The global tea market is witnessing robust expansion, driven by rising consumer preference for convenience, premiumization, and health-conscious beverage choices. According to Grand View Research, the global tea market size was valued at USD 65.5 billion in 2022 and is projected to grow at a compound annual growth rate (CAGR) of 6.9% from 2023 to 2030. This surge in demand is catalyzing innovation in tea processing and packaging technologies, particularly in tea molding—a critical step in producing uniform, high-quality tea tablets, pyramid pouches, and compressed forms. As brands seek efficient, scalable, and hygienic manufacturing solutions, the need for advanced tea molding machinery has intensified. In this evolving landscape, a select group of manufacturers has emerged as leaders, combining engineering precision, automation, and compliance with international food safety standards to meet the expectations of modern tea producers worldwide. The following list highlights the top 9 tea molding manufacturers shaping this dynamic industry.

Top 9 Tea Molding Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Toyo Seikan Group Holdings, Ltd.

Domain Est. 2012

Website: tskg-hd.com

Key Highlights: Toyo Seikan Group Holdings has grown to a world-class comprehensive packaging manufacturer through delivering a wide range of packaging containers that ……

#2 YIZUMI

Domain Est. 2012

Website: yizumi.com

Key Highlights: As a leading injection molding equipment manufacturer, YIZUMI provides complete turnkey solutions for injection molding, rubber injection, die casting, ……

#3 Sidel

Domain Est. 1996

Website: sidel.com

Key Highlights: A solution for every need. From packaging and blowing to filling, labelling and packing, through palletising, we have solutions designed to meet any need….

#4 Consumer Food and Beverage Molding

Domain Est. 1999

Website: global-plastics.com

Key Highlights: At Global Plastics, we offer an all-inclusive solution to meet consumer food and beverage plastic packaging injection molding needs….

#5 Tea Light Silicone Molds

Domain Est. 2004

#6 Bubble Tea Cup mold

Domain Est. 2007

Website: highwingmold.com

Key Highlights: Rating 4.0 (92) Bubble Tea Cup mold. We make custom food packaging for any size, shape, color, and other requirement. We offer food packaging mold + final production ……

#7 Tea cup resin mold

Domain Est. 2015

#8 Boba Tea Resin Mold

Domain Est. 2017

#9 Boba Tea Resin Mold

Website: vot.ug

Key Highlights: In stock Rating 4.5 (74) 6 days ago · Boba Tea Silicone Mold – Maker is Moon Noodle Shop – Backed Shaker – For resin crafts – NOT food safe – Used a few times…

Expert Sourcing Insights for Tea Molding

H2: 2026 Market Trends for Tea Molding

The tea molding industry—a niche but growing segment within the broader tea and beverage market—is poised for significant transformation by 2026. Driven by consumer demand for convenience, sustainability, and innovation, tea molding refers to the process of shaping loose-leaf or powdered tea into compressed forms such as tablets, spheres, bricks, or custom 3D designs. These molded teas serve both functional and aesthetic purposes, enhancing brewing efficiency, portability, and visual appeal. Below are the key market trends projected for 2026:

-

Rise of Functional and Infused Tea Molds

By 2026, tea molding will increasingly integrate functional ingredients such as adaptogens, probiotics, vitamins, and CBD. Consumers are gravitating toward health-enhancing beverages, and molded tea formats offer a precise, consistent dosing method. Brands will leverage this trend by introducing targeted wellness formulations—such as “calm,” “energy-boost,” or “immune support” tea tablets—that appeal to the growing nutraceutical tea market. -

Sustainability-Driven Packaging and Materials

With environmental concerns at the forefront, tea molding techniques are expected to shift toward biodegradable and compostable binding agents. Innovations in natural adhesives derived from plant cellulose or pectin will allow for cohesive molding without synthetic additives. Additionally, molded tea products reduce the need for individual tea bags or sachets, minimizing plastic and paper waste—an attractive value proposition for eco-conscious consumers. -

Customization and Personalization

Advancements in small-batch manufacturing and 3D food printing will enable personalized tea molding. By 2026, direct-to-consumer platforms may offer customizable tea tablets where users select flavor profiles, caffeine levels, and herbal blends, which are then molded into unique shapes or branded designs. This trend will gain traction in premium and gifting segments, especially in markets like China, Japan, and Western specialty tea retailers. -

Expansion in Ready-to-Drink (RTD) and On-the-Go Formats

Tea molds are becoming ideal for single-serve, portable consumption. Soluble tea tablets or fast-dissolving molded spheres will dominate convenience channels, appealing to urban professionals and travelers. These formats dissolve instantly in hot or cold water, aligning with the global RTD tea market growth. Major beverage companies are expected to invest in molded tea innovations to compete with instant coffee and powdered drink alternatives. -

Cultural and Aesthetic Revival

Traditional tea molding practices—such as Chinese pu-erh tea cakes or Japanese matcha tablets—are being reimagined with modern design and branding. By 2026, artisanal tea brands will capitalize on the aesthetic and ceremonial value of molded teas, marketing them as collectible or experiential products. Limited-edition releases and artist collaborations could further elevate tea molds as cultural artifacts. -

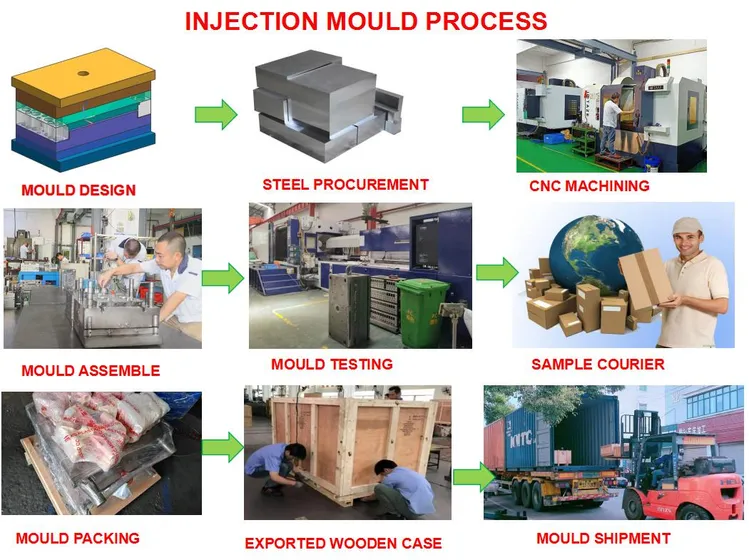

Technological Advancements in Molding Equipment

Automation and precision engineering will lower production costs and improve scalability. High-pressure, low-temperature molding systems will preserve delicate tea compounds and volatile aromas, maintaining quality. AI-driven quality control and IoT-enabled production lines will ensure consistency in shape, density, and dissolution time—critical for both mass-market and premium segments. -

Geographic Market Expansion

While Asia remains the core market for tea molding, North America and Europe are expected to see accelerated adoption by 2026. This growth will be fueled by rising interest in specialty teas, plant-based lifestyles, and clean-label products. Emerging markets in Southeast Asia and Latin America will also explore localized molded tea variants using indigenous herbs and flavors.

Conclusion:

By 2026, tea molding will evolve from a traditional preservation method into a dynamic, innovation-driven sector. Success will depend on balancing heritage with technology, sustainability with scalability, and functionality with sensory experience. Companies that invest in R&D, consumer education, and eco-friendly production will lead the next wave of tea consumption—shaping the future, one molded tea at a time.

Common Pitfalls Sourcing Tea Molding (Quality, IP)

Sourcing tea molding—whether referring to molded tea products (like compressed tea cakes) or components used in tea packaging and processing equipment—presents several challenges, particularly in the areas of quality consistency and intellectual property (IP) protection. Overlooking these aspects can lead to supply chain disruptions, legal risks, and reputational damage. Below are key pitfalls to avoid.

Quality Inconsistencies in Raw Materials and Production

One of the most frequent issues in sourcing tea molding is variability in the quality of raw tea leaves or molding materials. Factors such as climate, harvest time, processing methods, and storage conditions significantly affect the final product. Suppliers may use inconsistent grading standards or blend lower-grade teas without disclosure, leading to off-flavors, poor aroma, or substandard appearance in molded tea products like pu-erh cakes. Additionally, improper compression techniques can cause crumbling or uneven aging, diminishing product integrity.

Lack of Standardized Manufacturing Processes

Tea molding often involves artisanal or semi-automated processes that vary widely between suppliers. Without clear specifications and process controls, buyers risk receiving products with inconsistent density, shape, or moisture content. These inconsistencies not only affect shelf life and consumer experience but can also complicate packaging and distribution. Failing to audit supplier facilities or require adherence to international food safety standards (e.g., HACCP, ISO 22000) increases the risk of contamination or non-compliance.

Intellectual Property Infringement Risks

When sourcing molded tea products or related equipment, IP concerns arise particularly with branded designs, proprietary molds, or patented production techniques. Using molds that replicate protected designs—such as those associated with famous tea brands or regional trademarks (e.g., “Dian Hong” or “Longjing”)—can lead to trademark or design patent violations. Furthermore, if a supplier reverse-engineers a proprietary molding machine or process, sourcing from them could inadvertently involve the buyer in IP infringement, exposing the company to legal action, especially in export markets with strong IP enforcement.

Inadequate Supplier Verification and Transparency

Many tea molding suppliers, especially in regions with fragmented supply chains, lack traceability systems. This opacity makes it difficult to verify the origin of tea leaves, authenticity of organic certifications, or ethical labor practices. Buyers may unknowingly source from suppliers engaging in false labeling or unsustainable harvesting. Without proper due diligence, including on-site audits and third-party lab testing, companies risk reputational harm and regulatory penalties.

Failure to Secure IP Rights in Custom Tooling

When commissioning custom molds or machinery for tea molding, buyers often neglect to formalize IP ownership in contracts. Suppliers may retain rights to the mold design, allowing them to reproduce and sell identical tools to competitors. This undermines product differentiation and can lead to market dilution. Always ensure that contracts explicitly transfer IP rights for custom tooling to the buyer and include non-disclosure and non-compete clauses.

Overlooking Regulatory and Export Compliance

Molded tea products must meet food safety and labeling requirements in target markets (e.g., FDA in the U.S., EFSA in the EU). Sourcing from suppliers unfamiliar with these standards can result in rejected shipments or recalls. Additionally, packaging materials used in tea molding must comply with food-contact regulations; non-compliant dyes or adhesives can leach harmful substances. IP-related compliance, such as avoiding counterfeit packaging or unlicensed use of certification marks (e.g., Fair Trade, Organic), is equally critical.

Conclusion

Successfully sourcing tea molding requires more than competitive pricing—it demands rigorous quality control, transparent supplier relationships, and proactive IP management. Conduct thorough due diligence, insist on clear contractual terms for IP ownership, and prioritize suppliers with verifiable certifications and consistent production standards to mitigate these common pitfalls.

Logistics & Compliance Guide for Tea Molding

This guide outlines the essential logistics and compliance considerations for the manufacturing, handling, transportation, and distribution of tea molding products—such as tea bricks, compressed tea cakes, or molded tea shapes used in traditional and specialty tea markets.

Regulatory Compliance

Ensure adherence to all applicable food safety and labeling regulations in both the country of origin and destination markets. Key regulatory bodies include the U.S. Food and Drug Administration (FDA), European Food Safety Authority (EFSA), and relevant national agencies. All tea molding operations must comply with Good Manufacturing Practices (GMP) and Hazard Analysis and Critical Control Points (HACCP) standards. Registration with local food safety authorities and periodic audits are required.

Product Labeling Requirements

Labels must include the product name, ingredient list (including any additives or flavorings), net weight, country of origin, manufacturer information, batch number, and expiration or best-before date. In many jurisdictions, allergen declarations and nutrition facts are mandatory. For export, ensure labels meet the language and formatting requirements of the target market—for example, bilingual labeling in Canada or EU-compliant nutrition declarations.

Packaging Standards

Use food-grade, non-toxic, and moisture-resistant materials to maintain product integrity and prevent contamination. Packaging should protect against physical damage, light exposure, and humidity, which can affect the quality of molded tea. Vacuum sealing or nitrogen flushing may be used to extend shelf life. All packaging materials must comply with food contact regulations such as FDA 21 CFR or EU Regulation (EC) No 1935/2004.

Storage Conditions

Store molded tea in a cool, dry, and odor-free environment with controlled temperature (15–25°C recommended) and relative humidity below 65%. Avoid direct sunlight and strong-smelling substances to prevent flavor absorption. Use palletized storage with adequate airflow and implement first-expired, first-out (FEFO) inventory management to minimize spoilage.

Transportation & Distribution

Use clean, sanitized, and temperature-controlled vehicles for transport, especially in extreme climates. Protect loads from moisture, contamination, and physical damage during transit. For international shipments, comply with International Plant Protection Convention (IPPC) standards for wooden packaging and secure phytosanitary certificates when required. Maintain a cold chain if specified for specialty tea products.

Import & Export Documentation

Prepare all necessary documentation including commercial invoice, packing list, bill of lading/airway bill, certificate of origin, and phytosanitary certificate. For shipments to the U.S., submit Prior Notice to the FDA. EU imports may require a Health Certificate for certain tea categories. Verify tariff classifications (HS Code 0902 for tea) and ensure compliance with import restrictions or quotas.

Sustainability & Ethical Sourcing

Source tea leaves from certified sustainable farms (e.g., Rainforest Alliance, Fair Trade, or Organic certifications). Document supply chain transparency to meet consumer and regulatory demands. Minimize packaging waste and adopt recyclable or biodegradable materials where possible. Comply with due diligence requirements under regulations like the EU Deforestation Regulation (EUDR).

Quality Control & Traceability

Implement a traceability system to track tea batches from raw material sourcing through molding, packaging, and distribution. Conduct regular quality checks for moisture content, microbial contamination, pesticide residues, and foreign material. Maintain records for at least two years to support recalls or regulatory inquiries.

Recall Preparedness

Develop a product recall plan that includes procedures for identifying affected batches, notifying authorities, and communicating with distributors and consumers. Register with relevant recall coordination systems such as the FDA’s Reportable Food Registry. Conduct annual mock recalls to ensure readiness.

In conclusion, sourcing tea molds requires careful consideration of material quality, design functionality, supplier reliability, and compliance with food safety standards. Whether opting for silicone, wood, metal, or ceramic molds, the choice should align with the intended tea type, production scale, and desired aesthetic. Establishing strong relationships with reputable suppliers, conducting thorough quality inspections, and staying informed about market trends can significantly enhance sourcing efficiency and product consistency. Ultimately, a well-strategized sourcing approach ensures not only cost-effectiveness but also supports the creation of high-quality, visually appealing tea products that meet consumer expectations and strengthen brand reputation in the competitive tea industry.