The global thermoforming plastics market is experiencing robust growth, driven by rising demand across packaging, automotive, medical, and consumer goods industries. According to a 2023 report by Grand View Research, the market size was valued at USD 22.1 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 4.8% from 2023 to 2030. This growth is further accelerated by advancements in biodegradable and recyclable thermoplastic materials, as well as increasing automation in manufacturing processes. Another analysis by Mordor Intelligence forecasts a CAGR of 5.2% over the same period, citing the expanding foodservice packaging sector and lightweighting trends in automotive design as key contributors. As competition intensifies and regional manufacturing hubs evolve, identifying the leading thermoforming plastics manufacturers becomes critical for businesses seeking reliable, scalable, and innovative supply chain partners. Based on market presence, production capacity, material innovation, and global reach, the following ten companies represent the industry’s most influential players shaping the future of thermoformed plastic solutions.

Top 10 Thermoforming Plastics Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

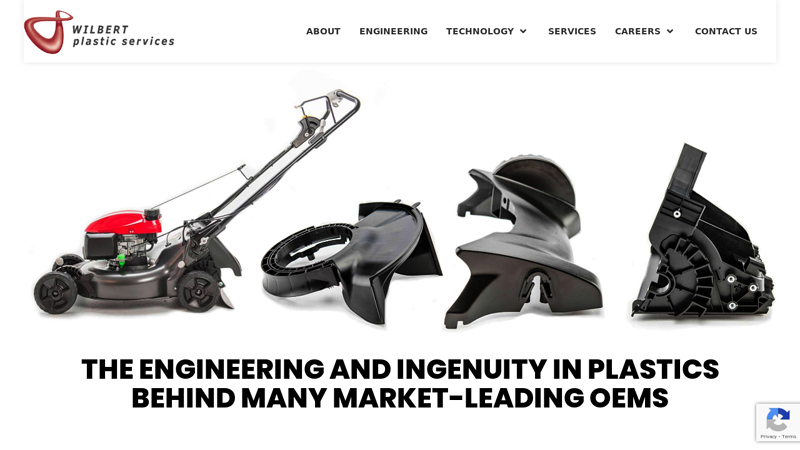

#1 Wilbert Plastic Services:

Domain Est. 2012

Website: wilbertplastics.com

Key Highlights: Wilbert Plastic Services manufactures components and assemblies using injection molding and thermoforming processes for some of the best OEMs in many major ……

#2 Allied Plastics

Domain Est. 1996

Website: alliedplastics.com

Key Highlights: Allied Plastics is a full service custom plastic thermoformer specializing in medium to heavy gauge quality thermoplastic parts with quick turnarounds….

#3 Thermoforming Plastics

Domain Est. 1998

Website: aero-plastics.com

Key Highlights: What Is Thermoforming Plastic? Thermoforming is a manufacturing process that uses heat and pressure to mold thermoplastic sheet materials into custom shapes….

#4 Plastic Components Inc.

Domain Est. 2002

Website: plasticcomponentsinc.com

Key Highlights: We specialize in supplying large and heavy-duty custom thermoformed plastic parts for daily production needs with lower tooling costs and lower minimum ……

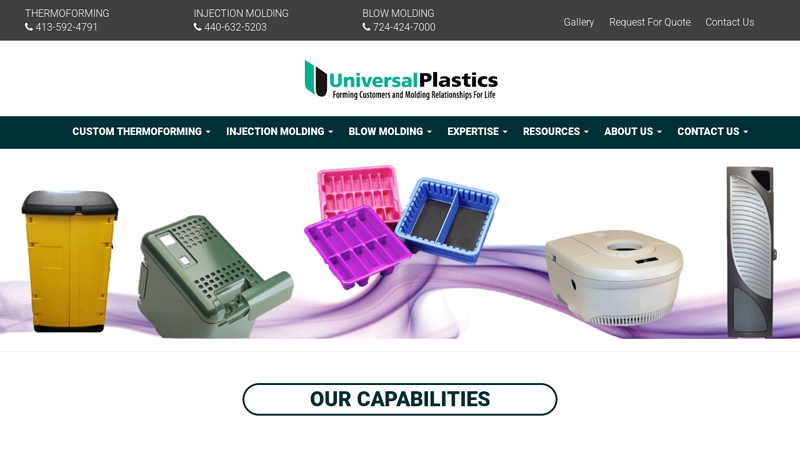

#5 Universal Plastics: Thermoforming

Domain Est. 1996

Website: universalplastics.com

Key Highlights: Universal Plastics offers many injection molding services, including structural foam and gas assist to offer the proper process, engineering support, global ……

#6 Prent Corporation

Domain Est. 1996

Website: prent.com

Key Highlights: Prent Corporation is a global leader in thermoform packaging specializing in thermoformed packaging trays for medical devices, electronics and more!…

#7 Plastic Ingenuity

Domain Est. 1997

Website: plasticingenuity.com

Key Highlights: Discover our thermoformed custom packaging solutions. We provide packaging for the food, healthcare, and consumer goods industries….

#8 Productive Plastics

Domain Est. 1998

Website: productiveplastics.com

Key Highlights: Productive Plastics is a contract / custom plastic thermoforming company specializing in heavy-gauge thermoforming: vacuum forming and pressure forming,…

#9 Global Thermoforming: Thermoforming Company

Domain Est. 2011

Website: globalthermoforming.com

Key Highlights: Global Thermoforming is an ISO-certified thermoforming company that offers vacuum forming, thick gauge, and thin gauge services….

#10 Thermoforming Machine

Domain Est. 2018

Website: onebmg.com

Key Highlights: Our thermoforming machines support a wide range of forming methods, including pressure forming, vacuum forming, and mechanical forming, enabling high-speed ……

Expert Sourcing Insights for Thermoforming Plastics

H2: 2026 Market Trends for Thermoforming Plastics

The global thermoforming plastics market is poised for significant evolution by 2026, driven by technological advancements, shifting consumer preferences, regulatory pressures, and sustainability imperatives. This analysis outlines key trends expected to shape the industry in the coming years.

1. Rising Demand for Sustainable and Biodegradable Materials

Environmental concerns are accelerating the shift toward eco-friendly thermoforming solutions. By 2026, demand for bioplastics—such as polylactic acid (PLA) and bio-based PET—is projected to grow at a CAGR of over 10%. Regulatory frameworks, including extended producer responsibility (EPR) and single-use plastic bans in Europe and North America, are compelling manufacturers to adopt compostable and recyclable thermoformed packaging. Companies are investing in bio-based feedstocks and closed-loop recycling systems to meet sustainability targets and consumer expectations.

2. Expansion in Food and Beverage Packaging

The food service and retail sectors remain the largest end-users of thermoformed plastics. Convenience, shelf appeal, and product protection continue to drive demand for rigid packaging solutions such as clamshells, trays, and cups. Innovations in barrier coatings and active packaging—extending shelf life while maintaining recyclability—are gaining traction. By 2026, the food packaging segment is expected to account for over 50% of the thermoforming market, particularly in emerging economies with rising disposable incomes and urbanization.

3. Technological Advancements in Thermoforming Processes

Automation, Industry 4.0 integration, and precision thermoforming technologies are enhancing production efficiency and reducing waste. Machine learning and AI-driven monitoring systems are enabling predictive maintenance and real-time quality control. Additionally, thin-gauge high-speed thermoforming lines are becoming more prevalent, allowing for faster cycle times and reduced material usage. These innovations are lowering operational costs and improving scalability, especially for high-volume applications.

4. Growth in Medical and Healthcare Applications

The healthcare sector is increasingly adopting thermoformed plastic packaging for sterile trays, diagnostic equipment housings, and disposable medical devices. Stringent regulatory standards (e.g., ISO 11607) are pushing manufacturers toward cleanroom-compliant, high-clarity, and tamper-evident solutions. By 2026, the medical thermoforming segment is expected to grow at a CAGR of approximately 7.5%, fueled by aging populations and increased demand for single-use medical products.

5. Regional Market Shifts and Supply Chain Reconfiguration

Asia-Pacific is anticipated to lead market growth by 2026, driven by China, India, and Southeast Asia’s expanding manufacturing base and consumer markets. However, geopolitical tensions and supply chain disruptions are prompting companies to regionalize production. Nearshoring and reshoring initiatives in North America and Europe are boosting local thermoforming capacity, reducing dependency on global supply chains and improving responsiveness to market demands.

6. Consolidation and Strategic Partnerships

Market consolidation is on the rise, with major players acquiring niche innovators to expand material science capabilities and geographic reach. Strategic partnerships between resin suppliers, packaging designers, and end-users are accelerating the development of next-generation thermoformed solutions. These collaborations are critical for navigating complex regulatory landscapes and bringing sustainable innovations to market faster.

Conclusion

By 2026, the thermoforming plastics market will be defined by sustainability, innovation, and regional diversification. Companies that invest in recyclable materials, digital manufacturing, and circular economy models will be best positioned to capitalize on emerging opportunities. As environmental regulations tighten and consumer awareness grows, the industry’s ability to adapt will determine its long-term viability and competitiveness.

Common Pitfalls Sourcing Thermoforming Plastics: Quality and Intellectual Property Risks

Sourcing thermoforming plastics involves more than just securing materials at the lowest cost. Overlooking critical quality and intellectual property (IP) factors can lead to production delays, product failures, legal disputes, and reputational damage. Below are key pitfalls to avoid:

Quality-Related Pitfalls

Inconsistent Material Properties

Thermoforming plastics must exhibit precise characteristics like melt strength, clarity, impact resistance, and thermal stability. Sourcing from suppliers with inadequate quality control can result in batch-to-batch variability, leading to warping, uneven wall thickness, or poor mold replication. Always verify supplier certifications (e.g., ISO 9001) and request material test reports (MTRs) for every shipment.

Unverified Food or Medical Compliance

When producing parts for food packaging or medical devices, using non-compliant materials poses serious health and regulatory risks. A common mistake is assuming all grades of a resin (e.g., PET or PP) are suitable. Ensure the supplier provides full documentation, such as FDA 21 CFR or EU 10/2011 compliance, and batch-specific declarations.

Poor Processing Suitability

Not all plastics labeled for thermoforming perform well across different processes (e.g., vacuum, pressure, twin-sheet). Materials may degrade at processing temperatures or fail to drape properly. Engage suppliers early with your processing parameters and request processing guidelines or trial samples before full-scale ordering.

Intellectual Property-Related Pitfalls

Unauthorized Use of Proprietary Resins

Some high-performance thermoforming plastics (e.g., specialty copolyesters, impact-modified grades) are protected by patents or trade secrets. Sourcing from non-licensed suppliers or using knock-off materials can expose your company to IP infringement claims. Always confirm the supplier is an authorized distributor or compounder of branded resins (e.g., Eastman’s Tritan™, SABIC’s LEXAN™).

Lack of IP Clauses in Supply Agreements

Contracts that fail to address ownership of custom formulations or tooling designs leave your innovations vulnerable. If you co-develop a material specification with a supplier, ensure the agreement clearly assigns IP rights and includes confidentiality and non-disclosure terms to prevent reverse engineering or reuse with competitors.

Counterfeit or Substituted Materials

In global supply chains, there’s a risk of receiving counterfeit resins or off-spec materials sold as genuine. This undermines product integrity and exposes you to liability. Implement supplier audits, use tamper-evident packaging, and conduct incoming material testing via FTIR or DSC analysis to verify resin identity.

By proactively addressing these quality and IP pitfalls, companies can ensure reliable, compliant thermoformed products while protecting their innovations and brand reputation.

Logistics & Compliance Guide for Thermoforming Plastics

Overview of Thermoforming Plastics

Thermoforming plastics involve heating a plastic sheet to a pliable forming temperature, shaping it in a mold, and trimming it to create a usable product. Common materials include ABS, HIPS, PET, PETG, PVC, and polystyrene. Efficient logistics and strict compliance are essential due to material sensitivity, regulatory requirements, and environmental considerations.

Material Handling and Storage

Proper handling and storage help maintain material integrity and prevent damage or contamination. Store plastic sheets in a clean, dry, temperature-controlled environment away from direct sunlight and moisture. Use vertical racks or pallets to prevent warping. Handle sheets with clean gloves to avoid surface scratches or contamination. Ensure packaging remains sealed until ready for processing.

Packaging and Transportation

Use protective packaging such as edge protectors, stretch wrap, and corrugated cardboard to prevent scratches and deformation during transit. Secure loads on pallets using banding or shrink wrapping to avoid shifting. For long-distance shipping, consider climate-controlled containers if the material is sensitive to temperature extremes. Clearly label packages with handling instructions (e.g., “Fragile,” “Do Not Stack,” “Protect from Sunlight”).

Regulatory Compliance

Ensure compliance with regional and international regulations. Key frameworks include:

- REACH (EU): Register, evaluate, and authorize chemicals used in plastic production. Ensure no restricted substances (e.g., phthalates in PVC) are present above permissible limits.

- RoHS (EU): Restrict hazardous substances in electrical and electronic equipment if thermoformed parts are used in such applications.

- FDA (USA): For food-contact applications, use FDA-compliant materials and maintain documentation proving compliance (e.g., 21 CFR).

- Proposition 65 (California): Provide warnings if products contain chemicals known to cause cancer or reproductive harm.

Environmental and Safety Regulations

Adhere to environmental standards for waste management and emissions:

- EPA Regulations (USA): Comply with air emission standards for volatile organic compounds (VOCs) released during heating.

- Waste Disposal: Recycle scrap and trimmings where possible. Follow local regulations for disposal of non-recyclable plastic waste.

- OSHA Compliance: Ensure safe workplace practices for handling heated plastics, including proper ventilation, PPE (e.g., heat-resistant gloves, face shields), and machine guarding.

Import and Export Considerations

When shipping thermoformed plastic products internationally:

- Verify customs classifications (HS codes) for accurate duty assessment.

- Prepare commercial invoices, packing lists, and certificates of origin.

- For regulated materials (e.g., food-grade or medical), provide compliance documentation (e.g., FDA certificate, EU Declaration of Conformity).

- Be aware of import restrictions or bans on certain plastics (e.g., single-use plastics in some countries).

Traceability and Documentation

Maintain detailed records for full traceability, including:

- Batch numbers and material certifications (e.g., CoA – Certificate of Analysis)

- Processing parameters (temperature, mold details)

- Quality inspection reports

- Compliance documentation (REACH, RoHS, FDA)

This supports audits, recalls, and customer requirements.

Sustainability and Circular Economy

Support sustainability goals by:

- Using recyclable or bio-based materials when feasible.

- Designing for disassembly and recyclability.

- Partnering with certified recycling facilities.

- Reporting environmental metrics (e.g., recycled content, carbon footprint) to meet ESG standards.

Conclusion

Effective logistics and compliance in thermoforming plastics require coordinated efforts in handling, regulatory adherence, documentation, and sustainability. Staying updated with evolving regulations and investing in robust supply chain practices ensures product quality, legal compliance, and market access.

In conclusion, sourcing thermoforming plastics requires a strategic approach that balances material properties, cost-efficiency, supplier reliability, and sustainability goals. Selecting the appropriate plastic type—such as PET, HIPS, PVC, or recycled materials—depends on the specific application, regulatory requirements, and performance needs. Establishing strong relationships with reputable suppliers ensures consistent quality, timely delivery, and access to technical support. Additionally, considering environmental impact and adopting recyclable or biodegradable materials can enhance brand reputation and compliance with evolving regulations. Ultimately, effective sourcing of thermoforming plastics involves a comprehensive evaluation of technical, economic, and environmental factors to achieve optimal production outcomes and long-term business sustainability.