The global temozolomide market is experiencing steady growth, driven by rising incidence rates of brain cancers—particularly glioblastoma multiforme—and increased demand for effective chemotherapy agents. According to Grand View Research, the global brain cancer treatment market was valued at USD 2.7 billion in 2022 and is projected to expand at a CAGR of 8.3% from 2023 to 2030, fueled by advancements in oncology therapeutics and growing healthcare expenditure. As a first-line treatment for malignant glioma, temozolomide plays a critical role in this landscape. With both branded and generic manufacturers expanding production capacity and geographic reach, competition remains robust. Based on market availability, regulatory approvals, and production scale, the following five companies have emerged as leading temozolomide manufacturers, shaping the supply and accessibility of this essential oncolytic agent worldwide.

Top 5 Temozolomid Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

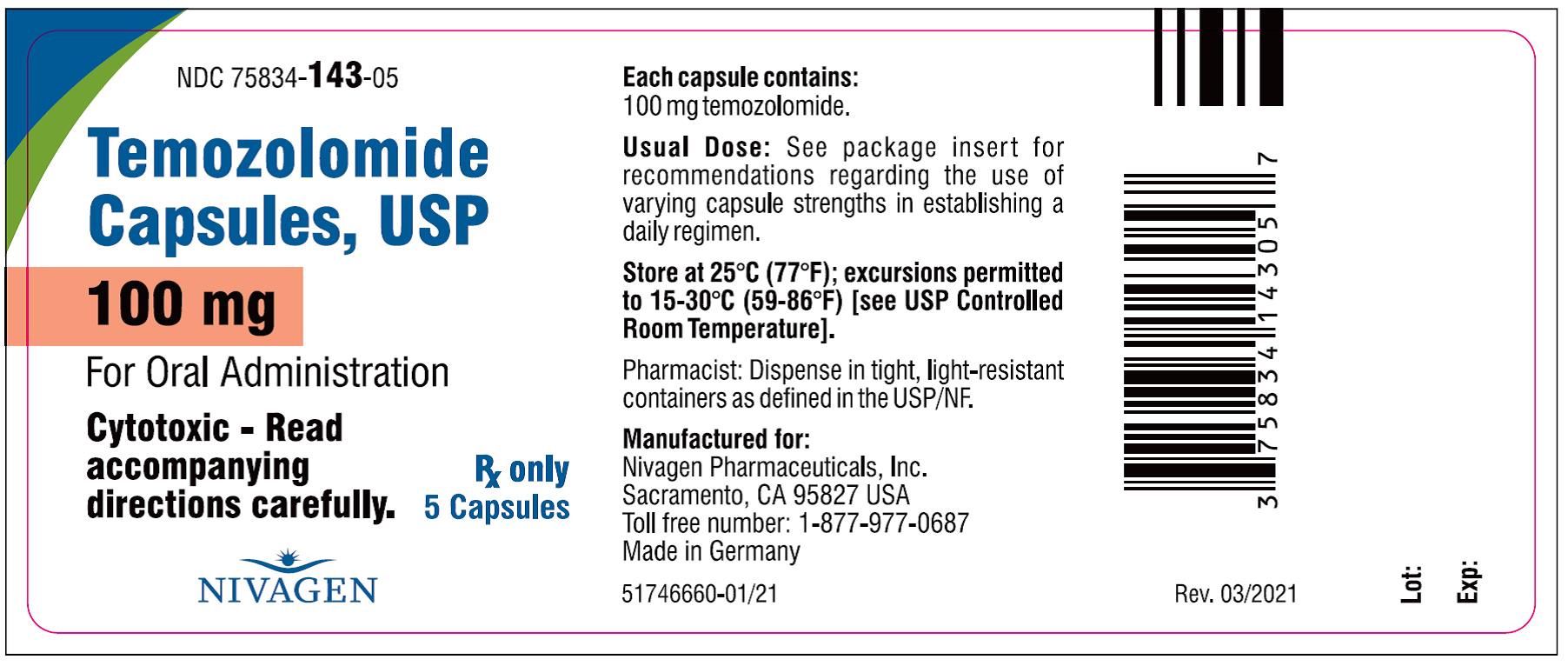

#1 Temozolomide, USP

Domain Est. 1998

Website: formosalab.com

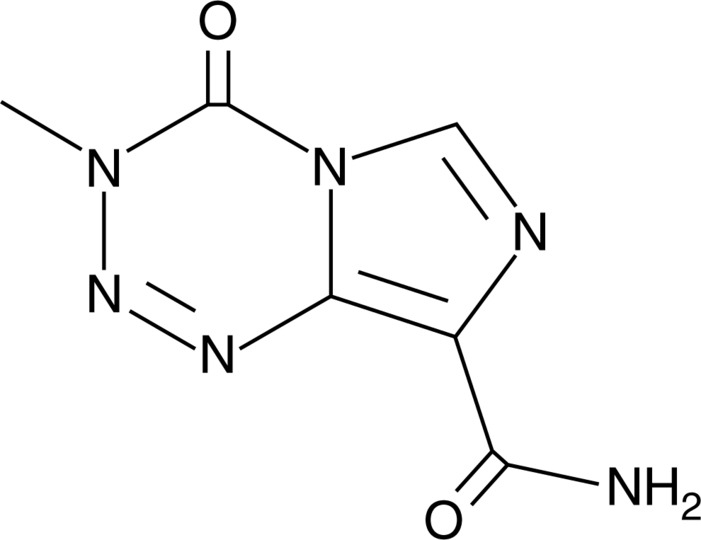

Key Highlights: Temozolomide is an alkylating drug indicated for the treatment of adults with newly diagnosed glioblastoma concomitantly with radiotherapy and then as ……

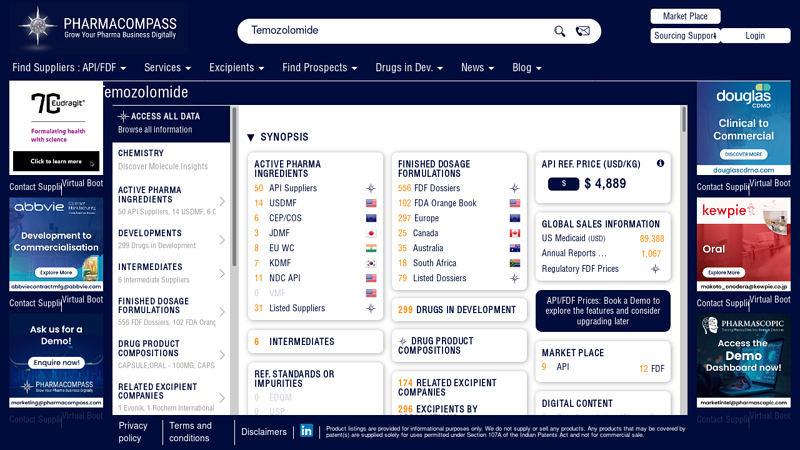

#2 Temozolomide

Domain Est. 2014

Website: pharmacompass.com

Key Highlights: PharmaCompass offers a list of Temozolomide API manufacturers, exporters & distributors, which can be sorted by GMP, USDMF, JDMF, KDMF, CEP (COS), WC, ……

#3 Temozolomide from Cayman Chemical

Domain Est. 1999

Website: biocompare.com

Key Highlights: ItemTemozolomide ; CompanyCayman Chemical ; Price $39.00Supplier PageView Company Product Page ; Catalog Number14163 ; Quantity10 mg ……

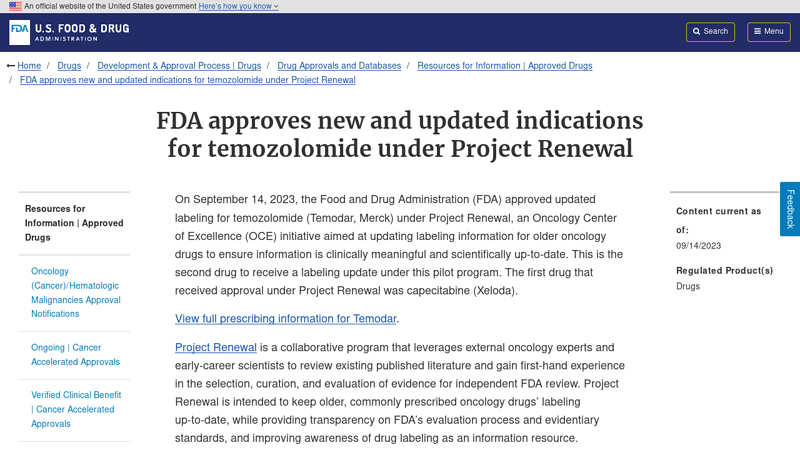

#4 FDA approves new and updated indications for temozolomide under …

Domain Est. 2000

Website: fda.gov

Key Highlights: On September 14, 2023, the Food and Drug Administration (FDA) approved updated labeling for temozolomide (Temodar, Merck) under Project Renewal….

#5 Temozolomide

Domain Est. 2007

Website: camberpharma.com

Key Highlights: Product Info ; Dosage FormCapsule ; TE CodeAB ; Brand ReferenceTemodar ; Therapeutic CategoryAalkylating agent ; PronunciationTEM-oh-ZOE-loe-mide ……

Expert Sourcing Insights for Temozolomid

H2: 2026 Market Trends for Temozolomide

The global Temozolomide market in 2026 is expected to be shaped by a complex interplay of factors, characterized by both stabilizing forces and emerging pressures. While the core demand remains anchored in its established use for glioblastoma multiforme (GBM) and anaplastic astrocytoma, the landscape is evolving due to patent expirations, generic competition, and shifting treatment paradigms.

1. Dominance of Generics and Price Pressure:

* Key Driver: The expiration of key patents (e.g., Merck’s US patent in 2015, subsequent global expirations) has led to a saturated generic market. By 2026, the market will be overwhelmingly dominated by low-cost generic versions from numerous manufacturers (e.g., Sun Pharma, Natco, Sandoz, Apotex).

* Impact: Intense competition among generic producers will continue to exert significant downward pressure on prices globally. This trend maximizes accessibility but severely limits revenue growth potential for branded and generic players alike. Market expansion will be driven almost entirely by volume, not value.

2. Stable but Challenging Core Indication (GBM):

* Demand Foundation: Glioblastoma multiforme (GBM) remains the primary driver of Temozolomide demand. Its role as the standard-of-care first-line treatment (Stupp protocol: radiotherapy + concurrent/adjuvant TMZ) ensures a baseline level of consistent, albeit limited, patient volume.

* Limiting Factor: The inherently poor prognosis of GBM (median survival ~15 months) inherently caps the total addressable market and long-term treatment duration for most patients. Progress in significantly improving GBM survival remains slow, limiting substantial market growth from this indication.

3. MGMT Promoter Methylation as a Key Biomarker:

* Treatment Optimization: The predictive value of MGMT promoter methylation status is increasingly standard in clinical practice. Patients with methylated MGMT derive significantly more benefit from Temozolomide.

* Impact in 2026: Wider adoption of MGMT testing will lead to more targeted use of Temozolomide, potentially reducing overall volume slightly by avoiding use in unmethylated patients unlikely to respond. However, it strengthens the drug’s position as the optimal choice for the responsive subgroup, solidifying its niche.

4. Pressure from Emerging Therapies & Clinical Trial Setbacks:

* Competitive Threats: The GBM treatment landscape is seeing increased activity with novel approaches:

* Tumor Treating Fields (TTFields – Optune): Gaining traction as part of standard care (based on EF-14 trial), used with Temozolomide, but represents a shift in the treatment ecosystem.

* Immunotherapies (Checkpoint Inhibitors, Vaccines): Despite numerous setbacks (e.g., CheckMate 498, 548 failures), research continues. A successful immunotherapy could eventually displace or reduce reliance on chemotherapy.

* Novel Targeted Agents & Combination Therapies: Ongoing clinical trials exploring new drugs (e.g., PARP inhibitors, EGFR inhibitors, oncolytic viruses) often in combination with or as alternatives to TMZ.

* Impact: While no single therapy is expected to replace Temozolomide as first-line standard by 2026, the pipeline pressure is significant. Failure of Temozolomide in key trials (like the CheckMate studies) highlights its limitations and fuels the search for better options, casting a long-term shadow over its market.

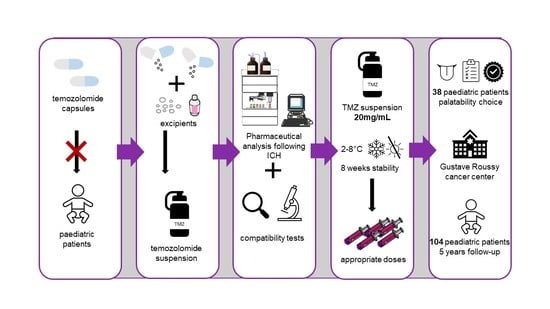

5. Pediatric Use and Other Indications:

* Secondary Driver: Use in pediatric brain tumors (e.g., high-grade gliomas, medulloblastoma relapse) and metastatic melanoma (though largely superseded) provides a smaller, secondary market segment.

* Impact: These uses contribute to overall volume but are unlikely to drive significant market growth compared to the GBM base. Pediatric formulations and access programs may be areas of focus for some manufacturers.

6. Geographic Variations:

* Mature Markets (US, EU, Japan): Characterized by fully saturated generic markets, strong price controls (especially in Europe), and rapid adoption of MGMT testing. Growth will be minimal, driven by population demographics and incremental improvements in diagnosis/treatment access.

* Emerging Markets (Asia-Pacific, Latin America): Potential for higher volume growth due to improving healthcare access, diagnosis rates, and affordability of generics. However, market penetration may be uneven.

Conclusion for 2026:

The Temozolomide market in 2026 will be a mature, generic-dominated commodity market. Growth will be stagnant or very low in terms of global market value due to relentless price erosion. Volume may see modest increases driven by population growth and improved access in emerging economies, but this will be offset by more targeted use based on MGMT status. The drug’s position as the cornerstone of first-line GBM therapy remains secure for now, but it faces increasing pressure from novel therapies and the inherent limitations of treating a devastating disease. The primary market dynamics will revolve around cost-effective manufacturing, distribution efficiency for generics, and navigating reimbursement pressures, rather than innovation or premium pricing. The long-term outlook hinges on developments in GBM treatment, where any significant breakthrough could eventually diminish Temozolomide’s central role.

Common Pitfalls Sourcing Temozolomide (Quality, IP)

Sourcing Temozolomide, a critical chemotherapy agent used primarily in the treatment of glioblastoma and other brain tumors, involves navigating significant challenges related to both product quality and intellectual property (IP) rights. Failure to address these pitfalls can lead to clinical, legal, and reputational risks.

Quality-Related Pitfalls

-

Substandard or Falsified Products: Sourcing from unregulated or non-GMP-compliant manufacturers increases the risk of receiving counterfeit, degraded, or impure Temozolomide. This can compromise patient safety and treatment efficacy, especially given the drug’s narrow therapeutic index.

-

Inconsistent Manufacturing Standards: Variability in raw materials, synthesis processes, or formulation can lead to batch-to-batch inconsistencies. This affects bioavailability and therapeutic outcomes, particularly critical in oncology where dosing precision is essential.

-

Lack of Regulatory Oversight: Procuring from suppliers in jurisdictions with weak regulatory enforcement may result in products that lack proper stability data, impurity profiling, or appropriate packaging (e.g., insufficient protection from moisture and light, which Temozolomide is highly sensitive to).

-

Inadequate Documentation and Traceability: Failure to obtain full Certificates of Analysis (CoA), stability data, and audit trails from suppliers can hinder verification of product quality and complicate regulatory compliance during inspections.

Intellectual Property-Related Pitfalls

-

Patent Infringement Risks: Temozolomide is or has been protected by patents in many jurisdictions (e.g., formulation and use patents held historically by Merck Sharp & Dohme). Sourcing generic versions without confirming patent expiry or obtaining proper licensing may expose buyers and distributors to legal action.

-

Unclear Legal Status of Generic Suppliers: Some manufacturers may market Temozolomide without transparently disclosing their IP licensing status. This is particularly prevalent in regions with complex or poorly enforced patent laws, increasing the risk of inadvertently sourcing infringing products.

-

Regulatory Exclusivity Considerations: Even after patent expiration, regulatory data exclusivity or market protection periods in certain countries may restrict lawful marketing and importation of generic versions, complicating supply chain decisions.

-

Lack of Due Diligence on Supplier IP Compliance: Failing to conduct thorough IP audits of suppliers—especially when sourcing through intermediaries—can result in supply chain disruptions, product seizures, or litigation.

To mitigate these risks, stakeholders should engage only with GMP-certified suppliers, verify regulatory approvals (e.g., FDA, EMA, or equivalent), conduct on-site audits when possible, and consult legal experts to confirm the IP status of the product in the target market.

Logistics & Compliance Guide for Temozolomide

Temozolomide is a cytotoxic chemotherapy agent used primarily in the treatment of certain brain tumors, such as glioblastoma multiforme and anaplastic astrocytoma. Due to its potent pharmacological activity and potential hazards, strict logistics and compliance protocols must be followed throughout its handling, storage, transportation, and administration. This guide outlines key considerations to ensure safety, regulatory compliance, and product integrity.

Regulatory Classification and Handling

Temozolomide is classified as a hazardous drug by regulatory bodies such as the National Institute for Occupational Safety and Health (NIOSH) and the European Medicines Agency (EMA). It requires adherence to standards for handling hazardous pharmaceuticals, including those outlined in USP <800> (United States) and equivalent national guidelines (e.g., Safe Handling of Cytotoxics in the UK, EU Good Manufacturing Practice Annex 3).

Personnel involved in the preparation, dispensing, or administration of temozolomide must be trained in safe handling practices. Appropriate personal protective equipment (PPE), including chemotherapy-rated gloves, gowns, eye protection, and respiratory protection when necessary, must be worn.

Storage Requirements

Temozolomide should be stored according to manufacturer specifications, typically at controlled room temperature (15–30°C / 59–86°F), protected from light and moisture. The product must remain in its original packaging until use to maintain stability and prevent exposure.

Storage areas must be secure, restricted to authorized personnel, clearly labeled as containing hazardous drugs, and equipped with spill containment measures. Refrigeration is generally not required unless specified by the formulation or local regulatory guidance.

Transportation and Distribution

During transportation, temozolomide must be shipped in compliance with national and international regulations for hazardous substances, including the U.S. Department of Transportation (DOT) and the International Air Transport Association (IATA) Dangerous Goods Regulations, when applicable.

Primary packaging should be leak-proof and tamper-evident. Secondary packaging must include absorbent material and be clearly labeled with hazard symbols (e.g., cytotoxic warning) and handling instructions. Shipments should maintain temperature control when required, using validated cold chain logistics if needed.

Courier services must be certified to transport pharmaceuticals, particularly hazardous drugs, with appropriate documentation (e.g., safety data sheets, shipping manifests).

Dispensing and Preparation

Temozolomide capsules or reconstituted injectable formulations must be prepared in a certified biological safety cabinet (BSC) or compounding aseptic containment isolator (CACI), as per USP <797> and <800> requirements.

All compounding activities must be documented, including batch preparation records, waste disposal logs, and personnel training records. Preparation should occur in designated areas separate from non-hazardous drug compounding.

Administration and Patient Safety

Healthcare providers must follow institutional protocols for patient verification, dose calculation, and administration route (oral or intravenous). Patients should receive clear counseling on handling oral capsules at home, including avoiding crushing or opening capsules and practicing hand hygiene before and after dosing.

Pregnant healthcare workers or individuals trying to conceive should avoid handling temozolomide due to its teratogenic potential.

Waste Disposal

All materials contaminated with temozolomide (e.g., vials, syringes, gloves, gowns) must be disposed of as hazardous pharmaceutical waste in accordance with local, state, and federal regulations (e.g., EPA, OSHA in the U.S.).

Waste containers must be puncture-resistant, leak-proof, and labeled with the appropriate biohazard and cytotoxic symbols. Spill kits specific to hazardous drugs must be readily available in storage and handling areas.

Recordkeeping and Compliance Audits

Facilities must maintain detailed records of:

- Receipt and inventory of temozolomide

- Staff training and competency assessments

- Compounding and dispensing logs

- Spill incidents and corrective actions

- Waste disposal documentation

Regular internal audits and external inspections should be conducted to ensure ongoing compliance with regulatory standards.

Emergency Procedures

In the event of exposure (skin contact, inhalation, ingestion), immediate action must be taken per institutional policies:

- Skin exposure: Wash with soap and water.

- Eye exposure: Flush with water for at least 15 minutes.

- Inhalation: Move to fresh air.

- Ingestion: Seek medical attention immediately.

All incidents must be reported and investigated to prevent recurrence.

Conclusion

Safe and compliant management of temozolomide requires a multidisciplinary approach involving pharmacists, oncologists, nurses, logistics personnel, and environmental health and safety officers. Adherence to regulatory standards, proper training, and vigilant monitoring are essential to protect patient safety, healthcare workers, and the environment.

Temozolomide is a potent prescription chemotherapy medication primarily used in the treatment of certain brain tumors, such as glioblastoma multiforme and anaplastic astrocytoma. Due to its critical therapeutic role and potential side effects, it must be sourced exclusively through legitimate, regulated channels under the supervision of a licensed healthcare provider.

In conclusion, when sourcing temozolomide, patients and healthcare providers must ensure:

- Prescription Requirement: Temozolomide should only be obtained with a valid prescription from an authorized medical professional.

- Licensed Pharmacies: It should be dispensed through accredited and licensed pharmacies—either local or verified online outlets—to ensure authenticity and safety.

- Regulatory Compliance: All sourcing must comply with national and international pharmaceutical regulations (e.g., FDA, EMA) to avoid counterfeit or substandard products.

- Patient Assistance Programs: For patients facing financial challenges, manufacturers and nonprofit organizations may offer patient support programs to improve access.

- Avoid Unregulated Sources: Sourcing from unverified websites or informal markets poses serious health risks due to potential counterfeit or contaminated products.

Ultimately, the safe and effective use of temozolomide depends on responsible sourcing through legal, medical, and ethical pathways. Always consult with a healthcare provider to ensure proper treatment and access to this essential medication.