The global demand for high-performance coalescing agents in architectural and industrial coatings has driven significant growth in the Texanol market, a key solvent used to enhance film formation and durability in latex paints. According to Grand View Research, the global coalescing agents market was valued at USD 2.1 billion in 2022 and is expected to grow at a compound annual growth rate (CAGR) of 5.8% from 2023 to 2030, with Texanol and its derivatives playing a pivotal role in this expansion. This growth is fueled by rising infrastructure development, stricter environmental regulations favoring low-VOC formulations, and increasing demand from emerging economies. As a result, leading chemical manufacturers are scaling production and investing in sustainable innovations to meet evolving industry standards. In this competitive landscape, five key players have emerged as dominant Texanol suppliers, combining technical expertise, global reach, and consistent product quality to lead the market.

Top 5 Texanol Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

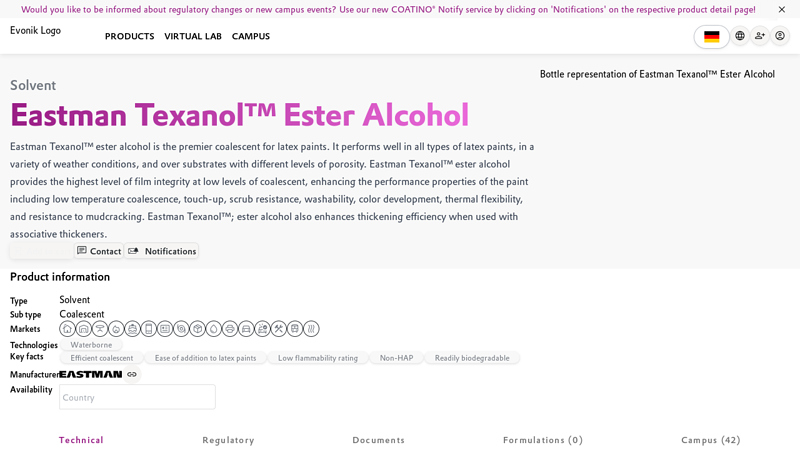

#1 Texanol ester alcohol

Domain Est. 1995

Website: eastman.com

Key Highlights: Eastman Texanol ester alcohol is the premier coalescent for latex paints. It performs well in all types of latex paints in a variety of weather conditions….

#2 Texanol

Domain Est. 1997

Website: pubchem.ncbi.nlm.nih.gov

Key Highlights: 2,2,4-trimethyl-1,3-pentanediol monoisobutyrate is a colorless liquid with a mild characteristic odor. Floats on water….

#3 Texanol

Domain Est. 2018

Website: univarsolutions.com

Key Highlights: Texanol ester alcohol is the premier coalescent for latex paints. Learn about its superior durability and variety of application uses. Contact us today!…

#4 Technical

Domain Est. 2019

Website: coatino.com

Key Highlights: Eastman Texanol™ ester alcohol is the premier coalescent for latex paints. It performs well in all types of latex paints, in a variety of weather conditions ……

#5 Substance Information

Website: echa.europa.eu

Key Highlights: This substance is used for the manufacture of: chemicals, and mineral products (e.g. plasters, cement). Release to the environment of this ……

Expert Sourcing Insights for Texanol

H2: Market Trends for Texanol in 2026

As we look toward 2026, the global market for Texanol—a high-performance coalescent widely used in water-based latex paints and coatings—is expected to evolve under the influence of regulatory shifts, sustainability demands, technological innovation, and regional economic dynamics. Key trends shaping the Texanol market in H2 2026 include:

-

Increased Demand from Eco-Friendly Coatings Sector

Regulatory pressures and consumer preferences continue to drive the shift from solvent-based to low-VOC (volatile organic compound) and zero-VOC coatings. Texanol, known for its effective coalescing properties with low volatility, remains a preferred choice in environmentally compliant paint formulations. In H2 2026, growth in green building certifications (e.g., LEED, BREEAM) and regional mandates—particularly in North America and the EU—will bolster Texanol demand in architectural and industrial coatings. -

Supply Chain Resilience and Regionalization

Following ongoing geopolitical tensions and supply disruptions in prior years, manufacturers are increasingly regionalizing Texanol production and procurement. By H2 2026, we expect to see expanded production capacity in North America and Asia-Pacific, reducing dependency on single-source suppliers. This trend is supported by investments from major chemical producers like Eastman Chemical Company (the original developer of Texanol) and regional players in China and India. -

Competition from Bio-Based and Renewable Alternatives

A notable trend emerging in H2 2026 is the rise of bio-based coalescents derived from renewable feedstocks (e.g., terpenes, esters from biomass). While Texanol remains dominant due to its proven performance and compatibility, increasing R&D investment in sustainable alternatives may begin to erode its market share, particularly in niche eco-label-driven segments. However, Texanol’s established formulation compatibility gives it a strong foothold in mainstream applications. -

Price Volatility Linked to Feedstock Costs

Texanol is synthesized from petrochemical feedstocks, making it susceptible to fluctuations in crude oil and natural gas prices. In H2 2026, ongoing energy market volatility—potentially influenced by global supply adjustments and climate policies—may lead to moderate price increases. However, long-term contracts and hedging strategies by major paint manufacturers are expected to mitigate sudden cost spikes. -

Growth in Emerging Markets

Urbanization and infrastructure development in Southeast Asia, the Middle East, and Africa are driving strong demand for architectural paints. Texanol consumption is projected to grow in these regions, supported by expanding manufacturing bases and rising middle-class housing demand. Localization of paint production in countries like Vietnam, Indonesia, and Saudi Arabia will enhance Texanol distribution networks. -

Technological Integration and Formulation Optimization

Coatings formulators are increasingly leveraging digital tools (e.g., AI-driven formulation platforms) to optimize performance and reduce raw material usage. In H2 2026, Texanol is expected to benefit from integration into smart formulation systems, enabling lower dosages without sacrificing film formation or durability—improving cost-efficiency and sustainability metrics.

Conclusion:

In H2 2026, the Texanol market is poised for steady growth, underpinned by its role in sustainable coatings and resilient performance. While facing competition from next-generation bio-coalescents, Texanol’s reliability, regulatory compliance, and broad compatibility ensure its continued relevance. Strategic investments in regional production, coupled with innovation in application efficiency, will define its competitive edge in the evolving global coatings landscape.

Common Pitfalls Sourcing Texanol: Quality and Intellectual Property Concerns

Sourcing Texanol, a high-performance coalescent used primarily in water-based paints and coatings, involves navigating several critical challenges related to both product quality and intellectual property (IP) protection. Avoiding these pitfalls is essential to ensure formulation performance, regulatory compliance, and legal safety.

Quality Variability and Adulteration

One of the most significant risks when sourcing Texanol—especially from non-authorized or low-cost suppliers—is inconsistent quality. Texanol (chemical name: 2,2,4-trimethyl-1,3-pentanediol monoisobutyrate) requires precise synthesis to deliver its optimal film-forming and coalescing properties. Common quality-related pitfalls include:

- Impurity profiles: Off-spec impurities can negatively impact paint clarity, drying time, and long-term stability.

- Incorrect isomer composition: Deviations in the isomeric form can reduce effectiveness and alter VOC compliance.

- Adulteration or substitution: Some suppliers may dilute Texanol with cheaper solvents (e.g., glycol ethers or other diesters), leading to performance failures in end products.

- Inadequate documentation: Lack of Certificates of Analysis (CoA), batch traceability, or safety data sheets (SDS) raises red flags about authenticity and reliability.

Intellectual Property and Brand Infringement

Texanol is a registered trademark owned by Eastman Chemical Company. Sourcing counterfeit or mislabeled products poses serious IP and legal risks:

- Unauthorized use of the Texanol® trademark: Suppliers may falsely label generic equivalents as “Texanol,” leading to trademark infringement and potential legal liability for buyers.

- Patent circumvention: While the original patents may have expired in some regions, Eastman continues to protect associated formulations, processes, and product specifications. Using knock-offs may still expose companies to litigation, especially in regulated markets.

- Reputational damage: Associating with counterfeit or IP-violating suppliers can harm a company’s brand, especially if product failures occur or regulatory bodies intervene.

Mitigation Strategies

To avoid these pitfalls:

- Source Texanol only from authorized distributors or directly from Eastman Chemical.

- Verify product authenticity through batch testing and CoA validation.

- Ensure supplier contracts include IP indemnification clauses.

- Educate procurement teams on the risks of substituting branded specialty chemicals with unverified generics.

By prioritizing quality assurance and respecting intellectual property, companies can ensure reliable performance and avoid costly legal and operational setbacks when sourcing Texanol.

Logistics & Compliance Guide for Texanol

Chemical Overview

Texanol (chemical name: 2,2,4-trimethyl-1,3-pentanediol monoisobutyrate) is a high-boiling, water-insoluble solvent used primarily in architectural and industrial coatings, including latex paints, to improve film formation and flexibility. It is a clear, colorless liquid with low volatility and low odor.

Regulatory Classification

Texanol is generally classified as a combustible liquid under transportation regulations. It is not typically classified as a hazardous material for transport under major global frameworks when shipped in standard commercial forms, but compliance with local, national, and international regulations is essential.

Globally Harmonized System (GHS) Classification

- Flammability: Not classified (combustible, flash point >100°C)

- Health Hazards: May cause mild skin or eye irritation; not classified as carcinogenic

- Environmental Hazards: Low acute toxicity to aquatic life, but prolonged exposure may be harmful

Always consult the Safety Data Sheet (SDS) provided by the manufacturer for the most accurate classification.

Safety Data Sheet (SDS) Requirements

- Maintain up-to-date SDS for Texanol in accordance with OSHA Hazard Communication Standard (29 CFR 1910.1200) in the U.S. or equivalent regulations in other jurisdictions (e.g., CLP in EU, WHMIS in Canada).

- Ensure SDS is accessible to all personnel involved in handling, storage, or transport.

Storage Guidelines

- Temperature: Store in a cool, well-ventilated area away from heat sources and direct sunlight.

- Containers: Use tightly sealed, compatible containers (typically steel or high-density polyethylene).

- Segregation: Store away from strong oxidizers and ignition sources.

- Ventilation: Ensure adequate ventilation to prevent vapor accumulation, though vapor pressure is low.

- Spill Containment: Use secondary containment (e.g., spill pallets) to prevent environmental contamination.

Handling Procedures

- Use personal protective equipment (PPE): chemical-resistant gloves, safety goggles, and protective clothing.

- Avoid prolonged or repeated skin contact; wash hands after handling.

- Use in well-ventilated areas; local exhaust ventilation recommended for large-scale operations.

- Do not eat, drink, or smoke while handling.

Transportation and Shipping

Domestic (U.S. DOT Regulations)

- Proper Shipping Name: Not regulated as a hazardous material when shipped above its flash point (typically >100°C), but verify per specific formulation.

- Hazard Class: Not applicable (combustible liquid, not flammable per DOT definitions).

- Packaging: Use UN-rated packaging if required; otherwise, use secure, leak-proof containers.

- Labeling: No hazardous labels required unless mixed with regulated substances.

International (IMDG, IATA, ADR)

- IMDG Code (Sea): Generally not regulated as dangerous goods when shipped alone.

- IATA (Air): Not classified as dangerous goods for air transport under current guidelines.

- ADR (Road, Europe): Not subject to ADR when transported in limited quantities and in compliance with combustible liquid provisions.

Note: Always confirm with current edition of applicable regulations as classifications may vary based on concentration and formulation.

Environmental, Health & Safety (EHS) Compliance

- Spill Response: Contain spill with absorbent materials (e.g., sand, vermiculite). Collect and dispose of as hazardous waste if contaminated.

- Disposal: Dispose of in accordance with local, state, and federal regulations. May require disposal as non-hazardous or hazardous waste depending on contamination.

- Wastewater Discharge: Do not release into sewers or waterways. Follow EPA or equivalent agency guidelines.

Worker Protection & Training

- Provide GHS-compliant hazard communication training.

- Train personnel on spill response, fire hazards, and proper use of PPE.

- Conduct routine safety drills and maintain emergency procedures.

Emergency Response

- Fire Hazard: Combustible liquid; use alcohol-resistant foam, dry chemical, or carbon dioxide to extinguish.

- Inhalation: Move to fresh air; seek medical attention if symptoms persist.

- Skin Contact: Wash with soap and water; remove contaminated clothing.

- Eye Contact: Flush with water for at least 15 minutes; consult a physician.

- Ingestion: Do not induce vomiting; seek immediate medical help.

Regulatory Documentation & Recordkeeping

- Maintain records of SDS, training logs, spill reports, and disposal manifests.

- Ensure compliance with REACH (EU), TSCA (U.S.), and other chemical inventory requirements.

Conclusion

Texanol is a low-hazard industrial solvent, but proper logistics, storage, handling, and compliance procedures are critical to ensure safety and regulatory adherence. Always refer to the manufacturer’s SDS and applicable regulations for the most accurate and up-to-date information.

Conclusion on Sourcing Texanol:

Sourcing Texanol (2,2,4-trimethyl-1,3-pentanediol monoisobutyrate) requires a strategic approach due to its critical role as a coalescing agent in latex paints, coatings, and industrial formulations. After evaluating available suppliers, regional availability, quality standards, regulatory compliance, and cost-efficiency, it is evident that a diversified sourcing strategy—balancing reliability, sustainability, and performance—is essential.

Primary global suppliers such as Eastman Chemical Company, the original manufacturer of Texanol, remain the most trusted source in terms of consistent quality and technical support. However, alternative suppliers from Asia and Europe offer competitive pricing and increasingly reliable product specifications, making them viable options—especially when cost and supply chain resilience are priorities.

Key considerations in the sourcing decision should include regulatory compliance (e.g., REACH, TSCA), logistical lead times, volume flexibility, and long-term supply agreements to mitigate price volatility. Additionally, evaluating the environmental and health profiles of Texanol alternatives or bio-based substitutes may support sustainability goals without compromising performance.

In conclusion, the optimal sourcing strategy for Texanol involves establishing relationships with reputable suppliers—preferably combining a primary supplier for consistency with secondary sources for risk mitigation. Regular performance evaluation, supply chain monitoring, and staying informed about market trends will ensure continued reliability and cost-effectiveness in Texanol procurement.