The global threaded pipe and fittings market is experiencing steady growth, driven by rising demand across construction, oil & gas, water treatment, and industrial manufacturing sectors. According to a report by Mordor Intelligence, the global pipes and fittings market was valued at USD 72.38 billion in 2023 and is projected to reach USD 92.67 billion by 2029, growing at a CAGR of 4.3% during the forecast period. Another analysis by Grand View Research estimates the market size at USD 74.8 billion in 2022, with an anticipated CAGR of 5.1% from 2023 to 2030, citing infrastructure expansion and urbanization—particularly in Asia-Pacific—as key growth catalysts. With increasing emphasis on corrosion-resistant materials, leak-proof connections, and compliance with standards such as ASTM, ASME, and ANSI, manufacturers of threaded pipe and fittings are innovating to meet the evolving demands of high-pressure and high-temperature applications. In this competitive landscape, a select group of manufacturers have emerged as industry leaders, combining precision engineering, global supply reach, and material expertise to serve critical industries worldwide.

Top 10 Threaded Pipe And Fittings Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

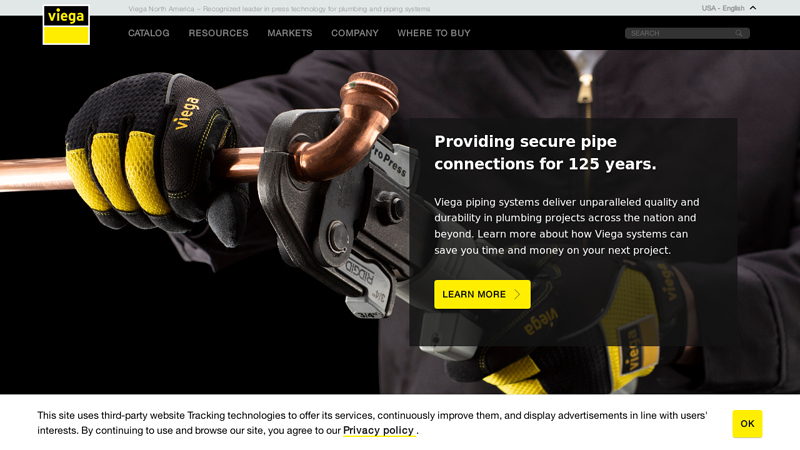

#1 Viega USA

Domain Est. 2002

Website: viega.us

Key Highlights: Viega pipe and fitting solutions for any build type. Whether the application be residential, industrial, commercial, or beyond, Viega has the solution. Let us ……

#2 Pipe Fittings

Domain Est. 2020

Website: asc-es.com

Key Highlights: Anvil’s Beck Brand is the nation’s top manufacturer of high quality steel pipe nipples and steel couplings. Beck pipe nipples and couplings are ……

#3 U.S. Pipe

Domain Est. 1995

Website: uspipe.com

Key Highlights: US Pipe, a Quikrete company, offers a complete range of Ductile Iron Pipe, Restrained Joint Pipe, Fabrication, Gaskets, and Fittings….

#4 Spears Manufacturing, PVC & CPVC Plastic Pipe Fittings & Valves

Domain Est. 1996

Website: spearsmfg.com

Key Highlights: ISO9001 Certified – PVC & CPVC Sch 40 and 80 fittings molded from 1/8 – 14 inch….

#5 Pipe Fittings: Essential Components for Piping Systems

Domain Est. 1997

Website: meritbrass.com

Key Highlights: Learn about the different alloys, joining methods & types of fittings used in piping applications for your project’s requirements….

#6 Star Pipe Products

Domain Est. 1998

Website: starpipeproducts.com

Key Highlights: Star Pipe Products has manufactured ductile iron pipe fittings, joint restraints, and castings for the waterworks industry for over 40 years….

#7 MSI

Domain Est. 2000

Website: msi-products.com

Key Highlights: Welcome to MSI Products, your trusted partner for high-quality pipe fittings and wholesale distribution solutions. Founded by experienced professionals in ……

#8 Threaded pipe Fittings

Domain Est. 2015

Website: petrosteelpipings.com

Key Highlights: We offer various types of forged threaded fittings including threaded elbow, threaded tee, threaded cross, threaded bends, threaded coupling, threaded caps, ……

#9 Threaded Pipe Fittings

Domain Est. 2019

Website: armkopipefittings.com

Key Highlights: We offer various types of forged threaded fittings including threaded elbow, threaded tee, threaded cross, threaded bends, threaded coupling, threaded caps, ……

#10 Fayette Pipe: American

Domain Est. 2019

Website: fayettepipe.com

Key Highlights: FayettePipe Company, a division of Specialty Conduit, manufactures high-quality ASTM A53 Grade A Schedule 7 EZ-Flow, 10, 40, and 80 ERW black steel pipe….

Expert Sourcing Insights for Threaded Pipe And Fittings

2026 Market Trends for Threaded Pipe and Fittings: Key Drivers and Projections

The global threaded pipe and fittings market is poised for steady growth through 2026, driven by infrastructure development, industrial expansion, and specific regional dynamics. Here’s a breakdown of the key trends shaping the market:

Increasing Demand from Infrastructure and Construction Sectors

A primary driver for the threaded pipe and fittings market is the surge in infrastructure and building construction activities worldwide. Government investments in water supply networks, wastewater treatment plants, and urban development projects—especially in emerging economies—require vast quantities of reliable piping systems. Threaded connections remain preferred in applications requiring ease of assembly, disassembly, and maintenance, such as plumbing and fire protection systems. The durability and leak-resistant properties of threaded joints make them ideal for high-pressure environments, further solidifying their role in large-scale civil engineering and commercial building projects.

Growth in Oil & Gas and Industrial Applications

The oil and gas industry continues to be a significant consumer of threaded pipe and fittings, particularly in upstream and midstream operations. As energy exploration expands into remote and challenging environments, the need for robust, easily installable piping solutions increases. Threaded connections are commonly used in wellhead equipment, gathering lines, and processing facilities due to their reliability and ability to withstand harsh conditions. Additionally, manufacturing, chemical processing, and power generation sectors are adopting standardized threaded components for process piping, boosting demand for carbon steel and stainless steel variants.

Regional Expansion in Asia-Pacific and the Middle East

The Asia-Pacific region is expected to lead market growth through 2026, fueled by rapid urbanization, industrialization, and government-led infrastructure initiatives in countries like India, China, and Southeast Asian nations. Similarly, the Middle East is witnessing increased investments in water desalination, petrochemical complexes, and smart city developments, all of which require extensive piping networks. These regions offer lucrative opportunities for manufacturers and distributors of threaded pipe and fittings, especially those offering cost-effective and corrosion-resistant solutions.

Shift Toward High-Performance Materials and Standards Compliance

There is a growing emphasis on using advanced materials such as duplex stainless steel, alloy steel, and corrosion-resistant coatings to extend the service life of piping systems in aggressive environments. Compliance with international standards (e.g., ASME, ASTM, API) is becoming non-negotiable, particularly in regulated industries. Manufacturers are investing in precision threading technology and quality assurance to meet stringent performance and safety requirements, thereby enhancing product reliability and market competitiveness.

Supply Chain Resilience and Localization Strategies

Post-pandemic disruptions have prompted companies to reevaluate global supply chains. By 2026, there is an increasing trend toward regional manufacturing and inventory localization to mitigate risks related to logistics and raw material shortages. This shift supports faster delivery times and reduces dependency on single-source suppliers, especially for critical infrastructure projects. As a result, local production hubs for threaded components are expanding in strategic markets.

Sustainability and Energy Efficiency Considerations

Environmental regulations and sustainability goals are influencing material selection and manufacturing processes. Recyclable materials like steel are gaining preference over plastics in certain applications due to their longevity and environmental footprint. Additionally, energy-efficient designs that minimize leakage and pressure loss are being prioritized, reinforcing the use of precision-threaded fittings that ensure tight seals and system integrity.

In conclusion, the 2026 threaded pipe and fittings market will be characterized by robust demand from infrastructure and industrial sectors, regional growth in Asia and the Middle East, material innovation, and a focus on quality and supply chain resilience. Companies that align with these trends—through product development, regional expansion, and compliance—are well-positioned to capture significant market share in the coming years.

Common Pitfalls Sourcing Threaded Pipe and Fittings (Quality, IP)

Sourcing threaded pipe and fittings involves several critical considerations, especially regarding quality and industrial packaging (IP). Overlooking these factors can lead to system failures, safety hazards, and increased costs. Below are common pitfalls to avoid:

Inadequate Material Verification

One of the most frequent issues is failing to verify the actual material composition of the pipe and fittings. Suppliers may provide substandard or misrepresented materials (e.g., using low-grade carbon steel instead of specified ASTM A53). Always request and review mill test certificates (MTCs) and conduct third-party material testing when sourcing from unfamiliar or offshore suppliers.

Poor Thread Quality and Tolerance Compliance

Threaded components must meet precise dimensional standards (e.g., NPT, BSPT) to ensure leak-free connections. Poorly cut threads—such as those with incorrect pitch, taper, or burrs—compromise seal integrity and can cause galling or leaks. Insist on adherence to recognized standards like ASME B1.20.1 and perform random inspections using thread gauges.

Inconsistent Coating and Corrosion Protection

Many threaded fittings require protective coatings (e.g., galvanizing, epoxy, or powder coating) to resist corrosion. Inconsistent or inadequate coating application—especially on internal threads—leads to premature degradation. Verify coating thickness (e.g., per ASTM A123 for galvanizing) and ensure proper post-coating rethreading if required.

Misunderstanding Industrial Packaging (IP) Requirements

Industrial packaging impacts both product protection and logistics. Underestimating IP needs can result in damaged goods during transit, particularly for long or fragile pipe sections. Common mistakes include using insufficient dunnage, improper bundling, or failing to protect thread ends with caps or plugs. Specify IP standards such as ASTM D6055 for unitized loads and ensure end protection per MSS SP-110.

Lack of Traceability and Documentation

Traceability is essential for compliance, especially in regulated industries like oil and gas or water treatment. Sourcing without proper documentation—such as heat numbers, batch traceability, and inspection reports—can lead to rejection during audits or field failures with no recourse. Ensure suppliers maintain full traceability from raw material to final product.

Overlooking Supplier Qualification and Certifications

Selecting suppliers based solely on price often leads to quality issues. Unqualified vendors may lack ISO 9001 certification, in-house testing capabilities, or adherence to industry standards like MSS, ASTM, or API. Conduct supplier audits and require proof of certifications and quality control processes.

Ignoring Regional and Application-Specific Standards

Threaded pipe standards vary globally (e.g., NPT in the U.S. vs. BSPT in Europe). Using incompatible fittings can result in leaks or assembly failures. Confirm that products meet the required regional and application-specific standards (e.g., ANSI, DIN, JIS) and are suitable for the intended service conditions (pressure, temperature, fluid type).

Avoiding these pitfalls requires due diligence in supplier selection, clear specifications, and robust incoming inspection protocols. Investing time upfront ensures long-term reliability and safety of piping systems.

Logistics & Compliance Guide for Threaded Pipe and Fittings

Overview and Product Classification

Threaded pipe and fittings are essential components in plumbing, oil and gas, construction, and industrial systems. They are typically manufactured from materials such as carbon steel, stainless steel, galvanized steel, or PVC, and are designed to be joined via threaded connections (e.g., NPT, BSPT). Proper logistics and compliance management are critical due to variations in material, size, standards, and international regulations.

Material and Packaging Specifications

Threaded pipe and fittings must be packaged to prevent thread damage, corrosion, and deformation during transit. Steel pipes are often bundled with protective end caps and wrapped in waterproof material. Fittings are typically boxed or palletized with separators. For international shipments, packaging must comply with ISPM 15 regulations for wooden pallets, requiring heat treatment or fumigation certification.

Transportation and Handling

Due to their weight and length, threaded pipes require flatbed trucks, cranes, or forklifts for loading and unloading. Pipes should be transported horizontally with adequate support to prevent bending. Fittings should be secured on stable pallets to avoid shifting. Special care must be taken to protect thread ends using plastic or metal caps. Handling should follow OSHA guidelines to ensure worker safety, particularly for heavy or long sections.

Storage and Inventory Management

Store pipes off the ground on racks or skids in a dry, covered area to prevent rust and contamination. Fittings should be stored in their original packaging in climate-controlled environments when possible. Implement a first-in, first-out (FIFO) inventory system to minimize material degradation and obsolescence. Clearly label all items with specifications (material, size, thread type, standard) for traceability.

Regulatory Compliance

Threaded pipe and fittings must comply with regional and international standards such as ASTM, ASME, API, ISO, and DIN. Certifications such as Mill Test Certificates (MTC) or Material Test Reports (MTR) are often required for quality assurance. In the EU, CE marking may be necessary under the Construction Products Regulation (CPR) for certain applications. In the U.S., compliance with OSHA and EPA regulations regarding hazardous materials (e.g., lead content in brass fittings) is mandatory.

Import/Export Documentation

International shipments require accurate documentation including commercial invoices, packing lists, certificates of origin, and bills of lading. For exports, verify Harmonized System (HS) codes—common codes include 7307 (steel pipe fittings) and 7304 (steel pipes). Importers must comply with customs regulations, including anti-dumping duties where applicable (e.g., on Chinese steel pipe imports). Obtain any required product-specific import licenses or permits.

Quality Assurance and Inspection

Implement quality controls at manufacturing and before shipment. Inspect threads for accuracy and damage, verify material grades, and conduct hydrostatic or dimensional testing as required. Third-party inspections (e.g., SGS, BV) may be required by buyers or customs authorities. Maintain detailed records of inspections and certifications for audit purposes.

Environmental and Safety Compliance

Ensure manufacturing and logistics processes comply with environmental regulations (e.g., EPA, REACH) regarding emissions, waste, and chemical use. For hazardous materials (e.g., chromate coatings), provide Safety Data Sheets (SDS) and label shipments per GHS standards. Implement spill prevention and worker protection protocols in storage and handling areas.

Traceability and Documentation Retention

Maintain full traceability from raw material sourcing to final delivery. Retain documentation such as heat numbers, test reports, shipping records, and compliance certificates for a minimum of 5–10 years, depending on industry requirements (e.g., oil and gas projects may require longer retention).

Conclusion

Effective logistics and compliance for threaded pipe and fittings require strict adherence to material standards, safe handling practices, accurate documentation, and regulatory alignment across jurisdictions. Proactive planning and quality assurance help avoid delays, rejections, and non-compliance penalties in global supply chains.

In conclusion, sourcing threaded pipe and fittings requires careful consideration of material type, specifications, standards (such as ASTM, ASME, or ANSI), and application requirements to ensure compatibility and reliability. It is essential to work with reputable suppliers who can provide certified materials, consistent quality, and timely delivery. Evaluating factors such as corrosion resistance, pressure ratings, dimensional accuracy, and thread standards (NPT, BSPT, etc.) will help prevent leaks and system failures. Additionally, conducting cost-benefit analyses, maintaining strong supply chain relationships, and staying informed about market trends contribute to efficient and effective procurement. Ultimately, a strategic sourcing approach ensures the long-term performance, safety, and cost-efficiency of piping systems across industrial, commercial, or residential applications.