The global tire manufacturing industry is experiencing robust growth, driven by rising vehicle production, increasing demand for replacement tires, and advancements in sustainable and high-performance materials. According to Grand View Research, the global tire market was valued at USD 177.1 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 4.2% from 2023 to 2030. Similarly, Mordor Intelligence projects a CAGR of 4.5% over the forecast period (2023–2028), with increasing urbanization, infrastructure development, and the expanding automotive sectors in Asia-Pacific and Latin America serving as key growth catalysts. Amid this upward trajectory, competition among manufacturers is intensifying, with leading players investing heavily in R&D, sustainability initiatives, and digital supply chain optimization. As the industry evolves to meet the demands of electric vehicles (EVs), fuel efficiency standards, and circular economy principles, the top tire manufacturers are positioning themselves at the forefront of innovation and market expansion. Here’s a look at the ten companies shaping the future of mobility through technological leadership and global reach.

Top 10 Tire Tyre Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Falken Tires

Domain Est. 1997

Website: falkentire.com

Key Highlights: Falken Tires, known as a leader in high performance tire technology for cars, trucks, SUVs and crossovers, has successfully built a reputation as a full-line ……

#2 U.S. Tire Manufacturers Association

Domain Est. 2017

Website: ustires.org

Key Highlights: The US Tire Manufacturers Association is the national trade association for tire manufacturers that produce tires in the United States….

#3 Goodyear Corporate

Domain Est. 1992

Website: corporate.goodyear.com

Key Highlights: Learn about The Goodyear Tire & Rubber Company’s history and vision, and find the latest career information, corporate reports, company news and more….

#4 Pirelli Global: Discover our world

Domain Est. 1995

Website: pirelli.com

Key Highlights: Pirelli Global, the magazine of the Pirelli world: discover interesting articles on cars, motorcycles, bicycles, sports and lifestyle, innovation and ……

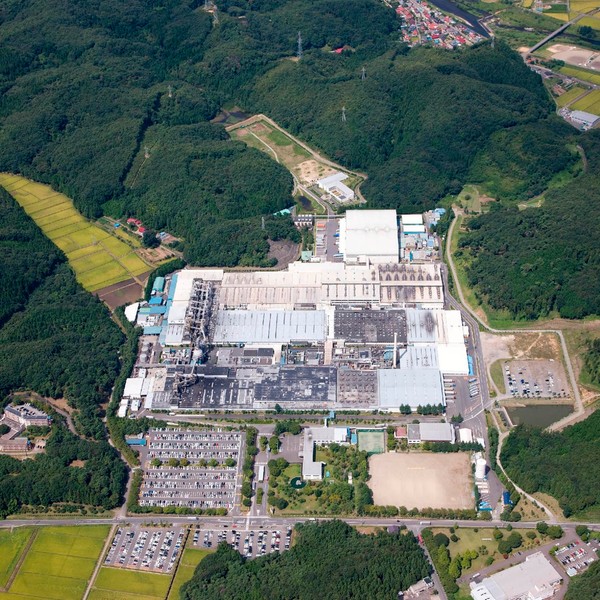

#5 Bridgestone Global Website

Domain Est. 1996

Website: bridgestone.com

Key Highlights: Bridgestone Corporation is the world’s largest tire and rubber company. In addition to tires, Bridgestone manufactures diversified products, which include ……

#6 Toyo Tires: Premium, dependable, and long

Domain Est. 1997

Website: toyotires.com

Key Highlights: The official website of Toyo Tires. Premium, dependable, and long-lasting tires for most trucks, cars, SUVs, and crossovers. Find your next set of tires ……

#7 Nitto Tire

Domain Est. 1998

Website: nittotire.com

Key Highlights: Fueled by enthusiasts, Nitto is driven to provide the highest quality car and truck tires for every vehicle on the road. Choose the tire that drives you….

#8 Hankook Tire USA

Domain Est. 2000

Website: hankooktire.com

Key Highlights: Explore Hankook tires built for SUVs, pickup trucks, and passenger cars. Trusted by drivers for durability, traction, and performance….

#9 Continental Tires

Domain Est. 2000

Website: continental-tires.com

Key Highlights: In need to replace your tires? Explore Continental tires’ extensive selection. Find winter and summer tires, options for cars and trucks, motorcycle and ……

#10 Giti Tires USA: Giti Tire USA

Domain Est. 2005

Website: gititireusa.com

Key Highlights: Giti Tire USA, a global tire company with more than 6500 U.S retail points. Giti Tire’s North American manufacturing facility is located in South Carolina….

Expert Sourcing Insights for Tire Tyre

H2: 2026 Market Trends for the Tire (Tyre) Industry

The global tire (tyre) market is poised for significant transformation by 2026, driven by technological innovation, shifting consumer demands, regulatory pressures, and evolving mobility ecosystems. As the automotive industry transitions toward sustainability and digitalization, tire manufacturers are adapting to remain competitive and meet future market needs. Below are the key H2 trends expected to shape the tire industry in 2026:

1. Accelerated Shift Toward Sustainable and Eco-Friendly Tires

Environmental regulations and consumer awareness are pushing tire manufacturers to adopt greener practices. By 2026, the use of sustainable raw materials—such as natural rubber from responsibly managed plantations, silica from renewable sources, and bio-based alternatives to synthetic rubber—will become mainstream. Major players like Michelin, Bridgestone, and Continental are investing in circular economy models, including tire recycling and retreading, aiming for near-zero waste. The EU’s tire labeling regulations and carbon footprint mandates will further compel companies to enhance transparency and reduce lifecycle emissions.

2. Growth in Electric Vehicle (EV) Tire Demand

With global EV adoption accelerating, the demand for specialized EV tires will surge by 2026. EVs require tires designed to handle higher vehicle weights, deliver lower rolling resistance for extended range, and minimize noise due to the absence of engine sound. Manufacturers are developing EV-specific tire lines with enhanced durability, optimized tread patterns, and smart materials. This niche segment is expected to grow at a CAGR of over 15% from 2023 to 2026, particularly in North America, Europe, and China.

3. Advancement of Smart and Connected Tire Technologies

Smart tires embedded with sensors to monitor pressure, temperature, tread wear, and road conditions will gain wider adoption by 2026. Integrated with vehicle telematics and AI-driven analytics, these tires support predictive maintenance, improve safety, and enhance fuel efficiency. Partnerships between tire companies and tech firms are enabling real-time data sharing with fleet operators and OEMs. Goodyear’s IntelliGrip and Continental’s ContiConnect platforms exemplify this trend, which will become a standard offering in premium and commercial vehicle segments.

4. Expansion in Emerging Markets and Localized Production

Asia-Pacific, particularly India, Southeast Asia, and Africa, will be key growth regions in 2026 due to rising vehicle ownership, urbanization, and infrastructure development. To reduce logistics costs and tariffs, global tire manufacturers are increasing localized production and forming joint ventures in these markets. Chinese tire brands such as Sailun,玲珑 (Linglong), and Giti are expanding overseas, challenging established Western brands with cost-effective, quality products.

5. Rising Focus on Performance and Customization

Consumers are increasingly seeking tires tailored to specific driving conditions, vehicle types, and performance needs. By 2026, mass customization—enabled by digital platforms and advanced manufacturing—will allow buyers to configure tires based on climate, road type, and usage patterns. Premium brands will leverage digital tools for personalized recommendations, enhancing customer experience and loyalty.

6. Supply Chain Resilience and Raw Material Innovation

Ongoing volatility in raw material prices (e.g., natural rubber, synthetic rubber, carbon black) and geopolitical disruptions will force tire makers to rethink supply chains. By 2026, greater investment in alternative materials—like guayule and dandelion rubber—and vertical integration will improve supply stability. Digital supply chain platforms using blockchain and AI will enhance traceability and responsiveness.

Conclusion

The 2026 tire market will be defined by sustainability, electrification, digital integration, and regional diversification. Companies that innovate in eco-materials, smart technologies, and customer-centric solutions will lead the industry. As mobility evolves, tires are no longer just consumable components but critical enablers of safety, efficiency, and environmental performance—positioning the tire sector at the forefront of the future of transportation.

Common Pitfalls Sourcing Tires (Quality, Intellectual Property)

Sourcing tires—whether spelled “tire” or “tyre”—involves navigating complex supply chains where quality control and intellectual property (IP) protection are critical. Failing to address these areas can lead to safety risks, reputational damage, and legal liabilities. Below are common pitfalls to avoid.

Quality-Related Pitfalls

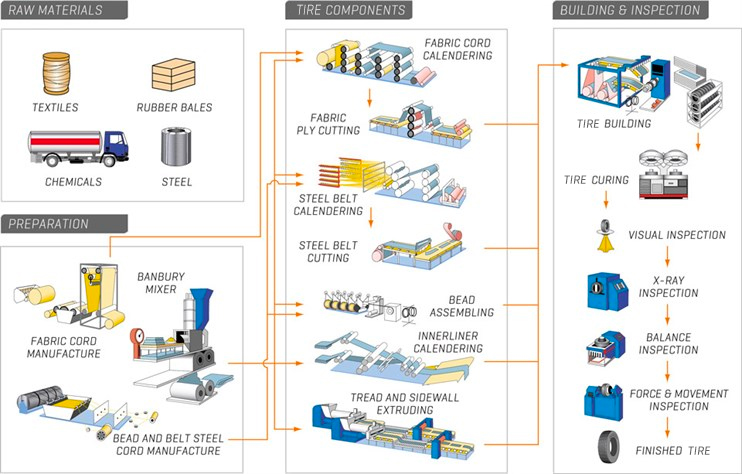

Inconsistent Manufacturing Standards

Tires sourced from manufacturers without adherence to international standards (e.g., DOT, ECE, ISO) often suffer from inconsistent quality. Variations in rubber composition, tread depth, and structural integrity can compromise safety and performance, especially under stress or extreme weather conditions.

Lack of Proper Testing and Certification

Many suppliers, particularly in emerging markets, may provide falsified or incomplete test reports. Relying solely on supplier-provided certificates without third-party verification increases the risk of receiving substandard products that fail durability, load, or speed rating requirements.

Poor Raw Material Sourcing

Low-cost tires may use inferior rubber, recycled materials, or inadequate reinforcement fabrics. This compromises tread life, fuel efficiency, and handling, leading to premature wear and potential blowouts.

Inadequate Quality Control Processes

Suppliers with weak or nonexistent in-line quality assurance procedures may pass defective tires through production. Without regular audits or on-site inspections, buyers may unknowingly receive batches with internal defects such as air pockets or delamination.

Intellectual Property-Related Pitfalls

Counterfeit or Replica Tires

A major issue in global tire sourcing is the prevalence of counterfeit products that mimic well-known brands. These replicas often carry fake logos, branding, and serial numbers, misleading buyers into believing they are purchasing genuine, high-quality tires.

Unauthorized Use of Brand Names and Trademarks

Some suppliers manufacture tires that appear nearly identical to branded models but are sold under slightly altered names (e.g., “Bridgstome” instead of “Bridgestone”). This trademark infringement can expose buyers to legal action, especially if the tires are imported into regions with strong IP enforcement.

Design and Patent Infringement

Tread patterns, sidewall designs, and internal construction technologies are often protected by patents. Sourcing tires that copy these proprietary features—even unknowingly—can result in IP violations, customs seizures, and liability for contributory infringement.

Lack of IP Due Diligence in Supplier Contracts

Failing to include IP warranties and indemnification clauses in procurement agreements leaves buyers vulnerable. If a supplier delivers infringing products, the buyer may bear legal and financial responsibility, especially in markets like the EU or the U.S.

Mitigation Strategies

To avoid these pitfalls, conduct thorough supplier vetting, require independent lab testing, audit manufacturing facilities, and verify IP rights. Use legally binding contracts that hold suppliers accountable for quality and IP compliance. Partnering with reputable distributors and leveraging customs IP registration systems can further reduce risks.

Logistics & Compliance Guide for Tires (Tyres)

Overview

This guide outlines the essential logistics and compliance considerations for the transportation, storage, import, and export of tires (tyres). Given the global nature of tire manufacturing and distribution, adherence to international regulations, environmental standards, and safety protocols is critical.

Classification and HS Codes

Correct classification ensures compliance with customs regulations and accurate duty assessment. Tires are typically classified under the Harmonized System (HS) codes:

– 4011: New pneumatic rubber tires for automobiles, aircraft, or other vehicles

– 4012: Regenerated or second-hand tires

– 4013: Inner tubes and flaps

Note: Specific sub-codes vary by country and tire type (e.g., radial vs. bias-ply, passenger vs. truck). Always verify with local customs authorities.

Packaging and Labeling Requirements

Proper packaging and labeling are essential for safety, traceability, and regulatory compliance.

– Use durable, weather-resistant packaging for bulk or container shipments

– Clearly label each unit with:

– Brand and model

– Size and load/speed ratings

– DOT (Department of Transportation) or ECE (Economic Commission for Europe) certification marks

– Country of origin

– Date of manufacture (DOT code)

– Recyclability symbol (where applicable)

Transportation and Handling

Tires are heavy and prone to damage if improperly handled.

– Maritime Shipping:

– Secure in containers or flat racks to prevent shifting

– Use dunnage and straps to minimize movement

– Avoid exposure to moisture and direct sunlight

– Road Transport:

– Stack vertically or horizontally with proper support

– Protect from sharp objects and extreme temperatures

– Air Freight:

– Subject to stricter size/weight limits; verify with carrier

– Lithium battery-powered tire pressure monitoring systems (TPMS) may require special handling

Import and Export Regulations

Compliance with destination country regulations is mandatory.

– Import Permits: Some countries require permits for used or retreaded tires

– Safety and Environmental Standards:

– U.S.: DOT FMVSS 109, EPA requirements

– EU: ECE Regulation 30 (tires), REACH, and end-of-life vehicle (ELV) directives

– China: CCC certification for new tires

– Phytosanitary & Sanitary Controls: Used tires may be subject to inspection due to risk of pest or disease transmission (e.g., mosquito breeding)

Environmental and Waste Compliance

Tires are classified as hazardous or controlled waste in many jurisdictions when discarded.

– End-of-Life Tire (ELT) Management:

– Comply with local tire stewardship or extended producer responsibility (EPR) programs

– Maintain records of tire recycling or disposal

– Export Restrictions:

– Basel Convention regulates transboundary movement of waste tires

– Many countries prohibit or restrict imports of waste tires

Storage Guidelines

Proper storage prevents degradation and ensures product quality.

– Store in cool, dry, well-ventilated areas away from direct sunlight

– Avoid contact with oils, solvents, or ozone-generating equipment

– Rotate stock using FIFO (First In, First Out) method

– Stack vertically when possible to prevent deformation

Documentation Requirements

Accurate documentation ensures smooth customs clearance and regulatory compliance.

– Commercial invoice

– Packing list

– Bill of lading or air waybill

– Certificate of Origin

– Test reports or conformity certificates (e.g., DOT, ECE, CCC)

– Material Safety Data Sheet (MSDS) for rubber compounds (if required)

– Waste shipment manifests (for used tires)

Risk Mitigation and Best Practices

- Partner with certified freight forwarders experienced in tire logistics

- Conduct regular compliance audits

- Train staff on hazardous materials handling (if applicable)

- Monitor regulatory updates in key markets (e.g., EU tire labeling, U.S. TREAD Act)

Conclusion

Effective logistics and compliance management for tires require attention to classification, safety, environmental rules, and documentation. Staying informed and proactive helps avoid delays, penalties, and reputational risks in the global tire supply chain.

Conclusion on Sourcing Tires/Tyres

In conclusion, sourcing tires/tyres effectively requires a strategic approach that balances quality, cost, reliability, and sustainability. Whether sourcing for automotive manufacturers, fleet operations, or retail distribution, it is essential to partner with reputable suppliers who adhere to international safety and performance standards such as DOT, ECE, or ISO certifications. Evaluating factors such as tread life, fuel efficiency, load capacity, and climate suitability ensures the right tire selection for specific applications.

Additionally, assessing total cost of ownership—not just purchase price—helps optimize long-term value. Building strong relationships with suppliers, leveraging economies of scale, and considering local versus global sourcing options can enhance supply chain resilience. With the growing emphasis on sustainability, incorporating eco-friendly materials and end-of-life recycling programs into sourcing decisions also supports environmental and corporate social responsibility goals.

Ultimately, a well-structured tire sourcing strategy contributes to improved vehicle performance, safety, operational efficiency, and customer satisfaction—making it a critical component of successful logistics, transportation, and manufacturing operations.