The global titanium market is experiencing robust growth, driven by rising demand across aerospace, medical, industrial, and automotive sectors. According to Grand View Research, the global titanium market size was valued at USD 24.6 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2024 to 2030. This upswing is fueled by titanium’s exceptional strength-to-density ratio, corrosion resistance, and biocompatibility—properties that make it indispensable in high-performance applications. As demand intensifies, cost-efficiency in titanium material production has become a pivotal factor for manufacturers and buyers alike. In this landscape, identifying leading titanium producers who balance quality with competitive pricing is critical. Based on production scale, material grades offered, geographic reach, and cost-competitiveness, the following nine manufacturers stand out as key contributors to the evolving titanium supply chain.

Top 9 Titanium Material Cost Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Sumitomo Corporation and OSAKA Titanium technologies Share the …

Domain Est. 1995

Website: sumitomocorp.com

Key Highlights: OTC is a manufacturer that produces titanium at source: we extract titanium from ore through smelting. In 1952, we became the first company ……

#2 Metals and metal products : Mid

Domain Est. 1997

Website: bls.gov

Key Highlights: Producer Price Index – Metals and metal products (not seasonally adjusted data)…

#3 Rio Tinto Iron and Titanium Quebec operations

Domain Est. 1997 | Founded: 1950

Website: riotinto.com

Key Highlights: Established in Sorel-Tracy since 1950, Rio Tinto Iron and Titanium Quebec Operations is a leading manufacturer of feedstocks for the titanium dioxide markets, ……

#4 Tronox

Domain Est. 2004

Website: tronox.com

Key Highlights: Tronox mines and processes titanium ore, zircon, rare earths and other materials, and manufactures titanium dioxide pigment….

#5 ATI Materials

Domain Est. 2013

Website: atimaterials.com

Key Highlights: The collective commitments cover nickel and titanium, materials critical to premium manufacturers as they ramp production to meet increasing demand….

#6 Chemours

Domain Est. 2014

Website: chemours.com

Key Highlights: Ti-Pure™ is the world’s largest manufacturer of titanium dioxide products. Chemical, chlor-alkali, transportation, and other industries use Nafion™ products ……

#7 Titanium Suppliers

Domain Est. 1998

Website: americanelements.com

Key Highlights: Titanium qualified commercial & research quantity preferred supplier. Buy at competitive price & lead time. In-stock for immediate delivery….

#8 Advanced Structural Technologies

Domain Est. 2016

Website: astforgetech.com

Key Highlights: AST has completed challenging metal spinning projects in complex shapes using aluminum, copper, titanium, stainless, and other alloys for our space and ……

#9 Tokyo Titanium

Website: en.tokyo-titanium.co.jp

Key Highlights: We are the only supplier that stock titanium alloy in Japan. We have different sizes available. Round Bar (Alloy) Compared to other metals, titanium alloy is ……

Expert Sourcing Insights for Titanium Material Cost

H2: 2026 Market Trends for Titanium Material Cost

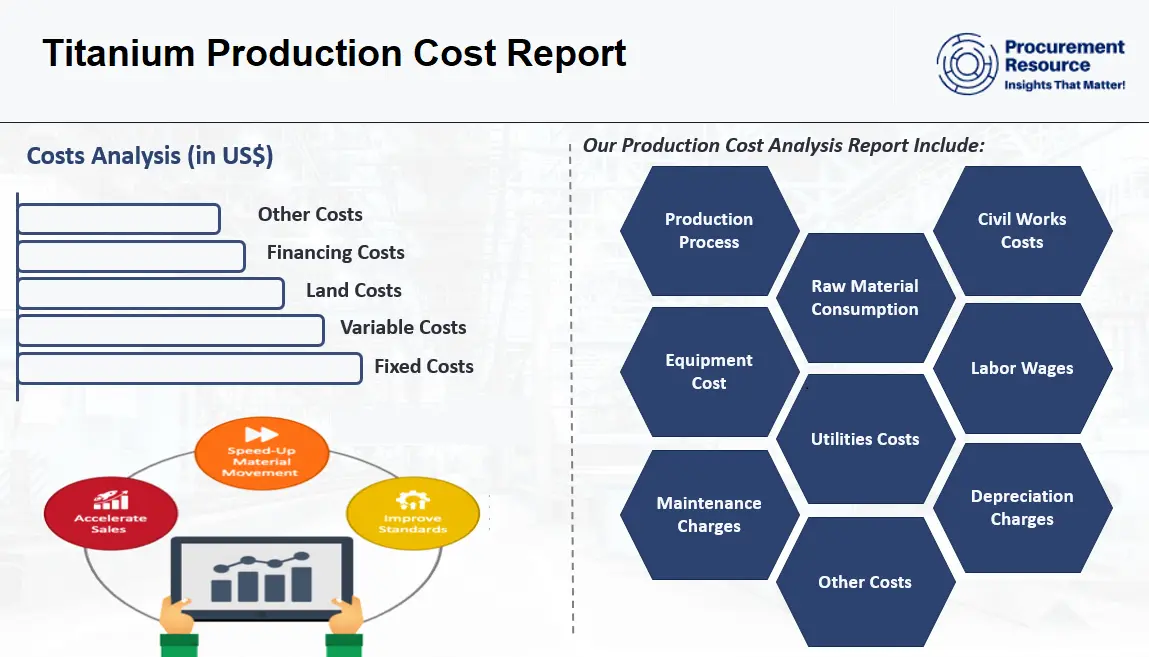

As the global industrial landscape evolves, the titanium material market is poised for significant shifts by 2026, driven by supply chain dynamics, technological advancements, and rising demand across key sectors. The cost of titanium is expected to experience moderate upward pressure over the next few years, influenced by several interconnected trends.

1. Rising Demand in Aerospace and Defense

The aerospace and defense industries remain the largest consumers of titanium, particularly high-grade alloys used in jet engines, airframes, and military platforms. With major aircraft manufacturers like Boeing and Airbus ramping up production to meet post-pandemic travel demand and next-generation aircraft development (e.g., sustainable aviation initiatives), titanium consumption is projected to grow at a CAGR of 5–6% through 2026. This sustained demand will support higher price levels, especially for aerospace-grade titanium sponge and mill products.

2. Expansion in Electric Vehicles and Energy Sectors

While traditionally limited by cost, titanium is gaining traction in electric vehicles (EVs) and renewable energy systems. Its corrosion resistance and strength-to-weight ratio make it ideal for hydrogen fuel cells, battery components, and offshore wind turbine structures. As green energy infrastructure scales globally, demand for titanium in these applications is expected to rise, contributing to tighter supply and upward pressure on prices.

3. Supply Chain Constraints and Geopolitical Factors

Titanium production is concentrated in a few key regions—primarily China, Russia, Japan, and Kazakhstan. Geopolitical tensions, export controls, and logistical disruptions could constrain the supply of titanium sponge, the primary raw material. China, the world’s largest producer, has implemented stricter environmental regulations and energy efficiency standards, potentially limiting output growth. These supply-side challenges are likely to contribute to cost volatility and modest price increases by 2026.

4. Advancements in Production Technology

Efforts to reduce titanium costs through innovative extraction and manufacturing methods—such as the FFC Cambridge process, additive manufacturing (3D printing), and recycling improvements—are gaining momentum. While these technologies are not yet widespread, their gradual adoption could help moderate long-term price increases by improving yield and reducing waste. However, in the 2026 timeframe, these benefits are likely to offset only a portion of overall cost growth.

5. Price Forecast

Based on current trajectories, the average price of titanium sponge is projected to rise from approximately $7.50–$8.00 per kilogram in 2023 to $9.00–$10.00 per kilogram by 2026. Mill products (e.g., sheet, bar, and tube) are expected to follow a similar trend, with increases of 3–5% annually, depending on grade and application.

Conclusion

By 2026, titanium material costs are expected to trend upward due to strong demand from aerospace, emerging applications in clean energy, and supply-side constraints. While technological innovations may help temper price growth, overall market conditions point to a tighter, more expensive titanium market. Stakeholders should focus on supply chain resilience, material substitution strategies where feasible, and investment in recycling to mitigate cost risks.

Common Pitfalls Sourcing Titanium Material Cost (Quality, IP)

Sourcing titanium materials involves significant cost considerations that extend beyond simple price per kilogram. Overlooking key factors related to quality and intellectual property (IP) can lead to unexpected expenses, project delays, and legal risks. Below are common pitfalls to avoid:

Underestimating Quality Variability and Certification Costs

Titanium quality varies significantly based on grade, purity, processing method, and supplier standards. Buyers often assume all titanium is equivalent, but aerospace-grade (e.g., Ti-6Al-4V) differs substantially from commercial or industrial grades in performance and cost. Failing to specify required certifications (e.g., AMS, ASTM, NADCAP) can result in receiving non-compliant material that fails inspection, leading to rework, scrap, or production delays. The cost of third-party testing, mill test reports, and traceability documentation should be factored into sourcing decisions.

Ignoring the Impact of Supply Chain Transparency

Many titanium suppliers source material from multiple mills or intermediaries, creating opacity in origin and processing history. This lack of transparency can conceal substandard production practices or recycled content not suitable for high-performance applications. Without full supply chain visibility, companies risk material inconsistencies, warranty issues, and potential compliance failures—especially in regulated industries like aerospace or medical devices. Ensuring auditable traceability from ingot to finished product is essential but often undervalued in initial cost assessments.

Overlooking Intellectual Property and Licensing Requirements

Certain titanium alloys, particularly advanced or proprietary formulations (e.g., Ti-10V-2Fe-3Al, Beta-C), are protected by patents or technical data rights. Unauthorized use or sourcing of such materials without proper licensing can expose buyers to IP infringement claims, fines, or supply disruptions. Additionally, some suppliers require licensing agreements for specific alloy production, adding hidden costs beyond material price. Failing to verify IP status during sourcing can lead to legal exposure and costly redesigns.

Assuming Global Price Uniformity

Titanium prices fluctuate based on geography, trade policies, and geopolitical factors. Relying solely on low-cost international suppliers may seem economical but can introduce risks related to import tariffs, customs delays, and inconsistent quality control. Moreover, transportation, insurance, and import duties can erode initial savings. Buyers must assess total landed cost—including compliance with export controls (e.g., ITAR)—rather than focusing on unit price alone.

Neglecting Long-Term Supplier Qualification

Selecting a supplier based only on short-term pricing often leads to reliability issues. Titanium requires stringent process controls; unqualified suppliers may lack the metallurgical expertise or quality systems needed for consistent output. Investing time in qualifying suppliers through audits and sample testing reduces long-term risk and cost, even if initial prices are higher. Poor qualification increases the likelihood of defects, recalls, and supply chain disruptions.

Logistics & Compliance Guide for Titanium Material Cost

Understanding and managing the logistics and compliance aspects associated with titanium materials is critical to controlling overall material costs. This guide outlines key considerations that directly influence procurement, transportation, handling, and regulatory compliance, all of which contribute to the total cost of titanium.

Procurement and Sourcing Strategy

Sourcing titanium from reliable, certified suppliers is essential to ensure material quality and compliance with international standards. Strategic sourcing can reduce material costs through long-term contracts, volume discounts, and partnerships with suppliers who adhere to environmental and ethical mining practices. Consider geopolitical factors, as titanium feedstock (e.g., ilmenite, rutile) is concentrated in a few countries, potentially affecting supply chain stability and pricing.

International Trade Regulations and Import/Export Compliance

Titanium and titanium-containing products may be subject to export controls, especially if used in aerospace, defense, or dual-use applications. Compliance with regulations such as the International Traffic in Arms Regulations (ITAR) or the Export Administration Regulations (EAR) in the U.S. is mandatory. Failure to comply can result in delays, fines, or shipment seizures, increasing logistics costs. Accurate classification under Harmonized System (HS) codes ensures correct duty assessment and avoids customs complications.

Transportation and Handling Requirements

Titanium in raw or semi-finished forms (ingots, sheets, powders) requires careful handling due to its value and sensitivity to contamination. Secure, insured shipping is necessary to prevent theft or damage. For titanium powder—common in additive manufacturing—specialized packaging and transport compliant with hazardous materials regulations (e.g., UN 3170 for metal powders) may apply, increasing logistics complexity and cost. Air freight may be faster but significantly more expensive than sea freight; cost-benefit analysis is essential.

Storage and Inventory Management

Titanium materials must be stored in dry, corrosion-controlled environments to prevent oxidation and contamination. Proper inventory management, including just-in-time (JIT) practices, reduces carrying costs and minimizes the risk of obsolescence. For high-purity or aerospace-grade titanium, segregated storage and traceability systems are required to meet quality standards like AS9100 or NADCAP.

Regulatory and Environmental Compliance

Titanium production involves energy-intensive processes and environmental impacts. Compliance with environmental regulations (e.g., EPA standards, REACH in the EU) affects supplier costs, which are passed down the supply chain. End-of-life recycling of titanium is encouraged and regulated in many regions; proper documentation of recycling and material traceability can reduce compliance risks and support sustainability goals, potentially lowering long-term costs.

Certification and Documentation

Each titanium shipment must be accompanied by proper documentation, including Material Test Reports (MTRs), Certificates of Conformance (CoC), and origin certificates. These documents verify compliance with industry standards (e.g., ASTM, AMS) and are essential for audits, quality control, and customs clearance. Incomplete or inaccurate documentation can lead to delays and additional inspection fees.

Risk Mitigation and Total Cost of Ownership

Logistics and compliance issues contribute significantly to the total cost of ownership of titanium materials. Proactive risk management—such as diversifying suppliers, investing in supply chain visibility tools, and training staff on regulatory requirements—helps avoid unplanned expenses. Monitoring regulatory changes and market trends enables organizations to anticipate cost fluctuations and adjust procurement strategies accordingly.

By addressing these logistics and compliance factors systematically, companies can minimize unexpected costs, ensure uninterrupted supply, and maintain the integrity of their titanium material sourcing operations.

In conclusion, sourcing titanium material involves a careful evaluation of multiple cost factors, including raw material prices, processing expenses, supplier location, market demand, and supply chain logistics. While titanium offers exceptional strength-to-weight ratio, corrosion resistance, and performance in extreme environments, its high extraction and refinement costs contribute to a significantly higher price point compared to alternative metals like aluminum or steel. Strategic sourcing—such as building long-term supplier relationships, exploring global markets, and considering recycled titanium—can help mitigate expenses. Ultimately, a comprehensive cost-benefit analysis tailored to the specific application is essential to determine whether the performance advantages of titanium justify its procurement costs. Effective supplier vetting, volume negotiation, and awareness of market trends are key to optimizing titanium sourcing strategies and ensuring cost-efficiency without compromising quality.