The global therapeutic equipment market is experiencing robust expansion, driven by rising prevalence of chronic diseases, an aging population, and increasing demand for non-invasive treatment modalities. According to a report by Mordor Intelligence, the therapeutic equipment market was valued at USD 142.5 billion in 2023 and is projected to grow at a CAGR of 6.8% from 2024 to 2029. This growth is further supported by advancements in technology, greater healthcare accessibility, and growing awareness of rehabilitation and physiotherapy. As demand escalates across hospitals, rehabilitation centers, and home healthcare settings, manufacturers are innovating to deliver precision-driven, smart, and patient-centric therapeutic machines. In this evolving landscape, the following ten companies stand out as leaders in manufacturing high-impact therapeutic devices, combining engineering excellence with clinical efficacy.

Top 10 Therapeutic Machine Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Dynatronics

Domain Est. 1996

Website: dynatronics.com

Key Highlights: Dynatronics has been a leading manufacturer of therapeutic modalities and supplies for muscle and pain therapy for over 40 years….

#2

Domain Est. 1998

Website: g-5.com

Key Highlights: We are the sole manufacturers and distributors of genuine G5® brand massage and percussion products. Learn More….

#3 Bio

Domain Est. 2000

Website: bio-therapeutic.com

Key Highlights: Bio-Therapeutic’s professional skin care technology offerings include comprehensive microcurrent facial toning systems, wet/dry microdermabrasion, ……

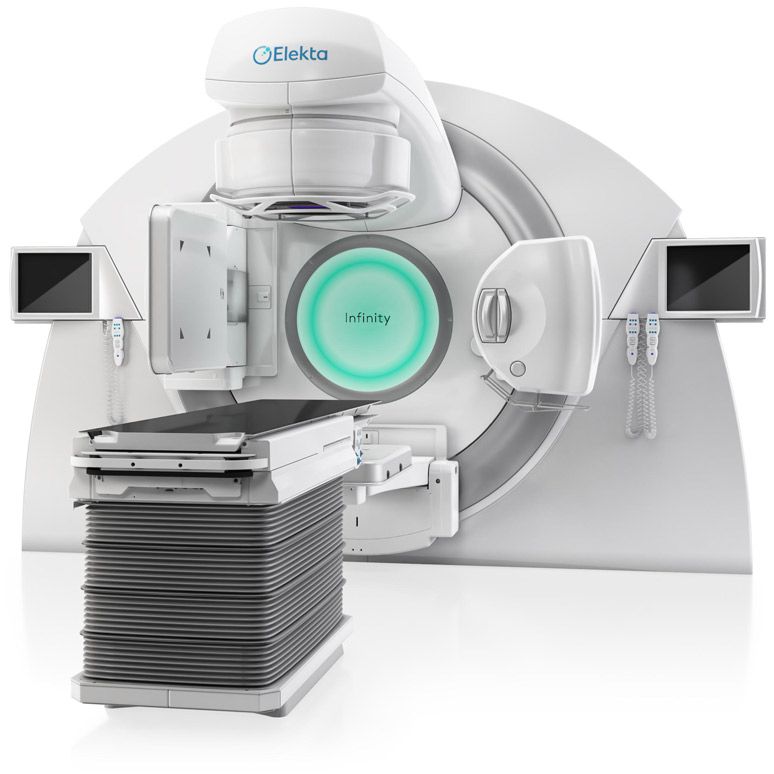

#4 Elekta

Domain Est. 1993

Website: elekta.com

Key Highlights: Helping clinicians treat cancer & brain disorders through precision radiation medicine. Our radiotherapy treatments target the tumour & protect the patient….

#5 Spark Wave Therapy by MTS Medical

Domain Est. 2001

Website: mts-medical.com

Key Highlights: Discover Spark Wave Therapy – advanced electrohydraulic shockwave therapy for sports medicine, rehabilitation, sexual health, wound care and pain management ……

#6 Restorative Therapies

Domain Est. 2004

Website: restorative-therapies.com

Key Highlights: Restorative Therapies’ Integrated FES has been proven to aid in restoring neurological function, gait training, and reduction of secondary complications….

#7 LivaNova

Domain Est. 2015

Website: livanova.com

Key Highlights: LivaNova is a global medical device company creating neuromodulation devices and cardiopulmonary products to improve the lives of patients worldwide….

#8 Industry-Leading Neuromodulation Therapies

Domain Est. 2018

Website: neuromodulation.abbott

Key Highlights: Neurostimulation therapies from Abbott allow people living with chronic pain and movement disorders to move easier and feel better….

#9 Galvanize Therapeutics

Domain Est. 2022

Website: galvanizetx.com

Key Highlights: Transforming Energy into Therapy. Galvanize designs and develops Pulsed Electric Field Systems to achieve meaningful and lasting outcomes for patients….

#10 Arterex

Domain Est. 2023

Website: arterexmedical.com

Key Highlights: Arterex Medical: manufacturing solutions for medical devices, products, and components to the world’s leading medical device, and life-sciences industries….

Expert Sourcing Insights for Therapeutic Machine

H2: 2026 Market Trends for Therapeutic Machines

As the global healthcare landscape evolves, the therapeutic machines market is poised for significant transformation by 2026. Driven by technological innovation, demographic shifts, and increasing demand for non-invasive treatment options, several key trends are expected to shape the industry in the coming years.

1. Rise of AI and Smart Therapeutics

Artificial intelligence (AI) and machine learning are increasingly being integrated into therapeutic devices, enabling personalized treatment protocols and real-time monitoring. By 2026, AI-powered machines—such as robotic rehabilitation systems and adaptive neuromodulation devices—are expected to dominate new product launches. These systems analyze patient data to optimize therapy delivery, improving outcomes and reducing recovery times.

2. Expansion of Home-Based Therapy Solutions

The shift toward decentralized care is accelerating the adoption of portable and user-friendly therapeutic machines for home use. Devices such as wearable pain management systems, compact TENS units, and home rehabilitation robots are becoming more prevalent. With telehealth integration, clinicians can remotely monitor patient progress, enhancing treatment adherence and reducing hospital readmissions.

3. Growth in Geriatric and Chronic Disease Management

An aging global population and the rising prevalence of chronic conditions like arthritis, cardiovascular diseases, and neurological disorders are fueling demand for therapeutic machines. Devices supporting mobility, pain relief, and neuromuscular rehabilitation—such as powered exoskeletons and pulsed electromagnetic field (PEMF) therapy units—are expected to see strong market growth by 2026.

4. Regulatory Advancements and Reimbursement Support

Regulatory bodies, including the FDA and EMA, are streamlining approval pathways for digital therapeutics and connected medical devices. By 2026, clearer regulatory guidelines and expanded insurance coverage are anticipated to improve patient access and drive market adoption. Reimbursement models are gradually adapting to include digital and wearable therapeutic technologies.

5. Focus on Minimally Invasive and Regenerative Technologies

Therapeutic machines leveraging regenerative medicine—such as low-intensity focused ultrasound (LIFU) for tissue healing and extracorporeal shockwave therapy (ESWT)—are gaining traction. These non-invasive solutions offer alternatives to surgery, appealing to both patients and providers. Market expansion is expected in orthopedics, dermatology, and neurology applications.

6. Strategic Partnerships and Digital Health Integration

Collaborations between medical device manufacturers, tech companies, and healthcare providers are accelerating innovation. By 2026, integrated platforms combining therapeutic hardware with mobile apps, cloud analytics, and electronic health records (EHRs) will become standard, enabling holistic patient management.

Conclusion

The therapeutic machines market in 2026 will be defined by intelligence, connectivity, and patient-centric design. As technology continues to advance and healthcare systems prioritize efficiency and outcomes, therapeutic machines will play a central role in modern treatment paradigms. Companies that embrace innovation, interoperability, and personalized care will be best positioned to lead in this dynamic market.

Common Pitfalls in Sourcing Therapeutic Machines: Quality and Intellectual Property Risks

Sourcing therapeutic machines—such as MRI scanners, dialysis units, infusion pumps, or rehabilitation devices—requires careful navigation of complex regulatory, technical, and legal landscapes. Two of the most critical areas where organizations encounter pitfalls are quality assurance and intellectual property (IP) protection. Failing to address these properly can lead to product failures, regulatory non-compliance, legal disputes, and reputational damage.

Quality-Related Pitfalls

-

Inadequate Supplier Vetting

Selecting suppliers based solely on cost or speed without thorough evaluation of their quality management systems (QMS) is a major risk. Suppliers lacking ISO 13485 certification or a proven track record in medical device manufacturing may produce unreliable or unsafe equipment. -

Non-Compliance with Regulatory Standards

Therapeutic machines must meet stringent regulatory requirements (e.g., FDA 21 CFR Part 820, EU MDR, or local health authority regulations). Sourcing devices without confirmed compliance can result in import denials, recalls, or patient harm. -

Poor Manufacturing and Component Quality

Substandard materials or assembly processes can compromise device safety and performance. Without proper incoming inspection and ongoing quality audits, defects may go undetected until deployment. -

Lack of Traceability and Documentation

Inadequate documentation—such as design history files (DHF), device master records (DMR), and certificates of conformance—can hinder regulatory audits and post-market surveillance, increasing liability. -

Insufficient Validation and Testing

Skipping or inadequately performing performance, safety, and biocompatibility testing may result in devices that fail under real-world conditions, risking patient safety and regulatory penalties.

Intellectual Property-Related Pitfalls

-

Unlicensed or Infringing Technology

Sourcing machines that incorporate patented technologies without proper licensing exposes the buyer to infringement claims. This is especially common with innovative therapeutic algorithms or hardware designs. -

Ambiguous Ownership of Customizations

When therapeutic machines are modified or co-developed with a supplier, unclear IP agreements can lead to disputes over who owns the resulting technology, limiting future use or commercialization. -

Lack of IP Due Diligence

Failing to perform IP audits or freedom-to-operate (FTO) analyses before procurement may result in unintentional infringement, legal challenges, or forced redesigns. -

Misuse of Open-Source or Third-Party Software

Many therapeutic machines rely on embedded software. Using open-source components without adhering to licensing terms (e.g., GPL) can result in unintended IP exposure or mandatory disclosure of proprietary code. -

Insufficient Protection of Confidential Information

Sharing sensitive design specifications or clinical data during sourcing without robust non-disclosure agreements (NDAs) can compromise trade secrets and competitive advantage.

Mitigation Strategies

- Conduct comprehensive supplier audits, including on-site visits and QMS reviews.

- Verify regulatory approvals and certifications for target markets.

- Implement rigorous incoming inspection and ongoing quality monitoring.

- Engage legal and IP counsel to review contracts, licensing terms, and conduct FTO analyses.

- Clearly define IP ownership and usage rights in sourcing agreements.

- Use NDAs and data protection clauses when exchanging sensitive information.

By proactively addressing these quality and IP pitfalls, organizations can reduce risk, ensure patient safety, and protect their innovation and market position when sourcing therapeutic machines.

Logistics & Compliance Guide for Therapeutic Machines

This guide outlines the essential logistics and regulatory compliance considerations for the transportation, handling, and deployment of therapeutic medical devices (referred to as “Therapeutic Machines”). Adherence to these standards ensures patient safety, legal compliance, and optimal device performance.

Regulatory Classification and Requirements

Therapeutic Machines are typically classified as medical devices under regulatory frameworks such as the U.S. FDA (Food and Drug Administration), EU MDR (Medical Device Regulation), and other international standards. Classification (Class I, II, III) depends on risk level and intended use. Compliance requires:

- Valid regulatory approvals (e.g., FDA 510(k), CE Marking, Health Canada license)

- Device registration in relevant national databases

- Conformity with ISO 13485 (Quality Management Systems for Medical Devices)

- Technical documentation including risk analysis (ISO 14971), labeling, and clinical evaluation

Ensure all regulatory documentation travels with the device during international shipments.

Packaging and Handling Standards

Proper packaging safeguards device integrity and meets regulatory expectations:

- Use shock-absorbent, tamper-evident packaging compliant with ASTM D4169 or ISTA 3A standards

- Clearly label packages with “Fragile,” “This Side Up,” and “Medical Device” identifiers

- Include temperature indicators if the device is sensitive to thermal changes

- Prevent contamination with sterile or clean-room packaging where required

Handling must follow manufacturer instructions to avoid damage to sensitive components.

Temperature and Environmental Controls

Many Therapeutic Machines are sensitive to environmental conditions:

- Monitor temperature, humidity, and pressure during transport using data loggers

- Use climate-controlled vehicles or shipping containers when specified

- Define and adhere to specified storage conditions (e.g., 15–25°C, non-condensing humidity)

- Validate cold chain logistics if applicable (e.g., devices with biological components)

Environmental deviations must be documented and assessed for impact on device safety and performance.

Transportation and Shipping Protocols

Transport logistics must ensure prompt, secure delivery:

- Use certified medical device logistics providers with GDP (Good Distribution Practice) compliance

- Avoid air cargo cabin vs. cargo hold discrepancies that affect temperature and pressure

- Track shipments in real-time using GPS and RFID where feasible

- Minimize transit time and avoid unnecessary transfers

- Ensure compliance with IATA Dangerous Goods Regulations if batteries or hazardous components are included

Import/Export Compliance

International movement of Therapeutic Machines requires strict adherence to trade and health regulations:

- Obtain necessary export licenses (e.g., U.S. Commerce Department for certain technologies)

- Prepare accurate customs documentation: commercial invoice, packing list, certificate of origin, and regulatory certificates

- Comply with import regulations in destination countries (e.g., CE Marking for EU, ANVISA for Brazil, PMDA for Japan)

- Account for tariffs, duties, and local agent requirements

Engage customs brokers experienced in medical device shipments.

Installation, Commissioning, and Training

Upon delivery, ensure compliant deployment:

- Installation must follow manufacturer protocols and site readiness checks

- Perform commissioning and calibration by certified personnel

- Document installation and verification in the device log

- Provide end-user training on safe operation, maintenance, and emergency procedures

- Maintain service records and update device history files (DHF)

Post-Market Surveillance and Recall Preparedness

Compliance extends beyond delivery:

- Implement a post-market surveillance system to monitor device performance and adverse events

- Report incidents to regulatory authorities as required (e.g., FDA MAUDE, EUDAMED)

- Maintain a field safety corrective action (FSCA) and recall plan

- Ensure traceability via UDI (Unique Device Identification) system

Record Keeping and Documentation

Retain all logistics and compliance records for regulatory audits:

- Shipping manifests, customs documents, and temperature logs

- Certificates of conformity, calibration, and installation

- Training records and service reports

- Retention period: typically 5–10 years post-device withdrawal, per jurisdiction

Maintain both digital and physical copies as required.

Conclusion

Effective logistics and compliance management for Therapeutic Machines is critical for regulatory approval, patient safety, and operational success. By integrating quality systems, regulatory knowledge, and best logistics practices, organizations can ensure reliable and lawful distribution of these vital medical technologies.

Conclusion for Sourcing a Therapeutic Machine

In conclusion, sourcing a therapeutic machine requires a strategic and comprehensive approach that balances clinical effectiveness, cost-efficiency, regulatory compliance, and long-term sustainability. By clearly defining the therapeutic needs, evaluating key technical specifications, and selecting reputable suppliers with proven track records, healthcare providers can ensure the acquisition of high-quality equipment that enhances patient care and treatment outcomes.

Due diligence in assessing safety certifications, after-sales support, training availability, and warranty terms is essential to minimize operational risks and downtime. Additionally, considering factors such as scalability, integration with existing systems, and future technological advancements will support long-term value and adaptability in a rapidly evolving healthcare landscape.

Ultimately, a well-structured sourcing process not only ensures the selection of a reliable and effective therapeutic machine but also contributes to improved patient satisfaction, operational efficiency, and overall clinical success. Ongoing evaluation and feedback mechanisms post-implementation will further refine the decision-making process for future procurement needs.