The global tempered glass market, a critical component in industries ranging from construction and automotive to consumer electronics, is experiencing robust growth driven by increasing demand for safety, durability, and energy-efficient materials. According to Grand View Research, the global tempered glass market size was valued at USD 34.9 billion in 2022 and is expected to expand at a compound annual growth rate (CAGR) of 6.4% from 2023 to 2030. This sustained growth is fueled by rising infrastructure development, expanding automotive production, and the proliferation of smart devices requiring shatter-resistant displays. With such strong market momentum, the role of advanced glass cutting technologies has become increasingly pivotal. Precision cutting ensures minimal waste, optimal yield, and adherence to stringent quality standards—factors that distinguish leading manufacturers in this competitive landscape. As demand escalates, a select group of manufacturers have emerged at the forefront, combining innovation, scalability, and advanced engineering to meet the evolving needs of global industries. Here, we spotlight the top 10 tempered glass cutting manufacturers shaping the future of the sector.

Top 10 Tempered Glass Cutting Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Tempered Glass Manufacturer & Supplier

Domain Est. 1998

Website: jerseytemperedglass.com

Key Highlights: Jersey Tempered Glass offers cost-effective, high-quality tempered glass that we will customize to suit your needs and project. Our glass comes in custom ……

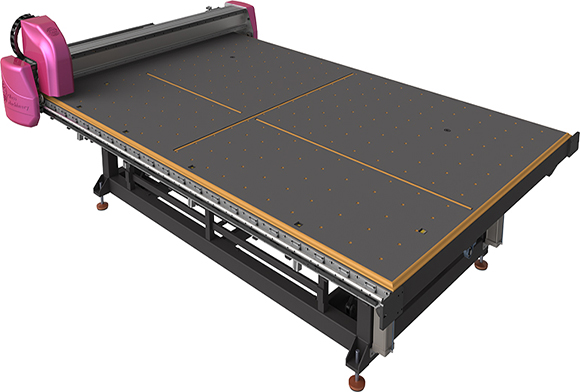

#2 CMS Glass Machinery

Domain Est. 1998

Website: cmsmachine.com

Key Highlights: We produce glass cutting machine, double glass machine, laminated glass machine, glass processing machine, glass tempering furnace, glass production lines….

#3 M3 Glass Technologies

Domain Est. 2006

Website: m3glass.com

Key Highlights: M3 Glass Technologies is your trusted designer and manufacturer of innovative, custom design-glass. Complete assistance from design to production….

#4 Lippert Tempered Glass Manufacturing

Domain Est. 1996

Website: corporate.lippert.com

Key Highlights: We offer custom tempered glass solutions designed to meet your unique specifications, providing enhanced strength, safety, and precision for a wide range of ……

#5 Cardinal Glass Industries

Domain Est. 1997

Website: cardinalcorp.com

Key Highlights: A world-leading glass provider for nearly any application. Advanced LoĒ™ coatings, durable insulating glass, tempering, lamination and more. Product Overview ……

#6 Swift Glass

Domain Est. 1998

Website: swiftglass.com

Key Highlights: Swift Glass is a worldwide leader in manufacturing quality fabricated glass parts, offering capabilities such as glass cutting, waterjet cutting and more….

#7 Glass Machinery

Domain Est. 2005

Website: ladglass.com

Key Highlights: LAD specializes in producing professional glass machine for glass tempering, glass cutting, edging and polishing, washing, sandblasting, etc….

#8 TEMPCO GLASS

Domain Est. 2012

Website: tempcoglass.com

Key Highlights: Tempco is IGCC-certified to fabricate dual-sealed insulated glass units using a wide selection of high-performance low-e coatings proudly made in the USA, ……

#9 Modern Glass company produces IGUs, tempered, painted and …

Domain Est. 2020

Website: modernglassltd.com

Key Highlights: Modern Glass company is the technological leader of float glass processing in Russian Federation. We produce IGUs, tempered, painted and laminated glass….

#10 Shape Glass

Domain Est. 2020

Website: shapeglass.net

Key Highlights: Shape Glass LLC, is a North-American Glass Company specializing in manufacturing and distribution of glass and mirror products….

Expert Sourcing Insights for Tempered Glass Cutting

H2: Projected 2026 Market Trends in Tempered Glass Cutting

The tempered glass cutting industry is poised for significant transformation by 2026, driven by technological innovation, rising demand across key end-use sectors, and evolving regulatory standards. As tempered glass remains a critical material in construction, automotive, electronics, and renewable energy industries, advancements in precision cutting technologies and automation are reshaping market dynamics.

-

Growth in Demand from Construction and Architecture

The global construction sector, particularly in emerging economies, is expected to continue driving demand for tempered glass. With increasing emphasis on energy-efficient buildings and aesthetically modern designs, architects are favoring large-scale, custom-cut tempered glass for façades, windows, and interior applications. By 2026, the trend toward smart buildings and green construction will further boost demand for high-precision cutting solutions to meet exact dimensional and safety requirements. -

Automotive Sector Advancements

The automotive industry remains a major consumer of tempered glass, especially with the rise of electric vehicles (EVs) and advanced driver-assistance systems (ADAS). Tempered glass is used not only for side and rear windows but also in panoramic roofs and sensor-integrated glazing. By 2026, original equipment manufacturers (OEMs) will demand more complex, lightweight, and curved glass components—necessitating high-accuracy cutting and shaping technologies such as waterjet and laser cutting. -

Expansion in Consumer Electronics

The proliferation of smartphones, tablets, wearable devices, and foldable screens is fueling demand for ultra-thin, scratch-resistant tempered glass. As device designs become more sophisticated, manufacturers require micron-level precision in glass cutting. By 2026, the integration of AI-driven robotics and laser scoring systems will enable mass production of intricately shaped glass with minimal waste and high yield rates. -

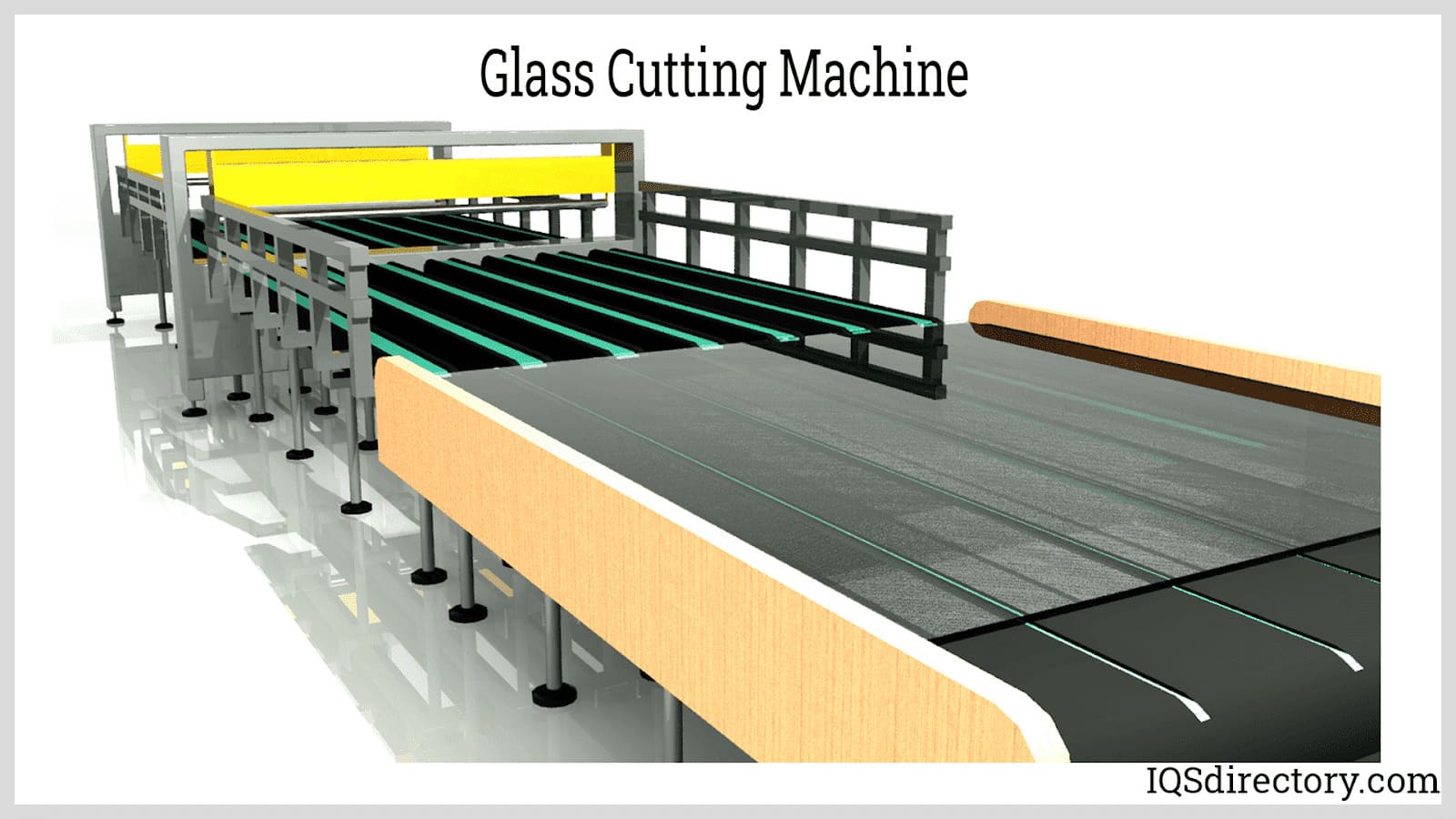

Adoption of Automation and Smart Manufacturing

Automation is becoming central to the tempered glass cutting process. By 2026, smart factories equipped with IoT-enabled cutting machines, predictive maintenance systems, and real-time quality monitoring will dominate the market. These technologies enhance throughput, reduce human error, and support customization—key factors in meeting diverse client specifications efficiently. -

Sustainability and Waste Reduction

Environmental regulations and corporate sustainability goals are pushing manufacturers to adopt eco-friendly practices. In tempered glass cutting, this includes optimizing cutting patterns using AI algorithms to minimize material waste and recycling glass offcuts. By 2026, companies that invest in closed-loop production systems and energy-efficient cutting equipment will gain a competitive edge. -

Regional Market Shifts

Asia-Pacific, led by China and India, will remain the largest market for tempered glass cutting due to rapid urbanization and industrial growth. However, North America and Europe are expected to see increased adoption of advanced cutting technologies, driven by high labor costs and stringent safety standards. Localized production hubs with automated cutting lines will rise to reduce logistics costs and lead times. -

Technological Innovations

Laser cutting and CNC-controlled waterjet systems are expected to surpass traditional mechanical methods by 2026 due to their precision, speed, and ability to handle complex geometries. Additionally, developments in cold-cutting techniques for post-tempering adjustments—once considered impossible—are emerging, potentially revolutionizing repair and customization processes.

In conclusion, the 2026 tempered glass cutting market will be characterized by heightened precision, automation, and sustainability. Companies that embrace digital transformation and invest in R&D for advanced cutting technologies will be best positioned to capitalize on expanding opportunities across multiple high-growth industries.

Common Pitfalls in Sourcing Tempered Glass Cutting (Quality, IP)

Sourcing tempered glass cutting services or products can be challenging, especially when balancing quality requirements and intellectual property (IP) concerns. Below are some common pitfalls to watch out for:

Poor Quality Control Standards

One of the most frequent issues when sourcing tempered glass cutting is inconsistent or subpar quality. Since tempered glass undergoes thermal or chemical treatment to increase strength, any flaw introduced during cutting—especially post-tempering—can compromise structural integrity. Many suppliers may claim to offer precision cutting but lack proper quality assurance processes, resulting in chipped edges, inaccurate dimensions, or internal stress fractures.

Misunderstanding of Post-Tempering Cutting Limitations

Tempered glass cannot be cut or modified after the tempering process without shattering. A common mistake is assuming that standard cutting techniques apply. Suppliers unfamiliar with this limitation may promise post-production adjustments, leading to project delays and material waste. Always verify that glass is cut to size before tempering.

Lack of Certification and Compliance

Reputable suppliers should adhere to international standards such as ANSI Z97.1 or EN 12150. Failure to ensure compliance can result in safety hazards and legal liabilities, especially in architectural or automotive applications. Always request certifications and test reports before finalizing a supplier.

Inadequate Intellectual Property Protections

When sourcing custom-cut tempered glass for proprietary designs (e.g., consumer electronics, specialty enclosures), IP theft is a real risk. Suppliers in certain regions may replicate designs or share tooling with third parties. Without strong contractual safeguards—such as NDAs, IP assignment clauses, and audit rights—your designs could be compromised.

Insufficient Documentation and Traceability

High-quality sourcing requires full traceability, including batch numbers, heat treatment records, and cutting specifications. Some suppliers provide minimal documentation, making it difficult to troubleshoot issues or ensure consistency across production runs.

Overlooking Tooling and Fixture Ownership

Custom jigs or cutting templates developed for your project may become IP assets. If contracts don’t explicitly assign ownership of these tools to your company, the supplier may reuse them for competitors or charge additional fees for future production.

Communication and Technical Misalignment

Language barriers, time zone differences, or lack of technical expertise on the supplier’s side can lead to misinterpretations of blueprints or tolerances. This often results in incorrect cuts or material rejection upon delivery.

Conclusion

To avoid these pitfalls, conduct thorough due diligence on suppliers, insist on quality certifications, secure IP rights contractually, and ensure all cutting is performed prior to tempering. Regular audits and clear communication channels are essential for maintaining both quality and IP integrity.

Logistics & Compliance Guide for Tempered Glass Cutting

Tempered glass, while valued for its strength and safety properties, cannot be cut, drilled, or modified after the tempering process without shattering. This fundamental characteristic has significant implications for logistics, handling, planning, and regulatory compliance throughout its supply chain. This guide outlines key considerations.

Understanding the Irreversibility of Tempering

Once glass undergoes the thermal tempering process—where it is heated to near softening point and then rapidly cooled—it develops internal stresses that give it enhanced strength and its characteristic break pattern. Any attempt to cut, edge, drill, or deeply scratch tempered glass disrupts these stresses, causing it to fracture completely into small, relatively harmless pieces. This means all cutting and shaping must occur prior to tempering.

Pre-Tempering Fabrication and Measurement Accuracy

All dimensional requirements for tempered glass must be finalized before the tempering stage. This includes precise measurements for cutting, notching, hole drilling, and edge treatments (e.g., seaming, polishing). Logistics must ensure that:

– Fabrication drawings are accurate and approved before glass enters the tempering queue.

– Measurement tolerances are clearly defined and adhered to, typically within ±1/16 inch (±1.5 mm) for standard applications.

– Changes after ordering are avoided or managed through rework of annealed glass, adding cost and delay.

Transportation and Handling of Finished Tempered Glass

Due to its post-tempering fragility to edge and surface damage, tempered glass requires careful handling:

– Use padded racks or cradles during transport to prevent chipping or impact.

– Avoid stacking without protective interleaving; upright storage is preferred.

– Handle with clean gloves to prevent contamination and use suction lifters for larger panels.

– Clearly label packages as “Tempered Glass – Handle with Care – Do Not Drill or Cut.”

Regulatory and Safety Compliance

Compliance with safety standards is critical, particularly because tempered glass is often used in hazardous locations (e.g., doors, shower enclosures, railings):

– ANSI Z97.1 (USA) and CPSC 16 CFR 1201 (Category I & II): These standards govern the safety performance of glass in buildings. Tempered glass must pass impact and breakage tests to qualify.

– Building Codes: Jurisdictions often require safety glazing in specific applications (e.g., doors, low-level windows, near stairs). Tempered glass is a common solution; verify local code requirements.

– Labeling Requirements: Tempered glass must bear a permanent, legible manufacturer’s mark (often a silk-screened or sandblasted logo) indicating it is tempered. This is required by CPSC and building codes for identification in the field.

– OSHA and Workplace Safety: Handling procedures must align with OSHA guidelines to protect workers during transport and installation, including proper lifting techniques and PPE.

Documentation and Traceability

Maintain detailed records for compliance and quality assurance:

– Mill certificates or test reports verifying tempering process compliance.

– Fabrication drawings and approval records.

– Shipping manifests with breakage tracking.

– Certification documentation for safety glazing applications.

Common Pitfalls and Mitigation Strategies

- Last-Minute Design Changes: Avoid changes post-tempering. Use mockups and confirm dimensions early.

- Incorrect Glass Type Ordered: Double-check specifications (tempered vs. laminated vs. annealed) before fabrication.

- Damage During Installation: Train installers on handling procedures and ensure job site conditions are controlled (e.g., no welding sparks near glass).

- Non-Compliant Substitutions: Never substitute annealed glass for tempered in safety-critical areas.

Conclusion

Successful logistics and compliance in tempered glass operations depend on meticulous pre-tempering planning, strict adherence to safety standards, and careful handling throughout the supply chain. By respecting the irreversible nature of the tempering process and following regulatory requirements, stakeholders can ensure safety, reduce waste, and maintain project timelines.

Conclusion on Sourcing Tempered Glass Cutting:

Sourcing tempered glass cutting requires careful consideration due to the inherent properties of tempered glass, which cannot be cut, drilled, or modified after the tempering process without shattering. As such, accurate measurements, precise specifications, and detailed planning are essential before placing an order. It is critical to work with reputable suppliers or manufacturers who offer custom cutting services prior to tempering, ensuring the final product meets exact size, shape, and safety requirements.

Additionally, factors such as edge finishing, hole placement, notches, and compliance with safety standards (e.g., ANSI, EN, or CPSC) must be communicated clearly during the sourcing process. Lead times, logistics, and cost implications should also be evaluated, especially for large-scale or time-sensitive projects.

In summary, successful sourcing of cut tempered glass hinges on early collaboration with experienced fabricators, meticulous design planning, and adherence to industry standards—ensuring both quality and safety in the final application.