The global antifungal pharmaceuticals market is experiencing steady growth, driven by rising prevalence of fungal infections, increasing immunocompromised patient populations, and expanded healthcare access. According to Grand View Research, the global antifungal drugs market was valued at USD 13.6 billion in 2023 and is projected to grow at a compound annual growth rate (CAGR) of 6.8% from 2024 to 2030. A key segment within this space includes oral antifungals such as terbinafine and itraconazole—broad-spectrum agents widely prescribed for dermatophytosis, onychomycosis, and systemic mycoses. Terbinafine, an allylamine, and itraconazole, a triazole, remain first-line therapies due to their efficacy, safety profiles, and cost-effectiveness in both generic and branded formulations. With growing demand across emerging markets and increasing generic penetration, the manufacturing landscape for these active pharmaceutical ingredients (APIs) and finished dosages has expanded globally. This has led to the emergence of specialized manufacturers, particularly in Asia-Pacific and North America, focusing on quality compliance, scale, and innovation in drug delivery. Based on production capacity, regulatory approvals (such as FDA, EDQM, and WHO-GMP), and market reach, the following nine companies stand out as leading manufacturers of terbinafine and itraconazole worldwide.

Top 9 Terbinafine And Itraconazole Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 ANTIFUNGALS, ORAL

Domain Est. 2007

Website: txvendordrug.com

Key Highlights: Brand Name/Generic Name TERBINAFINE HCL 250 MG TABLET – 30EA terbinafine HCl, NDC/Manufacturer 62135057230. CHARTWELL RX LL, FFS Clinical Prior Auth Required ……

#2 Generic Product List

Domain Est. 1996

Website: cipla.com

Key Highlights: ITRACONAZOLE USP 100 MG, CAPSULES. ITRACIP 200 4’S, ITRACONAZOLE 200 MG … TERBINAFINE HYDROCHLORIDE 250 MG, TABLETS. TERCAN CREAM 10 GM, TERBINAFINE ……

#3 Label

Domain Est. 1997

Website: dailymed.nlm.nih.gov

Key Highlights: FLUCONAZOLE USP 4% / IBUPROFEN USP 2% / ITRACONAZOLE USP 1% / TERBINAFINE HCL USP 4%. Solution 15gm…

#4 Oral Terbinafine Pulse for Onychomycosis Treatment

Domain Est. 1997

Website: pmc.ncbi.nlm.nih.gov

Key Highlights: FDA-approved oral treatment for onychomycosis includes terbinafine and itraconazole, and fluconazole is used off-label. Due to fewer collateral ……

#5 Terbinafine

Domain Est. 2000

Website: dermnetnz.org

Key Highlights: Terbinafine is an allylamine medicine used to treat fungal infections. It is especially effective against dermatophytes (tinea infections)….

#6 Systopic Laboratories Private Limited

Domain Est. 2000

Website: systopic.com

Key Highlights: … Terbinafine, Itraconazole, Ketoconazole,. read more. ORTHOPAEDICS. Orthopaedic segment is our inherent segment and we have been serving it for ……

#7 Itraconazole Terbinafine Tablets Suppliers

Domain Est. 2014

Website: trumachealthcare.net

Key Highlights: Trumac Healthcare launches new product: Terbinafine 250mg + Itraconazole 100mg tablets under its derma division Arcas Biolabs….

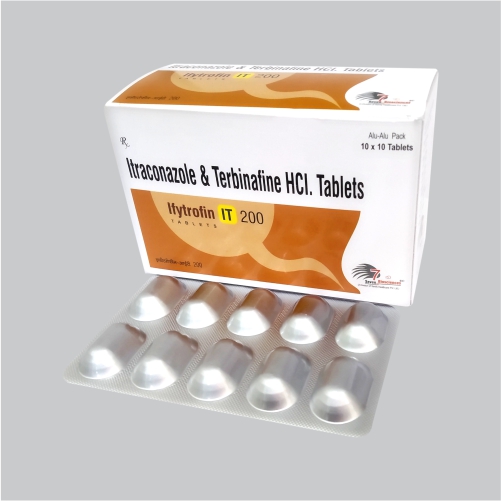

#8 [PDF] Sporanox, Tolsura (itraconazole) C4734

Domain Est. 2014

Website: molinamarketplace.com

Key Highlights: SPORANOX (itraconazole) capsules are indicated for the treatment of the following fungal infections in immunocompromised and non- ……

#9 itraconazole

Domain Est. 2021

Website: vtvformulations.com

Key Highlights: VTV FORMULATIONS INDIA PVT LTD manufactures Itraconazole 200mg & Terbinafine 250mg Tablets, therefore serve our customers with quality life and healthcare ……

Expert Sourcing Insights for Terbinafine And Itraconazole

H2: Market Trends for Terbinafine and Itraconazole in 2026

As the global pharmaceutical landscape evolves, antifungal agents such as Terbinafine and Itraconazole continue to hold significant positions in the treatment of fungal infections. By 2026, several key market trends are expected to shape the demand, competition, and innovation surrounding these two widely prescribed medications.

-

Stable Demand for Dermatophytosis Treatments

Terbinafine, a leading allylamine antifungal, remains a first-line therapy for dermatophytosis, including onychomycosis and tinea infections. The rising prevalence of fungal skin and nail infections—driven by factors such as diabetes, aging populations, and increased awareness—supports sustained demand. In 2026, oral and topical formulations of Terbinafine are expected to maintain strong market presence, particularly in emerging economies where dermatological healthcare access is expanding. -

Growing Use of Itraconazole for Systemic and Resistant Fungal Infections

Itraconazole, a broad-spectrum triazole, is increasingly utilized for systemic mycoses such as aspergillosis, histoplasmosis, and candidiasis. Its role in treating resistant fungal strains and off-label uses (e.g., in chronic candidiasis or fungal asthma) is expected to bolster its market share. By 2026, improved formulations—such as submicron or intravenous versions—are likely to enhance bioavailability and expand clinical applications, especially in hospital and immunocompromised patient settings. -

Generic Dominance and Price Competition

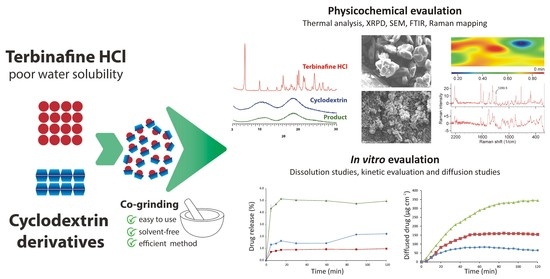

Both Terbinafine and Itraconazole are available as generics worldwide, leading to intense price competition. In 2026, the market will remain highly genericized, particularly in the U.S., Europe, and Asia-Pacific. This cost advantage ensures widespread accessibility but pressures manufacturers to innovate through improved delivery systems (e.g., topical nanocarriers or extended-release tablets) to differentiate their products. -

Regional Market Dynamics

Asia-Pacific is projected to be a high-growth region due to rising healthcare expenditure, increasing incidence of fungal infections, and expanding distribution networks. India and China, in particular, are key producers and consumers of generic antifungals. Meanwhile, North America and Europe will focus on therapeutic optimization and safety monitoring, especially for long-term Itraconazole use due to potential hepatotoxicity and drug interactions. -

Regulatory and Safety Considerations

Regulatory agencies continue to emphasize pharmacovigilance for antifungal agents. In 2026, labeling updates and prescribing guidelines may further refine the use of Itraconazole in patients with cardiac or hepatic risks. Terbinafine, generally considered safer, may see expanded use in pediatric populations, supported by ongoing clinical data. -

Innovation and Combination Therapies

Though both drugs are well-established, research into combination therapies (e.g., Terbinafine with azoles or antiseptics) and novel delivery systems (e.g., nail lacquers, transdermal patches) may open new market segments. Additionally, digital health tools for monitoring treatment adherence in chronic fungal conditions could integrate with prescription patterns for these antifungals.

In conclusion, by 2026, Terbinafine and Itraconazole are anticipated to remain cornerstone therapies in antifungal treatment. While market growth may be moderate due to saturation and generics, opportunities exist in formulation innovation, emerging markets, and expanded clinical applications—ensuring continued relevance in the global healthcare ecosystem.

H2: Common Pitfalls in Sourcing Terbinafine and Itraconazole (Quality and Intellectual Property Concerns)

Sourcing active pharmaceutical ingredients (APIs) such as Terbinafine and Itraconazole presents several challenges, particularly relating to quality assurance and intellectual property (IP) compliance. Inadequate due diligence in these areas can lead to regulatory, legal, and reputational risks for manufacturers, distributors, and healthcare providers.

-

Inconsistent Quality and Purity

A major pitfall in sourcing Terbinafine and Itraconazole is variability in API quality. Suppliers, especially from regions with less stringent regulatory oversight, may provide materials with substandard purity, incorrect polymorphic forms, or high levels of impurities. This can affect drug efficacy and patient safety. For example, residual solvents or genotoxic impurities in Itraconazole can pose serious health risks if not properly controlled. -

Lack of Regulatory Compliance

Many suppliers may not adhere to international standards such as those set by the U.S. FDA, EMA, or WHO. Sourcing from facilities without current Good Manufacturing Practice (cGMP) certification increases the risk of regulatory rejection or product recalls. Terbinafine and Itraconazole produced in non-compliant facilities may lack proper documentation, batch traceability, or validation data. -

Falsified or Counterfeit Materials

The global API market is vulnerable to counterfeit or adulterated products. Some suppliers may misrepresent the origin, composition, or concentration of the API. Without rigorous testing—such as HPLC, mass spectrometry, or X-ray diffraction—buyers may unknowingly procure falsified Terbinafine or Itraconazole, leading to ineffective formulations. -

Intellectual Property Infringement

Terbinafine and Itraconazole, although off-patent in many jurisdictions, may still be covered by secondary patents (e.g., formulation, process, or delivery method patents) in certain countries. Sourcing APIs from manufacturers that use patented synthesis routes or infringe process patents can expose buyers to legal liability, including injunctions or damages. -

Unverified Supplier Credentials

Relying on intermediaries or brokers without directly auditing the API manufacturer increases the risk of sourcing from unqualified or unreliable entities. Fake certifications, forged audit reports, or shell companies can mislead buyers about the true source and quality of the material. -

Supply Chain Transparency Issues

Lack of transparency in the supply chain—such as undisclosed subcontractors or multiple sourcing tiers—makes it difficult to ensure consistent quality and ethical sourcing. This opacity also complicates compliance with regulations like the U.S. Drug Supply Chain Security Act (DSCSA). -

Stability and Storage Risks

Improper handling during shipping and storage can degrade Terbinafine and Itraconazole. Sourcing from suppliers without adequate cold chain logistics or environmental controls may result in compromised API stability, reducing shelf life and therapeutic effectiveness.

Mitigating these pitfalls requires comprehensive supplier qualification, routine quality testing, patent landscape analysis, and adherence to regulatory guidelines. Establishing long-term partnerships with audited, cGMP-compliant manufacturers and conducting regular audits are essential steps in ensuring safe and lawful sourcing of these antifungal APIs.

Logistics & Compliance Guide for Terbinafine and Itraconazole

Overview

Terbinafine and itraconazole are prescription antifungal medications used to treat a variety of fungal infections, including dermatophytosis (e.g., athlete’s foot, ringworm), onychomycosis (fungal nail infections), and systemic fungal infections. Due to their medical significance and regulatory status, proper logistics and compliance protocols must be followed to ensure safety, traceability, and legal adherence throughout the supply chain.

Regulatory Classification

Terbinafine and itraconazole are classified as prescription-only medicines (POM) in most jurisdictions, including the United States (FDA), European Union (EMA), and many other countries. They are not scheduled under international drug control conventions (e.g., UN Single Convention on Narcotic Drugs) but are subject to national pharmaceutical regulations.

- Terbinafine: Available in oral tablet, topical cream, and spray formulations.

- Itraconazole: Primarily available as oral capsules, oral solution, and intravenous infusion (in clinical settings).

Both require valid prescriptions for dispensing and are controlled under standard pharmaceutical distribution laws.

Import & Export Requirements

Required Documentation

- Valid import/export licenses issued by national health authorities (e.g., FDA Form 3464 in the U.S., EU Export Certificates).

- Certificate of Analysis (CoA) for each batch confirming identity, purity, potency, and compliance with pharmacopoeial standards (e.g., USP, Ph. Eur.).

- Certificate of Pharmaceutical Product (CPP) or Statement of Licensing Status, where required.

- Commercial invoice, packing list, and bill of lading/airway bill.

- Regulatory approval from the destination country’s health authority (e.g., import permit, prior notification).

Special Considerations

- Temperature-sensitive formulations (e.g., itraconazole oral solution) require cold chain logistics (typically 2–8°C).

- Both drugs may be subject to anti-diversion monitoring in certain regions due to potential for misuse or illicit importation.

- Export to countries with strict pharmaceutical regulations (e.g., Saudi Arabia, China) may require product registration and local regulatory approval prior to shipment.

Storage & Handling

Environmental Conditions

- Storage Temperature:

- Terbinafine tablets and topical forms: Store at 15–25°C (controlled room temperature), protect from moisture.

- Itraconazole capsules: 15–30°C; oral solution: 2–8°C (refrigerate, do not freeze).

- Light Sensitivity: Both drugs should be protected from direct sunlight and UV exposure.

- Humidity Control: Relative humidity should be maintained below 60% to prevent degradation.

Segregation & Security

- Store separately from controlled substances and hazardous materials.

- Maintain restricted access in warehouses; logging required for inventory movement.

- Use tamper-evident packaging and serialization where mandated (e.g., EU Falsified Medicines Directive).

Transportation Requirements

Mode of Transport

- Ground, air, and sea freight are permissible, but cold chain integrity must be maintained for temperature-sensitive forms.

- Use validated shipping containers with temperature data loggers for active monitoring.

Labeling & Packaging

- Outer packaging must display:

- Product name, strength, and formulation.

- Batch number, expiration date.

- Storage conditions (e.g., “Refrigerate,” “Protect from light”).

- Prescription-only symbol and regulatory markings (e.g., “Rx Only” in the U.S.).

- Shipments must comply with IATA DGR (Dangerous Goods Regulations) if applicable (e.g., for intravenous formulations classified as medicinal products).

Compliance & Traceability

Serialization & Track-and-Trace

- In the EU: Must comply with the Falsified Medicines Directive (FMD) – unique identifier (UI) and anti-tampering device (ATD) on packaging.

- In the U.S.: Comply with the Drug Supply Chain Security Act (DSCSA) – product tracing at the package level by 2023 requirements.

- Other regions: Follow local track-and-trace regulations (e.g., China’s electronic supervision code, Turkey’s KDS system).

Record Keeping

- Maintain records of:

- Batch numbers and expiration dates.

- Distribution chain (from manufacturer to pharmacy/clinic).

- Temperature monitoring data for cold chain shipments.

- Regulatory documents (CoA, import permits, customs clearance).

- Retention period: Minimum 5 years post-expiration date (varies by jurisdiction).

Quality Assurance & Regulatory Inspections

- Conduct regular audits of suppliers, distributors, and logistics partners.

- Ensure GDP (Good Distribution Practice) certification for all entities handling the products.

- Be prepared for inspections by regulatory authorities (e.g., FDA, MHRA, TGA) with full documentation available.

Disposal & Returns

- Do not return dispensed or temperature-compromised products to stock.

- Expired or damaged products must be disposed of per local hazardous waste regulations.

- Destruction must be documented with certificates of destruction.

Summary

Proper logistics and compliance management for terbinafine and itraconazole are essential to maintain product integrity, patient safety, and regulatory adherence. Key focus areas include: prescription-only handling, temperature control for sensitive formulations, documentation accuracy, serialization compliance, and adherence to GDP standards throughout the supply chain. Regular training and audits are recommended to ensure ongoing compliance.

In conclusion, sourcing terbinafine and itraconazole requires careful consideration of quality, regulatory compliance, and supply chain reliability. Both antifungal agents are essential in the treatment of a wide range of fungal infections, and ensuring access to safe, effective, and affordable supplies is critical for public health. Sourcing from manufacturers that adhere to Good Manufacturing Practices (GMP) and are approved by stringent regulatory authorities—such as the FDA, EMA, or WHO—helps guarantee product quality and patient safety. Additionally, evaluating cost-effectiveness, availability, and supply chain stability is vital, especially in low- and middle-income settings. Diversifying suppliers, conducting regular audits, and staying informed about market trends and potential shortages can further mitigate risks. Ultimately, a strategic, transparent, and compliance-driven approach to sourcing terbinafine and itraconazole supports consistent therapeutic outcomes and strengthens global antifungal treatment efforts.

![[PDF] Sporanox, Tolsura (itraconazole) C4734](https://www.sohoinchina.com/wp-content/uploads/2026/01/pdf-sporanox-tolsura-itraconazole-c4734-719.jpg)