The global frame manufacturing industry has experienced steady expansion, driven by rising demand across eyewear, construction, and display sectors. According to Grand View Research, the global eyewear market size was valued at USD 164.2 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, with frame production representing a significant portion of this value chain. Similarly, Mordor Intelligence projects the architectural framing market to expand at a CAGR of over 6.2% during the same period, fueled by increased construction activity and demand for energy-efficient materials. As innovation in materials—such as sustainable acetate, lightweight metals, and smart frames—reshapes product offerings, competition among manufacturers has intensified. In this evolving landscape, eight companies have emerged as leaders, combining scale, technology, and design excellence to capture significant market share and set industry benchmarks.

Top 8 The Frame Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Frame Factory

Domain Est. 1997 | Founded: 1970

Website: framefactory.com

Key Highlights: Established in 1970, Frame Factory can fullfill all your framing needs. Galleries, museums, professional decorators, and individual clients framing for home or ……

#2 The Frame Factory of State College, Pa provides Custom Framing

Domain Est. 2009 | Founded: 1975

Website: statecollegeframing.com

Key Highlights: The Frame Factory has been locally owned and operated by Bill Ebken since 1975 when he located the shop at its existing location….

#3 The Frame Factory

Domain Est. 2011

Website: theframefactory1.com

Key Highlights: Custom Framing in Northern Virginia providing the VA MD DC area for over forty years with quality custom framing at wholesale prices….

#4 The Frame Factory

Domain Est. 2014

Website: shoptheframe.com

Key Highlights: The Frame Factory originated in 1989 as Delta Mat and Moulding, a wholesale distributor of picture framing supplies to retail stores, frame shops and artists….

#5 Frame Factory & Gallery

Domain Est. 2019 | Founded: 1978

Website: framefactoryharrisonburg.com

Key Highlights: The Frame Factory & Gallery has been providing custom framing services in the Shenandoah Valley since 1978. For the last 15+ years, the business has been woman ……

#6 Contact

Domain Est. 2021

Website: usframefactory.com

Key Highlights: Contact us now: (337) 282-5877 or email us at [email protected] ; Michael Fatjo Inside Sales Metal Studs and Accessories ; Dumbani Mbolembole Inside Sales…

#7 Creating Picture Memories For Everyone

Website: theframefactory.info

Key Highlights: The Frame Factory is Botswana’s No. 1 provider of custom Picture Framing, Canvas Stretch, and Acrylic Prints. Learn about our company!…

#8 Privacy policy

Website: framefactory.app

Key Highlights: This Privacy Policy describes Our policies and procedures on the collection, use and disclosure of Your information when You use the Service…

Expert Sourcing Insights for The Frame

H2 2026 Market Trends Analysis for Samsung The Frame

As we look toward the second half of 2026, Samsung’s The Frame smart TV is poised to navigate a dynamic and increasingly competitive market. Several key trends will shape consumer demand, technological development, and competitive positioning, influencing The Frame’s trajectory in the premium lifestyle TV segment.

1. Heightened Demand for Seamless Home Integration & Aesthetic Flexibility:

By H2 2026, consumers will prioritize electronics that blend effortlessly into home decor, moving beyond mere functionality. The Frame’s core value proposition—transforming into art when not in use—will remain highly relevant. Expect increased demand for:

* Enhanced Customization: Wider availability of interchangeable bezels (wood, metal, colored finishes) and deeper integration with smart home ecosystems (e.g., automatic art changes based on time of day, calendar events, or ambient lighting).

* AI-Powered Art Curation: Advanced AI will personalize displayed artwork, learning user preferences, suggesting pieces from expanded digital galleries (including NFT integration and partnerships with major museums), and adapting to room aesthetics.

* Thinner Profiles & Improved Anti-Reflective Coatings: Advancements in display and backlighting tech will enable even slimmer designs with superior matte finishes, further reducing glare and enhancing the “true canvas” illusion.

2. Expansion of the “Ambient Experience” Ecosystem:

The Frame will increasingly function as a central ambient hub, not just a TV. Key H2 2026 trends include:

* Beyond Art: Integration of wellness features (calming nature scenes, guided meditations), ambient information displays (weather, news headlines, calendars), and subtle smart home status updates.

* Context-Aware Content: Deeper AI integration will allow The Frame to display contextually relevant art or information (e.g., displaying travel photography when vacation plans are detected, workout visuals when fitness gear is detected nearby).

* Voice & Gesture Control for Ambient Mode: Hands-free control of the Frame’s art and ambient functions via advanced voice assistants or simple gestures will become a standard expectation.

3. Sustainability & Premium Materials as Key Differentiators:

Eco-consciousness will be a major purchase driver. Samsung will likely emphasize:

* Recycled & Sustainable Materials: Increased use of recycled plastics and bio-based materials in bezels and packaging, appealing to environmentally aware premium buyers.

* Longevity & Modularity: Marketing will focus on The Frame as a long-term investment, potentially offering easier module upgrades (e.g., new bezels, updated sensors) to extend product life and reduce e-waste.

* Energy Efficiency in Ambient Mode: Significant improvements in low-power ambient display modes to minimize energy consumption during extended art display periods.

4. Intensified Competition in the Lifestyle TV Niche:

The Frame will face stiffer competition, pushing innovation:

* Luxury & Design Collaborations: Rivals (like LG OLED Gallery, potential new entrants) may partner with high-end designers or artists, forcing Samsung to secure similar premium partnerships.

* Improved Non-LG OLED Alternatives: Competitors may close the gap in picture quality for non-OLED “art mode” TVs, challenging The Frame’s QLED/OLED advantage in bright rooms.

* Software & Ecosystem Wars: The battle will extend beyond hardware to the quality, exclusivity, and personalization of the digital art/content platform. Samsung must expand its content partnerships and app ecosystem.

5. Evolution of Display Technology (Balancing Performance & Aesthetics):

While OLED remains ideal for art mode due to perfect blacks, advancements will focus on:

* Next-Gen QLED/MicroLED for Brighter Environments: Improved QLED with better local dimming and MicroLED variants could offer compelling alternatives for very bright rooms where OLED glare is a concern, potentially offering larger Frame-like designs.

* Anti-Reflective Tech Breakthroughs: New coatings or surface treatments will further minimize reflections, crucial for the “frame” illusion near windows.

* Higher Resolution for Art Display: While 4K is standard, 8K resolution could become a differentiator for displaying ultra-high-resolution digital art and photography, though mainstream adoption may still be limited.

Conclusion:

H2 2026 will see The Frame solidify its position as a leader in the premium lifestyle TV market, but success will depend on Samsung’s ability to innovate beyond the core concept. Winning will require deeper AI personalization, significant advancements in sustainable materials and energy efficiency, expansion of the ambient ecosystem, and strategic content partnerships to stay ahead of increasingly sophisticated competition. The Frame must evolve from a “TV that looks like art” to an intelligent, sustainable, and deeply integrated ambient art and wellness hub to maintain its premium appeal.

Common Pitfalls Sourcing The Frame (Quality, IP)

When sourcing a frame—whether for a product, artwork, display, or industrial application—businesses often encounter critical challenges related to quality and intellectual property (IP). Overlooking these aspects can lead to financial losses, reputational damage, or legal complications. Below are key pitfalls to avoid:

Inconsistent or Substandard Quality

One of the most frequent issues in frame sourcing is receiving products that fail to meet specified quality standards. This can stem from unclear specifications, lack of supplier vetting, or inadequate quality control processes. Common quality-related problems include:

- Material Defects: Frames made from warped, scratched, or weak materials due to poor sourcing or manufacturing practices.

- Poor Craftsmanship: Misaligned joints, uneven finishes, or weak structural integrity that compromise both aesthetics and functionality.

- Inconsistent Dimensions: Tolerances not adhered to, causing fit issues in assembly or display.

- Durability Issues: Frames that degrade quickly under normal use, such as chipping, fading, or warping.

To mitigate these risks, implement strict quality assurance protocols, conduct on-site factory audits, and request pre-production samples.

Intellectual Property (IP) Infringement

Sourcing frames—especially custom or design-intensive ones—poses significant IP risks. Common pitfalls include:

- Copying Protected Designs: Suppliers may replicate patented or copyrighted frame designs without authorization, exposing the buyer to legal liability.

- Unlicensed Use of Trademarks: Using branded materials or logos (e.g., in premium display frames) without proper licensing.

- Lack of IP Clauses in Contracts: Failing to define ownership of custom designs or assume responsibility for IP violations in supplier agreements.

To protect against IP exposure:

– Conduct due diligence on suppliers’ design sources.

– Require written warranties that the product does not infringe on third-party rights.

– Clearly define IP ownership in contracts for custom-developed frames.

Avoiding these pitfalls requires proactive management, clear communication, and legal foresight throughout the sourcing process.

Logistics & Compliance Guide for The Frame

This guide outlines the essential logistics and compliance considerations for the distribution, handling, installation, and regulatory adherence of The Frame—a premium wall-mounted display product designed to blend into home environments as art. Proper logistics planning and compliance with international and local regulations are critical to ensure product safety, timely delivery, and customer satisfaction.

Product Handling & Packaging Standards

The Frame requires careful handling due to its delicate display panel and premium finish. Adherence to packaging and handling protocols minimizes damage during transit.

- Packaging Specifications: Use manufacturer-approved double-wall corrugated boxes with custom die-cut foam inserts to immobilize the display and frame components. Include anti-static protection for internal electronics.

- Fragile Labeling: Clearly mark all outer packages with “Fragile,” “This Side Up,” and “Do Not Stack” indicators to guide warehouse and courier handling.

- Component Separation: Frame attachments, mounting hardware, and the One Connect Box must be secured in separate compartments to prevent scratching or deformation.

- Environmental Protection: Ensure packaging includes moisture-resistant barriers, particularly for ocean freight shipments or high-humidity regions.

Transportation & Distribution

Efficient transportation planning ensures The Frame reaches retail outlets and end customers in optimal condition while minimizing lead times and costs.

- Mode Selection:

- Air Freight: Recommended for time-sensitive or high-value shipments, particularly for new product launches.

- Ocean Freight: Cost-effective for bulk shipments; use climate-controlled containers to protect against humidity and temperature extremes.

- Final Mile Delivery: Partner with last-mile carriers experienced in white-glove delivery for oversized electronics.

- Inventory Management: Maintain regional distribution centers in North America, EMEA, and APAC to reduce delivery times and customs delays.

- Insurance: Carry comprehensive cargo insurance covering damage, theft, and transit delays for all shipments exceeding $1,000 in value.

Import/Export Compliance

Compliance with international trade regulations is mandatory to avoid customs delays, penalties, or shipment seizures.

- Harmonized System (HS) Code: Classify The Frame under HS 8528.72 (Flat-panel television receivers). Confirm local tariff classifications per destination country.

- Documentation:

- Commercial Invoice

- Packing List

- Bill of Lading / Air Waybill

- Certificate of Origin (preferably Form A for GSP-eligible countries)

- Restricted Parties Screening: Conduct regular screenings against OFAC, BIS, and EU sanctions lists prior to shipment.

- Export Controls: Verify that embedded technology (e.g., smart TV platform, connectivity features) complies with dual-use regulations under EAR (Export Administration Regulations).

Regulatory & Safety Certifications

The Frame must meet regional safety, electromagnetic compatibility (EMC), and environmental standards.

- North America:

- FCC Part 15, Subpart B (EMC)

- UL 62368-1 (Safety of Audio/Video Equipment)

- ENERGY STAR® certification (if applicable)

- European Union:

- CE Marking (covering RED, LVD, EMC, RoHS, and ErP directives)

-符合 EN 62368-1, EN 55032, EN 55035 - Ecodesign and Energy Labeling (EU 2019/2021)

- United Kingdom:

- UKCA Marking (post-Brexit compliance; CE still accepted until December 2024)

- Asia-Pacific:

- KC Mark (South Korea)

- PSE Mark (Japan)

- CCC Mark (China – applicable for certain models with wireless functions)

- Australia & New Zealand: RCM Mark per AS/NZS standards

Product Labeling & User Documentation

Accurate labeling and multilingual documentation are required for compliance and customer support.

- Physical Labels:

- Model and serial number

- Input voltage (e.g., 100–240 V~, 50/60 Hz)

- Regulatory marks (FCC, CE, etc.)

- QR code linking to digital user manual and compliance information

- User Manuals: Provide documentation in the official language(s) of the destination country, including safety instructions, disposal guidelines (WEEE), and warranty terms.

- Quick Start Guide: Include visual setup instructions for wall mounting and Art Mode configuration.

Environmental & Sustainability Compliance

The Frame must comply with environmental regulations regarding materials, energy efficiency, and end-of-life disposal.

- RoHS Compliance: Ensure all electronic components are free of restricted substances (lead, mercury, cadmium, etc.).

- REACH (EU): Declare Substances of Very High Concern (SVHC) if present above threshold.

- WEEE Directive: Register with national WEEE compliance schemes in Europe; provide take-back instructions to consumers.

- Battery Directive: Comply if remote controls contain batteries; include battery symbol and proper disposal info.

- Packaging Waste: Meet EU Directive 94/62/EC or equivalent local regulations for recyclable packaging materials.

After-Sales & Reverse Logistics

Efficient handling of returns, repairs, and end-of-life equipment ensures customer satisfaction and regulatory compliance.

- Return Authorization (RMA): Implement a digital RMA system with tracking and condition assessment upon return.

- Repair & Refurbishment: Use authorized service centers with proper ESD protection and calibration tools.

- End-of-Life Management: Partner with certified e-waste recyclers to ensure proper dismantling and material recovery in accordance with Basel Convention guidelines.

- Data Security: For returned smart displays, perform factory reset and data wipe procedures compliant with GDPR or CCPA.

Audit & Continuous Compliance

Maintain compliance through regular internal and third-party audits.

- Annual Compliance Review: Assess changes in regulations (e.g., new ErP tiers, updated EMC standards).

- Supplier Audits: Ensure component suppliers adhere to quality and environmental standards.

- Record Retention: Keep shipping documents, compliance certificates, and audit reports for a minimum of 5 years.

By adhering to this logistics and compliance framework, stakeholders ensure The Frame is delivered safely, legally, and sustainably across global markets.

Conclusion for Sourcing the Frame Factory:

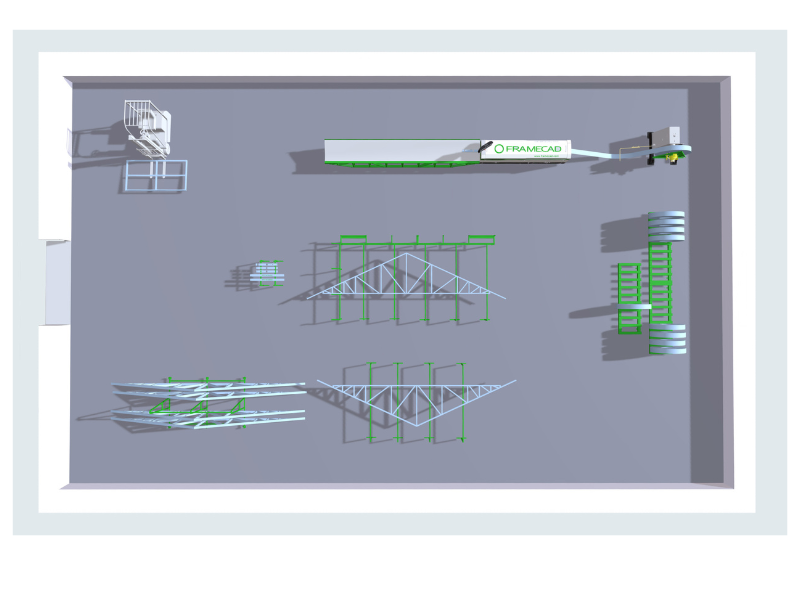

After a comprehensive evaluation of potential suppliers, market conditions, quality standards, cost structures, and logistical feasibility, sourcing from the selected frame factory is a strategic and viable decision. The chosen factory demonstrates strong manufacturing capabilities, consistent product quality, competitive pricing, and the scalability needed to support current and future production demands. Additionally, its compliance with industry standards and willingness to collaborate on innovation and lead time improvements further strengthens the partnership potential.

Sourcing from this factory not only aligns with our cost-efficiency goals but also supports our commitment to reliability and product excellence. With proper management of communication, quality control, and supply chain logistics, this sourcing decision positions the company for improved operational performance and enhanced market competitiveness. It is recommended to proceed with an initial trial order to validate performance before scaling up long-term commitments.