The global titanium forging market is experiencing robust growth, driven by increasing demand from aerospace, defense, medical, and industrial sectors. According to Grand View Research, the global titanium market size was valued at USD 5.3 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. A significant portion of this growth is attributed to titanium forging, which offers superior strength-to-density ratios, corrosion resistance, and performance under extreme temperatures—critical attributes for high-stress applications. Mordor Intelligence further supports this trajectory, projecting a CAGR of over 6% for the titanium market through 2029, with aerospace and defense as the dominant end-use segments. As demand for lightweight, high-performance materials rises, particularly in commercial aviation and next-generation defense platforms, the need for reliable, precision titanium forging manufacturers has never been greater. In this evolving landscape, a select group of global suppliers have emerged as leaders in quality, innovation, and production capacity—shaping the future of advanced manufacturing.

Top 10 Titanium Forging Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

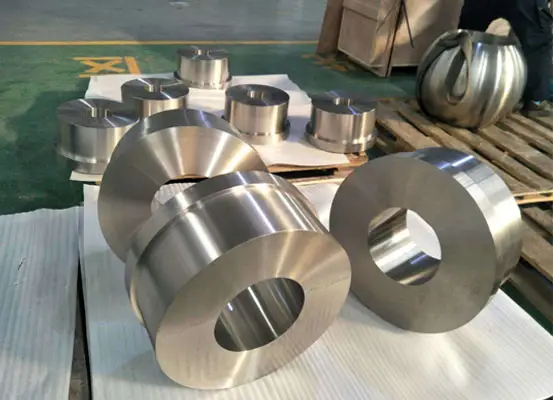

#1 China OEM Customized Free Sample Titanium Forging …

Domain Est. 2014

Website: ystitanium.com

Key Highlights: We’re professional Titanium Forging manufacturers and suppliers in China, specialized in providing OEM Customized Titanium Forging with competitive price….

#2 Forged Parts

Domain Est. 1994

Website: steelforge.com

Key Highlights: All Metals & Forge Group manufactures open die forgings and seamless rolled rings in our 160,000 S.F. · AMFG is an ISO9001, AS9100 manufacturer ……

#3 Titanium Forgings

Domain Est. 1995

Website: laube.com

Key Highlights: Our titanium forgings are trusted for components such as airframes, medical implants (titanium for joint replacements), marine hardware, and industrial ……

#4 Titanium

Domain Est. 2013

Website: atimaterials.com

Key Highlights: ATI is a leading global supplier and manufacturer of titanium and titanium alloy products. We produce high strength commercially pure titanium and titanium ……

#5 Titanium Forging

Domain Est. 2014

Website: usa-titanium.com

Key Highlights: Titanium and titanium alloy flanges are used as pipe connections for chemical and petrochemical equipment. It has low density and performs impressively in ……

#6 Titanium Alloy Forging

Domain Est. 1996

Website: titanium.net

Key Highlights: The titanium alloy forging process is widely used in the aviation and aerospace manufacturing industries….

#7 Titanium Forgings

Domain Est. 1997

Website: scotforge.com

Key Highlights: RevMethods Tracking – GTM Custom HTML Tag….

#8 Perryman Company

Domain Est. 1999

Website: perrymanco.com

Key Highlights: A global leader in the manufacturing of titanium products. And, through our Forge & Fabrication contract manufacturing operations, we provide high-quality ……

#9 TMS Titanium

Domain Est. 2014

Website: tmstitanium.com

Key Highlights: TMS Titanium is a supplier and stocking distributor of titanium mill products. We stock the highest quality products, including sheet, plate, block, bar, ……

#10 Titanium Forgings

Website: titalia.eu

Key Highlights: Titanium specialists since 15 years. We select, distribute, process and forge maximum quality titanium with expertise and passion….

Expert Sourcing Insights for Titanium Forging

H2: Projected Market Trends in Titanium Forging for 2026

The global titanium forging market is poised for substantial growth by 2026, driven by increasing demand across high-performance industries such as aerospace, defense, medical, and energy. Several key trends are expected to shape the market landscape during this period.

-

Aerospace and Defense as Primary Growth Drivers

The aerospace and defense sectors will remain the dominant consumers of titanium forgings, accounting for over 60% of market demand. The continued production ramp-up of commercial aircraft—including Boeing and Airbus next-generation fleets—and the modernization of military platforms (e.g., stealth fighters, unmanned systems) will drive demand for high-strength, lightweight titanium components. Titanium’s excellent strength-to-density ratio and corrosion resistance make it ideal for critical parts such as landing gear, engine discs, and airframes. -

Advancements in Forging Technologies

By 2026, investment in advanced forging techniques—such as isothermal and precision near-net-shape forging—will increase significantly. These technologies reduce material waste, lower post-processing costs, and improve mechanical properties, making them especially attractive for complex aerospace components. Automation and digital twin integration in forging processes are also expected to enhance consistency and reduce lead times. -

Geopolitical Shifts and Supply Chain Localization

Growing geopolitical tensions and supply chain vulnerabilities are prompting manufacturers to localize titanium forging capabilities. Countries such as the United States, India, and members of the European Union are investing in domestic titanium production and forging infrastructure to reduce reliance on single-source suppliers. This trend is expected to spur regional market growth and encourage partnerships between raw material suppliers and forging companies. -

Rising Adoption in Medical and Industrial Applications

Beyond aerospace, the medical sector is emerging as a high-growth area for titanium forgings, particularly in orthopedic implants and surgical instruments. The biocompatibility and durability of titanium make it ideal for long-term medical devices. Additionally, the oil & gas and power generation industries are increasingly using titanium forgings in high-pressure, corrosive environments, especially in offshore and subsea applications. -

Sustainability and Recycling Initiatives

Environmental concerns and regulatory pressures are pushing the industry toward sustainable practices. By 2026, closed-loop recycling of titanium scrap will become more widespread, reducing energy consumption and raw material dependency. Forging companies are expected to adopt greener manufacturing processes and pursue certifications to meet ESG (Environmental, Social, and Governance) standards. -

Price Volatility and Raw Material Challenges

Despite growth, the market may face headwinds from fluctuating titanium sponge prices and constrained supply chains. Geopolitical factors, energy costs, and mining limitations in key producing regions (e.g., China, Japan, and Kazakhstan) could lead to price volatility. As a result, long-term supply agreements and vertical integration strategies will become more common among major players.

In summary, the titanium forging market in 2026 will be characterized by strong demand from aerospace and defense, technological innovation, regionalization of supply chains, and expanding applications in healthcare and energy. Companies that invest in advanced manufacturing, sustainability, and supply chain resilience will be best positioned to capitalize on emerging opportunities.

Common Pitfalls Sourcing Titanium Forging: Quality and Intellectual Property Risks

Sourcing titanium forgings—critical components in aerospace, medical, and high-performance industrial applications—exposes buyers to significant risks if not managed carefully. Two major areas of concern are quality inconsistencies and intellectual property (IP) exposure. Failing to address these pitfalls can lead to safety issues, regulatory non-compliance, financial losses, and long-term competitive disadvantages.

Quality-Related Pitfalls

-

Inconsistent Material Traceability

Titanium’s performance is highly dependent on its chemical composition and metallurgical history. A common pitfall is sourcing from suppliers who lack rigorous material traceability systems, making it difficult to verify the alloy grade, heat number, or origin of raw material. This increases the risk of receiving substandard or counterfeit material, potentially leading to part failure in service. -

Non-Compliance with Industry Specifications

Industries like aerospace (e.g., AMS, ASTM, NADCAP) and medical (e.g., ASTM F67/F136) impose strict standards on titanium forgings. Suppliers may claim compliance but lack proper certification, testing, or process controls. Relying on self-reported certifications without independent audits can result in non-conforming parts that fail inspection or in-service performance. -

Inadequate Forging Process Controls

Titanium requires precise temperature control, forging techniques, and post-forging heat treatments. Suppliers with outdated equipment or insufficient process monitoring may produce forgings with internal defects such as porosity, laps, or inconsistent grain structure. These flaws can compromise mechanical properties and fatigue life. -

Insufficient Non-Destructive Testing (NDT)

Comprehensive NDT—such as ultrasonic, radiographic, or fluorescent penetrant inspection—is essential for detecting internal and surface defects. Some suppliers may perform minimal or poorly documented testing to cut costs, leaving critical flaws undetected until after delivery or during final assembly. -

Poor Surface Finish and Dimensional Accuracy

Titanium is difficult to machine, so forged near-net shapes are preferred. If the forging lacks dimensional consistency or has surface defects (e.g., scale, cracking), it increases scrap rates and machining costs. Suppliers without tight process control may deliver parts requiring costly rework or rejection.

Intellectual Property-Related Pitfalls

-

Lack of IP Protection Agreements

Sharing detailed technical drawings, material specifications, or proprietary designs with forging suppliers without strong contractual IP protections exposes companies to misuse or unauthorized replication. This is especially risky when sourcing from regions with weaker IP enforcement. -

Reverse Engineering and Technology Leakage

Sophisticated titanium forgings often embody years of R&D. Unscrupulous suppliers may reverse engineer parts or use process knowledge gained during production to serve competitors. Without clear contractual prohibitions and monitoring, this can erode a company’s technological edge. -

Unauthorized Subcontracting

A key risk is suppliers subcontracting work to unapproved third parties without the buyer’s knowledge. This breaks the chain of control over both quality and IP, increasing the likelihood of IP theft, inconsistent production, and loss of auditability. -

Inadequate Control Over Tooling and Fixtures

Custom dies, molds, and tooling used in titanium forging are often company-specific assets. Failure to retain ownership and control over these tools—especially when manufactured offshore—can enable unauthorized production or replication by the supplier or its affiliates. -

Weak Data Security and Digital IP Exposure

Modern forging processes involve CAD/CAM files, simulation data, and process parameters shared digitally. Suppliers with poor cybersecurity practices may expose sensitive design data to breaches or unauthorized access, risking IP leakage even without malicious intent.

Mitigation Strategies

- Conduct thorough supplier audits, including on-site assessments of quality systems and IP safeguards.

- Require full material traceability with certified mill test reports.

- Enforce compliance with industry standards through third-party certifications (e.g., NADCAP).

- Implement robust contractual agreements covering IP ownership, confidentiality, and restrictions on subcontracting.

- Retain ownership of tooling and require secure handling of digital design data.

- Perform regular quality inspections and batch testing, even with trusted suppliers.

By proactively addressing these quality and IP pitfalls, companies can ensure reliable supply, maintain regulatory compliance, and protect their competitive advantage when sourcing titanium forgings.

Logistics & Compliance Guide for Titanium Forging

Titanium forging presents unique logistical and regulatory challenges due to the material’s high value, specialized processing requirements, and stringent industry standards. This guide outlines key considerations for the safe, efficient, and compliant handling, transportation, and documentation of titanium forgings across the supply chain.

Material Handling and Storage

Titanium is highly reactive in its raw and semi-finished states, especially at elevated temperatures. Proper handling and storage are critical to prevent contamination and maintain material integrity.

- Clean Environment: Store titanium forgings in a clean, dry, and climate-controlled area free from dust, moisture, and chemical fumes. Avoid contact with carbon steel or iron particles, which can lead to contamination and subsequent corrosion.

- Segregation: Keep titanium separate from other metals, particularly ferrous materials, to prevent cross-contamination. Use dedicated racks, containers, or storage zones clearly marked for titanium.

- Handling Equipment: Use non-ferrous tools (e.g., brass, plastic, or stainless steel) and lifting devices fitted with protective coatings or slings to avoid surface damage. Never drag forgings across surfaces.

- Protection from Moisture: Use vapor-corrosion inhibitors (VCIs) or plastic wrapping for long-term storage. Condensation must be avoided at all costs.

Packaging and Transportation

Due to titanium’s aerospace and medical applications, packaging must ensure protection from damage, contamination, and theft.

- Custom Crating: Use wooden or composite crates lined with anti-static and moisture-resistant materials. Include internal supports to prevent movement during transit.

- Labeling: Clearly label packages with contents, alloy grade (e.g., Ti-6Al-4V), heat number, lot traceability, and handling instructions (e.g., “Fragile,” “This Side Up,” “Protect from Moisture”).

- Transport Mode Selection: Choose transportation methods that minimize vibration and temperature extremes. Air freight is common for high-value or urgent shipments; sea freight requires enhanced moisture protection.

- Chain of Custody: Maintain a documented chain of custody for high-security or regulated end uses (e.g., defense, aerospace). Use tamper-evident seals and GPS tracking if necessary.

Regulatory and Industry Compliance

Titanium forgings are subject to rigorous quality and traceability standards, particularly in aerospace, defense, and medical sectors.

- Material Certification: Provide full traceability documentation including:

- Mill Test Reports (MTRs) or Certified Material Test Reports (CMTRs)

- Heat and lot numbers

- Chemical composition and mechanical properties

- NDT (Non-Destructive Testing) results (e.g., ultrasonic, dye penetrant)

- Standards Compliance:

- Aerospace: AS9100, AMS specifications (e.g., AMS 2249, AMS 2371), NADCAP accreditation for forging and testing processes

- Medical: ISO 13485, ASTM F67/F136 for implant-grade titanium

- Defense: ITAR (International Traffic in Arms Regulations) compliance if applicable

- Export Controls: Titanium and forged components may be subject to export restrictions under EAR (Export Administration Regulations) or ITAR. Verify classification under the U.S. Munitions List (USML) or Commerce Control List (CCL). Obtain necessary licenses for international shipments.

- Environmental and Safety Regulations: Comply with OSHA, REACH (EU), and RoHS where applicable. Properly manage machining swarf and grinding dust, which may require special handling due to flammability risks.

Quality Assurance and Traceability

Maintaining end-to-end traceability is non-negotiable in titanium forging logistics.

- Lot Tracking: Implement a robust system (e.g., ERP or MES) to track material from raw billet through forging, heat treatment, machining, and final shipment.

- Documentation Retention: Retain all quality records (e.g., test reports, inspection records, process parameters) for a minimum of 10 years, or as required by the customer or industry standard.

- Audits and Certification: Be prepared for customer and regulatory audits. Maintain active certifications (e.g., ISO 9001, AS9100) and undergo periodic NADCAP audits for special processes.

Risk Management and Contingency Planning

- Supply Chain Resilience: Diversify sources of raw titanium billets to mitigate geopolitical or market disruptions.

- Insurance: Ensure adequate coverage for high-value shipments, including protection against damage, loss, and theft.

- Recall Preparedness: Establish a recall protocol in case of non-conformance, leveraging traceability data for rapid response.

By adhering to these logistics and compliance guidelines, manufacturers and distributors can ensure the reliable delivery of high-integrity titanium forgings while meeting the exacting demands of regulated industries.

Conclusion for Sourcing Titanium Forging

Sourcing titanium forgings requires a strategic approach that balances material quality, manufacturing capability, cost efficiency, and supply chain reliability. Titanium’s exceptional strength-to-weight ratio, corrosion resistance, and performance in extreme environments make it indispensable in critical industries such as aerospace, defense, medical, and energy. However, its high cost and complex processing demand careful supplier evaluation.

A successful sourcing strategy involves selecting qualified suppliers with proven expertise in titanium metallurgy and precision forging techniques, including strict adherence to industry standards (e.g., AMS, ASTM, NADCAP). Factors such as geographic location, lead times, scalability, and quality control systems must be assessed to mitigate risks and ensure continuity of supply.

Additionally, building long-term partnerships, investing in supplier audits, and considering total cost of ownership—not just unit price—will enhance supply chain resilience. As advancements in near-net-shape forging and digital manufacturing continue to reduce waste and improve efficiency, staying informed on technological trends will provide competitive advantages.

In conclusion, effective titanium forging sourcing hinges on a comprehensive, proactive approach that prioritizes quality, compliance, and collaboration—ultimately ensuring reliability and performance in mission-critical applications.