The global gemstone market, valued at approximately USD 28.1 billion in 2023, is projected to expand at a CAGR of 6.3% through 2030, driven by rising demand for rare and ethically sourced stones—according to Grand View Research. Within this landscape, Tanzanite stands out as one of the most sought-after gemstones, with over 80% of global supply originating from Tanzania’s Merelani Hills. As consumer preference shifts toward transparent, traceable sourcing, demand for high-quality rough Tanzanite has surged, prompting increased activity among specialized manufacturers. Mordor Intelligence reports that the African gemstone sector, particularly in East Africa, is witnessing strategic consolidation and investment, positioning key Tanzanite producers at the forefront of a growing luxury and jewelry supply chain. Based on production volume, industry reputation, and supply consistency, the following nine manufacturers represent the leading sources of rough Tanzanite dominating today’s market.

Top 9 Tanzanite Rough Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 About Us

Domain Est. 2006

Website: toptanzanite.com

Key Highlights: We are a true “mine to market” manufacturer. Our exceptional Tanzanite gems are ethically sourced directly from the mines, then cut and crafted in-house….

#2 Tanzanite mis

Domain Est. 1996

Website: orchid.ganoksin.com

Key Highlights: of rough tanzanite a year. This would mean that a 20% yield, would have placed 55 MILLION carats of cut tanzanite into the market place last ……

#3 The World’s Finest Tanzanite Jewellery

Domain Est. 1999

Website: shimansky.com

Key Highlights: Shimansky Tanzanite are the best in the world. With over 25 years’ experience, only the top colors are selected, then cut and polished into flawless gems….

#4 From Kaisilver

Domain Est. 2003

Website: tanzanite.kaijewels.com

Key Highlights: Big Tanzanite Rough: A large 12,000 carat piece of rough tanzanite gem stone has been found. So how large would the the final cut tanzanite gems be from this ……

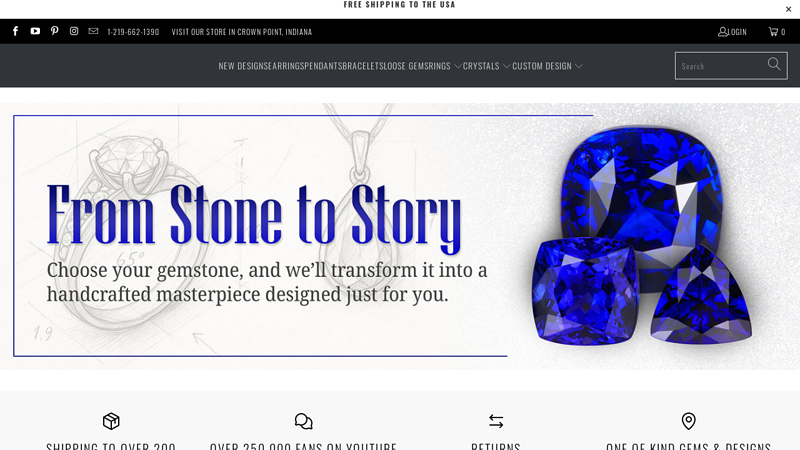

#5 Tanzanite Jewelry

Domain Est. 2005

Website: tanzanitejewelrydesigns.com

Key Highlights: Authentic and genuine Tanzanite jewelry & gemstones including rings, pendants, earrings & bracelets for over 30 years. One-of-a-kind designs brought back ……

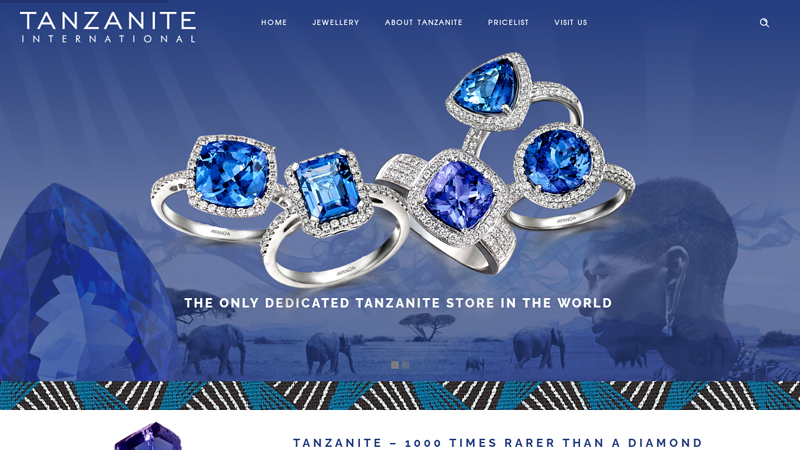

#6 Tanzanite International

Domain Est. 2006

Website: tanzanite-int.com

Key Highlights: The Queen of Tanzanite, is an exclusive range of exceptional quality loose tanzanite stones and unique tanzanite jewellery. The range has just been extended to ……

#7 Tanzanite Knowledge

Domain Est. 2008

Website: tanzaniteexperience.com

Key Highlights: Tanzanite stones are graded using the Tanzanite Quality Scale, an internationally recognized system that accurately describes a stone’s color and quality….

#8 Rare Tanzanite Investment Collection

Domain Est. 2016 | Founded: 1974

Website: theraregemstonecompany.com

Key Highlights: Free delivery 14-day returnsDiscover rare, ethically sourced Tanzanite direct from Tanzania. Shop fine Tanzanite from the experts – cutting Tanzanite since 1974. Shop Tanzanite rin…

#9 About Us

Domain Est. 2017

Website: tanzanitedirect.com

Key Highlights: Discover Tanzanite Direct, your source for certified Tanzanite jewelry. Learn about our commitment to quality, ethical sourcing, and exceptional products….

Expert Sourcing Insights for Tanzanite Rough

H2: 2026 Market Trends Forecast for Tanzanite Rough

The global market for tanzanite rough is anticipated to experience notable shifts by 2026, driven by evolving supply dynamics, increasing demand from luxury markets, and growing emphasis on ethical sourcing and sustainability. As one of the rarest gemstones in the world—found exclusively in a single mining area near Mount Kilimanjaro in northern Tanzania—tanzanite’s finite availability continues to shape its market trajectory.

1. Supply Constraints and Government Influence

By 2026, supply limitations are expected to remain a dominant factor. The Tanzanian government has increased its control over gemstone mining, including tanzanite, through policy reforms aimed at boosting domestic value addition. The state-owned Mining and Minerals Development Corporation (MMDC) has been central to efforts to formalize artisanal mining and restrict raw gem exports. This could reduce the volume of rough tanzanite available on the international market, potentially driving up prices for uncut material.

2. Rising Demand in High-End Jewelry Markets

Global demand for tanzanite rough is projected to grow, particularly in the United States, China, and the Middle East, where it is marketed as a unique and luxurious alternative to sapphires and other blue gemstones. With increased consumer interest in rare and distinctive gemstones, especially for engagement rings and bespoke jewelry, demand for high-quality rough suitable for cutting into premium gems will likely rise.

3. Price Trends and Investment Potential

Analysts anticipate a gradual increase in the price of tanzanite rough by 2026, due to scarcity and growing demand. High-color-grade rough (vivid blue to violet) is expected to appreciate significantly, with prices potentially rising 6–10% annually. This trend may position tanzanite rough as a niche investment commodity, similar to other rare colored gemstones.

4. Ethical Sourcing and Certification

By 2026, ethical sourcing will play a critical role in market access. International buyers and luxury brands are increasingly requiring traceability and certification for gemstones. Initiatives such as the Tanzania Gemstone Marketing Board’s certification system and blockchain tracking are expected to gain traction, enhancing the value of responsibly sourced tanzanite rough.

5. Impact of Synthetics and Imitations

While synthetic tanzanite is not commercially widespread, the presence of imitations (such as synthetic forsterite or dyed quartz) could influence market perception. However, due to its unique geological origin and strong branding, natural tanzanite rough is expected to maintain its premium status, particularly in certified transactions.

Conclusion

The 2026 outlook for tanzanite rough indicates a tightening supply, rising prices, and increasing demand from ethically conscious luxury markets. As Tanzania strengthens its regulatory framework and value-added processing, international buyers may face higher costs and greater compliance requirements. For investors and gemstone traders, high-quality tanzanite rough is expected to remain a valuable and strategically important commodity in the colored gemstone sector.

Common Pitfalls Sourcing Tanzanite Rough (Quality, IP)

Sourcing tanzanite rough—especially for cutting, resale, or investment—comes with significant risks related to both quality and intellectual property (IP) concerns. Being aware of these pitfalls is essential for buyers, traders, and manufacturers to avoid financial loss, legal complications, and reputational damage.

Misjudging Quality of Tanzanite Rough

One of the biggest challenges when sourcing tanzanite rough is accurately assessing its potential quality. Raw tanzanite often appears dull or unremarkable, making it difficult to judge color, clarity, and cut potential.

-

Color Misrepresentation: Tanzanite’s prized blue-violet hues are not always evident in the rough. Overheating or improper lighting can mask true color, leading to overvaluation. Buyers may pay premium prices for stones that yield only commercial-grade material after cutting.

-

Inclusion and Fracture Risks: Tanzanite is often fractured or heavily included. These flaws may not be visible initially but can severely limit yield or render a stone unsuitable for faceting.

-

Lack of Standardized Grading: Unlike diamonds, tanzanite lacks a globally accepted grading system for rough material. This inconsistency allows for subjective evaluations and inflated claims by sellers.

-

Treatment Concealment: Some rough tanzanite has already been heat-treated to enhance color, but this may not be disclosed. Untreated rough is rarer and more valuable, so misrepresentation here directly impacts value.

Intellectual Property and Ethical Concerns

While tanzanite is naturally associated with intellectual property in branding and certification, sourcing also intersects with ethical and legal risks.

-

Counterfeit or Illegally Mined Material: A significant portion of tanzanite enters the market through informal or illegal channels in Tanzania. Sourcing from unverified suppliers risks involvement in smuggling, tax evasion, and support of unethical labor practices.

-

Brand and Certification Fraud: Legitimate tanzanite brands (e.g., TanzaniteOne, Moyo Gems) use traceability programs and certifications to protect their IP and ensure ethical sourcing. Counterfeit certifications or forged documents may mislead buyers into believing they are purchasing ethically sourced, high-quality material.

-

Lack of Provenance Documentation: Without proper documentation and chain-of-custody records, buyers cannot verify the origin of the rough. This not only raises ethical red flags but may also affect resale value and marketability, especially in regions with strict import regulations (e.g., EU, USA).

-

Trademark and Repackaging Risks: Some suppliers repackage lower-grade or synthetic material as genuine tanzanite. Using brand names or logos without authorization infringes on IP rights and can lead to legal liability.

Conclusion

To mitigate these pitfalls, buyers should work with reputable, certified suppliers, conduct independent gemological assessments, and insist on full traceability and documentation. Due diligence in both quality evaluation and IP compliance is essential for sustainable and profitable tanzanite sourcing.

Logistics & Compliance Guide for Tanzanite Rough

Shipping and trading tanzanite rough requires strict adherence to Tanzanian regulations and international standards to ensure legal compliance, ethical sourcing, and secure logistics. This guide outlines key steps and requirements for handling tanzanite rough from mining to export.

Regulatory Framework in Tanzania

Tanzania maintains full control over its mineral resources, including tanzanite. The Ministry of Minerals and the Tanzania Gemstone Board (TGB) oversee gemstone mining, valuation, and export. The Mining Act of 2010 and the Gemstones Act (Cap 132) form the legal basis for tanzanite regulation. All gemstone exports must be licensed, and rough tanzanite may only be exported by registered gemstone merchants with a valid Gemstone Export License.

Licensing and Permits

Exporters of rough tanzanite must obtain the following:

- Gemstone Export License from the Tanzania Gemstone Board

- Mining License or Purchase Authorization if sourcing directly from a mine

- Certificate of Origin issued by the Tanzania Chamber of Commerce, Industry and Agriculture (TCCIA)

- Ministry of Minerals Export Permit for each consignment

All documentation must be up to date and submitted to the Tanzania Revenue Authority (TRA) prior to shipment.

Valuation and Certification

All rough tanzanite must be submitted to the Tanzania Gemstone Certification and Valuation Laboratory (TGCVL) for:

- Official grading and classification

- Valuation for tax and export purposes

- Issuance of a Gemstone Valuation and Export Certificate

This certificate is mandatory for customs clearance and must accompany the shipment.

Export Procedures

- Pre-Export Declaration: File with the Tanzania Revenue Authority (TRA) through the ASYCUDA World system.

- Physical Inspection: TRA and TGB officials may inspect the consignment at bonded warehouses.

- Payment of Export Duties: Based on the TGCVL valuation, including any applicable royalties and levies.

- Customs Clearance: Submit all required documents including:

- Export permit

- Valuation certificate

- Commercial invoice

- Packing list

- Bill of lading or airway bill

- Sealing and Shipment: Approved consignments are sealed and released for transport.

Transport and Logistics

- Use secure, insured transport from mine or warehouse to port/airport.

- Shipments must be tamper-evident sealed and tracked throughout transit.

- Air freight is commonly used due to the high value and low volume of tanzanite.

- Partner with logistics providers experienced in high-value mineral shipments and compliant with IATA regulations.

Due Diligence and Ethical Compliance

- Implement a Due Diligence System aligned with the OECD Due Diligence Guidance for Responsible Supply Chains of Minerals from Conflict-Affected and High-Risk Areas.

- Maintain complete chain-of-custody records from mine to export.

- Ensure sourcing does not involve illegal mining, child labor, or environmental violations.

- Consider third-party audits or membership in recognized ethical sourcing initiatives.

Import Regulations (Destination Countries)

Check import requirements in the destination country, which may include:

- Import licenses

- Declaration of mineral origin

- Compliance with the U.S. Lacey Act, EU Conflict Minerals Regulation, or other relevant legislation

- Payment of import duties and VAT

Record Keeping

Retain all export documentation for a minimum of five years, including:

- Export licenses and permits

- Valuation certificates

- Customs declarations

- Sales contracts and invoices

- Transport and insurance records

Penalties for Non-Compliance

Failure to comply with Tanzanian export regulations may result in:

- Seizure of goods

- Fines or penalties

- Suspension or revocation of export licenses

- Criminal prosecution in cases of smuggling or fraud

Adherence to these guidelines ensures smooth logistics operations and supports the sustainable and legal development of Tanzania’s tanzanite sector.

In conclusion, sourcing tanzanite rough requires a strategic, ethical, and well-informed approach due to the gemstone’s rarity and single-source origin in Tanzania. Given that tanzanite is exclusively mined in the Merelani Hills near Mount Kilimanjaro, building strong relationships with licensed local miners, cooperatives, and reputable trading entities is essential. Responsible sourcing must prioritize compliance with Tanzanian mining regulations, adherence to fair labor practices, and transparency in the supply chain to avoid conflict minerals and support sustainable development in local communities.

Furthermore, engaging with certified gemstone dealers or partnering with organizations that follow the Kimberley Process-like standards—though not formally applied to tanzanite—can enhance credibility and reduce risks associated with illegal mining and smuggling. The volatility of tanzanite supply, coupled with potential governmental policy changes and the anticipation of deeper mining ventures or nationalization, underscores the importance of agility and due diligence.

Ultimately, successful tanzanite rough sourcing balances economic viability with ethical responsibility, ensuring long-term access to high-quality material while contributing positively to Tanzania’s economy and mining sector.