The global tire leak sealant market is experiencing robust growth, driven by increasing demand for preventive maintenance solutions in the automotive sector. According to Grand View Research, the market was valued at USD 392.8 million in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 5.1% from 2023 to 2030. This expansion is fueled by rising vehicle ownership, growing consumer preference for quick and cost-effective tire repair solutions, and the expanding aftermarket automotive industry. Additionally, innovations in sealant formulas—such as non-toxic, eco-friendly, and permanent-fix technologies—are enhancing product adoption across passenger cars, commercial vehicles, and off-road applications. As competition intensifies, manufacturers are focusing on R&D and strategic partnerships to capture market share. In this dynamic landscape, a select group of companies are leading the way through technological advancements, global distribution networks, and strong brand positioning. Here’s a look at the top 10 tire leak sealant manufacturers shaping the industry’s future.

Top 10 Tire Leak Sealant Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Permatex®

Domain Est. 1995

Website: permatex.com

Key Highlights: Proven and Reliable OEM Partner. As a leader in supplying automotive sealants, Permatex offers superior R&D, production, distribution capabilities and more….

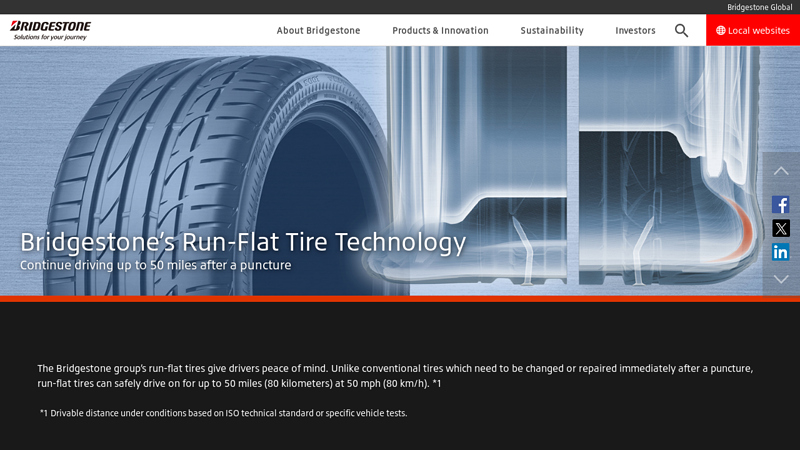

#2 Run

Domain Est. 1996

Website: bridgestone.com

Key Highlights: Bridgestone’s run-flat tire technology which enables you to continue to drive for 50 miles after a puncture….

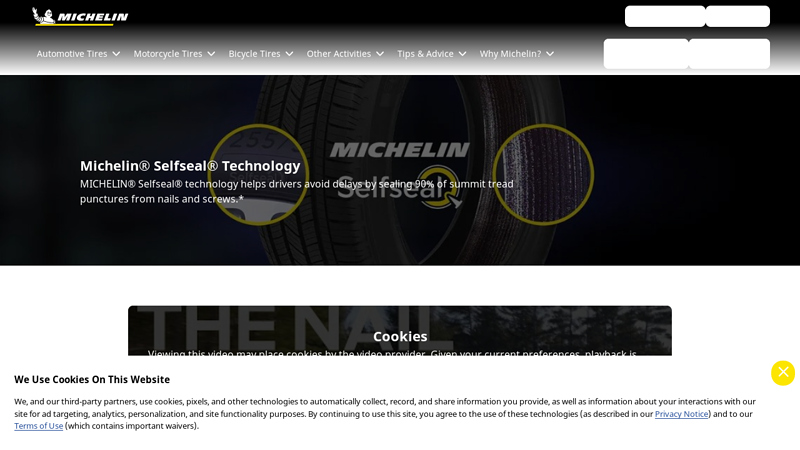

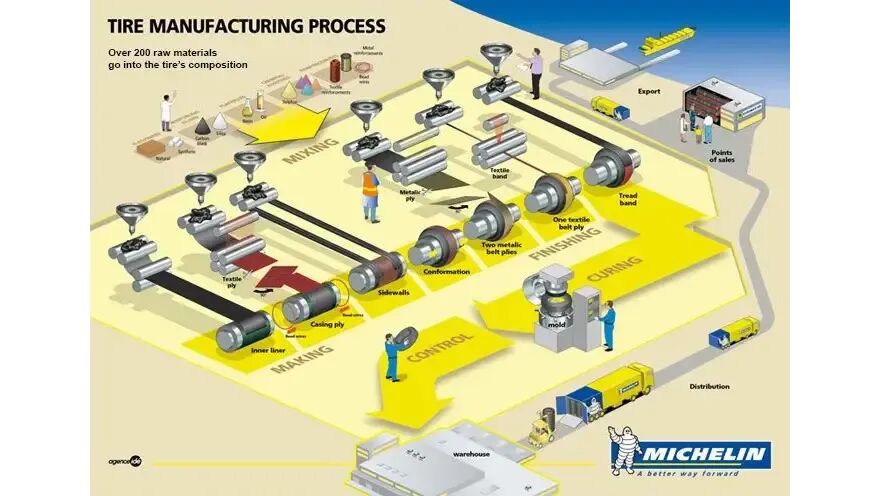

#3 Michelin SelfSeal Technology

Domain Est. 2001

Website: michelinman.com

Key Highlights: Michelin Selfseal Technology fixes flats before they happen, and it’s an environmentally friendly potion by using a natural rubber sealant….

#4 Tire Sealants

Domain Est. 1995

Website: slime.com

Key Highlights: No More Flats! From your car/truck/SUV tires, to your bicycle, mower, ATV/UTV, & other off-highway vehicle tires, Slime has a sealant to repair your flat ……

#5 Sealant

Domain Est. 1995

Website: stans.com

Key Highlights: 6–7 day delivery 30-day returnsStan’s Original Tubeless SealantThe first tubeless sealant in the world, formulated by our founder Stan in 2001 and still the number one choice of ri…

#6 Berryman® Seal

Domain Est. 1997

Website: berrymanproducts.com

Key Highlights: Instantly seals leaks and protects pneumatic tires and tubes from small nails, thorns, and other sharp objects. Stays liquid permanently….

#7 Fix

Domain Est. 1999

Website: fixaflat.com

Key Highlights: Fix-a-Flat is designed to seal small tire punctures in seconds and provide enough inflation to lift the rim off the ground….

#8 ContiSeal

Domain Est. 2000

Website: continental-tires.com

Key Highlights: ContiSeal seals 80% of tire punctures, so you don’t have to change your tire, call for help or wait for roadside assistance immediately. Anyhow, to avoid ……

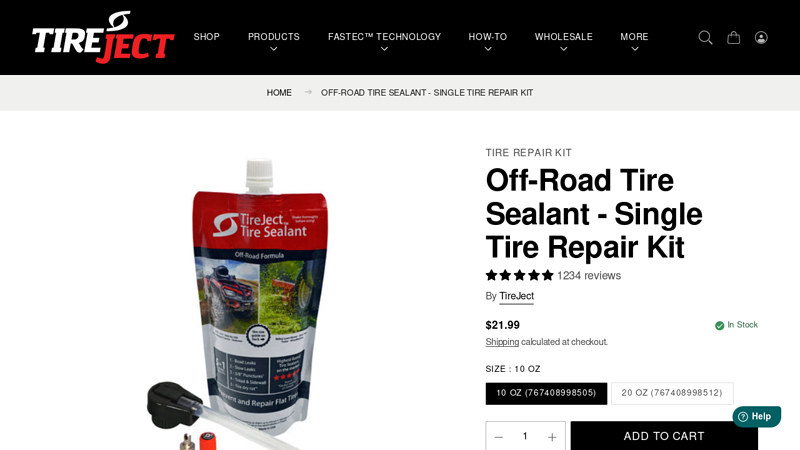

#9 Off

Domain Est. 2009

#10 Tire Repair Basics

Domain Est. 2017

Website: ustires.org

Key Highlights: Tire repairs cannot overlap with other repairs. A rubber stem, or plug, must be applied to fill the puncture injury and a patch must be applied to seal the ……

Expert Sourcing Insights for Tire Leak Sealant

H2: 2026 Market Trends for Tire Leak Sealant

The global tire leak sealant market is poised for significant evolution by 2026, driven by technological advancements, increasing vehicle ownership, and a growing emphasis on vehicle safety and maintenance efficiency. This analysis explores key trends shaping the market landscape over the forecast period.

-

Rising Demand for Preventive Maintenance Solutions

With consumers and fleet operators prioritizing cost-effective and time-efficient vehicle maintenance, tire leak sealants are gaining traction as preventive tools. The ability to instantly seal punctures and extend tire life aligns with the broader automotive trend toward minimizing downtime and repair costs. By 2026, this shift is expected to boost adoption across passenger cars, commercial vehicles, and off-road applications. -

Growth in E-Commerce and DIY Culture

The expansion of online retail platforms has made tire leak sealants more accessible to end-users. Coupled with the rising do-it-yourself (DIY) automotive culture, especially in regions like North America and Europe, consumers are increasingly purchasing sealants for personal use. Enhanced product labeling, instructional videos, and compatibility with smartphones (e.g., integration with tire pressure monitoring systems) are further driving consumer confidence. -

Technological Innovations in Sealant Formulations

By 2026, manufacturers are expected to launch next-generation sealants featuring eco-friendly, non-toxic, and biodegradable formulas. Advances in nanotechnology and polymer science are enabling longer-lasting seals, improved temperature resistance, and compatibility with tubeless and run-flat tires. These innovations are critical in meeting stringent environmental regulations and expanding product usability across diverse climates. -

Expansion in Emerging Markets

Rapid urbanization, rising disposable incomes, and growing vehicle production in Asia-Pacific, Latin America, and Africa are creating new growth avenues. Countries like India, Indonesia, and Brazil are witnessing a surge in two-wheeler and light commercial vehicle sales, where tire maintenance is a persistent challenge. Localized production and affordable product variants are expected to capture substantial market share by 2026. -

Integration with Smart Tire Systems

As connected vehicles become mainstream, tire leak sealants are being designed to work in tandem with smart tire technologies. Some sealants now include additives that do not interfere with tire pressure monitoring systems (TPMS), while others are marketed as part of holistic tire health solutions. By 2026, partnerships between sealant manufacturers and automotive OEMs could lead to factory-installed or recommended sealant systems. -

Sustainability and Regulatory Pressures

Environmental regulations are pushing manufacturers to reduce volatile organic compound (VOC) emissions and improve recyclability. The industry is responding with water-based sealants and refillable packaging solutions. By 2026, sustainability credentials are likely to become a key differentiator in competitive markets, influencing both B2B and B2C purchasing decisions.

In conclusion, the tire leak sealant market in 2026 will be characterized by innovation, sustainability, and increased consumer empowerment. Stakeholders who adapt to these trends—through R&D investment, strategic marketing, and supply chain optimization—will be best positioned to capitalize on the expanding global demand.

Common Pitfalls When Sourcing Tire Leak Sealant (Quality & Intellectual Property)

Sourcing tire leak sealant involves navigating several critical quality and intellectual property (IP) challenges. Overlooking these pitfalls can lead to product failures, safety risks, legal disputes, and reputational damage.

Inadequate Performance Testing and Quality Control

Many suppliers offer sealants that perform inconsistently under real-world conditions. Buyers often assume standard formulations are sufficient, but without rigorous third-party testing for viscosity, particle suspension, temperature stability, and sealing efficiency across various puncture types and tire materials, the product may fail when needed most. Relying solely on self-reported data from manufacturers increases the risk of receiving subpar or ineffective products.

Misrepresentation of Formula Composition

Some suppliers may exaggerate or falsify the chemical composition of their sealants, such as claiming “fiber-free” or “ammonia-free” formulas when such components are present. This misrepresentation can affect compatibility with tire pressure monitoring systems (TPMS), cause corrosion, or compromise long-term tire health. Lack of transparency in material safety data sheets (MSDS) or refusal to provide detailed formulation information should raise red flags.

Intellectual Property Infringement Risks

Sourcing from generic manufacturers, particularly in regions with lax IP enforcement, increases the risk of inadvertently procuring products that infringe on patented formulations or branded technologies. For example, replicating sealants that mimic well-known brands’ proprietary sealing mechanisms—such as specific rheological properties or nano-particle suspensions—can expose the buyer to legal liability, shipment seizures, or forced product recalls.

Lack of Regulatory Compliance and Certifications

Tire sealants must comply with regional safety and environmental standards (e.g., REACH, RoHS, DOT, or TÜV). Sourcing without verifying compliance can result in non-compliant products entering the market. This not only poses safety hazards but may also lead to fines, import bans, or voided insurance policies—especially if the sealant interferes with tire recyclability or emits hazardous fumes when heated.

Inconsistent Batch-to-Batch Quality

Suppliers with poor manufacturing controls may deliver sealants with variable performance between batches. Differences in mixing time, temperature, or raw material sourcing can alter viscosity, shelf life, and sealing capability. Without strict quality assurance protocols and batch traceability, such inconsistencies undermine reliability and customer trust.

Insufficient Protection of Custom Formulations

When developing a private-label or proprietary sealant, failure to secure proper IP protection—such as patents, trade secrets, or non-disclosure agreements (NDAs) with manufacturers—can result in formula theft or unauthorized replication. Suppliers may use the developed formulation to create competing products, eroding market advantage and brand value.

Overlooking Long-Term Compatibility and Environmental Impact

Some sealants degrade rubber, corrode rims, or damage TPMS sensors over time. Additionally, environmentally harmful ingredients (e.g., volatile organic compounds or non-biodegradable polymers) may conflict with sustainability goals or regulations. Sourcing decisions must consider lifecycle effects, not just immediate sealing performance.

Avoiding these pitfalls requires due diligence: conducting independent lab testing, verifying supplier credentials, securing IP rights, and ensuring contractual compliance with quality and regulatory standards.

Logistics & Compliance Guide for Tire Leak Sealant

Product Classification and Regulatory Overview

Tire leak sealant is typically classified as a chemical preparation intended for automotive maintenance. Depending on formulation, it may contain flammable liquids, volatile organic compounds (VOCs), or other regulated substances. As such, it is subject to transportation regulations, environmental standards, and safety compliance requirements across global markets.

Hazard Classification and UN Number

Most tire leak sealants are classified under the United Nations (UN) Model Regulations as flammable liquids (Class 3) due to alcohol- or solvent-based formulations. The specific classification may vary:

– UN 1993, FLAMMABLE LIQUID, N.O.S. (Not Otherwise Specified), Class 3, PG II or III

– Proper shipping name must reflect actual ingredients and flash point

– Some water-based or non-flammable formulations may be exempt from hazardous classification—verify via Safety Data Sheet (SDS)

Safety Data Sheet (SDS) Requirements

A current, GHS-compliant SDS (per OSHA HazCom 2012 or CLP Regulation in EU) is mandatory. The SDS must include:

– Hazard identification (flammability, skin/eye irritation, environmental hazards)

– Composition/information on ingredients (including VOC content)

– First-aid and firefighting measures

– Handling, storage, and disposal recommendations

– Transport information (UN number, class, packing group)

Transportation and Packaging Standards

International Air Transport (IATA)

- Must comply with IATA Dangerous Goods Regulations (DGR) if flammable

- Limited quantities (LQ) or excepted quantities (EQ) may apply to reduce documentation and packaging requirements

- Use UN-certified packaging with proper labeling (Class 3 flammable liquid label, orientation arrows)

- Passenger aircraft restrictions may apply—cargo-only for larger quantities

Ground Transport (ADR/RID in Europe, 49 CFR in USA)

- ADR (Europe): Class 3, tunnel code restrictions may apply

- 49 CFR (USA): Hazardous materials regulations enforced by DOT; requires placarding for large shipments

- Packaging must pass UN performance tests (e.g., drop, leakproofness)

- Use compatible containers (typically HDPE bottles with secure cap and tamper evidence)

Labeling and Marking Requirements

- Primary label: GHS pictograms (flame, exclamation mark, etc.), signal word (“Danger” or “Warning”), hazard statements

- Transport label: Class 3 flammable liquid diamond label (black flame on red background)

- Proper shipping name and UN number clearly visible

- Net quantity displayed

- Supplier contact information

Storage and Handling Precautions

- Store in a cool, well-ventilated area away from ignition sources

- Keep containers tightly closed and upright

- Avoid exposure to direct sunlight or temperatures above 50°C (122°F)

- Use personal protective equipment (PPE) such as gloves and safety glasses during handling

- Segregate from oxidizers and strong bases

Environmental and Disposal Compliance

- Do not dispose of down drains or in regular trash if classified as hazardous

- Follow local, state, and federal regulations for hazardous waste disposal (e.g., EPA RCRA in USA)

- Some formulations may be subject to VOC regulations (e.g., SCAQMD, EU Solvents Directive)

- Recycling programs may exist for packaging or residual product

Import/Export and Customs Documentation

- Accurate HS (Harmonized System) code required (e.g., 3819.00 for prepared additives for mineral oils)

- Certificates of Analysis (CoA) or compliance (e.g., REACH, TSCA) may be required

- Import permits may apply in certain countries for flammable goods

- Ensure SDS is available in local language(s) for destination country

Regional Compliance Considerations

- USA: Comply with EPA, DOT, OSHA, and CARB (if sold in California)

- EU: Subject to REACH, CLP, and potential restrictions under Annex XVII

- Canada: Transported under TDG regulations; requires French/English labeling

- Australia: Complies with ADG Code and NICNAS (now AICIS)

- Asia: Varies by country—check local chemical control laws (e.g., K-REACH, China MEA)

Quality Assurance and Recordkeeping

- Retain SDS, test reports (flash point, stability), and compliance certifications

- Audit supply chain partners for regulatory adherence

- Track formulation changes that may affect classification

- Maintain shipping records for minimum of 2 years (as required by DOT and IATA)

Emergency Response and Incident Management

- Include spill response procedures (absorb with inert material, ventilate area)

- Provide emergency contact number on packaging or SDS

- Train staff on handling leaks, fires, or exposure incidents

- Report significant incidents per local regulatory requirements (e.g., EPA, ECHA)

Conclusion

Successful logistics and compliance for tire leak sealant require proactive classification, accurate documentation, and adherence to evolving global regulations. Regular training, supplier collaboration, and compliance audits are essential to maintain safety and legal distribution.

Conclusion for Sourcing Tire Leak Sealant:

After a thorough evaluation of the market, supplier capabilities, product specifications, and cost considerations, sourcing tire leak sealant presents a viable and beneficial opportunity to enhance vehicle maintenance efficiency and reduce downtime. The selection of an appropriate sealant—balancing quality, performance, compatibility with tire types, and environmental safety—is critical.

Key factors such as ease of application, long-term sealing effectiveness, shelf life, and compliance with industry standards must guide the sourcing decision. Additionally, partnering with reliable suppliers offering competitive pricing, consistent supply, technical support, and sustainable packaging solutions will ensure long-term success.

In conclusion, strategic sourcing of high-quality tire leak sealant not only supports operational reliability and cost savings but also contributes to improved safety and customer satisfaction. A final vendor selection should align with organizational goals, sustainability initiatives, and technical requirements to deliver optimal value.