neutrality goals, are pushing suppliers to reduce emissions across their operations.

- Initiatives: Tong Yang Parts has invested in green manufacturing processes, including energy-efficient die-casting and recycled aluminum use.

- Certifications: Achieved ISO 14064 and Science-Based Targets initiative (SBTi) validation in early 2026.

- Market Advantage: Sustainability compliance is becoming a procurement prerequisite; Tong Yang’s early adoption strengthens its position with environmentally conscious OEMs.

4. Growth in ADAS and Smart Mobility Components

Advanced Driver Assistance Systems (ADAS) and vehicle connectivity are becoming standard features even in mid-tier vehicles.

- Opportunity: Tong Yang Parts has developed lightweight structural components with embedded sensor integration capabilities (e.g., radar-compatible bumpers and sensor mounts).

- Collaboration: Joint development projects with Tier 1 suppliers like Bosch and ZF are expected to yield commercial contracts by Q3 2026.

- Projection: Smart mobility-related product lines could contribute up to 15% of incremental revenue in H2 2026.

5. Commodities and Inflation Management

While global inflation has stabilized in H2 2026, aluminum and copper prices remain volatile due to renewable energy sector demand.

- Challenge: Input cost fluctuations pressure margins.

- Mitigation: Tong Yang has implemented long-term hedging contracts and vertical integration in key materials sourcing.

- Result: Gross margins have stabilized around 18–19%, slightly improved from 2025 levels due to operational efficiencies.

6. Consolidation in the Tier 2 Supplier Ecosystem

Market pressures are driving consolidation among mid-tier automotive suppliers.

- Trend: Smaller competitors are being acquired or exiting the market.

- Tong Yang’s Strategy: The company is exploring strategic M&A opportunities in Southeast Asia to expand its footprint in emerging EV markets.

- H2 2026 Outlook: Potential acquisition of a Vietnamese auto parts manufacturer is under review to enhance regional integration.

Conclusion: Strategic Positioning for Growth

In H2 2026, Tong Yang Parts is well-positioned to capitalize on the structural transformation of the automotive industry. By pivoting toward electrification, enhancing global supply chain agility, and investing in sustainability and smart technologies, the company is transitioning from a traditional component supplier to a forward-looking mobility solutions provider.

Key Recommendations for Tong Yang Parts:

– Accelerate R&D in thermal management systems for next-gen EVs.

– Expand joint ventures with battery and semiconductor firms.

– Leverage digital twins and AI in manufacturing to improve yield and reduce waste.

With strong execution, Tong Yang Parts is poised to achieve double-digit revenue growth in 2026 and solidify its role in the future of mobility.

Common Pitfalls Sourcing Tong Yang Parts (Quality, IP)

Quality Inconsistencies

One of the primary risks when sourcing Tong Yang parts—especially through third-party or gray-market suppliers—is inconsistent quality. While Tong Yang Moolsan is a reputable South Korean manufacturer known for engines and power equipment components, parts labeled as “Tong Yang” may not always be genuine or manufactured to original specifications. Counterfeit or substandard replicas often circulate in global supply chains, leading to premature failures, poor performance, and increased maintenance costs. Buyers should verify authenticity through authorized distributors and request certification or batch testing data to mitigate this risk.

Intellectual Property (IP) and Counterfeiting Concerns

Sourcing Tong Yang parts carries significant intellectual property risks, particularly when dealing with unofficial suppliers or low-cost manufacturers in regions with lax IP enforcement. Many components marketed as “compatible” or “equivalent” Tong Yang parts may infringe on patented designs or trademarks. Using such parts can expose companies to legal liability, especially in regulated industries or when supplying to OEMs with strict compliance requirements. Additionally, counterfeit parts may lack proper documentation, making traceability and warranty claims difficult. To avoid IP violations, procure only through authorized channels and confirm the supplier’s legitimacy and compliance history.

Logistics & Compliance Guide for Tong Yang Parts

This guide outlines the essential logistics procedures and compliance requirements for handling Tong Yang parts to ensure efficient operations, regulatory adherence, and customer satisfaction.

Shipping and Receiving Procedures

All inbound and outbound shipments of Tong Yang parts must follow standardized processes. Use approved freight carriers with experience in automotive components. Shipments must include a packing slip, bill of lading, and commercial invoice (for international shipments) with accurate part numbers, quantities, and descriptions. Receiving staff must verify shipment contents against purchase orders and inspect for damage before acceptance.

Inventory Management

Maintain accurate real-time inventory tracking using an approved ERP or warehouse management system (WMS). Conduct regular cycle counts and annual physical inventories. Store Tong Yang parts in designated, labeled areas with proper environmental controls (temperature, humidity) where required. Ensure first-in, first-out (FIFO) rotation for parts with expiration or shelf-life considerations.

Packaging and Labeling Standards

Ship Tong Yang parts in manufacturer-recommended packaging to prevent damage. Labels must include part number, description, quantity, batch/lot number (where applicable), date of packaging, and handling symbols (e.g., “Fragile,” “This Side Up”). For international shipments, include harmonized system (HS) codes and country of origin.

Import and Export Compliance

Comply with all local and international trade regulations when shipping across borders. Obtain required export licenses or permits for controlled goods. Accurately classify Tong Yang parts under the appropriate HS code. Ensure proper documentation, including commercial invoices, certificates of origin, and export declarations. Adhere to U.S. EAR, EU dual-use regulations, or other relevant export control regimes as applicable.

Customs Documentation

Prepare complete and accurate customs documentation for all cross-border movements. This includes commercial invoices with declared value, packing lists, and any required permits or certificates (e.g., Certificate of Conformity). Misdeclaration of value, origin, or classification may result in delays, fines, or seizure of goods.

Regulatory and Safety Compliance

Ensure all Tong Yang parts meet relevant safety and environmental regulations in the destination market (e.g., REACH, RoHS, EPA standards). Maintain records of material safety data sheets (MSDS/SDS) for applicable components. Follow hazardous materials handling protocols if shipping regulated substances.

Record Retention

Retain all logistics and compliance documentation—including shipping records, customs filings, compliance certifications, and inventory logs—for a minimum of seven years or as required by local regulations. Digital records must be securely backed up and accessible for audits.

Audit and Continuous Improvement

Conduct regular internal audits of logistics and compliance processes. Address non-conformities promptly and implement corrective actions. Stay updated on changes in trade regulations, carrier requirements, and Tong Yang’s policies to ensure ongoing compliance and operational efficiency.

Conclusion for Sourcing Tong Yang Parts:

In conclusion, sourcing Tong Yang parts presents a viable and cost-effective solution for acquiring high-quality components, particularly in industries such as power equipment, outdoor machinery, and small engines. Tong Yang, known for its reliable manufacturing standards and broad product range, offers parts that meet OEM specifications, ensuring compatibility and performance. However, successful sourcing requires due diligence in selecting authorized distributors or reputable suppliers to avoid counterfeit products and ensure authenticity. Additionally, considerations such as lead times, warranty support, and after-sales service should be factored into the procurement strategy. By establishing strong supply chain partnerships and maintaining quality control measures, businesses can effectively integrate Tong Yang parts into their operations, balancing efficiency, reliability, and cost savings.