The global thermoforming market is experiencing robust growth, driven by increasing demand across industries such as packaging, automotive, healthcare, and consumer goods. According to Grand View Research, the market was valued at USD 22.8 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 4.7% from 2024 to 2030. This expansion is fueled by the rising need for lightweight, cost-effective, and sustainable packaging solutions, particularly in food and medical applications. Additionally, advancements in materials—such as the development of biodegradable and recyclable thermoplastics—are reshaping manufacturing priorities, pushing leading thermoforming companies to innovate in both process efficiency and environmental performance. As global production capacity increases and regional demand shifts, identifying the top manufacturers becomes critical for supply chain optimization and strategic sourcing. In this context, the following list highlights the 10 most influential thermoforming manufacturers based on production scale, technological capability, geographic reach, and market reputation.

Top 10 Thermo Forming Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Custom Thermoforming

Domain Est. 2002

Website: lundellplastics.com

Key Highlights: Lundell Plastic’s advanced thermoforming technology allows for the cost-effective production of plastic parts with minimal tooling costs….

#2 Allied Plastics

Domain Est. 1996

Website: alliedplastics.com

Key Highlights: Allied Plastics is a full service custom plastic thermoformer specializing in medium to heavy gauge quality thermoplastic parts with quick turnarounds….

#3 Thermoforming Plastics

Domain Est. 1998

Website: aero-plastics.com

Key Highlights: Thermoforming is a manufacturing process that uses heat and pressure to mold thermoplastic sheet materials into custom shapes. The plastic sheet is heated until ……

#4 Formech

Domain Est. 1998

Website: formech.com

Key Highlights: Formech is a designer & manufacturer of vacuum forming machines. Browse our range of compact desktop to fully automatic production vacuum machines….

#5 Prent Corporation

Domain Est. 1996

Website: prent.com

Key Highlights: Prent Corporation is a global leader in thermoform packaging specializing in thermoformed packaging trays for medical devices, electronics and more!…

#6 Universal Plastics: Thermoforming

Domain Est. 1996

Website: universalplastics.com

Key Highlights: Universal Plastics offers many injection molding services, including structural foam and gas assist to offer the proper process, engineering support, global ……

#7 Plastic Ingenuity

Domain Est. 1997

Website: plasticingenuity.com

Key Highlights: Discover our thermoformed custom packaging solutions. We provide packaging for the food, healthcare, and consumer goods industries….

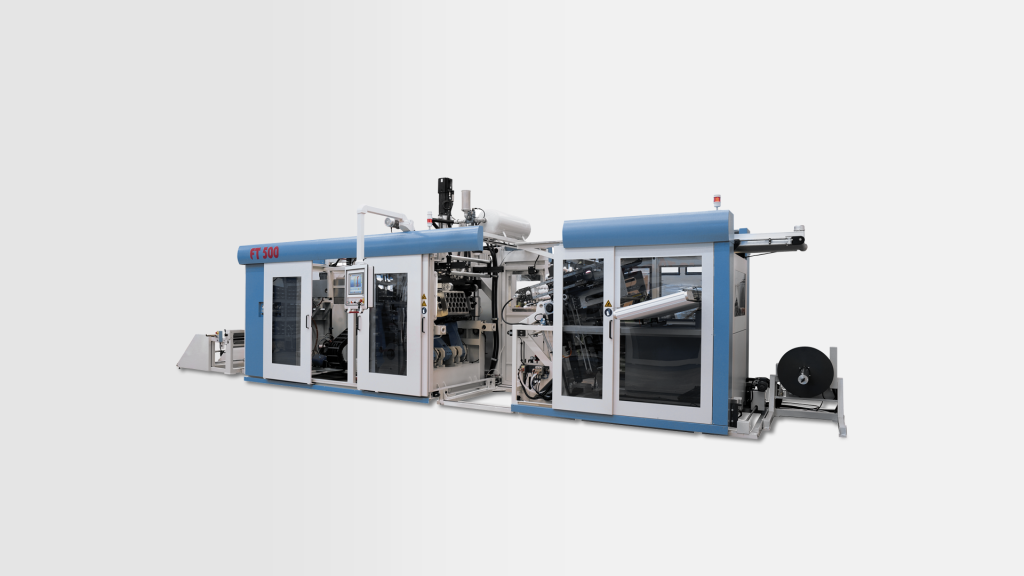

#8 WM Thermoforming Machines

Domain Est. 2011 | Founded: 1981

Website: wm-thermoforming.com

Key Highlights: At WM Thermoforming, we’ve been building thermoforming machines since 1981 with one clear goal: making thermoforming simpler, smarter, and more efficient….

#9 Global Thermoforming: Thermoforming Company

Domain Est. 2011

Website: globalthermoforming.com

Key Highlights: Global Thermoforming is an ISO-certified thermoforming company that offers vacuum forming, thick gauge, and thin gauge services….

#10 Thermoforming Machine

Domain Est. 2018

Website: onebmg.com

Key Highlights: Our thermoforming machines support a wide range of forming methods, including pressure forming, vacuum forming, and mechanical forming, enabling high-speed ……

Expert Sourcing Insights for Thermo Forming

H2: 2026 Market Trends for Thermoforming

The thermoforming industry is poised for significant transformation and growth by 2026, driven by technological innovation, sustainability mandates, and shifting consumer demands. As manufacturers seek cost-effective, scalable, and eco-conscious packaging and product solutions, thermoforming continues to gain traction across diverse sectors including food and beverage, healthcare, automotive, and consumer goods.

-

Rising Demand for Sustainable Materials

By 2026, sustainability will be a dominant trend shaping the thermoforming market. Regulatory pressures in regions like the European Union and North America are accelerating the shift toward recyclable, compostable, and bio-based plastics. Polyethylene terephthalate glycol (PETG), polylactic acid (PLA), and other bio-derived thermoplastics are expected to replace traditional petroleum-based materials. Companies are investing in closed-loop recycling systems and designing products for easier end-of-life processing, aligning with circular economy principles. -

Technological Advancements in Automation and Digitalization

Automation and Industry 4.0 integration are enhancing efficiency and precision in thermoforming operations. By 2026, smart thermoforming machines equipped with IoT sensors, AI-driven process optimization, and predictive maintenance capabilities will become standard. These technologies reduce waste, improve energy efficiency, and allow for rapid changeovers, supporting customization and just-in-time manufacturing—especially important in e-commerce and on-demand packaging. -

Growth in Medical and Healthcare Applications

The medical sector is increasingly adopting thermoformed solutions for sterile packaging, trays, and disposable components. The demand for lightweight, contamination-resistant, and customizable packaging will expand as telemedicine and home healthcare services grow. Thermoforming offers design flexibility for complex geometries and tight tolerances, critical for medical device packaging and diagnostic equipment enclosures. -

Expansion in Food Packaging Innovation

With the global rise in food delivery and convenience foods, thermoformed packaging is becoming more advanced in functionality. By 2026, active and intelligent packaging—such as oxygen scavengers, temperature indicators, and antimicrobial surfaces—will be integrated into thermoformed containers. Resealable, microwave-safe, and portion-controlled designs will enhance consumer appeal while meeting safety and sustainability standards. -

Regional Market Shifts and Emerging Economies

While North America and Europe remain key markets due to stringent regulations and mature supply chains, Asia-Pacific—particularly China, India, and Southeast Asia—is projected to experience the fastest growth. Rising urbanization, expanding middle-class populations, and government support for plastic waste management are driving investment in local thermoforming capabilities. -

Lightweighting and Material Efficiency

To reduce material use and transportation costs, manufacturers are focusing on lightweight thermoformed products without compromising strength. Advanced simulation tools and thinner-gauge materials, such as high-stiffness PP and APET, are enabling this trend. This is especially relevant in the automotive industry, where thermoformed interior components contribute to vehicle weight reduction and fuel efficiency.

Conclusion

By 2026, the thermoforming market will be defined by a convergence of sustainability, digital innovation, and functional performance. Companies that invest in eco-friendly materials, adopt smart manufacturing technologies, and respond to sector-specific needs will be best positioned to capitalize on emerging opportunities. As environmental regulations tighten and consumer expectations evolve, thermoforming will remain a vital and adaptable manufacturing process across global industries.

Common Pitfalls in Sourcing Thermoforming: Quality and Intellectual Property Concerns

Sourcing thermoformed parts, particularly from overseas or new suppliers, presents several risks that can impact product performance, timelines, and legal standing. Two critical areas prone to pitfalls are quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to costly rework, delays, customer dissatisfaction, or even litigation.

Quality-Related Pitfalls

-

Inconsistent Material Specifications: Suppliers may use substandard or off-spec materials to reduce costs, leading to variations in strength, clarity, heat resistance, or chemical compatibility. Without clear material certifications (e.g., FDA, UL, RoHS), compliance risks arise.

-

Poor Mold Accuracy and Wear: Thermoforming relies heavily on mold precision. Low-cost suppliers may use inferior mold materials or fail to maintain them, resulting in dimensional inaccuracies, warping, or surface defects over time.

-

Inadequate Process Control: Variations in heating, vacuum pressure, cooling rates, and trimming can lead to thin spots, incomplete forming, flash, or inconsistent wall thickness. Suppliers lacking robust process documentation or statistical process control (SPC) are more likely to produce non-conforming parts.

-

Insufficient Quality Testing and Documentation: Some suppliers may skip critical quality checks such as thickness mapping, seal integrity testing, or environmental stress cracking resistance. Lack of traceability and batch records complicates root cause analysis during failures.

-

Hidden Costs from Rework and Rejection: Poor quality often surfaces after parts are shipped, leading to expensive rework, production line stoppages, or recalls. These downstream costs are frequently underestimated during sourcing.

Intellectual Property-Related Pitfalls

-

Lack of IP Ownership Clarity: Without a clear contract, suppliers may claim co-ownership of molds, designs, or tooling improvements. This can restrict your ability to switch suppliers or modify designs without legal complications.

-

Inadequate NDA Enforcement: Sharing design files (e.g., CAD models, 3D scans) without a strong, jurisdiction-specific non-disclosure agreement (NDA) exposes your product design to misuse or replication by the supplier or their subcontractors.

-

Tooling and Mold Misappropriation: Molds are often the most valuable IP asset in thermoforming. Suppliers may duplicate molds or use them to produce parts for competitors, especially in regions with weak IP enforcement.

-

Design Leakage Through Subcontracting: Suppliers may outsource parts of the production without your consent, increasing the risk of design exposure and reducing control over quality and IP security.

-

Failure to Register IP in Sourcing Countries: If components are manufactured abroad, failing to register design patents, trademarks, or utility models in those jurisdictions limits your legal recourse in case of infringement.

To mitigate these risks, buyers should conduct thorough supplier audits, insist on detailed quality agreements, secure comprehensive IP clauses in contracts, and consider third-party inspections or on-site quality monitoring—especially during initial production runs.

Logistics & Compliance Guide for Thermoforming

Thermoforming is a widely used manufacturing process for shaping plastic sheets into various products, from packaging to automotive components. Ensuring efficient logistics and strict compliance throughout the thermoforming supply chain is critical for operational success, safety, and regulatory adherence. This guide outlines key considerations for managing logistics and compliance in thermoforming operations.

Raw Material Sourcing and Handling

Selecting and managing raw materials—primarily plastic sheets such as PET, PVC, PP, and HIPS—requires careful planning. Materials must be sourced from certified suppliers adhering to industry standards (e.g., ISO 9001, FDA for food-grade applications). Proper storage is essential: plastic sheets should be kept in dry, temperature-controlled environments to prevent warping, moisture absorption, or contamination. Implement a first-in, first-out (FIFO) inventory system to minimize degradation and ensure material consistency.

Equipment and Facility Compliance

Thermoforming equipment must comply with safety and operational regulations, including OSHA (Occupational Safety and Health Administration) and local industrial safety codes. Regular maintenance schedules and operator training are mandatory to prevent workplace accidents. Facilities should also meet environmental standards for emissions (e.g., VOCs during heating) and noise levels. Install proper ventilation systems and conduct periodic audits to ensure compliance with EPA or equivalent environmental regulations.

Transportation and Distribution

Finished thermoformed products—especially packaging—often require specialized handling during transport. Use protective packaging to prevent scratches, deformation, or contamination. For temperature-sensitive items (e.g., food packaging), consider climate-controlled shipping. Coordinate with logistics partners experienced in handling lightweight, high-volume plastic goods to optimize palletization, reduce freight costs, and prevent damage in transit. Track shipments using GPS and inventory management systems to enhance supply chain visibility.

Regulatory and Industry Standards

Compliance with applicable regulations is crucial. For food-contact products, ensure materials and processes meet FDA (U.S.) or EFSA (EU) requirements. Medical or pharmaceutical applications may require adherence to ISO 13485 or USP Class VI standards. Always maintain documentation such as Certificates of Compliance (CoC), material safety data sheets (MSDS/SDS), and test reports. Stay updated on evolving regulations, such as plastic waste directives (e.g., EU Single-Use Plastics Directive) and recycling mandates.

Waste Management and Sustainability

Thermoforming generates scrap material (trim waste) that must be managed responsibly. Implement in-house recycling systems where feasible, converting trim into regrind for reuse in non-critical applications. Partner with certified waste management providers for proper disposal or recycling of non-recyclable plastics. Track waste metrics and set sustainability goals aligned with environmental regulations and corporate social responsibility (CSR) initiatives.

Quality Assurance and Documentation

Establish a robust quality management system (QMS) compliant with ISO 9001. Conduct routine inspections of raw materials, in-process items, and finished goods. Maintain comprehensive records of production batches, equipment calibration, non-conformance reports, and corrective actions. Digital traceability systems can enhance compliance and streamline audits.

International Trade Considerations

For cross-border thermoforming operations, ensure compliance with customs regulations, import/export controls, and international standards (e.g., REACH, RoHS). Accurate product classification (HS codes), proper labeling, and adherence to packaging regulations (e.g., ISTA for shipping) are essential. Monitor geopolitical and tariff changes that may impact supply chain efficiency.

By integrating these logistics and compliance practices, thermoforming operations can achieve operational excellence, reduce risk, and support sustainable growth in a competitive and regulated industry.

Conclusion for Sourcing Thermoforming

Sourcing thermoforming services requires a strategic evaluation of several key factors to ensure quality, cost-efficiency, and timely production. The process involves selecting the right materials, identifying capable suppliers with appropriate tooling and technical expertise, and balancing in-house production versus outsourcing. Key considerations include mold complexity, production volume, material specifications, and regulatory compliance, especially for industries such as medical, packaging, or automotive.

Partnering with experienced thermoforming suppliers who demonstrate consistent quality control, scalability, and innovation can significantly enhance product development and time-to-market. Additionally, geographic location, supply chain reliability, and total cost of ownership—beyond just unit pricing—play critical roles in long-term success.

In conclusion, effective sourcing of thermoforming services hinges on a thorough supplier assessment, clear communication of design and performance requirements, and fostering collaborative relationships. By prioritizing these elements, companies can leverage thermoforming as a versatile and cost-effective manufacturing solution while maintaining high standards of quality and efficiency.