The global bimetal thermostatic market is experiencing steady growth, driven by increasing demand for precision temperature control across industries such as HVAC, automotive, appliances, and industrial manufacturing. According to a 2023 report by Mordor Intelligence, the global thermostat market is projected to grow at a CAGR of over 6.8% from 2023 to 2028, with thermostatic bimetal components playing a critical role due to their reliability, cost-effectiveness, and passive operation. Similarly, Grand View Research estimates that the broader temperature sensors market, which heavily relies on bimetallic technologies, will expand at a CAGR of 6.9% from 2023 to 2030, fueled by automation and energy efficiency mandates worldwide. As demand rises, manufacturers of high-quality thermostatic bimetals are scaling innovation in material science and manufacturing precision. Below are the top five companies leading this space, recognized for their technical expertise, global reach, and consistent performance in thermally responsive materials.

Top 5 Thermostatic Bimetal Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Thermostatic Bimetal Price

Domain Est. 2001

Website: shanghaimetal.com

Key Highlights: Shanghai Metal Corporation is a trusted Thermostatic Bimetal supplier in china, we have extensive inventory of Thermostatic Bimetal, and other metals in ……

#2 Thermostatic Bimetal Manufacturer

Domain Est. 2017

Website: domadia.net

Key Highlights: Domadia is a top Thermostatic Bimetal manufacturer, providing high-performance bimetal solutions with fast service and competitive rates….

#3 Thermostatic Bimetal Parts/Strips

Domain Est. 1998

Website: shivalikbimetals.com

Key Highlights: A thermostatic bimetal consists of two or more layers of different alloys firmly bonded together, having different coefficient of thermal expansion result….

#4 TruFlex™ Bimetal

Domain Est. 2000

Website: emsclad.com

Key Highlights: Thermostatic Bimetal is comprised of two metals with different coefficients of thermal expansion (CTE) that are bonded together….

#5 Thermostatic Bimetals

Domain Est. 2023

Website: trianglealloy.com

Key Highlights: Bimetals are composite materials consisting of two metals with different coefficients of thermal expansion. This design allows the material to bend or ……

Expert Sourcing Insights for Thermostatic Bimetal

H2: 2026 Market Trends for Thermostatic Bimetal

The global thermostatic bimetal market is projected to experience steady growth through 2026, driven by increasing demand across multiple industrial and consumer sectors, technological advancements, and a growing emphasis on energy efficiency and automation. Key trends shaping the market in 2026 include:

-

Expansion in Home Appliances and HVAC Systems

The rising adoption of smart home technologies and energy-efficient appliances continues to fuel demand for thermostatic bimetal components. In HVAC systems, bimetal thermostats remain essential for temperature regulation due to their reliability and cost-effectiveness, particularly in emerging markets where affordability is critical. -

Growth in Industrial Automation and Electrical Protection

Industrial sectors are increasingly deploying thermostatic bimetal in overload relays, circuit breakers, and motor protectors. As industries adopt predictive maintenance and safer electrical systems, the need for reliable temperature-sensing components like bimetal strips is expected to rise significantly by 2026. -

Automotive Sector Integration

Although electric vehicles (EVs) are reducing traditional mechanical components, thermostatic bimetal still finds applications in battery thermal management systems, cabin climate control, and auxiliary heating units. The shift toward electrification is prompting innovation in high-precision, miniaturized bimetal elements tailored for automotive safety and performance. -

Material Innovation and Customization

Manufacturers are investing in advanced bimetal alloys with improved thermal responsiveness, durability, and corrosion resistance. Customization for specific temperature ranges and response times is becoming a competitive differentiator, especially in medical devices and aerospace applications. -

Regional Market Dynamics

Asia-Pacific remains the largest and fastest-growing market, led by China, India, and Southeast Asia, due to rapid urbanization, industrialization, and infrastructure development. North America and Europe show moderate growth, supported by retrofitting of older systems and regulatory push for energy efficiency. -

Sustainability and Regulatory Compliance

Environmental regulations restricting the use of mercury and other hazardous materials in thermostats are accelerating the shift toward bimetal-based alternatives. This regulatory tailwind supports market expansion, especially in Europe under RoHS and REACH directives. -

Supply Chain Optimization and Localization

In response to geopolitical uncertainties and supply chain disruptions, companies are localizing production and forging strategic partnerships. This trend enhances resilience and reduces lead times, particularly for high-volume applications in appliances and industrial equipment.

In summary, the thermostatic bimetal market in 2026 is characterized by sustained demand across traditional sectors, innovation in materials and design, and strategic regional growth—positioning the industry for continued relevance despite advancing digital alternatives.

Common Pitfalls Sourcing Thermostatic Bimetal (Quality, IP)

Sourcing high-performance thermostatic bimetal requires careful attention to both material quality and intellectual property (IP) considerations. Overlooking these aspects can lead to product failures, supply chain disruptions, and legal risks. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Composition and Layer Bonding

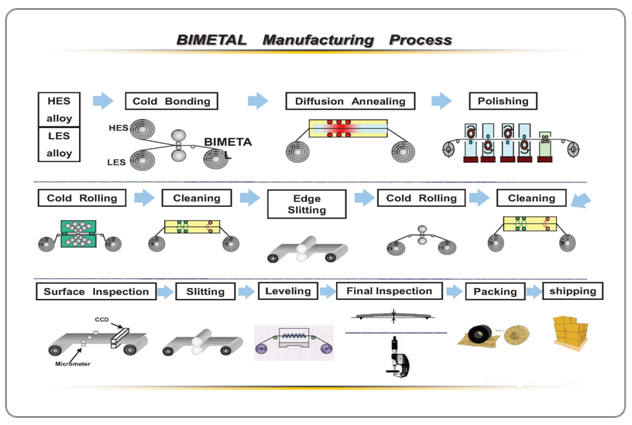

Thermostatic bimetal relies on precise layering of two metals with different coefficients of thermal expansion. Poor control over alloy composition or bonding techniques (e.g., roll bonding) can result in delamination, inconsistent thermal response, or premature fatigue. Sourcing from suppliers without rigorous in-house metallurgical testing increases the risk of batch-to-batch variability.

Inadequate Performance Testing and Certification

Many suppliers provide only basic dimensional tolerances without comprehensive performance data such as curvature change per degree (bimetal sensitivity), fatigue life, or corrosion resistance. Relying on uncertified test results or third-party data without verification may lead to component failure in real-world applications.

Lack of Traceability and Process Control

Reputable thermostatic bimetal producers maintain full traceability from raw materials to finished strips, including heat lot tracking and process documentation. Sourcing from vendors with opaque manufacturing practices increases the risk of counterfeit or substandard material entering the supply chain.

Insufficient Customization and Application Support

Thermostatic bimetal often requires custom formulations and geometries for specific applications (e.g., circuit breakers, thermal switches). Suppliers without engineering support may offer off-the-shelf products that don’t meet operational requirements, leading to reliability issues.

IP-Related Pitfalls

Unlicensed Use of Proprietary Alloys or Processes

Several thermostatic bimetal compositions and manufacturing techniques are protected by patents (e.g., specific Ni-Fe-Cr or Ni-Fe-Mn formulations). Sourcing from suppliers who do not license these technologies—or worse, reverse-engineer them—exposes buyers to IP infringement claims, particularly in regulated markets.

Ambiguous Ownership of Custom Formulations

When co-developing a custom bimetal strip, failure to clearly define IP ownership in contracts can result in disputes. Suppliers may claim rights to the formulation, limiting your ability to source from alternative vendors or scale production.

Lack of Freedom-to-Operate (FTO) Analysis

Buyers often assume that purchasing bimetal strips transfers all necessary IP rights. However, integration into end products (e.g., thermostats, safety devices) may still infringe on third-party patents. Conducting an FTO analysis before product launch is essential but frequently overlooked.

Counterfeit or Grey Market Materials

Unscrupulous suppliers may repackage or mislabel bimetal strips, falsely claiming compliance with standards or licensed technologies. This not only risks IP violations but also compromises product safety and reliability, especially in high-stakes applications like medical or automotive devices.

Conclusion

To mitigate these risks, buyers should prioritize suppliers with proven metallurgical expertise, full quality certifications (e.g., ISO 9001, IATF 16949), transparent IP licensing, and strong technical collaboration. Due diligence in both quality assurance and IP compliance is critical for long-term product success and legal safety.

Logistics & Compliance Guide for Thermostatic Bimetal

Thermostatic bimetal is a critical engineered material used in temperature-sensitive devices such as thermostats, circuit breakers, and thermal switches. Due to its specific metallurgical composition and application in regulated industries, proper logistics and compliance practices are essential to ensure product integrity, safety, and regulatory adherence. This guide outlines key considerations for transporting, storing, and ensuring compliance when handling thermostatic bimetal.

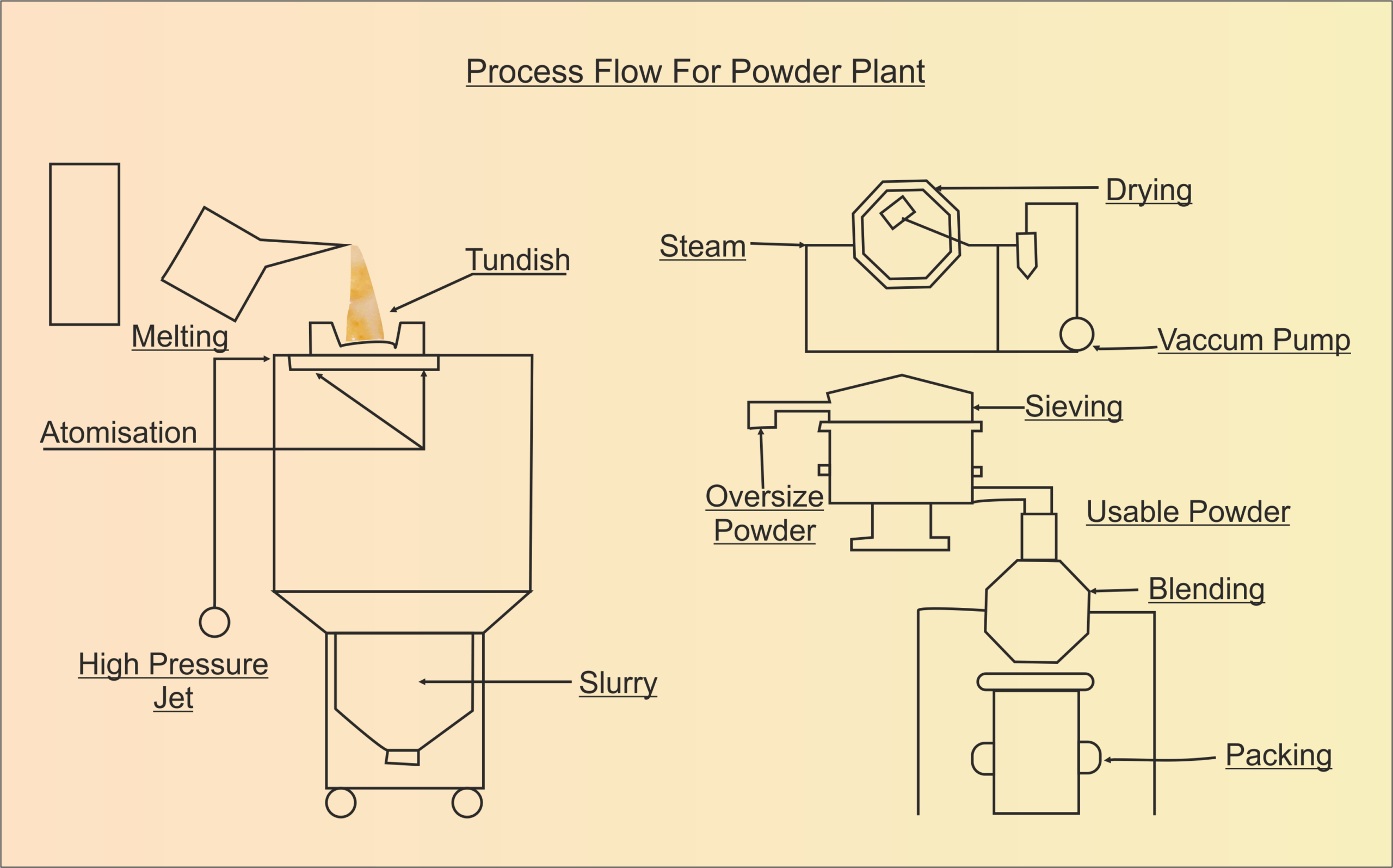

Material Classification and Handling

Thermostatic bimetal is typically composed of two or more metals (often steel, copper, nickel, and manganese alloys) bonded together to respond predictably to temperature changes. The material is sensitive to mechanical stress, moisture, and contamination, which can affect its performance.

- Packaging Requirements: Use moisture-resistant, anti-corrosive packaging (e.g., VCI paper or sealed plastic wraps) to prevent oxidation.

- Handling: Avoid bending, scratching, or applying excessive force during handling. Use gloves to prevent oil and moisture transfer from skin.

- Labeling: Clearly label packages with “Fragile,” “Moisture Sensitive,” and relevant material identification (e.g., alloy type, batch number).

Storage Conditions

Proper storage is vital to maintain the calibration and response accuracy of thermostatic bimetal components.

- Environment: Store in a dry, temperature-controlled environment (15–25°C, 30–60% RH).

- Shelving: Use non-abrasive, elevated shelving to avoid floor moisture and physical damage.

- Shelf Life: Monitor shelf life based on manufacturer specifications; typically 12–24 months if stored correctly.

- Segregation: Store away from chemicals, strong magnetic fields, and high-vibration areas.

Transportation Guidelines

Transportation must preserve material integrity and comply with domestic and international regulations.

- Domestic Shipping: Use enclosed, climate-controlled vehicles where possible. Secure loads to prevent shifting.

- International Shipping: Comply with IMDG (for sea), IATA (for air), and ADR (for road) regulations as applicable. While thermostatic bimetal is generally non-hazardous, verify alloy-specific classifications.

- Documentation: Include packing lists, material certifications (e.g., RoHS, REACH), and safety data sheets (SDS) with shipments.

- Customs Compliance: Provide accurate HS codes (typically 7326.90 for other articles of steel), country of origin, and value declarations.

Regulatory Compliance

Thermostatic bimetal may be subject to multiple regulatory frameworks depending on end-use and destination.

- RoHS (EU): Ensure lead, cadmium, mercury, and other restricted substances are below permissible limits.

- REACH (EU): Confirm compliance with SVHC (Substances of Very High Concern) requirements; provide necessary declarations.

- Conflict Minerals (U.S. Dodd-Frank Act): If applicable, verify that tin, tungsten, tantalum, or gold (if used in alloys or coatings) are sourced responsibly.

- Export Controls: Check EAR (Export Administration Regulations) for potential controls on dual-use technologies involving temperature control materials.

- Product Certification: Components may require certification (e.g., UL, CE, CSA) depending on the application.

Quality Assurance and Traceability

Maintaining traceability ensures compliance and facilitates recall management if needed.

- Batch Tracking: Implement a system to track alloy batches, heat numbers, and production dates.

- Inspection: Conduct incoming and outgoing inspections for dimensional accuracy, surface quality, and packaging integrity.

- Documentation Retention: Keep records of compliance certificates, test reports, and shipping documents for a minimum of 5–10 years, depending on industry standards.

Environmental and Disposal Considerations

- Recycling: Thermostatic bimetal is recyclable. Partner with certified metal recyclers to handle scrap responsibly.

- Waste Disposal: Follow local regulations for metal waste; avoid landfill disposal when possible.

Conclusion

Effective logistics and compliance management for thermostatic bimetal ensures product reliability, regulatory adherence, and supply chain integrity. By following proper handling, storage, transportation, and documentation practices, companies can mitigate risks and support sustainable, compliant operations in global markets. Always consult with material suppliers and regulatory experts to stay updated on evolving requirements.

Conclusion for Sourcing Thermostatic Bimetal

Sourcing thermostatic bimetal requires a careful evaluation of material quality, supplier reliability, technical specifications, and compliance with industry standards. Due to its critical role in temperature-sensitive applications such as thermostats, electrical protection devices, and heating controls, the performance and consistency of thermostatic bimetal directly impact the safety and efficiency of end products.

A successful sourcing strategy should prioritize suppliers with proven expertise in bimetal manufacturing, stringent quality control processes, and the capability to deliver customized solutions based on specific thermal expansion requirements. Additionally, factors such as lead times, cost-effectiveness, and long-term supply chain stability must be considered to ensure uninterrupted production.

In conclusion, organizations should adopt a strategic and collaborative approach when sourcing thermostatic bimetal, balancing performance requirements with supply chain resilience. Establishing strong partnerships with qualified and certified suppliers will ultimately enhance product reliability, reduce risks, and support innovation in temperature control technologies.