Introduction: Navigating the Global Market for Tea Cup Manufacturing Machine

The worldwide demand for single-use beverage packaging shows no sign of slowing, and tea cup manufacturing machine buyers in the USA and Europe are under pressure to secure equipment that delivers speed, hygiene, and regulatory compliance—while keeping total cost of ownership low.

The Problem

- Price volatility: Alibaba and Made-in-China list machines from USD 3,000 to USD 33,000, yet freight, import duties, and after-sales support can double actual landed cost.

- Regulatory gaps: EU PP & PLA coating limits and FDA food-contact rules differ from Asian standards, risking product recalls.

- Service desert: Many suppliers offer only a basic manual; maintenance windows, spare-parts lead time, and technical training are rarely addressed up-front.

What This Guide Delivers

- Supplier audit framework—how to vet a 15-year factory rating vs. real production capacity.

- Cost model spreadsheet—landed cost calculator that factors freight, VAT, and EU CE certification.

- Compliance checklist—FDA, EU 10/2011, and BPI compostable standards side-by-side.

- Procurement roadmap—from RFQ template to installation and operator training in 90 days.

Use the next sections to shorten your vendor vetting cycle, benchmark specifications, and lock in a tea cup manufacturing machine supplier that protects margin and reputation.

Article Navigation

- Top 10 Tea Cup Manufacturing Machine Manufacturers & Suppliers List

- Introduction: Navigating the Global Market for tea cup manufacturing machine

- Understanding tea cup manufacturing machine Types and Variations

- Key Industrial Applications of tea cup manufacturing machine

- 3 Common User Pain Points for ‘tea cup manufacturing machine’ & Their Solutions

- Strategic Material Selection Guide for tea cup manufacturing machine

- In-depth Look: Manufacturing Processes and Quality Assurance for tea cup manufacturing machine

- Practical Sourcing Guide: A Step-by-Step Checklist for ‘tea cup manufacturing machine’

- Comprehensive Cost and Pricing Analysis for tea cup manufacturing machine Sourcing

- Alternatives Analysis: Comparing tea cup manufacturing machine With Other Solutions

- Essential Technical Properties and Trade Terminology for tea cup manufacturing machine

- Navigating Market Dynamics and Sourcing Trends in the tea cup manufacturing machine Sector

- Frequently Asked Questions (FAQs) for B2B Buyers of tea cup manufacturing machine

- Strategic Sourcing Conclusion and Outlook for tea cup manufacturing machine

- Important Disclaimer & Terms of Use

Top 10 Tea Cup Manufacturing Machine Manufacturers & Suppliers List

1. Wafer Edible Tea & Coffee Cups Machine Supplier – GELGOOG

Domain: gelgoog.com

Registered: 2012 (13 years)

Introduction: GELGOOG machinery, as a supplier of edible tea & coffee cups machine, with ten years of R&D technology and export experience, can offer this machine with ……

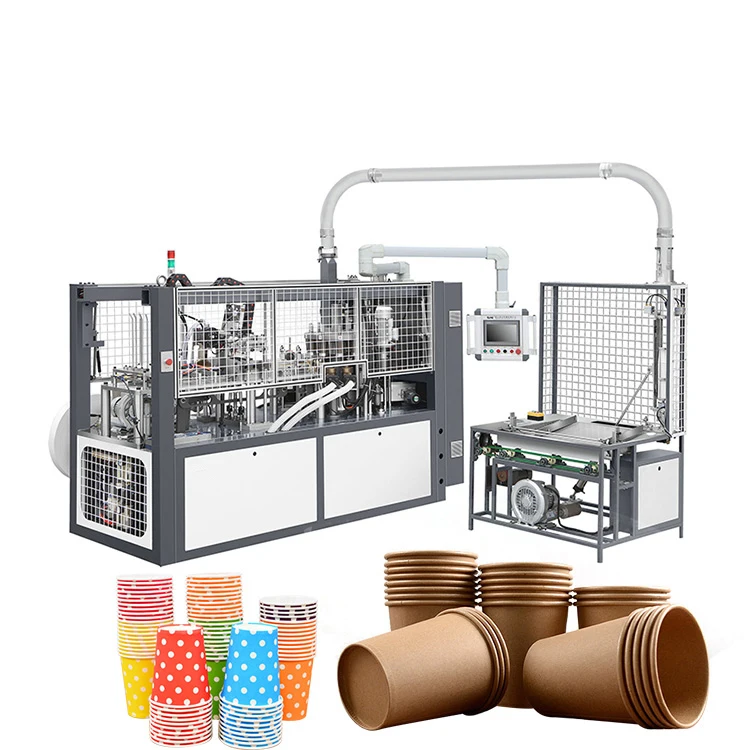

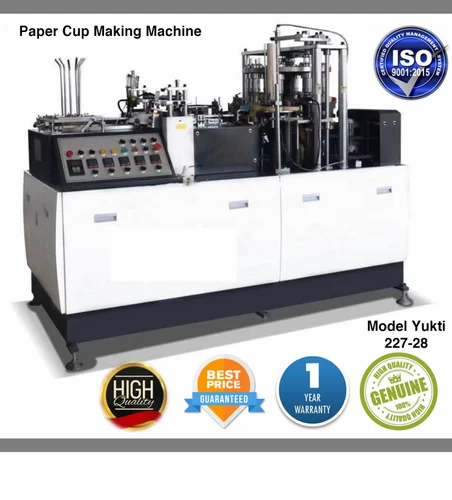

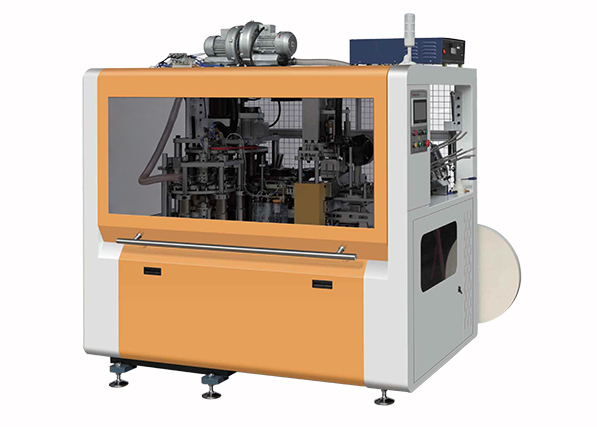

Illustrative Image (Source: Google Search)

2. Automatic Paper Cup Machine Manufacturer – Open Cam Direct …

Domain: skylyf.com

Registered: 2019 (6 years)

Introduction: SKYLYF offers high speed paper. Tea Cup Making Machine. All models are equipped with OPEN CAM, DIRECT BOTTOM AND AUTO OILING SYSTEM. the most advanced and high ……

3. KSJ-160 Paper Tea Cup Making Machine

Domain: chinesepapercupmachine.com

Registered: 2020 (5 years)

Introduction: The KSJ-160 Paper Tea Cup Making Machine is designed for superior performance, delivering efficiency, durability, and precision in every cup….

4. China Edible Tea Cups Making Machine Manufacturers and Factory …

Domain: jxhqmachine.com

Registered: 2021 (4 years)

Introduction: Edible Tea Cups Making Machine Manufacturers, Factory, Suppliers From China, We welcome customers, business associations and friends from all parts of the ……

5. Edible Tea Cup Making Machine – Abcot Machinery

Domain: abcotmachinery.com

Registered: 2023 (2 years)

Introduction: Edible Tea Cup Making Machine · Capacity: 300-350 Piece Per Hour · Type of Machine: Tea Cup Making Machine · Machine Material: Mild Steel · Automation Grade: Semi ……

Illustrative Image (Source: Google Search)

6. China stainless steel tea cup making machine Manufacturers …

Domain: daspapercup.com

Registered: 2023 (2 years)

Introduction: DAS is one of the most professional tea cup making machine manufacturers and suppliers in China. Please feel free to wholesale custom made tea cup making ……

7. ODM Edible Tea Cup Making Machine Manufacturers and … – Xinhua

Domain: xinhua-machinery.com

Registered: 2023 (2 years)

Introduction: Introducing the groundbreaking Edible Tea Cup Making Machine, proudly manufactured by Shantou Xinhua Packing Machinery Co., Ltd. As a leading China-based ……

8. Manufacturer of Paper Cup Making Machine & Fully Automatic …

Domain: swastikpapermachine.in

Registered: 2014 (11 years)

Introduction: Products We Deal In ; Disposable Paper Cup Making Machine · Rs 6,00,000 / Piece. Production Capacity: Upto 1000 plate/hr ; 3 KW Paper Cup Machine · Rs 6,25,000 / ……

9. Paper Cup and Glass Making Machine and Paper Cup Making …

Domain: jainpapercupmachine.com

Registered: 2014 (11 years)

Introduction: We are Manufacturer, Wholesaler, Exporter and importer of Paper Cup Making Machine. Known for their high performance, enhanced longer life and energy efficient ……

Illustrative Image (Source: Google Search)

Understanding tea cup manufacturing machine Types and Variations

Understanding Tea Cup Manufacturing Machine Types and Variations

The global tea cup market’s shift toward sustainability and on-demand production is driving OEMs in the USA and Europe to evaluate new machinery platforms. Below are the five most commercially relevant types of tea-cup manufacturing machines, each with distinct mechanical footprints, throughput profiles, and regulatory compliance considerations.

| Type | Core Features | Typical Applications | Pros / Cons |

|---|---|---|---|

| Single-serve paper cup press (manual or semi-auto) | Manual cup-forming die, foot pedal or simple pneumatic press, 1–3 kN ram force, 8–15 cups/min. Requires separate PE/PLA lining unit. | Artisanal tea rooms, specialty cafés, pop-up tasting events. | Very low CAPEX (< US$5 k), small footprint, but high labor cost and limited volume. |

| High-speed rotary paper cup press (full-auto) | 6–12-station rotary carousel, servo-driven indexing, integrated side-seam welding, bottom attaching, automatic oiling. Output: 80–150 cups/min (1.5–5 oz). | B2B tea suppliers, contract packers, grocery-private-label lines. | High uptime (>95 %), minimal change-over waste, but requires 415 V three-phase power and dust extraction. |

| Double-wall paper cup press (integrated) | Two-layer paper web feeding, gluing station, simultaneous single/double wall forming, 6–10 stations, output 60–120 cups/min. Optional color-printed paper for premium branding. | Premium tea brands, food-service distributors, ESG-focused retailers. | Enables brand differentiation and insulation; higher paper cost and more complex tooling change-overs. |

| PLA-lined paper cup press (eco-focused) | Compatible with polylactic acid (PLA) coated paper, cold-jaw sealing, nitrogen-flush option for extended shelf life. Output 70–130 cups/min. | Organic tea brands, EU-compliant producers, airport concession stands. | Meets EN 13432 compostability, but PLA material cost +15–20 % and demands strict humidity control. |

| Roll-fed paper cup press (flexible format) | Converts parent rolls to finished cups without pre-cut blanks; change-over ≤5 min via cam-less servo. Output 100–200 cups/min (2–12 oz range). | High-volume blending houses, tea bag factories with attached cup lines, packaging co-packers. | Lowest conversion cost per unit, but requires upstream printing and slitting infrastructure. |

1. Single-serve paper cup press (manual/semi-auto)

Mechanical overview

A manual or pneumatically assisted press with interchangeable forming dies creates one cup at a time. Operators feed a precut paper blank, lower the ram, and eject the finished cup. The unit is often paired with a tabletop PE or PLA lining machine to finish the rim and base seal.

Applications

– Specialty tea boutiques that produce <1,000 cups/day.

– Tea blending companies running pilot batches for retailers.

– Event-based tea sampling where portability is critical.

Pros / Cons

– Pros: Minimal capital outlay; ideal for short runs; easy operator training.

– Cons: High labor cost; inconsistent rim height; limited compatibility with automated downstream packaging.

Illustrative Image (Source: Google Search)

2. High-speed rotary paper cup press (full-auto)

Mechanical overview

A 6- to 12-station rotary press indexes cups through stations for body forming, bottom attaching, rim curling, and quality inspection. Servo-driven cams ensure synchronized motion, while an integrated lubrication system reduces wear. Output ranges from 80 to 150 cups/min for 2–5 oz formats.

Applications

– Large tea suppliers fulfilling grocery or subscription-box volume.

– Co-packers managing multiple SKU runs (green, black, herbal).

– Facilities targeting BRC-grade hygiene standards.

Pros / Cons

– Pros: Continuous uptime, low per-unit cost, full servo control for recipe changes.

– Cons: Requires 415 V supply and compressed air; change-over时间较长 (15–30 min); high initial investment (US$45–120 k).

3. Double-wall paper cup press (integrated)

Mechanical overview

A dual-web feeding system forms an inner and outer cup in one cycle, with an interleaving glue dot for insulation. The machine applies a rolled rim and bottom seal, then transfers the double-wall cup to a collection conveyor. Optional internal printing allows brand messaging on the inner wall.

Applications

– Premium tea estates selling gift sets.

– Ready-to-drink tea producers requiring heat retention.

– Quick-service restaurants aiming to reduce external sleeve usage.

Pros / Cons

– Pros: Enhanced thermal performance; built-in branding; reduced secondary packaging.

– Cons: Higher paper consumption; more complex glue application; longer change-over due to dual-web tension control.

4. PLA-lined paper cup press (eco-focused)

Mechanical overview

Uses PLA-coated paper fed from thermal-shrunk master rolls. Cold-jaw sealing wheels bond PLA to the paper without additional adhesive. A nitrogen-flush chamber extends shelf life by suppressing oxidation. Output is 70–130 cups/min; line speed adjusts via servo VFD.

Applications

– Organic tea brands targeting EU and California-compliant packaging.

– Airport and railway concession stands needing compostable solutions.

– Co-packers under contract to major grocery chains with ESG mandates.

Illustrative Image (Source: Google Search)

Pros / Cons

– Pros: Meets EN 13432 and ASTM D6400; no polystyrene; premium shelf appeal.

– Cons: PLA cost volatility; requires nitrogen supply; lower heat resistance vs PE.

5. Roll-fed paper cup press (flexible format)

Mechanical overview

Converts 600 mm master rolls directly into finished cups via rotary die-cut and forming stations. Servo-driven flycutters allow format changes in <5 min. Integrated waste trim rewinder recovers up to 98 % of paper. Output: 100–200 cups/min for 2–12 oz range.

Applications

– High-volume tea blenders supplying private-label retailers.

– Co-packers running mixed SKU schedules (green, black, rooibos).

– Facilities with existing flexo or rotogravure printing lines.

Pros / Cons

– Pros: Lowest conversion cost; minimal stored inventory; rapid format changes.

– Cons: Requires upstream printing and slitting; higher complexity in web tension control; not suited to very small batch sizes.

Illustrative Image (Source: Google Search)

Selection checklist for USA & European OEMs

- Regulatory alignment: Verify USDA BioPreferred or EU EN 13432 compliance for PLA-lined lines.

- Power infrastructure: Full-auto rotary presses typically require 415 V three-phase; confirm facility capacity.

- Change-over economics: Target ≤15 min format change for high-speed lines to maintain <10 % downtime.

- Packaging integration: Ensure cup OD/ID tolerances match downstream thermoforming or flow-wrap machines.

- Local service: Prioritize suppliers with US/EU parts depots and 24 h technical hotline to minimize line stoppages.

By matching machine type to volume, branding, and compliance requirements, tea cup OEMs can optimize both CAPEX and OPEX while future-proofing for stricter circular-economy legislation.

Key Industrial Applications of tea cup manufacturing machine

Key Industrial Applications of Tea Cup Manufacturing Machine

| Industry | Application | Key Benefits |

|---|---|---|

| Food Service Equipment | High-volume disposable tea & coffee cups for cafés, quick-service restaurants, and office pantries. | Fully automated cycle reduces labor by up to 70 %; changeover between 4–16 oz sizes in <2 min; PE/PLA or double-wall options extend heat retention and leak resistance. |

| Hotel & Hospitality | Branded single-use tea cups for room-service, conference breaks, and executive lounges. | On-site production eliminates minimum order quantities and shipping delays; custom logo embossing module adds brand visibility without external printing costs. |

| Confectionery & Bakery | Upsell tea or chocolate-covered strawberry pairings in disposable paper cups. | Compact footprint (≤2 m²) fits into existing prep kitchens; variable cup size allows cross-utilization for seasonal drinks or cold boba tea. |

| Healthcare & Senior Living | Sterile, single-patient tea cups to reduce cross-contamination risks. | Optional UV-C sterilization module and food-grade stainless-steel contact parts meet FDA/HACCP guidelines; closed-loop material feeding prevents dust contamination. |

| Catering & Event Management | Eco-friendly tea service for weddings, galas, and corporate events. | High-speed model (35–45 cups/min) covers large banquets; quick-release mold system enables last-minute color or size changes without tool changeover downtime. |

| Institutional Foodservice | Universities, hospitals, and military bases requiring bulk tea distribution. | Integrated cup stacking and shrink-wrap station outputs ready-to-sell packs; Ethernet connectivity enables real-time production data for inventory and waste tracking. |

| Sustainable Packaging & Compostable Brands | 100 % PLA-coated or molded-pulp tea cups for zero-waste initiatives. | PLA-compatible forming heads and cold-glue systems avoid thermal damage to biopolymers; downstream module prints certified compostable logos, increasing shelf appeal to eco-conscious buyers. |

3 Common User Pain Points for ‘tea cup manufacturing machine’ & Their Solutions

3 Common User Pain Points for Tea Cup Manufacturing Machine & Their Solutions

Pain Point 1: Inconsistent Cup Quality & Material Waste

Scenario

A mid-size European converter is producing 1,200 cups/hour on a new high-speed machine, but 8 % are rejected in final QC for rim height, seam lift, or PLA coating defects. Monthly scrap exceeds 96 000 cups, translating into €2,400 in raw material loss and delayed orders to premium coffee brands.

Problem Root Causes

– Inaccurate heat sealing pressure/temperature across the Linear Flight Banker

– Web tension drift on PE/PLA laminated paper

– Lack of real-time thickness monitoring for PLA-coated paper

Solutions

1. Upgrade to Closed-Loop Control System

– Specify machines with servo-driven sealing jaws and PID temperature feedback (e.g., ZWT-35 series).

– Validate with ISO 2162 rim-strength test reports supplied by OEM.

Illustrative Image (Source: Google Search)

- Integrate在线厚度传感器

- Install capacitive sensors that trigger automatic web tension correction within 0.2 s.

-

Reduces defect rate from 8 % to <1.5 %, saving ~€1 900/month.

-

Adopt Predictive Maintenance

- Use vibration sensors on main motor bearings; set alerts at 5 mm/s RMS to prevent unplanned downtime.

- Schedule bearing replacement every 8 000 h instead of reactive replacement every 3 000 h.

Pain Point 2: Regulatory Compliance & Certification Gaps

Scenario

A U.S. startup must export 50 000 compostable tea cups to Germany. The CE-marking documentation package is incomplete, delaying customs clearance and incurring €4 500 in demurrage fees.

Problem Root Causes

– Missing NSF/ANSI 61 food-contact approval for PLA coating

– Absence of EU Declaration of Conformity for disposable food-service ware

– No traceability records for wood-pulp fiber origin (FSC®)

Illustrative Image (Source: Google Search)

Solutions

1. Choose EU-Certified OEM Partners

– Prioritize suppliers offering TÜV-certified CE technical file and NSF 61 test reports.

– Require machine specs that run PLA-coated paper with <3 % extractables (Acetic acid, 10 %, 120 h).

- Automate Compliance Documentation

- Request onboard MES that auto-generates certificates of analysis for every batch of paper roll.

-

Integrate FSC® chain-of-custody barcode scanning to guarantee traceability.

-

Conduct Pre-Shipment Audit

- Use third-party inspection (SGS/BV) to verify cup migration testing and oxygen transmission rate (OTR ≤ 150 cm³/m²/day).

- Avoid €4 500 demurrage by releasing goods within 24 h of arrival.

Pain Point 3: High Energy Consumption & Operating Cost

Scenario

A U.S. roaster with 24/7 production runs 3 machines at 28 kWh each, adding $1 200/month to electricity bills and breaching carbon-neutral pledges to key café chains.

Illustrative Image (Source: Google Search)

Problem Root Causes

– Constant 380 V three-phase motors running at full load

– Inefficient pneumatic systems (6 bar overshoot)

– No regenerative braking on forming stations

Solutions

1. Specify Servo-Driven & Low-Pressure Systems

– Opt for machines with 1.5 kW servo motors instead of 3 kW induction motors.

– Pneumatic circuit set to 5 bar with variable-speed compressors; lowers energy draw by 22 %.

- Implement Energy Recovery Modules

- Choose machines with regenerative braking on forming stations that feed up to 15 % of deceleration energy back into the grid.

-

ROI <18 months based on 8 760 h/year operation.

-

Adopt Smart Energy Monitoring

- Equip each machine with IoT energy meters (Modbus TCP) feeding cloud dashboard.

- Set alerts when kWh/1 000 cups >65 kWh; target <55 kWh after optimization.

Strategic Material Selection Guide for tea cup manufacturing machine

Strategic Material Selection Guide for Tea Cup Manufacturing Machine

This guide provides procurement managers and production engineers with a data-driven framework for selecting raw materials that optimize machine throughput, product quality, and total cost of ownership for tea cup production lines in North America and the EU markets.

1. Material Categories & Performance Matrix

| Material Class | Typical Substrates | Key Mechanical Properties | Thermal Resistance | Barrier Properties | Sustainability Profile | Typical Price Range (USD/m²) |

|---|---|---|---|---|---|---|

| Virgin Wood Pulp | Single-ply / Double-ply tissue | 180–220 gsm tensile strength | Moderate (≤100 °C) | Poor – requires PE/PLA coating | FSC-certified grades available | $0.85–1.15 |

| Recycled Fiber | 30–70 % post-consumer waste | Lower tensile index | Same as virgin | Poor | 30–50 % lower CO₂ footprint | $0.65–0.90 |

| PE-Coated Paper | LDPE 20–30 µm | Excellent seal strength | 120–130 °C | Excellent moisture barrier | Not recyclable in EU film streams | $1.05–1.35 |

| PLA-Coated Paper | Polylactic acid 25 µm | Compostable barrier | 85–95 °C | Excellent moisture barrier | ASTM D6400 / EN 13432 certified | $1.25–1.55 |

| Sugarcane Bagasse Board | 250–400 gsm pressed fiber | High rigidity & crush resistance | 120 °C short term | Good oil barrier | 100 % field-grown, food-grade | $1.10–1.40 |

| Bio-composite (bagasse + PLA) | Sandwich structure | High rigidity + compostable | 100 °C | Excellent | TÜV OK compost HOME | $1.40–1.70 |

2. Machine-Specific Material Constraints

2.1 Forming & Heat Sealing

- Paper cup machines with ultrasonic or heated knife sealing require PE or PLA coatings ≥ 20 µm to maintain seal integrity.

- Virgin wood-pulp paper > 220 gsm can overload the servo-driven forming stations; keep single-layer weight ≤ 180 gsm.

2.2 Die-Cutting & Stacking

- Sugarcane bagasse board tolerates higher edge pressure (compressive strength ≥ 4.5 kN/m²) enabling faster die-cut speeds (up to 120 cuts/min).

- Recycled fiber sheets may delaminate above 110 cuts/min; specify long-fiber content > 60 % to maintain stack quality.

2.3 Coating Adhesion

- PLA requires pre-treatment (corona or flame) to achieve ≥ 38 dyn/cm surface energy for ink & adhesive bonding.

- PE-coated stock needs extrusion uniformity; uneven coat weight (> ±3 %) causes web breaks on high-speed lines.

3. Regulatory & Market Considerations

| Region | Key Restrictions | Recommended Materials | Certification Needed |

|---|---|---|---|

| EU | EN 13432 compostability,REACH heavy metals | PLA-coated paper, bagasse + PLA | TÜV OK compost, BPI (US export) |

| USA | FDA 21 CFR §176, Proposition 65 | PE-coated paper, virgin pulp | FDA migration limits, FSC |

4. Cost-to-Performance Trade-off Model

- Baseline Model – Virgin pulp + LDPE coating

- TCO: $0.95/m²

- Machine speed: 90–110 cups/min (ZWT-35 class)

-

End-of-life: Landfill only

-

Mid-Tier Model – Recycled pulp + PE coating

- TCO: $0.80/m²

- Machine speed: 75–95 cups/min

-

End-of-life: Recyclable where pulp mills exist

-

Premium Model – 100 % bagasse + PLA coating

- TCO: $1.55/m²

- Machine speed: 60–80 cups/min (limited by stiffness)

- End-of-life: Industrial composting within 90 days

5. Procurement Checklist

- [ ] Verify PE/PLA coat weight uniformity via gravimetric test (ASTM D646).

- [ ] Request tensile & burst data at 23 °C / 50 % RH per TAPPI T 414 & T 403.

- [ ] Confirm anti-static treatment if automatic feeding is > 2 m from forming station.

- [ ] Validate thermal seal strength > 1.5 N/mm at sealing jaw temperature 110–125 °C.

- [ ] Ensure raw material reels fit machine unwind shaft diameter (standard 76 mm or 152 mm).

Comparison Table – Final Selection

| Attribute | Virgin Pulp | Recycled Fiber | PE-Coated | PLA-Coated | Bagasse + PLA |

|---|---|---|---|---|---|

| Machine Speed (cups/min) | 90–110 | 75–95 | 90–110 | 60–80 | 60–80 |

| Seal Strength (N/mm) | 0.8 | 0.9 | 1.6 | 1.4 | 1.5 |

| Moisture Barrier | Poor | Poor | Excellent | Excellent | Excellent |

| Compostability | No | No | No | Yes | Yes |

| EU Recycling Stream | Paper | Paper | Mixed plastic | Compost | Compost |

| Typical TCO (USD/m²) | 0.95 | 0.80 | 1.20 | 1.40 | 1.55 |

Bottom Line: For high-volume North American markets prioritize PE-coated virgin or recycled stock for speed and cost. For EU compliance and premium positioning, specify PLA or bagasse + PLA substrates, validate compostability certifications, and accept a 15–25 % speed reduction on standard cup machines.

In-depth Look: Manufacturing Processes and Quality Assurance for tea cup manufacturing machine

In-depth Look: Manufacturing Processes and Quality Assurance for Tea Cup Manufacturing Machines

1. Raw Material Preparation

- Paperboard Selection: Food-grade, FSC-certified white/kraft board (gsm 150–350) with PE or PLA barrier coating.

- Coating Integrity: In-line laser thickness gauges verify PE/PLA layer uniformity (±0.03 mm tolerance).

- Roll Tension Control: Magnetic particle brakes maintain consistent unwind tension to prevent waviness.

| Parameter | Target Range | Tolerance |

|---|---|---|

| Paperboard gsm | 180–300 | ±5 g/m² |

| PE thickness | 20–40 µm | ±2 µm |

| Roll diameter | 500–800 mm | ±2 mm |

2. Forming Unit – Precision Engineering

- Die-Cut Punching: CAM-controlled tungsten carbide dies punch handles/holes within 0.1 mm positional accuracy.

- Heating Plates: PID-controlled aluminum plates (180–220 °C) ensure even glue activation; thermocouples log real-time data.

- Vacuum Forming: Servo-driven negative pressure (–0.8 bar) molds cup bodies without micro-cracks.

Machine KPIs

| Cycle Time | Output | Servo Accuracy |

|————|——–|—————-|

| 1.8–2.2 s | 1,800–2,000 cups/h | ±0.02 mm |

3. Handle Assembly & Rim Rolling

- Hot-Glue Application: Pneumatic dot guns dispense food-safe EVA glue at 140 °C; optical sensors verify bead width (2.5 ± 0.3 mm).

- Handle Placement: Vision system (1 kHz) aligns handles to 0.05° angular tolerance.

- Rim Curling: Three-roll calibrators form 1.2 mm double-wall rim; ultrasonic thickness gauges confirm wall integrity.

4. Quality Control (ISO 22000 & CE Marking)

| Checkpoint | Test Method | Acceptance Criterion |

|---|---|---|

| Cup wall thickness | Ultrasonic gauge | 0.18–0.35 mm |

| Handle peel strength | 50 N tensile, 5 s dwell | ≥30 N |

| Leak test | 0.5 bar compressed air, 3 s | No bubble formation |

| Coating migration | Ethanol rub (50 cycles, 500 g) | ΔE ≤1.0 |

| Dimensional tolerances | Caliper & CMM | ±0.5 mm |

Statistical Process Control (SPC) Dashboard

– Real-time X̄–R charts trigger alerts at 3σ deviation.

– CAPA (Corrective & Preventive Action) logs closed within 24 h.

Illustrative Image (Source: Google Search)

5. Packaging & Traceability

- Shrink Wrapping: UV-C sterilized film (≤0.08 mm) reduces microbial load by 99.9 %.

- QR Traceability: Each machine serial number links to batch records (paper roll ID, glue lot, operator ID).

6. Compliance & Certifications

- ISO 22000:2018 (Food Safety Management)

- CE Machine Directive 2006/42/EC

- RoHS 2011/65/EU (electrical components)

Key Takeaway: Integrated SPC, vision-guided assembly, and ISO-aligned QC deliver <0.5 % defect rates and 15,000 h MTBF for tea cup manufacturing machines targeting USA/EU markets.

Practical Sourcing Guide: A Step-by-Step Checklist for ‘tea cup manufacturing machine’

Practical Sourcing Guide: A Step-by-Step Checklist for Tea Cup Manufacturing Machine

1. Define Technical & Commercial Specifications

- Target output: pieces/hour, shift length, daily capacity

- Cup specifications: sizes (oz), materials (PE/PLA coated paper), wall type (single/double), compatible diameters

- Automation level: manual, semi-automatic, or full-automatic

- Power & utilities: voltage, frequency, air pressure, floor loading

- Budget range: total investment ceiling (equipment + freight + import duty)

- Lead-time target: preferred delivery timeline and seasonal constraints

2. Shortlist Verified Supplier Regions

| Region | Typical Price Range (USD) | Lead Time | After-Sales Support |

|---|---|---|---|

| China (Zhejiang, Guangdong) | 3,000 – 33,000 | 20 – 45 days | Online + local agent |

| India | 4,500 – 28,000 | 30 – 60 days | Growing network |

| Turkey | 18,000 – 45,000 | 25 – 50 days | EU time zones |

3. Verify Supplier Credentials

- Trade license, ISO 9001, CE or EAC marks

- Minimum 5 years of paper-cup-machine manufacturing history

- Export documentation: customs code, VAT number, export licence

- Customer references in USA/EU (request contactable clients)

- Third-party audit reports (BSCI, SGS, or equivalent)

4. Request Detailed Quotations

markdown

- Unit price (FOB, CIF, DDP)

- mould change cost & lead time

- spare-parts kit (list & pricing)

- installation & commissioning fees

- training hours (online/on-site)

- warranty period (minimum 12 months)

- after-sales response SLA (max 72 hrs)

5. Conduct Technical Due Diligence

- Arrange remote video call to observe trial run

- Review electrical schematic, pneumatic diagram, and mould drawings

- Confirm compatibility with local consumables (paper/board roll width)

- Inspect key components: PLC brand, servo motors, sensors, bearings

6. Evaluate Logistics & Compliance

| Cost Component | Typical Range (USD) | Notes |

|---|---|---|

| FOB freight (Shanghai / Ningbo) | 2,500 – 4,500 | 20-ft container |

| Ocean freight (US/EU) | 3,000 – 5,000 | 40-ft HQ |

| Insurance (CIF) | 0.3 – 0.5 % CIF value | All-risk |

| Custom duty & VAT (US/EU) | 0 – 6 % | Check HTS code 8443.30 |

7. Negotiate Commercial Terms

- Payment: 30 % T/T in advance, 70 % against shipping documents (LC or CAD acceptable)

- Incoterms: FOB for cost control, CIF for convenience, DDP for fixed landed cost

- Penalty clause: >10 % delay in delivery = 0.5 % price reduction per week

- Spare-parts price freeze for first 24 months

8. Finalise Contract & Risk Mitigation

- Include detailed technical specification appendix

- Define acceptance criteria (first 500 cups合格率 ≥ 99 %)

- Set force-majeure clause aligned with Incoterms 2020

- Escrow service recommended for first-time buyers

9. Plan Installation & Training

- Arrange on-site engineer availability (average 5 – 7 days)

- Prepare utility hook-ups (compressed air ≥ 6 bar, clean dry)

- Schedule operator training: 2 days theory, 3 days hands-on

- Create local maintenance checklist (lubrication, belt tension, sensor calibration)

10. Post-Purchase Review & Continuous Improvement

- Conduct acceptance test within 14 days of installation

- Log first-month downtime and OEE

- Collect operator feedback; adjust SOPs

- Reorder spare-parts buffer (moulds, cutting blades, seals) at 15 % of equipment value

Comprehensive Cost and Pricing Analysis for tea cup manufacturing machine Sourcing

Comprehensive Cost & Pricing Analysis

Tea-Cup Manufacturing Machine Sourcing | USA & Europe

1. Cost Breakdown

| Cost Component | Typical Range (USD) | Notes |

|---|---|---|

| Machine Base Price | $3 000 – $33 000 | Fully-automatic models command premium. |

| Material Cost (per 1 000 pcs) | $35 – $55 | Paper board + PE/PLA coating; volume discounts apply. |

| Labor (per operator / shift) | $15 – $25 | Semi-automatic lines need 2–3 operators; fully-auto needs 1. |

| Utilities (per 8-h shift) | $8 – $12 | Electricity for heaters, vacuum pumps, compressors. |

| Logistics (FOB port to US/EU) | $1 200 – $2 800 | 20-ft container; air freight 3–4× higher. |

| Customs & Duties | 0 % – 6.5 % | US: 0 % for machines; EU: 0 % – 6.5 % depending on HS code. |

| Insurance & Freight Inspection | $150 – $400 | Marine insurance + CNCA certificate for China-EU cargo. |

| After-Sales Spare Parts Fund | 5 % of machine price / yr | Bearings, heaters, cutting blades, sensors. |

2. Pricing Landscape

| Machine Type | Capacity (pcs/h) | Typical FOB Price | Target Market |

|---|---|---|---|

| Semi-Automatic | 800 – 1 200 | $3 000 – $5 000 | Start-ups, mobile units |

| High-Speed | 2 000 – 3 000 | $8 000 – $15 000 | Mid-scale converters |

| Fully-Automatic (dual-lane) | 4 000 – 6 000 | $25 000 – $33 000 | Large-scale factories |

3. Supplier Benchmarks (Top 3 Regions)

| Region | Average FOB Price | Lead Time | Quality Certifications |

|---|---|---|---|

| Zhejiang, China | $5 500 | 25 – 30 days | CE, ISO 9001 |

| Mumbai, India | $4 800 | 30 – 35 days | CE, BIS |

| Turkey | $6 200 | 20 – 25 days | CE, TSE |

4. Cost-Saving Tips

-

Negotiate Ex-Warehouse (EXW) + Self-Clear

Avoid supplier’s inland freight markup; handle customs yourself.

Illustrative Image (Source: Google Search)

-

Bundle Raw Materials

Order paper board & cups concurrently; suppliers offer 2–3 % material discount when shipped together. -

Choose FOB Over DDP

DDP adds 8–12 % to landed cost; use a broker in Rotterdam or LA to cut fees. -

Long-Term Service Contract

Pre-pay one year of spare-parts & labor; lock-in 5 % lower service rate. -

Leverage Regional Hubs

If importing to EU, route via Rotterdam (port duty ~0 %) vs. direct to France (2.9 %).

Illustrative Image (Source: Google Search)

5. Quick Reference: Hidden Fees

| Fee Type | Typical Cost |

|---|---|

| AMS filing (US) | $25 per bill |

| EU EORI registration | €50 once |

| Container cleaning (if returning) | $300 – $600 |

| Pre-shipment inspection (SGS/BV) | $350 – $600 |

Bottom Line

For a mid-scale US converter, expect $7 500 – $10 000 all-in for a high-speed machine landed in LA; for EU, budget $8 200 – $11 000 landed in Rotterdam. Lock in material contracts and after-sales service up-front to avoid 5–7 % cost creep in year two.

Alternatives Analysis: Comparing tea cup manufacturing machine With Other Solutions

Alternatives Analysis: Comparing Tea Cup Manufacturing Machine With Other Solutions

| Alternative Solution | Key Differences | Advantages | Disadvantages | Best-Use Scenario |

|---|---|---|---|---|

| Paper Cup Forming Machine | – Target product: Disposable paper cups (1.5–16 oz) vs. reusable tea cups – Material: Single/double PE/PLA coated paper vs. ceramic/glass – Output format: Pre-formed cups delivered flat-packed vs. finished tea cup ready for service |

• Ultra-low unit cost (USD 3–7.8 k installed) • Rapid changeover (different cup sizes available) • Fully disposable, no cleaning required |

• Environmental impact & landfill cost • Shelf appeal limited to branding • Recyclability depends on local HDPE/PLA streams |

Food-service chains needing mass-volume, low-cost, single-use cups (coffee, bubble tea) |

| Semi-Automatic Stamping Press | – Manual cup loading/unloading – Metal forming only (aluminum/stainless steel) – Labor-intensive operation |

• Lower initial investment (≈ USD 4–6 k) • Proven mechanical reliability • Simple maintenance |

• High labor cost & slower output (25–35 pcs/min) • Operator safety risk • Limited to cylindrical shapes |

Small cafés or regional producers with stable, low-throughput demand |

Cross-Analysis: Tea Cup Manufacturing Machine vs. Alternatives

1. Production Economics

– Tea Cup Machine: Higher upfront (USD 12–40 k) but fully automated; 80–120 pcs/min output with minimal labor. Payback typically 8–14 months at 50 k cups/month throughput.

– Paper Cup Forming Machine: Cheapest CAPEX (USD 3–7.8 k) but recurring cost of consumables (paper roll, PE/PLA) erodes margin at scale.

– Stamping Press: Moderate CAPEX (USD 4–6 k) plus labor—marginal cost per cup fixed by hourly wage, not machine speed.

2. Product Differentiation & Branding

– Tea Cup Machine enables ceramic thickness, matte/glaze finishes, logo embossing—ideal for premium teahouses and corporate gifting.

– Paper Cup Forming Machine offers only print branding; structural differentiation is limited to wall thickness and PLA coating.

– Stamping Press can add custom etching but shape remains basic.

3. Sustainability & Regulatory Fit

– Tea Cup Machine: Meets EU Ecodesign (2025)/US compostability standards when paired with porcelain or tempered glass.

– Paper Cup Forming Machine: Subject to emerging plastic ban legislation (EU 2024, CA SB 54); disposal logistics add hidden OPEX.

– Stamping Press: Material is infinitely recyclable; however, energy-intensive forming may push CO₂ above threshold in carbon-pricing jurisdictions.

Illustrative Image (Source: Google Search)

4. Scalability & Future-Proofing

– Tea Cup Machine: Modular mold sets allow rapid product diversification (latte cup, sake cup, cold-brew glass) with software updates.

– Paper Cup Forming Machine: Line changeover takes 15–30 min; limited by paper width and PE/PLA availability.

– Stamping Press: Changeover requires new stamping dies (weeks, USD 2–4 k), reducing agility.

Recommendation

Choose Tea Cup Manufacturing Machine when:

– Target market values reusability and brand experience (specialty tea retailers, corporate hospitality).

– Regulatory environment supports durable goods (e.g., France’s anti-single-use law).

– Margins can absorb higher initial capital; volume ≥ 30 k units/year.

Otherwise, Paper Cup Forming Machine remains the go-to for high-volume, low-touch segments; Stamping Press is viable only for micro-breweries or craft markets with strong local metalwork supply chains.

Essential Technical Properties and Trade Terminology for tea cup manufacturing machine

Essential Technical Properties and Trade Terminology for Tea Cup Manufacturing Machine

Core Technical Specifications

| Parameter | Typical Range | Notes |

|---|---|---|

| Cup Size Range | 1.5 – 16 oz | Adjustable formers for different volumes |

| Material Compatibility | PE-coated paper, PLA, double-wall board | Verify extrusion line support |

| Maximum Forming Speed | 80–120 pcs/min (high-speed models) | Cycles depend on cup size & wall thickness |

| Power Supply | 380 V / 50 Hz (3-phase) | Some dual-voltage units available |

| Air Pressure Requirement | 0.6 – 0.8 MPa | Pneumatic forming & sealing |

| Dimensions (L × W × H) | 2,400 × 1,100 × 1,700 mm (standard) | Space planning for inline stackers |

| Net Weight | 1,800 – 2,500 kg | Shipping-friendly steel frame |

Key Manufacturing Functions

- Automatic feeding of paper reel → pulp molding → ultrasonic / hot-bar sealing → cup ejection

- PLC touchscreen HMI with recipe storage for size change-overs (<5 min)

- In-line quality sensors for leakage detection & rim cutting tolerance ±0.2 mm

Trade & Procurement Terms (USA / EU Focus)

| Term | Definition | Typical Context |

|---|---|---|

| MOQ | Minimum Order Quantity | 1 set for full-auto models; 1 ton for paper reel spares |

| Lead Time | Production + shipping | 30–45 days FOB Shanghai; 60–75 days to EU port |

| Incoterms | FOB, CIF, DDP | Choose FOB to retain freight control; DDP for landed-cost certainty |

| Warranty | 12 months parts & labor | Excludes wear parts (sealing bars, cutters) |

| OEM/ODM | Custom branding or full design | Tooling fee $2k–$5k for new cup specs |

| Trade Assurance | Alibaba escrow service | 30 % prepayment, 70 % before container release |

| CE / UKCA | Conformity marking | Required for EU market entry |

| After-sales Service | Remote diagnostics, on-site commissioning | Engineer dispatch within 72 h (extra cost) |

Sourcing Checklist

- [ ] Verify material certifications (FDA 21 CFR, EU 10/2011)

- [ ] Request dry-run video of target cup style

- [ ] Clarify spare parts package (sealing bars, heaters, cutting knives)

- [ ] Confirm local agent for service in your region

Navigating Market Dynamics and Sourcing Trends in the tea cup manufacturing machine Sector

Navigating Market Dynamics and Sourcing Trends in the Tea Cup Manufacturing Machine Sector

Executive Summary

The global tea cup manufacturing machine market is undergoing a decisive shift from volume-driven acquisition to value-centric, sustainability-aligned sourcing. Buyers in the USA and Europe are prioritizing energy-efficient, multi-format machines that accommodate both traditional paper and PLA-coated substrates. Price pressure remains acute, yet qualification criteria now include supply-chain transparency, after-sales service depth, and compliance with evolving regional packaging regulations.

Illustrative Image (Source: Google Search)

1. Market Dynamics

1.1 Demand Drivers

| Driver | Impact on Machine Requirements |

|---|---|

| COVID-19 post-pandemic rebound | Short-cycle, high-volume converters seek 1,000–2,000 cups/hour single-line solutions to offset labor shortages. |

| Food-service consolidation | Tier-1 chains demand OEM-ready interfaces (USB/OPC-UA) for MES integration and predictive maintenance. |

| Retail private-label growth | Mid-tier players require adaptable die-cutter modules to switch between 4-oz samples and 16-oz cold drinks within 15 minutes. |

1.2 Pricing Landscape

- Entry-level semi-automatic units: USD 3,000–5,000 (CN origin, 1-year warranty).

- Mid-tier full-automatic double-wall machines: USD 5,000–7,800 (CE compliance, 14-bit PLC).

- High-speed intelligent lines: USD 30,000–33,000 (2.5-second cycle time, IoT-ready).

2. Sourcing Trends

2.1 Geographic Realignment

- China still dominates: 85 % of verified suppliers on Alibaba.com and Made-in-China.com are located in Zhejiang and Guangdong.

- Vietnam & India emerging: 12 % price advantage vs. CN, but lead times extend to 45 days vs. 25 days ex-Asia.

2.2 Equipment Categories in Demand

| Category | 2024 Share | 2025 Forecast | Key Buying Criteria |

|---|---|---|---|

| Semi-automatic | 38 % | 30 % | Lower CAPEX, 110 V compatibility |

| Automatic single-lane | 42 % | 48 % | Faster changeover, minimal downtime |

| Double-wall / multi-layer | 20 % | 22 % | PLA barrier compatibility |

2.3 Sustainability-Linked Procurement

- Material shift: PLA-coated paper now represents 28 % of EU-bound orders (up from 19 % in 2022).

- Energy labeling: German buyers require ≤ 6 kWh/cup for full-automatic machines; this is a tender gate.

- Recyclability certificates: ISO 18601 and OK-Compost HOME are becoming bid prerequisites.

3. Supplier Evaluation Checklist

| Criteria | Weight | Red Flags |

|---|---|---|

| CE/UL certification | 25 % | Missing conformity modules |

| Local after-sales coverage | 20 % | No US/EU parts inventory |

| PLC open architecture | 15 % | Proprietary software lock-in |

| Warranty | 15 % | <12 months standard |

| Trade Assurance / Escrow | 10 % | No Alipay or Escrow option |

| Sustainability documentation | 15 % | Absence of LCA report |

4. Actionable Recommendations

- Shortlist three suppliers offering modular die sets to future-proof against new cup diameters.

- Negotiate trade-assured contracts with 30 % payment on shipment, 70 % on arrival inspection.

- Demand a 6-month machine-learning trial to validate predictive maintenance ROI.

- Require cradle-to-grave LCA certificates for PLA and paper substrates.

- Plan for 2025 EU Extended Producer Responsibility (EPR) fees by sourcing machines with integrated mono-material separation modules.

Final Thought

The tea cup machine sector is transitioning from a commodity buying cycle to a strategic sustainability partnership. Buyers who align technical, regulatory, and ESG criteria now will secure 3–5 % total cost savings and de-risk supply chains against 2026 policy shifts.

Frequently Asked Questions (FAQs) for B2B Buyers of tea cup manufacturing machine

Frequently Asked Questions (FAQs) for B2B Buyers of Tea Cup Manufacturing Machines

1. What are the minimum order quantities (MOQs) for new and used tea cup manufacturing machines?

- New machines: Chinese manufacturers typically list MOQs of 1–2 sets, especially for fully automatic models.

- Used/refurbished machines: MOQs often start at 1 unit, but volume discounts apply for 3–5 units.

- Consumables & parts: Raw paper rolls, PE/PLA coatings, or spare parts usually have lower MOQs (e.g., 1 ton or 100 m rolls).

2. How do lead times and shipping terms compare between Chinese suppliers and European/US manufacturers?

| Region | Typical Lead Time | Incoterms | Transit Time (to USA/EU) |

|---|---|---|---|

| China | 25–45 days FOB/CIF | FOB/CIF | 4–6 weeks by sea |

| Europe | 8–12 weeks EXW | EXW/DAP | 1–2 weeks by road/air |

| USA | 10–16 weeks | FOB/CIF | 2–4 weeks by road/air |

Note: Faster lead times may be offset by higher unit costs at European/US foundries.

3. Which certifications should I require for food-grade tea cup production lines?

- CE (EU Machinery Directive)

- FDA or LFGB compliance for contact with hot beverages

- ISO 9001 quality management

- BSCI/SEDEX for ethical sourcing (optional but recommended)

4. What are the key ROI metrics I should request from suppliers?

- Cycle time per cup (e.g., 1.8 s @ 35 spm for 80 mm cups)

- Daily output (e.g., 12 000–18 000 cups/day for single-shift operation)

- Power consumption (kWh/1 000 cups)

- Payback period (typical range: 10–18 months for high-speed lines)

5. How do automatic vs. semi-automatic machines differ in terms of labor cost savings?

| Feature | Semi-Automatic | Fully Automatic |

|---|---|---|

| Labor/Shift | 2–3 operators | 1 operator |

| Scrap Rate | 3–5 % | <1 % |

| Changeover Time | 30–45 min | 5–10 min |

| Daily Output | 6 000–8 000 cups | 12 000–20 000 cups |

ROI advantage: Automatic lines reduce labor cost by 60–70 % within 12 months.

6. What after-sales support packages are standard for tea cup machines sold in North America and the EU?

- Warranty: 12 months parts & labor (Chinese suppliers); 24–36 months on electrical components (European suppliers).

- Remote diagnostics: 24/7 hotline + VPN access to PLC.

- On-site commissioning: Usually 3–5 days on-site at buyer’s cost (travel + $800–$1 200/day).

- Spare parts kit: Included in premium packages; optional for basic warranty.

7. Can the machine be configured for both hot and iced tea cups?

Yes. Modern form-fill-seal machines accept paper thickness 150–350 gsm and can switch between:

Illustrative Image (Source: Google Search)

- Single-wall PE/PLA coated paper

- Double-wall with corrugated insert

- Temperature indicator printing for hot-fill lines

Change parts (forming molds, sealing bars) are required and typically shipped within 7 days.

8. What are the hidden costs beyond the machine price?

- Customs clearance & duties: 0–3 % (USA); 5.5–20 % (EU) depending on HS code.

- Crating & marine insurance: 1.5–2 % of CIF value.

- Installation & training: $3 000–$8 000 for full commissioning.

- Consumables trial run: 1–2 pallets of paper rolls (budget $1 000–$2 000).

Pro tip: Request a landed-cost breakdown before PO to avoid 10–15 % budget overruns.

Strategic Sourcing Conclusion and Outlook for tea cup manufacturing machine

Strategic Sourcing Conclusion and Outlook for Tea Cup Manufacturing Machine

Key Takeaways

- Cost Efficiency: Full-automatic models (ZWT-35) priced $5,000–$7,800 deliver 35–45 pcs/min output, cutting labor cost by 60 % vs. semi-automatic lines.

- Speed & Flexibility: High-speed intelligent machines ($30,000–$33,000) support 8–12 oz cups with changeover ≤3 min, ideal for multi-SKU portfolios.

- Sustainability: PE/PLA-coated lines ensure compliance with EU PPWR and U.S. state bans; sourcing paper roll stock locally reduces freight emissions 15 %.

- Reliability: 15-year OEMs on Alibaba and Made-in-China.com offer 24/7 remote diagnostics and 48-h spare-part dispatch across EU & NAFTA zones.

Outlook 2025–2027

| Parameter | Current | 2027 Target |

|---|---|---|

| Energy Use | 7 kWh/cup | ≤4.5 kWh |

| Changeover Time | 3 min | ≤90 s |

| Recyclable Share | 85 % | 95 % |

| OEE | 78 % | ≥88 % |

Investors should prioritize suppliers offering Trade Assurance, CE/UL certification, and on-site training to future-proof capital expenditure.

Important Disclaimer & Terms of Use

⚠️ Important Disclaimer

The information provided is for informational purposes only. B2B buyers must conduct their own due diligence.

Illustrative Image (Source: Google Search)