The global thermal glass market is experiencing robust growth, driven by rising energy efficiency standards, increasing construction activities, and growing demand for insulated glazing in both residential and commercial buildings. According to Grand View Research, the global insulated glass market size was valued at USD 11.8 billion in 2022 and is projected to expand at a compound annual growth rate (CAGR) of 6.3% from 2023 to 2030. Similarly, Mordor Intelligence forecasts a CAGR of over 5.8% during the 2023–2028 period, citing rapid urbanization and stricter building codes in North America and Europe as key drivers. With thermal glass playing a critical role in reducing heat transfer and improving HVAC efficiency, manufacturers are investing heavily in low-emissivity (Low-E) coatings, gas fills, and advanced spacer technologies. As demand surges, a select group of innovators are leading the charge in quality, scalability, and technological advancement—here are the top 10 thermal glass manufacturers shaping the industry.

Top 10 Thermal Glass Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Glass manufacturer company

Domain Est. 2001

Website: guardianglass.com

Key Highlights: Guardian Glass is a world leader in glass innovation and production, constantly finding new ways to build, design and inspire with glass….

#2 Tempered & Insulated Facade Glass Manufacturer

Domain Est. 2021

Website: zeyglass.com

Key Highlights: As Zey Glass, we specialise in the production of heat insulated glass, tempered glass, laminated glass, enamel painted glass, decorative glass and other glass ……

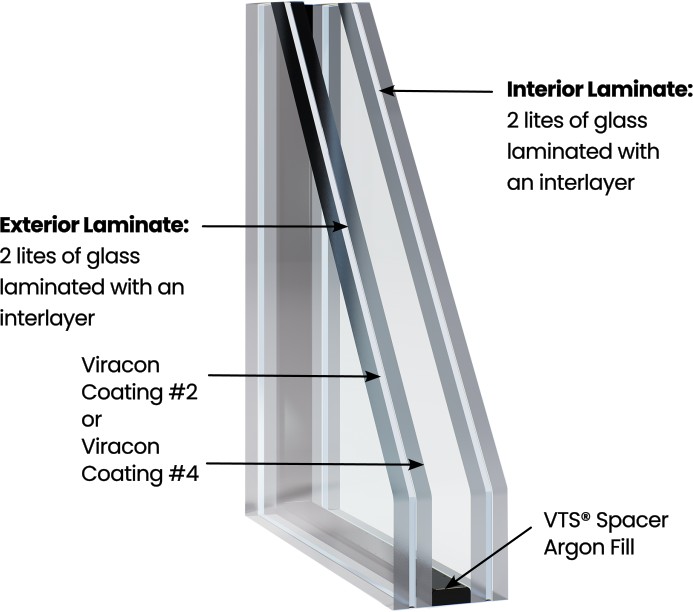

#3 Viracon

Domain Est. 1996

Website: viracon.com

Key Highlights: Viracon is a leading single-source architectural glass fabricator. We partner with best-in-class architecture firms and glazing contractors to provide glass ……

#4 Cardinal Glass Industries

Domain Est. 1997

Website: cardinalcorp.com

Key Highlights: Cardinal Glass is a world-leading glass provider offering comprehensive solutions for any residential application….

#5 FOAMGLAS® thermal insulation made of cellular glass

Domain Est. 1997

Website: foamglas.com

Key Highlights: FOAMGLAS® cellular glass insulation is a light weight, rigid and durable insulation material, composed of millions of completely sealed glass cells….

#6 Tecnoglass

Domain Est. 1998

Website: tecnoglass.com

Key Highlights: We are leading Laminated Glass, Insulating Glass and Monolithics Glass industry. Products and solutions for safety application. Contact us….

#7 Thermalsun Glass Products, Inc

Domain Est. 1999

Website: thermalsun.com

Key Highlights: Home · Products · Resources · Project Gallery · Company · Contact Us · Payment. More. Home · Products · Resources · Project Gallery · Company · Contact Us ……

#8 Quality Sealants Insulated Glass (IG) Manufacturing Industry

Domain Est. 2006

Website: fenzi-na.com

Key Highlights: Fenzi North America is the only true 100% glass-focused company specializing in insulated glass (IG) sealants, automotive, and decorative glass coatings….

#9 LUXWALL®

Domain Est. 2020

Website: luxwall.com

Key Highlights: Our next–generation product solutions deliver between R-18 and R-23 thermal insulation – outperforming current glass and window product offerings by up to 5X….

#10 Vacuum Insulated Glass

Domain Est. 2021

Website: thermglass.com

Key Highlights: VIG is the first Insulated glass which eliminates heat transfer and has thermal conductivity (U-Value) of almost zero….

Expert Sourcing Insights for Thermal Glass

H2: 2026 Market Trends for Thermal Glass

The global thermal glass market is projected to experience significant growth and transformation by 2026, driven by increasing demand for energy-efficient building materials, stringent government regulations on energy consumption, and advancements in smart glass technologies. Thermal glass—also known as insulating or low-emissivity (Low-E) glass—plays a critical role in reducing heat transfer, improving indoor comfort, and lowering energy costs in residential, commercial, and industrial buildings.

-

Rising Energy Efficiency Standards

Governments worldwide are implementing stricter building energy codes to combat climate change. In the European Union, the Energy Performance of Buildings Directive (EPBD) and similar regulations in the U.S. (such as ASHRAE 90.1) are pushing for higher thermal performance in building envelopes. This regulatory environment is accelerating the adoption of thermal glass, with double- and triple-glazed units becoming standard in new constructions and retrofits. -

Growth in Green Building Certifications

The rise of green building certifications like LEED (Leadership in Energy and Environmental Design), BREEAM, and WELL is influencing architectural design choices. Thermal glass contributes significantly to energy and daylight optimization credits, making it a preferred choice for developers aiming for sustainability benchmarks. By 2026, an estimated 45% of new commercial buildings in North America and Europe are expected to incorporate high-performance thermal glass systems. -

Expansion in Emerging Markets

Urbanization and infrastructure development in Asia-Pacific, the Middle East, and Latin America are driving demand for energy-efficient building materials. Countries like India, China, and Saudi Arabia are investing heavily in smart cities and sustainable construction. The thermal glass market in Asia-Pacific is expected to grow at a CAGR of over 7% from 2022 to 2026, fueled by residential and commercial expansion. -

Technological Innovations

Advancements in coating technologies, such as dynamic or electrochromic thermal glass, are shaping the market. Smart thermal glass that adjusts tint based on sunlight exposure enhances both energy efficiency and occupant comfort. By 2026, smart thermal glass is anticipated to capture a growing share of the high-end commercial and luxury residential segments. -

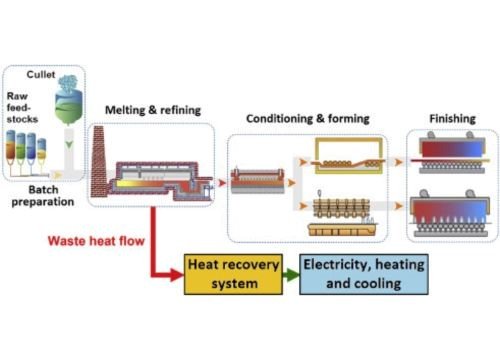

Sustainability and Circular Economy Trends

Manufacturers are increasingly focusing on sustainable production methods, including the use of recycled glass and energy-efficient manufacturing processes. Product transparency via Environmental Product Declarations (EPDs) is becoming a competitive advantage. Consumers and building owners are prioritizing low-carbon materials, further boosting demand for eco-friendly thermal glass solutions. -

Integration with Building Automation Systems (BAS)

Thermal glass is being integrated into broader building management systems to optimize HVAC performance and reduce energy loads. This convergence with IoT-enabled systems allows real-time monitoring and control of indoor environments, enhancing the value proposition of thermal glass in smart buildings.

In conclusion, by 2026, the thermal glass market will be defined by regulatory support, technological innovation, and a strong emphasis on sustainability. Stakeholders across the value chain—from manufacturers to architects—will need to adapt to evolving performance standards and customer expectations to capitalize on this growing market.

Common Pitfalls in Sourcing Thermal Glass: Quality and Intellectual Property Risks

Sourcing thermal glass, essential for energy-efficient buildings, solar applications, and specialty equipment, involves navigating significant risks beyond price and delivery. Two critical areas prone to pitfalls are product quality and intellectual property (IP). Overlooking these can lead to project failures, safety hazards, financial losses, and legal disputes.

Quality Pitfalls

- Inadequate Performance Verification: Relying solely on supplier claims or generic certifications without demanding verifiable, independent test reports for specific performance parameters (e.g., U-value, Solar Heat Gain Coefficient (SHGC), visible light transmittance, thermal stress resistance) can result in glass that fails to meet energy efficiency or comfort requirements.

- Inconsistent Manufacturing Standards: Sourcing from suppliers with lax quality control processes or inconsistent manufacturing standards leads to batches with significant variations in thickness, optical clarity, coating uniformity, or edge quality, compromising performance and aesthetics.

- Substandard or Counterfeit Coatings: Thermal glass often relies on advanced low-emissivity (low-e) or solar control coatings. Sourcing risks include receiving glass with inferior, incorrectly applied, or counterfeit coatings that degrade rapidly (delamination, corrosion) or fail to deliver promised thermal performance.

- Poor Edge Sealing (for IGUs): For Insulated Glass Units (IGUs), the quality of the edge seal is paramount. Weak or improperly applied seals lead to premature moisture ingress, fogging, and complete failure of the unit’s insulating properties, drastically reducing lifespan.

- Insufficient Durability & Environmental Testing: Glass not rigorously tested for long-term durability (e.g., resistance to humidity, UV degradation, thermal cycling, salt spray for coastal areas) may fail prematurely in real-world conditions, leading to costly replacements and reputational damage.

- Lack of Traceability & Documentation: Inadequate batch traceability and missing or incomplete documentation (material certs, test reports, processing records) make it difficult to investigate failures, ensure compliance, or manage warranties effectively.

Intellectual Property (IP) Pitfalls

- Infringement of Patented Technologies: Thermal glass often incorporates patented manufacturing processes (e.g., specific sputtering techniques for coatings), coating formulations, or structural designs (e.g., novel spacer systems). Sourcing from suppliers using such technologies without proper licensing exposes the buyer to infringement claims, potentially halting projects, incurring damages, or requiring costly redesigns.

- Unlicensed Use of Trademarks & Branding: Sourcing glass marketed under a well-known brand name (e.g., “Low-E,” “Solarban”) without authorization constitutes trademark infringement. Buyers can be held liable, especially if they knew or should have known the goods were counterfeit or unauthorized.

- Misappropriation of Trade Secrets: Engaging with suppliers who may have acquired proprietary knowledge (e.g., specific process parameters, coating recipes) through improper means (e.g., ex-employee poaching) creates significant legal and reputational risk for the buyer, even if unintentional.

- Ambiguous IP Ownership in Custom Designs: When commissioning custom glass solutions (e.g., unique size, shape, coating pattern), failing to clearly define IP ownership in the contract can lead to disputes. Does the buyer own the design specifications, or can the supplier reuse them for competitors?

- Lack of Supplier IP Due Diligence: Failing to conduct adequate due diligence on a supplier’s IP position (e.g., requesting proof of licenses for key technologies, reviewing their own IP portfolio) leaves the buyer vulnerable to downstream IP disputes originating from the supply chain.

- Grey Market Goods: Sourcing “genuine” branded glass through unauthorized channels (grey market) may involve IP infringement if the goods were diverted or manufactured without the brand owner’s consent for that market, potentially voiding warranties and exposing the buyer to risk.

Mitigating these pitfalls requires thorough supplier vetting, demanding independent quality verification, insisting on comprehensive documentation, conducting IP due diligence, and establishing clear contractual terms regarding quality standards and IP rights.

Logistics & Compliance Guide for Thermal Glass

Overview of Thermal Glass

Thermal glass, also known as insulated glass or double/triple glazing, is engineered to improve thermal efficiency in buildings by reducing heat transfer. It typically consists of two or more glass panes separated by a sealed air or gas-filled space. Due to its size, weight, fragility, and specific handling requirements, transporting and ensuring compliance for thermal glass requires careful planning and adherence to international and local regulations.

Packaging and Handling Requirements

Proper packaging is essential to prevent breakage and moisture damage during transit. Thermal glass units must be packed vertically in sturdy wooden crates or metal racks with protective interlayers such as foam, cardboard spacers, or non-abrasive film. Each unit should be labeled with handling instructions, including “This Side Up,” “Fragile,” and orientation arrows. Avoid horizontal stacking unless specifically designed for it. Use edge protectors and corner guards to reinforce vulnerable areas.

Transportation and Shipping

Thermal glass should be transported in enclosed, climate-controlled vehicles to protect against temperature fluctuations, moisture, and physical impact. Secure units with straps or locking mechanisms to prevent shifting. For international shipments, comply with International Safe Transit Association (ISTA) standards. Use freight forwarders experienced in handling oversized and fragile cargo. Clearly mark shipping containers with hazard labels if required and ensure insurance covers breakage and delays.

Regulatory Compliance

Compliance varies by region but generally includes adherence to building codes and energy efficiency standards. In the European Union, thermal glass must meet CE marking requirements under Regulation (EU) No 305/2011 (Construction Products Regulation). In the United States, products should comply with standards from the National Fenestration Rating Council (NFRC) and ENERGY STAR®. Canada requires compliance with the Canadian Standards Association (CSA) A440.2 for energy performance. Always verify local building codes before shipment.

Import and Export Documentation

Prepare accurate documentation to avoid customs delays. Required documents typically include commercial invoice, packing list, bill of lading/air waybill, certificate of origin, and conformity assessment (e.g., CE certificate or NFRC label). For countries with specific import regulations, such as Russia (EAC certification) or China (CCC mark), obtain the necessary product certifications in advance. Include detailed product specifications (U-value, SHGC, dimensions) on all documents.

Environmental and Sustainability Standards

Thermal glass contributes to energy-efficient buildings and may qualify for green building certifications such as LEED, BREEAM, or Green Star. Ensure manufacturing processes and materials comply with environmental regulations like REACH (EU) and TSCA (US). Recyclability of glass and spacer materials should be documented. Maintain records of low-emission coatings and inert gas (e.g., argon) usage for sustainability reporting.

Safety and Worker Protection

Personnel involved in handling thermal glass must be trained in proper lifting techniques and use personal protective equipment (PPE), including gloves, safety glasses, and steel-toed boots. Use mechanical aids such as suction lifters and forklifts with glass clamps. Follow OSHA (US), HSE (UK), or equivalent local workplace safety regulations. Establish emergency procedures for glass breakage, including safe cleanup protocols for sharp debris.

Quality Assurance and Inspection

Conduct pre-shipment inspections to verify dimensions, seal integrity, absence of fogging, and surface quality. Use standardized checklists aligned with ISO 12543 (Glass in Building – Insulating Glass Units). Retain inspection reports for traceability and compliance audits. Address defects prior to dispatch to minimize returns and customer complaints.

Storage Guidelines

Store thermal glass in a dry, level, and well-ventilated area, protected from direct sunlight and temperature extremes. Keep units vertically on racks at a slight incline (5°–10°) to prevent stress on seals. Limit stack height to manufacturer recommendations. Avoid prolonged outdoor storage; if unavoidable, cover with UV-resistant, breathable material—never plastic sheeting, which can trap moisture.

Final Compliance Checklist

Before shipping, confirm:

– Proper packaging and labeling

– Valid product certifications for destination market

– Complete and accurate shipping documentation

– Compliance with local energy and safety standards

– Worker safety protocols are in place

– Insurance coverage for full shipment value

Adhering to this guide ensures safe, efficient logistics and full regulatory compliance for thermal glass across global markets.

Conclusion for Sourcing Thermal Glass:

Sourcing thermal glass requires a strategic approach that balances performance, cost, sustainability, and supply chain reliability. Thermal glass plays a critical role in energy efficiency, comfort, and environmental control in both residential and commercial buildings. Therefore, selecting the right supplier involves evaluating key factors such as product quality, compliance with industry standards (e.g., low U-value, high solar control), customization capabilities, delivery timelines, and technical support.

Through thorough market analysis and supplier assessment, it becomes evident that partnering with reputable manufacturers who offer advanced glazing technologies—such as double or triple glazing, low-emissivity (Low-E) coatings, and inert gas fills—ensures optimal thermal performance and long-term value. Additionally, considering local versus international suppliers, logistical costs, and environmental impact contributes to a more sustainable and economically sound procurement strategy.

In conclusion, successful sourcing of thermal glass hinges on a holistic evaluation of technical specifications, supplier reliability, and lifecycle benefits. By prioritizing energy efficiency and partnering with high-quality suppliers, organizations can enhance building performance, reduce energy consumption, and support sustainability goals effectively.