The global commercial furniture market, particularly for restaurant-grade tables and chairs, is experiencing sustained growth driven by rising foodservice demand, urbanization, and the expansion of casual dining and quick-service restaurant (QSR) chains. According to a 2023 report by Mordor Intelligence, the global commercial furniture market was valued at USD 68.9 billion and is projected to grow at a CAGR of 5.2% from 2023 to 2028, with the food and beverage sector emerging as a key end-user. Similarly, Grand View Research noted that increasing investments in hospitality infrastructure and the growing preference for ergonomic, durable, and aesthetically versatile furniture are accelerating demand for high-quality restaurant seating solutions. As operators prioritize longevity, space efficiency, and design cohesion, sourcing from reliable and innovative manufacturers has become critical. This list highlights the top 10 table and chair manufacturers for restaurants, selected based on production capacity, material quality, design innovation, global distribution, and customer reviews—offering data-backed insights for restaurant owners and procurement professionals seeking optimal ROI.

Top 10 Table And Chair For Restaurant Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

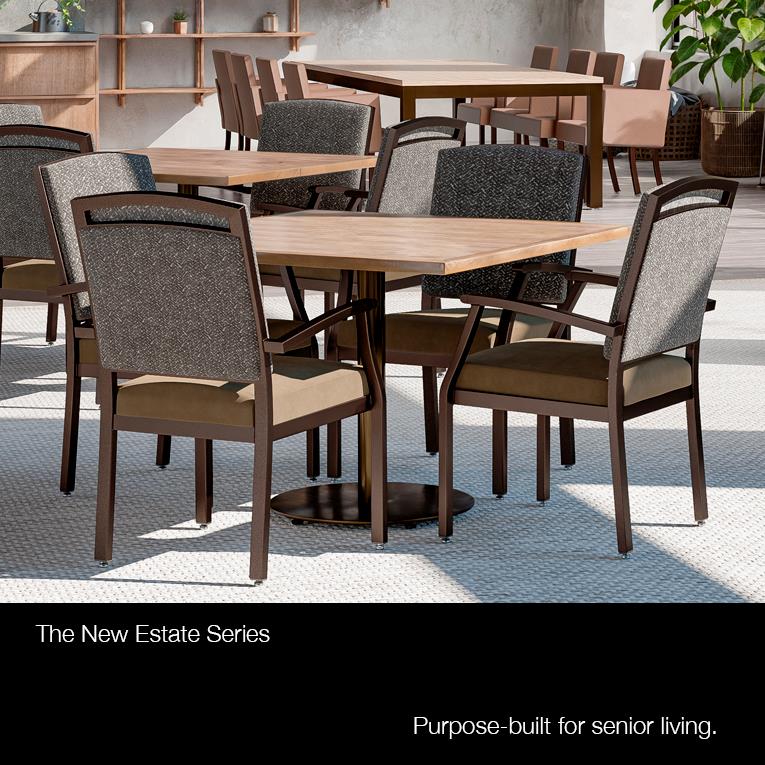

#1 MityLite: Award

Domain Est. 1995

Website: mitylite.com

Key Highlights: Shop high-quality commercial furniture at MityLite. From chairs to tables and more, find durable and stylish furniture for any setting. Shop now!…

#2 Plymold

Domain Est. 1996

Website: plymold.com

Key Highlights: Your Furniture Should Work Harder. We are leading the way in Commercial Furniture for. Restaurant and Workplace environments. Shop Now Contract Inquiries ……

#3 MTS Seating

Domain Est. 1997

Website: mtsseating.com

Key Highlights: MTS Seating is a premier provider of seating for the hotel, restaurant, gaming and convention industries….

#4 Emeco

Domain Est. 1999 | Founded: 1944

Website: emeco.net

Key Highlights: Shop chairs, stools, tables and sofas for in & out. Made in Pennsylvania since 1944. Tariff free. Built to last. Sustainable….

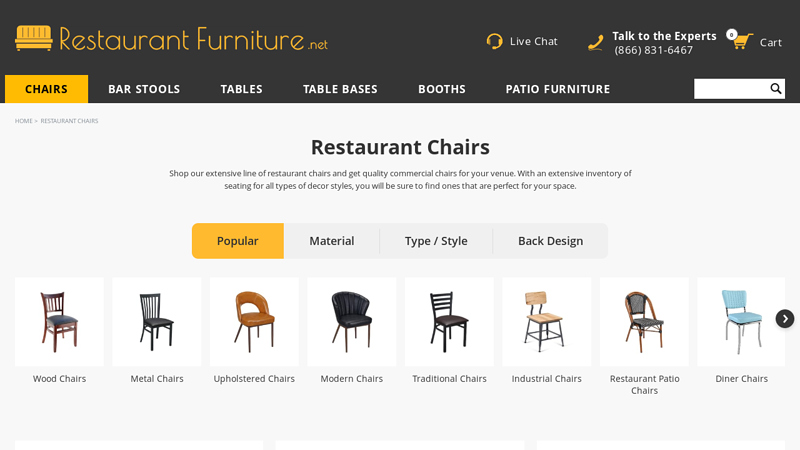

#5 Restaurant Furniture

Domain Est. 2001

#6 Restaurant Chairs & Dining Chairs for Sale

Domain Est. 2002

#7 Florida Seating

Domain Est. 2004

Website: floridaseating.com

Key Highlights: Florida Seating is a leading supplier of commercial furniture to the restaurant, hospitality, and design industries….

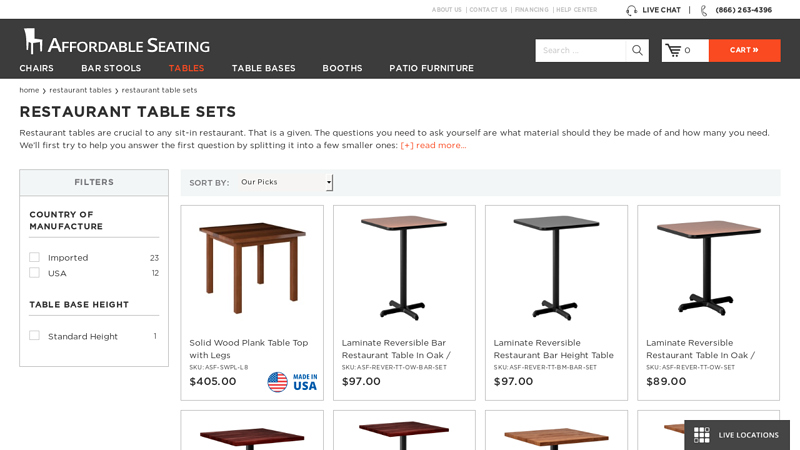

#8 Commercial Restaurant Table Tops and Bases

Domain Est. 2006

Website: affordableseating.net

Key Highlights: $230 deliveryAffordable Seating offers a wide selection of restaurant tables at competitive prices. Our selection includes wood restaurant tables, laminate, ……

#9 Page for TCB

Domain Est. 2007

Website: tableschairsbarstools.com

Key Highlights: We sell a wide variety of commercial grade furniture direct to restaurants & bars. Don’t pay more than you have to for top quality furniture, shop online ……

#10 Restaurant Seating

Domain Est. 2007

Website: modernlinefurniture.com

Key Highlights: $500 delivery 14-day returnsThe Palermo Package is a fully coordinated booth, table, and chair ensemble that brings high-end craftsmanship and vibrant style to any dining space….

Expert Sourcing Insights for Table And Chair For Restaurant

H2: 2026 Market Trends for Tables and Chairs for Restaurants

The global market for restaurant tables and chairs is poised for significant transformation by 2026, influenced by evolving consumer behaviors, sustainability demands, technological integration, and post-pandemic dining preferences. Below is an in-depth analysis of the key trends expected to shape the industry in the coming years.

H2: Rising Demand for Sustainable and Eco-Friendly Furniture

Environmental consciousness continues to influence purchasing decisions across the foodservice industry. By 2026, an increasing number of restaurant operators are expected to prioritize furniture made from sustainable materials such as reclaimed wood, recycled metals, and bioplastics. Certifications like FSC (Forest Stewardship Council) and GREENGUARD will become standard purchasing criteria. Manufacturers are responding by adopting circular economy principles, offering modular designs that extend product life and reduce waste.

H2: Emphasis on Multi-Functional and Space-Efficient Designs

Urbanization and rising real estate costs are driving demand for compact, flexible dining solutions. Restaurants, especially in densely populated cities, will increasingly adopt stackable chairs, foldable tables, and convertible furniture that can be reconfigured for different service models—dine-in, takeaway, or events. Convertible furniture supports hybrid dining concepts and enables quick transitions between peak and off-peak hours.

H2: Integration of Smart Furniture and IoT Technology

By 2026, smart restaurant furniture will move beyond novelty to practical application. Tables embedded with wireless charging, built-in tablets for ordering, and sensors to monitor seating occupancy are expected to gain traction, particularly in fast-casual and tech-forward dining establishments. These integrations enhance customer experience and provide operators with real-time data on table utilization and customer flow.

H2: Growth of Outdoor and Hybrid Dining Spaces

The pandemic accelerated the adoption of outdoor dining, and this trend is expected to persist through 2026. Restaurants are investing in weather-resistant tables and chairs designed for patios, rooftops, and sidewalk seating. Demand for durable, stylish outdoor furniture made from powder-coated aluminum, teak, and UV-resistant composites will rise. Modular outdoor sets that allow social distancing while maintaining aesthetic appeal will be particularly sought after.

H2: Customization and Brand-Centric Design

As restaurants focus on differentiation and brand identity, customized furniture solutions will become essential. Operators will seek tables and chairs that reflect their brand’s aesthetic—whether minimalist, rustic, industrial, or luxury. Customization includes color, finish, material, and even branding elements like logos etched into tabletops. This trend supports the rise of niche manufacturers offering made-to-order solutions.

H2: Influence of E-Commerce and Direct-to-Business (B2B) Platforms

Digital procurement will dominate the restaurant furniture supply chain by 2026. Online B2B marketplaces offering 3D previews, bulk pricing, and fast delivery will make it easier for restaurateurs to source furniture efficiently. Augmented reality (AR) tools will allow operators to visualize how tables and chairs will look in their space before purchasing, reducing return rates and improving decision-making.

H2: Regional Market Variations and Emerging Economies

While North America and Europe remain strong markets, growth in Asia-Pacific, Latin America, and the Middle East will accelerate due to rising disposable incomes and expanding foodservice sectors. Localized design preferences—such as low tables in parts of Asia or communal seating in Latin American cafes—will drive region-specific product development. Manufacturers with agile supply chains will capitalize on these opportunities.

H2: Labor and Supply Chain Considerations

Ongoing supply chain volatility and labor shortages will influence furniture design and logistics. Lightweight, flat-pack furniture that is easy to assemble and ship will gain favor. Manufacturers may localize production to reduce shipping times and costs, especially in high-demand urban markets.

In conclusion, the restaurant tables and chairs market in 2026 will be defined by sustainability, technological integration, flexibility, and brand alignment. Success will depend on manufacturers’ ability to innovate while responding to the operational and aesthetic needs of a rapidly evolving hospitality landscape.

Common Pitfalls When Sourcing Tables and Chairs for Restaurants (Quality, IP)

Sourcing furniture for a restaurant involves more than just aesthetics—overlooking key factors related to quality and intellectual property (IP) can lead to long-term operational, financial, and legal issues. Below are common pitfalls to avoid.

Poor Material Quality and Durability

One of the most frequent mistakes is selecting tables and chairs made from substandard materials. Restaurant furniture must withstand constant use, spills, cleaning chemicals, and heavy traffic. Opting for cheap particleboard, thin metal frames, or low-grade upholstery may save money upfront but often results in frequent replacements, increased maintenance costs, and a poor customer experience.

Inadequate Structural Design and Stability

Furniture that wobbles or feels flimsy undermines both safety and brand perception. Poor joinery, weak welds, or undersized components compromise structural integrity. Ensuring that tables have sturdy bases and chairs have reinforced joints and proper weight distribution is crucial, especially in high-turnover environments.

Ignoring Ergonomics and Comfort

Uncomfortable seating leads to shorter dining times and reduced customer satisfaction. Chairs that lack proper lumbar support, incorrect seat height, or overly hard padding can deter repeat visits. Prioritizing ergonomics helps enhance guest experience and supports longer stays, especially in full-service or fine dining settings.

Overlooking Maintenance and Cleanability

Restaurant furniture must be easy to clean and resistant to stains, scratches, and moisture. Materials like untreated wood or porous fabrics can harbor bacteria and degrade quickly. Choosing finishes that are scratch-resistant, water-repellent, and compatible with commercial cleaning products ensures hygiene and longevity.

Failure to Verify Intellectual Property Rights

When sourcing branded or designer-style tables and chairs, restaurants risk infringing on intellectual property rights. Replicas or knock-offs of patented designs—such as iconic chair models protected by design patents or trademarks—can lead to legal action, fines, or forced removal of furniture. Always confirm that suppliers have the proper licenses or are offering original, legally compliant designs.

Relying on Unverified Suppliers

Sourcing from manufacturers or distributors without proper vetting increases the risk of receiving counterfeit or subpar products. Unreliable suppliers may cut corners on materials or fail to adhere to safety standards. Conduct due diligence by requesting samples, checking certifications, and reviewing third-party reviews or industry references.

Not Considering Long-Term Total Cost of Ownership

Focusing solely on purchase price ignores long-term costs related to repairs, replacements, and downtime. High-quality, durable furniture may have a higher initial cost but often delivers better value over time. Evaluate total cost of ownership, including expected lifespan, maintenance needs, and warranty coverage.

Skipping Prototypes or Sample Testing

Bypassing the step of ordering samples before bulk purchases can result in mismatches in color, texture, size, or comfort. Testing furniture in real restaurant conditions—such as during service hours—helps identify functional flaws and ensures it meets both design and operational needs.

By addressing these quality and IP-related pitfalls early in the sourcing process, restaurant owners can invest in furniture that enhances the dining experience, supports brand integrity, and avoids costly legal or operational setbacks.

Logistics & Compliance Guide for Tables and Chairs for Restaurants

Product Classification and HS Code

When importing or exporting tables and chairs for restaurant use, it is essential to correctly classify the products under the Harmonized System (HS) Code. Typical classifications include:

– HS Code 9403.60: For wooden tables and chairs

– HS Code 9403.89: For tables and chairs made of other materials (e.g., metal, plastic)

Accurate classification ensures correct duty assessment and compliance with customs regulations in the destination country.

Import/Export Documentation

Ensure all required documentation is prepared and accurate:

– Commercial Invoice

– Packing List

– Bill of Lading (for sea freight) or Air Waybill (for air freight)

– Certificate of Origin (may be required for preferential tariffs under trade agreements)

– Import/Export License (if required by the destination country)

– Product Compliance Certificates (e.g., safety, material, or environmental standards)

Packaging and Labeling Requirements

Proper packaging protects items during transit and meets regulatory standards:

– Use sturdy cartons with internal padding to prevent damage

– Label packages with:

– Product description

– Quantity per package

– Handling instructions (e.g., “Fragile,” “This Side Up”)

– Country of origin

– Include barcodes or RFID tags if required for inventory or retail purposes

Transportation and Freight Options

Choose the appropriate mode of transport based on urgency, cost, and volume:

– Sea Freight: Ideal for large orders; cost-effective but slower

– Air Freight: Faster but more expensive; suitable for urgent or smaller shipments

– Ground Transport: Used for domestic or regional delivery; ensure vehicles are equipped to handle bulky items

Consider using specialized furniture logistics providers experienced in handling restaurant furniture.

Customs Clearance Procedures

To avoid delays at customs:

– Submit accurate documentation in advance

– Pay applicable duties and taxes promptly

– Be aware of anti-dumping or countervailing duties on certain imported furniture (particularly from specific countries)

– Engage a licensed customs broker if necessary

Safety and Compliance Standards

Restaurant furniture must meet safety and quality standards in the target market:

– USA: Comply with CPSC (Consumer Product Safety Commission) standards; flammability requirements may apply for upholstered chairs

– EU: Meet EN 1725 (furniture safety standards for domestic use, often referenced); CE marking may be required if applicable

– Other Regions: Check local regulations for structural safety, edge rounding, chemical emissions (e.g., formaldehyde limits in wood products)

Environmental and Sustainability Regulations

Many countries enforce environmental standards for furniture:

– CARB (California Air Resources Board): Regulates formaldehyde emissions from composite wood products

– FSC Certification: Recommended for wood-based furniture to prove sustainable sourcing

– REACH & RoHS (EU): Regulate hazardous substances in materials

Ensure suppliers provide documentation proving compliance with these standards.

Assembly and Installation Logistics

For ready-to-assemble (RTA) furniture:

– Include clear, multilingual assembly instructions

– Ship all necessary hardware and tools separately but within the same package

– Consider offering professional installation services for bulk orders

For flat-packed items, optimize packaging dimensions to reduce freight costs.

Warranty and Returns Management

Establish a clear returns and warranty policy:

– Define warranty period (e.g., 1–5 years for structural defects)

– Set procedures for handling damaged or defective items upon delivery

– Partner with local service providers for repairs or replacements to reduce return shipping costs

Record Keeping and Audit Readiness

Maintain detailed records for at least 5–7 years (depending on jurisdiction), including:

– Purchase orders and invoices

– Shipping and customs documents

– Compliance test reports and certifications

These records support audits and demonstrate regulatory compliance.

Final Recommendations

- Work with suppliers who understand international compliance requirements

- Conduct pre-shipment inspections for quality control

- Stay updated on trade regulations and tariff changes affecting furniture imports/exports

- Use a supply chain management system to track shipments and compliance documentation

Following this guide ensures smooth logistics operations and full compliance when sourcing and distributing tables and chairs for restaurants globally.

Conclusion:

After carefully evaluating various suppliers, materials, designs, and cost considerations, sourcing tables and chairs for the restaurant should prioritize durability, comfort, aesthetics, and value for money. The selected furniture should align with the restaurant’s theme and target customer experience, while also being practical for daily operations and easy to maintain. Bulk purchasing from a reputable supplier offering a balance between quality and affordability is recommended to ensure consistency and long-term savings. Additionally, considering eco-friendly materials and customizable options can enhance sustainability and brand image. By making informed decisions based on thorough research and sample testing, the restaurant can create a welcoming and functional dining environment that supports customer satisfaction and operational efficiency.