The global carbon fiber market is experiencing robust growth, driven by rising demand in aerospace, defense, automotive, and renewable energy sectors. According to Grand View Research, the market was valued at USD 4.3 billion in 2023 and is projected to expand at a compound annual growth rate (CAGR) of 9.2% from 2024 to 2030. A significant portion of this growth is attributed to high-performance T700-grade carbon fiber, widely recognized for its optimal balance of strength, stiffness, and cost-efficiency. As manufacturers worldwide seek reliable T700 supply chains, three key players have emerged as leading producers, consistently delivering high-quality filaments that meet stringent industry standards. These manufacturers not only dominate in production capacity but also lead in technological innovation and global market penetration.

Top 3 T700 Carbon Manufacturers 2026

(Ranked by Factory Capability & Trust Score)

#1 Torayca® Carbon Fibers

Domain Est. 2012

Website: toray-cfe.com

Key Highlights: Torayca® Carbon Fibers offer the widest range of fibers on the market that has been developed to offer a solution for each of your projects….

#2 TORAYCA™ Carbon Fiber for Applications

Domain Est. 2016

Website: toraycma.com

Key Highlights: Toray’s TORAYCA™ carbon fiber is globally recognized for its outstanding performance, quality, and consistency in processing. Call us today to learn more….

#3 Carbon Fiber Composite Materials

Domain Est. 2021

Website: cf-composites.toray

Key Highlights: Toray group supplies the most comprehensive range of carbon fiber materials in the market, from high-performance premium fiber for aircraft applications….

Expert Sourcing Insights for T700 Carbon

H2: 2026 Market Trends for T700 Carbon Fiber

As the global demand for lightweight, high-strength materials intensifies across aerospace, automotive, renewable energy, and industrial sectors, the T700 carbon fiber market is poised for significant evolution by 2026. T700, a standard-modulus carbon fiber known for its balanced strength, stiffness, and cost-efficiency, continues to serve as a foundational material in high-performance applications. The following analysis outlines the key market trends shaping the T700 carbon fiber landscape in 2026:

1. Rising Aerospace and Defense Demand

The aerospace industry remains the largest consumer of T700-grade carbon fiber, driven by ongoing aircraft production—including commercial jets like the Boeing 787 and Airbus A350—and next-generation defense platforms. By 2026, increased defense spending globally and modernization of unmanned aerial vehicles (UAVs), drones, and satellite systems are expected to sustain strong demand for T700 composites due to their reliability and performance under extreme conditions.

2. Expansion in Automotive Lightweighting

Automakers are accelerating the use of carbon fiber to meet stringent emissions and fuel efficiency regulations. While higher-cost grades dominate premium electric vehicles (EVs), T700 is gaining traction in performance and semi-structural automotive components—such as driveshafts, springs, and battery enclosures—where its cost-performance ratio is favorable. Mass adoption remains limited by price, but advancements in automated layup and resin transfer molding (RTM) technologies are improving scalability.

3. Growth in Renewable Energy Applications

The wind energy sector is emerging as a key growth driver. T700 fibers are increasingly used in longer, more efficient wind turbine blades, particularly in offshore installations where strength-to-weight ratio is critical. By 2026, as global wind capacity expands to meet net-zero targets, demand for T700 in hybrid blade designs (combined with glass fiber) is expected to rise steadily.

4. Regional Shifts in Production and Supply Chain

China has solidified its position as the leading producer of T700 carbon fiber, with companies like Sinofiber, Weihai Guangwei, and CNSILC scaling up capacity. This domestic growth reduces reliance on imports from Japan (Toray, the original developer of T700) and strengthens Asia-Pacific’s dominance in the supply chain. Meanwhile, geopolitical tensions and trade policies are prompting Western manufacturers to explore localized or near-shored production, potentially increasing investment in U.S. and European carbon fiber facilities by 2026.

5. Price Stabilization and Competition from Alternative Grades

After volatility in raw material costs and supply disruptions post-pandemic, the T700 market is expected to stabilize by 2026 due to improved manufacturing yields and expanded capacity. However, competition from newer intermediate modulus fibers (e.g., T800, T1000) and lower-cost alternatives (such as industrial-grade carbon fiber) may pressure margins. T700 will maintain its niche by balancing performance and affordability, particularly in mid-tier applications.

6. Sustainability and Recycling Initiatives

Environmental concerns are driving innovation in carbon fiber recycling. By 2026, closed-loop recycling programs and thermoplastic matrix systems compatible with T700 are expected to gain traction, especially in Europe under stricter circular economy regulations. Manufacturers are investing in eco-friendly production methods to reduce energy consumption and lifecycle emissions, enhancing the sustainability profile of T700 composites.

Conclusion

By 2026, the T700 carbon fiber market will be characterized by robust demand in aerospace and renewable energy, increased regional production capacity—particularly in China—and growing emphasis on cost reduction and sustainability. While facing competition from higher-performance and lower-cost alternatives, T700 remains a critical material due to its proven track record and balanced properties. Strategic investments in manufacturing efficiency and recycling will determine its long-term competitiveness in a rapidly evolving advanced materials landscape.

H2: Common Pitfalls in Sourcing T700 Carbon Fiber – Quality and Intellectual Property Concerns

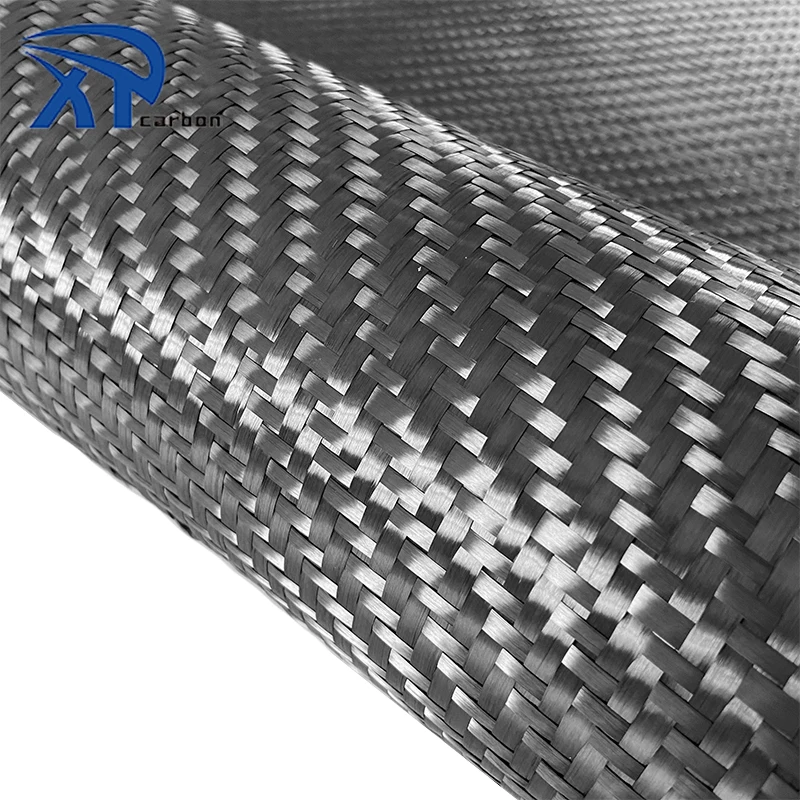

Sourcing T700 carbon fiber, a high-performance grade known for its excellent strength-to-weight ratio and widespread use in aerospace, automotive, and defense applications, involves several critical challenges, particularly concerning quality consistency and intellectual property (IP) protection. Procurement teams and manufacturers must navigate these pitfalls carefully to ensure material reliability and legal compliance.

1. Quality Inconsistency and Counterfeit Materials

One of the most significant risks when sourcing T700 carbon fiber—especially from non-OEM or secondary suppliers—is receiving substandard or counterfeit material. T700 is a proprietary grade originally developed by Toray Industries, and genuine T700 meets strict specifications for tensile strength (~4,900 MPa), modulus (~230 GPa), and fiber diameter (~7 μm).

- Inconsistent Mechanical Properties: Non-certified or unverified suppliers may offer “T700-grade” fibers that do not meet the original Toray specifications. This can result in batch-to-batch variability, compromising structural integrity in critical applications.

- Lack of Traceability: Reputable suppliers provide certified test reports (e.g., ASTM D4018) and lot traceability. Poor documentation increases the risk of receiving re-spun, recycled, or downgraded fibers misrepresented as virgin T700.

- Storage and Handling Issues: Carbon fiber is sensitive to moisture and static. Improper storage—common with unauthorized distributors—can degrade performance even if the initial quality was acceptable.

2. Intellectual Property and Brand Misuse

T700 is a trademarked product name owned by Toray Industries. Unauthorized use of the “T700” designation by third-party manufacturers constitutes IP infringement and misleads buyers.

- Mislabeling and Brand Confusion: Many suppliers label generic 3K or 12K high-strength carbon fibers as “T700” to capitalize on Toray’s brand reputation. While some fibers may be functionally similar, they are not equivalent unless tested and certified to the same standards.

- Legal Exposure: Purchasing or specifying materials under the T700 name from non-licensed sources may expose companies to IP liability, especially in regulated industries where material provenance is audited.

- Lack of Technical Support: Genuine Toray T700 comes with comprehensive technical data, process guidelines, and support for composite manufacturing. Counterfeit or imitation products lack this ecosystem, increasing the risk of processing failures.

3. Supply Chain Opacity and Authorized Distribution

Toray tightly controls the distribution of T700 carbon fiber through authorized partners and direct sales to strategic customers. Procuring outside this network increases exposure to quality and IP risks.

- Unauthorized Distributors: Intermediaries or online marketplaces may claim to sell “original Toray T700” without proper certification or chain of custody.

- No Warranty or Recourse: If performance issues arise, buyers of non-OEM material often have no recourse for warranty claims or material replacement.

Best Practices to Mitigate Risks

- Source Directly or via Authorized Distributors: Verify supplier credentials through Toray’s official distribution network.

- Demand Certification: Require mill test reports, COAs (Certificates of Analysis), and lot traceability for every shipment.

- Conduct Independent Testing: Perform third-party mechanical and spectroscopic testing (e.g., tensile, SEM, FTIR) to verify fiber identity and performance.

- Include IP Clauses in Contracts: Ensure supply agreements explicitly state material origin and prohibit IP-infringing substitutes.

- Engage Early with Toray: For high-volume or mission-critical applications, establish direct engagement with Toray for technical collaboration and supply assurance.

In conclusion, while T700 carbon fiber offers exceptional performance, sourcing it outside authorized channels introduces substantial quality and legal risks. Ensuring authenticity through rigorous supplier vetting and material verification is essential for performance, compliance, and long-term project success.

H2: Logistics & Compliance Guide for T700 Carbon Fiber

T700 carbon fiber is a high-performance material widely used in aerospace, automotive, and industrial applications due to its excellent strength-to-weight ratio and durability. Proper logistics and compliance measures are essential to ensure safe handling, transportation, regulatory adherence, and environmental responsibility. This guide outlines key considerations for the logistics and compliance associated with T700 carbon fiber.

H2: Handling and Storage Requirements

- Environmental Conditions: Store T700 carbon fiber in a clean, dry, and temperature-controlled environment (15–25°C, 30–50% relative humidity). Avoid exposure to moisture, direct sunlight, and extreme temperatures to prevent degradation of resin matrices (if pre-impregnated).

- Packaging: Maintain original sealed packaging until use. Prepreg materials should remain frozen (typically at -18°C or lower) and be tracked with thawing logs.

- Handling: Use appropriate gloves and protective gear to prevent skin irritation. Avoid creating dust during cutting or machining—use wet methods or dust extraction systems.

H2: Transportation Regulations

- Classification: T700 carbon fiber in dry fabric form is generally not classified as hazardous material under IATA, IMDG, or ADR regulations. However, resin-impregnated (prepreg) forms may contain hazardous chemicals and require proper labeling.

- Packaging for Shipment: Use robust, moisture-resistant packaging. Prepreg must be shipped in insulated containers with dry ice or refrigerants, complying with UN3373 (Biological Substance, Category B) or specific chemical regulations if applicable.

- Documentation: Include safety data sheets (SDS), packing declarations, and temperature logs (for frozen shipments). Declare any hazardous components in accordance with regional transport laws.

H2: Regulatory Compliance

- REACH & RoHS (EU): Ensure T700 carbon fiber and associated resins comply with EU REACH (Registration, Evaluation, Authorization, and Restriction of Chemicals) and RoHS (Restriction of Hazardous Substances) directives. Verify no restricted substances are present.

- ITAR/EAR (USA): Carbon fiber materials, especially those used in aerospace or defense, may be subject to export controls under the International Traffic in Arms Regulations (ITAR) or Export Administration Regulations (EAR). Confirm classification under ECCN 1C010 or USML Category XV.

- Customs and Import: Provide accurate HS codes (e.g., 5510.30 for synthetic filament yarn) and country-of-origin documentation. Be prepared for inspections, especially in regulated industries.

H2: Workplace Safety and Environmental Considerations

- OSHA & GHS Compliance: Follow OSHA guidelines for handling fibers and resins. Implement GHS-compliant labeling and training programs for employees.

- Waste Disposal: Carbon fiber waste is typically non-hazardous but should be disposed of according to local regulations. Recycling via pyrolysis or mechanical grinding is encouraged to support sustainability.

- Ventilation & PPE: Use local exhaust ventilation in processing areas. Require personal protective equipment (PPE), including respirators (N95 or equivalent), eye protection, and gloves.

H2: Quality Assurance and Traceability

- Batch Tracking: Maintain full traceability of T700 carbon fiber lots from supplier to end use. Document storage conditions, shelf life, and usage dates—especially critical for prepreg materials with limited out-time.

- Certifications: Ensure material is supplied with mill certificates, conformance reports, and compliance with standards such as ASTM D3039 (tensile properties) or AMS 3830/3861 (aerospace-grade carbon fiber).

H2: Emergency Procedures

- Spill Response: For dry fiber, avoid creating airborne dust. Clean with HEPA-filtered vacuums. For resin spills, follow SDS instructions—use absorbent materials and appropriate PPE.

- Fire Safety: Carbon fiber itself is not flammable but can burn under extreme conditions. Prepreg resins may be combustible. Use CO₂ or dry chemical extinguishers. Evacuate and ventilate area if smoke is present.

Adhering to this logistics and compliance guide ensures the safe, legal, and efficient management of T700 carbon fiber across the supply chain. Regular audits, staff training, and documentation are essential to maintain compliance and operational excellence.

In conclusion, sourcing T700 carbon fiber requires a strategic approach that balances quality, cost, and reliability. As a high-performance material widely used in aerospace, automotive, and defense applications, T700 carbon fiber demands strict adherence to technical specifications and consistency in supply. Key considerations include identifying reputable suppliers—such as Toray, the original manufacturer—or approved licensed producers, ensuring material traceability and certification, and evaluating logistical and regulatory factors, especially for international procurement.

Additionally, establishing long-term partnerships, negotiating favorable terms, and monitoring market trends can help mitigate supply chain risks and price volatility. Due diligence in supplier qualification, combined with thorough testing and quality control upon delivery, is essential to maintain product integrity and performance standards. Ultimately, successful sourcing of T700 carbon fiber hinges on a well-structured supply chain strategy that supports both immediate project needs and long-term operational goals.