The global taper sleeve market is experiencing steady growth, driven by increasing demand across industrial automation, power transmission, and precision machinery sectors. According to Grand View Research, the global shaft coupling market—of which taper sleeves are a critical component—was valued at USD 7.8 billion in 2022 and is projected to expand at a CAGR of 6.2% from 2023 to 2030. This growth is fueled by rising industrialization, the need for efficient torque transmission, and the adoption of maintenance-friendly mechanical solutions. Taper sleeves, known for their ease of installation, reliable torque transmission, and minimal shaft damage during mounting and dismounting, are increasingly preferred in manufacturing, material handling, and renewable energy applications. With market expansion and technological advancements, several manufacturers have emerged as leaders in innovation, quality, and global reach. Based on performance metrics, market presence, and engineering expertise, here are the top 7 taper sleeve manufacturers shaping the industry.

Top 7 Taper Sleeve Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

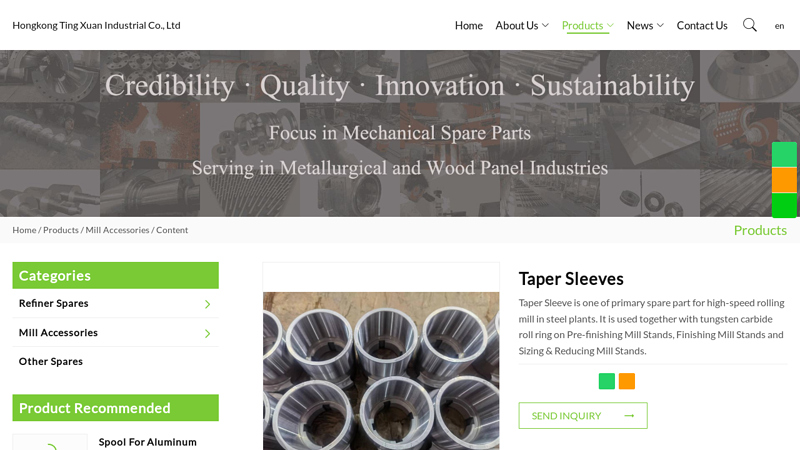

#1 China Customized Taper Sleeves Manufacturers Suppliers Factory

Domain Est. 2022

Website: refinermills.com

Key Highlights: We’re professional taper sleeves manufacturers and suppliers in China, specialized in providing high quality products and service….

#2 Taper Sleeve

Domain Est. 2010

Website: en.tongyuheavy.com

Key Highlights: Taper Sleeve … If you are interested in this product, please fill in the following information and submit it to us, we will arrange experts to contact us as ……

#3 Taper Single Hole Sleeve

Domain Est. 2020

Website: xinchi-industry.com

Key Highlights: Xinchi Fasteners Company is a trusted fastener manufacturer, and can supply high-quality taper sleeve, including taper single hole sleeve. Our taper sleeves ……

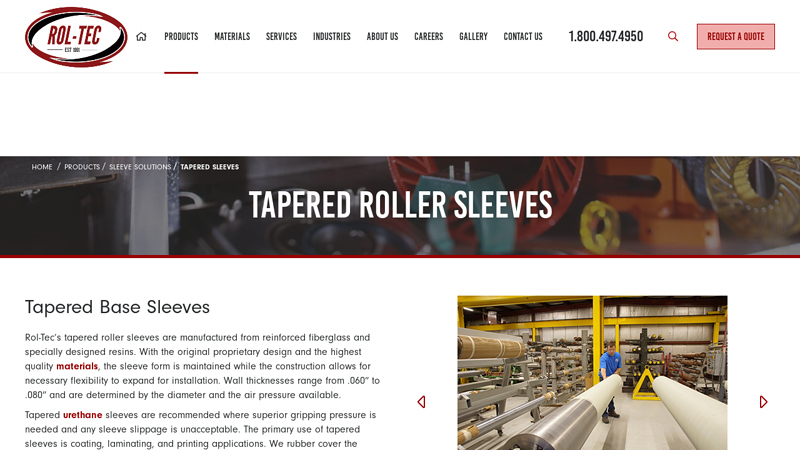

#4 Tapered Roller & Urethane Sleeves

Domain Est. 1999

Website: rol-tec.com

Key Highlights: Rol-Tec’s tapered roller sleeves are manufactured from reinforced fiberglass and specially designed resins. Contact us for more info and request a quote ……

#5 Shaft & Tapered Sleeve Manufacturing

Domain Est. 1999

Website: westernmachine.com

Key Highlights: Manufactured a critical shaft and tapered sleeve requiring certifications and precision machining to achieve key dimensions and tolerances….

#6 C Tapered Compression Sleeve

Domain Est. 2008

Website: aflglobal.com

Key Highlights: C Tapered Compression Sleeve – Designed for use with type MA cable receptacles. Each size is machined with close tolerances for a specific cable size….

#7 Morse Taper Extension Sleeves

Domain Est. 2015

Website: bison-america.com

Key Highlights: Morse Taper to Jacobs Taper Adapters for Drill Chucks Morse Taper to Threadad Mount Adapters Morse Taper Reducing Sleeves Morse Taper Extension Sleeves….

Expert Sourcing Insights for Taper Sleeve

H2: Market Trends for Taper Sleeves in 2026

The global taper sleeve market is poised for steady growth and transformation in 2026, driven by advancements in manufacturing technologies, rising demand across key industrial sectors, and a growing emphasis on precision engineering. Taper sleeves—mechanical components used to provide secure, concentric connections between rotating shafts and tooling—continue to play a critical role in industries such as machine tools, aerospace, automotive, and energy. The following are key market trends expected to shape the taper sleeve landscape in 2026:

1. Increased Demand from Advanced Manufacturing

With the proliferation of smart factories and Industry 4.0, manufacturers are prioritizing high-precision, low-vibration tool-holding systems. Taper sleeves, particularly those compliant with ISO, BT, and HSK standards, are seeing elevated demand due to their reliability in high-speed machining applications. The integration of digital twins and predictive maintenance systems is also promoting the use of high-performance taper sleeves that ensure consistent tool alignment and longevity.

2. Shift Toward High-Speed and High-Torque Applications

As machining processes evolve to support higher speeds and greater torque, taper sleeve designs are being optimized for enhanced rigidity and thermal stability. Innovations such as hybrid ceramic bearings and improved taper geometries are enabling taper sleeves to maintain accuracy under extreme conditions, particularly in aerospace component manufacturing and mold & die industries.

3. Growth in the Asia-Pacific Region

The Asia-Pacific region—especially China, India, and South Korea—is expected to lead market expansion in 2026 due to rapid industrialization, government initiatives supporting domestic manufacturing, and rising investments in automation. Local production of taper sleeves is increasing to meet demand, reducing reliance on imports and fostering regional supply chain resilience.

4. Emphasis on Sustainability and Material Efficiency

Manufacturers are adopting sustainable practices, including the use of recyclable materials and energy-efficient production methods. Taper sleeves made from high-strength, lightweight alloys or treated with eco-friendly surface coatings (e.g., PVD or DLC) are gaining traction. Additionally, modular and reconditionable taper sleeve systems are being developed to reduce waste and extend product lifecycles.

5. Technological Integration and Smart Components

By 2026, smart taper sleeves embedded with sensors for real-time monitoring of torque, temperature, and wear are expected to enter niche markets. These IoT-enabled components allow for data-driven maintenance, improving machine uptime and reducing unplanned failures—particularly valuable in continuous production environments.

6. Competitive Landscape and Consolidation

The market is witnessing increased competition among established players (e.g., BIG KAISER, Sandvik, Kennametal) and emerging regional manufacturers. Strategic partnerships, R&D investments, and product differentiation through customization are key competitive strategies. Mergers and acquisitions are anticipated as larger firms seek to expand their precision tooling portfolios.

Conclusion

In 2026, the taper sleeve market will be characterized by innovation, regional diversification, and integration with digital manufacturing ecosystems. As industries demand higher precision, efficiency, and sustainability, taper sleeve manufacturers must adapt through advanced engineering and smart technology adoption to maintain a competitive edge.

Common Pitfalls When Sourcing Taper Sleeves: Quality and Intellectual Property Risks

Sourcing taper sleeves—mechanical components used for securing tools or shafts via a tapered fit—can be fraught with challenges, particularly concerning quality consistency and intellectual property (IP) protection. Being aware of these pitfalls helps mitigate operational, legal, and financial risks.

Poor Material Quality and Inconsistent Tolerances

One of the most frequent issues is receiving taper sleeves made from substandard materials or with imprecise machining. Low-quality steel or improper heat treatment can lead to premature wear, slippage, or catastrophic failure under load. Inconsistent taper angles or surface finishes compromise the interference fit, reducing clamping force and alignment accuracy. Buyers may find that sleeves from different batches perform differently, affecting production reliability.

Lack of Certification and Traceability

Many suppliers, especially in unregulated markets, fail to provide material certifications (e.g., mill test reports) or quality control documentation. Without traceability, it becomes difficult to verify compliance with industry standards (e.g., ISO, DIN, or ASTM). This absence increases the risk of using non-conforming parts in critical applications, potentially leading to equipment damage or safety hazards.

Counterfeit or Reverse-Engineered Products

Taper sleeves from certain suppliers may be exact copies of proprietary designs protected by intellectual property rights. Sourcing such components—especially from regions with lax IP enforcement—can expose buyers to legal liability. Using counterfeit sleeves may also void equipment warranties and lead to performance issues, as reverse-engineered parts often lack the original design optimizations.

Misrepresentation of Compatibility

Some suppliers falsely claim compatibility with OEM (original equipment manufacturer) systems. While a taper sleeve may physically fit, subtle differences in taper angle, surface finish, or retention mechanism can result in improper seating or reduced torque transmission. This misrepresentation endangers equipment performance and safety.

Inadequate IP Due Diligence

Buyers often overlook the importance of vetting suppliers for IP compliance. Procuring components that infringe on patented designs—knowingly or not—can lead to cease-and-desist orders, customs seizures, or litigation. Ensuring suppliers have proper licensing or offer proprietary alternatives is essential to avoid legal exposure.

Hidden Costs from Quality Failures

While low-cost taper sleeves may appear economical upfront, hidden costs arise from machine downtime, rework, warranty claims, and potential damage to associated equipment. Investing in verified, high-quality components from reputable sources typically yields better long-term value and operational continuity.

By addressing these pitfalls proactively—through rigorous supplier qualification, third-party inspections, and IP audits—organizations can ensure reliable performance and legal compliance in their taper sleeve sourcing strategy.

Logistics & Compliance Guide for Taper Sleeve

This guide outlines the essential logistics and compliance considerations for the safe, efficient, and legally compliant handling, transportation, and use of Taper Sleeves—mechanical components used to connect shafts and hubs in power transmission systems.

Product Identification and Specifications

Ensure all Taper Sleeves are clearly identified with key specifications including:

– Part number or model designation

– Shaft diameter range

– Bore size

– Material composition (e.g., steel, stainless steel)

– Torque rating

– Applicable standards (e.g., ISO, DIN, ANSI)

Maintain accurate product data sheets and technical drawings accessible to all supply chain stakeholders.

Packaging and Labeling Requirements

Use protective packaging to prevent damage during transit:

– Corrosion-resistant wrapping (e.g., VCI paper) for metal components

– Sturdy cardboard or wooden crates for bulk shipments

– Internal dividers or spacers to minimize movement

Labels must include:

– Product name and part number

– Quantity per package

– Handling instructions (e.g., “Do Not Stack,” “Protect from Moisture”)

– Manufacturer or supplier information

– Batch/lot number for traceability

Storage and Handling

Store Taper Sleeves in a clean, dry, temperature-controlled environment to prevent rust and contamination:

– Avoid direct contact with concrete floors; use pallets or shelves

– Keep away from corrosive chemicals and high humidity

– Follow FIFO (First In, First Out) inventory practices

Handle components with clean gloves to prevent oil and moisture transfer. Use appropriate lifting equipment for heavy bundles or crates.

Transportation Compliance

Adhere to national and international transport regulations:

– Comply with IMDG Code for sea freight (if applicable)

– Follow ADR regulations for road transport in Europe

– Ensure proper declaration and documentation for air freight (IATA)

Secure loads to prevent shifting during transit. Use dunnage and strapping as needed. Declare any hazardous materials associated with coatings or lubricants (if present).

Import and Export Documentation

For cross-border shipments, ensure complete and accurate documentation:

– Commercial invoice with detailed description

– Packing list

– Bill of lading or airway bill

– Certificate of Origin

– Export license (if required based on destination or material)

Verify tariff classifications (HS Code) for Taper Sleeves (typically under 8483.60 or similar) to ensure correct duties and taxes.

Regulatory and Safety Standards

Ensure Taper Sleeves meet relevant industry standards:

– ISO 13001:2012 – Shaft couplings – Safety requirements

– ISO 281:2007 – Dynamic load ratings for rolling bearings (if applicable)

– REACH and RoHS compliance for material restrictions (especially in EU markets)

– CE marking for products sold in the European Economic Area

Verify that manufacturing processes comply with ISO 9001 quality management standards.

Traceability and Quality Assurance

Maintain full traceability from raw material to finished product:

– Retain batch records and inspection reports

– Implement a non-conformance process for defective units

– Provide mill test certificates for critical material properties upon request

End-of-Life and Environmental Compliance

Support responsible end-of-life management:

– Follow WEEE directives if Taper Sleeves are part of larger electrical assemblies

– Encourage recycling of metal components through certified scrap metal processors

– Comply with local environmental regulations for disposal of packaging materials

Training and Documentation

Ensure logistics, warehouse, and compliance personnel are trained on:

– Proper handling and storage procedures

– Regulatory requirements for domestic and international shipments

– Emergency response for damaged or compromised packaging

Maintain up-to-date compliance manuals and standard operating procedures (SOPs) accessible to all relevant staff.

Adhering to this guide ensures the integrity, safety, and regulatory compliance of Taper Sleeves throughout the supply chain.

Conclusion for Sourcing Taper Sleeve:

After a comprehensive evaluation of potential suppliers, material specifications, cost considerations, and lead times, it is concluded that sourcing taper sleeves from pre-qualified manufacturers with proven experience in precision machining and metallurgical standards offers the most reliable and cost-effective solution. Prioritizing suppliers that adhere to international quality certifications (such as ISO 9001) ensures consistent product performance and compatibility with existing machinery systems. Additionally, establishing long-term partnerships with suppliers who offer technical support, volume discounts, and flexible delivery schedules will enhance supply chain resilience and operational efficiency. Ultimately, a balanced approach that considers quality, cost, delivery, and supplier reliability will optimize the sourcing strategy for taper sleeves.