The global thermoplastic polymer resin market is experiencing robust expansion, driven by rising demand across industries such as automotive, packaging, electronics, and construction. According to Grand View Research, the market was valued at USD 413.6 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 5.7% from 2023 to 2030. This growth is fueled by the increasing adoption of lightweight, durable, and recyclable materials, particularly in sustainability-focused applications. Mordor Intelligence further supports this outlook, citing strong regional demand in Asia-Pacific—especially in China and India—due to rapid industrialization and urbanization. As innovation accelerates and environmental regulations tighten, leading manufacturers are investing heavily in advanced formulations and production capacities. In this evolving landscape, the following ten companies have emerged as top thermoplastic polymer resin manufacturers, shaping the future of material science through scale, R&D, and global supply chain reach.

Top 10 Thermoplastic Polymer Resin Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Polymers

Domain Est. 2007

Website: lyondellbasell.com

Key Highlights: Catalloy process resins. Our reactor technology produces thermoplastic polyolefins combining the durability of polyolefins with the flexibility of elastomers….

#2 Polymers

Domain Est. 1998

Website: sabic.com

Key Highlights: CYCOLAC™ Resin – An engineering thermoplastic known for its excellent aesthetics, toughness, and dimensional stability. CYCOLAC resin offers outstanding ……

#3 Americhem

Domain Est. 1997

Website: americhem.com

Key Highlights: High-Performance Custom Masterbatch & Thermoplastic Compound Solutions. Your trusted global partner in designing and manufacturing polymer solutions. Request ……

#4 PolyQuest

Domain Est. 2000

Website: polyquest.com

Key Highlights: The Value-Added Distributor of Virgin Thermoplastics and Manufacturer of Recycled Thermoplastics. (910) 342-9554. Applications. Bottle · Film · Textiles…

#5 Poly USA, Inc.

Domain Est. 2007

Website: polyusainc.com

Key Highlights: Poly USA has been a leader in recycling and distributing thermoplastic resins and compounds. Our goals have been to maximize value and provide unparalleled ……

#6 RTP Company

Domain Est. 1996

Website: rtpcompany.com

Key Highlights: RTP Company’s engineered thermoplastic compounds provide you with solutions, customization, and services for all your thermoplastic needs….

#7 M. Holland Company

Domain Est. 2000

Website: mholland.com

Key Highlights: M. Holland is a leading international distributor of thermoplastic resin, helping clients and suppliers with everything from sourcing and logistics solutions….

#8 Homepage

Domain Est. 2000

Website: lastique.com

Key Highlights: Premier Supplier of Prime, and Recycled Plastic Resins. Lastique International Corporation, based in Louisville, Kentucky, supplies a wide variety of prime, ……

#9 Polyram Group

Domain Est. 2014

Website: polyram-group.com

Key Highlights: Polyram specializes in high-performance thermoplastics, providing durable and efficient solutions for various industries worldwide….

#10 All Thermoplastic Resin Types

Domain Est. 2018

Website: nexeoplastics.com

Key Highlights: We supply nearly every type of plastic resin for thermoforming, molding, and other applications. Learn more about each type and find available resins now!…

Expert Sourcing Insights for Thermoplastic Polymer Resin

H2: 2026 Market Trends for Thermoplastic Polymer Resin

The global thermoplastic polymer resin market is poised for robust growth by 2026, driven by technological advancements, expanding applications across industries, and increasing demand for sustainable materials. Key trends shaping the market include:

-

Rising Demand from Automotive and Transportation Sectors

The automotive industry continues to be a major consumer of thermoplastic resins due to their lightweight properties, which contribute to fuel efficiency and reduced emissions. High-performance resins such as polyamide (PA), polycarbonate (PC), and polypropylene (PP) are increasingly used in interior components, under-the-hood applications, and structural parts. Electric vehicle (EV) production growth further boosts demand for impact-resistant and heat-stable resins. -

Growth in Packaging and Consumer Goods

Polyethylene (PE) and polyethylene terephthalate (PET) remain dominant in flexible and rigid packaging due to their durability, clarity, and recyclability. With e-commerce expansion, demand for lightweight and protective packaging solutions is accelerating, reinforcing the role of thermoplastics. Innovations in multilayer and barrier films enhance shelf life and functionality. -

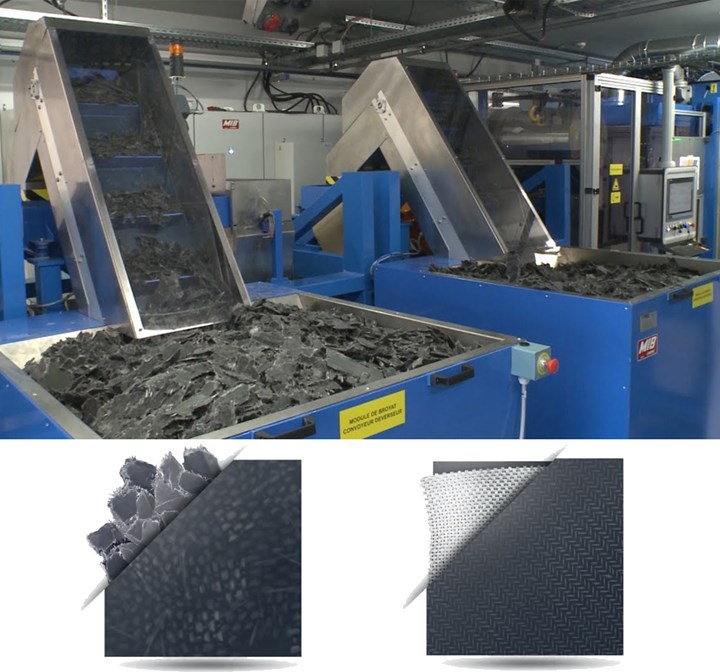

Sustainability and Circular Economy Initiatives

Environmental regulations and consumer pressure are pushing manufacturers toward bio-based and recyclable thermoplastics. Biodegradable resins such as polylactic acid (PLA) and bio-PET are gaining traction. Chemical recycling technologies are being adopted to process mixed plastic waste into virgin-quality resins, supporting circular economy goals in regions like Europe and North America. -

Advancements in High-Performance and Engineering Thermoplastics

Engineering resins like PEEK (polyether ether ketone), PPS (polyphenylene sulfide), and PEI (polyetherimide) are witnessing increased adoption in aerospace, medical devices, and electronics due to their thermal stability, chemical resistance, and mechanical strength. 3D printing applications are also driving demand for specialty thermoplastic filaments. -

Regional Market Dynamics

Asia-Pacific dominates the market, led by China, India, and Southeast Asia, due to rapid industrialization, urbanization, and manufacturing growth. North America and Europe are focusing on innovation and sustainability, with strong R&D investments in advanced materials and recycling infrastructure. -

Raw Material Volatility and Supply Chain Adaptation

Fluctuations in crude oil prices and supply chain disruptions remain challenges. However, companies are diversifying feedstock sources and investing in domestic production to mitigate risks. The shift toward renewable feedstocks is expected to accelerate in response to carbon neutrality targets. -

Digitalization and Smart Manufacturing

Integration of Industry 4.0 technologies in resin production—such as AI-driven process optimization and real-time quality monitoring—is improving efficiency and reducing waste, enabling faster response to market demands.

In summary, by 2026, the thermoplastic polymer resin market will be characterized by innovation, sustainability, and diversification, with growth concentrated in high-performance applications and emerging economies. Strategic investments in green technologies and circular solutions will be critical for long-term competitiveness.

Common Pitfalls Sourcing Thermoplastic Polymer Resin: Quality and Intellectual Property Risks

Sourcing thermoplastic polymer resins involves significant challenges beyond simple price and availability. Two critical areas where companies often encounter costly pitfalls are Quality Consistency and Intellectual Property (IP) Protection. Overlooking these can lead to production failures, reputational damage, legal disputes, and financial losses.

Quality Consistency Challenges

Ensuring consistent resin quality is paramount, as variations can disrupt manufacturing processes and compromise final product performance.

- Inconsistent Material Properties: Resins from different batches or suppliers can exhibit variations in key properties like melt flow index (MFI), molecular weight distribution, color, viscosity, thermal stability, and mechanical strength (tensile, impact). This inconsistency can lead to defects in injection molding, extrusion, or other processing techniques, causing scrap, rework, and production downtime.

- Undisclosed Additives or Fillers: Suppliers, especially unverified ones, may alter formulations by adding lower-cost fillers (e.g., calcium carbonate, talc) or different stabilizers, plasticizers, or colorants without notification. These changes can drastically affect processing behavior, long-term durability (e.g., UV resistance, hydrolysis), and end-product performance.

- Contamination: Poor handling or storage at the supplier or distributor level can introduce contaminants (moisture, foreign particles, cross-contaminated resins). Moisture, in particular, is critical for hygroscopic resins (like nylons or ABS), leading to hydrolysis during processing and degraded mechanical properties.

- Counterfeit or Substandard Materials: The market includes counterfeit resins falsely labeled as specific grades (e.g., engineering-grade PC/ABS sold as virgin) or resins made from inferior raw materials or improper recycling streams. These fail to meet required specifications and can cause catastrophic failures in demanding applications (e.g., automotive, medical).

- Lack of Traceability and Certifications: Inadequate documentation (e.g., missing Certificates of Analysis – CoA, unclear batch traceability) makes it difficult to verify quality, troubleshoot issues, or comply with regulatory requirements (e.g., FDA, UL, REACH, RoHS).

Intellectual Property (IP) Protection Risks

Sourcing resins, especially custom formulations or high-performance grades, poses significant IP exposure.

- Reverse Engineering and Formula Theft: Sharing detailed material specifications, performance requirements, or application data with potential suppliers increases the risk of competitors or unscrupulous suppliers reverse-engineering proprietary formulations. This is especially critical when developing new materials or custom compounds.

- Unauthorized Use of Trade Secrets: Collaborating with toll compounders or custom compounders requires sharing sensitive information. Without robust, legally binding agreements, there’s a risk the compounder could use your formulation knowledge or proprietary additives to benefit other clients or create competing products.

- Infringement on Patented Technologies: Sourcing resins without due diligence may lead to unintentional use of materials covered by third-party patents (e.g., specific polymerization processes, unique additive packages, or novel resin grades). This exposes the buyer to infringement lawsuits, even if the infringement was unknowing.

- Weak or Absent Legal Agreements: Relying on informal agreements or standard purchase orders without comprehensive confidentiality agreements (NDAs), material-specific IP clauses, or clear ownership definitions for jointly developed modifications leaves the buyer vulnerable. Supplier contracts may contain unfavorable IP clauses assigning rights to the supplier.

- Grey Market and Diverted Materials: Purchasing from unauthorized distributors can result in “diverted” genuine materials originally intended for specific markets or customers. While the resin might be authentic, its use can violate the original manufacturer’s distribution agreements and potentially breach IP licenses associated with its use in certain regions or applications.

Mitigation Strategies: To avoid these pitfalls, implement rigorous supplier qualification processes, demand comprehensive and consistent quality documentation (CoA, SDS), conduct regular audits, use accredited testing labs for incoming inspection, and establish strong, IP-protective legal contracts with all partners. Prioritize direct relationships with reputable, authorized suppliers whenever possible.

Logistics & Compliance Guide for Thermoplastic Polymer Resin

Overview

Thermoplastic polymer resins are widely used materials in industries such as automotive, packaging, electronics, and consumer goods due to their recyclability, versatility, and ease of processing. Proper logistics handling and regulatory compliance are essential to ensure safe transportation, storage, and use while meeting environmental, health, and safety standards globally.

Classification and Identification

Thermoplastic polymer resins are generally classified as non-hazardous solids under international transport regulations when in pellet, powder, or flake form and not containing hazardous additives. However, classification may vary based on resin type, additives, and intended use.

- UN Number: Typically not assigned unless resins contain hazardous substances (e.g., plasticizers, flame retardants).

- Proper Shipping Name: “Plastic in solid form, not otherwise specified” or specific resin name (e.g., “Polyethylene pellets”).

- Hazard Class: Usually Class 9 (Miscellaneous) if classified, but often non-regulated for transport.

- CAS Number: Varies by resin (e.g., Polyethylene: 9002-88-4; Polypropylene: 9003-07-0).

Always consult the Safety Data Sheet (SDS) for accurate classification.

Packaging Requirements

Proper packaging ensures product integrity and prevents contamination or spillage during transit.

- Primary Packaging: Resins are commonly shipped in multi-wall poly-lined paper bags (25 kg), bulk bags (500–1000 kg), or rigid containers.

- Secondary Packaging: Palletized loads secured with stretch wrap or strapping.

- Moisture Protection: Use moisture barriers if resin is hygroscopic (e.g., Nylon, PET).

- Labeling: Include product name, batch/lot number, net weight, manufacturer details, and handling symbols (e.g., “Protect from Moisture”).

Storage Conditions

Optimal storage preserves resin quality and prevents degradation.

- Temperature: Store in a dry, well-ventilated area between 10°C and 30°C.

- Humidity: Maintain low humidity, especially for resins sensitive to moisture.

- Sunlight: Protect from direct sunlight and UV exposure to prevent discoloration or degradation.

- Segregation: Store away from strong oxidizers, acids, and flammable materials.

- Shelf Life: Typically 1–2 years when stored properly; rotate stock using FIFO (First In, First Out).

Transportation Guidelines

Transportation methods must comply with regional and international regulations.

- Road/Rail: Use covered, dry vehicles. Secure loads to prevent shifting. Avoid contamination from previous cargo.

- Marine (IMDG Code): If classified as hazardous (e.g., Class 9), comply with IMDG packaging, marking, and documentation. Non-hazardous resins typically shipped under general cargo rules.

- Air (IATA DGR): Most thermoplastics are permitted as non-dangerous goods. Confirm via SDS and IATA Special Provision A177.

- Documentation: Include commercial invoice, packing list, and SDS. For regulated shipments, provide a Dangerous Goods Declaration if applicable.

Regulatory Compliance

Adherence to regulations ensures legal and safe handling across jurisdictions.

- GHS (Globally Harmonized System): SDS must be GHS-compliant, including hazard classification, precautionary statements, and first aid measures.

- REACH (EU): Ensure resins and additives are registered under REACH. Provide SCIP notification if SVHCs (Substances of Very High Concern) are present above threshold.

- RoHS (EU): Verify compliance for resins used in electrical/electronic equipment (restricts hazardous substances).

- TSCA (USA): Confirm resin substances are listed on the TSCA Inventory.

- Proposition 65 (California): Disclose if resin contains chemicals listed under Prop 65.

- REACH & CLP (UK): Post-Brexit, UK REACH and CLP regulations apply separately.

Handling and Worker Safety

Safe handling minimizes exposure risks and prevents accidents.

- Personal Protective Equipment (PPE): Use safety glasses, gloves, and dust masks when handling powders or in dusty environments.

- Ventilation: Ensure adequate ventilation in processing and storage areas.

- Dust Control: Implement dust collection systems to prevent combustible dust accumulation (especially with fine powders).

- Spill Management: Sweep up spills; avoid creating dust. Dispose of waste per local regulations.

Environmental and Disposal Considerations

- Recycling: Thermoplastics are recyclable. Follow regional recycling codes and guidelines.

- Waste Disposal: Dispose of contaminated or non-recyclable resin as solid industrial waste in compliance with local environmental laws.

- Incineration: If incinerated, use facilities with proper emission controls to avoid release of toxic fumes.

- Spill Response: Contain spills to prevent entry into drains or waterways. Report significant spills per environmental regulations.

Documentation and Traceability

Maintain accurate records for compliance and quality control.

- Safety Data Sheet (SDS): Provide up-to-date SDS (ISO 11014 or ANSI Z400.1 compliant).

- Certificates of Analysis (CoA): Include batch-specific test results (e.g., melt flow index, moisture content).

- Traceability: Track batch numbers from production to delivery for quality and recall purposes.

Emergency Response

- Fire: Use water spray, foam, CO₂, or dry chemical extinguishers. Melted resin may flow and spread fire.

- Inhalation: Move to fresh air if exposed to dust or fumes.

- Skin Contact: Wash with soap and water.

- Eye Contact: Rinse thoroughly with water for at least 15 minutes.

- Spill: Refer to SDS Section 6 for specific response measures.

Conclusion

Safe and compliant logistics of thermoplastic polymer resins require understanding material properties, regulatory frameworks, and best practices in handling and transportation. Always refer to the manufacturer’s SDS and stay updated on evolving regulations in target markets to ensure uninterrupted and responsible supply chain operations.

Conclusion:

Sourcing thermoplastic polymer resin requires a strategic approach that balances material performance, cost-efficiency, supplier reliability, and sustainability. With a wide variety of thermoplastics available—such as polyethylene (PE), polypropylene (PP), polycarbonate (PC), and acrylonitrile butadiene styrene (ABS)—selecting the appropriate resin depends on the specific requirements of the application, including mechanical strength, thermal resistance, chemical exposure, and regulatory compliance.

Successful sourcing involves evaluating multiple suppliers to ensure consistent quality, on-time delivery, and competitive pricing. Establishing long-term partnerships with reputable suppliers who adhere to industry standards and certifications (e.g., ISO, REACH, RoHS) enhances supply chain resilience. Additionally, considering the environmental impact of resin sourcing—including recyclability, use of bio-based materials, and carbon footprint—is increasingly important to meet sustainability goals and regulatory demands.

In conclusion, an effective thermoplastic resin sourcing strategy integrates technical specifications, supply chain security, cost management, and environmental responsibility to support innovation, product quality, and long-term business success.