The global thermistor sensors market is experiencing robust growth, driven by rising demand for precision temperature sensing across industries such as automotive, healthcare, consumer electronics, and industrial automation. According to Mordor Intelligence, the thermistor market was valued at USD 3.2 billion in 2023 and is projected to grow at a CAGR of over 6.8% from 2024 to 2029. This expansion is fueled by advancements in smart manufacturing, increased electrification in vehicles, and stringent regulatory standards for energy efficiency and environmental monitoring. As reliance on accurate thermal management systems grows, thermistor sensors—particularly NTC (Negative Temperature Coefficient) types—remain critical components due to their high sensitivity and cost-effectiveness. In this evolving landscape, a select group of manufacturers leads in innovation, product quality, and global reach. Here, we present the top 10 thermistor sensor manufacturers shaping the future of temperature sensing, based on market share, technological prowess, and strategic developments.

Top 10 Thermistor Sensors Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 NTC Thermistors

Domain Est. 1994

Website: murata.com

Key Highlights: NTC thermistors are elements whose resistance falls with an increase in temperature, and find use in applications such as temperature sensing….

#2 Taiwan Leading Thermistor Manufacturers and Suppliers

Domain Est. 1999 | Founded: 1994

Website: sen-tech.com

Key Highlights: SEN TECH was established in 1994 and is a professional manufacturer of sensor devices. With a strong background in NTC chip and thermistor manufacturing….

#3 Temperature Sensors

Domain Est. 2013

Website: amphenol-sensors.com

Key Highlights: Thermometrics, Inc., offers a wide range of NTC Thermistors. They are manufactured from the oxides of transition metals and can operate over the range of ……

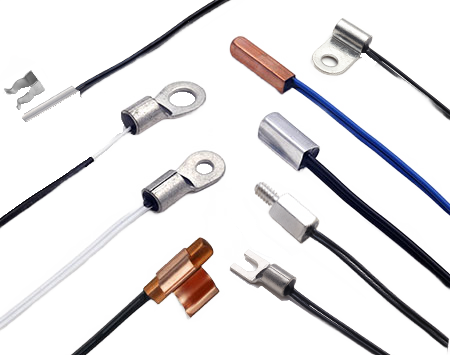

#4 EI Sensor Technologies

Domain Est. 2018

Website: ei-sensor.com

Key Highlights: EI Sensor is a prominent manufacturer and provider of temperature sensors. Our products include PTC and NTC Thermistors, RTDs (Resistance Temperature Detectors ……

#5 Temperature sensors

Domain Est. 1986

Website: ti.com

Key Highlights: Watch our video series on digital and analog temperature sensors, temperature switches and linear thermistors. Covering temperature sensor error and ……

#6 CTS Corporation

Domain Est. 1993

Website: ctscorp.com

Key Highlights: Discover how advanced precision temperature-sensing technologies are helping shape modern medical solutions. Join CTS and expert Rafal for a detailed ……

#7 Ametherm

Domain Est. 1996

Website: ametherm.com

Key Highlights: Our Inrush Current Limiters and Temperature Sensors are built to last. We proudly manufacture our products in Carson City, Nevada – USA. Rugged and Reliable ……

#8 Temperature Sensors

Domain Est. 1996

Website: littelfuse.com

Key Highlights: Littelfuse offers a broad portfolio of thermistors, resistance temperature detectors (RTDs), digital temperature indicators, and probes and assemblies….

#9 Thermocouple Type K, J, T, E, R, S, B, C, RTD Sensors & RTD …

Domain Est. 1999

Website: thermometricscorp.com

Key Highlights: Thermometrics Corporation has built thermistor probe capable of measuring temperatures up to 1000°C. This sensor can be a direct replacement for thermocouple ……

#10 Thermistor Sensors

Website: mmc.co.jp

Key Highlights: Mitsubishi Materials uses thermistors to develop, manufacture, and sell temperature sensors for vehicles and for air conditioners, refrigerators, washing ……

Expert Sourcing Insights for Thermistor Sensors

H2: 2026 Market Trends for Thermistor Sensors

The thermistor sensor market is poised for significant transformation by 2026, driven by technological advancements, growing demand across key industries, and the global push toward energy efficiency and smart systems. Several critical trends are expected to shape the market landscape over the coming years.

-

Rising Demand in Consumer Electronics and Wearables

By 2026, the proliferation of smart devices—ranging from smartphones and laptops to fitness trackers and smartwatches—will continue to fuel demand for compact, high-precision thermistor sensors. These sensors are essential for thermal management, ensuring optimal device performance and safety. Miniaturization trends and the need for real-time temperature monitoring in wearables are accelerating innovation in surface-mount and flexible thermistor technologies. -

Expansion in Automotive and Electric Vehicle (EV) Applications

The automotive sector, particularly electric vehicles, will be a major growth driver. Thermistors are critical components in battery thermal management systems (BTMS), power electronics, and climate control units. As EV production scales globally, demand for NTC (Negative Temperature Coefficient) thermistors—known for their stability and accuracy in extreme conditions—is expected to surge. Integration with vehicle diagnostics and predictive maintenance systems will further enhance their value. -

Growth in Industrial Automation and IoT Integration

The rise of Industry 4.0 and the Industrial Internet of Things (IIoT) will increase deployment of thermistor sensors in manufacturing, HVAC systems, and process control. Their ability to provide precise, real-time temperature feedback makes them ideal for predictive maintenance, energy optimization, and equipment safety. By 2026, wireless thermistor sensor nodes integrated with cloud platforms are expected to become commonplace in smart factories. -

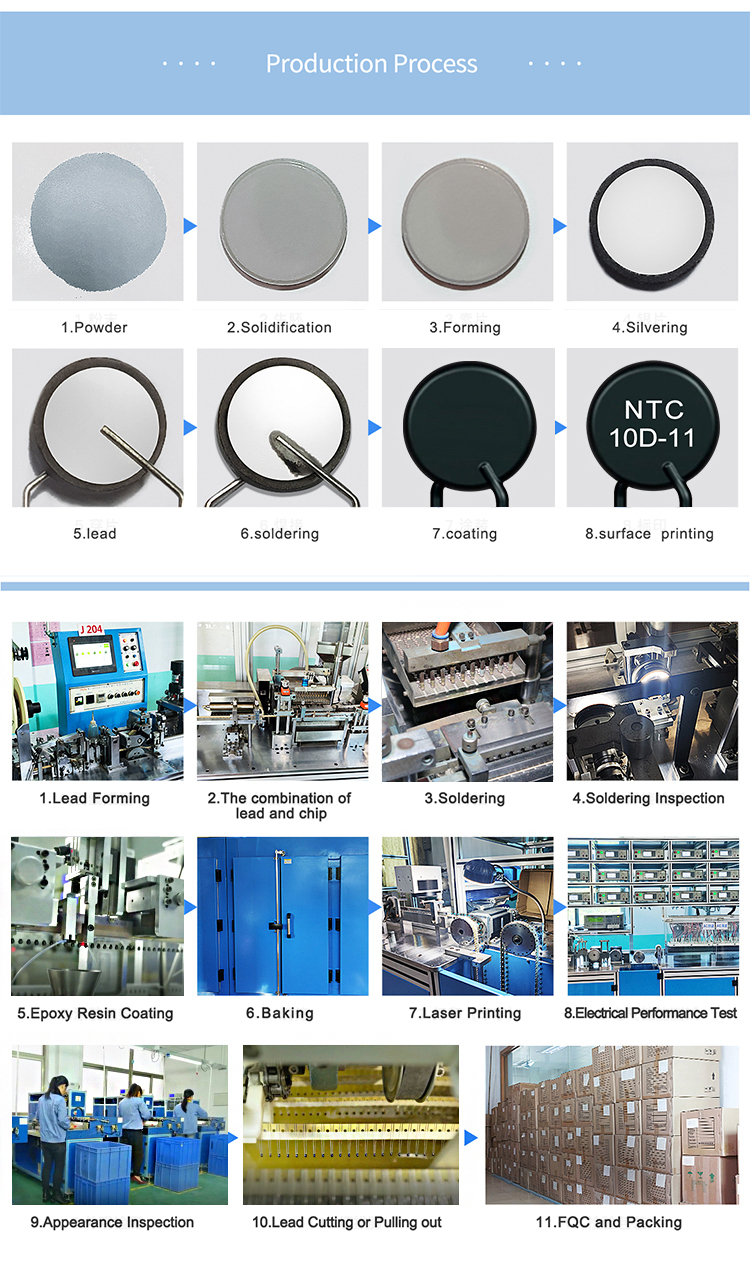

Advancements in Sensor Materials and Manufacturing

Ongoing R&D in ceramic and polymer-based materials is improving thermistor sensitivity, response time, and durability. Innovations such as thin-film and MEMS (Micro-Electro-Mechanical Systems) thermistors are enabling higher accuracy and faster response in smaller footprints. These advancements will open new applications in medical devices, aerospace, and high-reliability environments. -

Sustainability and Energy Efficiency Regulations

Global regulatory focus on reducing energy consumption and carbon emissions is pushing industries to adopt more efficient thermal monitoring solutions. Thermistors play a vital role in optimizing energy use in appliances, lighting, and renewable energy systems such as solar inverters and wind turbines. Compliance with environmental standards will drive adoption, particularly in Europe and North America. -

Regional Market Shifts

Asia-Pacific is expected to dominate the thermistor sensor market by 2026, led by China, Japan, and South Korea, due to robust electronics manufacturing, EV production, and government investments in smart infrastructure. North America and Europe will see steady growth, driven by automotive innovation and industrial automation.

In conclusion, the 2026 thermistor sensor market will be characterized by increased integration with smart systems, diversification of applications, and a strong emphasis on performance under extreme conditions. Companies that invest in miniaturization, digital integration, and material innovation will be best positioned to capture emerging opportunities.

Common Pitfalls When Sourcing Thermistor Sensors (Quality & IP)

Sourcing thermistor sensors involves critical considerations beyond basic specifications. Overlooking quality assurance and intellectual property (IP) aspects can lead to reliability issues, supply chain disruptions, and legal risks. Below are key pitfalls to avoid:

Poor Quality Control and Inconsistent Performance

Many suppliers, especially low-cost or unverified ones, may lack rigorous quality control processes, resulting in thermistors with inconsistent resistance-temperature characteristics, poor long-term stability, or inadequate tolerance adherence. This can lead to inaccurate temperature readings, product failures, or costly field recalls. Always verify that suppliers follow recognized standards (e.g., AEC-Q200 for automotive, ISO 9001) and provide detailed test reports and batch traceability.

Lack of Material and Process Transparency

Some vendors do not disclose the materials used in thermistor construction (e.g., base metal oxides, binders, electrode materials) or their manufacturing process. This opacity can lead to compatibility issues in harsh environments (e.g., moisture, thermal cycling) and may violate industry-specific compliance requirements (e.g., RoHS, REACH). Insist on full material disclosure and compatibility data sheets.

Counterfeit or Gray Market Components

The electronics market is vulnerable to counterfeit thermistors that mimic genuine parts but fail prematurely or perform outside specifications. These often originate from unauthorized distributors or gray market channels. Always source from authorized distributors or directly from OEMs, and verify component authenticity through lot traceability and independent testing when high volumes are involved.

Inadequate IP Protection and Design Infringement

Thermistor designs, especially precision or application-specific variants (e.g., medical or automotive-grade), may be protected by patents or trade secrets. Using a component without verifying freedom-to-operate (FTO) can expose your product to IP litigation. Ensure suppliers warrant that their products do not infringe third-party IP and request documentation such as IP indemnification clauses in supply agreements.

Misleading or Incomplete Datasheets

Some suppliers provide incomplete or overly optimistic performance data, omitting critical parameters like time constants, self-heating effects, or long-term drift. This can result in design flaws when the sensor is integrated into the final system. Always cross-check datasheet claims with independent test data or request samples for validation under real operating conditions.

Insufficient Scalability and Long-Term Supply Commitment

Startups or small suppliers may offer attractive pricing but lack the production capacity or financial stability to support long-term or high-volume needs. This can lead to supply shortages or forced redesigns. Evaluate the supplier’s manufacturing footprint, financial health, and willingness to sign long-term supply agreements (LTSA) before committing.

Avoiding these pitfalls requires due diligence in supplier selection, thorough technical validation, and legal awareness around IP rights—ensuring reliable performance and regulatory compliance in your final application.

Logistics & Compliance Guide for Thermistor Sensors

Thermistor sensors are widely used in industries such as healthcare, automotive, HVAC, and consumer electronics for precise temperature measurement. Ensuring proper logistics handling and regulatory compliance is essential to maintain product integrity, safety, and legal conformity. This guide outlines key logistics considerations and compliance requirements for the storage, transportation, and distribution of thermistor sensors.

Storage and Handling

Proper storage conditions are critical to preserving the performance and accuracy of thermistor sensors. These components are often sensitive to environmental factors and mechanical stress.

- Temperature and Humidity Control: Store thermistors in a climate-controlled environment with temperatures between 15°C and 30°C and relative humidity below 60%. Avoid exposure to condensation or extreme temperature fluctuations.

- Static Protection: Use anti-static packaging and storage containers to prevent electrostatic discharge (ESD), which can degrade sensor performance.

- Packaging: Keep thermistors in original sealed packaging until ready for use. Use moisture barrier bags (MBBs) if required, especially for surface-mount device (SMD) types.

- Shelf Life Management: Monitor expiration dates and implement a first-in, first-out (FIFO) inventory system to prevent the use of aged components.

Transportation Requirements

Transporting thermistor sensors requires attention to physical protection, environmental stability, and proper documentation.

- Packaging Standards: Use shock-absorbent and crush-resistant packaging. Include desiccants and humidity indicators when necessary.

- Labeling: Clearly label packages with “Fragile,” “Electrostatic Sensitive Device (ESD),” and “Keep Dry” warnings. Include handling instructions and product identifiers.

- Shipping Environment: Avoid shipping through extreme climates unless temperature-controlled transit options are used. Minimize exposure to rapid temperature changes.

- Carrier Selection: Choose carriers experienced in handling electronic components, preferably with certified ESD-safe transport protocols.

Regulatory Compliance

Thermistor sensors must comply with various international and regional regulations, depending on the end-use application and destination market.

- RoHS (Restriction of Hazardous Substances): Ensure thermistors comply with EU Directive 2011/65/EU, restricting the use of lead, mercury, cadmium, and other hazardous substances.

- REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals): Confirm that materials used in thermistors are registered and compliant with EU Regulation (EC) No 1907/2006.

- Conflict Minerals Compliance: Adhere to the U.S. Dodd-Frank Act Section 1502 and equivalent regulations by ensuring sourcing transparency for tin, tantalum, tungsten, and gold (3TG).

- WEEE (Waste Electrical and Electronic Equipment): For sensors sold in the EU, ensure compliance with proper labeling and recyclability requirements under Directive 2012/19/EU.

- CE Marking: Affix CE marking if the thermistor is sold as a standalone component or integrated into a CE-marked device within the European Economic Area (EEA).

- UL / CSA Certification: For use in North America, verify thermistors are certified by recognized testing laboratories (e.g., UL, CSA) if required by the end application (e.g., medical or industrial equipment).

Import and Export Considerations

Cross-border logistics for thermistor sensors involve adherence to trade regulations and customs documentation.

- HS Code Classification: Use the appropriate Harmonized System (HS) code—typically 8541.40 or 9033.00 depending on classification—to facilitate customs clearance.

- Export Controls: Check if thermistors fall under export control regulations such as the U.S. Export Administration Regulations (EAR) or EU Dual-Use Regulation. Most standard thermistors are not controlled, but high-precision or military-grade variants may require licenses.

- Documentation: Prepare commercial invoices, packing lists, certificates of origin, and compliance declarations (e.g., RoHS, REACH) for international shipments.

- Incoterms: Clearly define responsibilities using standard Incoterms (e.g., FOB, DDP) to avoid misunderstandings regarding shipping, insurance, and customs duties.

Quality and Traceability

Maintaining a traceable supply chain ensures compliance and enables effective recalls or audits if necessary.

- Batch Traceability: Retain records of batch numbers, manufacturing dates, and supplier certifications for each shipment.

- Certificates of Conformance (CoC): Require CoCs from suppliers verifying compliance with specifications and regulatory standards.

- Audit Preparedness: Maintain documentation for internal or third-party audits related to quality (ISO 9001), environmental (ISO 14001), or industry-specific standards (e.g., IATF 16949 for automotive).

Conclusion

Effective logistics and compliance management for thermistor sensors safeguard product reliability and ensure adherence to global regulatory frameworks. By implementing proper storage, transportation, documentation, and certification practices, organizations can minimize risks, reduce delays, and maintain customer trust in their sensor supply chain. Regular review of evolving regulations and industry standards is recommended to remain compliant in dynamic markets.

Conclusion for Sourcing Thermistor Sensors

Sourcing thermistor sensors requires a strategic approach that balances technical specifications, quality, cost, and supplier reliability. Thermistors are critical components in temperature sensing applications across industries such as automotive, healthcare, consumer electronics, and industrial automation. Therefore, selecting the right thermistor—whether NTC (Negative Temperature Coefficient) or PTC (Positive Temperature Coefficient)—must align with the application’s accuracy, response time, and environmental requirements.

Key considerations in the sourcing process include temperature range, resistance tolerance, beta (β) value, stability, package type, and long-term reliability. Additionally, working with reputable suppliers that adhere to international quality standards (such as ISO, IATF, or AEC-Q200 for automotive applications) ensures consistent performance and reduced risk of field failures.

Cost efficiency should not compromise quality; instead, lifecycle cost analysis—including performance, maintenance, and failure risk—should guide procurement decisions. Establishing strong partnerships with manufacturers or distributors offering technical support, volume scalability, and responsive service can enhance supply chain resilience.

In conclusion, effective sourcing of thermistor sensors involves a comprehensive evaluation of technical needs, application context, and supplier capabilities. By adopting a proactive and informed sourcing strategy, organizations can ensure optimal performance, reliability, and cost-effectiveness in their temperature sensing solutions.